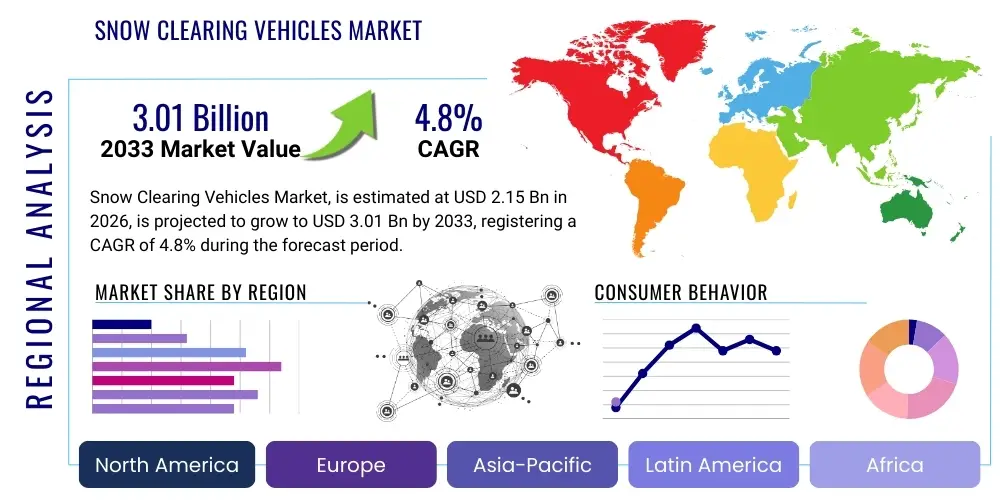

Snow Clearing Vehicles Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438435 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Snow Clearing Vehicles Market Size

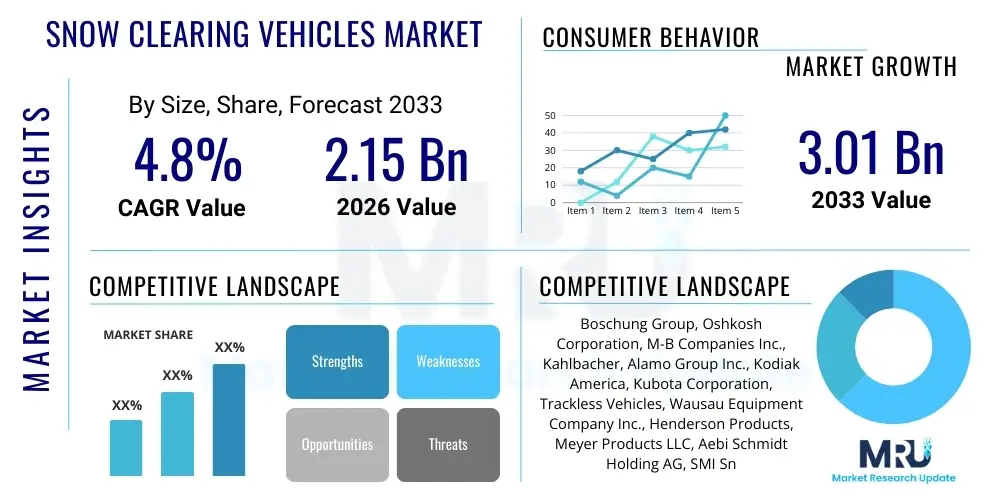

The Snow Clearing Vehicles Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 2.15 Billion in 2026 and is projected to reach USD 3.01 Billion by the end of the forecast period in 2033.

Snow Clearing Vehicles Market introduction

The Snow Clearing Vehicles Market encompasses a specialized range of heavy-duty machinery designed for the removal and management of snow and ice from essential infrastructure, including roadways, runways, airport aprons, and large commercial premises. Key products within this market segment include rotary snow blowers, articulated snowplows, dedicated salt and sand spreaders, and multipurpose carriers equipped with interchangeable attachments. These vehicles are critical for maintaining operational continuity and safety across sectors, particularly in regions prone to severe winter weather. The escalating demand for reliable snow management is intrinsically linked to urbanization and the necessity of keeping global logistics chains functional, even under adverse weather conditions.

Major applications for snow clearing vehicles span municipal services, where public safety and road accessibility are paramount, airport operations, which require the highest precision and speed for runway clearance, and private commercial sector applications, such as retail parking lots, industrial facilities, and large institutional campuses. The core benefits derived from these advanced vehicles include enhanced efficiency through wider clearing paths and faster operation speeds, reduced labor costs compared to manual methods, and significantly improved safety performance, both for operators and the traveling public. Modern vehicles often incorporate advanced features like GPS tracking, automated spreading calibration, and ergonomic cab designs to maximize output during critical weather events.

The primary driving factors propelling the expansion of this market include increasing severity and unpredictability of winter storms attributed to climate variability, substantial governmental investments in infrastructure upgrades across developed and rapidly developing economies, and stringent regulatory requirements imposing mandatory levels of operational readiness for critical infrastructure like international airports and national highway systems. Furthermore, the technological shift towards more fuel-efficient, lower-emission engines and the integration of smart technologies for optimized route planning and material usage are reshaping purchasing decisions and driving the replacement cycle of aging fleets globally.

Snow Clearing Vehicles Market Executive Summary

The Snow Clearing Vehicles Market is currently characterized by significant business trends centered on sustainability and automation, which are fundamentally altering the competitive landscape and technological trajectories. Key business trends include a pronounced shift toward vehicles utilizing electric and hybrid powertrains, driven by strict urban emission standards and corporate sustainability goals, alongside increasing adoption of advanced telematics and IoT systems that optimize fleet deployment and predictive maintenance scheduling. Furthermore, there is a growing consolidation among niche manufacturers focusing on specialized attachments and system integration, allowing major original equipment manufacturers (OEMs) to offer highly customizable, multi-functional vehicle platforms tailored for specific operational environments, from high-altitude passes to densely populated metropolitan areas.

Regionally, North America and Europe continue to dominate the market share, largely due to extensive established road networks, significant municipal budgets allocated for winter maintenance, and a higher propensity for severe snow events. However, the Asia Pacific (APAC) region is demonstrating the fastest growth trajectory, fueled by large-scale infrastructure development projects in countries like China and India, where growing middle-class populations necessitate reliable transportation infrastructure year-round, prompting governments to invest heavily in modern snow management fleets. The Middle East and Africa (MEA) market, though smaller, is showing slow, targeted growth, primarily driven by investments in high-altitude tourism areas and specific industrial zones requiring controlled environments.

Segment trends reveal that the most rapid growth is occurring within the vehicle-mounted segment, particularly for high-capacity rotary snow blowers and combination units that can plow and spread de-icing agents simultaneously, offering versatile solutions to maintenance crews. Based on power source, the electric and autonomous-ready segment, while currently smaller, is projected to exhibit superior CAGR over the forecast period, reflecting global efforts to decarbonize public and private fleets. Moreover, the end-user preference is noticeably shifting towards performance-based procurement models, emphasizing overall operational cost reduction (Total Cost of Ownership, TCO) achieved through reduced fuel consumption, minimized downtime via proactive diagnostics, and extended equipment lifespan.

AI Impact Analysis on Snow Clearing Vehicles Market

Common user questions regarding AI's impact on the Snow Clearing Vehicles Market primarily revolve around the feasibility and safety of autonomous operations in unpredictable conditions, how AI systems can optimize resource allocation (like salt or fuel), and the integration of real-time weather data for predictive routing. Users are keenly interested in understanding if AI-driven systems can reliably manage 'black ice' detection, variable density snow loads, and simultaneous traffic interactions. The key themes emerging from this analysis center on operational efficiency, safety enhancement through advanced sensor fusion, and cost reduction achievable via sophisticated predictive analytics. Stakeholders expect AI to transition snow clearing from a reactive necessity to a highly proactive, data-driven operation, drastically minimizing public disruption and optimizing taxpayer spending on winter maintenance.

The application of Artificial Intelligence and Machine Learning (ML) is fundamentally transforming the operational paradigm of snow clearing vehicles. AI algorithms are being integrated into vehicle management systems to process massive datasets derived from vehicle telematics, satellite imagery, and municipal IoT infrastructure. This allows for unparalleled optimization of spreading rates for de-icing materials based on real-time road surface temperatures and friction coefficients, thereby reducing environmental impact and material waste. Furthermore, ML models are utilized to predict localized snow drift accumulation and potential high-risk zones, enabling preemptive deployment of crews and ensuring maximum effectiveness when a storm hits.

The most significant, albeit nascent, impact of AI is the push toward fully or semi-autonomous snow clearing vehicles, especially in controlled environments like airport runways or large interstate stretches that are closed during storms. AI-powered sensor suites combining LiDAR, radar, and thermal cameras allow these vehicles to perceive their environment accurately, navigate complex routes without human intervention, and maintain precise clearances. While regulatory hurdles and safety concerns in mixed traffic environments remain, the adoption in specialized, high-stakes contexts is rapidly accelerating, promising 24/7 operational capability and reduced risk to human operators. This technological evolution demands high-level computational power and robust cybersecurity frameworks to ensure system reliability in mission-critical applications.

- AI-driven route optimization reduces travel time and fuel consumption by up to 20%.

- Predictive analytics forecast material needs (salt/brine) based on hyper-local weather models, minimizing waste.

- Advanced sensor fusion (LiDAR, thermal imaging) enables accurate autonomous navigation and hazard detection in whiteout conditions.

- Machine Learning algorithms optimize engine performance and attachment settings based on snow density and vehicle load for efficiency.

- Real-time diagnostics and predictive maintenance scheduling minimize vehicle downtime during peak winter months.

- Computer Vision systems assist human operators by identifying lane markings and road edges obscured by snow (Augmented Operator Assistance).

DRO & Impact Forces Of Snow Clearing Vehicles Market

The dynamics of the Snow Clearing Vehicles Market are governed by a complex interplay of Drivers, Restraints, and Opportunities, collectively influenced by underlying Impact Forces such as technological disruption and regulatory shifts. The market is primarily driven by the increasing unpredictability and severity of winter weather events globally, necessitating more robust and high-capacity clearing solutions. Concurrently, rapid urbanization and corresponding expansion of critical infrastructure, particularly highways, bridges, and regional airports, mandate consistent investment in winter maintenance fleets. These drivers are tempered by significant restraints, predominantly the high initial capital expenditure required for specialized, heavy-duty equipment and the inherently seasonal nature of the business, leading to low utilization rates during off-seasons. However, the market structure is being redefined by compelling opportunities, including the growing commercial viability of electric and hydrogen-powered vehicles offering long-term operational savings, and the integration of vehicles into smart city ecosystems via telematics for optimized resource management.

Drivers are exerting substantial upward pressure on the market, particularly governmental mandates prioritizing public safety and economic continuity. For instance, in regions like North America and Northern Europe, stringent service level agreements (SLAs) for road clearance require local authorities to maintain state-of-the-art fleets, accelerating the replacement cycle of older, less efficient vehicles. The technological driver related to performance efficiency, such as advanced hydraulics and improved blade materials reducing wear and tear, also motivates fleet renewal. However, the market faces structural restraints related to labor shortages—finding and retaining skilled drivers capable of operating specialized equipment is becoming increasingly difficult, pushing demand toward automation and advanced operator assistance systems that simplify the driving task and broaden the potential labor pool.

The strongest impact force shaping the future is regulatory pressure toward environmental sustainability. New and forthcoming emission standards (e.g., Euro VI, US EPA Tier 4 Final) are forcing OEMs to rapidly innovate in engine technology and explore alternative fuel sources. This regulatory landscape simultaneously acts as a restraint (raising immediate production costs) and an opportunity (creating a segmented market for premium, eco-friendly vehicles). The opportunity for integrating these specialized fleets into broader digital infrastructure—using vehicles as mobile data collection points for weather and road condition monitoring—is substantial, paving the way for lucrative service contracts and value-added offerings beyond mere equipment sales, significantly expanding the market's total addressable service value.

Segmentation Analysis

The Snow Clearing Vehicles Market is segmented based on Type, Application, and Power Source, reflecting the diverse operational requirements across different geographical and infrastructural environments. The segmentation provides critical insight into demand patterns, with vehicle type typically dictated by the volume and type of snow encountered (e.g., heavy snow requires rotary blowers, while light snow needs conventional plows) and the size of the infrastructure being cleared. Application segmentation highlights the difference in required equipment sophistication; airports demand highly specialized, rapid-clearance vehicles, whereas municipal applications rely on versatile, multi-functional trucks.

Further granularity is achieved through segmentation by Power Source, which is rapidly gaining importance as sustainability initiatives become market differentiators. While the diesel-powered segment remains the dominant incumbent due to robust performance and established infrastructure, the electric and hybrid categories are emerging as high-growth areas, particularly in urban centers where noise pollution and localized emissions are critical concerns. Understanding these segment dynamics is vital for manufacturers to tailor their R&D investments and for purchasing entities to optimize their fleet mix for efficiency and compliance.

This comprehensive segmentation allows market participants to precisely target product development and marketing efforts. The increasing complexity of winter maintenance tasks, coupled with the need for immediate, reliable response capabilities, means end-users often seek custom vehicle configurations, blurring traditional lines between segment categories and favoring modular designs that offer high adaptability across various storm intensities and operational mandates.

- Type

- Snow Plows (Front-mounted, Underbody)

- Snow Blowers (Two-stage, Rotary)

- Snow Pushers

- Salt and Sand Spreaders (V-Box, Tailgate, Liquid/Brine)

- Multi-purpose Equipment (Combination Units)

- Application

- Municipal Roads and Highways

- Airport Runways and Aprons

- Commercial and Industrial Premises (Parking Lots, Ports)

- Residential and Sidewalks (Mini and Compact Vehicles)

- Power Source

- Diesel/Gasoline Powered

- Electric and Hybrid

- Alternative Fuel (CNG/Hydrogen - Niche)

Value Chain Analysis For Snow Clearing Vehicles Market

The value chain for the Snow Clearing Vehicles Market begins with upstream activities, focusing on the sourcing of specialized raw materials, including high-grade structural steel, advanced polymer composites for corrosion resistance, and precision components for hydraulic and mechanical systems. Upstream analysis highlights the critical importance of secure supply chains for heavy-duty engines and transmissions, often customized for severe duty cycles. Manufacturing is highly specialized, typically involving welding, assembly, and rigorous testing of complex vehicle platforms and proprietary attachments (like specialized moldboards or impeller systems). Manufacturers often face challenges related to fluctuating commodity prices and the need for significant capital investment in highly automated assembly lines that can handle large, specialized vehicle chassis. Strategic supplier relationships, especially for electronic control units (ECUs) and telematics hardware, are crucial for maintaining a technological edge.

The downstream segment of the value chain is dominated by highly technical distribution channels. Due to the specialized nature and high cost of these vehicles, sales primarily occur through a network of authorized dealers who possess deep technical expertise in vehicle customization, regulatory compliance, and localized service support. Direct sales are common for very large government or airport contracts, where procurement involves complex bidding processes and long-term maintenance agreements. The after-sales service segment is a critical profit center, encompassing spare parts inventory, preventative maintenance programs, and emergency repair services, especially important given the mission-critical nature of the equipment during winter emergencies.

Distribution channels exhibit a mix of direct and indirect engagement. Indirect channels, utilizing specialized distributors, facilitate access to smaller municipal or commercial clients and offer localized financing and maintenance options. Direct channels, managed by major OEMs, focus on maximizing efficiency for high-volume orders from federal agencies or international airport authorities. The efficiency of the entire chain relies heavily on robust inventory management for rapid parts supply and the quality of the technical training provided to end-user operators, ensuring optimal performance and longevity of the costly assets. Furthermore, the integration of digital tools for remote diagnostics and software updates is increasingly essential in the post-sales service phase.

Snow Clearing Vehicles Market Potential Customers

The primary customer base for Snow Clearing Vehicles is diverse but highly concentrated within governmental and large infrastructure management entities that bear the responsibility for public safety and transportation accessibility during winter months. The largest and most consistent buyers are municipal and state transportation departments (DOTs), which require high volumes of combination plows, spreaders, and heavy-duty trucks for maintaining extensive road and highway networks. These public sector entities typically prioritize vehicle reliability, durability, ease of maintenance, and adherence to specific emissions and safety standards outlined in stringent public tenders. The procurement cycles for these customers are often lengthy and budget-dependent, necessitating long-term sales strategies focusing on Total Cost of Ownership (TCO) rather than just initial purchase price.

Another crucial customer segment involves airport authorities and large private aviation organizations. Airports, due to the critical nature of maintaining operational status and the specialized requirements of runway surfaces, demand ultra-high-capacity, fast-moving equipment, such as large runway snow blowers and dedicated high-speed sweepers. These customers require highly specific vehicle specifications related to clearing width, speed, and precision de-icing capabilities, making this segment a high-value, albeit smaller, specialized market. The purchasing decisions here are often driven by international aviation regulations and the economic imperative to avoid flight cancellations due to weather.

Finally, the commercial and institutional sector represents a growing segment, including logistics hubs, large retail chains, universities, hospitals, and industrial parks located in snow-prone regions. These customers generally purchase smaller, more maneuverable equipment, such as compact utility tractors with plow attachments or smaller brine spreaders, managed either internally or through third-party facilities management contractors. Demand in this sector is highly sensitive to labor costs and insurance liability, driving interest in automated or highly efficient systems that minimize manual labor and ensure clear access for continuous business operations, even during major snow events.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 2.15 Billion |

| Market Forecast in 2033 | USD 3.01 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Boschung Group, Oshkosh Corporation, M-B Companies Inc., Kahlbacher, Alamo Group Inc., Kodiak America, Kubota Corporation, Trackless Vehicles, Wausau Equipment Company Inc., Henderson Products, Meyer Products LLC, Aebi Schmidt Holding AG, SMI Snow Makers Inc., Arctic Equipment Manufacturing Corporation, Vammas (Fortbrand Services), Zaugg AG Eggiwil, ASH Group, Hilltip, Viking-Cives Inc., Henke Manufacturing. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Snow Clearing Vehicles Market Key Technology Landscape

The technological landscape of the Snow Clearing Vehicles Market is undergoing rapid transformation, moving away from purely mechanical solutions toward highly digitized, integrated systems optimized for precision and environmental performance. Central to this evolution is the pervasive integration of Telematics and IoT devices, which provide real-time data on vehicle location, operational status, engine performance, and attachment efficiency. This connectivity allows fleet managers to dynamically re-route vehicles based on changing weather conditions or accident reports, maximizing resource deployment speed and effectiveness during critical periods. Furthermore, advanced hydraulic controls and sophisticated electronic control units (ECUs) are enhancing the precision with which plow angles, cutting depths, and spreader calibrations are managed, drastically improving operational effectiveness while simultaneously reducing operator fatigue and increasing safety margins.

A significant area of innovation involves power sources and powertrain design, responding directly to stringent emission standards and the demand for lower noise operation in urban and airport environments. The development of high-voltage battery systems for heavy-duty electric snow clearing vehicles is a major focus, requiring solutions that can handle the high power demands of large rotary blowers and operate reliably in extreme cold without significant performance degradation. Additionally, manufacturers are investing heavily in material science for both the vehicle body and the ground engagement tools. The adoption of specialized composite materials and high-strength, low-alloy (HSLA) steels is increasing vehicle durability, resisting corrosion from harsh de-icing chemicals (salts and brines), and reducing overall vehicle weight, which in turn leads to lower fuel consumption and reduced infrastructure wear.

Perhaps the most disruptive technological trend is the development of autonomous and semi-autonomous capabilities, heavily reliant on advanced sensor fusion technologies including high-resolution GPS, LiDAR, and specialized road surface condition sensors. These systems enable highly precise operations, especially crucial for clearing airport runways where deviation tolerance is minimal. The underlying technological infrastructure includes sophisticated software platforms for predictive maintenance, which analyze usage patterns and component health data to schedule repairs proactively, minimizing the risk of mechanical failure during peak demand periods. This confluence of connectivity, advanced materials, and smart automation defines the competitive edge in the modern snow clearing vehicle market, fundamentally raising the performance expectations of municipal and commercial end-users.

Regional Highlights

- North America (Dominance and Technological Adoption)

North America, encompassing the United States and Canada, stands as the largest and most mature market for snow clearing vehicles, characterized by substantial governmental spending on infrastructure maintenance and the necessity of managing extensive highway networks prone to heavy snowfalls. This region exhibits high demand across all product segments, particularly for large V-plows and high-capacity rotary snow blowers necessary for clearing interstates and high-traffic municipal arteries. The market here is driven by a strong focus on high performance, fleet reliability, and the rapid adoption of advanced telematics and sensor technology to optimize deployment. Stringent safety regulations and a competitive private contracting market further push demand for modern, efficient, and technologically integrated fleets, with an increasing pilot program adoption of electric snow management vehicles in major cities aiming for carbon neutrality.

The U.S. Federal Highway Administration (FHWA) and state Departments of Transportation (DOTs) are primary purchasers, often driving procurement standards toward vehicles that can utilize advanced de-icing liquid dispensing systems, minimizing the environmental impact of road salts. Canada, with its extended winter seasons and vast geographical expanse, demands highly robust, cold-weather-optimized equipment, fueling innovation in drivetrain and hydraulic fluid technology designed to operate reliably at extremely low temperatures. Furthermore, the region is a leader in incorporating vehicle-to-infrastructure (V2I) communication, leveraging snow clearing fleets as mobile data collectors to provide real-time road condition intelligence back to traffic management centers, solidifying its position as a technological frontrunner in winter maintenance solutions.

- Europe (Environmental Focus and Specialized Equipment)

Europe represents a highly segmented market, largely driven by strict environmental protection laws and noise pollution regulations, particularly in the Nordic countries, the Alps region, and key central European cities. The demand structure favors compact and specialized equipment (like dedicated sidewalk plows and smaller, multi-functional carriers) suitable for navigating narrow European city streets and mountain roads. The emphasis on minimizing noise pollution has been a major catalyst for the early adoption of electric and hybrid powertrain solutions in municipal applications across countries such as Norway, Sweden, and Switzerland, where local governments often mandate quiet operation. Procurement decisions in Europe heavily weigh fuel efficiency and lower emissions, leading to a strong preference for advanced diesel engines compliant with Euro VI standards.

The European market is dominated by local specialization, with companies like Aebi Schmidt Holding AG (ASH Group) providing customized solutions for specific regional challenges, ranging from high-altitude snow removal in ski regions to precision airport clearing in major international hubs. The harmonization of equipment standards across the European Union facilitates cross-border operations and sales, though national purchasing habits and climate variance maintain a degree of fragmentation. Furthermore, the region is pioneering the use of advanced road weather information systems (RWIS) integrated directly with the vehicle controls, allowing for automated adjustment of brine application rates based on minute-by-minute surface conditions, setting a global benchmark for material efficiency.

- Asia Pacific (APAC) (Infrastructure Growth and Emerging Demand)

The Asia Pacific market is poised for the highest growth rate, though starting from a smaller base compared to North America and Europe. This growth is predominantly driven by significant infrastructure investment in major economies like China, which is rapidly expanding its high-speed rail networks and highway systems into historically colder northern and western regions, necessitating modern snow management capabilities. Similarly, Japan and South Korea maintain highly advanced and demanding winter fleets, particularly for their extensive metropolitan areas and high-altitude transport corridors, favoring compact, highly maneuverable equipment with advanced features.

The market in developing APAC countries is driven by the transition from rudimentary snow removal methods to mechanized processes, spurred by increased economic activity and the need for consistent logistical flow. Challenges include variable quality standards, reliance on imported technology, and the initial high cost of ownership. However, as local governments prioritize safety and infrastructure resilience, there is increasing acceptance of international quality standards and high-technology equipment. The adoption of specialized heavy machinery for mountain regions (e.g., Himalayas in China and India) is a specific high-growth niche within this region, highlighting the diverse and rapidly evolving needs across the vast APAC geography.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Snow Clearing Vehicles Market.- Aebi Schmidt Holding AG (ASH Group)

- Oshkosh Corporation (including Pierce Manufacturing)

- Boschung Group

- Alamo Group Inc.

- M-B Companies Inc.

- Kahlbacher

- Wausau Equipment Company Inc.

- Kubota Corporation

- Trackless Vehicles

- Henderson Products

- Meyer Products LLC

- SMI Snow Makers Inc.

- Arctic Equipment Manufacturing Corporation

- Vammas (Fortbrand Services)

- Zaugg AG Eggiwil

- Hilltip

- Viking-Cives Inc.

- Henke Manufacturing

- Kodiak America

- Ditch Witch (The Charles Machine Works, Inc.)

Frequently Asked Questions

Analyze common user questions about the Snow Clearing Vehicles market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the market shift toward electric snow clearing vehicles?

The transition to electric snow clearing vehicles is primarily driven by stringent urban emission regulations (targeting zero local emissions), municipal commitments to carbon neutrality, and the need for reduced operational noise, especially during nighttime clearing operations in densely populated areas. While initial battery capacity limitations in extreme cold remain a factor, advancements in high-density batteries and fast-charging infrastructure are rapidly overcoming these restraints, making the electric segment increasingly competitive, especially for specialized sidewalk and urban road clearing tasks.

How are advanced telematics systems used to optimize snow removal operations?

Advanced telematics systems integrate GPS, IoT sensors, and fleet management software to optimize snow removal by providing real-time data on vehicle location, fuel consumption, spreading material usage, and attachment performance. This allows dispatchers to dynamically adjust routes, ensure optimized spreading rates of de-icing agents based on localized road temperatures, and manage predictive maintenance schedules, significantly reducing operational costs and improving service response times during severe weather events.

Which application segment requires the most specialized snow clearing equipment?

The Airport Runways and Aprons application segment requires the most specialized equipment. Airport operations demand extremely high-speed, precise clearance capabilities using vehicles such as massive rotary snow blowers and dedicated high-speed sweepers that can clear wide swathes quickly and accurately, minimizing downtime and meeting strict international aviation safety standards that govern surface conditions.

What is the primary constraint impacting market growth despite technological advancements?

The primary constraint impacting sustained market growth is the high initial capital expenditure (CAPEX) required for specialized, heavy-duty snow clearing equipment, coupled with the inherently seasonal nature of its usage. This results in significant budget barriers for smaller municipalities or commercial operators and necessitates long depreciation cycles, slowing down the adoption rate of newer, more efficient technological upgrades such as autonomous capabilities and electric powertrains.

How is climate variability influencing investment decisions in the Snow Clearing Vehicles Market?

Climate variability, leading to increasingly unpredictable and often severe winter storms, forces governments and private entities to invest in higher-capacity, more reliable, and versatile snow clearing vehicles. Investment decisions are shifting toward multi-functional equipment capable of handling diverse precipitation types (heavy snow, ice, or freezing rain) and utilizing advanced material spreading technologies (liquid brine systems) to ensure operational readiness under a wider range of rapidly changing environmental conditions.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager