Snow Shovel Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435026 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Snow Shovel Market Size

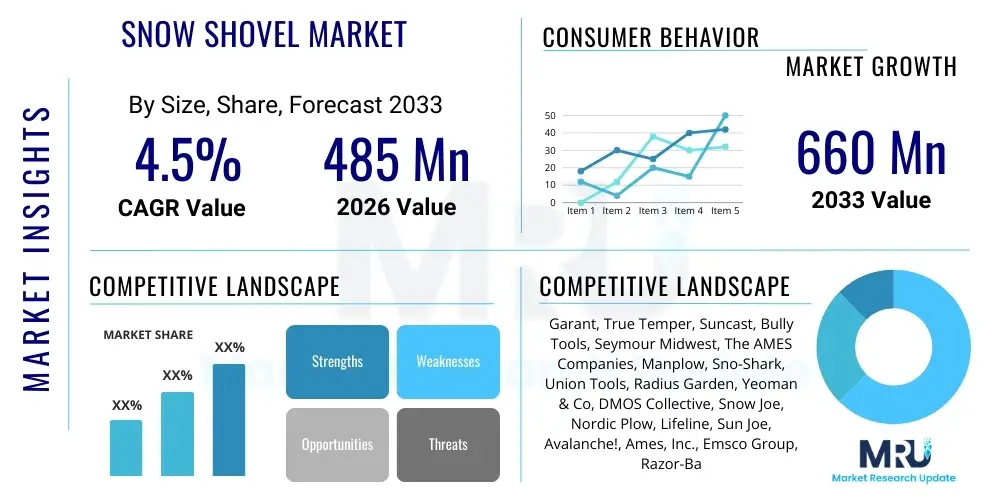

The Snow Shovel Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.5% between 2026 and 2033. The market is estimated at USD 485 million in 2026 and is projected to reach USD 660 million by the end of the forecast period in 2033. This consistent expansion is primarily attributed to recurring snowfall events in the Northern Hemisphere, coupled with increasing consumer awareness regarding ergonomic designs that mitigate strain and injury during snow removal activities. Furthermore, the development of lightweight, composite materials has enhanced product durability and user comfort, contributing positively to replacement cycles and new purchase decisions across residential and commercial sectors. The market trajectory is also influenced by advancements in specialized distribution networks, ensuring timely availability of seasonal inventory.

The market valuation reflects not only unit sales volume but also the increasing average selling price (ASP) driven by premiumization in the manual shovel category and the introduction of higher-priced, specialized equipment such as electric-assisted shovels and wheeled snow pushers. The residential segment remains the dominant revenue generator, consistently requiring reliable and easy-to-use tools for driveway and sidewalk clearance. However, the commercial and institutional segment, which includes property management firms and municipal services, exhibits a faster growth rate due to the demand for heavy-duty, industrial-grade shovels designed for frequent and extensive use in challenging environments. Geographic expansion into high-altitude or previously underserved snow-prone areas also supports the upward revision of market size forecasts.

Snow Shovel Market introduction

The Snow Shovel Market encompasses the manufacturing, distribution, and sale of hand-held tools specifically designed for clearing snow and ice from surfaces such as walkways, driveways, patios, and roads. These tools, ranging from traditional manual scoop designs to modern, highly ergonomic, and specialized powered variants, are essential seasonal items in regions experiencing significant winter precipitation. Product descriptions span a wide array of materials, including reinforced polyethylene plastics, durable aluminum, and composite structures, each tailored to specific snow conditions—from light, powdery snow to heavy, wet accumulations or icy layers. The continuous innovation in material science focuses on achieving an optimal balance between low weight for maneuverability and high tensile strength for longevity, directly addressing the key consumer pain points associated with manual snow removal.

Major applications of snow shovels are broadly categorized into residential use, where homeowners seek quick and safe methods for personal property clearance, and commercial applications, utilized by businesses, property managers, and maintenance companies to maintain safety and access standards. Furthermore, institutional applications include usage by governmental agencies, schools, and hospitals to ensure essential infrastructure remains operational during severe weather events. The primary benefits driving market demand include improved public safety by preventing slips and falls, maintaining accessibility to homes and businesses, and providing a cost-effective alternative to larger, motorized snow removal equipment for smaller areas. These benefits are consistently highlighted in marketing campaigns that emphasize efficiency, health benefits associated with ergonomic design, and durability in harsh weather.

Driving factors stimulating the growth of this market include increasingly unpredictable and sometimes heavier snowfall patterns attributed to climate volatility, necessitating reliable snow removal tools. Additionally, stringent municipal regulations regarding timely snow clearance from public walkways and sidewalks place direct responsibility on property owners, boosting mandatory replacement and new purchases. Ergonomic advancements, such as curved handles, adjustable grips, and specialized blade angles, serve as a significant driver, attracting health-conscious consumers and older demographics who prioritize tools that minimize physical strain and reduce the risk of back injuries. The effective leveraging of e-commerce platforms also ensures year-round product visibility and accessibility, accelerating market penetration beyond traditional peak winter periods.

Snow Shovel Market Executive Summary

The Snow Shovel Market is currently characterized by robust business trends centered on material innovation and ergonomic superiority, aiming to capture consumers willing to pay a premium for reduced physical exertion. Key manufacturers are investing heavily in research and development to introduce lighter, more durable polymeric and composite materials that resist corrosion and damage from abrasive surfaces. The market is witnessing a strong shift towards multichannel distribution, with online sales accelerating rapidly, complementing traditional brick-and-mortar hardware stores. Furthermore, sustainability is emerging as a critical trend, compelling companies to explore recycled materials and eco-friendly manufacturing processes to appeal to environmentally conscious consumers, although the primary focus remains on performance and structural integrity.

Regionally, North America, particularly the U.S. and Canada, dominates the market due to high frequency and intensity of snow events, established consumer purchasing habits, and a significant residential housing stock that necessitates individual clearance tools. Europe, especially Scandinavian countries and Central European nations, represents another critical market, demonstrating steady growth driven by similar climate conditions and a strong focus on high-quality, long-lasting products. The Asia Pacific region, while currently smaller, is showing emergent growth, specifically in high-altitude zones in China and Japan, where urbanization and increased infrastructure development necessitate formalized snow clearance solutions, although operational challenges remain concerning logistics and supply chain establishment.

Segmentation trends indicate that manual shovels, particularly the traditional scoop and pusher variants, maintain the largest market share by volume, benefiting from their low cost and simplicity. However, the electric/battery-powered segment, though niche, is exhibiting the highest Compound Annual Growth Rate (CAGR), reflecting consumer desire for automated assistance, especially among the elderly and those with physical limitations. In terms of material, reinforced polyethylene plastic remains dominant due to its cost-effectiveness and non-stick properties, but aluminum shovels are preferred in commercial settings for their exceptional strength-to-weight ratio. The residential application segment drives the bulk of sales, though specialized commercial-grade heavy-duty shovels command higher margins due to rigorous performance requirements.

AI Impact Analysis on Snow Shovel Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Snow Shovel Market frequently center on themes such as predictive inventory management, climate change mitigation through forecasting, and the potential for AI integration into mechanized or robotic snow removal tools. Users are keen to understand how manufacturers can use AI to optimize seasonal production runs, minimizing both stockouts during heavy seasons and excess inventory during mild winters. Furthermore, questions arise about how machine learning algorithms could analyze weather patterns with unprecedented accuracy, providing retailers with crucial lead time for logistical planning and seasonal marketing launches. The collective concern revolves around improving supply chain resilience and leveraging data insights to match fluctuating demand efficiently.

While the product itself remains a fundamentally low-tech, mechanical tool, the primary influence of AI is exerted through optimization of the entire value chain, rather than direct product application. AI-driven predictive maintenance models can be applied to the machinery used in manufacturing the shovels, ensuring minimal downtime during peak production months. More significantly, advanced geospatial and meteorological modeling, powered by AI, allows major distributors and retailers to forecast regional demand fluctuations based on climate anomalies, population density, and historical consumption data. This enables precision targeting of inventory, drastically reducing overstocking risks in unexpected mild regions and preventing catastrophic stock shortages in severe weather zones, thereby maximizing revenue realization and enhancing customer satisfaction.

Ultimately, AI technology is transforming the market's operational backend, ensuring that the right types of shovels—whether ergonomic plastic pushers or commercial aluminum scoops—are present at the correct point of sale when the snow starts falling. This optimization, while invisible to the end-user, results in lower operational costs for manufacturers and better product availability for consumers. The future integration of AI might also involve sensor technology in advanced clearing devices, using machine vision to differentiate between snow, ice, and pavement, thereby optimizing the power output or angle of robotic snow removers, although this remains peripheral to the core manual shovel market.

- AI-powered predictive climate modeling enhances inventory positioning and seasonal distribution logistics.

- Machine learning optimizes manufacturing schedules, reducing lead times and minimizing seasonal inventory risk.

- AI algorithms analyze sales data and weather correlations to improve retail merchandising and promotional timing.

- Supply chain resilience is bolstered through AI-driven demand forecasting and bottleneck identification.

- Potential future use includes integration with robotic or electric snow removal tools for autonomous operation optimization.

DRO & Impact Forces Of Snow Shovel Market

The dynamics of the Snow Shovel Market are shaped by a complex interplay of Drivers, Restraints, and Opportunities (DRO), which collectively form the Impact Forces influencing long-term profitability and market structure. The primary driver is the undeniable necessity of snow clearance for safety and accessibility, especially in densely populated, snow-prone urban and suburban areas. Opportunities are largely concentrated around ergonomic innovation and sustainable material development, aiming to capture premium consumer segments willing to invest in tools that reduce physical strain and environmental impact. Conversely, the market faces significant restraints, chiefly the highly seasonal nature of demand, leading to long periods of low sales and logistical challenges related to warehousing off-season inventory.

Impact forces are exerted by both climate volatility and consumer health trends. Climate change introduces severe unpredictability; while mild winters depress sales temporarily, extreme and unexpected blizzards can trigger massive, short-term surges in demand, placing immense pressure on the supply chain to react instantaneously. The increasing prevalence of back injuries associated with strenuous snow removal is a powerful force driving demand for ergonomic and wheeled shovels. Furthermore, competition from motorized alternatives, such as snow blowers, acts as a restraint, particularly in larger property segments, compelling manual shovel manufacturers to focus intensely on niche advantages like portability, low maintenance, and environmental friendliness (zero emissions).

Overall, the market is characterized by medium-to-high seasonal volatility, but the essential nature of the product ensures sustained demand. Manufacturers mitigate seasonality risks by diversifying product lines into other seasonal maintenance tools (e.g., garden implements) or by employing highly efficient, flexible manufacturing systems. The most potent opportunity lies in educating consumers on the long-term health benefits of specialized shovels, justifying their higher price point and shifting the purchasing decision from a commodity-based choice to a health- and safety-driven investment. Addressing the restraint of competition requires continued product differentiation, emphasizing the manual shovel's advantages in noise reduction, proximity clearing, and lightweight storage.

Segmentation Analysis

The Snow Shovel Market segmentation offers granular insights into consumer preferences and industrial requirements, allowing manufacturers to tailor product development and marketing strategies effectively. The market is primarily segmented based on the type of shovel, the material used in construction, the application (end-user), and the distribution channel employed for sales. Analyzing these segments reveals varying growth rates and profitability margins, with specialized and higher-value segments, such as ergonomic and battery-powered shovels, typically demonstrating faster expansion compared to conventional, standard manual scoops. This structure allows companies to focus either on high-volume, cost-competitive manual segments or high-margin, innovation-driven niche markets, depending on their core competencies and production capabilities.

The segmentation by material highlights the perpetual trade-off between weight, durability, and cost. While plastic shovels dominate the volume segment due to their low cost and non-stick properties, aluminum and steel variants maintain dominance in professional and heavy-duty commercial applications where structural resilience against ice and heavy snow is paramount. The distribution channel segmentation confirms the significant rise of e-commerce, which has drastically extended the geographical reach for specialized products, challenging the traditional stronghold of local hardware stores, particularly for premium or niche brands. Understanding these cross-segment dynamics is crucial for optimizing supply chain allocation and identifying areas ripe for disruption through new material science or innovative product designs that bridge gaps between segments.

- Type:

- Manual Shovels (Standard, Ergonomic, Pusher, Scoop)

- Electric/Battery-Powered Shovels

- Wheeled Snow Shovels/Pushers

- Material:

- Plastic/Polyethylene

- Aluminum

- Steel/Metal

- Composite Materials (Fiberglass, Carbon Fiber Reinforced)

- Application:

- Residential

- Commercial (Property Management, Retail)

- Industrial/Institutional (Municipalities, Transport Hubs)

- Distribution Channel:

- Offline Retail (Hardware Stores, Supermarkets, DIY Chains)

- Online Retail (E-commerce Platforms, Brand Websites)

Value Chain Analysis For Snow Shovel Market

The value chain of the Snow Shovel Market begins with upstream activities focused on raw material sourcing and primary manufacturing. Upstream analysis involves the procurement of key materials, predominantly high-density polyethylene (HDPE) resins, virgin aluminum, specialized steel alloys, and high-strength wood or composite materials for handles. Key activities in this stage include plastic molding, metal stamping, and specialized coating processes (e.g., anti-stick finishes). Efficiency and cost management at this stage are paramount, as the price volatility of plastics and metals directly impacts the final product cost. Manufacturers often seek long-term contracts with major chemical and metal suppliers to stabilize input costs, while simultaneously investing in automated manufacturing techniques like injection molding to maximize output volumes during the brief pre-season manufacturing window.

Midstream activities involve core manufacturing, assembly, quality control, packaging, and branding. Because snow shovels are bulky and typically low-value per unit (in the manual segment), optimizing logistics and packaging to reduce shipping costs is critical. Effective quality assurance processes focus on the stress points of the shovel, specifically the blade-to-handle connection and the durability of the cutting edge against ice. Downstream analysis focuses on distribution and sales. The distribution channel is bifurcated into direct channels (primarily large commercial contracts or direct-to-consumer online sales) and indirect channels (retailers and wholesalers). Indirect channels, particularly large home improvement and mass merchandise retailers, drive the majority of residential sales, leveraging their widespread geographic presence and strong seasonal inventory management capabilities.

The interaction between direct and indirect channels is evolving; while physical retail captures the immediate "need-based" purchase during a snow event, online platforms facilitate research-based purchasing, particularly for ergonomic or specialized products where consumers compare features like weight, handle design, and warranty. Successful market players focus on creating a robust omni-channel presence, ensuring that their products are easily found both physically and digitally. Effective downstream marketing emphasizes seasonal readiness, ergonomic benefits, and localized advertising tailored to regional weather forecasts, ensuring high visibility precisely when consumer demand is peaking. The final stage involves post-sale support, including warranty services and managing returns related to breakage or material failure, which feeds back into upstream quality improvement cycles.

Snow Shovel Market Potential Customers

Potential customers for snow shovels are diverse, segmented mainly across residential, commercial, and governmental end-users, each possessing distinct purchasing drivers, volume requirements, and product specifications. The largest segment remains the residential homeowner, particularly those residing in detached or semi-detached housing units within climate zones that receive moderate to heavy annual snowfall. These buyers prioritize ease of use, ergonomic comfort to prevent injury, and a reasonable price point. Their purchasing decisions are highly seasonal and often reactive, spurred by the first snowfall of the season or the failure of an older unit. Marketing towards this group focuses heavily on convenience, safety, and durability, often through mass-market retail channels.

The commercial segment represents a crucial buyer group characterized by high volume procurement and a focus on rugged durability and efficiency. This includes property management companies responsible for clearing large apartment complexes, shopping centers, and office parks, as well as maintenance crews for hotels and large retail chains. These customers purchase specialized, industrial-grade shovels, often featuring non-slip materials, reinforced aluminum blades, and extended warranties to withstand daily rigorous use and professional handling. Their buying cycles are typically planned well in advance of the winter season, relying on B2B suppliers and specialized hardware distributors rather than general retail, placing high value on bulk pricing and reliability of supply.

Furthermore, institutional and governmental entities, such as municipal public works departments, departments of transportation, schools, and hospitals, constitute essential end-users. These organizations require highly specialized, durable tools for clearing public access points and emergency routes, often complementing heavy machinery operations. Their procurement is driven by public safety regulations and budgetary constraints. Finally, a growing niche market includes consumers actively seeking premium, technologically advanced solutions, such as battery-powered shovels or lightweight composite designs, willing to invest significant capital to minimize physical effort. These buyers often search for products online and value technical specifications and independent performance reviews highly.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 485 million |

| Market Forecast in 2033 | USD 660 million |

| Growth Rate | 4.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Garant, True Temper, Suncast, Bully Tools, Seymour Midwest, The AMES Companies, Manplow, Sno-Shark, Union Tools, Radius Garden, Yeoman & Co, DMOS Collective, Snow Joe, Nordic Plow, Lifeline, Sun Joe, Avalanche!, Ames, Inc., Emsco Group, Razor-Back Tools |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Snow Shovel Market Key Technology Landscape

The technology landscape within the Snow Shovel Market, although rooted in simple mechanical design, is undergoing subtle yet significant transformations driven by advancements in material science and ergonomic engineering. The shift from traditional wooden and basic steel constructions to lightweight, non-stick, reinforced polymers (polyethylene, polypropylene) and specialized aircraft-grade aluminum alloys represents the most prominent technological evolution. These materials incorporate anti-stick surfaces achieved through chemical treatments or specialized molding techniques, drastically reducing the effort required to shed heavy, wet snow. Furthermore, the development of composite handles (such as fiberglass) provides superior strength and shock absorption compared to conventional wood or tubular metal, directly addressing user comfort and product longevity concerns that were historically major failure points.

Beyond materials, ergonomic design technology, often influenced by biomechanical studies, is central to modern shovel development. This involves sophisticated analyses of user posture and motion during the act of shoveling, leading to innovations such as curved or multi-angle handles, secondary power grips, and adjustable shafts that accommodate various user heights and physical capabilities. These ergonomic features are no longer niche elements but are rapidly becoming standard expectations, leveraging intellectual property around patented handle designs and pivoting blade mechanisms to maximize leverage and minimize lumbar strain. The integration of wheels into push-style shovels, employing basic leverage mechanics combined with robust wheel bearing systems, also falls within this technological scope, transforming the physical motion from lifting to pushing.

A burgeoning technological segment involves the incorporation of battery-powered micro-motors, leading to the rise of electric snow shovels. These devices use advanced lithium-ion battery technology, borrowed heavily from the power tool industry, to power small augers or impeller systems. While they do not replace full-scale snow blowers, their technological appeal lies in their portability, low noise profile, and zero-emission operation, catering specifically to small areas like decks and single-car driveways. The technological differentiation here centers on battery life, motor efficiency, and the design of the impeller system to handle varying snow types (from powder to slush) without clogging, representing a critical area of ongoing research and development investment for key market players seeking to innovate beyond the manual segment.

Regional Highlights

The global Snow Shovel Market exhibits distinct regional consumption patterns, largely dictated by climatic conditions, infrastructure development, and established consumer habits. North America, encompassing the United States and Canada, is the most dominant market region, characterized by high disposable incomes and a pervasive culture of individual property maintenance. The prevalence of detached homes and frequent, intense snowfalls necessitates the widespread ownership of multiple types of snow removal tools per household. Demand here is exceptionally high for both high-end ergonomic manual shovels and sophisticated electric/battery-assisted variants, driven by a strong focus on personal health and rapid clearance solutions. Furthermore, the highly developed retail infrastructure and efficient logistics networks in North America ensure timely seasonal inventory placement, which further supports market dominance.

Europe represents the second largest market, with strong demand originating primarily from Northern and Central European nations, including the Nordic countries, Germany, and Russia. This region emphasizes quality, durability, and often requires products that adhere to strict safety standards, leading to a preference for robust aluminum and high-grade plastic shovels designed for longevity in icy conditions. While the residential segment is significant, municipal and industrial demand is also substantial, driven by public mandates for clear pedestrian areas and transport links. Eastern Europe, specifically, is seeing rapid growth in demand fueled by increased urbanization and rising consumer purchasing power, although price sensitivity remains higher compared to Western European markets.

The Asia Pacific (APAC) region, while exhibiting lower overall market penetration, holds significant growth potential, concentrated mainly in Japan, South Korea, and the mountainous regions of China. Demand is driven by local climate conditions and increasing adoption of Western standards of property maintenance. However, logistical challenges and the traditional use of smaller, localized tools currently constrain market size. Latin America and the Middle East and Africa (MEA) currently account for a negligible share due to predominantly warm climates, with sales strictly limited to high-altitude or mountainous areas (e.g., the Andes or certain regions in Iran and Turkey). These regions rely heavily on specialized, imported equipment and represent marginal, niche markets focused on essential infrastructure maintenance rather than mass consumer sales.

- North America (Dominant Market): High demand driven by widespread home ownership, heavy snowfall incidence, and consumer preference for ergonomic and electric-assisted models. The market benefits from advanced retail infrastructure and proactive seasonal purchasing.

- Europe (Second Largest Market): Steady growth characterized by high quality requirements, especially in Nordic and Central European nations. Strong institutional demand supports the commercial segment. Focus on durable aluminum and specialized steel shovels.

- Asia Pacific (Emergent Growth): Potential expansion in areas like Japan and mountainous regions of China, driven by modernization and localized climate conditions. Challenges related to logistics and awareness persist.

- Latin America & MEA (Niche Markets): Extremely limited market size, confined to specific high-altitude zones. Demand is purely functional, focusing on commercial and governmental utility.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Snow Shovel Market.- Garant

- True Temper

- Suncast

- Bully Tools

- Seymour Midwest

- The AMES Companies

- Manplow

- Sno-Shark

- Union Tools

- Radius Garden

- Yeoman & Co

- DMOS Collective

- Snow Joe

- Nordic Plow

- Lifeline

- Sun Joe

- Avalanche!

- Ames, Inc.

- Emsco Group

- Razor-Back Tools

Frequently Asked Questions

Analyze common user questions about the Snow Shovel market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary advantages of ergonomic snow shovels over traditional designs?

Ergonomic snow shovels are designed with curved shafts, secondary grips, or adjustable handles to minimize bending and optimize leverage, significantly reducing strain on the lower back and shoulders. This technology lowers the risk of common shoveling injuries, making snow removal safer and less physically demanding, especially for older users or those with pre-existing back conditions.

How does the choice of blade material impact a snow shovel's performance?

Blade material dictates suitability for different snow types and conditions. Plastic/Polyethylene blades are lightweight, non-stick, and ideal for powdery snow on smooth surfaces. Aluminum blades offer superior strength-to-weight ratio and are preferred for heavy, wet snow and light scraping. Steel blades are the heaviest but provide maximum durability and ice-breaking capability, generally reserved for commercial or heavy-duty institutional applications.

Is the snow shovel market significantly affected by the proliferation of motorized snow blowers?

While motorized snow blowers dominate the market for large properties, they do not significantly displace the core manual shovel market. Manual shovels remain essential for clearing tight spaces, decks, stairs, and areas inaccessible to large machines. They also serve as an affordable, low-maintenance, zero-emission option, maintaining strong market relevance for small-to-medium residential properties.

What role does e-commerce play in the distribution of snow shovels?

E-commerce plays an increasingly critical role, particularly in selling specialized, premium, or niche ergonomic shovels not commonly stocked by local hardware stores. Online platforms facilitate price comparison, feature research, and direct shipping, allowing consumers to procure high-quality or innovative products well before the onset of the snow season, thereby stabilizing demand fluctuations for manufacturers.

What are the current sustainability trends impacting snow shovel manufacturing?

The sustainability trend is focused on utilizing recycled plastics, particularly high-density polyethylene (HDPE), in blade manufacturing to reduce the reliance on virgin materials. Manufacturers are also exploring processes to enhance the longevity and repairability of shovels to minimize replacement frequency, appealing to environmentally conscious consumers seeking durable, eco-friendly winter tools.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager