Sneeze Guard Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438263 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Sneeze Guard Market Size

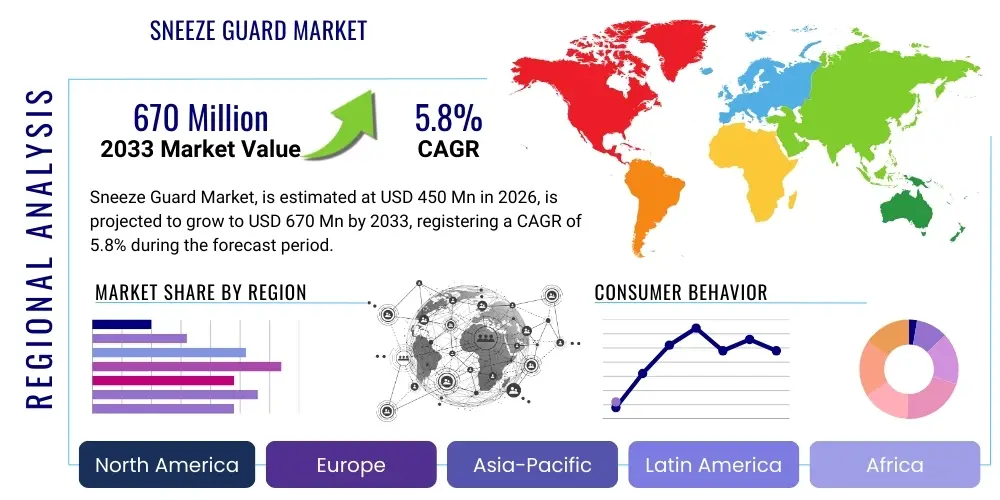

The Sneeze Guard Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 670 Million by the end of the forecast period in 2033.

Sneeze Guard Market introduction

The Sneeze Guard Market, fundamentally redefined by global health security concerns, encompasses the manufacturing and distribution of protective barriers designed to prevent the transmission of respiratory droplets between individuals. Historically used primarily in food service settings like buffets and salad bars, the market scope dramatically expanded during the recent pandemic era to include retail checkout counters, office spaces, medical reception areas, and public transportation hubs. These barriers, often constructed from materials such as acrylic, polycarbonate, tempered glass, and composite plastics, serve as essential physical shields, playing a crucial role in maintaining hygiene standards and promoting perceived safety among employees and consumers alike. The increasing recognition of airborne pathogen transmission risks has cemented the sneeze guard's position as a permanent fixture in modern commercial architecture and design, moving beyond temporary emergency installation to integrated structural components. The sophistication of product offerings has also evolved, incorporating features like pass-through windows, modular designs, and aesthetic integration, catering to diverse industry-specific requirements.

Product descriptions within this market segment are diverse, ranging from permanent, ceiling-mounted architectural installations to portable, free-standing desktop shields. Materials choice is a significant differentiator; tempered glass offers superior scratch resistance and longevity, crucial for high-end retail and medical facilities, while acrylic remains favored for its cost-effectiveness, lightweight nature, and ease of installation in temporary or quick-setup environments. Major applications span a wide spectrum, including quick-service restaurants (QSRs), healthcare facilities (hospitals and clinics), educational institutions (universities and schools), and banking/financial services sectors where transactional safety is paramount. The adaptability of these products to various operational environments—from high-traffic public areas requiring robust, clear protection to intricate office layouts needing discreet separation—underscores the market’s inherent elasticity and broad applicability across the global economy.

The primary benefit driving sustained market demand is enhanced public health compliance and risk mitigation. Sneeze guards demonstrably reduce the cross-contamination risk, bolstering consumer confidence and facilitating business continuity, particularly in environments where close physical proximity is unavoidable. Key driving factors include stringent government regulations mandating hygiene protocols in food handling and public interaction zones, continuous awareness surrounding infectious disease prevention, and the sustained investment by businesses into permanent infrastructure improvements that signal a commitment to employee and customer well-being. Furthermore, aesthetic improvements and the move toward sustainable, recyclable barrier materials are creating new avenues for market expansion, ensuring that sneeze guards remain relevant not just as protective equipment but as elements of thoughtful, modern workspace design. This synthesis of safety, compliance, and design versatility ensures robust market trajectory throughout the forecast period.

- Product Description: Physical barriers (acrylic, glass, polycarbonate) designed to intercept respiratory droplets, available in freestanding, mounted, and modular formats.

- Major Applications: Food service, retail checkouts, banking, healthcare reception, office cubicles, and educational institutions.

- Benefits: Reduces pathogen transmission, enhances employee and consumer safety, improves public health compliance, and facilitates business continuity.

- Driving Factors: Strict health regulations, post-pandemic hygiene prioritization, corporate investment in durable infrastructure, and aesthetic product innovation.

Sneeze Guard Market Executive Summary

The Sneeze Guard Market is currently experiencing a transition from rapid, reactive growth—characteristic of the initial health crisis period—to a more measured, strategic expansion driven by permanent infrastructure investments and regulatory consolidation. Business trends indicate a strong move toward customization and integration; companies are increasingly demanding sneeze guards that seamlessly integrate with existing point-of-sale systems, architectural aesthetics, and accessibility requirements. Manufacturers are responding by focusing on modular designs, material innovation (e.g., anti-microbial coatings), and optimizing supply chains to deliver tailored solutions quickly. The market structure remains fragmented, though consolidation is anticipated as larger material science firms and commercial furniture manufacturers seek to acquire specialized barrier producers to internalize this lucrative product line. Sustainability is emerging as a critical competitive factor, with demand increasing for eco-friendly and fully recyclable barrier solutions.

Regionally, North America and Europe retain the largest market shares, primarily due to rigorous health standards, high public awareness, and substantial corporate spending on workspace modifications. However, the Asia Pacific (APAC) region is projected to exhibit the highest Compound Annual Growth Rate (CAGR), fueled by rapid urbanization, increasing governmental focus on food safety regulations in developing economies, and the massive expansion of the retail and quick-service restaurant (QSR) sectors. Regulatory harmonization across various European Union nations is standardizing demand for specific material quality and structural integrity, streamlining procurement. Conversely, market maturity in North America necessitates a focus on replacement cycles and aesthetic upgrades rather than initial installations, shifting the competitive landscape towards value-added features like ease of cleaning and durability.

Segmentation trends highlight the increasing dominance of the tempered glass segment, particularly in high-traffic and permanent installation settings where durability and perceived professionalism are paramount. While acrylic remains dominant in portable and temporary applications due to its cost advantage, glass is preferred for long-term strategic investments in corporate environments and high-end retail. By application, the retail and commercial services segment (including banks and offices) represents the largest and fastest-growing category, surpassing the traditional food service sector. This shift is indicative of the sneeze guard's evolution from a niche safety item to a standard component of modern transactional and collaborative spaces. Furthermore, the rising demand for sophisticated, fully customizable barriers that incorporate LED lighting, digital display mounts, and ergonomic pass-throughs signals a premiumization trend within the market.

AI Impact Analysis on Sneeze Guard Market

User inquiries concerning the impact of Artificial Intelligence (AI) on the Sneeze Guard Market generally center on efficiency, design optimization, and market intelligence rather than physical product manufacturing, which remains a material science and fabrication process. Common themes include how AI can predict future pandemic preparedness requirements, how machine learning (ML) algorithms can optimize barrier placement and design in complex architectural blueprints to maximize airflow and minimize contact points, and the potential for AI-driven demand forecasting to stabilize highly volatile supply chains. Users are keen to understand if AI can personalize protective solutions for niche environments or streamline the regulatory compliance process by automating the assessment of barrier efficacy against evolving health standards. The consensus expectation is that AI will not replace the product but will profoundly enhance its lifecycle, from initial design consultation to post-installation maintenance and replacement scheduling, driving efficiency gains across the value chain.

The integration of AI tools within the Sneeze Guard market is primarily focused on operational improvements. Manufacturers are leveraging predictive analytics to anticipate regional spikes in demand, especially correlating with seasonal health trends or localized outbreak data, thereby optimizing inventory levels and reducing lead times for essential safety equipment. On the design front, computational fluid dynamics (CFD) simulations, often powered by AI/ML, are being used to test and refine barrier geometry, ensuring optimal droplet dispersion mitigation without impeding crucial business functions like audio communication or material exchange. This shift towards data-driven barrier design is moving the industry beyond basic physical protection toward scientifically validated, performance-optimized solutions. Furthermore, AI is being explored in robotic fabrication processes, ensuring precision cutting and assembly of complex modular systems, which is vital for high-volume, customized orders.

Beyond manufacturing and logistics, AI is transforming customer engagement and market strategy. AI-powered virtual configurators allow potential customers (e.g., restaurant owners, facility managers) to upload floor plans and receive AI-generated recommendations for optimal sneeze guard placement, material selection, and cost estimation, dramatically shortening the sales cycle. Chatbots and natural language processing (NLP) tools are now frequently used by key distributors to answer highly technical questions regarding material safety certifications and installation protocols, providing instant support that traditional sales teams cannot match. This AI-driven customer service enhances the overall buying experience, reinforcing the perception of the market as technologically advanced and responsive to immediate safety needs, thus strengthening market adoption and customer loyalty.

- Supply Chain Optimization: AI-driven predictive modeling stabilizes volatile supply chains by forecasting material and product demand based on public health metrics and regional regulations.

- Design Validation: Machine Learning and Computational Fluid Dynamics (CFD) simulations optimize barrier height, material choice, and placement for validated aerosol mitigation.

- Automated Compliance: AI tools streamline regulatory assessment, ensuring barriers meet rapidly evolving health and safety standards across jurisdictions.

- Personalized Consultation: Virtual configurators use AI to analyze customer floor plans and recommend optimized, custom sneeze guard solutions, improving sales efficiency.

- Robotic Fabrication: Implementation of robotic systems guided by AI for high-precision, high-volume cutting and assembly of complex modular barrier systems.

DRO & Impact Forces Of Sneeze Guard Market

The Sneeze Guard Market is shaped by a robust interplay of Drivers, Restraints, and Opportunities (DRO), collectively forming the primary Impact Forces that dictate its growth trajectory. The most potent driver is the institutionalization of hygiene protocols worldwide, moving away from temporary measures toward permanent, budgeted safety installations in commercial and public sectors. This institutionalization is supported by government mandates, high consumer demand for visible safety measures, and corporate liability concerns. Conversely, the market faces significant restraints, including aesthetic conflicts—where traditional protective barriers detract from sophisticated interior design—and the challenge of maintaining high pricing power amidst increasing commoditization. Opportunities primarily lie in material innovation, such as developing smart barriers that incorporate integrated sensors or anti-microbial surfaces, and expansion into non-traditional markets like residential settings for home offices and specialized educational environments.

Drivers are centered on public health consciousness and regulatory pressure. The sustained global focus on infectious disease preparedness ensures that budgets allocated for facility protection remain high. The shift from low-cost plastic sheeting to durable, professionally installed glass and polycarbonate structures signals long-term market stability. Furthermore, businesses recognize that visible safety measures directly translate into higher customer footfall and trust, making sneeze guards a critical component of their customer experience strategy. The driving force of regulatory updates, particularly concerning food safety and workplace ventilation standards, compels continuous replacement and upgrading of older, less compliant barrier systems, thereby ensuring consistent replacement demand even after the initial mass installation phase subsided post-pandemic.

Restraints predominantly involve installation complexity and material costs. High-quality tempered glass solutions, while durable, require specialized installation and come with significant upfront investment, particularly challenging for small and medium-sized enterprises (SMEs). Moreover, the initial rush led to market saturation with low-quality, basic acrylic shields, leading to price wars and margin erosion in the lower segment. A key behavioral restraint is 'safety fatigue,' where consumers and employees might perceive excessive physical barriers as unwelcoming or overly restrictive, prompting businesses to seek minimalist, less intrusive designs that are often more technologically complex and expensive to produce. Addressing these aesthetic and cost restraints is crucial for sustaining growth in the mid-to-high market tiers.

Opportunities are primarily focused on product diversification and geographic expansion. The development of modular, collapsible, and easily stored sneeze guard systems opens up significant potential in the events and temporary exhibition industries. Material science advancements, including self-cleaning surfaces or barriers that double as digital signage displays, represent value-added propositions that justify higher price points. Geographically, untapped potential exists in emerging economies in Africa and Southeast Asia, where rising income levels and increasing adherence to global hygiene standards, particularly in the burgeoning food and beverage sector, create fertile ground for market penetration. Strategic partnerships with interior design firms and architectural planning companies are essential to integrate barrier design from the initial planning stages, rather than treating them as afterthoughts.

- Drivers: Mandatory health regulations, sustained public health awareness, corporate investment in durable workplace safety infrastructure, and rising consumer confidence tied to visible protection.

- Restraints: High initial cost of tempered glass solutions, aesthetic conflicts with interior design, market commoditization of basic acrylic barriers, and regulatory complexity across diverse jurisdictions.

- Opportunities: Development of smart anti-microbial barriers, expansion into temporary and events markets, geographic penetration into rapidly developing economies, and integration into modern architectural planning processes.

- Impact Forces: Institutionalization of hygiene standards (High positive impact), Material price volatility (Medium negative impact), and Architectural integration trend (High positive impact).

Segmentation Analysis

The Sneeze Guard Market is meticulously segmented across dimensions of material type, product design, application, and distribution channel, providing a granular view of market dynamics and consumer preferences. The analysis of these segments is vital for manufacturers to tailor product development and for distributors to optimize inventory stocking and marketing strategies. The overarching trend observed across all segments is a gravitation toward higher quality, durable, and aesthetically superior products, reflecting the market’s shift from urgency-driven purchasing to long-term capital expenditure. This segmentation allows for targeted market entry and pricing strategies, distinguishing between the commoditized basic acrylic market and the premium, custom-fabricated glass market. Understanding segment-specific growth rates is key to forecasting overall market evolution.

The segmentation by material type is crucial, separating high-growth, high-margin materials like tempered glass and polycarbonate from volume-driven, lower-margin segments such as standard acrylic and plastic composites. Tempered glass continues to gain traction due to its superior clarity, scratch resistance, and enhanced safety profile, making it the material of choice for permanent installations in banking, high-end retail, and healthcare environments. Conversely, segmentation by product design differentiates between freestanding (portable), countertop-mounted, and ceiling-suspended barriers. The portability offered by freestanding units ensures consistent demand across dynamic environments, such as pop-up shops or temporary exhibitions, while mounted and suspended systems dominate static, high-volume interaction points like grocery store checkouts and institutional cafeterias. Each design type requires distinct manufacturing and installation expertise, influencing competitive advantages.

Application segmentation remains highly instructive, distinguishing the traditional food service sector (QSRs, buffets) from the rapidly expanding commercial services and institutional segments (schools, government offices, libraries). The commercial services segment is driving innovation, particularly in terms of integrating barriers with existing office technology and furniture. Finally, the distribution channel segmentation separates direct sales (often used for large, custom corporate orders) from indirect channels (e.g., janitorial suppliers, office supply stores, e-commerce platforms). The increasing effectiveness of specialized e-commerce platforms offering custom design tools is democratizing access to high-quality barriers, previously only available through bespoke architectural consultations, thereby rapidly transforming the indirect distribution landscape and optimizing reach.

- By Material Type:

- Tempered Glass

- Acrylic (Plexiglass)

- Polycarbonate

- Plastic Composites

- By Product Design:

- Freestanding/Portable Barriers

- Countertop Mounted Shields

- Suspended/Ceiling Mounted Systems

- Modular and Customizable Walls

- By Application:

- Food Service (Restaurants, Cafeterias, Buffets)

- Retail and Commercial Services (Checkouts, Banks, Salons)

- Healthcare (Reception Desks, Pharmacies)

- Institutional (Schools, Libraries, Government Offices)

- Corporate Offices and Collaborative Spaces

- By Distribution Channel:

- Direct Sales (B2B Large Orders)

- Indirect Sales (Wholesalers, Janitorial Supply, E-commerce)

Value Chain Analysis For Sneeze Guard Market

The Value Chain for the Sneeze Guard Market begins with the Upstream Analysis, which focuses heavily on the procurement and processing of raw materials. This stage is dominated by large chemical and material science companies supplying essential components: acrylic sheets (methyl methacrylate), tempered glass panels, and various aluminum or steel extrusions for framing. Price volatility in petrochemical derivatives significantly impacts the cost structure of acrylic and polycarbonate barriers, forcing manufacturers to engage in rigorous hedging and strategic sourcing. Key considerations upstream involve material quality certifications, specifically related to clarity, durability, fire resistance, and increasingly, recyclability. Efficiency gains at this stage often stem from long-term supply agreements and vertical integration attempts by major barrier manufacturers to control material input quality and cost, especially for high-demand tempered glass products.

The Midstream component involves manufacturing, fabrication, and assembly. This is where value addition occurs through precise cutting (laser or CNC), edge polishing, application of specialized coatings (anti-scratch, anti-microbial), and assembly of modular kits. Technology plays a crucial role here, with automated fabrication allowing for complex custom designs to be produced efficiently. Quality control, particularly ensuring optical clarity and structural stability, is paramount. Manufacturers who invest in advanced machinery capable of handling both large glass panels and intricate acrylic cuts hold a competitive advantage, enabling them to service both the high-end and high-volume segments simultaneously. The ability to rapidly prototype and execute customized orders is a key differentiator in the increasingly fragmented market landscape.

Downstream Analysis encompasses distribution, marketing, and installation services. The distribution channel is bifurcated into direct sales for large institutional clients requiring bespoke installation (e.g., major hospital chains or banking headquarters) and indirect sales through specialized distributors and expansive e-commerce platforms. Direct channels allow for higher margins and better control over the final customer experience, including professional installation and maintenance contracts. Indirect channels leverage established logistics networks to quickly deliver standard, portable units to SMEs and residential customers. Effective downstream strategy relies on optimizing logistics for large, fragile components (glass) and providing comprehensive, easy-to-follow installation guides for DIY-friendly products, ensuring customer satisfaction across all segments.

Sneeze Guard Market Potential Customers

The potential customer base for the Sneeze Guard Market is exceptionally broad, spanning nearly all sectors that involve close human interaction or public transactions, reflecting its utility as a general safety mechanism. The primary End-Users/Buyers include institutional buyers such as educational systems (K-12 schools and higher education campuses), which require large volumes of durable, easily cleanable barriers for classrooms, libraries, and administrative offices. Healthcare facilities—ranging from small dental practices and local clinics to large multi-specialty hospitals—are high-value customers, demanding highly transparent, non-yellowing, medical-grade materials, often integrating barriers at triage, testing, and pharmacy counters to protect staff and sensitive equipment. These institutional segments prioritize long-term durability and compliance with strict regulatory standards.

Another crucial segment comprises the Retail and Hospitality industries. Retail stores, particularly grocery chains and big-box stores, continuously refresh or upgrade barriers at their point-of-sale (POS) systems, often requiring modular units that accommodate conveyor belts and payment terminals. The hospitality sector, encompassing hotels, quick-service restaurants (QSRs), and fine dining establishments, utilizes sneeze guards not only in traditional buffet lines but also at check-in desks, concierge services, and food preparation areas. For these buyers, aesthetic considerations are highly important; the barriers must complement the décor without appearing overly clinical, driving demand for polished edges, custom sizing, and low-profile mounting hardware that blend seamlessly into the environment.

Finally, the corporate and financial services sectors represent a rapidly growing customer demographic. Corporate offices are installing permanent barriers in open-plan workspaces (cubicle dividers), reception areas, and high-density meeting rooms to facilitate safe return-to-office strategies. Financial institutions, including banks and credit unions, require highly secure, ballistic-resistant or tempered glass sneeze guards at teller windows, ensuring both physical protection from droplets and security against potential threats. These customers typically require large, customized orders that involve significant architectural planning and integration, making them ideal targets for direct sales channels and manufacturers specializing in bespoke structural solutions, ensuring premium pricing and consistent maintenance contract opportunities.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 670 Million |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Sneeze GuardEZ, Clear Solutions, Acme Plastic, Guardian Technologies, Sneeze Guard, Inc., Glass & Acrylic Works, PlexiglassPro, Custom Guards LLC, Thermofisher Scientific (Indirectly), 3M (Material Supplier), L&W Industries, Creative Store Solutions, Displays2go, Alufab Inc., Safe Barriers Co., Protective Shield Systems, Transparent Solutions Group, Modular Safety Designs, Global Safety Products, PolyShield Fabricators. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Sneeze Guard Market Key Technology Landscape

The technological landscape of the Sneeze Guard Market is defined less by disruptive digital innovation and more by advanced material science, precision fabrication, and integration capabilities. The core technology involves the precise cutting, polishing, and shaping of polymers and glass using high-accuracy machinery, such as Computer Numerical Control (CNC) routers and laser cutters, ensuring clean edges and seamless component mating crucial for aesthetic appeal and structural integrity. A significant advancement is the deployment of specialized coatings. Anti-microbial coatings, utilizing silver ions or copper compounds embedded in the material surface, provide an added layer of biological protection, reducing pathogen survival time on the barrier surface, which is a major selling point in healthcare and food service applications. This focus on material engineering enhances the value proposition beyond simple physical separation.

Fabrication technology is also evolving toward modularity and rapid customization. Manufacturers are adopting advanced injection molding techniques for plastic composites and specialized tempering processes for glass to create lighter, stronger, and more complex geometric forms. The increasing demand for curved, cornered, or multi-panel sneeze guards necessitates sophisticated design software (CAD/CAM) to minimize material waste and maximize production efficiency. Furthermore, technological innovation extends to mounting and installation systems. Modern sneeze guards utilize low-profile, high-strength magnetic or interlocking joint systems that allow for easy, tool-free installation and quick dismantling for cleaning or storage. This design technology directly addresses the restraint of complex installation previously faced by customers.

Integration technology represents the future direction of the market. There is a growing trend to embed passive electronic features and sensors into the physical barriers. Examples include integrating near-field communication (NFC) chips for inventory management, subtle LED lighting strips for enhanced visibility, or sensors that monitor air quality and cleanliness around the barrier, alerting staff when cleaning is required. While full AI integration is nascent, the use of augmented reality (AR) tools in the sales process allows customers to visualize different sneeze guard styles superimposed onto their physical space before purchase, significantly streamlining decision-making and customization. This technological evolution ensures the product remains functionally relevant in increasingly smart commercial environments.

Regional Highlights

The Sneeze Guard Market exhibits distinct regional maturity and growth patterns, heavily influenced by local regulatory environments, consumer health priorities, and economic development cycles. North America, encompassing the United States and Canada, represents the most mature market, characterized by high adoption rates, stringent workplace safety regulations (e.g., OSHA guidelines), and significant corporate spending on durable safety infrastructure. The regional emphasis here is on replacement demand, aesthetic upgrades, and integration of high-end materials like tempered glass in corporate and financial sectors. The US market specifically drives innovation in customizable and highly engineered solutions, often demanding products that adhere to complex local building codes and accessibility standards. Due to the high purchasing power, manufacturers focus on premium features and long-term service contracts.

Europe stands as the second-largest market, marked by robust standardization efforts and a strong public commitment to environmental sustainability. Regulatory bodies across the EU have been proactive in mandating specific hygiene standards in food service and public interaction zones, maintaining stable demand. Key countries such as Germany, the UK, and France are focused on high-quality, recyclable materials (such as low-iron glass for maximum clarity) and sleek designs that comply with sophisticated European interior aesthetics. The market dynamics are heavily influenced by the speed of adopting the European Union's harmonized standards regarding safety equipment, which tends to favor manufacturers capable of achieving continent-wide certification efficiently. Eastern Europe, while smaller, represents a high-growth area as safety regulations catch up with Western European standards.

The Asia Pacific (APAC) region is forecasted to be the fastest-growing market globally. This rapid growth is propelled by high population density, rapid expansion of the QSR and retail chains (especially in China, India, and Southeast Asia), and increasing governmental investment in public health infrastructure modernization. While cost remains a critical factor, driving strong demand for affordable acrylic solutions, there is simultaneous growth in the premium segment driven by multinational corporations establishing regional headquarters that adhere to global safety standards. Japan and South Korea lead in adopting technologically integrated barriers, reflecting their advanced position in retail and healthcare technology. The diversity of regulatory landscapes across APAC necessitates localized production and distribution strategies to cater effectively to heterogeneous market needs and cultural preferences regarding public interaction.

Latin America (LATAM) and the Middle East & Africa (MEA) currently hold smaller market shares but are exhibiting promising growth trajectories. In LATAM, market growth is often volatile, tied to economic stability, but major cities in Brazil and Mexico are seeing significant uptake, particularly in formalized retail and banking sectors seeking to establish high safety benchmarks. The MEA region, specifically the Gulf Cooperation Council (GCC) countries, is investing heavily in tourism, hospitality, and large-scale public events (e.g., expos, sporting events), driving demand for temporary, high-volume, and aesthetically impressive barrier solutions that align with modern architectural projects. Challenges in these regions primarily include complex logistics and the reliance on imported materials, which increase final product cost and procurement lead times, requiring local distribution partnerships to mitigate these logistical restraints and optimize market penetration.

- North America: Highest maturity, focus on replacement cycles, high-end customization (tempered glass), stringent regulatory compliance, and corporate adoption in open-plan offices.

- Europe: Driven by standardization, sustainability goals (recyclable materials), high aesthetic integration requirements, and strong compliance in food service sectors across the EU.

- Asia Pacific (APAC): Fastest growth due to urbanization, QSR expansion, high population density, and governmental infrastructure investment in public health; cost-sensitivity remains a key factor.

- Middle East & Africa (MEA): Emerging market driven by investment in hospitality, tourism infrastructure, and large event management; demand for bespoke, architecturally integrated designs in GCC nations.

- Latin America (LATAM): Growth concentrated in urban centers and formal retail/banking sectors; market stability linked to broader regional economic performance and increasing hygiene standards.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Sneeze Guard Market.- Sneeze GuardEZ

- Clear Solutions International

- Acme Plastic Products

- Guardian Technologies

- Sneeze Guard, Inc.

- PlexiglassPro

- Custom Guards LLC

- Thermofisher Scientific (Supply Chain/Indirect)

- 3M Company (Raw Material and Coating Supplier)

- L&W Industries

- Creative Store Solutions

- Displays2go

- Alufab Inc.

- Safe Barriers Co.

- Protective Shield Systems

- Transparent Solutions Group

- Modular Safety Designs

- Global Safety Products

- PolyShield Fabricators

- Marlin Steel Wire Products

Frequently Asked Questions

Analyze common user questions about the Sneeze Guard market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the current market trend regarding materials used for sneeze guards?

The dominant market trend is a significant shift toward durable, premium materials, specifically tempered glass and high-grade polycarbonate, particularly for permanent installations in corporate, banking, and healthcare environments. While acrylic remains cost-effective for portable units, glass is preferred due to its superior clarity, scratch resistance, and enhanced longevity, aligning with long-term facility investment strategies. Furthermore, the integration of anti-microbial coatings on all material types is becoming a standard expectation for high-hygiene applications like food service.

How do global health regulations impact the future demand for sneeze guards?

Global health regulations are transitioning from temporary emergency measures to institutionalized, permanent public health standards, significantly bolstering sustained demand. Government mandates concerning food safety, air quality, and workplace interaction protocols now often require physical separation barriers as a standard operating procedure. This regulatory pressure ensures continuous replacement, upgrading, and expansion into new institutional sectors (like transport hubs and libraries), driving stable market growth rather than merely reactive purchasing spikes.

Which application segment shows the highest growth potential in the forecast period?

The Retail and Commercial Services segment, which includes retail checkouts, banking centers, and corporate office spaces, is anticipated to exhibit the highest growth potential. This segment is moving aggressively toward customizing and integrating high-quality, architecturally designed barriers into existing interior layouts. The continuous need for businesses to facilitate secure, face-to-face transactions while ensuring perceived safety drives robust investment in permanent, aesthetically pleasing sneeze guard installations, surpassing the growth rate of the traditional food service segment.

What are the primary challenges restraining the widespread adoption of sneeze guards in aesthetic-sensitive environments?

The primary restraint is the aesthetic conflict arising when functional, protective barriers clash with sophisticated interior design. Traditional, bulky plastic shields can detract from a space's professional or welcoming ambiance. This restraint is forcing manufacturers to invest in solutions like low-profile mounting hardware, frameless tempered glass, and highly customizable designs that minimize visual intrusion. Successful market players are those who can deliver high-performance safety features that blend seamlessly into the environment, effectively turning a protective barrier into an integrated design feature.

How is the Sneeze Guard Market addressing sustainability and environmental concerns?

The market is actively addressing sustainability by increasing the use of fully recyclable materials, primarily tempered glass and certain types of high-grade polycarbonate, over single-use or hard-to-recycle plastics. Manufacturers are also focusing on optimizing material utilization through advanced CNC cutting techniques to minimize scrap waste during fabrication. Furthermore, the emphasis on durability and longevity (especially through lifetime warranties on glass barriers) directly reduces the frequency of replacement, aligning the industry with broader circular economy principles and meeting the growing environmental demands of corporate clients.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager