Smartphone Console Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433144 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Smartphone Console Market Size

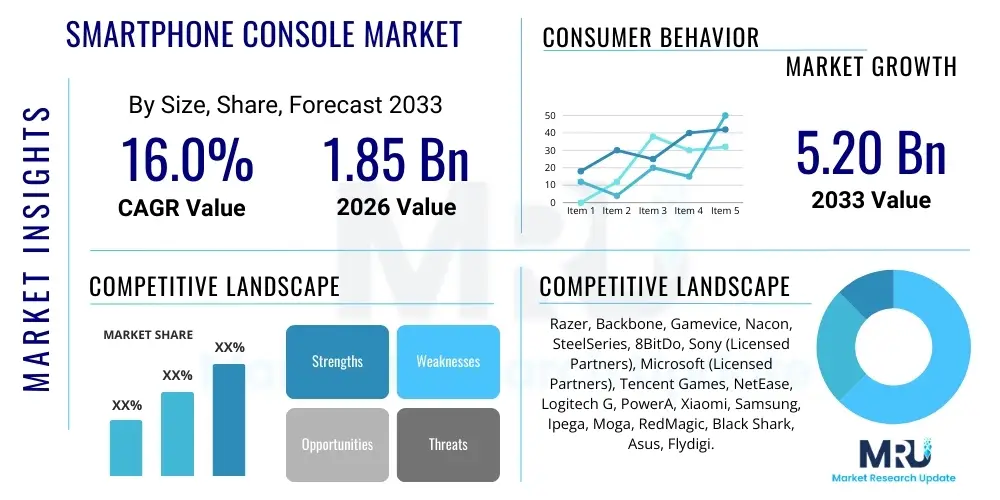

The Smartphone Console Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 16.0% CAGR between 2026 and 2033. The market is estimated at $1.85 Billion in 2026 and is projected to reach $5.20 Billion by the end of the forecast period in 2033.

Smartphone Console Market introduction

The Smartphone Console Market encompasses peripherals, accessories, and specialized devices designed to transform conventional smartphones into dedicated, high-performance gaming handhelds. This transformation primarily involves detachable physical controllers, ergonomic grips, cooling solutions, and optimized software overlays that enhance the mobile gaming experience, bridging the gap between traditional console play and highly accessible smartphone ecosystems. These solutions cater directly to the increasing complexity and graphical fidelity of mobile games, particularly those in the AAA category that demand precise input and sustained performance, making the mobile platform viable for serious competitive play beyond simple touch interactions.

The core product offerings within this market segment include physical controllers that attach directly to the smartphone, utilizing connections like USB-C or Lightning for minimal latency, or high-efficiency Bluetooth connections. Major applications span casual gaming, where controllers provide greater comfort, to hardcore gaming and professional esports, where precision and tactile feedback are critical performance differentiators. The primary benefit these consoles provide is the elimination of screen obstruction caused by on-screen touch controls, coupled with superior ergonomics necessary for extended play sessions. This enhanced control paradigm facilitates deep engagement with complex titles such as Genshin Impact, Call of Duty Mobile, and high-fidelity cloud streaming services like Xbox Cloud Gaming or NVIDIA GeForce NOW, leveraging the existing computational power of modern smartphones.

Driving factors for the accelerated adoption of smartphone console accessories include the massive global penetration of smartphones capable of running sophisticated games, coupled with significant advancements in 5G infrastructure, which makes cloud gaming and multiplayer experiences seamless. Furthermore, game developers are increasingly optimizing titles for controller input, acknowledging the shift toward console-like experiences on mobile devices. The rising consumer disposable income, particularly in emerging markets, allows gamers to invest in premium accessories that elevate their gameplay, transforming a daily communication tool into a dedicated portable entertainment system capable of competing functionally with dedicated handheld gaming devices.

Smartphone Console Market Executive Summary

The Smartphone Console Market is characterized by robust commercial growth driven primarily by the convergence of high-performance smartphone technology, the global proliferation of competitive mobile esports, and the maturity of cloud gaming infrastructure. Key business trends indicate a strong emphasis on ergonomic design, low-latency connectivity solutions (often mandatory USB-C/Lightning connections replacing traditional Bluetooth for performance), and integrated cooling technology to manage thermal throttling during demanding gameplay. Strategic partnerships between controller manufacturers and leading game developers are becoming essential, ensuring plug-and-play compatibility and optimized user interfaces, thereby driving premium pricing models in the high-end accessory segment.

Regionally, the market dynamics are heavily influenced by the adoption rates of mobile broadband and the cultural acceptance of mobile gaming as a primary entertainment source. The Asia Pacific (APAC) region, spearheaded by massive gaming populations in China, Japan, and South Korea, dominates the market, exhibiting the highest demand for premium, performance-focused consoles due to the intensity of mobile esports culture. North America and Europe show substantial growth, largely attributed to the increasing popularity of cross-platform titles and the accessibility provided by cloud gaming services, which transforms older smartphones into capable gaming portals. Investment in local distribution networks and targeted marketing toward specific regional gaming communities remains a crucial differentiator for vendors.

Segment trends reveal a preference for the Detachable Controllers category, which offers flexibility and portability, allowing the smartphone to revert easily to its primary function when not in use. However, the Integrated Handheld segment, often featuring built-in batteries and specialized cooling systems, is gaining traction among hardcore gamers seeking a dedicated, uninterrupted experience. The Hardcore Gaming application segment holds the largest revenue share, reflecting the willingness of dedicated gamers to invest significant capital into precision peripherals. Future growth is anticipated in the software optimization and subscription service segment, where manufacturers offer proprietary companion apps or specialized gaming hubs to enhance the functionality and value proposition of their physical accessories.

AI Impact Analysis on Smartphone Console Market

User inquiries regarding the impact of Artificial Intelligence on the Smartphone Console Market frequently center on how AI can enhance the core gaming experience, personalize controller settings, and automate certain game functions. Common themes include the potential for AI-driven adaptive difficulty adjustments based on player input precision (measured via the console), the use of machine learning for advanced anti-cheat detection in competitive titles that rely on controller input, and the development of intelligent companion apps that optimize device performance (CPU/GPU allocation, network prioritization) specific to the game being played. Users are concerned about whether AI integration might lead to unfair advantages (like automated aiming or rapid-fire functions controlled by the accessory) but are simultaneously hopeful for AI-enhanced personalization and superior input responsiveness.

AI's primary influence will be twofold: optimization and personalization. On the optimization front, AI algorithms will be increasingly integrated into the firmware of high-end controllers and their companion applications. These algorithms analyze input lag, thermal signatures, and network fluctuations, dynamically adjusting the smartphone's settings to ensure peak performance specifically during gaming sessions. This predictive thermal management, facilitated by data gathered through the connected accessory, minimizes performance drops due to heat, a major concern for intensive mobile gaming. Furthermore, AI can contribute significantly to battery management, intelligently scaling power consumption based on detected game load and accessory usage patterns.

In terms of personalization and developer utilities, AI is set to revolutionize control mapping and accessibility. Machine learning models can analyze a user’s playstyle—such as reaction time, button press duration, and common control sequence errors—to suggest optimal sensitivity settings, custom button layouts, or even personalized ergonomic grip recommendations for future product iterations. From a competitive standpoint, sophisticated AI-based behavioral analytics, potentially integrated into the accessory's software, could provide developers and esports organizers with deeper insights into player behavior, aiding in the identification of highly sophisticated, hardware-enabled cheating methods that bypass current software-only detection systems.

- AI-driven optimization of smartphone thermal management based on controller usage data.

- Personalized control mapping and sensitivity suggestions utilizing machine learning analysis of player input patterns.

- Enhanced accessibility features, including AI assistance for complex input sequences (e.g., combo execution in fighting games).

- Advanced anti-cheat detection mechanisms integrated into controller firmware to identify hardware-assisted exploits.

- Dynamic adjustment of game streaming quality (in cloud gaming) based on predicted latency and network conditions, leveraging accessory feedback.

- Integration of AI-powered voice commands or haptic feedback calibration based on in-game events.

DRO & Impact Forces Of Smartphone Console Market

The Smartphone Console Market is fundamentally shaped by a dynamic interplay of Drivers, Restraints, and Opportunities (DRO), which collectively constitute the critical Impact Forces determining its growth trajectory. The most significant driver is the exponential improvement in mobile SoC (System-on-Chip) performance, transforming standard smartphones into devices capable of running console-quality games, thereby necessitating console-like controllers for an appropriate input experience. Coupled with this is the explosion of the mobile esports ecosystem and the increasing acceptance of mobile devices as legitimate platforms for competitive, high-stakes gaming, which directly elevates the demand for low-latency, high-precision peripherals. However, the market faces strong restraints, primarily centered around high device fragmentation across Android ecosystems, which complicates universal hardware compatibility and software integration, leading to a sometimes inconsistent user experience.

Key opportunities exist in the burgeoning cloud gaming sector, where smartphone consoles act as the essential bridge connecting consumers to high-fidelity, resource-intensive titles without requiring them to own powerful native hardware. This lowers the barrier to entry for AAA gaming experiences on mobile. Further opportunities arise from integrating sophisticated haptic feedback technologies and specialized mechanical buttons that replicate the tactile superiority of dedicated consoles. The major restraint remains the inherent tension between the desire for portability and the need for large, comfortable ergonomics; consumers often prioritize slim device profiles, making the bulky nature of some console accessories a deterrent. Additionally, the premium price point of high-quality accessories, sometimes rivaling the cost of entry-level dedicated handheld consoles, acts as a barrier for mass market adoption in price-sensitive regions.

The impact forces influencing this market are predominantly technological and competitive. Technological forces, such as the rollout of faster connection standards (USB 3.1/3.2 protocols in USB-C controllers), constantly push the boundaries of performance and responsiveness. Competitive forces are driven by new entrants from traditional console accessory manufacturers and specialized mobile-focused startups, leading to rapid innovation cycles and frequent feature upgrades, particularly concerning battery life and proprietary software overlays. These forces dictate pricing strategies and product differentiation, compelling manufacturers to continually refine the balance between cost, performance, and cross-platform compatibility to maintain relevance in a rapidly evolving mobile hardware landscape.

Segmentation Analysis

The Smartphone Console Market is systematically segmented primarily based on Type, Application, and Platform, allowing for a granular understanding of consumer preferences and market behavior across diverse user groups. The Type segmentation distinguishes between highly flexible detachable controllers, which clip onto either side of the smartphone, and integrated handhelds, which often encase the device entirely and feature built-in cooling or power banks for extended, dedicated gaming sessions. Application segmentation differentiates between demand originating from casual gamers seeking comfort improvements and hardcore gamers or professional esports participants requiring absolute precision and low latency. Platform segmentation is vital due to the inherent differences between iOS (Lightning/USB-C, strict hardware control) and Android (USB-C, high fragmentation, greater customization).

The dominance of the detachable controller segment stems from its universal appeal, offering high portability and ease of use, making it suitable for both quick gaming sessions and extended travel. However, the integrated handheld segment commands higher average selling prices (ASPs) due to the incorporation of advanced features like active cooling fans, specialized macro buttons, and superior battery integration, catering to the niche but high-value segment of competitive mobile gamers. Analysis of the application segments reveals that while the casual gaming segment represents the largest volume base, the hardcore gaming and professional esports applications are the primary revenue drivers, characterized by a willingness to pay a premium for features that offer a competitive edge, such as mechanical triggers and high-resolution thumbsticks.

Geographically, segmentation by platform shows a strong concentration of iOS-compatible accessories in markets with high iPhone penetration, such as North America and specific European regions. Conversely, the Android segment dominates the vast and rapidly growing APAC market, necessitating manufacturers to invest heavily in broad compatibility testing and standardized software interfaces that function reliably across a wide array of device form factors and operating system versions. This complex fragmentation dictates manufacturing scale and regional distribution strategies, emphasizing the need for flexible design architectures that minimize dependence on specific device dimensions or proprietary manufacturer specifications, driving the shift towards standardized USB-C connectivity across the board.

- Type:

- Detachable Controllers (Clip-on or Telescopic)

- Integrated Handhelds (Full Encasement with Cooling/Power)

- Application:

- Casual Gaming

- Hardcore Gaming

- Professional Esports

- Cloud Gaming

- Platform:

- Android

- iOS

Value Chain Analysis For Smartphone Console Market

The value chain for the Smartphone Console Market begins with upstream activities involving the sourcing and manufacturing of specialized components. This upstream phase is highly reliant on suppliers of micro-switches, high-precision Hall effect sensors for thumbsticks and triggers, specialized plastics, and advanced connectivity modules (e.g., proprietary low-latency USB-C or Bluetooth chipsets). Key challenges in the upstream sector involve maintaining supply chain resilience and securing access to high-quality, durable components that can withstand intensive gaming use, particularly mechanical buttons rated for millions of cycles. Innovation in haptic technology and high-efficiency thermal materials also occurs predominantly at this foundational stage, influencing the final product's quality and cost structure.

The midstream segment involves the core manufacturing, assembly, and integration processes. This is where Original Equipment Manufacturers (OEMs) design the ergonomic form factor, develop proprietary firmware, and integrate the specialized software required for seamless smartphone communication (e.g., mapping software, low-latency modes). Direct distribution channels involve manufacturers selling premium products through their own e-commerce platforms or dedicated brand stores, which allows for higher margin capture and direct customer interaction. Indirect distribution, which represents the majority of volume, relies on partnerships with major electronics retailers, specialized gaming stores, and large e-commerce marketplaces (Amazon, JD.com, Taobao), necessitating robust logistics and channel management to ensure global reach and consistent inventory levels.

Downstream activities center on marketing, sales, and post-sale support, focusing on reaching the end consumer. Effective marketing relies heavily on collaborations with mobile esports teams, professional streamers, and influential gaming personalities to demonstrate the performance benefits in real-world scenarios, leveraging credibility within the competitive gaming community. The relationship with smartphone manufacturers (e.g., Samsung, Xiaomi, Apple) is increasingly critical in the downstream phase; optimization and official accessory status can significantly boost sales volume and consumer trust. Post-sale support, including firmware updates, compatibility patches for new phone models, and customer service, is essential for maintaining brand loyalty and managing the user experience amidst rapid changes in smartphone operating systems and hardware iterations.

Smartphone Console Market Potential Customers

The primary potential customers in the Smartphone Console Market are highly engaged mobile gamers, particularly those categorized as 'Hardcore Gamers' or those participating in 'Professional Esports.' These customers view gaming on their smartphone as a serious leisure activity or a competitive pursuit, dedicating significant time and financial resources to achieving optimal performance. They are acutely aware of input latency, ergonomic deficiencies of touchscreens, and thermal issues, making them the ideal target for premium, feature-rich console accessories. Their purchasing decisions are driven by technical specifications—specifically, mechanical button quality, connection reliability (low latency), and advanced features like programmable macro buttons and integrated cooling solutions.

A secondary, rapidly growing customer segment is the 'Cloud Gaming Enthusiast.' As services like Xbox Cloud Gaming, GeForce NOW, and PlayStation Remote Play become more prevalent, users are seeking high-quality, comfortable controllers to utilize these services on their existing mobile devices, transforming their smartphone into a versatile remote play portal for console and PC titles. These customers value cross-platform compatibility, ease of pairing, and extended battery life, prioritizing versatility over purely competitive features. This segment is characterized by a slightly broader age demographic, often including users who traditionally preferred home consoles but now seek portability without compromising control fidelity.

Finally, 'Affluent Casual Gamers' form a steady customer base. While not focused on competitive performance, this group purchases smartphone consoles primarily for comfort, enhanced immersion, and the ability to enjoy complex single-player titles without hand strain. They typically opt for the more basic, detachable clip-on controllers that offer a significant upgrade over touch controls without the complexity or high cost of professional-grade integrated handhelds. Marketing efforts toward this group emphasize comfort, aesthetics, and ease of setup, rather than raw performance metrics, broadening the market appeal beyond the core competitive community.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.85 Billion |

| Market Forecast in 2033 | $5.20 Billion |

| Growth Rate | 16.0% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Razer, Backbone, Gamevice, Nacon, SteelSeries, 8BitDo, Sony (Licensed Partners), Microsoft (Licensed Partners), Tencent Games, NetEase, Logitech G, PowerA, Xiaomi, Samsung, Ipega, Moga, RedMagic, Black Shark, Asus, Flydigi. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Smartphone Console Market Key Technology Landscape

The technological landscape of the Smartphone Console Market is defined by intense innovation focused on overcoming the limitations of mobile gaming, particularly input latency, thermal management, and cross-platform compatibility. A foundational technology involves the shift from standard Bluetooth connectivity to proprietary low-latency protocols or, preferably, direct physical connections via USB-C or Lightning ports. This shift is crucial because competitive gaming demands latency measured in single-digit milliseconds, which standard wireless connections often cannot reliably achieve. Furthermore, the integration of Hall effect sensors in thumbsticks and triggers is a growing trend, offering enhanced durability, eliminating potential stick drift issues associated with traditional potentiometers, and providing highly precise, linear input crucial for racing and first-person shooter games.

Another pivotal technological development involves sophisticated thermal management solutions integrated within the accessory itself, particularly in the Integrated Handheld segment. Since sustained high-fidelity mobile gaming generates significant heat, leading to CPU throttling and performance degradation, console manufacturers are incorporating active cooling systems, such as Peltier cooling chips and internal fans, directly into the grips. These systems draw heat away from the smartphone's rear panel, ensuring the device can maintain peak processing speeds for extended periods. This technology is becoming a standard differentiator in the premium accessory category, directly addressing a primary pain point for hardcore mobile gamers.

Finally, the software overlay and proprietary companion application technologies are essential for maximizing the utility of the hardware. Modern smartphone consoles utilize advanced screen mapping software that translates physical button presses into specific touch inputs recognized by the game, enabling compatibility with titles that lack native controller support. Innovations here include AI-driven customization of macro functions, specialized firmware for rapid charging or power passthrough to the smartphone, and sophisticated haptic feedback engines (e.g., high-definition rumble) that significantly enhance immersion beyond basic vibration motors. The evolution of these integrated software systems determines the console's ultimate value proposition and ease of cross-game configuration.

Regional Highlights

- Highlight key countries or regions and their market relevance:

Asia Pacific (APAC): APAC is the unequivocally dominant market for smartphone consoles, primarily driven by the enormous population base and the ingrained culture of competitive mobile gaming, particularly in countries like China, South Korea, and Southeast Asian nations. Mobile esports in these regions receive substantial investment, creating a massive, dedicated consumer base that demands the highest performance peripherals. Chinese brands, in particular, lead in integrating aggressive features like active cooling and specialized triggers at competitive price points. The rapid rollout of 5G infrastructure also fuels the growth of high-fidelity mobile gaming, solidifying APAC's lead in both consumption and manufacturing.

North America (NA): North America represents a high-value market characterized by high Average Selling Prices (ASPs) and strong brand loyalty towards premium manufacturers. Growth here is accelerating due to the rapid adoption of cloud gaming services (Xbox Cloud Gaming, Stadia remnants, GeForce NOW) and the strong cross-platform appeal of major titles like Fortnite and Call of Duty. Consumers in NA prioritize ergonomic design, seamless integration with major platforms (especially iOS controllers), and official endorsement from major console ecosystems (Sony, Microsoft). The market favors sophisticated, polished accessories that deliver a near-console experience.

Europe: The European market displays heterogeneity, with Western Europe showing strong parallels to North America in terms of cloud gaming adoption and premium accessory demand. However, Eastern and Southern Europe are more price-sensitive, leading to robust demand for mid-range and value-oriented detachable controllers. Regulatory standards regarding electronics and sustainability are also key factors influencing product design and distribution across the diverse economic landscape of the continent. The market is slowly integrating mobile accessories into the mainstream gaming retail environment.

Latin America (LATAM): LATAM is an emerging market experiencing significant growth, driven by increasing smartphone penetration and the youth demographic's strong affinity for mobile entertainment. While price sensitivity is high, the increasing availability of mobile data plans and the development of local mobile esports scenes in countries like Brazil and Mexico are boosting demand. The market predominantly favors affordable, robust controllers, with increasing interest in integrated cooling solutions as hardware performance improves across the region.

Middle East and Africa (MEA): The MEA market, particularly the Gulf Cooperation Council (GCC) states, shows high potential due to affluent consumer bases and high mobile connectivity rates. The region exhibits high demand for premium, luxury gaming peripherals. However, hardware availability and specialized distribution networks remain a challenge in broader African nations, where the focus is strictly on affordability and basic functionality. Growth is concentrated in urban centers with robust mobile infrastructure.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Smartphone Console Market.- Razer

- Backbone

- Gamevice

- Nacon

- SteelSeries

- 8BitDo

- Sony (Licensed Partners)

- Microsoft (Licensed Partners)

- Tencent Games

- NetEase

- Logitech G

- PowerA

- Xiaomi

- Samsung

- Ipega

- Moga

- RedMagic

- Black Shark

- Asus

- Flydigi

Frequently Asked Questions

Analyze common user questions about the Smartphone Console market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected Compound Annual Growth Rate (CAGR) for the Smartphone Console Market?

The Smartphone Console Market is projected to exhibit a robust growth trajectory, achieving a Compound Annual Growth Rate (CAGR) of approximately 16.0% between the forecast years of 2026 and 2033, driven by mobile esports expansion and cloud gaming services.

How does device fragmentation impact the development of smartphone console accessories?

Device fragmentation, particularly within the Android ecosystem, is a significant restraint because varying screen sizes, port placements, and software interfaces complicate the design of universally compatible physical controllers and require continuous software updates for mapping and integration.

Which region currently leads the global Smartphone Console Market in terms of revenue and volume?

The Asia Pacific (APAC) region currently holds the dominant share of the global Smartphone Console Market, fueled by the massive participation rates in mobile esports and the high concentration of both manufacturers and dedicated mobile gaming consumers in key economies like China and South Korea.

What role do AI and machine learning play in the future of smartphone console accessories?

AI technology is pivotal for enhancing personalization and performance optimization, enabling features such as AI-driven thermal management to prevent overheating, personalized controller sensitivity suggestions, and integration of sophisticated anti-cheat mechanisms within the accessory firmware.

What is the difference between Detachable Controllers and Integrated Handhelds in this market?

Detachable Controllers clip onto the sides of a smartphone, prioritizing portability and flexibility, while Integrated Handhelds fully encase the device, offering dedicated features such as built-in batteries, active cooling systems, and specialized ergonomic grips suitable for extended, hardcore gaming sessions.

Market Dynamics Deep Dive: Technological and Competitive Forces

The core momentum driving the Smartphone Console Market is a continuous cycle of technological innovation aimed at mimicking or surpassing the performance quality of dedicated gaming devices while maintaining the mobility of the smartphone platform. This technological imperative pushes manufacturers to rapidly adopt new standards, such as magnetic mounting systems (Magsafe compatibility for iPhones) and proprietary high-speed data transmission protocols through USB-C, effectively minimizing input lag to sub-10ms levels. This pursuit of ultra-low latency is a fundamental differentiator, moving the market away from general-purpose Bluetooth controllers toward purpose-built, direct-connect peripherals that appeal directly to the professional and competitive mobile gaming community where fractions of a second matter significantly.

Furthermore, the competitive landscape is intensely dynamic, characterized by a mix of established peripheral giants (e.g., Razer, Logitech) leveraging their brand reputation and distribution networks, alongside agile, mobile-native startups (e.g., Backbone, Gamevice) focusing solely on optimizing the mobile gaming experience. This competitive tension fosters rapid product iteration, leading to the frequent introduction of enhanced features such as mechanical face buttons, customizable back paddles, and specialized ergonomic designs tailored for specific smartphone models or genres (e.g., asymmetrical stick layout favored by many FPS players). Pricing strategies are increasingly polarized, with premium products commanding high prices based on latency and feature integration, while value brands compete aggressively based on broad compatibility and mass-market accessibility.

The interplay between software ecosystems (Apple Arcade, Google Play Games) and hardware manufacturers is becoming a crucial market force. Official certification or partnerships, such as those seen between accessory providers and major cloud gaming platforms (like Microsoft’s Xbox), significantly impact consumer trust and perceived value. The ability of a manufacturer to provide robust, frequently updated companion software that simplifies control mapping, manages firmware updates, and offers performance monitoring capabilities is often as important as the physical build quality of the console itself. The convergence of hardware and proprietary software is essential for navigating the complex compatibility challenges presented by the ever-evolving mobile operating systems and APIs.

Cross-Platform Gaming and Cloud Streaming Influence

The maturation of cross-platform gaming, where titles are playable across PC, console, and mobile (e.g., Fortnite, Call of Duty: Warzone Mobile), has fundamentally redefined the value proposition of smartphone consoles. If a serious player transitions from a console session to a mobile session, they expect the input experience to be as consistent as possible to maintain competitive parity. Smartphone controllers directly address this expectation by providing the familiar feel and function of a dedicated console gamepad, thereby ensuring that mobile users are not inherently disadvantaged against PC or console players in cross-play environments. This trend elevates the smartphone console from a mere accessory to a necessary competitive tool for maintaining performance consistency across different platforms.

Cloud streaming technology represents an equally transformative influence on market demand. Services like Xbox Cloud Gaming and NVIDIA GeForce NOW enable even mid-range or older smartphones to stream graphically demanding AAA games, bypassing the limitations of the device's native processing power. For these services to be viable, however, a precise and functional controller is mandatory, as relying on touch controls for complex streamed games is generally impractical. Consequently, the cloud gaming subscriber base directly correlates with the demand for quality smartphone controllers, turning the accessory into the de facto interface for high-definition mobile streaming. Manufacturers are actively positioning their products as "Cloud Gaming Ready," often bundling free trial subscriptions or exclusive features optimized for these platforms.

The market response to cloud and cross-platform pressures involves designing controllers that are universally recognized by major gaming operating systems and cloud services (XInput compatibility being standard). This necessitates continuous collaboration with platform holders to ensure that firmware updates keep pace with changes in API requirements. Furthermore, manufacturers are exploring specialized features, such as dedicated buttons for accessing streaming menus or quick-launch features for cloud libraries, thereby integrating the accessory deeper into the overall gaming ecosystem. This technological integration ensures that the smartphone console is seen not just as a peripheral for local mobile games but as a gateway to the broader digital gaming universe.

Segment Deep Dive: Hardcore Gaming and Integrated Handhelds

The Hardcore Gaming application segment remains the most lucrative niche within the Smartphone Console Market, exhibiting the highest willingness-to-pay for performance-enhancing features. Hardcore gamers—defined by high engagement frequency and a strong competitive focus—demand uncompromising build quality, highly tactile mechanical triggers, and features that mimic professional console controllers, such as back buttons for advanced control customization (e.g., mapping jump or slide actions to less conventional, yet faster, inputs). This segment prioritizes performance specifications over portability or general versatility, leading to the proliferation of accessories that often feature substantial grips and specialized surfaces for maximum comfort during multi-hour sessions.

Aligned closely with the demands of hardcore gamers is the Integrated Handheld segment within the Type segmentation. These accessories are fundamentally designed to optimize the physical connection between the player and the game, often incorporating dedicated physical infrastructure for power management and heat dissipation. Integrated handhelds typically feature proprietary designs that provide pass-through charging at maximum speeds, minimize cable clutter, and, critically, embed active cooling elements (fans or thermal pads) directly against the phone's hotspot areas. While they sacrifice the simple clip-on convenience of detachable models, they offer a dedicated, superior experience necessary for competitive play in resource-intensive titles like Call of Duty Mobile or PUBG Mobile, where sustained high frame rates are mandatory for competitive advantage.

Market trends indicate that differentiation in the integrated segment will increasingly rely on material science and ergonomic engineering. Manufacturers are experimenting with advanced materials for improved heat transfer and lightweight, durable chassis construction. Furthermore, the integration of specialized, high-resolution haptic feedback systems, capable of delivering nuanced tactical sensations, is becoming a key feature to enhance immersion. As smartphone form factors standardize around centralized USB-C ports, integrated handheld designers are finding slightly easier pathways to universal compatibility, allowing them to focus resources on enhancing internal performance technologies rather than solely managing the physical attachment mechanisms.

Manufacturing and Supply Chain Challenges

The manufacturing process for smartphone consoles faces several unique challenges rooted in the rapid obsolescence cycle of consumer electronics and the need for high precision in gaming peripherals. The primary manufacturing difficulty lies in managing inventory and product lifecycles. Since flagship smartphones are updated annually with significant dimensional changes or port relocations, controller manufacturers must constantly adapt mold designs and internal wiring harnesses. This rapid iteration increases R&D costs and can lead to inventory write-offs if previous models become incompatible with new generations of high-end phones, creating substantial supply chain risk.

Supply chain resilience is another critical factor. The high demand for specialized components, particularly low-latency chipsets, custom mechanical switches, and advanced thermal solutions (e.g., miniature Peltier coolers), often creates reliance on a limited number of specialized suppliers, primarily located in East Asia. Any disruption to these component supplies—due to geopolitical factors, logistics constraints, or health crises—can severely impede production schedules and lead to missed market opportunities during peak demand seasons, such as major game launches or holiday periods. Maintaining redundancy in the sourcing of key materials is essential for managing this risk and ensuring consistent product delivery.

Furthermore, quality control is paramount in the gaming accessory sector. Consoles are subjected to rigorous physical stress and demanding performance expectations (e.g., button durability, stick precision, zero drift). Manufacturers must implement stringent quality assurance processes to ensure the tactile feel and responsiveness meet the high standards of competitive gamers. Defects in component assembly or firmware calibration can lead to immediate negative reviews and significant brand damage, particularly in a market heavily influenced by community reviews and professional endorsements. Therefore, investment in highly automated assembly and sophisticated testing rigs is necessary, adding to the overall cost of goods sold.

Future Outlook and Innovation Vectors

The future outlook for the Smartphone Console Market is highly optimistic, underpinned by continuous increases in mobile device processing power and the normalization of cloud gaming. Key innovation vectors point toward deeper integration with augmented reality (AR) applications, specialized controllers that feature dedicated haptic interfaces for specific AR feedback, and even modular designs that allow users to customize button layouts and grip sizes based on the game genre or ergonomic preference. Modularity addresses the long-standing conflict between device-specific design and universal compatibility, offering a sustainable path for product longevity.

Another significant area of future development is the convergence of professional mobile controllers with lifestyle and communication features. Future accessories may integrate microphones optimized for noise cancellation during competitive play or feature quick-access buttons for social features, voice chats, or streaming controls, turning the peripheral into a command center rather than just an input device. Furthermore, advanced battery technology in integrated handhelds, allowing for significantly extended play times without draining the phone's battery or requiring frequent recharging of the accessory itself, will be a crucial competitive advantage in the coming years, particularly appealing to global travelers and commuters.

Finally, the market will likely see intensified competition around proprietary software ecosystems and the implementation of AI features. Manufacturers will strive to create "walled garden" gaming experiences through their companion apps, offering exclusive software benefits like optimized network settings, personalized input profiling, and direct access to gaming communities. The success of future market leaders will depend not only on manufacturing superior physical hardware but also on establishing a robust, continuously evolving software service layer that adds intangible value and justifies premium pricing in a crowded accessory landscape.

Sustainability and Consumer Perception

Consumer perception of smartphone consoles is rapidly shifting from viewing them as niche add-ons to essential gaming tools, especially among the younger demographic who grew up with mobile gaming as their primary gaming platform. This elevated status demands corresponding improvements in product longevity and sustainability. Users are increasingly concerned about electronic waste (e-waste) generated by accessories that become obsolete when their phone model changes. Manufacturers are responding by focusing on more repairable, modular designs and using recycled materials in chassis construction to align with broader corporate social responsibility (CSR) goals and consumer ethical expectations.

The market faces a challenge in defining the "value" of a peripheral that is intrinsically dependent on another device (the smartphone). Consumer confidence is directly linked to the manufacturer's commitment to long-term compatibility updates. Brands that offer robust driver support, firmware updates spanning multiple years, and transparent communication regarding compatibility with new OS versions (iOS and Android) are likely to gain a significant competitive advantage over those that produce throwaway, single-generation accessories. This focus on software longevity is now an important component of a product's overall sustainability footprint.

Furthermore, marketing narratives are emphasizing the quality difference between generic, low-cost accessories and premium, engineered console replacements. Consumers are learning that investing in a high-quality, durable controller is cost-effective in the long run due to superior performance and reduced replacement frequency. This shift in perception, driven by detailed reviews and professional endorsements highlighting the importance of input precision, is encouraging mass-market consumers to move up the value chain, fostering a healthier, more sustainable market focused on quality rather than purely on price competition.

Regulatory Landscape and Standardization Efforts

While the Smartphone Console Market is relatively free from direct gaming-specific governmental regulations, it is heavily influenced by general electronics and wireless communication standards. Compliance with regional certifications, such as FCC standards in North America and CE marking in Europe, is mandatory for accessories utilizing wireless technology (Bluetooth or proprietary wireless protocols). Additionally, battery safety regulations and power delivery standards (especially for devices using USB Power Delivery and fast-charging passthrough) are critical compliance areas that impact design complexity and manufacturing costs.

A major indirect regulatory influence comes from the platform owners themselves. Companies like Apple and Google impose strict guidelines through their developer programs regarding accessory connectivity, power consumption, and security protocols (e.g., MFi certification for Lightning/USB-C accessories). These requirements, while not governmental regulations, effectively standardize technical specifications and dictate which manufacturers can achieve seamless, official compatibility, acting as a high barrier to entry for smaller or non-compliant brands. Adherence to these platform standards is essential for achieving optimal performance and accessing large distribution channels.

Future standardization efforts will likely focus on input mapping and interface consistency. As cloud gaming and cross-platform play expand, there is a growing industry need for universal input protocols beyond the current XInput/DInput standards to handle complex mobile-specific inputs (like touch gestures translated to buttons). Industry consortiums and competitive bodies may drive standardization of performance metrics, such as maximum allowable latency or thermal management effectiveness, to ensure fair competition and a reliable consumer experience across all mobile gaming accessories.

Marketing Strategy and Community Engagement

Effective marketing in the Smartphone Console Market relies heavily on grassroots community engagement and leveraging the authenticity of the mobile esports scene. Unlike traditional console peripherals, smartphone consoles must prove their necessity over the native touchscreen interface. Marketing strategies therefore focus on demonstrating quantifiable performance benefits, such as reduced reaction times in competitive scenarios, superior control precision in fast-paced games, and enhanced comfort during long sessions—all typically showcased through professional gameplay demonstrations and verifiable benchmarks.

A crucial component of successful strategy involves influencer marketing, particularly partnering with top mobile streamers and esports athletes who use the product in competitive tournaments. These partnerships provide immediate credibility and tangible proof of performance. Targeted advertising on platforms popular with mobile gamers, such as Twitch, YouTube Gaming, and TikTok, is essential for reaching the core demographic. Furthermore, product launches are often strategically timed to coincide with major mobile game releases or large-scale esports events to maximize visibility and establish immediate relevance.

Community feedback loops are vital for product improvement and sustained brand loyalty. High-end manufacturers actively engage with user communities (e.g., Reddit, Discord channels) to gather input on firmware features, ergonomic preferences, and compatibility issues. This direct engagement not only provides valuable R&D insight but also builds a loyal customer base that feels invested in the product's evolution. Offering exclusive software features or early access to updates for community members strengthens this bond, transforming customers into brand advocates within the highly interconnected world of mobile gaming.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager