Snow Blowers Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438591 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Snow Blowers Market Size

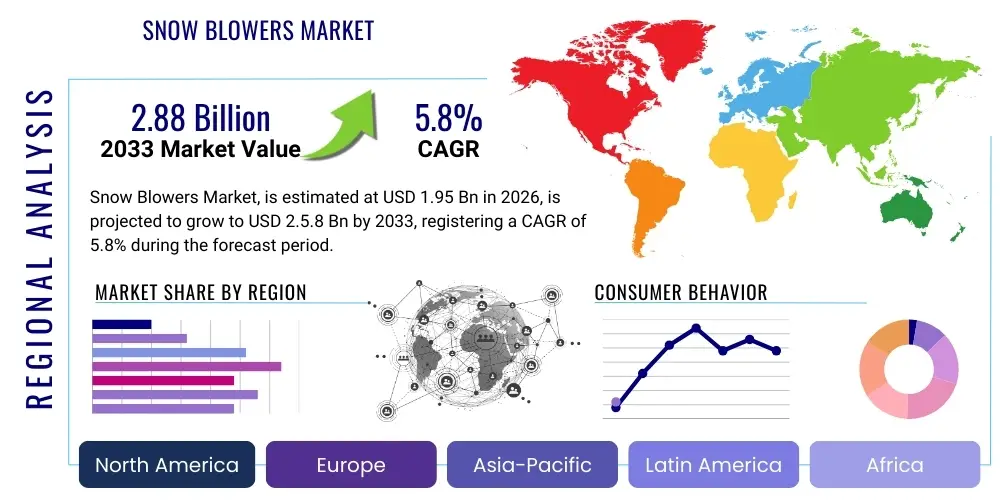

The Snow Blowers Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at $1.95 Billion in 2026 and is projected to reach $2.88 Billion by the end of the forecast period in 2033. This consistent expansion is primarily fueled by increasing residential construction in high snowfall regions, coupled with the rising consumer preference for efficient, battery-powered equipment that minimizes manual labor during severe winter weather events. The demand is further solidified by continuous product innovation focused on improved ergonomics, extended runtimes, and reduced emissions, positioning snow blowers as essential winter maintenance tools for both commercial and residential sectors across North America and Europe.

Snow Blowers Market introduction

The Snow Blowers Market encompasses the manufacturing, distribution, and sale of specialized equipment designed to remove snow from surfaces such as driveways, sidewalks, and parking lots. These machines utilize an auger or impeller mechanism to collect and forcefully discharge snow, significantly reducing the time and physical effort required compared to manual shoveling. Products range from single-stage electric models suitable for light, residential snowfalls to heavy-duty, three-stage gasoline-powered units capable of clearing dense, frozen drifts in commercial or municipal settings. Key product types include electric corded, battery-powered (cordless), and gasoline-powered snow blowers, categorized further by the number of stages (single, two, or three).

Major applications for snow blowers span residential maintenance, commercial property management (including retail centers and office parks), and governmental use for clearing public pathways and smaller roads. The primary benefits driving market adoption include enhanced efficiency, reduced risk of injury associated with heavy lifting and shoveling, and the ability to rapidly clear large areas following heavy snow events, ensuring accessibility and safety. The increasing frequency and intensity of winter storms attributed to climate variability further underscore the necessity of reliable snow removal equipment.

Driving factors propelling market growth include technological advancements, particularly in lithium-ion battery technology, which addresses historical range and power limitations of electric models, making them viable alternatives to traditional gasoline units. Furthermore, stringent environmental regulations aimed at reducing carbon emissions stimulate demand for cleaner, battery-operated solutions. Robust housing starts in northern latitudes and heightened consumer spending on home maintenance equipment contribute significantly to the residential segment's robust performance.

Snow Blowers Market Executive Summary

The Snow Blowers Market is currently experiencing a profound shift characterized by the rapid electrification of equipment, driven by environmental concerns and advancements in battery technology. Business trends indicate a competitive landscape dominated by established manufacturers focusing heavily on expanding their cordless product lines, emphasizing power parity with gasoline engines, and incorporating smart features like IoT connectivity for maintenance alerts and performance monitoring. Regional trends highlight North America and Europe as the dominant revenue generators due to sustained high snowfall levels and high consumer disposable income, though Asia Pacific is emerging as a critical market, particularly in countries like Japan and South Korea, where urbanization is driving demand for compact, efficient residential units.

Segment trends confirm the growing dominance of two-stage snow blowers for their versatility across moderate to heavy snow conditions, securing the largest market share by product type. Concurrently, the battery-powered segment is exhibiting the highest CAGR, spurred by residential users seeking quiet, low-maintenance alternatives. The market structure emphasizes direct-to-consumer digital sales channels alongside traditional big-box retailers, optimizing inventory management and customer reach. Overall market performance is resilient, strongly correlated with seasonal weather patterns and global macroeconomic stability influencing consumer purchasing power.

Manufacturers are strategically partnering with battery technology providers to enhance energy density and fast-charging capabilities, ensuring consumer satisfaction regarding runtime constraints. Regulatory frameworks supporting emissions reduction continue to shape product development, favoring non-combustion engine solutions. The convergence of favorable weather variability, technological maturity in electric power, and strategic marketing targeting ease-of-use ensures sustainable growth momentum across the forecast period, making the transition toward cordless outdoor power equipment a definitive market trajectory.

AI Impact Analysis on Snow Blowers Market

User inquiries regarding AI's impact on the Snow Blowers Market center primarily on the potential for autonomous operation, predictive maintenance, and optimized resource allocation. Key themes reflect user expectations for snow blowers that can automatically detect snowfall, self-navigate complex residential landscapes, and manage their charging cycles efficiently. Concerns often revolve around the cost premium associated with AI integration, data privacy in connected devices, and the reliability of autonomous systems in harsh, unpredictable weather environments. Users are increasingly seeking clarity on how AI can transition snow removal from a reactive chore to a proactive, automated service. The consensus expectation is that AI integration will fundamentally elevate the performance, safety, and convenience of high-end snow clearing equipment.

The integration of Artificial Intelligence and machine learning is poised to revolutionize the operational efficiency and user experience of snow clearing equipment, moving beyond traditional mechanical improvements. AI algorithms can be deployed in connected snow blowers to analyze local weather patterns and hyper-local forecasts, allowing the machine or a connected fleet manager to predict optimal clearing times and automatically adjust operational parameters, such as auger speed and discharge trajectory, based on snow density and depth. This level of predictive functionality allows commercial operators to optimize fleet dispatch and maintenance schedules, significantly reducing downtime and operational costs associated with unexpected component failures.

Furthermore, AI facilitates the development of semi-autonomous or fully autonomous snow blowers, particularly for large commercial properties, industrial sites, and airports. Using computer vision and LiDAR, AI-powered navigation systems enable precise mapping and obstacle avoidance, ensuring comprehensive clearing without human intervention. This shift addresses the labor shortage challenges often faced by commercial snow removal contractors. For residential users, AI integration through smartphone applications enables remote diagnostics and personalized operational guidance, effectively minimizing the learning curve and maximizing the equipment’s lifespan through proactive, sensor-based maintenance notifications. The enhanced efficiency derived from AI is a critical differentiator in the premium segment.

- AI-driven predictive maintenance optimizes service intervals based on usage patterns and component wear, minimizing unexpected failures.

- Autonomous navigation systems utilizing computer vision and machine learning enable self-operating snow blowers for commercial applications.

- Smart connectivity allows for remote diagnostics, operational parameter adjustments, and firmware updates improving user convenience.

- Weather and snow density algorithms optimize engine or motor performance in real-time for maximum efficiency and battery life.

- Supply chain optimization benefits from AI forecasting demand based on long-range weather predictions, improving manufacturing scalability.

DRO & Impact Forces Of Snow Blowers Market

The dynamics of the Snow Blowers Market are fundamentally shaped by a delicate balance between environmental factors stimulating demand and operational constraints affecting adoption. Key drivers include increased severity of winter weather events and rapid technological maturation in battery systems. Restraints predominantly involve the high initial cost of premium electric models and the seasonal nature of demand, which complicates production planning. Opportunities lie in expanding into emerging cold regions and developing specialized autonomous solutions. These forces, collectively, determine market penetration rates and influence manufacturer investment in R&R (Research & Development). The market exhibits strong inelasticity concerning weather variability; severe winters translate directly into robust sales, making climate a major exogenous impact force.

Drivers: Significant market acceleration is attributed to the enhanced performance and reduced environmental footprint of electric and battery-powered snow blowers. Lithium-ion technology now offers runtimes and power outputs comparable to smaller gasoline engines, removing a major barrier to adoption. Furthermore, suburban expansion in northern latitudes increases the total addressable market of homeowners requiring efficient snow removal. Regulatory pushes, particularly in Europe and parts of North America, to phase out small gasoline engines due to emissions concerns, act as a powerful catalyst driving the transition to electric models, reinforcing the sustainability narrative within the consumer durable goods sector.

Restraints: The primary restraint remains the high initial purchasing price of advanced two-stage and three-stage snow blowers, particularly those incorporating premium battery technology or autonomous features, limiting immediate adoption in price-sensitive markets. Additionally, the inherent seasonality of the product leads to high inventory volatility and necessitates substantial off-season storage and operational adjustments for retailers and manufacturers. Concerns over battery degradation in extreme cold temperatures, although mitigated by modern technology, still pose a perceived risk for some consumers considering large-scale investments in cordless equipment.

Opportunities: Major opportunities exist in developing highly customized solutions for specialized applications, such as airport tarmac clearing or solar farm maintenance in snowy regions, requiring heavy-duty, highly efficient, and low-emission equipment. The proliferation of e-commerce channels facilitates direct manufacturer-to-consumer sales, allowing for better margin control and personalized customer service. Furthermore, integrating smart home systems with automated snow clearing schedules presents a lucrative avenue for premium, connected product offerings targeting tech-savvy homeowners.

Impact Forces: External factors such as climate change, which increases the unpredictability and intensity of snowfall in previously moderate regions, significantly impact demand spikes. Economic conditions, including consumer confidence and disposable income levels, directly affect the replacement cycle and new purchase rates, particularly for discretionary equipment. Supply chain disruptions, often related to semiconductor availability for smart components or battery raw materials, also exert a strong impact on production capacity and pricing stability across the market.

Segmentation Analysis

The Snow Blowers Market is meticulously segmented based on product type, operation stage, power source, end-user application, and distribution channel, reflecting the diverse needs of the global consumer base. Product segmentation distinguishes between single-stage, two-stage, and three-stage models, primarily dictated by the volume and density of snow they are designed to handle. Single-stage blowers are generally lighter and suited for minor residential clearances, while two-stage and the highly advanced three-stage models cater to deeper, icy snow conditions typical of commercial or large suburban properties. The power source segmentation—gasoline, electric corded, and battery-powered—is perhaps the most dynamic, with battery technology rapidly increasing its share due to performance improvements and environmental mandates.

End-user categories clearly delineate between Residential and Commercial/Industrial sectors, each having distinct requirements regarding durability, operational hours, and power capacity. Residential users prioritize ease of use, maneuverability, and low noise, driving demand for battery-powered units. Conversely, Commercial users, including property managers, municipalities, and facility operators, require robust, high-horsepower gasoline or industrial electric units capable of extended operation in challenging conditions. The ongoing shift toward professionalization in property maintenance also fuels demand for commercial-grade equipment.

Analyzing these segments provides strategic insights into manufacturing priorities; for example, investment is heavily flowing toward refining two-stage, battery-powered systems, recognized as the optimal combination of power and sustainability for the mass consumer market. Geographic segmentation also plays a crucial role, with markets like North America driving demand for heavy-duty, multi-stage units due to high average snowfall, whereas densely populated European cities show greater preference for lighter, electric models suitable for compact urban areas and strict noise regulations. Understanding this granular segmentation is essential for effective product portfolio management and targeted marketing efforts.

- By Product Type:

- Single-Stage Snow Blowers

- Two-Stage Snow Blowers

- Three-Stage Snow Blowers

- By Power Source:

- Gasoline-Powered Snow Blowers

- Electric (Corded) Snow Blowers

- Battery-Powered (Cordless) Snow Blowers

- By End User:

- Residential

- Commercial/Industrial (Including Municipalities)

- By Operation Stage:

- Walk-Behind

- Attachment (Tractor/ATV mounted)

- By Distribution Channel:

- Offline (Specialty Stores, Retail Chains, Dealerships)

- Online (E-commerce Platforms, Manufacturer Websites)

Value Chain Analysis For Snow Blowers Market

The value chain of the Snow Blowers Market begins with the sourcing of critical raw materials and components, which include steel and composite plastics for chassis and housing, high-precision electronic components, and specialized lithium-ion cells for electric models. Upstream analysis focuses on suppliers of engines (for gasoline units), electric motors, and, most critically, advanced battery management systems (BMS). Efficient and cost-effective component procurement is vital, as volatility in steel and semiconductor prices directly impacts final product cost and manufacturing lead times. Manufacturers must manage complex global supplier networks to ensure quality and supply continuity, especially given the seasonal demand spikes. Strategic partnerships with key battery providers are crucial for ensuring competitive advantages in the electric segment.

The core manufacturing and assembly stage involves design, fabrication, and quality assurance processes, with a heavy emphasis on incorporating robust components to withstand harsh operating conditions. Distribution channels represent a critical nexus in the downstream analysis. These channels are broadly categorized into direct sales (online manufacturer platforms) and indirect sales, primarily through big-box retailers (like Home Depot and Lowe’s), specialty outdoor power equipment dealers, and independent distributors. Indirect channels, particularly major retail chains, offer unparalleled market reach and customer visibility, necessitating complex logistics for seasonal inventory stocking and rapid fulfillment just prior to winter seasons.

The structure of the distribution channel directly influences market penetration. Specialty dealers offer superior product knowledge, repair services, and after-sales support, crucial for high-value commercial customers. Conversely, online platforms provide competitive pricing and convenience for residential buyers, accelerating the direct-to-consumer model. The aftermarket segment, including parts, accessories (e.g., drift cutters, protective covers), and specialized maintenance services, forms a significant part of the downstream value proposition, ensuring product longevity and customer satisfaction. Optimized inventory management across all channels is paramount to mitigate risks associated with unpredictable seasonal demand.

Snow Blowers Market Potential Customers

Potential customers for the Snow Blowers Market are broadly categorized into residential end-users and professional/commercial buyers, each demonstrating distinct purchasing criteria and volume requirements. Residential customers, primarily homeowners in regions experiencing moderate to heavy annual snowfall (e.g., the Northeast US, Central Canada, Nordic countries), seek ease of use, reliability, and minimal maintenance. This segment increasingly favors battery-powered, two-stage models that offer a balance between power and portability. The purchasing decision for this group is heavily influenced by factors such as driveway length, available storage space, and community noise restrictions, driving demand for technologically advanced, quieter equipment.

The commercial segment encompasses property management firms, landscaping and snow removal service providers, educational institutions, hospital complexes, and government entities (e.g., municipal public works departments). These buyers require high-durability, maximum-power solutions, often opting for heavy-duty, gasoline-powered, or industrial-grade electric three-stage blowers designed for continuous, extended use in severe conditions. Their purchasing decisions are driven by total cost of ownership (TCO), fuel efficiency, fleet management capabilities, and access to rapid maintenance and spare parts, making specialized dealers their preferred distribution channel.

A burgeoning segment includes agricultural facilities and large industrial sites requiring clearance of substantial open areas and access roads. These end-users often seek highly efficient, sometimes attachment-based or autonomous, snow clearing machinery tailored for heavy-duty, wide-path clearance. Manufacturers are strategically tailoring product lines to meet the specific demands of these diverse buyer groups, focusing on modular designs for commercial fleets and user-friendly, quiet operation for the expanding residential consumer base seeking environmentally conscious alternatives.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.95 Billion |

| Market Forecast in 2033 | $2.88 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | The Toro Company, Ariens Company, Honda Motor Co., Ltd., MTD Products Inc (Techtronic Industries), Husqvarna Group, Snow Joe LLC, Ryobi Tools (Techtronic Industries), Briggs & Stratton LLC, Craftsman (Stanley Black & Decker), Greenworks Tools, EGO Power+ (Chervon), Generac Power Systems, Troy-Bilt, DR Power Equipment, WEN Products, Simplicity, John Deere, Cub Cadet. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Snow Blowers Market Key Technology Landscape

The technological landscape of the Snow Blowers Market is rapidly evolving, moving away from purely mechanical innovations toward integration of advanced power management and connectivity solutions. Central to this evolution is the deployment of high-density lithium-ion batteries (typically 80V or higher systems) that provide sufficient energy capacity and discharge rates to rival small internal combustion engines in cold environments. Manufacturers are employing intelligent battery management systems (BMS) to optimize performance, prevent thermal runaway, and ensure longevity, which is critical for consumer acceptance in cold weather climates. Furthermore, brushless motor technology is becoming standard across premium electric models, offering superior torque, energy efficiency, and reduced maintenance needs compared to traditional brushed motors, thereby extending operational life and maximizing runtime per charge.

Beyond core power systems, connectivity and smart features are distinguishing high-end product lines. Integration of Bluetooth and Wi-Fi capabilities allows users to monitor battery status, track location, and receive diagnostic alerts via mobile applications. This capability supports both residential convenience and commercial fleet management efficiency. In two-stage and three-stage models, advanced features such as automatic steering assists (e.g., Zero-Turn steering), electronic chute control, and specialized drift cutter technologies enhance maneuverability and effectiveness in varied snow conditions. These mechanical refinements, coupled with electronic controls, contribute to a significantly improved user experience and operational safety.

The push towards environmental sustainability has also driven significant R&D into electric drivetrain optimization and noise reduction technologies, making snow blowers more suitable for use in densely populated areas with strict noise ordinances. Future innovations are expected to heavily focus on modular battery platforms that can be interchanged across multiple outdoor power tools from the same brand, enhancing consumer value proposition. Furthermore, early stage autonomous prototypes utilizing sophisticated sensor arrays and GPS mapping are being tested, representing the next frontier for commercial and industrial applications aiming for fully automated winter maintenance solutions.

Regional Highlights

- North America: North America remains the paramount market for snow blowers, driven by consistently heavy snowfall in the Northeast, Midwest United States, and large portions of Canada. The region exhibits high consumer disposable income and a strong cultural reliance on mechanized snow removal, resulting in substantial demand for high-powered, two-stage and three-stage gasoline and premium battery-powered units. The US and Canada collectively account for the largest share of the global market revenue, bolstered by robust residential construction activity and substantial commercial infrastructure that necessitates efficient clearing. Manufacturers frequently introduce new models here first, leveraging the demanding conditions as a primary testing ground for innovation.

- Europe: Europe represents a significant and rapidly evolving market, particularly across the Nordic countries (Sweden, Norway, Finland) and Central Europe (Germany, Switzerland, Austria). Unlike North America, European growth is highly concentrated in the battery-powered segment due to stricter noise regulations and a greater overall emphasis on environmental sustainability and emission reduction mandates. The market favors compact, efficient, and quiet single-stage and smaller two-stage models suitable for smaller driveways and urban pathways. Government incentives promoting green technology further stimulate the demand for electric snow removal equipment.

- Asia Pacific (APAC): While smaller than the established Western markets, APAC is demonstrating rapid growth, primarily fueled by demand in high-altitude and northern regions of countries such as Japan, South Korea, and parts of China. Urbanization trends in these areas are driving the need for compact, easily storable residential units. Japan, with its high density and technologically advanced consumer base, is a key adopter of premium electric models. The market is increasingly opening up to Western brands but also relies heavily on strong local manufacturing capabilities tailored to specific regional snow conditions and space constraints.

- Latin America, Middle East, and Africa (MEA): This region constitutes a peripheral but specialized market. Demand is highly localized to mountainous regions or areas that experience unique high-altitude snowfall (e.g., Andes mountains, Atlas mountains). Sales volumes are generally lower, focusing on specific commercial and governmental needs rather than widespread residential consumption. Specialized heavy-duty blowers are sometimes imported for infrastructure projects or mining operations in cold climates, but the overall market size contribution remains modest compared to established cold weather regions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Snow Blowers Market.- The Toro Company

- Ariens Company

- Honda Motor Co., Ltd.

- MTD Products Inc (Techtronic Industries)

- Husqvarna Group

- Snow Joe LLC

- Ryobi Tools (Techtronic Industries)

- Briggs & Stratton LLC

- Craftsman (Stanley Black & Decker)

- Greenworks Tools

- EGO Power+ (Chervon)

- Generac Power Systems

- Troy-Bilt

- DR Power Equipment

- WEN Products

- Simplicity

- John Deere

- Cub Cadet

Frequently Asked Questions

Analyze common user questions about the Snow Blowers market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the growth of the electric snow blower segment?

The primary driver is the significant advancement in high-voltage lithium-ion battery technology (e.g., 80V systems), which provides comparable power and extended runtimes to mid-sized gasoline models, coupled with rising consumer demand for low-maintenance, quiet, and zero-emission outdoor power equipment.

How does a two-stage snow blower differ from a three-stage model?

A two-stage blower uses an auger to feed snow to an impeller (fan) which discharges it. A three-stage blower adds an accelerator or inducer screw ahead of the auger system. This accelerator breaks up dense, frozen, or icy snow before it reaches the impeller, significantly increasing clearing speed and throw distance, making it ideal for extremely heavy conditions.

Are snow blowers incorporating autonomous technology commercially available?

While fully autonomous snow blowers are currently in the developmental and early pilot stages, primarily targeting large commercial or municipal contracts, some high-end commercial models incorporate semi-autonomous features like GPS guidance and self-propelled systems to assist the operator, improving efficiency and reducing physical strain.

Which geographic region holds the largest market share for snow blowers?

North America, specifically the United States and Canada, holds the largest market share due to the combination of frequently severe winter weather, high residential density in snow zones, and high consumer spending capacity for durable seasonal equipment.

What key maintenance advantages do battery-powered snow blowers offer over gasoline models?

Battery-powered models require minimal maintenance, primarily involving charging and storage. They eliminate the need for oil changes, spark plug replacements, carburetor cleaning, and seasonal fuel stabilization, significantly simplifying the ownership experience and reducing long-term operational costs.

The global snow blowers market is intricately linked to climate variability, disposable income, and regulatory pressure concerning emissions, establishing a dynamic environment for technological innovation. Manufacturers are consistently focused on improving the power-to-weight ratio of electric units and integrating smart technologies for superior performance and user convenience. The shift toward sustainable outdoor power equipment is irreversible, positioning battery-powered models as the defining growth vector for the foreseeable future, especially as commercial-grade battery power solutions mature and become more cost-effective. Continued investment in durable, connected, and environmentally friendly designs will be paramount for maintaining competitive advantage and capturing market share within this essential segment of winter maintenance equipment.

The residential sector, in particular, demonstrates robust resilience in purchasing, often treating high-quality snow blowers as long-term capital investments essential for property safety and access during winter months. This stability, combined with the expanding opportunities in emerging cold regions, ensures a steady, albeit seasonally cyclical, growth trajectory for the market. Strategic marketing emphasizing ease of use, lower lifetime operational costs, and environmental responsibility is essential for accelerating the consumer transition away from traditional internal combustion engine products toward the next generation of electric snow removal solutions. Furthermore, advancements in specialized components, such as low-temperature optimized batteries and advanced composite materials, will continue to enhance the overall durability and efficiency of the product category.

Commercial application demand is increasingly complex, requiring solutions that are not only powerful but also scalable and manageable across large fleets. The emergence of proprietary fast-charging networks and interchangeable battery systems designed for commercial use is critical for overcoming operational downtime concerns inherent in electric equipment. Companies that successfully develop robust telematics and fleet management platforms, leveraging AI for predictive maintenance and optimized deployment schedules, will secure lucrative contracts within the commercial services and governmental segments. The competitive intensity is high, requiring continuous differentiation through feature sets, warranty programs, and superior after-sales support networks globally.

In summary, the Snow Blowers Market is navigating a compelling confluence of climate necessity and technological opportunity. While seasonality remains a fundamental challenge, the mitigating factors of advanced electrification, digitalization of equipment, and the steady replacement cycle of aging gasoline models provide a strong foundation for sustained growth, projecting a market environment focused on maximizing efficiency and minimizing environmental impact through smart product design and strategic operational enhancements.

The shift towards electric power is also influencing the competitive landscape, facilitating the entry of technology-focused companies that specialize in battery and software integration, often challenging the traditional dominance of established heavy equipment manufacturers. These new entrants often excel in marketing the convenience and environmental benefits, appealing directly to modern residential consumers who prioritize digital integration and sustainability. Existing industry leaders are responding by acquiring or partnering with battery technology specialists to rapidly close the innovation gap and maintain their market authority, particularly in the high-margin two-stage and three-stage segments where power delivery is paramount.

Moreover, regulatory frameworks are anticipated to become even stricter during the forecast period, especially concerning noise pollution in dense urban centers. This regulatory pressure acts as a powerful barrier to entry for manufacturers unwilling or unable to invest in quieter electric or highly sound-dampened gasoline engine designs. Consequently, the market is fragmenting slightly, with ultra-quiet, compact electric models dominating urban sales, while heavy-duty, robust solutions continue to satisfy the needs of vast suburban properties and commercial entities with less restrictive noise constraints. Investment in advanced materials research is also growing, aiming to reduce the overall weight of the blowers without compromising the structural integrity required to withstand clearing heavy, icy snow, thereby improving ergonomics for all user segments.

The demand for rental snow blowers, particularly commercial-grade units, shows a steady increase, offering a low-commitment option for users who experience infrequent heavy snowfall or those requiring equipment for specialized, short-term projects. This rental market segment influences manufacturer sales strategies, as durable, standardized equipment that can withstand rigorous use becomes highly valuable. Standardization of parts and accessible maintenance procedures are therefore becoming key features prioritized by manufacturers targeting both the direct sales and rental fleet markets, enhancing the overall lifetime value and operational reliability of their product lines across all power sources.

Finally, global economic health significantly impacts the timing of discretionary purchases like snow blowers. Although considered a necessity in high-snow regions, consumers often delay replacement purchases during periods of economic uncertainty. Market resilience is therefore often tested by macroeconomic fluctuations. However, the essential nature of snow removal for maintaining public and private access ensures that the market typically recovers quickly following economic downturns, especially when coupled with severe winter weather events that force immediate replacement or first-time purchases. This combination of necessity and technological appeal provides a stable outlook for the sector's continued profitability.

The increasing frequency of power outages during severe winter storms, a consequence of extreme weather, has subtly influenced the choice of power source. While battery-powered units are preferred for daily use, some commercial operators and remote residential users still maintain gasoline-powered back-up units due to their independence from the electrical grid, especially where multi-day clearing operations might be necessary without access to reliable charging infrastructure. This dual strategy ensures resilience, though the gasoline segment faces increasing scrutiny regarding long-term environmental sustainability and operational noise. Manufacturers are attempting to bridge this gap by developing robust, solar-assisted charging solutions for remote electric units, aiming for grid independence while maintaining zero-emission operation.

Furthermore, product liability and safety standards continually evolve, necessitating ongoing design adjustments. Features such as dead-man controls, improved discharge chute safety mechanisms, and standardized engine shut-off procedures are essential compliance requirements that manufacturers must adhere to, particularly in the North American and European markets. These regulatory hurdles ensure consumer safety but also contribute to the overall manufacturing cost and R&D requirements. The market rewards manufacturers who proactively exceed minimum safety standards, often establishing these enhancements as premium features that drive consumer purchasing decisions based on perceived product quality and reliability.

The supply chain for battery-powered snow blowers is becoming highly sensitive to global lithium and nickel availability. Geopolitical stability and mining regulations in source countries directly impact the cost of battery cells, creating margin pressure for manufacturers who cannot fully absorb input cost increases. Diversification of battery chemistries, exploring options beyond pure lithium-ion (such as sodium-ion for specialized applications), is an ongoing R&D area aimed at mitigating supply risk and stabilizing component pricing over the long term. This strategic focus on material security is vital for maintaining the aggressive growth trajectory predicted for the cordless snow blower segment.

In terms of consumer engagement, digital marketing and social media campaigns tailored to specific regional snow forecasts are highly effective. Timely advertising that directly responds to impending storm systems maximizes sales velocity during the brief but crucial peak buying season. Manufacturers are also leveraging augmented reality (AR) technologies, allowing consumers to digitally visualize different snow blower models in their driveways, facilitating product comparison and reducing return rates associated with sizing and maneuverability issues. This shift to highly personalized, data-driven marketing reinforces the industry’s adaptation to modern retail dynamics.

Finally, the growing popularity of compact, multi-purpose lawn and garden equipment platforms (where batteries are interchangeable across mowers, trimmers, and snow blowers) is shaping consumer purchasing habits. Customers are increasingly opting for single-brand ecosystems to simplify battery inventory and charging logistics. This trend significantly benefits diversified outdoor power equipment manufacturers, who can leverage existing brand loyalty and established battery standards to drive cross-selling opportunities within the snow blower segment, further solidifying the dominance of electric solutions in the residential market.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager