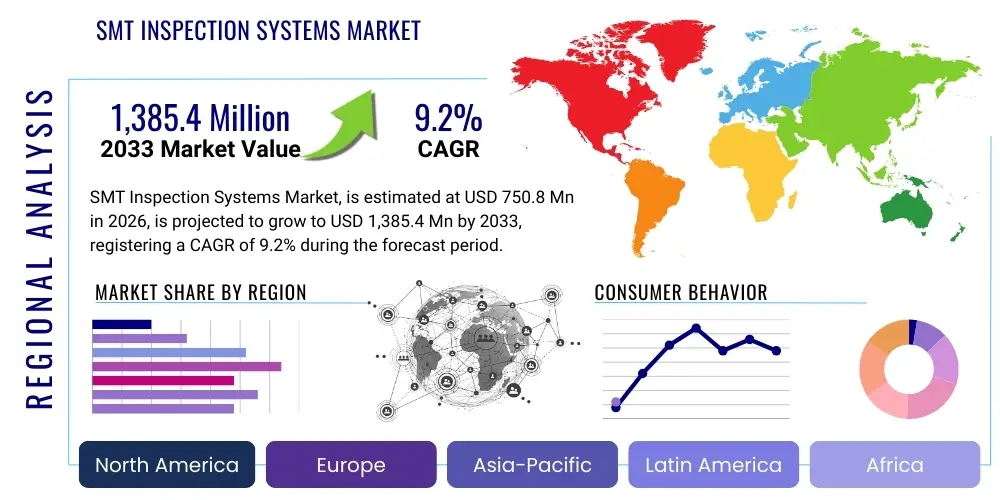

SMT Inspection Systems Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436589 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

SMT Inspection Systems Market Size

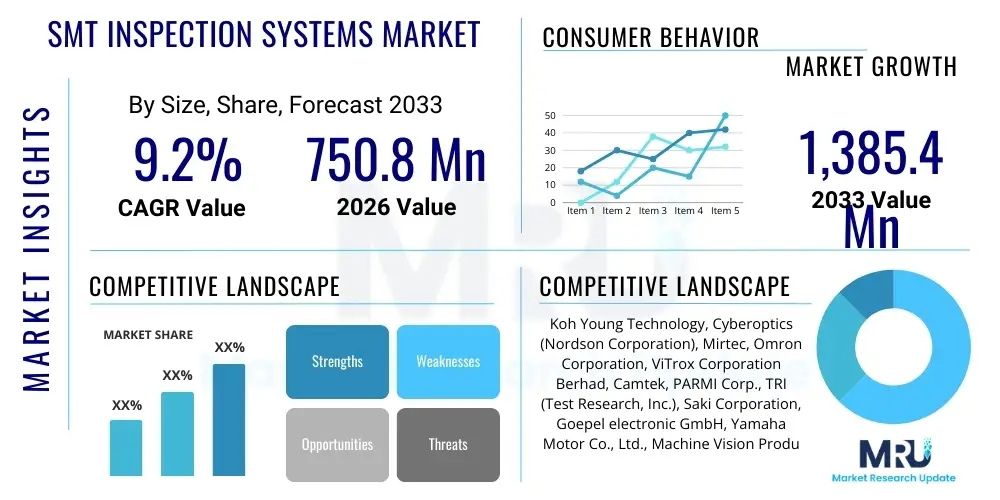

The SMT Inspection Systems Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.2% between 2026 and 2033. The market is estimated at $750.8 Million in 2026 and is projected to reach $1,385.4 Million by the end of the forecast period in 2033.

SMT Inspection Systems Market introduction

SMT Inspection Systems are critical components in the modern electronics manufacturing process, specifically within the fabrication of printed circuit boards (PCBs) utilizing surface mount technology (SMT). These sophisticated systems are deployed to ensure the quality, reliability, and precision of electronic assemblies by detecting defects such as incorrect component placement, solder joint anomalies, bridging, and insufficient solder paste deposition. The core function of these systems is to minimize human error and facilitate high-volume, high-yield production, thereby driving down manufacturing costs and enhancing product performance in sectors ranging from consumer electronics to automotive and aerospace.

The product portfolio within this market primarily includes Automated Optical Inspection (AOI) systems, Automated X-ray Inspection (AXI) systems, and Solder Paste Inspection (SPI) systems. AOI systems utilize high-resolution cameras and advanced algorithms to visually inspect PCB surfaces post-solder, while AXI systems use X-ray technology to inspect hidden solder joints, such as those beneath Ball Grid Array (BGA) and Quad Flat No-lead (QFN) components. SPI systems are utilized at the very beginning of the SMT line to verify the volume and alignment of solder paste, recognized as the most critical step impacting overall yield.

Major applications for SMT inspection systems span high-reliability electronics, including mission-critical military and defense systems, advanced driver-assistance systems (ADAS) in vehicles, complex medical devices, and high-density computing infrastructure. Key benefits derived from the adoption of these inspection technologies include improved throughput, reduced rework expenses, enhanced component traceability, and stringent adherence to quality standards like IPC regulations. The primary driving factors fueling market expansion are the rapid miniaturization of electronic components, the increasing complexity of PCB designs (e.g., higher layer counts and finer pitch components), and the accelerating demand for zero-defect manufacturing, particularly within the 5G infrastructure and electric vehicle (EV) markets.

SMT Inspection Systems Market Executive Summary

The global SMT Inspection Systems Market is characterized by robust growth, primarily propelled by the ongoing shift towards advanced, high-density PCBs and the stringent quality requirements imposed by high-reliability end-use sectors. Business trends indicate a strong focus among leading manufacturers on integrating AI and machine learning capabilities into existing AOI and AXI platforms, moving beyond simple defect detection to predictive analysis and process optimization. Furthermore, the push for Industry 4.0 standards is necessitating seamless integration of inspection data with manufacturing execution systems (MES), making real-time data analytics a cornerstone of competitive advantage. Investment in combined 2D and 3D inspection capabilities is accelerating, as 3D measurement offers superior volume and height confirmation for complex solder joints, mitigating the limitations inherent in traditional 2D inspection.

Regionally, the Asia Pacific (APAC) continues to dominate the market, largely due to its status as the global hub for electronics manufacturing and assembly (EMS). Countries such as China, South Korea, and Taiwan house the majority of high-volume SMT lines, driving immense demand for both initial setup and replacement systems. North America and Europe are exhibiting significant growth, characterized by strong adoption in niche, high-value sectors such as defense, aerospace, and advanced medical equipment, where quality compliance and traceability are paramount. The European market, specifically, is seeing increased penetration of highly sophisticated, low-volume inspection systems customized for specialized industrial electronics and automotive applications.

In terms of segmentation, Automated Optical Inspection (AOI) systems currently hold the largest market share by volume, due to their speed and applicability for general assembly inspection. However, the Automated X-ray Inspection (AXI) segment, particularly 3D AXI, is projected to witness the highest growth rate, driven by the proliferation of complex components like BGAs, where solder joints are hidden beneath the component body. By end-user, the Consumer Electronics segment remains the volume leader, but the Automotive Electronics segment is experiencing exponential growth, fueled by the complex safety systems and battery management units required for electric and autonomous vehicles, demanding the highest level of inspection scrutiny.

AI Impact Analysis on SMT Inspection Systems Market

User queries regarding AI's influence on the SMT Inspection Systems Market primarily revolve around defect classification accuracy, reduction of false calls (false positives), and the ability of AI to handle the increasing complexity and variety of new electronic components and materials. Key user concerns focus on whether existing inspection systems can be retrofitted with AI capabilities and how AI integration will standardize inspection criteria across multiple production lines globally. Expectations are high regarding AI's potential to dramatically improve yield rates by enabling predictive maintenance of manufacturing equipment and identifying subtle, process-related defects that traditional rule-based algorithms often miss, ultimately leading to a shift from purely defect detection to comprehensive process control.

The adoption of deep learning models, specifically Convolutional Neural Networks (CNNs), is transforming the capability of SMT inspection. These AI models allow systems to be trained on vast datasets of both defective and non-defective images, enabling them to recognize patterns and classify defects with significantly higher accuracy than conventional vision algorithms. This reduces the need for extensive manual tuning and drastically minimizes the frequency of false calls, a major pain point in high-speed SMT environments. Consequently, manufacturers can achieve higher throughput without compromising inspection rigor.

Furthermore, AI is extending the utility of inspection systems beyond simple pass/fail criteria. Integrated machine learning algorithms analyze aggregated inspection data—across SPI, pre-reflow AOI, and post-reflow AOI/AXI stages—to identify correlations between upstream process variations (like slight changes in paste volume or component placement drift) and final product defects. This closed-loop feedback mechanism allows manufacturers to proactively adjust printing and placement parameters, achieving true process optimization and contributing significantly to the vision of smart manufacturing environments under Industry 4.0.

- False Call Reduction: Deep learning algorithms decrease false positive defect identifications, significantly improving operational efficiency.

- Adaptive Defect Classification: AI enables systems to automatically recognize and classify defects in components not explicitly programmed, handling new product introductions efficiently.

- Predictive Process Control: Machine learning analyzes multi-stage inspection data (SPI, AOI, AXI) to predict and prevent future defects by offering real-time feedback to upstream equipment.

- Automated Training and Tuning: AI accelerates system setup and calibration, reducing reliance on expert operators for complex algorithm tuning.

- Data Integration: Facilitation of seamless integration of inspection results into MES and cloud platforms for enterprise-wide quality management.

- 3D Reconstruction Enhancement: AI improves the speed and accuracy of volumetric measurement and complex 3D image reconstruction in AXI and 3D AOI systems.

DRO & Impact Forces Of SMT Inspection Systems Market

The market dynamics are governed by a robust interplay of Drivers (D), Restraints (R), Opportunities (O), and pervasive Impact Forces. The primary driver is the pervasive demand for miniaturized, high-performance electronics across all sectors, coupled with the global adoption of high-speed communication technologies (5G/6G) that necessitate impeccable PCB quality. Restraints largely center on the high initial capital investment required for advanced 3D AXI and high-resolution 3D AOI systems, particularly for smaller and medium-sized EMS providers, alongside the technical challenge of maintaining zero-defect inspection accuracy for increasingly complex micro-components like 0201 and 01005 packages. Opportunities abound in the burgeoning fields of electric vehicle electronics, IoT sensor deployment, and the integration of highly specialized inspection techniques like CT scanning for industrial applications. These forces collectively shape vendor strategies, forcing innovation towards cost-effective, high-accuracy, and AI-enabled solutions.

A key internal impact force is the rapidly evolving IPC standard requirements (e.g., IPC-A-610 and J-STD-001) that continually push the boundaries of acceptable solder joint quality, making human visual inspection nearly obsolete and mandating automated inspection systems. External impact forces include geopolitical trade tensions affecting global electronics supply chains, which spur regional investment in localized, fully automated manufacturing facilities, increasing the pervasiveness of automated inspection technology. Furthermore, the transition to lead-free soldering processes introduced inherent complexity in solder joint formation, making advanced 3D inspection crucial for reliable quality assurance.

The balance between high-speed inspection needs and the necessity for three-dimensional metrology drives continuous technological innovation. While 2D AOI offers unparalleled speed, the limitations in measuring solder joint height and confirming volume for hidden joints mandate the adoption of 3D technologies, despite their higher cost and complexity. Vendors who successfully offer scalable, hybrid systems combining the speed of 2D checks with the metrology of 3D analysis, often augmented by AI for rapid decision-making, are best positioned to capture market share. The need for precise inspection of components in harsh environments, such as those found in automotive under-the-hood applications, further underscores the irreplaceable role of highly accurate automated inspection.

Segmentation Analysis

The SMT Inspection Systems Market is comprehensively segmented based on technology, end-user industry, application stage, and geographical regions, allowing for a nuanced understanding of market dynamics and adoption patterns across different manufacturing environments. The technology segmentation highlights the rivalry and complementarity between 2D and 3D inspection methods, showcasing the market's trajectory towards volumetric measurement capabilities. End-user categorization reveals the highest value and volume consumers, with key focus shifting towards high-reliability sectors like automotive and medical devices that impose stringent quality demands. Analyzing the application stage provides insights into where quality control investment is prioritized within the SMT line, underscoring the critical nature of pre-reflow SPI and post-reflow inspection.

- By Technology:

- Automated Optical Inspection (AOI)

- 2D AOI

- 3D AOI

- Automated X-ray Inspection (AXI)

- 2D AXI

- 3D AXI (Laminography/Tomography)

- Solder Paste Inspection (SPI)

- 2D SPI

- 3D SPI

- Automated Optical Inspection (AOI)

- By Application Stage:

- Pre-reflow (Solder Paste Inspection)

- Post-paste Placement Inspection

- Post-reflow Inspection (Final Quality Check)

- By End-User Industry:

- Consumer Electronics (Smartphones, Tablets, Wearables)

- Automotive Electronics (ADAS, Infotainment, BMS)

- Aerospace and Defense

- Medical Devices

- Industrial Electronics (Automation, Power Management)

- Telecommunications (5G Infrastructure, Networking Hardware)

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America

- Middle East & Africa (MEA)

Value Chain Analysis For SMT Inspection Systems Market

The value chain for SMT Inspection Systems starts with upstream component suppliers, primarily focused on providing highly specialized hardware, including high-resolution cameras, advanced X-ray tubes and detectors, high-precision lasers (for 3D systems), and sophisticated computing hardware necessary for image processing. Key upstream activities involve intense R&D to enhance detection speed and resolution, often leveraging partnerships with AI chip manufacturers to optimize on-board processing capabilities. The competitive edge at this stage lies in proprietary sensor technology and the ability to integrate heterogeneous hardware components into a robust, industrial-grade system capable of operating continuously in demanding factory environments.

Midstream activities involve the core manufacturing and system integration performed by major SMT inspection system vendors. This stage focuses heavily on software development, specifically the creation of powerful, user-friendly inspection algorithms (rule-based and AI-driven), and comprehensive user interfaces for programming and data analysis. Distribution channels are typically a combination of direct sales for large, global electronics manufacturing services (EMS) providers and highly specialized indirect distribution through regional distributors and integrators who provide local maintenance, application support, and training. The complexity and high cost of these systems necessitate a strong service component within the distribution network.

The downstream segment encompasses the end-users—the electronics assembly houses and original equipment manufacturers (OEMs)—who implement and operate these machines as integral parts of their production lines. Downstream focus is centered on achieving maximum uptime, seamless integration with MES, and leveraging the inspection data for process improvements (closed-loop manufacturing). Direct sales are crucial for maintaining strong relationships with Tier 1 EMS providers, allowing vendors to rapidly address technical challenges and customize solutions. Indirect channels serve smaller or geographically diverse customers, providing essential local expertise and enabling broader market reach for maintenance and periodic calibration services.

SMT Inspection Systems Market Potential Customers

Potential customers for SMT Inspection Systems are highly diversified, ranging from global mega-factories assembling millions of consumer devices annually to specialized defense contractors producing low-volume, high-value mission-critical electronics. The primary buyers are Electronics Manufacturing Services (EMS) providers, such as Foxconn, Flextronics, and Jabil, who require systems capable of high speed, high accuracy, and rapid reprogramming to accommodate diverse client demands. These customers typically purchase a mix of SPI, AOI, and AXI systems to cover all stages of the SMT process, often prioritizing 3D capabilities for future-proofing their assembly lines against increasing component complexity.

Original Equipment Manufacturers (OEMs) also constitute a significant customer base, particularly those in high-reliability sectors. Automotive OEMs and Tier 1 suppliers (e.g., Bosch, Continental) are major purchasers, driven by the need for zero-defect production of safety-critical components like engine control units (ECUs) and sensors for autonomous driving. Similarly, medical device manufacturers require the highest precision inspection to meet strict regulatory compliance (e.g., FDA requirements), focusing heavily on 3D AXI to verify internal connections within miniaturized devices. The underlying trend across all potential customer segments is the increasing requirement for systems that provide not just defect detection, but quantifiable data and full component traceability throughout the entire assembly process.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $750.8 Million |

| Market Forecast in 2033 | $1,385.4 Million |

| Growth Rate | 9.2% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Koh Young Technology, Cyberoptics (Nordson Corporation), Mirtec, Omron Corporation, ViTrox Corporation Berhad, Camtek, PARMI Corp., TRI (Test Research, Inc.), Saki Corporation, Goepel electronic GmbH, Yamaha Motor Co., Ltd., Machine Vision Products (MVP), Pemtron, JUTZE Intelligence Technology Co., Ltd., KLA Corporation, Keysight Technologies, Dage (Nordson Corporation), Mycronic AB, ASC International, and Viscom AG. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

SMT Inspection Systems Market Key Technology Landscape

The current technology landscape in the SMT Inspection Systems Market is highly dynamic, characterized by a rapid convergence of optical and X-ray techniques, alongside the ubiquitous integration of advanced computational power. The predominant technological shift is the move from 2D to 3D inspection across all major categories (SPI, AOI, and AXI). For Solder Paste Inspection (SPI), the use of fringe projection and laser triangulation techniques is standard, enabling volumetric measurement of solder paste deposition, which is crucial as the accuracy of paste printing directly affects final product yield. 3D AOI systems leverage structured light projection to generate topographical data, confirming the coplanarity and lift of components and accurately measuring solder fillet volume, surpassing the limitations of shadow-prone 2D imaging.

Automated X-ray Inspection (AXI) technology remains essential for inspecting hidden joints (BGAs, QFNs, etc.). The market is aggressively transitioning from basic 2D AXI to highly advanced 3D AXI, utilizing techniques such as Computed Tomography (CT), Laminography (or SMT), and Digital Tomosynthesis. These methods allow for non-destructive slicing of the PCB image, enabling clear, layer-by-layer inspection of critical, complex interconnects that are visually inaccessible. This technological depth is non-negotiable for sectors requiring the highest integrity, such as defense and aerospace electronics, where the cost of failure is catastrophic.

Crucially, the effectiveness of these advanced hardware platforms is increasingly dependent on sophisticated software. High-speed, multi-core processing units handle the massive data flow generated by 3D imaging, while AI/Machine Learning models enhance the decision-making process. The use of cloud connectivity and edge computing optimizes data processing and allows for centralized management of inspection results across multiple facilities. The competitive advantage is now less about hardware resolution and more about the proprietary algorithms used for defect classification, false call reduction, and seamless real-time communication with upstream placement and reflow ovens for automated process correction.

Regional Highlights

- Asia Pacific (APAC): APAC represents the dominant market share holder globally, primarily due to the concentration of the world’s largest electronics contract manufacturers (EMS) and OEMs in countries like China, Taiwan, South Korea, and Vietnam. The region is characterized by high-volume manufacturing, driving strong demand for fast, efficient 2D/3D AOI and 3D SPI systems. Government initiatives supporting local semiconductor manufacturing and advanced technology adoption further solidify APAC's leading position, particularly in the rapid deployment of 5G and high-density computing infrastructure.

- North America: North America is a critical market, driven by high R&D intensity and the presence of leading aerospace, defense, and high-end computing companies. Demand here is focused on precision and traceability, favoring advanced 3D AXI (CT/Laminography) systems capable of inspecting highly complex, often low-volume, high-value boards. The resurgence of regional manufacturing spurred by supply chain diversification efforts is expected to accelerate investment in fully automated inspection lines.

- Europe: The European market demonstrates significant growth, largely driven by the robust automotive electronics sector (focused on ADAS and EV battery management systems) and specialized industrial automation. European manufacturers prioritize systems that adhere to strict environmental and safety regulations, focusing on customizable, high-precision inspection tools. Germany, in particular, is a strong adopter, fueled by its leadership in Industry 4.0 implementation and advanced machine vision technology.

- Latin America & Middle East and Africa (LAMEA): These regions represent emerging markets characterized by selective growth. Demand is often concentrated in high-growth industrial and telecom sectors, particularly in Brazil and Mexico (serving North American supply chains) and parts of the UAE/Saudi Arabia (driven by large infrastructure and technology investment projects). While 2D AOI remains prevalent for cost efficiency, there is growing interest in entry-level 3D systems as manufacturing capabilities mature and quality requirements increase.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the SMT Inspection Systems Market.- Koh Young Technology

- Cyberoptics (Nordson Corporation)

- Mirtec

- Omron Corporation

- ViTrox Corporation Berhad

- Camtek

- PARMI Corp.

- TRI (Test Research, Inc.)

- Saki Corporation

- Goepel electronic GmbH

- Yamaha Motor Co., Ltd.

- Machine Vision Products (MVP)

- Pemtron

- JUTZE Intelligence Technology Co., Ltd.

- KLA Corporation

- Keysight Technologies

- Dage (Nordson Corporation)

- Mycronic AB

- ASC International

- Viscom AG

Frequently Asked Questions

Analyze common user questions about the SMT Inspection Systems market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the most critical inspection stage in SMT manufacturing?

Solder Paste Inspection (SPI) is widely considered the most critical stage, as over 60% of assembly defects originate from issues related to solder paste deposition (volume, shape, and registration). Accurate 3D SPI directly minimizes rework and maximizes overall line yield.

How do 2D AOI systems compare to 3D AOI systems?

2D AOI systems are faster and cheaper but rely on contrast and intensity, making them susceptible to shadow and reflection errors, and unable to measure height or volume. 3D AOI uses structured light to provide precise volumetric measurements, drastically improving defect detection accuracy for modern complex components and hidden solder fillets.

Why is Automated X-ray Inspection (AXI) necessary in SMT lines?

AXI is necessary to inspect solder joints that are hidden beneath components, such as those found in Ball Grid Arrays (BGAs) and Quad Flat No-leads (QFNs). 3D AXI (Laminography/CT) provides non-destructive, detailed internal views, essential for ensuring the reliability of high-density interconnects in critical applications.

Which end-user segment is driving the fastest growth in the market?

The Automotive Electronics segment is currently experiencing the fastest growth, driven by the exponential demand for Advanced Driver-Assistance Systems (ADAS), electric vehicle battery management systems (BMS), and autonomous vehicle computing platforms, all of which require mandatory zero-defect manufacturing standards verified by sophisticated 3D inspection.

What role does Artificial Intelligence (AI) play in modern SMT inspection systems?

AI significantly enhances system performance by reducing false calls, improving the classification accuracy of complex defects, and enabling predictive process control. AI analyzes integrated data from multiple inspection points to suggest real-time adjustments to upstream equipment, transitioning quality control from detection to prevention.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager