Snowboard Bindings Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437908 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Snowboard Bindings Market Size

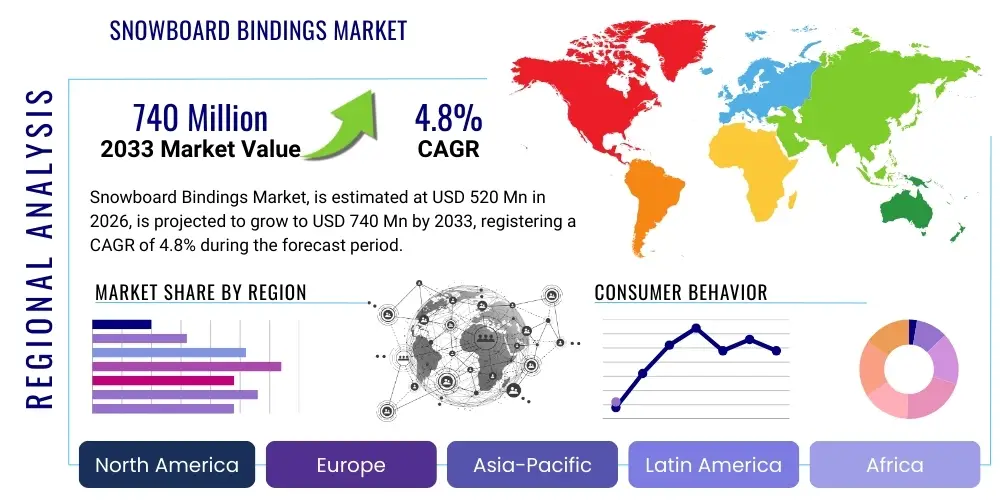

The Snowboard Bindings Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 520 Million in 2026 and is projected to reach USD 740 Million by the end of the forecast period in 2033.

Snowboard Bindings Market introduction

The Snowboard Bindings Market encompasses the design, manufacture, and distribution of essential components linking a snowboarder's boot to the snowboard deck. These components are critical for controlling the board, transferring energy, and ensuring rider safety and comfort. Market growth is fundamentally driven by the rising popularity of winter sports globally, increased investment in snow resorts and infrastructure, and continuous technological advancements focused on improving performance and user-friendliness. The consumer base ranges from recreational novices seeking easy-entry systems to professional athletes demanding high responsiveness and precise control for competitive environments.

Snowboard bindings are categorized primarily by design—strap-in, rear-entry (Flow-style), and step-on/step-in systems (e.g., Burton Step On). Each design caters to different user priorities regarding ease of use, security, and connection stiffness. Product description involves materials such as aluminum, composite plastics (nylon, fiberglass blends), and high-grade polymers, which are chosen based on the desired flex rating, weight reduction, and durability. Performance bindings often incorporate sophisticated dampening pads and adjustable features like highback lean and strap angle customization to maximize energy transmission and minimize fatigue during aggressive riding.

Major applications of snowboard bindings span across various snowboarding disciplines, including freestyle (park and pipe), freeride (backcountry and powder), and all-mountain cruising. The primary benefits driving consumer purchases include enhanced safety through secure boot retention, improved control and responsiveness crucial for executing complex maneuvers, and significant reductions in setup time, particularly offered by quick-entry systems. Driving factors include favorable demographic trends, particularly among younger generations engaging in action sports, robust marketing efforts by key industry players, and innovation cycles introducing lighter, stronger, and more adjustable binding models annually, compelling frequent upgrades among core enthusiasts.

Snowboard Bindings Market Executive Summary

The Snowboard Bindings Market exhibits stable growth underpinned by strong consumer interest in outdoor recreational activities and sustained innovation in product design. Business trends indicate a robust shift towards quick-entry and proprietary interface systems, significantly reducing the time required for securing the boots, thus appealing strongly to the casual and intermediate rider segments. Leading manufacturers are focusing heavily on intellectual property protection surrounding these step-in technologies, creating strong competitive barriers. Furthermore, sustainability is emerging as a critical purchasing criterion, pushing companies toward utilizing recycled materials and implementing eco-friendly manufacturing processes for baseplates and highbacks, aligning with broader consumer ecological consciousness.

Regional trends highlight North America and Europe as mature markets characterized by high penetration rates and strong demand for premium, high-performance bindings suitable for diverse terrain, particularly the challenging conditions found in the Rocky Mountains and the Alps. Conversely, the Asia Pacific region, particularly countries like China, Japan, and South Korea, is poised for exponential growth, driven by increasing disposable incomes, government investment in winter sports ahead of major global events, and the rapid expansion of ski resort infrastructure catering to a newly affluent middle class interested in leisure activities. This regional divergence necessitates customized product strategies, focusing on performance in the West and ease-of-use and accessibility in emerging markets.

Segmentation trends reveal that the strap-in segment currently dominates the market share due to its proven reliability, lower cost, and wide range of adjustability, remaining the standard choice for professional and advanced riders. However, the step-in/quick-entry segment is the fastest-growing category, projected to capture significant market share over the forecast period, reflecting consumer demand for convenience without sacrificing performance. In terms of end-users, the intermediate rider segment is the largest driver of sales volume, consistently seeking mid-range bindings that offer a balance between comfort, responsiveness, and affordability, whereas specialized segments like splitboarding bindings are witnessing niche growth driven by dedicated backcountry enthusiasts.

AI Impact Analysis on Snowboard Bindings Market

Common user questions regarding AI’s impact on the Snowboard Bindings Market frequently revolve around personalization, material science, and supply chain efficiency. Users inquire if AI can design bindings tailored to individual riding styles, foot biomechanics, and preferred mountain terrain. There is significant interest in how machine learning can accelerate the discovery of novel composite materials offering superior strength-to-weight ratios and how predictive analytics can optimize production schedules and inventory management, ensuring bindings are available when peak demand hits. Key themes summarize to customization at scale, revolutionary material formulation, and streamlining the highly seasonal supply chain to prevent stockouts and waste.

While AI does not directly interact with the physical binding during use, its influence permeates the manufacturing, design, and marketing phases. AI-powered computational design tools allow engineers to run thousands of stress simulations on baseplate geometries and highback stiffness profiles virtually, minimizing physical prototyping cycles and drastically reducing development time. Furthermore, machine learning algorithms analyze vast datasets encompassing consumer purchasing patterns, social media engagement, and seasonal weather forecasts to optimize inventory placement and predict the ideal timing for product launches, ensuring maximum profitability and minimizing obsolescence risk. This data-driven approach enhances market responsiveness and allows for the creation of micro-segmented product lines.

- Design Optimization: AI facilitates topology optimization for baseplates, reducing material usage while maintaining structural integrity, resulting in lighter and more robust bindings.

- Material Innovation: Machine learning predicts optimal composite ratios (e.g., carbon fiber to nylon blends) for specific flex characteristics and temperature performance.

- Personalized Recommendations: AI engines analyze rider profiles (weight, height, riding style) to recommend the exact binding model, size, and stiffness settings.

- Supply Chain Prediction: Predictive analytics forecasts regional demand spikes influenced by weather patterns and resort opening schedules, improving logistics efficiency.

- Quality Control Automation: Computer vision systems powered by AI are employed in manufacturing to detect minute flaws in molded parts, ensuring consistent product quality.

DRO & Impact Forces Of Snowboard Bindings Market

The Snowboard Bindings Market dynamics are primarily shaped by robust drivers such as the escalating participation in outdoor and extreme sports, alongside significant technological advancements offering improved ease-of-use and customized performance features. However, the market faces restraints, including the highly seasonal nature of the sport, making demand volatile, and the relative maturity of certain geographical markets leading to high competition and price sensitivity in the standard strap-in segment. Opportunities are abundant in emerging economies like China and Eastern European nations, coupled with the rapid adoption of niche segments such as splitboard bindings and advanced step-in systems. These forces collectively dictate pricing power, innovation cycles, and overall market growth trajectory.

Key drivers include the continuous pursuit of advanced performance by core riders, who frequently upgrade their equipment to leverage marginal gains offered by lighter materials (e.g., titanium hardware, forged carbon highbacks) and more efficient power transfer mechanisms. Simultaneously, the growing recreational segment prioritizes convenience, fueling the immense success of step-in technologies that offer near-instantaneous board connection without the need for manual strap manipulation. Increased media coverage of winter sports and targeted youth marketing by major brands further reinforces consumer aspiration and purchasing behavior, ensuring a steady stream of new participants and replacement sales. These drivers sustain growth even amid economic fluctuations.

Major restraints include the necessity for significant capital investment in highly specialized manufacturing equipment, the inherent limitations posed by fluctuating snow conditions globally due to climate change, and the consumer perception that bindings have a long lifespan, which can slow down replacement cycles compared to soft goods. Impact forces resulting from these dynamics push manufacturers towards two distinct strategies: first, radical innovation in quick-entry mechanisms to stimulate replacement demand based on convenience; and second, establishing strong brand loyalty through superior durability and specialized feature sets targeting high-end riders who prioritize resilience over cost, thereby mitigating price competition in premium tiers.

- Drivers:

- Rising global participation rates in recreational snowboarding and associated winter tourism.

- Continuous introduction of easy-to-use quick-entry and step-in binding technologies.

- Focus on lightweight, high-performance materials (carbon composites, aluminum) improving energy transfer and responsiveness.

- Increased disposable income in developing economies facilitating expenditure on specialized sports equipment.

- Restraints:

- High seasonality of the product leading to challenges in inventory management and stable production planning.

- High initial cost of premium equipment, which can deter entry-level participation.

- The long average lifespan of bindings, potentially extending the consumer replacement cycle.

- Potential impact of inconsistent global snow conditions linked to climate change.

- Opportunities:

- Expansion into untapped emerging markets, particularly Asia Pacific, through focused marketing and distribution.

- Development of specialized products for niche segments, such as splitboarding and adaptive sports.

- Integration of IoT sensors and smart technology for real-time performance feedback and safety monitoring.

- Adoption of sustainable and recycled materials to appeal to environmentally conscious consumers.

- Impact Forces:

- High barriers to entry due to necessary R&D investment in proprietary quick-release systems.

- Intense competitive rivalry among established brands focusing on feature differentiation and patents.

- Significant influence of professional snowboarder endorsements and brand sponsorship on consumer adoption rates.

- Strong bargaining power of key distributors and specialized retail channels, influencing retail pricing.

Segmentation Analysis

The Snowboard Bindings Market is comprehensively segmented across several key dimensions, providing a granular view of consumer preferences and market drivers. Segmentation by type differentiates between traditional strap-in systems, which remain the industry standard for performance, and the technologically advancing quick-entry systems, which capture the convenience-driven market. Analysis by materials helps determine cost structure and performance attributes, contrasting heavy-duty aluminum chassis favored by aggressive riders with lightweight composite blends preferred for freestyle and park riding. The end-user segmentation is critical, separating the needs of novices and intermediates from advanced and professional riders, necessitating diverse product feature sets and price points across the entire portfolio.

The Type segment is pivotal to market growth projection, with the Step-In/Quick-Entry category expected to display the highest growth CAGR over the forecast period, driven by innovations such as proprietary lock mechanisms and seamless boot-to-binding integration that promise immediate and reliable engagement. Conversely, the All-Mountain category dominates the application segment, reflecting the vast majority of consumer riding habits that involve traversing various terrains and conditions, from groomed runs to light powder. Understanding this usage pattern allows manufacturers to design bindings with moderate flex, high dampening, and versatile adjustment capabilities, appealing to the widest possible consumer base seeking a 'do-it-all' solution.

Further analysis of the Distribution Channel segment reveals the enduring importance of specialized sports retail stores, which provide crucial expert advice, fitting services, and immediate hands-on experience with equipment, particularly vital for performance-focused products like bindings. However, the E-commerce segment continues its rapid expansion, fueled by global accessibility, competitive pricing, and extensive online reviews. Manufacturers are increasingly utilizing direct-to-consumer (D2C) channels to maintain higher margins, foster direct customer relationships, and control brand messaging, thereby influencing the overall market structure and reducing reliance on traditional intermediary distribution networks.

- By Type:

- Strap-in Bindings

- Rear-Entry Bindings (e.g., Flow)

- Step-in/Quick-Entry Bindings (e.g., Burton Step On, K2 Clicker)

- By Material:

- Composite/Plastic (Nylon, Fiberglass-blends)

- Aluminum Alloy

- Hybrid (Aluminum Heelcups with Composite Baseplates)

- By Flex Rating:

- Soft (Beginner/Freestyle)

- Medium (All-Mountain/Intermediate)

- Stiff (Freeride/Advanced)

- By Application/Discipline:

- All-Mountain

- Freestyle (Park/Pipe)

- Freeride (Backcountry/Powder)

- Splitboarding

- By End-User:

- Beginner/Novice Riders

- Intermediate Riders

- Advanced/Professional Riders

- Rental/Commercial Use

- By Distribution Channel:

- Specialized Sports Stores

- Online Retail (E-commerce)

- Hypermarkets and Supermarkets (Limited Selection)

- Direct-to-Consumer (D2C) Websites

Value Chain Analysis For Snowboard Bindings Market

The value chain for the Snowboard Bindings Market begins with upstream activities focused on raw material sourcing, predominantly involving the procurement of high-grade plastics, aluminum, carbon fiber, and various metals for hardware. Optimization at this stage is crucial, as the fluctuating costs of raw materials, particularly petroleum-derived polymers and aluminum, directly impact manufacturing profitability. Key upstream suppliers include specialized chemical and composite material producers. Manufacturers then engage in proprietary design, tooling, and precision injection molding or die-casting processes, where intellectual property related to quick-entry mechanisms is heavily guarded, representing significant value creation.

Downstream activities involve specialized assembly, quality assurance, and packaging tailored for international shipment. The distribution channel plays a vital role in reaching the highly specific consumer base. Direct channels include brand-owned websites and flagship stores, offering maximal control over pricing, inventory, and consumer feedback collection. Indirect channels utilize global third-party distributors, large sporting goods retailers, and local specialized snowboard shops. Specialized retailers are particularly important as they offer crucial fitment services, advice, and maintenance, adding significant value to the final consumer purchase decision and validating the product’s technical specifications.

Effective value chain management necessitates a strong connection between design and manufacturing to ensure rapid iteration and quality control. Given the seasonal nature of demand, inventory risk management is paramount, often involving Just-In-Time (JIT) manufacturing principles where feasible. The final stage of the value chain involves after-sales service, including warranty provisions, spare parts supply (straps, ladders, heel loops), and educational content provision, all of which contribute to long-term customer satisfaction and brand loyalty. The shift towards proprietary step-in systems reinforces vertical integration, as manufacturers often bundle boots and bindings to ensure system compatibility and maximize capture of the end-user value.

Snowboard Bindings Market Potential Customers

Potential customers for the Snowboard Bindings Market are broadly categorized by skill level, dedication to the sport, and preferred riding style. The largest volume segment consists of Intermediate All-Mountain riders, typically individuals who engage in snowboarding multiple times per season, seek a balanced binding offering medium flex, durability, and moderate technical features, and are generally receptive to new technologies that enhance convenience, such as moderately priced quick-entry systems. This segment serves as the volume backbone, driving sales of mid-tier product lines and benefiting from promotional bundles and entry-level upgrades.

A high-value potential customer segment includes Advanced and Professional Freeride/Backcountry enthusiasts. These buyers prioritize ultimate performance, demanding stiff, responsive, and lightweight bindings (often utilizing carbon or high-grade aluminum) that ensure maximum energy transfer for high-speed carving and stability in demanding, deep powder conditions. This group is less price-sensitive and frequently invests in specialized products, such as splitboard bindings, requiring superior durability and unique mechanisms for touring functionality, thereby driving innovation and supporting premium pricing structures for specialized equipment.

The third significant segment encompasses Novice Riders and Commercial Rental Operators. Novices are primarily concerned with ease of use, comfort, and low cost, making entry-level strap-in bindings or robust, simple rear-entry systems highly appealing. Rental operators, crucial bulk buyers, seek exceptionally durable, universally compatible, and easily adjustable bindings that withstand constant, rigorous use and quick changes between users. Manufacturers targeting the rental market focus on reinforced construction, tool-less adjustment features, and standardized sizing conventions to minimize maintenance downtime and maximize operational efficiency, making durability the primary purchasing criterion for this institutional consumer base.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 520 Million |

| Market Forecast in 2033 | USD 740 Million |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Burton Snowboards, Union Bindings, SP Bindings, Flow Snowboarding, K2 Snowboards, Ride Snowboards, Rome SDS, Salomon, Nidecker, Gnu, Bent Metal Binding Works, Arbor Snowboards, NOW Bindings, Karakoram, Atomic (Historical), Head, Rossignol, Technine, Switchback Bindings, GNU Snowboards |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Snowboard Bindings Market Key Technology Landscape

The Snowboard Bindings Market is currently defined by technological competition centered around maximizing convenience and minimizing weight while enhancing energy transfer. Proprietary quick-entry systems represent the leading technological advancements, exemplified by solutions like Burton's Step On and Flow's Rear-Entry mechanism. These technologies demand significant intellectual property protection and complex engineering to ensure secure, reliable connection that matches the performance of traditional strap systems. The integration of specialized hardware, such as sophisticated toe clips and robust heel anchors, guarantees both instantaneous entry and effective lateral and vertical rigidity, critical for high-speed maneuverability and safety. This push towards seamless integration is reshaping consumer expectations regarding setup time on the mountain.

Material science and computational design form the foundation of next-generation binding development. Manufacturers are increasingly utilizing advanced composite molding techniques, blending high-modulus carbon fibers with specialized nylon polymers to create highbacks and baseplates that are significantly lighter yet offer superior responsiveness and vibration dampening compared to traditional plastic or heavier aluminum constructions. Furthermore, computer-aided engineering (CAE) and Finite Element Analysis (FEA) are essential tools used to simulate stress distribution across components, allowing engineers to remove excess material without compromising strength, thereby perfecting the flex profile (torsional and lateral stiffness) to match specific riding styles and user weight characteristics, a level of precision previously unattainable.

The rise of splitboarding has necessitated the development of highly specialized binding interfaces, such as the Karakoram and Spark R&D systems, which incorporate rapid transition mechanisms allowing riders to seamlessly switch between touring mode (skinning uphill) and ride mode (descending). These designs often utilize lightweight aluminum chassis, specialized hinge points, and robust locking levers that can handle the extreme stresses of backcountry travel and variable snow conditions. Additionally, comfort technologies, including canted footbeds (which align the knee and ankle joint biomechanically), advanced EVA foam dampening, and micro-adjustable straps, continue to evolve, addressing rider fatigue and enhancing overall user experience, demonstrating a holistic approach to technological innovation.

Regional Highlights

- North America (United States and Canada): This region is a mature, dominant market, characterized by high consumer spending on premium and specialized equipment. The US, particularly states with extensive mountain ranges (Colorado, Utah, California), drives significant demand for advanced Freeride and All-Mountain bindings. Canada contributes strongly through its vast winter sports infrastructure and a culture that highly values outdoor activities. The region is a key testing ground for new proprietary technologies, such as quick-entry systems, and hosts the headquarters of many industry leaders, fostering intense competitive innovation.

- Europe (Germany, France, Switzerland, Austria): Europe represents the second-largest market, fueled by the Alps and strong skiing traditions in Central and Western Europe. Demand is heavily stratified, with German-speaking regions prioritizing precision engineering and durability, while French and Swiss markets show high uptake of both performance-oriented and specialized touring bindings (splitboarding). Favorable skiing policies and established winter tourism contribute to consistent demand, particularly for high-stiffness bindings designed for icy conditions and steep terrain found across the major Alpine resorts.

- Asia Pacific (APAC) (China, Japan, South Korea): APAC is the fastest-growing market, primarily driven by China's aggressive investment in winter sports infrastructure following the Beijing Winter Olympics. Japan, with its renowned powder snow and established winter culture, maintains a steady demand for high-end gear. South Korea also contributes robustly due to modernization and increasing disposable incomes. This region exhibits a growing preference for technologically convenient solutions, positioning it as the main growth vector for step-in binding manufacturers aiming for volume market expansion.

- Latin America (LATAM): While smaller, this market shows seasonal potential, particularly in Chile and Argentina, where winter sports activities are concentrated in the Andes. The market is highly influenced by imports and focuses primarily on high-value tourists and local affluent consumers, leading to a demand bias towards durable, mid-to-high range All-Mountain bindings that perform reliably under varied conditions.

- Middle East and Africa (MEA): This is the smallest regional segment, dominated by niche indoor ski facilities and limited natural snow resorts. Demand is highly localized and often met through specialized import channels or via high-end tourist purchases. However, emerging economies within the MEA region that are developing tourism infrastructure (e.g., specific Gulf states investing in extreme sports) present minimal long-term opportunities for core market growth.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Snowboard Bindings Market.- Burton Snowboards (Pioneers of Step On technology and market leaders)

- Union Bindings (Renowned for durability, high-performance strap bindings, and comprehensive roster of professional riders)

- SP Bindings (Specializing in quick-entry and rear-entry systems)

- Flow Snowboarding (A long-standing provider of high-quality rear-entry binding technology)

- K2 Snowboards (Offers a wide range including Clicker Step-In system derivatives and traditional models)

- Ride Snowboards (Known for robust chassis and innovative strap designs)

- Rome SDS (Focuses on customizable features and unique flex patterns)

- Salomon (Offers integrated binding systems and strong brand presence in the equipment sector)

- Nidecker (Parent company of multiple snowboard brands, leveraging economies of scale)

- Gnu (Emphasizes unique designs and environmentally conscious materials)

- Bent Metal Binding Works (Known for their unique Flex Control Drive Plates and advanced composite use)

- Arbor Snowboards (Promotes sustainable practices and high-quality construction)

- NOW Bindings (Distinguished by Skate-Tech pivot mechanism for enhanced edge control)

- Karakoram (Market leader in specialized splitboard binding systems and interfaces)

- Spark R&D (Major competitor in the lightweight splitboarding binding segment)

- Head (Global sports equipment provider offering mid-range and rental-focused bindings)

- Rossignol (Strong legacy brand offering integrated packages and reliable performance)

- Technine (Known for freestyle-focused, robust, and often colorful designs)

- Switchback Bindings (Offers tool-less customizable modular bindings)

- Deeluxe (Primarily a boot company, often collaborating or integrating with binding manufacturers)

- Völkl Snowboards (Part of the larger Völkl group, focusing on precision engineering)

- Drake Bindings (Offers diverse range of strap and rear-entry options)

- Bataleon Snowboards (Often designs bindings optimized for their unique board shaping technology)

Frequently Asked Questions

Analyze common user questions about the Snowboard Bindings market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between strap-in and quick-entry snowboard bindings?

The primary difference lies in the mechanism of engagement. Strap-in bindings utilize traditional ratchets and ladders requiring manual tightening and release of two straps (toe and ankle), offering maximum adjustability and robust performance transfer, making them preferred by advanced riders. Quick-entry or step-in bindings, such as Burton Step On or Flow, allow the boot to lock into the binding baseplate almost instantaneously without manual strap operation, prioritizing speed and convenience, which appeals strongly to recreational and intermediate users.

How does the flex rating of a snowboard binding affect riding performance?

The flex rating, categorized generally as soft, medium, or stiff, directly dictates responsiveness and forgivingness. Soft-flex bindings are suitable for beginners or freestyle riders, providing comfort, forgiveness, and easy maneuverability in the park. Stiff-flex bindings are essential for advanced freeride or high-speed carving, maximizing energy transfer from the rider to the board’s edge instantly, offering stability and precise control at speed and in demanding terrain.

Which material is most commonly used for high-performance snowboard binding baseplates?

High-performance binding baseplates commonly utilize lightweight aluminum alloys or advanced fiber-reinforced composite plastics, such as glass-filled nylon or carbon fiber blends. Aluminum offers superior stiffness and direct power transmission favored by aggressive riders, while advanced composites provide an excellent strength-to-weight ratio and superior dampening capabilities, optimizing comfort and reducing overall setup weight for freestyle and all-mountain applications.

Is the Snowboard Bindings Market expected to grow more rapidly in North America or Asia Pacific (APAC) over the forecast period?

While North America remains the largest mature market, the Asia Pacific (APAC) region, driven largely by infrastructural investment and increasing participation rates in China, Japan, and South Korea, is projected to exhibit the highest Compound Annual Growth Rate (CAGR) over the forecast period (2026-2033). This rapid growth is supported by expanding consumer disposable income and government initiatives promoting winter sports tourism and engagement.

What technological innovations are currently driving consumer upgrades in snowboard bindings?

Consumer upgrades are primarily driven by patented quick-entry/step-in technologies which eliminate the need for sitting down to strap in, offering unparalleled convenience. Further drivers include continuous improvements in lightweight material science (e.g., carbon composites, titanium hardware) to enhance board feel and reduce fatigue, and the integration of specialized features like canted footbeds and tool-less adjustments, offering personalized fit and improved biomechanical alignment.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager