Snap Fastener Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435916 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Snap Fastener Market Size

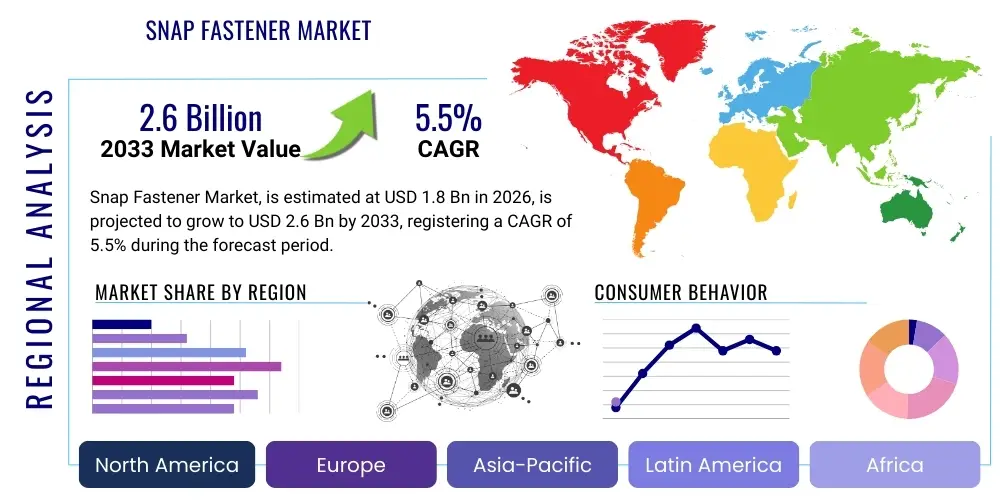

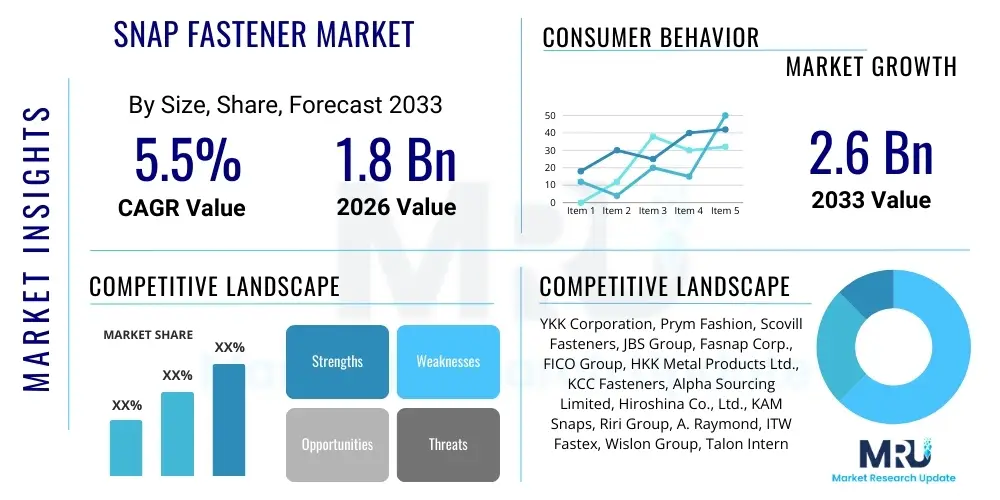

The Snap Fastener Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.5% between 2026 and 2033. The market is estimated at USD 1.8 Billion in 2026 and is projected to reach USD 2.6 Billion by the end of the forecast period in 2033.

Snap Fastener Market introduction

The Snap Fastener Market encompasses the global manufacturing and distribution ecosystem dedicated to producing press studs, often referred to as snaps or poppers, utilized across a vast array of consumer and industrial products for quick, temporary, and secure material joining. These mechanical closure devices are engineered to provide high functional reliability, operating through a simple male/female interlock system (stud and socket) that offers a tactile and audible confirmation of closure. The product utility spans from low-stress consumer goods to high-specification applications in defense and aerospace. The foundational product description involves components typically stamped or molded from durable materials such as brass, stainless steel, aluminum, or advanced thermoplastic polymers like polyacetal and nylon, each selected based on specific requirements for strength, corrosion resistance, weight, and aesthetic presentation.

Major applications for snap fasteners are critically concentrated in the textile industry, supporting segments such as high-end denim, technical outerwear, children's clothing, and specialized industrial protective gear. Beyond apparel, significant demand originates from the automotive sector for securing interior components, upholstery, and modular paneling where hidden, vibration-resistant fasteners are essential for safety and aesthetics. The primary benefits driving market adoption include their robust durability compared to conventional buttons, efficiency in assembly lines using automated setting machines, and the versatility of design elements, allowing manufacturers to incorporate corporate branding, specific color coatings, and specialized functional characteristics such as low-profile or non-conductive properties, meeting stringent industry performance metrics and consumer expectations for longevity.

The market growth is substantially propelled by several driving factors, notably the continuous and aggressive expansion of global textile manufacturing, particularly in fast-developing economies, coupled with increased consumer demand for performance and durability in finished goods, such as extreme weather apparel and specialized sporting equipment. Furthermore, stringent regulatory environments in mature markets (Europe, North America) mandating nickel-free and low-lead content fasteners push manufacturers towards innovation in material science and cleaner manufacturing processes, inadvertently raising the barriers to entry for low-quality competitors and securing higher average selling prices for compliant, premium components. Supply chain optimization through advanced digital tools is also crucial, enabling quick response to fluctuating raw material costs and dynamic design requirements from global brands.

Snap Fastener Market Executive Summary

The Snap Fastener Market exhibits stable structural growth supported by diversified end-user demand and technological advancements in manufacturing precision and material composition. Current business trends emphasize enhanced sustainability throughout the product lifecycle, compelling leading manufacturers to invest in environmentally friendly plating methods, increase the utilization of recycled metals, and engineer long-lasting components to reduce overall material consumption. Strategic consolidation through M&A activities remains a significant trend, as major players seek to integrate vertical supply chains, secure access to specialized technology (e.g., non-magnetic plastic molding), and achieve economies of scale necessary to compete effectively against aggressive Asian manufacturers. Furthermore, digital transformation efforts are focused on improving the interface between designers and manufacturers, enabling faster prototyping and customization of high-specification fasteners for niche markets.

Regional trends clearly delineate a geographical shift in manufacturing dominance towards the Asia Pacific region, specifically Southeast Asia, driven by lower operational costs, robust industrial ecosystems, and proximity to major textile production hubs. However, consumption patterns remain strongest in North America and Europe for premium, technologically advanced fasteners used in luxury goods and compliance-heavy sectors like medical and defense, generating higher revenue per unit. Emerging regions such as Latin America and the Middle East are accelerating their consumption due to local manufacturing growth in automotive and basic consumer goods, presenting significant market penetration opportunities for global suppliers willing to adapt to local logistical and regulatory landscapes.

Segment-specific trends highlight the accelerating transition towards high-performance plastic snap fasteners in applications historically dominated by metal, largely due to demand for lightweight, non-corrosive, and non-magnetic solutions in automotive interiors and infant safety products. Concurrently, the metal segment is evolving by incorporating advanced finishes, such as ceramic coatings and PVD (Physical Vapor Deposition) techniques, to provide superior scratch resistance and extended durability for use in high-stress outdoor and industrial environments. The application segment growth is robust across all categories, with specialized industrial fasteners (used in infrastructure and renewable energy protection covers) showing particularly high CAGR due to significant global infrastructure investments requiring extremely rugged closure solutions.

AI Impact Analysis on Snap Fastener Market

Analysis of common user questions regarding the influence of Artificial Intelligence (AI) on the Snap Fastener Market reveals a strong focus on operational efficiency and predictive capabilities. Users are predominantly interested in how AI can optimize high-volume manufacturing throughput, specifically in areas such as minimizing material waste during stamping, enhancing the consistency of plating thickness, and predicting machinery maintenance requirements before catastrophic failure occurs. There is significant curiosity about using AI and machine learning (ML) to process large datasets related to global raw material commodity markets (brass, zinc, polymer resins) to forecast cost fluctuations accurately, thereby enabling proactive procurement strategies and stable contract pricing for large OEM buyers. Furthermore, end-users are keen to see AI improve quality control, moving beyond simple visual inspection to complex defect prediction based on machine parameter correlations.

The integration of AI technologies is expected to fundamentally transform the manufacturing floor by enabling hyper-efficiency. AI algorithms can manage complex multi-step processes, such as cold forging followed by intricate surface finishing, by constantly monitoring thousands of data points—including temperature, pressure, material feed rate, and tooling wear—and adjusting parameters in real-time to maintain near-perfect specification adherence. This level of automated precision significantly reduces the variance in fastener performance, a critical factor for automotive and defense applications where failure rates must be near zero. By optimizing energy consumption and material utilization, AI contributes directly to sustainability goals while substantially lowering the overall cost of goods sold, providing a crucial competitive edge.

Strategically, AI offers advanced capabilities in demand sensing and inventory management that are particularly valuable in the highly volatile fashion and apparel sectors. Machine learning models analyze consumer sales data, social media trends, and macroeconomic indicators to generate highly refined, granular forecasts that inform production planning down to the SKU level. This predictive capability allows manufacturers to scale production up or down rapidly, reducing the risk of holding obsolete inventory and accelerating the supply response to rapidly changing seasonal demands. The analytical strength of AI therefore moves the market from reactive manufacturing to proactive, demand-driven production planning, which is essential for global market leaders managing vast product portfolios across multiple continents and regulatory regimes.

- AI-driven Predictive Maintenance Systems: Utilizes machine learning on vibration and temperature sensor data within stamping presses and plating lines to forecast equipment failure, dramatically reducing unplanned downtime and optimizing maintenance schedules for maximum capacity utilization.

- Automated High-Speed Quality Inspection: Deployment of computer vision and deep learning models to perform rapid, non-destructive inspection of thousands of units per minute, identifying microscopic defects, plating inconsistencies, or minor dimensional deviations that traditional methods often miss, ensuring zero-defect output for critical applications.

- Optimal Resource Planning (ORP) and Procurement: ML algorithms analyze volatile commodity prices (brass, zinc, nylon) and geopolitical data to provide predictive sourcing recommendations, stabilizing input costs and enhancing contract negotiating positions for bulk purchases.

- Factory Floor Robotics Optimization: AI dynamically manages the coordination and movement of robotic arms used in assembly and packaging, optimizing speed, path efficiency, and energy consumption across highly complex, multi-stage production facilities, improving throughput consistency.

- Customization and Design Optimization Simulation: AI tools rapidly run virtual stress tests and material compatibility simulations for new fastener designs (e.g., custom fasteners for new automotive interiors), significantly accelerating the R&D cycle from concept to mass production compliance.

DRO & Impact Forces Of Snap Fastener Market

The Snap Fastener Market is experiencing robust acceleration primarily due to the ubiquitous demand generated by the expanding global middle class, which translates directly into higher consumer spending on apparel, accessories, and durable goods like automobiles. Key drivers include the innovation in performance textiles, such as military, technical, and outdoor wear, which require fasteners capable of extreme durability, high tensile strength, and specific environmental resistance (e.g., salt spray, UV exposure). Furthermore, urbanization and infrastructure spending globally increase the demand for industrial textile applications, suchting durable snap fasteners for large protective covers, awnings, and temporary shelters, supporting steady growth across diverse industrial sectors that prioritize functional closure systems over aesthetic considerations.

Despite strong drivers, the market faces inherent restraints, most notably the significant vulnerability to fluctuations in the global commodity markets, particularly copper, zinc, and specialized petroleum-derived polymers, which constitute the core raw materials. This volatility often forces manufacturers to absorb unexpected cost hikes or implement complex pricing mechanisms, potentially affecting competitiveness. Another restraint is the pervasive threat of counterfeiting and low-quality imitation products, especially from non-compliant regional players, which erodes the brand equity of premium manufacturers and presents safety risks to end-users, compelling major players to invest heavily in brand protection and anti-counterfeiting measures within their supply chains.

Opportunities for future expansion are substantial, anchored in the development of sophisticated, application-specific fasteners. The market can significantly capitalize on the burgeoning field of smart textiles by developing conductive snap fasteners that facilitate power transfer or data connectivity in wearable electronics without compromising mechanical function or comfort. Moreover, penetrating underserved regions in Africa and parts of Latin America through localized production facilities and distribution partnerships offers pathways to capture new market share. The continuous refinement of plastic fastener technology—making them lighter, stronger, and more aesthetically versatile—presents an opportunity to displace traditional metal fasteners in weight-sensitive and corrosion-prone environments, catering to future mobility solutions and specialized medical equipment.

The impact forces shaping the market environment are predominantly regulatory and technological. Regulatory impact, particularly in Europe and North America, mandates strict controls over hazardous substances (like lead and nickel), pushing the industry toward sustainable sourcing and advanced, non-toxic surface treatments. This force drives up compliance costs but simultaneously enhances product safety and quality across the board. The technological impact force dictates that manufacturers must continuously adopt Industry 4.0 techniques, including advanced robotics and data analytics, not just to reduce labor costs but also to achieve the microscopic precision required for modern, high-stress applications, ensuring that the manufacturing capacity remains globally competitive and aligned with future digital requirements.

Segmentation Analysis

The Snap Fastener Market segmentation is essential for dissecting the diverse demand landscape and optimizing product portfolio strategies across various end-use sectors. Segment analysis confirms that the Material Type remains a critical differentiator, with Metal Snaps providing the benchmark for tensile strength and traditional durability required in heavy-duty applications like military gear and rugged denim. Conversely, Plastic Snaps offer specialized advantages, including resistance to moisture and chemicals, non-conductivity, and light weight, making them indispensable for medical, marine, and specific automotive applications where performance criteria deviate from standard expectations. Understanding this material-based dichotomy is key to forecasting raw material demand and managing supply chain resilience against commodity price fluctuations.

Segmentation by Application reveals the dominant revenue streams, with the Apparel sector holding the highest market share volume due to the sheer scale of global garment production, particularly in categories utilizing snaps extensively, such as jackets, coats, and specialized children's clothing. However, the fastest growth is observed in the technical segments, notably Automotive and Industrial, driven by increasing vehicle complexity and the need for reliable, high-temperature closures in engine compartments or safety systems, and the proliferation of industrial textile products used in construction, agriculture, and protective barriers. These high-value industrial segments generally command higher pricing due to specialized material requirements and stringent performance certifications.

Product Type segmentation, distinguishing between components like Ring Snaps, Cap Snaps, and Stud/Socket systems, reflects diverse functional requirements and aesthetic preferences. Ring snaps are valued for strength and simplicity, while cap snaps allow for customized logos or high-polish finishes, linking the component directly to brand identity in consumer goods. This granularity in segmentation allows manufacturers to tailor marketing efforts and maintain focus on continuous product innovation within each niche, ensuring that both functional utility and aesthetic appeal are maximized for specific end-user environments and maintaining highly optimized manufacturing runs based on forecasted demand within each product category.

- Material Type

- Metal Snap Fasteners (Brass, Stainless Steel, Aluminum, Zinc Alloy)

- Plastic Snap Fasteners (Polyacetal, Nylon 6/6, ABS, High-Performance Polymers)

- Product Type

- Ring Snaps (Heavy Duty Utility)

- Cap Snaps (Aesthetic and Branding Focus)

- Stud and Socket Systems (Standard Press Fasteners)

- Prong Snaps (Lightweight, Non-Sewing Fasteners)

- Grommets and Eyelets (Reinforcement and Airflow)

- Application

- Apparel and Footwear (Denim, Outerwear, Activewear, Infant Safety Wear)

- Automotive and Transportation (Interior Trim, Seating, Airbag Covers, Convertible Tops)

- Industrial and Construction (Tarpaulins, Protective Covers, Awnings, Filtration Systems)

- Medical and Healthcare (Reusable Patient Gowns, Sterilizable Equipment Covers)

- Marine and Outdoor Equipment (Boat Covers, Tents, Backpacks)

- Distribution Channel

- Direct Sales (High Volume, OEM Contracts)

- Indirect Sales (Distributors, Wholesalers, E-commerce Platforms)

Value Chain Analysis For Snap Fastener Market

The upstream segment of the Snap Fastener Value Chain is centered on securing high-quality, compliant raw materials, a phase characterized by intense price negotiation and risk management. This includes procuring base metals such as specialized brass alloys and non-corrosive stainless steel, requiring partnerships with certified metal refineries and processors who can guarantee minimal impurities and traceable origin, crucial for meeting international safety standards. Similarly, the procurement of engineering polymers demands specialized knowledge of polymerization processes and additive requirements (e.g., UV stabilizers, fire retardants). Effective upstream analysis requires manufacturers to employ sophisticated hedging strategies and dual-sourcing policies to mitigate the financial impact of global commodity market volatility and ensure a continuous, uninterrupted supply flow to high-volume stamping and molding facilities.

The core manufacturing and processing stages are highly capital intensive, involving precision engineering activities such as multi-stage cold stamping, advanced die-casting for complex metal components, and state-of-the-art injection molding for plastic variants. Surface finishing, including specialized electroplating (e.g., non-nickel finishes for compliance) and aesthetic coatings (e.g., PVD for durability and premium looks), adds significant value and complexity. Quality control at this stage is paramount, utilizing automated vision systems and rigorous mechanical testing to ensure every component meets exact dimensional specifications, closure tolerances, and resistance parameters, thereby confirming the fastener's long-term reliability in the end-user application before distribution.

The downstream distribution channels are highly stratified, encompassing both direct sales and complex indirect networks. Direct distribution involves dedicated sales teams managing large, bespoke contracts with Original Equipment Manufacturers (OEMs) in the apparel and automotive sectors, often requiring just-in-time delivery and integrated technical support for setting machinery. Indirect distribution relies on a global network of specialized industrial distributors, component wholesalers, and smaller regional suppliers who service fragmented markets, custom tailors, and repair businesses. The effectiveness of the distribution channel is increasingly reliant on digital platforms, offering detailed product specifications, application guides, and localized inventory tracking, ensuring the right fastener and the correct setting machine accessories reach the diverse global customer base efficiently, minimizing delivery lead times and enhancing overall customer satisfaction.

Snap Fastener Market Potential Customers

The primary cohort of potential customers for snap fasteners is the global mass production textile industry, particularly focusing on large multinational apparel corporations and specialized manufacturers of high-performance sportswear and outdoor equipment. These buyers require massive volumes, strict adherence to quality specifications (e.g., consistent pull-out strength), and guaranteed compliance with hypoallergenic standards, making purchasing decisions highly reliant on supplier reputation and certification rigor. For these customers, the choice of fastener often balances cost-efficiency with high durability, ensuring the component outlasts the garment itself through rigorous use and frequent laundering cycles, thereby protecting the apparel brand’s reputation for quality.

A secondary, but rapidly growing and high-value customer segment is the automotive Tier 1 and Tier 2 supply chain. These customers require fasteners for securing interior components such as headliners, seat covers, carpet retainers, and specialized compartments. The key purchasing criteria here revolve around vibration resistance, fire retardation standards (FMVSS 302), tolerance for extreme temperatures (both hot and cold), and integration into complex assembly lines that prioritize automated application. Suppliers to the automotive sector must demonstrate robust quality systems and be capable of integrating their product specifications seamlessly into the vehicle design process, often years in advance of production launch.

Other vital end-users include military and defense contractors, who demand fasteners built to meet specific governmental specifications for extreme environmental resilience, specific tactical color matching (low-infrared reflection), and superior tensile strength for use in heavy equipment, tactical vests, and specialized tents. Additionally, the medical device sector and healthcare garment manufacturers represent a niche yet crucial customer base, requiring non-toxic, non-magnetic, and easily sterilizable plastic fasteners for gowns, reusable wraps, and patient monitoring device attachments, prioritizing material safety and hygiene over traditional performance metrics like ultimate tensile strength.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.8 Billion |

| Market Forecast in 2033 | USD 2.6 Billion |

| Growth Rate | 5.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | YKK Corporation, Prym Fashion, Scovill Fasteners, JBS Group, Fasnap Corp., FICO Group, HKK Metal Products Ltd., KCC Fasteners, Alpha Sourcing Limited, Hiroshina Co., Ltd., KAM Snaps, Riri Group, A. Raymond, ITW Fastex, Wislon Group, Talon International Inc., Ningbo Sunny Garment Accessories, Durables Inc., Ucan Fasteners, Sharda Buttons, Zhejiang Donglong Fastener Co., Ltd., KYY Group, and Dongguan Haozheng Hardware Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Snap Fastener Market Key Technology Landscape

The technological evolution in the Snap Fastener Market is predominantly driven by manufacturing precision, material science, and automation integration, aiming to enhance product lifecycle and compliance. Precision stamping and cold forming techniques remain crucial for metal fasteners, utilizing multi-slide machines capable of producing complex geometries with micron-level accuracy at high speeds. This high level of precision is necessary to ensure consistent snap action and retention strength, which is vital for safety-critical applications. Furthermore, the development of sophisticated tooling materials and predictive tool wear analytics, often integrated with AI, minimizes production variance and significantly extends the operational life of highly specialized dies, thereby reducing overhead costs in large-scale operations.

Material innovation is focusing heavily on two fronts: advanced metal surface treatments and high-performance polymer composites. For metal snaps, PVD (Physical Vapor Deposition) technology is increasingly adopted over traditional electroplating, offering superior resistance to abrasion, chemicals, and corrosion, while meeting stringent nickel-free and low-lead mandates in European and North American markets. On the polymer side, manufacturers are developing engineered plastics, such as specialized grades of polyacetal or carbon-fiber-reinforced nylon, that offer exceptional mechanical properties, allowing plastic snaps to compete with metal counterparts in medium-stress applications while providing inherent non-conductivity and reduced weight, essential for electric vehicle interiors and sensitive medical equipment.

Automation and digitalization, central to the Industry 4.0 paradigm, are transforming the application and assembly stages. High-speed, fully automated setting machines utilize sensor technology to monitor fabric tension and thickness, adjusting the application force dynamically to prevent damage to delicate materials while ensuring optimal fastener fixation. These machines often incorporate data logging capabilities, providing real-time quality metrics and traceability data for every batch produced, fulfilling the demanding compliance requirements of major global brands. The ability to network these machines globally allows for centralized management and rapid deployment of updated application protocols, streamlining production across geographically dispersed manufacturing facilities and maintaining global consistency in final product quality.

Regional Highlights

The Asia Pacific (APAC) region continues to exert massive influence over the Snap Fastener Market, solidifying its position as the global manufacturing core. This dominance is attributed to the presence of large-scale textile and automotive assembly industries, favorable governmental policies supporting industrial exports, and well-established, cost-effective supply chains for metal processing and polymer production. The regional market is not only a powerhouse for supply but also increasingly a major consumer, with rising affluence in countries like China, India, and Indonesia translating into higher domestic demand for quality finished goods, stimulating local growth in the medium to high-end fastener segments that require imported technology and advanced coatings.

Europe maintains its position as a highly discerning market, characterized by demand for regulatory compliance, innovation, and premium aesthetic appeal. European manufacturers and brands prioritize sustainability, driving the market toward eco-certified materials, recycled content, and transparent supply chains. The region’s focus on high-performance sectors, including luxury fashion, specialized outdoor equipment, and aerospace interiors, ensures sustained demand for high-margin, custom-engineered fasteners, often featuring unique design elements and technologically advanced surface finishes. Regulatory vigilance, particularly concerning chemicals and labor practices, sets the global standard for responsible fastener production.

North America is defined by large, stable demand from the automotive industry, which continuously seeks specialized, durable fasteners for its assembly lines, and the iconic denim and casual wear segments, which rely on robust, branded metal snaps. The market is also heavily influenced by government and military procurement, requiring highly specialized, often domestically sourced fasteners that adhere to strict military specifications (Mil-Spec) regarding durability, camouflage, and non-corrosive properties. While manufacturing volume in North America is lower than APAC, the market commands significant revenue due to the high average selling price of specialized, compliant products and the strong emphasis on intellectual property protection and reliable domestic supply chains.

- Asia Pacific (APAC): Global production leader; fastest growth in domestic consumption; highly competitive pricing environment; focus on mass volume and efficiency (China, Vietnam).

- Europe: Premium segment leader; strong regulatory pressure (REACH compliance); high demand for sustainable, luxury, and technical fasteners; innovation hub for non-toxic plating.

- North America: Stable, high-value market driven by established automotive OEMs and military/defense contractors; emphasis on high durability, brand security, and Mil-Spec compliance.

- Latin America (LATAM): Emerging automotive and textile manufacturing bases (Mexico, Brazil); market growth tied to regional economic stability and local industrial expansion.

- Middle East and Africa (MEA): Growing industrial and construction textile applications; increasing local apparel manufacturing presence in Turkey and Egypt; market opportunity for basic and industrial fasteners.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Snap Fastener Market.- YKK Corporation

- Prym Fashion

- Scovill Fasteners

- JBS Group

- Fasnap Corp.

- FICO Group

- HKK Metal Products Ltd.

- KCC Fasteners

- Alpha Sourcing Limited

- Hiroshina Co., Ltd.

- KAM Snaps

- Riri Group

- A. Raymond

- ITW Fastex

- Wislon Group

- Talon International Inc.

- Ningbo Sunny Garment Accessories

- Durables Inc.

- Ucan Fasteners

- Sharda Buttons

- Zhejiang Donglong Fastener Co., Ltd.

- KYY Group

- Dongguan Haozheng Hardware Co., Ltd.

- Fast Retailing Components

- Takashima & Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Snap Fastener market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the Compound Annual Growth Rate (CAGR) projected for the Snap Fastener Market?

The Snap Fastener Market is projected to experience a stable Compound Annual Growth Rate (CAGR) of 5.5% over the forecast period from 2026 to 2033. This growth is primarily fueled by consistent demand from the global textile sector and increasing adoption in high-specification automotive and technical applications.

How does the volatility of brass prices affect snap fastener manufacturers?

Volatility in brass and zinc prices directly impacts the cost of goods sold, as these metals are the primary raw materials for most durable snap fasteners. Manufacturers mitigate this risk through strategic commodity hedging, long-term procurement contracts, and shifting production towards advanced polymer alternatives in certain non-critical applications to stabilize profit margins.

Which application segment provides the highest volume demand for snap fasteners globally?

The Apparel and Footwear segment consistently provides the highest volume demand for snap fasteners globally. Within this sector, the production of denim goods, jackets, and high-volume fast-fashion items drives immense unit requirements, although the average revenue per unit in this segment is generally lower than in specialized industrial markets.

What are the key compliance challenges facing European snap fastener suppliers?

European suppliers face significant compliance challenges primarily related to the EU REACH regulation, which strictly limits the use of hazardous substances, particularly nickel, lead, and certain phthalates. This requires substantial investment in nickel-free plating, stringent traceability protocols, and third-party material testing for all components destined for the European market.

How is Artificial Intelligence (AI) improving quality control in fastener manufacturing?

AI improves quality control through the deployment of highly advanced machine vision systems. These systems utilize deep learning to analyze high-resolution images of fasteners at production line speed, accurately detecting microscopic flaws, plating defects, and dimensional non-conformities far beyond human capability, ensuring zero-defect rates in mission-critical applications.

What is the significance of plastic snap fasteners in the medical industry?

Plastic snap fasteners are highly significant in the medical industry because they are lightweight, non-magnetic, and chemically resistant, making them ideal for patient gowns and reusable surgical drapes that require frequent high-temperature sterilization (autoclaving) without degradation or corrosion, thereby ensuring hygienic standards and patient safety.

Why is the Asia Pacific region dominating the global production capacity?

The Asia Pacific region dominates global production capacity due to established textile and automotive manufacturing clusters, favorable economies of scale, lower operational and labor costs compared to North America and Europe, and strong governmental support for export-oriented industrial activities in countries like China and Vietnam.

What differentiates a high-performance snap fastener used in automotive applications?

A high-performance automotive snap fastener is engineered to resist extreme temperature fluctuations, withstand constant vibration without spontaneous disengagement, and often incorporates specific fire-retardant (FR) properties. They must also maintain precise dimensional stability to ensure silent and seamless integration into vehicle interiors over the vehicle's lifespan.

How do manufacturers address consumer demands for sustainable products?

Manufacturers address sustainability demands by investing in cleaner production technologies, such as water-saving plating processes and energy-efficient automation. They also actively develop and promote products made from recycled materials, including post-consumer recycled plastics and recycled brass alloys, along with ensuring transparent supply chain auditing for ethical sourcing.

What is the function of a grommet or eyelet in relation to snap fasteners?

While not a closure system itself, a grommet or eyelet is a closely related fastener used to reinforce a hole in fabric or material, typically utilized alongside snaps in industrial textiles or footwear to prevent tearing around the stressed application point, thereby significantly enhancing the overall durability of the finished product.

How do specialized PVD coatings enhance metal snap fasteners?

Physical Vapor Deposition (PVD) coatings enhance metal snap fasteners by providing an extremely hard, highly durable, thin surface layer that offers superior abrasion, chemical, and corrosion resistance compared to traditional electroplating. This technology also allows for unique aesthetic finishes while ensuring compliance with stringent safety standards.

What role does the downstream technical service play in the value chain?

Downstream technical service is critical as it involves training end-users on the correct operation and maintenance of setting machinery, troubleshooting application issues, and providing customized tooling. This ensures the fastener is correctly applied to achieve its intended mechanical performance, thereby minimizing defect rates for large-scale manufacturers.

Which factors contribute to the higher average selling price (ASP) in the European market?

The higher average selling price (ASP) in the European market is primarily due to the stringent regulatory requirements mandating expensive compliance testing, the demand for aesthetically customized and branded finishes, and the prevalence of high-value applications in luxury and technical textile sectors that require certified, high-performance materials.

In the context of the supply chain, what is dual-sourcing?

Dual-sourcing is a procurement strategy where a manufacturer secures essential raw materials (like brass or polymers) from two or more independent suppliers simultaneously. This strategy is employed to mitigate risks associated with geopolitical instability, single-supplier failure, and unpredictable commodity price fluctuations, ensuring continuous production stability.

How is the market influenced by the expansion of the military and defense sectors?

The military and defense sectors influence the market by driving demand for extremely durable, high-specification fasteners known as Mil-Spec components. These fasteners must meet rigorous standards for pull-out strength, extreme temperature endurance, and often specific material compositions that resist corrosion and minimize infrared signature for tactical equipment.

What are the limitations of plastic snap fasteners compared to metal ones?

The primary limitation of plastic snap fasteners is their lower ultimate tensile and shear strength compared to their metal counterparts, making them unsuitable for heavy-duty industrial or high-stress apparel applications like thick denim or military equipment where maximum retention force and traditional ruggedness are non-negotiable requirements.

Which technology is crucial for achieving aesthetic customization on snap fasteners?

Advanced technologies such as laser etching, specialized electroplating techniques, and high-precision coloring processes (including custom enameling or powder coating) are crucial for achieving aesthetic customization, allowing brands to integrate complex logos, unique textures, and specific color matches onto the visible cap component of the fastener.

What is the current growth trend for fasteners used in smart textiles?

Fasteners used in smart textiles are exhibiting accelerated, albeit niche, growth. This segment requires innovation in conductive materials and non-intrusive designs that facilitate the connection of electronic components to fabric, enabling function in wearables, health monitoring devices, and interactive performance clothing without compromising comfort or washability.

How does the concept of "functional aesthetics" apply to the snap fastener market?

Functional aesthetics refers to the simultaneous demand for a fastener that performs its mechanical duty flawlessly while also contributing positively to the overall visual design and branding of the product. This drives the use of premium materials, custom colors, and detailed finishes on the visible component (cap), especially in luxury and fashion apparel.

What are the barriers to entry for new competitors in the high-quality snap fastener segment?

Barriers to entry in the high-quality segment are high due to the necessity of substantial capital investment in precision stamping and molding machinery, the requirement for complex certifications (e.g., REACH, ISO quality management), the need for global distribution networks, and the difficulty in securing long-term OEM contracts without a proven track record of zero-defect supply.

How do manufacturers ensure material traceability?

Manufacturers ensure material traceability by implementing digitized supply chain management systems (SCMS) that track raw materials from their source (e.g., specific batch of brass alloy) through every production stage (plating, assembly) and into the final product delivery, providing detailed batch records that are often required by major brands for quality auditing purposes.

What specific demands does the outerwear market place on snap fasteners?

The outerwear market places demands for high water resistance, superior cold-weather performance (snaps must not freeze or become brittle), high pull-off strength to resist external forces, and enhanced corrosion resistance against elements like salt, crucial for ski jackets, marine gear, and professional protective rainwear.

In what ways do advanced setting machines contribute to market growth?

Advanced automated setting machines contribute to market growth by significantly increasing the speed and consistency of fastener application, reducing labor costs, minimizing fabric damage, and enabling high-volume manufacturers to handle complex materials with greater efficiency, thus scaling production capacity globally to meet rising consumer demand.

What distinguishes stud and socket snaps from ring snaps in application?

Stud and socket snaps are the standard, foundational closure mechanism featuring male (stud) and female (socket) components, designed for secure, permanent attachment to the fabric. Ring snaps specifically refer to a type of socket design that uses a visible metal ring structure, often favored for simple, rugged utility applications where aesthetic subtlety is less critical than robustness.

How do logistics challenges impact market penetration in the MEA region?

Logistics challenges, including complex customs procedures, high transportation costs due to fragmented infrastructure, and varying local regulatory standards, impact market penetration in the MEA region. Successful market entry often requires strategic partnerships with local distributors who possess established regional warehousing and operational expertise.

What is the projected market size by 2033?

The Snap Fastener Market is projected to reach a total value of USD 2.6 Billion by the end of the forecast period in 2033, reflecting steady investment in product quality, specialization for niche applications, and sustained global demand across consumer and industrial sectors.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager