Snow Chain Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432941 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Snow Chain Market Size

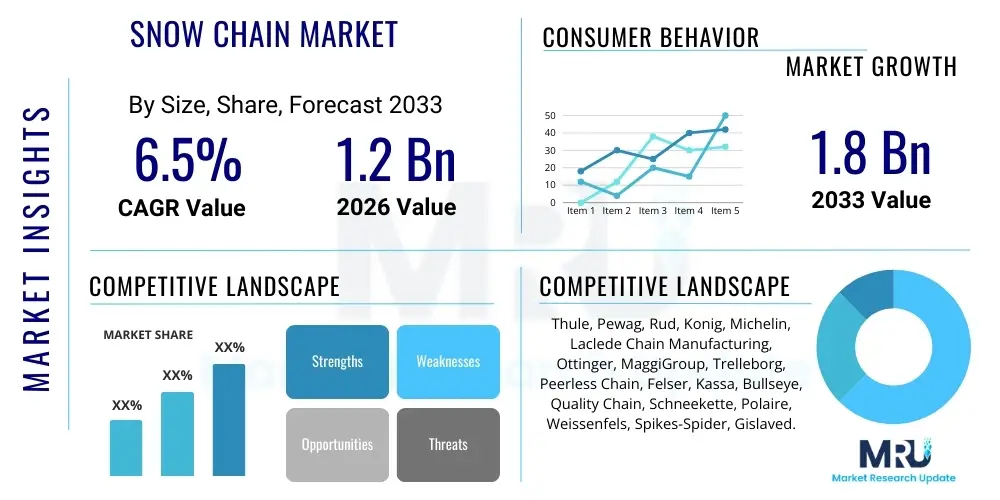

The Snow Chain Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at $1.2 Billion in 2026 and is projected to reach $1.8 Billion by the end of the forecast period in 2033. This growth is primarily fueled by stringent governmental regulations in key geographies mandating the use of traction devices during winter months, coupled with increasing vehicle ownership in mountainous and high-altitude regions globally. The steady progression in product innovation, particularly the introduction of automatic and composite snow chain systems, also contributes significantly to market expansion.

Market valuation reflects the increasing consumer awareness regarding road safety and the necessity of dependable traction solutions for diverse vehicle types, ranging from passenger cars to heavy commercial vehicles. Furthermore, the rising popularity of winter tourism and recreational activities necessitates the adoption of reliable snow chains, especially for vehicles accessing remote or unprepared areas. Economic stability in developed nations allows consumers to invest in high-quality, durable snow chain products, prioritizing safety over low cost, thereby driving revenue growth in the premium segment.

Geographically, regions such as Europe and North America remain the primary revenue generators due to well-established winter driving laws and a high concentration of automotive aftermarket sales. However, emerging markets in Asia Pacific, particularly countries experiencing occasional heavy snowfall and rapid infrastructure development, are exhibiting high growth potential. The shift towards lightweight, easy-to-install, and technically advanced materials, such as specific polymers and composites, is reshaping the competitive landscape and supporting the projected CAGR.

Snow Chain Market introduction

The Snow Chain Market encompasses the manufacturing, distribution, and sale of devices affixed to the tires of vehicles to provide maximum traction on snow or ice-covered roads. These critical safety accessories are essential for maintaining vehicle control, preventing skidding, and ensuring mobility in severe winter conditions. The core products range from traditional metal link chains (ladder, diamond patterns) to advanced alternatives like cable chains, composite chains, and automatic or hydraulic systems designed for rapid deployment. Key applications span across passenger vehicles (sedans, SUVs), light commercial vehicles, and heavy-duty transport (trucks, buses) utilized in logistics, construction, and public transport sectors operating in seasonally affected areas.

The primary benefit of snow chains is enhanced vehicular safety and regulatory compliance in regions where winter tire use is insufficient or mandatory. Driving factors accelerating market penetration include increasingly unpredictable weather patterns leading to unexpected heavy snowfall, stricter road safety standards imposed by governmental bodies across Europe and North America, and continuous advancements in materials science resulting in lighter, more durable, and easier-to-install products. Moreover, the growth of the global automotive fleet, particularly the rise of SUVs and AWD vehicles requiring specialized chains, further stimulates demand.

Snow Chain Market Executive Summary

The Snow Chain Market is characterized by stable demand driven by mandatory safety regulations and seasonal volatility, showing a steady technological shift toward composite and automatic solutions. Key business trends indicate intensified competition among established European manufacturers focusing on proprietary locking mechanisms and material innovation for superior wear resistance and ease of use. Regional trends show robust mature markets (North America, Western Europe) focused on premium aftermarket sales, while emerging economies present significant opportunities for basic and cost-effective chain systems due to rapid infrastructure expansion and increasing vehicle density. The market is also experiencing vertical integration, with manufacturers optimizing supply chains to manage the highly seasonal demand cycle efficiently.

Segment trends highlight the dominance of the conventional metal chain segment in terms of volume, primarily due to cost-effectiveness and proven performance in heavy-duty applications. However, the non-metallic/composite segment is witnessing the fastest growth rate, fueled by passenger vehicle owners preferring lightweight, non-scratching, and simpler installation methods. Furthermore, the segmentation by application underscores the continuous necessity of high-strength chains in the commercial vehicle sector (logistics and freight transport), where downtime due to inclement weather results in substantial financial losses, thus driving investment in reliable traction solutions.

Strategic movements within the industry include mergers and acquisitions aimed at consolidating manufacturing capabilities and expanding distribution networks, particularly into Asian markets. Sustainability is also becoming a consideration, with manufacturers exploring recyclable materials and processes to align with broader automotive environmental standards. The integration of advanced testing methodologies, simulating diverse ice and snow conditions, is elevating product quality and reinforcing brand reputation in this safety-critical sector.

AI Impact Analysis on Snow Chain Market

User inquiries regarding AI's influence on the Snow Chain Market predominantly center on how intelligent systems can enhance product development, optimize logistics, and potentially automate the deployment of traction devices. Key themes revolve around predictive maintenance—determining when chains are needed based on real-time weather and road condition data—and supply chain efficiency, using AI algorithms to forecast highly seasonal and localized demand spikes accurately. Consumers and industry professionals are also keenly interested in the potential for AI-driven material science to develop "smarter" materials that dynamically adjust friction based on surface conditions, potentially blurring the lines between traditional tires and traction aids. The primary expectation is that AI will make snow chain usage more intuitive, efficient, and integrated into the vehicle's safety system, reducing driver dependency and improving overall road safety.

The practical application of Artificial Intelligence currently targets operational efficiencies rather than core product structure. For manufacturers, AI-powered quality control systems using computer vision can meticulously inspect complex chain links for structural defects at high speed, ensuring maximum reliability, which is paramount for safety. Furthermore, predictive modeling utilizes vast datasets encompassing historical weather data, traffic patterns, and inventory levels to optimize production schedules, minimizing costly overstocking during off-seasons and preventing shortages during peak winter demand, leading to more resilient supply chains.

In the long term, AI integration into vehicle telemetry systems holds transformative potential. Machine learning models could interpret data from vehicle sensors (wheel spin, temperature, GPS location) and external sources (local weather services) to provide highly precise, automated recommendations or even deploy integrated, automatic snow chain systems preemptively. This enhanced situational awareness, facilitated by edge computing and vehicle-to-infrastructure (V2I) communication, moves the market toward proactive safety solutions, making the decision process for drivers instantaneous and reducing accident rates significantly during adverse weather events.

- AI-driven Predictive Demand Forecasting: Optimizes inventory management and production planning based on localized climate models.

- Enhanced Quality Control (Computer Vision): Automates inspection of chain links and welds for structural integrity, reducing manufacturing defects.

- Integration with Vehicle Safety Systems: Machine learning predicts optimal deployment time based on real-time traction loss indicators.

- Logistics and Route Optimization: Uses AI to reroute commercial vehicles through areas requiring traction devices, ensuring delivery timelines.

- Material Science Innovation: AI algorithms accelerate the discovery and testing of advanced polymers for lightweight composite chains.

- Automated Customer Support: Chatbots and AI tools handle seasonal inquiries regarding installation and compliance regulations efficiently.

DRO & Impact Forces Of Snow Chain Market

The Snow Chain Market is fundamentally driven by safety mandates and environmental volatility, while simultaneously constrained by user inconvenience and competitive alternatives. Primary drivers include stringent government legislation requiring winter traction devices, growth in the automotive sector, and increased public consciousness regarding safe winter driving practices. Restraints largely center on the cumbersome manual installation process associated with traditional chains, the inherent seasonality of demand leading to volatile sales cycles, and the emergence of advanced winter tire technologies (like studless tires) that offer a year-round alternative. Opportunities lie in developing fully automatic and smart chain systems, expanding distribution into regions previously less affected by snow, and leveraging advanced, high-performance materials. The combined impact forces strongly favor market progression, as mandatory safety standards consistently override the inconvenience factors, ensuring sustained market relevance and expansion.

Key drivers creating momentum for the snow chain industry include the increasing frequency of extreme weather events attributed to climate change, which mandates preparedness even in regions not traditionally associated with heavy snow. Furthermore, global freight and logistics dependence on road transport ensures continuous demand from the heavy commercial vehicle segment, where snow chains are indispensable for maintaining operational continuity and avoiding costly delays. Regulatory harmonization across economic blocs concerning vehicle safety and winter road standards further solidifies the foundational demand structure, pushing reluctant users toward compliance and market participation. The focus on reducing road fatalities and improving mobility during harsh conditions provides legislative backing for market growth.

However, significant restraints temper growth expectations. The widespread adoption of all-season and dedicated winter tires, which have improved considerably in performance, offers a viable substitute for many passenger vehicle owners in less severe winter conditions. Consumer resistance often stems from the necessity of stopping, crawling under the vehicle, and manually fitting chains—a process perceived as dirty and difficult, particularly in freezing temperatures. Additionally, the limited applicability of snow chains (typically requiring speeds under 30 mph) and potential for damage to roads or tires if improperly installed or used on dry pavement act as deterrents for casual users, necessitating educational efforts by manufacturers and retailers.

Opportunities for high-value growth are embedded in technological innovation, particularly the advancement of quick-fitting systems, automatic retractable chains built into the vehicle chassis (gaining traction in the commercial sector), and composite materials that offer superior grip without the weight and noise of steel chains. Expanding global urbanization and the resultant need for enhanced public safety infrastructure in developing economies experiencing winter conditions also open new markets. Strategic partnerships between snow chain manufacturers and Original Equipment Manufacturers (OEMs) to offer integrated or certified accessories present a lucrative path for increasing consumer trust and simplifying the purchasing process.

Segmentation Analysis

The Snow Chain Market is primarily segmented based on Type (Metal Chains, Cable Chains, Composite/Non-metallic Chains, Automatic Chains), Application (Passenger Vehicles, Commercial Vehicles), and Sales Channel (OEM, Aftermarket). This structure allows for targeted market strategies addressing the distinct needs of each user group. The segmentation by Type reveals a progressive shift: while metal chains dominate historical volume, composite and automatic systems are capturing a growing share of the value market due to convenience and performance factors catering specifically to the affluent passenger vehicle segment. The heavy dependence of the commercial vehicle segment on high-durability metal chains contrasts sharply with the passenger segment's preference for lightweight alternatives.

Analyzing the Application segmentation underscores the strategic importance of the Commercial Vehicle sector. These users prioritize strength, durability, and compliance with strict weight regulations, driving demand for heavy-duty, robust chains often utilizing advanced steel alloys. Conversely, the Passenger Vehicle segment is highly sensitive to ease of installation, weight, and aesthetic impact, promoting rapid adoption of innovative materials like reinforced polymers and textiles that avoid scratching alloy wheels. The increasing market penetration of SUVs and Crossovers globally further necessitates the development of specialized chain designs compatible with larger wheel sizes and tighter wheel well tolerances.

The Sales Channel segmentation highlights the dominance of the Aftermarket, particularly through specialized automotive retailers, hardware stores, and burgeoning e-commerce platforms, where consumers make last-minute or mandated purchases. Although OEM installation remains niche—primarily limited to certain high-end vehicles or fleet specifications—collaboration with OEMs is a key strategy for market visibility and guaranteed compatibility. Understanding these segmentation nuances is critical for manufacturers to align product development, pricing strategies, and regional distribution efforts effectively across the highly diversified global market landscape.

- Segmentation by Type:

- Metal Chains (Steel Alloy, Standard Link, Diamond Pattern)

- Cable Chains (Light-duty, High-speed compatibility)

- Composite/Non-metallic Chains (Textile, Reinforced Polymer, Rubber)

- Automatic/Self-Tensioning Chains (Hydraulic, Integrated Systems)

- Segmentation by Application:

- Passenger Vehicles (Sedans, Hatchbacks, SUVs, Crossovers)

- Commercial Vehicles (Light Commercial Vehicles, Heavy-Duty Trucks, Buses)

- Segmentation by Sales Channel:

- OEM (Original Equipment Manufacturer)

- Aftermarket (Retail Stores, Online Channels, Distributors)

- Segmentation by Region:

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, UK, Nordic Countries, Rest of Europe)

- Asia Pacific (Japan, China, South Korea, Rest of APAC)

- Latin America (Brazil, Argentina, Rest of LATAM)

- Middle East & Africa (UAE, South Africa, Rest of MEA)

Value Chain Analysis For Snow Chain Market

The value chain for the Snow Chain Market begins with highly specialized upstream suppliers focusing on raw materials, predominantly high-tensile strength steel alloys for traditional chains, and advanced polymers and textiles for composite alternatives. Upstream analysis highlights the critical role of material cost and quality control; volatility in global steel prices directly impacts production costs, compelling manufacturers to secure long-term contracts and optimize material usage. Key strategic activities at this stage include sourcing materials that meet stringent safety certifications and focusing on sustainable or recycled components where feasible, particularly for non-metallic products.

The core manufacturing process involves precision welding, forming, and heat treatment to ensure durability and reliability. Aftermarket domination dictates that distribution is a crucial, high-value component of the chain. Products move through large national distributors, specialized automotive parts wholesalers, and a fragmented network of local retailers and installers. Direct and indirect distribution channels coexist; direct sales are often utilized for large commercial fleet contracts (OEM or bulk aftermarket), while indirect channels handle the massive, localized, and seasonal consumer demand, relying heavily on third-party logistics to ensure rapid regional deployment ahead of forecasted snowfall events.

Downstream analysis focuses on the end-user interaction, encompassing installation, usage, and replacement cycles. The service segment, particularly automotive garages and tire service centers, plays a vital role in educating consumers, ensuring correct sizing, and often providing installation services. Given the seasonal nature, inventory management (logistics and warehousing) to handle peak demand fluctuation represents a significant operating cost. Successful players manage this complexity by accurately forecasting regional weather patterns and positioning stock strategically to minimize delivery times when mandated usage is suddenly required, thus optimizing the final link to the consumer.

Snow Chain Market Potential Customers

Potential customers for the Snow Chain Market span across various sectors, primarily categorized by vehicle ownership type and geographical necessity. The largest and most frequent buyers are private vehicle owners located in high-altitude regions or areas with mandated winter driving laws, particularly those who regularly use their vehicles for commuting or winter recreational travel. These end-users are highly sensitive to ease of use, product weight, and vehicle compatibility, driving the demand for quick-fitting, non-scratch composite and cable chains. Marketing efforts targeting this demographic focus heavily on safety messaging and installation convenience.

Another critical customer segment includes commercial fleet operators, comprising logistics companies, public transport authorities (buses), emergency services (police, ambulance, fire), and construction firms that must maintain operations regardless of weather. For these professional buyers, reliability, compliance, extreme durability, and minimal vehicle downtime are paramount. This segment often purchases heavy-duty metal chains or invests in automatic, chassis-integrated systems to ensure rapid deployment and maximum traction under continuous heavy loads and adverse conditions. Bulk purchasing and long-term supply contracts are standard in this sector.

A burgeoning niche customer base involves the rental car industry, which equips its fleet with chains in regulated regions to comply with local laws and ensure customer safety. Government agencies, including municipal and state highway departments responsible for snow removal and maintenance, also represent a significant customer base for specialized, heavy-duty traction equipment for their maintenance vehicles. Understanding the distinct procurement cycles and performance requirements of these diverse groups is essential for effective market segmentation and product portfolio planning.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.2 Billion |

| Market Forecast in 2033 | $1.8 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Thule, Pewag, Rud, Konig, Michelin, Laclede Chain Manufacturing, Ottinger, MaggiGroup, Trelleborg, Peerless Chain, Felser, Kassa, Bullseye, Quality Chain, Schneekette, Polaire, Weissenfels, Spikes-Spider, Gislaved. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Snow Chain Market Key Technology Landscape

The technological landscape of the Snow Chain Market is undergoing a rapid evolution, shifting away from basic, heavy steel links toward advanced, multi-material systems focused on ease of use, reduced weight, and improved road contact. A key technological focus is on self-tensioning and quick-fit mechanisms, which utilize ratcheting systems or integrated elastic components to ensure the chain remains taut during motion, eliminating the need for periodic manual adjustments after initial fitting. This innovation directly addresses the primary consumer restraint—the difficulty of installation—making modern chains far more accessible and appealing to the general driving public. These technologies enhance both safety and convenience, offering superior performance without the associated hassle of older designs.

Material science innovation is equally significant, particularly the rise of composite and textile chains. These non-metallic alternatives, often made from high-strength reinforced polymers or specialized woven textiles, offer excellent traction on packed snow and ice, are significantly lighter, produce less noise, and eliminate the risk of damage to expensive alloy wheels, making them highly popular in the passenger vehicle segment. For heavy commercial applications, technological advancements focus on specialized steel alloys offering increased tensile strength and corrosion resistance, ensuring longevity under extreme stress and chemical exposure (e.g., road salt). The development of integrated, automatic snow chain systems for trucks and buses, which deploy hydraulically or pneumatically via a cab control, represents the high-end technology frontier in this sector.

Further technological integration is observed in digital compatibility, albeit nascent. This involves designing chains compatible with modern vehicle safety features like Anti-lock Braking Systems (ABS), Electronic Stability Control (ESC), and Traction Control, ensuring the traction device does not interfere with the vehicle's onboard computer systems. Future trends point towards embedding passive RFID tags or similar identifiers within the chains, allowing fleet managers to track inventory and usage, or potentially enabling vehicle systems to automatically recognize that chains are mounted and adjust driving assistance parameters accordingly. Standardization and robust testing methodologies (simulating diverse temperature and surface conditions) are paramount for ensuring these technologies deliver reliable safety performance.

Regional Highlights

The global Snow Chain Market exhibits distinct regional dynamics driven by localized regulatory frameworks, climate conditions, and consumer preferences regarding vehicle safety investment. Europe, particularly the Alpine regions (Switzerland, Austria, Germany, Italy), dominates the market in terms of both revenue and technological adoption. Strict legal requirements mandating the carriage and use of snow chains or approved winter tires on specific roads during designated periods ensure consistently high demand. This region is a hotbed for innovation, driving the market towards premium, quick-fitting, and automatic solutions, and features intense competition among established European manufacturers.

North America, led by the United States and Canada, represents the second major market. Demand is strong in the Rocky Mountains and the Northeast, driven by both commercial logistics continuity and passenger safety. While regulations can vary by state or province, the emphasis on safety and the size of the heavy-duty commercial vehicle fleet ensure robust sales of traditional metal chains. The region is seeing increasing adoption of composite chains for passenger vehicles due to ease of use and reduced highway speed restrictions compared to metal alternatives.

Asia Pacific (APAC) is projected to be the fastest-growing region, fueled by rising vehicle ownership and increased infrastructure development in countries like Japan, South Korea, and parts of China that experience significant snowfall. While historical chain usage was lower, modernization and stricter governmental emphasis on road safety are spurring rapid market expansion. This region offers substantial opportunities for manufacturers focusing on cost-effective, durable products initially, with a gradual transition toward premium products as disposable incomes and regulatory enforcement increase.

- Europe: Market leader due to stringent, mandatory winter driving laws and a high concentration of specialized, quality-focused manufacturers. Key countries include Germany, Austria, and the Nordic nations.

- North America: Strong demand driven by extensive commercial trucking routes and localized heavy snowfall areas (e.g., mountainous states, Canadian provinces). Emphasis on heavy-duty and robust products.

- Asia Pacific (APAC): Emerging high-growth market, particularly in Japan and South Korea, influenced by increasing consumer focus on winter safety and rapidly modernizing automotive accessory markets.

- Latin America and MEA: Generally smaller markets, with demand concentrated in specific high-altitude zones (e.g., Andes region) or areas subject to extreme, albeit infrequent, weather variability.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Snow Chain Market.- Thule

- Pewag

- Rud

- Konig

- Michelin

- Laclede Chain Manufacturing

- Ottinger

- MaggiGroup

- Trelleborg

- Peerless Chain

- Felser

- Kassa

- Bullseye

- Quality Chain

- Schneekette

- Polaire

- Weissenfels

- Spikes-Spider

- Gislaved

- Trygg

Frequently Asked Questions

Analyze common user questions about the Snow Chain market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary differences between metal and composite snow chains?

Metal snow chains (usually steel alloy) offer superior durability and traction for heavy-duty commercial vehicles and extreme ice conditions. Composite or non-metallic chains are lighter, easier to install, quieter, and gentler on alloy wheels, making them preferred for passenger cars in moderate snowy conditions where speed limits are lower.

Are snow chains mandatory in all cold weather regions?

No, the mandate varies significantly by region and country. In many areas, particularly Europe's Alpine regions and specific U.S. states, snow chains are legally required to be carried or installed on certain mountainous roads during winter months. Always verify local traffic regulations before traveling in snowy areas.

How does the installation difficulty of modern snow chains compare to older models?

Modern snow chains, especially those featuring quick-fit and self-tensioning technologies, have drastically simplified the installation process. These systems typically require minimal manual effort and eliminate the need for re-tightening after a short drive, significantly improving user convenience compared to traditional designs.

Can snow chains be used on vehicles with ABS and ESC safety features?

Yes, most modern snow chains are designed to be compatible with ABS and ESC systems. However, users must ensure they select the correct chain size and type specified by both the vehicle and chain manufacturer to prevent interference with sensors or wheel wells, which could impair safety system function.

What is the current growth driver for the composite snow chain segment?

The composite snow chain segment is primarily driven by the increasing demand from passenger vehicle owners for lightweight, user-friendly traction aids that prevent wheel damage. Regulatory approval in various regions and the rising popularity of SUVs/AWD vehicles further fuel the adoption of these modern, non-metallic solutions.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Automatic Snow Chain Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Snow Chain Market Size Report By Type (Metal Snow Chain, Nonmetal Snow Chain), By Application (Passenger Cars, Commercial Vehicles, Other Vehicles), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Steel Snow Chain Market Statistics 2025 Analysis By Application (Passenger Cars, Commercial Vehicles, Other Vehicles), By Type (Consumer, Professional), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Passenger Vehicles Snow Chain Market Statistics 2025 Analysis By Application (R14-17, R17-20), By Type (Nonmetal Snow Chain, Metal Snow Chain), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Commercial Vehicles Snow Chain Market Statistics 2025 Analysis By Application (R19-20, R20-24), By Type (Nonmetal Snow Chain, Metal Snow Chain), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager