Smartphone Repair Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434276 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Smartphone Repair Market Size

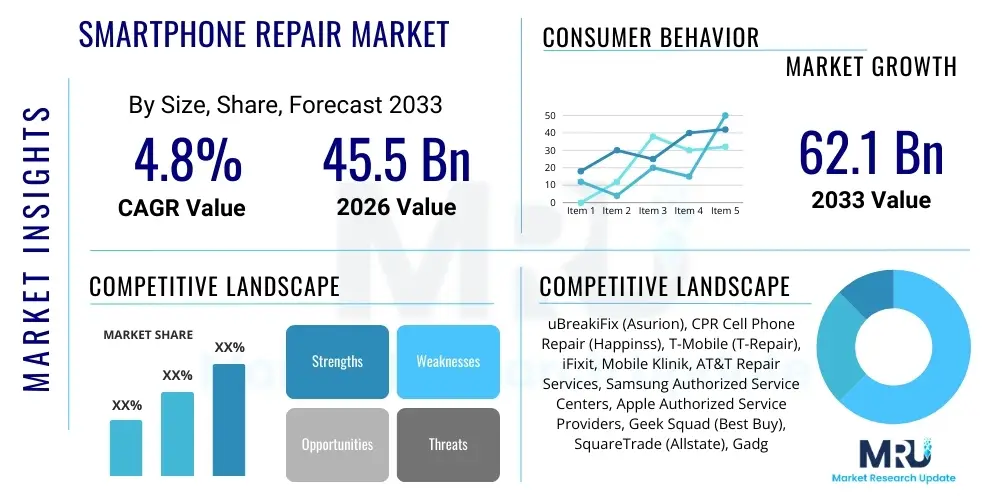

The Smartphone Repair Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 45.5 Billion in 2026 and is projected to reach USD 62.1 Billion by the end of the forecast period in 2033.

Smartphone Repair Market introduction

The Smartphone Repair Market encompasses the entire ecosystem dedicated to the maintenance, restoration, and replacement of components for mobile smart devices. This sector is characterized by a wide array of services, primarily focused on addressing physical damage such as screen cracks, battery degradation, and water damage, alongside complex internal component failures like motherboard issues and software malfunctions. The increasing average lifespan of smartphones, driven by rising device costs and enhanced durability standards, contributes significantly to the sustained demand for high-quality repair services. As consumers hold onto their devices longer, the probability of component failure increases, cementing the repair sector's essential role in the technology lifecycle.

Major applications within this market span across individual consumer needs, catering to accidental damage or general wear and tear, and corporate applications, where fleet management and device longevity are critical for business operations. The primary product is the repair service itself, often differentiated by complexity—ranging from straightforward screen swaps to intricate micro-soldering procedures. Key benefits driving market adoption include cost-effectiveness compared to new device purchases, rapid turnaround times offered by third-party repair shops, and the environmental advantage of reducing electronic waste (e-waste) by promoting device reuse and refurbishment. These factors collectively position the market as a crucial enabler of sustainable technology consumption.

Driving factors propelling this market include the global increase in smartphone penetration, particularly in emerging economies, the introduction of expensive, non-user-serviceable designs by major OEMs (Original Equipment Manufacturers), and the growing consumer awareness regarding environmental responsibility. Furthermore, regulatory shifts, such as the 'Right to Repair' movement across North America and Europe, are fundamentally reshaping the market landscape by increasing access to genuine parts, repair documentation, and diagnostic tools for independent service providers, thus fostering competitive growth and better service accessibility for the end-user base.

Smartphone Repair Market Executive Summary

The Smartphone Repair Market is poised for substantial growth, driven primarily by evolving business trends that emphasize sustainability, device longevity, and robust aftermarket service ecosystems. A key trend involves the consolidation of independent repair shops under major national and international chains, enhancing service standardization and trust. Additionally, insurance providers are playing an increasingly dominant role, integrating repair services directly into their premium offerings, thereby ensuring a steady volume of repair work flows toward authorized and preferred third-party partners. Technological advancements in diagnostic tools and automated repair equipment are streamlining operations, reducing repair times, and improving service quality across the board.

Regionally, the market dynamics vary significantly. Asia Pacific (APAC) represents the largest volume market due to massive installed user bases in countries like China and India, high replacement cycles, and a proliferation of affordable, localized repair services. North America and Europe, however, lead in terms of revenue generated per repair, driven by higher average device costs, complex proprietary technology, and the enforcement of the 'Right to Repair' legislation which encourages formal, transparent repair channels. Latin America and the Middle East & Africa (MEA) are emerging as high-growth regions, fueled by rising disposable incomes and the increasing affordability of mid-range smartphones, requiring local infrastructure development for efficient after-sales support.

Segment trends highlight the dominance of screen replacement services, consistently representing the largest revenue share due to their high frequency of damage. However, the battery replacement segment is experiencing the highest growth CAGR, spurred by device optimization efforts, consumer demand for peak performance, and recent battery gate scandals emphasizing transparency. The shift toward third-party repair stores continues, as they offer significant price advantages and faster turnaround times compared to OEM authorized centers, although OEM efforts to restrict parts access remain a competitive constraint, leading to significant legal and policy debates influencing segment structure.

AI Impact Analysis on Smartphone Repair Market

Common user questions regarding AI's impact on the Smartphone Repair Market revolve around the potential for job displacement among repair technicians, the capability of AI-driven diagnostics to accurately pinpoint intermittent faults, and whether AI can automate complex repairs, reducing the need for specialized human intervention. Users are also concerned about the privacy implications of AI systems accessing device data during diagnostic processes and the role of machine learning in optimizing supply chains for spare parts. The core expectation is that AI will enhance efficiency, speed up the diagnostic process, and potentially lower costs for consumers, while the core concern remains the balance between automation efficiency and retaining the necessity for skilled manual repair expertise, especially for intricate hardware tasks like micro-soldering.

Artificial Intelligence and Machine Learning are revolutionizing the initial stages of the smartphone repair workflow, primarily through sophisticated diagnostic software. AI algorithms can analyze vast datasets of past repair failures and symptoms reported across multiple devices to predict component failure probability and instantly recommend optimal repair pathways. This capability significantly reduces the time spent by technicians on manual troubleshooting, ensuring higher accuracy, especially for intermittent or subtle software-hardware conflicts that are difficult for human technicians to isolate quickly. Furthermore, predictive maintenance models, often powered by embedded AI in modern operating systems, can alert users to potential component degradation (like battery wear or declining flash storage health) before catastrophic failure occurs, shifting the market towards proactive service.

The operational application of AI extends beyond diagnostics into logistical and inventory management. Machine learning models optimize the stocking of spare parts by analyzing regional failure rates, seasonal demand fluctuations, and supply chain lead times, minimizing inventory holding costs while ensuring parts availability for high-demand repairs like screen or battery replacements. While advanced hardware repairs still require human dexterity, AI-powered robotics are being tested for highly repetitive, standardized tasks, such as automated screw removal and reinstallation, or precise application of adhesives, particularly in OEM factory environments. This phased introduction of automation suggests AI will act more as an augmentative tool for technicians rather than a complete replacement, focusing skilled labor on high-value, non-standardized repairs.

- AI-powered predictive diagnostics accelerate fault identification and increase first-time fix rates.

- Machine learning algorithms optimize spare parts inventory management based on regional failure trends.

- Automation reduces labor costs for standardized tasks like screen removal and testing.

- Natural Language Processing (NLP) enhances remote troubleshooting and customer support interfaces.

- AI supports the development of sophisticated repair guides and augmented reality tools for technicians.

DRO & Impact Forces Of Smartphone Repair Market

The Smartphone Repair Market is shaped by a confluence of strong Drivers, inherent Restraints, substantial Opportunities, and impactful external forces. The key Driver is the skyrocketing cost of flagship smartphones, making repair a financially viable alternative to replacement. This is coupled with growing environmental consciousness, positioning repair as a key element of the circular economy. Restraints include the persistent challenge of OEM proprietary designs and warranty restrictions, which often push consumers toward authorized centers, limiting the competitive scope of independent providers. Opportunities arise from the global 'Right to Repair' movement, which promises standardized access to parts and schematics, and the rapid expansion of the refurbishment sector. The primary Impact Forces include rapid technological obsolescence and shifting consumer loyalty between price and authorized quality.

Drivers: The high saturation rates in mature markets mean growth must come from maintaining existing devices rather than new sales. Furthermore, improvements in the quality of replacement parts, even those sourced from third parties, have reduced the perceived risk associated with non-authorized repairs. The expansion of mobile insurance schemes globally acts as a significant volume driver, channeling insured damages into established repair pipelines. The psychological factor of data security also favors repair; consumers often prefer repairing an existing device rather than transferring sensitive information to a new handset, viewing repair as a less intrusive option.

Restraints: Significant restraints include the complexity introduced by modern device design, such as glued-in components and specialized fasteners, which require costly proprietary tools and high-level technical expertise. The counterfeit parts issue continues to plague the market, damaging consumer trust and creating safety hazards, especially concerning batteries. Moreover, the reliance on highly skilled technicians limits rapid scalability in certain specialized repair segments, such as intricate component-level motherboard repairs, creating bottlenecks in service delivery and raising labor costs.

Opportunities: A major opportunity lies in the B2B segment, specifically managing corporate device fleets and school technology programs, which require large-scale, consistent repair and maintenance contracts. The expansion into niche component-level repairs (micro-soldering services) offers higher profit margins and differentiates advanced providers from basic screen replacement shops. Furthermore, the growth in 5G device adoption introduces new repair complexities (e.g., integrated antennas, complex thermal management systems) that necessitate specialized training, creating a barrier to entry for untrained providers and providing an advantage to certified technicians and authorized service networks.

Impact Forces: The most significant impact force is regulatory change driven by the 'Right to Repair,' potentially democratizing the market by ensuring fair access to essential repair resources. Conversely, rapid technological advances, such as increasingly modular designs or sophisticated internal diagnostics, could simplify some repairs while making others more technologically inaccessible, necessitating continuous investment in new training and diagnostic equipment. Economic stability influences consumer decisions, with economic downturns often increasing repair volumes as consumers delay new purchases, while booming economies might slightly shift preference towards immediate replacement.

Segmentation Analysis

The Smartphone Repair Market is comprehensively segmented based on the type of repair service provided, the nature of the service provider, the specific device operating system, the component requiring attention, and the ultimate end-user requiring the service. This segmentation allows for precise market sizing and strategic targeting, recognizing that the demands and pricing structures differ significantly between, for instance, a simple battery replacement performed by a third-party store versus a complex sensor calibration carried out at an OEM authorized center. Understanding these segments is vital for businesses seeking to specialize or diversify their service offerings across the value chain, ensuring alignment with consumer readiness to pay and regional regulatory environments regarding component sourcing.

The segmentation by Type of Repair highlights the recurring nature of physical damage, dominated by screen and battery services, which drives high-volume transactional revenue. Conversely, water damage and component-level repairs, while lower in volume, command premium pricing due to the specialized equipment and technical skill required. The Service Provider segment distinguishes between the high trust, high-cost model of OEMs and the high-speed, lower-cost model of Independent Repair Professionals, reflecting different consumer priorities regarding warranty preservation versus immediate affordability. Device Type segmentation primarily addresses the ecosystem differences between iOS and Android devices, particularly concerning parts availability, proprietary locking mechanisms, and required specialized diagnostic software, heavily influencing the tools used by technicians.

- By Type of Repair:

- Screen Replacement

- Battery Replacement

- Camera & Sensor Repair

- Water Damage Repair

- Software/OS Fixes (incl. unlocking, data recovery)

- Component Replacement (IC/Motherboard)

- By Service Provider:

- OEM/Authorized Service Centers

- Third-Party Repair Stores (Chains/Franchises)

- Independent Repair Professionals

- Insurance Providers (Handling coordination)

- By Device Type:

- Android Smartphones

- iOS Smartphones

- Other OS Devices

- By Component:

- Internal Components (Motherboard, Logic Board, IC Chips)

- External Components (Display, Housing, Camera Module)

- By End-User:

- Individual Customers (B2C)

- Corporate/Enterprise Users (B2B Fleet Management)

Value Chain Analysis For Smartphone Repair Market

The Smartphone Repair Market value chain is complex, starting with the upstream sourcing of components and ending with the delivery of a serviced device back to the consumer. Upstream activities are dominated by component manufacturing, where OEMs and specialized aftermarket component suppliers produce screens, batteries, and integrated circuits. OEM suppliers maintain tight control over genuine parts, impacting availability and pricing for unauthorized service providers. Independent suppliers, largely based in Asia, focus on producing high-quality equivalent or refurbished parts, creating a tiered supply structure that dictates the quality and cost profile of the resulting repair service. Effective supply chain management, minimizing logistics costs and ensuring authenticity verification, is critical at this stage.

The midstream involves the core repair and service delivery processes. This stage is segmented by the service channel: Direct channels, typically operated by OEMs (e.g., Apple Store Geniuses, Samsung Authorized Service Centers), provide repairs using genuine parts with guaranteed warranties but often at a higher cost. Indirect channels involve third-party franchises (like uBreakiFix or CPR) and independent shops, which leverage scale or specialized skills (micro-soldering) to offer competitive pricing and faster turnaround times, often using aftermarket components. The performance of this stage is highly dependent on technical skill acquisition, efficient diagnostic tools, and managing customer expectations regarding part quality and repair complexity.

Downstream activities center on customer interaction, device handover, and the recycling/refurbishment loop. Distribution channels are primarily physical storefronts, mail-in services, and increasingly, mobile repair vans providing on-site services, enhancing convenience. Refurbishment, which relies heavily on repaired devices and salvaged components, acts as a crucial feedback loop, extending the device lifecycle and feeding components back into the supply chain, particularly for older models where new parts are scarce. The success of the downstream phase is measured by customer satisfaction, warranty fulfillment rates, and the seamless integration of logistics for device collection and return, ultimately supporting market stability and consumer trust in the repair ecosystem.

Smartphone Repair Market Potential Customers

Potential customers for the Smartphone Repair Market are broadly categorized into two main groups: individual consumers who constitute the vast majority of transactional volume, and corporate or enterprise clients who drive the demand for structured, high-volume maintenance contracts. Individual customers are typically driven by necessity stemming from accidental damage or component failure (e.g., shattered screens, dead batteries). Their purchasing decisions are highly sensitive to repair cost, turnaround time, and the perceived quality and longevity of the repair, often balancing the cost of repair against the remaining value of the device and the cost of a replacement.

The needs of these B2C customers vary significantly based on device age and cost. Owners of flagship, expensive devices often prioritize authorized repairs using genuine parts to maintain warranty status and perceived resale value, making them prime targets for OEM service centers. Conversely, owners of older or budget smartphones are highly focused on minimizing expense and maximizing convenience, making them ideal clients for third-party repair shops and independent technicians offering fast, affordable services using high-quality aftermarket parts. This segment also includes individuals seeking specialized services like advanced data recovery, a high-margin niche.

Corporate/Enterprise users represent a substantial potential customer base in the B2B segment. These organizations manage large fleets of devices, utilizing smartphones for essential operational activities. Their requirements center around minimizing device downtime, ensuring regulatory compliance regarding data wiping and security during service, and securing fixed-price, bulk maintenance contracts with guaranteed service levels (SLAs). Key buyers here include IT departments, telecommunications managers, and logistics companies, who prefer providers capable of handling complex logistics, providing detailed reporting on device health, and offering integrated trade-in or refurbishment options at the end of the contract term.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 45.5 Billion |

| Market Forecast in 2033 | USD 62.1 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | uBreakiFix (Asurion), CPR Cell Phone Repair (Happinss), T-Mobile (T-Repair), iFixit, Mobile Klinik, AT&T Repair Services, Samsung Authorized Service Centers, Apple Authorized Service Providers, Geek Squad (Best Buy), SquareTrade (Allstate), Gadget Surgeon, Hitech Gadget Repair, Fixez, Huawei Authorized Services, Xiaomi Service Centers, Nokia Care, Fonecare, Techy Company, Quick Mobile Repair, Mobiclinic |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Smartphone Repair Market Key Technology Landscape

The technology landscape of the Smartphone Repair Market is rapidly evolving, driven by the need for increased precision, speed, and diagnostic accuracy to handle increasingly complex device architectures. A core technological reliance is placed upon advanced diagnostic hardware and software platforms that can interface directly with proprietary device operating systems and identify component-level failures without extensive physical disassembly. Sophisticated multi-metering tools, coupled with thermal imaging cameras, are becoming standard requirements for troubleshooting short circuits or hidden board damage. Furthermore, specialized machines for screen refurbishment, utilizing vacuum laminators and precise cutting tools for glass replacement, significantly reduce the cost of screen repairs by enabling the separation and reuse of the original display panels and components, rather than replacing the entire module.

Another crucial technological advancement is in the field of micro-soldering and rework stations. As PCBs (Printed Circuit Boards) become smaller and more densely packed, the repair of integrated circuits (ICs), connectors, and complex components demands highly specialized equipment, including high-definition microscopes, precise temperature-controlled soldering irons, and BGA (Ball Grid Array) rework stations. These tools are essential for component-level repair, which offers a cost-effective alternative to expensive motherboard replacement and is a major differentiator for advanced independent repair facilities. Training protocols are also increasingly utilizing Virtual Reality (VR) and Augmented Reality (AR) tools to simulate complex procedures, enhancing technician proficiency before handling actual customer devices.

The implementation of secure data management and wiping solutions is paramount, especially when handling devices containing sensitive personal or corporate data. Technicians rely on certified, forensic-level data wiping tools to ensure compliance with privacy regulations (like GDPR) before and after certain repairs, especially for devices undergoing complete refurbishment or trade-in. Finally, the development of sophisticated inventory management software integrated with supply chain forecasting (often utilizing AI, as noted previously) ensures that the highly volatile demand for specific parts (e.g., the latest iPhone screen or Samsung battery) can be met efficiently, reducing customer waiting times and increasing service throughput across all service provider segments.

Regional Highlights

The global Smartphone Repair Market exhibits distinct regional consumption patterns, regulatory environments, and competitive structures, significantly influencing localized growth trajectories and market maturity.

- Asia Pacific (APAC): APAC is the largest market by volume, characterized by high mobile phone penetration, a fragmented competitive landscape featuring numerous small, independent repair shops, and rapid device replacement cycles in key economies like China and India. However, the sheer density of the population and the prevalent use of budget and mid-range devices mean that cost-sensitivity drives demand heavily towards affordable third-party repairs. OEM presence is strong but often outpaced by the speed and accessibility of local repair ecosystems, which face ongoing challenges related to component authenticity and quality control.

- North America: North America is defined by high average repair revenue due to the dominance of expensive flagship devices and a robust regulatory environment supporting consumer rights. The market is highly consolidated, with major insurance providers (like Asurion/uBreakiFix and Allstate/SquareTrade) and carrier-affiliated repair centers holding significant market share. The burgeoning 'Right to Repair' legislation at the state level is expected to rapidly increase the competitive access of independent repair professionals to genuine parts and diagnostic information, potentially driving down costs and improving service coverage outside major metropolitan areas.

- Europe: Europe represents a mature market with high regulatory standards, particularly driven by environmental and consumer protection policies focusing on e-waste reduction and promoting device longevity. The implementation of standardized EU-wide regulations regarding repairability indexes and the push for repair over replacement strongly favor formal repair channels, both authorized and certified third-party providers. Mail-in repair services are highly popular across several European nations due to efficient postal logistics and high urbanization rates, complementing the traditional brick-and-mortar repair presence.

- Latin America (LATAM): The LATAM region is characterized by significant price sensitivity, reliance on unofficial or grey market repair channels, and high import taxes on new devices, making repair an essential service. Growth is fueled by increasing smartphone adoption and a youthful population base. The primary challenge is the lack of formal infrastructure and training, leading to quality inconsistencies. This provides a significant opportunity for international franchise chains to establish standardized, reliable service networks and capture professional repair demand.

- Middle East and Africa (MEA): MEA is a rapidly growing market, driven by expanding mobile connectivity and improving economic conditions. The market structure is highly dependent on regional socio-economic factors, with wealthy GCC nations prioritizing authorized, high-quality repairs for premium devices, while African sub-regions exhibit strong demand for cost-effective repair solutions for older or budget feature phones and smartphones, often requiring innovative logistics and modular repair approaches due to supply chain complexities.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Smartphone Repair Market.- uBreakiFix (Asurion)

- CPR Cell Phone Repair (Happinss)

- T-Mobile (T-Repair)

- iFixit

- Mobile Klinik

- AT&T Repair Services

- Samsung Authorized Service Centers

- Apple Authorized Service Providers

- Geek Squad (Best Buy)

- SquareTrade (Allstate)

- Gadget Surgeon

- Hitech Gadget Repair

- Fixez

- Huawei Authorized Services

- Xiaomi Service Centers

- Nokia Care

- Fonecare

- Techy Company

- Quick Mobile Repair

- Mobiclinic

Frequently Asked Questions

Analyze common user questions about the Smartphone Repair market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the growth of the Smartphone Repair Market?

The core driver is the increasing cost of new smartphones, coupled with enhanced consumer awareness regarding the environmental benefits of extending device lifespan, making repair a financially and ecologically preferred choice over immediate replacement. Regulatory movements like 'Right to Repair' further accelerate this growth by easing access to necessary components.

How does the 'Right to Repair' movement specifically impact independent repair shops?

The 'Right to Repair' legislation mandates that OEMs provide access to genuine parts, diagnostic tools, and necessary repair documentation to independent repair shops and consumers. This access levels the playing field, reduces the monopoly on repairs held by authorized service centers, and increases the competitiveness and service scope of third-party providers, ensuring quality without voiding consumer warranties unnecessarily.

Which type of repair service generates the highest volume of transactions globally?

Screen replacement consistently generates the highest volume of repair transactions worldwide, followed closely by battery replacement. Due to their external nature and high susceptibility to accidental damage, display assemblies are the most frequently failed component, creating stable, high-volume demand for repair services across all market segments.

What is the role of Artificial Intelligence (AI) in modern smartphone repair diagnostics?

AI's role is primarily focused on accelerating fault diagnosis and optimizing supply chain logistics. AI systems analyze historical failure data to predict potential component issues and instantly recommend precise repair protocols, drastically reducing manual troubleshooting time and improving the accuracy of complex repairs like logic board failures, thereby enhancing overall service efficiency.

Are OEM authorized service centers generally preferred over third-party repair shops?

Preference is segmented. OEM authorized centers are generally preferred by owners of new, premium devices seeking to maintain official warranties and guarantee the use of genuine parts, despite higher costs and longer wait times. Third-party shops are preferred for older devices or by cost-sensitive consumers due to their lower pricing, faster turnaround times, and greater geographical accessibility.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager