Smoking Shelters Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434756 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Smoking Shelters Market Size

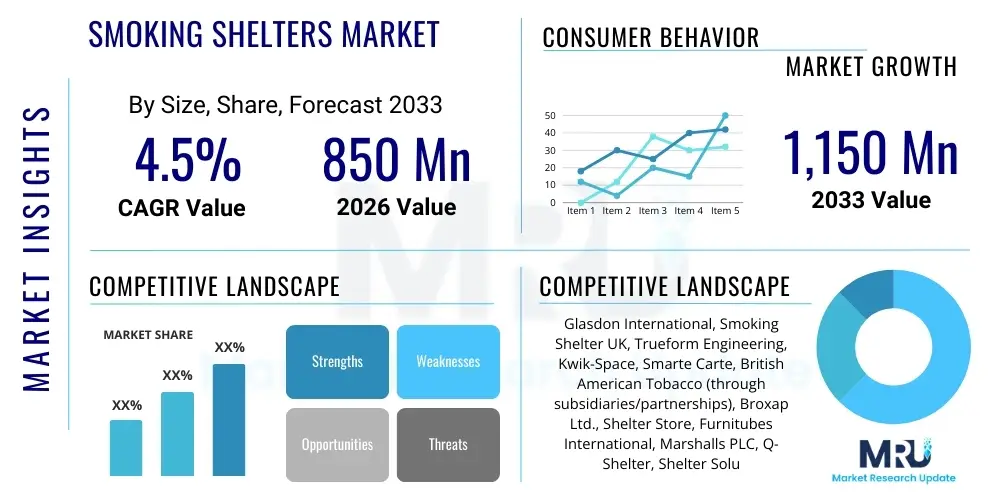

The Smoking Shelters Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.5% between 2026 and 2033. The market is estimated at USD 850 Million in 2026 and is projected to reach USD 1,150 Million by the end of the forecast period in 2033.

Smoking Shelters Market introduction

The Smoking Shelters Market encompasses the design, manufacturing, and installation of dedicated outdoor structures intended to provide legal, compliant, and comfortable designated areas for tobacco and sometimes vaping users. These structures are crucial for ensuring adherence to increasingly stringent public health legislation, which typically prohibits smoking within enclosed public and workplace environments. Modern smoking shelters are engineered for durability, using materials like steel, aluminum, and toughened polycarbonate, often incorporating features such as integrated seating, ventilation systems, and specialized waste receptacles (e.g., cigarette disposal bins). The necessity of these products is driven directly by occupational safety requirements and governmental mandates aimed at protecting non-smokers from secondhand smoke exposure.

The primary applications of smoking shelters span across diverse institutional and commercial landscapes, including large corporate headquarters, manufacturing facilities, transportation hubs such as airports and train stations, educational campuses, and healthcare premises. Their core benefit lies in harmonizing the legal right of individuals to smoke in designated zones with the public health requirement for smoke-free main premises. Furthermore, by providing a clearly defined area, these shelters help maintain the aesthetic cleanliness of surrounding outdoor spaces and manage smoke emissions effectively, thereby reducing litter and enhancing overall site management efficiency. The evolution of these shelters now includes modular and custom-built options, catering to specific architectural or spatial constraints.

Driving factors propelling market expansion include the global acceleration of anti-smoking legislation, particularly in developed economies, necessitating immediate facility upgrades by businesses and public entities to avoid hefty fines. There is a concurrent trend toward improving employee welfare, where employers recognize the value of providing high-quality, weather-protected areas for breaks. The integration of sustainable materials and smart features, such as solar-powered lighting and real-time occupancy sensors, further enhances the appeal and functional utility of these structures, positioning them as essential elements of modern facility infrastructure management.

Smoking Shelters Market Executive Summary

The global Smoking Shelters Market demonstrates robust growth primarily driven by regulatory enforcement and infrastructural modernization across institutional and commercial sectors. Key business trends include a strong shift toward modular construction and customizable, aesthetically integrated designs that complement modern architecture, moving away from utilitarian, temporary structures. Manufacturers are increasingly focusing on durable, low-maintenance materials like galvanized steel and high-grade aluminum, alongside UV-protected polycarbonate roofing, ensuring longevity and compliance with diverse weather conditions. Supply chain optimization is focusing on localized production and faster installation timelines to meet the urgent compliance deadlines faced by end-user organizations globally. Furthermore, the increasing demand for combined smoking/vaping solutions is reshaping product specifications.

Regionally, Europe remains a primary revenue generator, owing to its stringent, well-established anti-smoking directives (such as the EU Tobacco Products Directive and local national laws, e.g., in the UK and Ireland) which mandate clear demarcation of smoking areas, especially in employment settings and public access facilities. North America follows closely, characterized by significant investment in upgrading existing infrastructure in corporate parks and major transportation centers, often exceeding minimum legal requirements to enhance user comfort. The Asia Pacific (APAC) region is projected to register the fastest growth, fueled by rapid urbanization, increasing awareness of public health mandates, and the subsequent modernization of infrastructure in countries like India, China, and Southeast Asian nations. Regulatory adoption in these developing markets is accelerating the need for standardized shelter solutions.

Segment trends highlight the dominance of partially enclosed shelters, which offer adequate weather protection while satisfying open-air requirements specified in many legal codes. The material segment sees high demand for steel and aluminum due to their strength and recyclability. Application-wise, corporate campuses and manufacturing/industrial sites represent the largest segment, driven by the sheer number of employees requiring designated break areas. There is an emerging niche growth in the healthcare facilities segment, where strict rules regarding proximity to entrances necessitate high-specification, often bespoke, shelter designs to manage patient and visitor needs away from sterile zones.

AI Impact Analysis on Smoking Shelters Market

User queries regarding the impact of Artificial Intelligence on the Smoking Shelters Market generally revolve around optimizing usage, enhancing security, improving maintenance efficiency, and integrating these structures into broader Smart City frameworks. Common concerns include how AI can monitor shelter occupancy to inform cleaning schedules, whether facial recognition or sensor technology could enforce age restrictions or non-smoking policies within surrounding areas, and the use of predictive maintenance algorithms for structural integrity and ventilation systems. Users seek confirmation on whether AI could make the shelters "smarter" than simple, static structures, transforming them into data-gathering points that contribute to facility management dashboards. The key theme is the shift from passive compliance tools to active, managed environmental control units.

While AI does not directly influence the core manufacturing of the physical structure itself, its applications revolutionize the operational utility and management lifecycle of smoking shelters. The most immediate impact lies in data collection via Internet of Things (IoT) sensors integrated into the shelter design. These sensors, coupled with AI analytics, can monitor key environmental factors such as air quality, temperature, and most critically, real-time occupancy rates. This data allows facility managers to optimize resource allocation, ensuring cleaning teams are dispatched based on actual usage patterns rather than fixed schedules, leading to significant operational cost reductions and improved user experience. Furthermore, AI-driven camera systems can detect prohibited activities, such as attempted arson or vandalism, triggering immediate alerts.

A further sophisticated integration involves using predictive analytics for maintenance. By analyzing vibration data (for structural integrity) or usage spikes (for component wear like lighting or ventilation fans), AI algorithms can forecast potential failures before they occur. This proactive approach minimizes downtime and extends the lifespan of the assets. For municipalities adopting Smart City initiatives, the placement and utilization data gathered by AI-enabled shelters can inform urban planning decisions regarding public space allocation, pedestrian flow management, and targeted public health campaigns. This evolution transforms the smoking shelter from a static piece of street furniture into a dynamically managed component of a modern facility ecosystem.

- AI-powered sensor integration optimizes maintenance scheduling based on real-time occupancy data.

- Predictive maintenance algorithms analyze structural vibration and component usage to prevent operational failures.

- Smart ventilation systems use AI to modulate airflow intensity based on current air quality and user density.

- Computer vision systems monitor compliance within or immediately surrounding the shelter (e.g., detecting unauthorized dumping or fire hazards).

- Data analytics generated by shelters contributes to broader Smart Facility Management systems, informing resource allocation and security patrols.

DRO & Impact Forces Of Smoking Shelters Market

The market dynamics for smoking shelters are primarily dictated by a powerful intersection of stringent government regulations (Driver), high initial capital expenditure (Restraint), and the burgeoning trend towards corporate environmental and social governance (Opportunity). The overriding impact force is the non-negotiable nature of compliance; facilities must install designated areas to operate legally, regardless of internal preferences. This regulatory pressure ensures a persistent baseline demand. However, the market structure is also influenced by macroeconomic factors, such as construction material price volatility and the specialized nature of installation, which significantly impacts overall project cost and timeline variability.

Drivers: The dominant driver is the continuous tightening of global tobacco control laws and occupational health standards. Governments worldwide are consistently expanding the definition of smoke-free environments, pushing designated smoking areas further away from building entrances, ventilation systems, and public walkways. This legislative environment creates a non-discretionary procurement necessity for organizations. Furthermore, the growing corporate emphasis on employee wellbeing and responsible corporate citizenship fuels the demand for high-quality, comfortable, and safe shelters that demonstrate commitment to both smokers and non-smokers. The increasing complexity of differentiating between tobacco smoking and e-cigarette/vaping rules also necessitates clearer, custom-designed facilities, driving new product cycles.

Restraints: Significant restraints include the substantial initial investment required for high-quality, architecturally compliant shelters, particularly those meeting specific wind load and anti-vandalism standards. For small and medium-sized enterprises (SMEs) or facilities with limited outdoor space, the cost and spatial requirements can be prohibitive. Another major restraint is the societal push toward completely smoke-free campuses (e.g., within certain healthcare and educational sectors), which paradoxically reduces the perceived need for a designated shelter in favor of absolute prohibition. Additionally, the fluctuating costs of raw materials, such as galvanized steel, aluminum, and specialized polycarbonate, introduce unpredictability into manufacturing costs, affecting final market pricing and project budgeting.

Opportunities: Major opportunities lie in the development of multi-functional shelters that integrate renewable energy sources (solar power for lighting and charging ports) and sophisticated air purification technology, transforming them into environmental control units. The modular segment presents strong growth potential, allowing for rapid deployment and scalability across diverse geographic locations and temporary sites (e.g., construction projects or large outdoor events). Furthermore, the convergence of smoking and vaping regulations opens a niche for hybrid shelters designed specifically to manage both types of emissions, appealing to a broader user base and ensuring future regulatory compliance. Market players focusing on leasing or subscription models for shelters can mitigate the initial capital expenditure hurdle for customers, broadening market penetration.

Segmentation Analysis

The Smoking Shelters Market is meticulously segmented based on Type, Material, and Application, reflecting the diverse needs across industrial, commercial, and public sectors. The segmentation allows manufacturers to tailor solutions concerning regulatory compliance, aesthetic requirements, and budgetary constraints. Type segmentation, distinguishing between fully enclosed, partially enclosed, and modular units, is crucial as regulations often dictate the minimum level of openness required for a shelter to be legally considered "outside" or "open air." Material segmentation, including steel, aluminum, and polycarbonate, addresses durability, maintenance, and environmental considerations, with end-users often prioritizing long-lasting, weather-resistant options to minimize lifecycle costs. Application segmentation defines usage patterns and scale, ranging from small retail establishments to vast industrial complexes, each requiring specific capacities and installation complexity.

The partially enclosed segment dominates the market by type because it generally satisfies the legal requirements for designated smoking areas in most jurisdictions, which often necessitate a significant amount of permanent opening to be exempt from indoor air quality restrictions. These structures offer essential rain and wind protection without the intensive ventilation demands of fully enclosed systems, striking an optimal balance between compliance and user comfort. In terms of material, galvanized steel remains the backbone due to its strength, resistance to vandalism, and cost-effectiveness, although lightweight aluminum is gaining traction in areas requiring faster assembly and less intrusive foundation work. The ongoing innovation in polymer and polycarbonate sheeting focuses on enhanced UV protection and scratch resistance, improving the longevity of the transparent elements.

Application analysis confirms that the industrial and manufacturing sectors are the primary consumers, driven by large employee populations and mandatory compliance with occupational health and safety regulations on extensive sites. However, the commercial and public transport segment is experiencing significant qualitative growth, demanding high-end, bespoke architectural solutions that integrate seamlessly into modern airport terminals, railway stations, and corporate headquarters. The future growth trajectory is heavily weighted toward modular solutions, as they offer scalability and flexibility essential for dynamic environments or temporary installations, responding quickly to changes in facility layout or regulatory interpretation. Understanding these segments is paramount for strategic market entry and targeted product development.

- Type: Fully Enclosed, Partially Enclosed, Modular Shelters

- Material: Galvanized Steel, Aluminum, Polycarbonate, Toughened Glass, Others (Composite Materials)

- Application: Corporate Campuses & Offices, Manufacturing & Industrial Facilities, Public Spaces (Airports, Train Stations, Bus Stops), Healthcare Facilities, Educational Institutions, Retail and Hospitality

Value Chain Analysis For Smoking Shelters Market

The Value Chain for the Smoking Shelters Market starts with the upstream sourcing of raw materials, primarily steel, aluminum, and high-performance polymers (polycarbonate and acrylic). This upstream segment is highly sensitive to global commodity prices and relies on specialized suppliers ensuring material certifications (e.g., fire ratings and structural integrity standards). Manufacturers must maintain robust relationships with metal fabrication shops and material extruders to ensure consistent quality and timely delivery, as supply chain disruptions can heavily impact production lead times, which are crucial for meeting customer compliance deadlines. Efficiency in this stage focuses on negotiating favorable long-term contracts for standardized materials and optimizing cutting and welding processes to minimize waste.

The midstream phase involves manufacturing, assembly, and quality assurance. This stage focuses on precision engineering, incorporating features like anti-vandalism design, modularity for flat-pack shipment, and adherence to specific regional building codes (e.g., seismic or snow load requirements). Distribution is a critical junction, involving a mix of direct and indirect channels. Direct sales are common for large, bespoke corporate projects where consultation and customization are necessary. Indirect distribution utilizes specialized industrial equipment distributors, construction contractors, and facility management companies that incorporate smoking shelters into broader site development packages. The effectiveness of the indirect channel is tied to the distributors' geographic reach and existing client base within the relevant application sectors.

The downstream phase encompasses installation, commissioning, maintenance, and end-of-life management. Professional installation, often managed by the manufacturer or certified contractors, is vital to ensure structural integrity and warranty validity. Post-sale services, including maintenance contracts for cleaning, structural checks, and repairs (especially of polycarbonate panels prone to scratching), contribute significantly to the total revenue generated over the shelter's lifecycle. Direct channels typically manage comprehensive maintenance programs, while indirect channels might rely on third-party service providers. The ultimate downstream buyers, the end-users (corporations, hospitals, etc.), drive demand by seeking long-term, low-maintenance solutions.

Smoking Shelters Market Potential Customers

The primary consumers and end-users of smoking shelters are large institutions and commercial entities that operate extensive facilities and employ a significant workforce, making compliance with health and safety regulations a major operational priority. These organizations include multi-national corporations with large campuses, where employee morale and adherence to site-specific rules are essential. Secondly, heavy industrial sectors, such as manufacturing plants, refineries, logistics hubs, and warehouses, represent massive buying potential due to their vast employee numbers and the strict demarcation required between operational zones and rest areas. These industrial customers prioritize durability, robustness (anti-vandalism features), and low-cost maintenance over aesthetic appeal.

A second crucial customer group comprises government and public sector organizations, particularly those managing high-traffic public access points. This includes airport authorities, national railway operators, municipal bus depot administrators, and large government administrative buildings. Their purchasing decisions are heavily influenced by public tendering processes, emphasizing compliance with accessibility standards (ADA/DDA), fire safety, and integration into existing public infrastructure. The demand from this sector focuses on high capacity, superior durability, and long-term warranties, often necessitating custom designs to fit specific public space constraints and heritage considerations.

Finally, specialized sectors like healthcare and higher education institutions form a dedicated niche. Hospitals often have zero-tolerance policies requiring shelters to be situated far from patient entrances and vents, driving demand for specialized, sometimes highly discreet, units. Educational facilities, especially large universities, need multiple, scattered shelters to serve diverse campus populations while maintaining strict regulatory boundaries regarding student proximity to smoking areas. These customers frequently require shelters with integrated security features, such as CCTV integration and heavy-duty, tamper-proof construction, aligning with overall institutional security protocols.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 850 Million |

| Market Forecast in 2033 | USD 1,150 Million |

| Growth Rate | 4.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Glasdon International, Smoking Shelter UK, Trueform Engineering, Kwik-Space, Smarte Carte, British American Tobacco (through subsidiaries/partnerships), Broxap Ltd., Shelter Store, Furnitubes International, Marshalls PLC, Q-Shelter, Shelter Solutions Inc., Urban Metalwork, Steel Structures UK, Vaporshield, Outdoor Design, Shelter Works, A&S Landscape, Falco Street Furniture, The Smoking Shelter Company. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Smoking Shelters Market Key Technology Landscape

The technological landscape of the Smoking Shelters Market is increasingly focused on smart integration, material science advancements, and modular construction techniques to enhance functionality, sustainability, and ease of deployment. Traditional shelter manufacturing relied on basic metal fabrication, but modern demands necessitate advanced Computer-Aided Design (CAD) and modular engineering principles. Modular technology allows for the pre-fabrication of standardized components that can be quickly assembled on-site with minimal disruption, reducing construction time and labor costs significantly. This methodology is particularly relevant for large corporate clients or public sector projects requiring rapid deployment across multiple locations while maintaining uniform quality and design standards, effectively addressing scale and consistency challenges.

Material innovation plays a critical role in differentiating products. Key technological advances include the use of advanced coatings on steel (e.g., zinc-rich primers and polyester powder coatings) to maximize corrosion resistance in harsh industrial or coastal environments, significantly extending the asset lifespan and reducing long-term maintenance needs. Furthermore, the adoption of high-performance, UV-stabilized polycarbonate sheeting ensures transparency and impact resistance while preventing premature yellowing or structural degradation due to sunlight exposure. This focus on material science ensures compliance with stringent safety standards, including resistance to fire propagation and high wind loads, providing crucial longevity for the investment.

The integration of IoT (Internet of Things) and renewable energy technologies is redefining the functional capabilities of shelters. Modern, technologically advanced shelters incorporate low-voltage LED lighting powered by small solar panels, making them autonomous and environmentally friendly, eliminating the need for expensive trenching and electrical hookups. Integrated sensors for occupancy monitoring, air quality assessment (measuring particulate matter), and passive ventilation management contribute valuable data to facility managers. This technological convergence positions the smoking shelter as an intelligent asset rather than a passive structure, aligning the market with broader trends in smart building and sustainable infrastructure development.

Regional Highlights

- Europe: Europe is the most mature and dominant market segment for smoking shelters, driven by comprehensive national and regional legislative frameworks that explicitly mandate designated outdoor smoking areas in workplaces, public buildings, and hospitality settings. Countries like the United Kingdom, France, and Germany have long-established regulations requiring employers and facility owners to provide adequate facilities, ensuring a stable, replacement-driven demand. The European market prioritizes aesthetically pleasing, architecturally compatible designs that integrate well into complex urban environments and historical settings. Furthermore, strong union presence and focus on occupational health drive demand for high-quality, weather-protected, and well-ventilated structures, with a growing emphasis on environmentally sustainable materials and certification (e.g., ISO standards). The Nordic countries are pioneering the integration of smart technologies like automated heating and advanced air filtration within shelters due to severe weather conditions, setting a benchmark for premium product specifications. The market structure in Europe is characterized by stringent adherence to CEN standards and demanding compliance verification processes.

- North America (NA): North America, particularly the United States and Canada, represents a significant growth market fueled by patchwork state and municipal regulations, coupled with aggressive corporate compliance mandates. While federal legislation provides baseline direction, local ordinances often dictate specific setback distances from entrances, ventilation intakes, and windows, necessitating highly specific shelter designs. The US market is characterized by high demand for robust, prefabricated modular units, which facilitate quick installation across large corporate campuses, industrial parks, and government facilities subject to rapid expansion or relocation. The focus here is on durability, adherence to ADA requirements (accessibility), and minimizing visual impact. The strong corporate investment culture means many companies exceed minimum compliance requirements to enhance employee amenities, driving demand for premium shelters incorporating integrated charging stations and modern design elements. The market is fragmented but highly responsive to product innovation that promises low total cost of ownership (TCO) through reduced maintenance.

- Asia Pacific (APAC): APAC is poised to be the fastest-growing region, driven by rapid industrialization, burgeoning urbanization, and the progressive adoption of Western-style occupational health and public anti-smoking policies in populous nations like China, India, and Southeast Asian countries. While enforcement varies, the sheer scale of infrastructural development (new airports, industrial zones, and commercial centers) creates massive opportunities for initial installation. The demand is often bifurcated: highly modern, architecturally significant structures for commercial hubs in tier-one cities (e.g., Shanghai, Singapore), and cost-effective, high-volume basic shelters for industrial zones and public transport systems. Key challenges include navigating diverse local building codes and varying climate requirements (e.g., high humidity and monsoonal weather), which necessitate specialized material selection (e.g., anti-corrosive finishes). Increasing international corporate presence in the region further accelerates the adoption of globally compliant shelter standards.

- Latin America (LATAM): The LATAM market is developing, driven mainly by major metropolitan areas in countries like Brazil, Mexico, and Chile, where public health initiatives and modern labor laws are gaining traction. Market growth is closely tied to economic stability and foreign investment in commercial infrastructure. Procurement often involves addressing budget constraints, favoring cost-efficient, galvanized steel structures. The focus is on basic compliance and weather protection. Opportunities exist in supplying large-scale public transportation networks and expanding industrial manufacturing complexes. Regulatory enforcement is often the primary bottleneck, but increasing public awareness of environmental health is creating organic demand for designated, organized public spaces.

- Middle East and Africa (MEA): The MEA region presents a diverse market. The Gulf Cooperation Council (GCC) countries exhibit high demand for premium, durable shelters in extreme heat conditions (necessitating specialized UV protection and passive cooling designs) within major infrastructure projects (airports, business districts, mega-cities). Procurement is typically driven by government-backed development funds, focusing on quality and architectural integration. In contrast, the African segment is nascent, with demand concentrated in commercial centers, large mining operations, and international corporate hubs, prioritizing robust, simple, and easily secured structures. Extreme weather and security concerns influence product choice, favoring fully enclosed or highly secured partially enclosed options when necessary.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Smoking Shelters Market.- Glasdon International

- Smoking Shelter UK

- Trueform Engineering

- Kwik-Space

- Smarte Carte

- British American Tobacco (through subsidiaries/partnerships)

- Broxap Ltd.

- Shelter Store

- Furnitubes International

- Marshalls PLC

- Q-Shelter

- Shelter Solutions Inc.

- Urban Metalwork

- Steel Structures UK

- Vaporshield

- Outdoor Design

- Shelter Works

- A&S Landscape

- Falco Street Furniture

- The Smoking Shelter Company

Frequently Asked Questions

Analyze common user questions about the Smoking Shelters market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary regulatory drivers impacting the demand for new smoking shelters?

The primary drivers are global anti-smoking legislation, specifically laws prohibiting smoking within a mandated distance (often 10 to 25 feet) of building entrances, windows, and ventilation intakes, compelling facility owners to create designated, compliant outdoor zones.

Which type of smoking shelter is most widely adopted for compliance reasons?

Partially enclosed shelters are the most widely adopted type. They provide necessary weather protection while maintaining open-air status, which satisfies the legal definition of an outdoor designated area required by most public health and occupational safety regulations globally.

How does the integration of IoT technology benefit facility management using smoking shelters?

IoT technology, through integrated sensors, provides real-time data on occupancy rates and air quality. This data allows facility managers to optimize maintenance schedules, ensuring cleaning and waste disposal occur only when necessary, thereby reducing operational costs and improving service efficiency.

What major challenges does the APAC region face concerning the adoption of smoking shelters?

Major challenges in the APAC region include navigating the fragmented landscape of local building codes, mitigating the impact of diverse and challenging climates (e.g., high humidity), and balancing the need for compliance with budget constraints in rapidly industrializing areas.

Are smoking shelters designed to accommodate e-cigarettes and vaping devices?

Yes, there is a growing market trend toward "hybrid shelters" designed to accommodate both traditional tobacco smokers and vapers. These often incorporate distinct designated zones or enhanced ventilation systems to manage various types of aerosol and vapor emissions, ensuring broader compliance.

The necessity for smoking shelters is fundamentally linked to the global public health movement and workplace safety standards, creating a resilient market demand insulated from cyclical economic fluctuations, although capital expenditure remains sensitive to interest rate environments. The market is continuously refined by advancements in material durability and smart technology integration, shifting the product classification from basic utility furniture to a sophisticated, data-generating compliance asset integral to modern infrastructure management. Future growth will be significantly shaped by the standardization of regulations across emerging economies and the development of sustainable, low-environmental-impact modular units. Furthermore, manufacturers focusing on total lifecycle cost reduction through enhanced durability and predictive maintenance offerings will secure competitive advantages in the highly compliance-driven environment of the global Smoking Shelters Market.

In summary, while the core function of the smoking shelter remains constant—providing a legal designated area—the methods of delivery, maintenance, and integration are undergoing rapid modernization. The market’s resilience is derived from legal mandates that translate into non-discretionary corporate spending. The strategic expansion into modular designs allows key players to address diverse logistical challenges, particularly in regions experiencing rapid infrastructure development. As urbanization continues and regulatory oversight tightens globally, the role of high-quality, smart smoking shelters in maintaining public health, aesthetic standards, and corporate compliance will only become more pronounced, guaranteeing sustained market expansion through the forecast period. Competitive strategies increasingly focus on customization, material longevity, and advanced digital integration.

The regulatory convergence between tobacco and vaping products presents a specific and immediate opportunity for innovation. Companies capable of delivering multi-use, adaptable structures that satisfy the evolving legislative landscape around nicotine product consumption will capture significant market share. Moreover, the environmental impact of shelter construction, including sourcing of materials and energy efficiency (solar lighting), is an increasingly scrutinized factor, particularly in European and North American public procurement processes. Success in this market is therefore contingent upon achieving an optimal balance between compliance, cost-effectiveness, architectural integration, and environmental responsibility, pushing the industry toward a higher standard of functional design and material science application.

The analysis of the technological landscape confirms that simple, fixed-design shelters are becoming obsolete in major commercial sectors. The integration of passive environmental controls, superior structural load engineering, and connectivity features (via 4G or Wi-Fi for sensor data transmission) marks the transition to ‘Shelter 2.0.’ This shift requires manufacturers to invest heavily in specialized software and electronics capabilities, often achieved through partnerships with technology providers. The emphasis on modular design also facilitates global shipping and local assembly, effectively lowering the barriers to entry in geographically dispersed markets, particularly throughout Asia Pacific and Latin America. Standardization in component size, while allowing for custom finishes, is key to maximizing manufacturing throughput and reducing per-unit cost.

Geographical analysis strongly suggests that while mature markets (Europe, North America) prioritize quality replacement and technological upgrades, emerging markets (APAC, LATAM) focus on high-volume initial installation necessary for foundational compliance. Manufacturers must adapt their marketing and sales strategies to address these distinct requirements—offering premium, smart solutions in developed regions and robust, cost-optimized, scalable models in developing ones. Furthermore, understanding the nuances of local wind load standards (critical in hurricane-prone regions) or seismic requirements (in areas like Japan or Chile) is non-negotiable for product acceptance and long-term liability management. This regional complexity ensures that bespoke engineering remains a crucial competitive advantage over mass-produced, one-size-fits-all solutions, particularly in large public sector tenders which demand specific site suitability assurances.

The impact of AI, while indirect, is transformative in the long run, shifting the value proposition from merely selling a structure to offering a managed compliance service. By integrating monitoring and diagnostic tools, suppliers can move toward a subscription or service-based revenue model for facility maintenance optimization, ensuring shelters remain operational and compliant without constant manual oversight from the end-user. This approach not only generates recurring revenue streams but also strengthens customer loyalty by providing data-backed assurance of facility management efficiency. This transition towards smart asset management is vital for meeting the complex demands of large-scale corporate and public sector clients who increasingly rely on centralized digital dashboards for operational control and auditing purposes.

The raw material supply chain remains a constant point of vulnerability and strategic focus. Dependence on global steel and aluminum markets requires manufacturers to implement robust hedging strategies or diversify their material portfolio, potentially exploring advanced composites that offer comparable durability with lighter weight and superior insulation characteristics. Upstream risk mitigation includes securing long-term contracts with key suppliers, preferably from politically stable regions, to ensure consistent pricing and supply continuity. Downstream, the installation process requires standardized, certified training protocols for contractors to prevent faulty assembly, which can lead to structural failures and premature degradation, thereby safeguarding the brand reputation and minimizing warranty claims across the diverse geographic installation sites.

The competitive landscape is characterized by a mix of specialized street furniture manufacturers and large metal fabrication companies diversifying their offerings. Differentiation is increasingly achieved not just through aesthetic design, but via superior engineering certifications, modular design flexibility, and the integration of environmental technology. Key players are strategically focusing on obtaining certifications relevant to specific, highly regulated sectors, such as explosion-proof ratings for shelters intended for chemical or petrochemical industrial sites, or specialized fire ratings required by hospital systems. This targeted approach allows niche players to compete effectively against larger, more generalized manufacturers by offering specialized compliance assurance and superior technical documentation required for high-risk environments.

Finally, the long-term sustainability of the market rests on product innovation that addresses evolving public perception and environmental goals. This includes incorporating features that simplify recycling at the end of the shelter's lifespan and utilizing recycled content in the initial build. As corporate sustainability reports become standard requirements, end-users are increasingly scrutinizing the environmental credentials of their purchased assets, including smoking shelters. Manufacturers who lead in developing aesthetically pleasing, highly functional, and genuinely sustainable shelter solutions will be best positioned to capitalize on the increasing demands for green building materials and environmentally responsible procurement practices across global markets, ensuring both compliance and corporate social responsibility alignment.

The high initial capital cost restraint can be countered through innovative financing models. Leasing agreements or "Shelter-as-a-Service" models, where the shelter and its ongoing maintenance are provided for a fixed monthly fee, reduce the immediate financial barrier for SMEs and institutions with constrained capital budgets. This financial engineering is particularly critical in emerging economies where upfront capital allocation is often prioritized for core business operations rather than ancillary infrastructure like smoking shelters. This shift from outright asset purchase to operational expenditure (OpEx) procurement models broadens the addressable market size significantly, offering a substantial competitive leverage point for forward-thinking market participants.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager