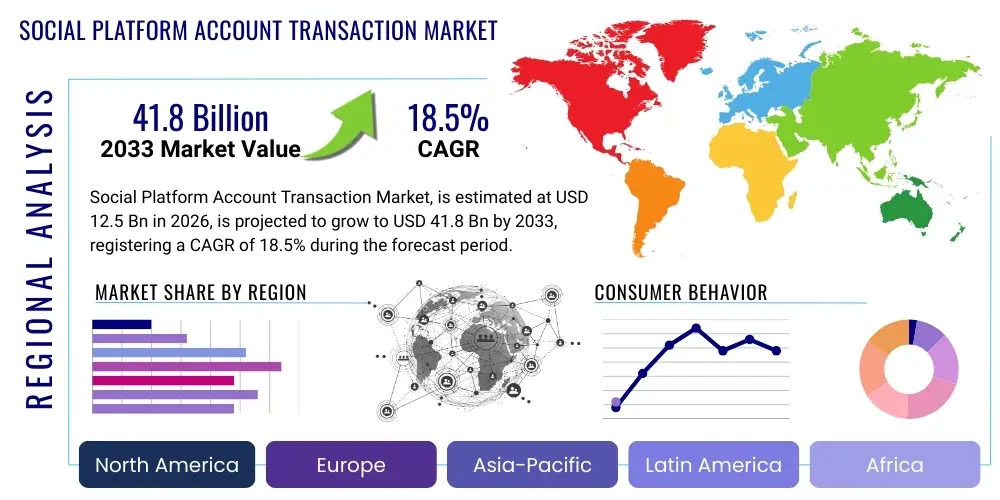

Social Platform Account Transaction Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436554 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Social Platform Account Transaction Market Size

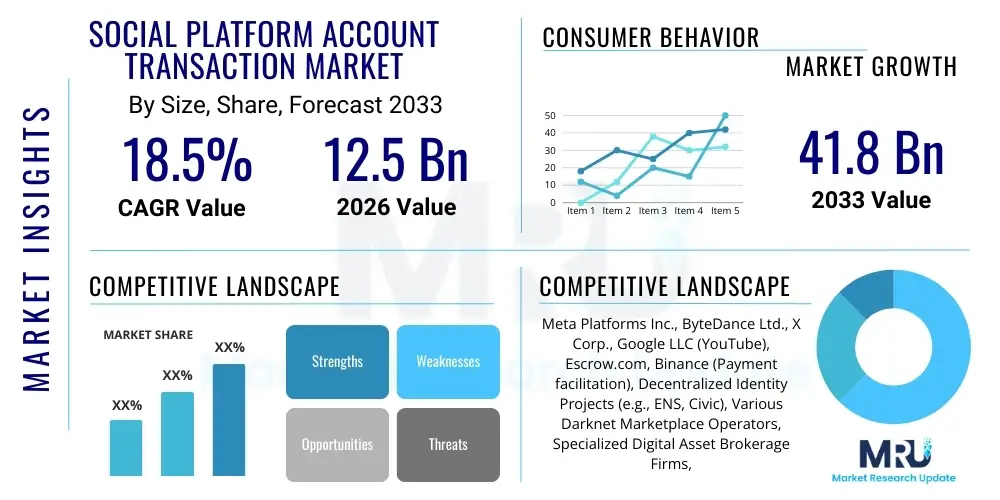

The Social Platform Account Transaction Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% between 2026 and 2033. The market is estimated at $12.5 Billion in 2026 and is projected to reach $41.8 Billion by the end of the forecast period in 2033. This valuation reflects the increasing financial value attributed to digital influence, established audience reach, and verified online identities, driving both legitimate transfers (e.g., M&A of digital assets) and illicit exchanges (e.g., account farming and credential stuffing).

Social Platform Account Transaction Market introduction

The Social Platform Account Transaction Market encompasses the commercial exchange—buying, selling, renting, or leasing—of established user accounts across major social media and digital interaction platforms. These transactions involve accounts possessing varying levels of credibility, audience size, verification status, and engagement metrics. The core product being traded is not merely access, but established digital identity and audience reach. Major applications span digital marketing, brand advocacy, instant content monetization, and gaming economy participation. For marketers, acquiring established accounts offers an immediate bypass of organic growth constraints, enabling swift market entry or targeted campaign deployment. This market thrives on the fundamental economic principle that time and effort spent building social capital can be capitalized upon.

Product descriptions within this market range from high-value verified accounts (often termed "OG accounts" or "blue-check accounts") utilized by corporations or high-profile individuals, to bulk sales of low-engagement, aged accounts used for spamming, bot networks, or initial growth bootstrapping. The legitimacy of these transactions is highly bifurcated; legitimate account transfers often occur when businesses merge or when intellectual property tied to a social profile is sold, usually requiring complex legal documentation, though still often violating platform terms of service (ToS). Conversely, the majority of the market operates in gray or black markets, facilitating phishing, identity theft, and rapid propaganda dissemination.

Major benefits driving market participation include accelerated audience acquisition, immediate authority establishment, circumventing platform growth algorithms, and enabling sophisticated cyber operations such as financial scams or large-scale disinformation campaigns. The primary driving factors are the exponential growth of the Creator Economy, where digital influence directly correlates with revenue potential; the increasing difficulty of organic growth on major platforms; and the sustained demand from marketing agencies and individuals seeking instant credibility and reach without the arduous investment in content creation and audience development. Furthermore, the proliferation of specialized escrow services and decentralized marketplaces has lowered the barriers to entry for participants in this market, further accelerating transaction volumes globally.

Social Platform Account Transaction Market Executive Summary

Current business trends indicate a critical shift towards valuing verified digital identity, especially following global events that have heightened the scrutiny on online authenticity and influence. Regional trends show that Asia-Pacific (APAC) is emerging as a dominant supply hub for farmed accounts due to lower operational costs and high density of digital workers, while North America and Europe remain the principal demand centers, driven by high purchasing power and sophisticated marketing industries. A significant segment trend involves the professionalization of gray market operations; transactions are increasingly handled via encrypted communication channels and utilizing cryptocurrencies for instantaneous settlement, thereby circumventing traditional financial scrutiny. Furthermore, there is a distinct vertical segmentation emerging where gaming accounts (offering high-value digital assets) are traded separately from general social influence accounts, each commanding specialized pricing structures and dedicated brokerage services.

The market faces inherent volatility driven by continuous platform policy changes; major social media providers routinely update their terms of service and implement stricter enforcement mechanisms, leading to fluctuating supply and pricing. Geopolitical risks also play a substantial role, as state actors and politically motivated groups leverage purchased accounts for influence operations, prompting regulatory bodies in key markets to investigate the origin and transfer of digital identities. From an investment perspective, the underlying infrastructure supporting secure transactions (e.g., decentralized finance escrow solutions) presents significant opportunity, provided legal frameworks can adapt to this inherently policy-violating domain. The most pressing challenge for businesses operating legitimately within this ecosystem is navigating the conflict between platform ToS, which usually prohibits account transfer, and the legitimate business need for acquiring digital assets during mergers or strategic expansions.

Segmentation analysis highlights that transactions involving high-follower accounts on platforms like Instagram and TikTok command the highest premiums due to their direct monetization potential via brand deals and advertising revenue. The rise of sophisticated account farming operations, utilizing AI-driven behavioral emulation, ensures a consistent supply of "aged" and "trusted" accounts, suppressing the price of low-tier transactions while maintaining the high cost of premium assets. Overall, the market remains highly dynamic, characterized by a continuous regulatory cat-and-mouse game between platform security teams seeking to enforce authenticity and market participants seeking efficiency and scale through transaction, underscoring its robust projected growth despite inherent legal and ethical hurdles.

AI Impact Analysis on Social Platform Account Transaction Market

User inquiries regarding AI's influence in the Social Platform Account Transaction Market frequently center on two opposing themes: how AI technology can be leveraged to automate the creation and farming of desirable accounts, thereby boosting supply, and conversely, how platform providers utilize sophisticated AI/ML models to detect and disable account transfers, thereby suppressing demand and increasing risk. Key themes identified include the expectation that AI will dramatically lower the cost of producing believable, high-activity bot accounts, making them indistinguishable from human users, thereby increasing the volume of available assets. Simultaneously, users express concerns about the rising sophistication of AI-powered platform security systems, which can identify anomalies in login locations, posting patterns, and network changes indicative of account transfer, making transactions riskier and reducing the lifespan of purchased profiles. Users also question AI's role in verifying the authenticity of accounts prior to purchase, focusing on algorithmic tools that promise "health checks" on digital assets.

- AI-Driven Account Generation: Sophisticated Large Language Models (LLMs) and generative algorithms are used to create realistic user profiles, automate content posting, and simulate organic engagement patterns, accelerating the farming process of high-quality, aged accounts ready for transaction.

- Fraud Detection Enhancement: Platform security leverages AI/ML to continuously monitor transaction markers, including sudden geographic shifts, payment method changes, IP address inconsistencies, and rapid changes in posting tone or subject matter, leading to swift account deactivation post-purchase.

- Pricing and Valuation Optimization: AI tools are employed by brokers to dynamically price accounts based on predicted engagement metrics, follower quality scores, and the likelihood of future monetization, moving beyond simple follower counts.

- Escrow and Verification Services: AI-powered tools assist in pre-transaction verification, analyzing follower integrity, bot percentage, and historical engagement health, offering buyers increased assurance and potentially reducing transaction risk.

- Automated Phishing and Credential Stuffing: Adversarial AI techniques enhance the efficiency of credential harvesting operations, ensuring a constant, cheap supply of compromised accounts entering the transaction market.

DRO & Impact Forces Of Social Platform Account Transaction Market

The market is primarily driven by the imperative for instant influence and scale in the digital economy, leveraging pre-built social capital to bypass organic growth bottlenecks. However, this growth is significantly restrained by stringent platform enforcement of terms of service, coupled with increasing governmental scrutiny regarding disinformation and identity manipulation. Opportunities lie in developing robust, legally compliant digital asset transfer mechanisms, such as decentralized identity systems and advanced escrow solutions that can mitigate risks for legitimate transactions, thereby professionalizing the ecosystem. The dominant impact force is the inherent conflict between platform policy favoring authenticity and the commercial demand for efficient, rapid audience acquisition, creating a perpetual state of regulatory instability and price volatility within the transaction market.

Impact forces are further categorized by technological advancement and regulatory backlash. On the technological front, sophisticated botting infrastructure consistently drives down the cost of creating marketable inventory, fueling supply. Conversely, regulatory actions, particularly in major Western jurisdictions, targeting financial intermediaries that facilitate illicit transactions pose a severe threat to market viability and necessitate complex workarounds for payment processing, which indirectly increases transaction costs and associated risks. The interplay between platform anti-fraud capabilities and the ingenuity of transaction facilitators dictates the market’s operational landscape, creating a high-risk, high-reward environment attractive to entrepreneurial brokers and specialized digital asset managers.

Ultimately, the long-term trajectory of the Social Platform Account Transaction Market is heavily influenced by external economic forces, primarily the health of the global digital advertising market and the continuing valuation of the creator economy. As brands allocate more budget toward influencer marketing, the demand for verified, established accounts (the digital equivalent of premium real estate) will persist, acting as a structural driver. Restraints, therefore, primarily affect the longevity and perceived security of the acquired asset, forcing buyers to factor in a high depreciation rate due to platform intervention, making the market inherently speculative.

Segmentation Analysis

The Social Platform Account Transaction Market is highly segmented based on the nature of the asset, the transaction mechanism, and the intended application. This granular segmentation allows participants to specialize in specific niches, optimizing supply chains for required follower demographics, platform compatibility, and account history (age, posting activity). The primary distinction lies between bulk, low-value transactions often used for spamming or initial follower padding, and high-value, bespoke transactions involving verified accounts with massive, engaged followings, typically facilitated through private brokers rather than public marketplaces. Understanding these segments is crucial as platform providers intensify efforts to disrupt the lower-tier transaction models, forcing brokers towards more sophisticated, higher-value asset management.

- By Transaction Type

- Account Buying (Permanent Transfer)

- Account Selling (Divestiture)

- Account Renting/Leasing (Temporary Access for Campaigns)

- Account Verification Services (Often bundled with account transfer)

- Digital Asset Mergers & Acquisitions (Legitimate business transfers)

- By Platform Type

- Instagram Account Transactions (Focus on visual influence)

- TikTok Account Transactions (Focus on viral reach and short-form video)

- X (Twitter) Account Transactions (Focus on rapid dissemination and high-frequency content)

- Facebook Account Transactions (Focus on community and older demographic reach)

- LinkedIn Account Transactions (Focus on professional networking and B2B influence)

- Gaming/Streaming Platforms (Twitch, YouTube Gaming, Steam)

- By End-User

- Individual Influencers and Content Creators

- Marketing and Advertising Agencies

- E-commerce and Direct-to-Consumer (DTC) Brands

- Cyber Security Researchers and Ethical Hackers (Acquiring accounts for testing)

- Malicious Actors and Cybercriminals (Phishing, fraud, disinformation)

- By Follower/Engagement Tier

- Low-Tier (0 to 10k Followers)

- Mid-Tier (10k to 100k Followers)

- High-Tier (100k+ Followers, often verified)

- Aged/Inactive Accounts (Used for farming and credibility building)

Value Chain Analysis For Social Platform Account Transaction Market

The value chain for the Social Platform Account Transaction Market begins with upstream activities focused on account creation and cultivation, moving through specialized intermediation, and concluding with downstream consumption by the end-user. Upstream analysis involves highly automated processes such as bot farming, IP rotation, and sophisticated behavioral simulation to create credible, "aged" accounts. These farming operations are often centralized in regions with low labor and infrastructure costs. The quality and volume of this initial inventory dictate the subsequent flow and pricing. Midstream activities are dominated by specialized digital brokers, encrypted forums, decentralized marketplaces, and escrow services, which connect supply (farmers/sellers) with demand (buyers), manage negotiations, conduct preliminary verification checks, and facilitate secure financial transfers, often using cryptocurrencies to maintain anonymity.

Downstream analysis focuses on the distribution channels and end consumption. Distribution primarily occurs through closed Telegram channels, specialized dark web marketplaces, and increasingly, secure peer-to-peer arrangements bypassing public listing sites. Direct channels involve buyers purchasing directly from farmers or individual sellers, while indirect channels rely heavily on professional brokers or automated transaction platforms that manage the technical transfer and payment clearance. The end-users—ranging from digital marketers seeking immediate audience scale to malicious actors requiring a distributed network of trusted profiles—derive value through the immediate utility of the acquired digital identity, which translates directly into marketing efficiency, monetization capability, or operational anonymity.

The key value addition occurs at the intermediation stage, where brokers transform raw, unverified accounts into "premium assets" through verification services, follower auditing, and secure transfer protocols. Payment processing, particularly the adoption of secure, anonymous digital currency rails, is critical to maintaining the functional integrity of the gray market segment. Disruptions to this value chain, such as mass platform purges (restraint) or the introduction of secure digital identity standards (opportunity), have profound, immediate effects on the pricing and perceived risk of all accounts traded within this dynamic ecosystem.

Social Platform Account Transaction Market Potential Customers

The potential customers for the Social Platform Account Transaction Market are diverse, ranging from individuals seeking personal influence to large multinational corporations executing complex digital strategy. The primary customer base comprises digital marketing agencies that require rapid scaling capabilities for client campaigns, bypassing the slow, costly process of organic growth to achieve immediate visibility and impression goals. Furthermore, the burgeoning Creator Economy features individual content creators and aspiring influencers who purchase established accounts to immediately enter higher monetization tiers, capitalizing on existing audience inertia and verification status to secure lucrative brand partnerships faster than their organically growing peers.

A significant, albeit less visible, customer segment includes e-commerce businesses and Direct-to-Consumer (DTC) brands that utilize purchased accounts to secure highly desirable, memorable platform usernames (digital real estate) or to distribute targeted advertisements from seemingly independent, trusted profiles. On the non-commercial side, cybersecurity researchers and identity verification firms occasionally participate to acquire accounts for testing platform vulnerabilities or studying disinformation network architecture, representing a niche but high-value demand stream focused on intelligence gathering rather than monetization.

Crucially, the market is sustained by sophisticated malicious actors, including state-sponsored groups and organized cybercrime syndicates. These entities are volume buyers, acquiring thousands of low-tier accounts for purposes such as large-scale phishing operations, disseminating financial fraud schemes, and executing geopolitical influence operations where the appearance of mass public consensus or dissent is required. Understanding these end-users underscores the high-stakes environment in which this market operates, demanding constant vigilance from platform providers and regulators attempting to curb illicit activities while navigating legitimate business asset transfers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $12.5 Billion |

| Market Forecast in 2033 | $41.8 Billion |

| Growth Rate | 18.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Meta Platforms Inc., ByteDance Ltd., X Corp., Google LLC (YouTube), Escrow.com, Binance (Payment facilitation), Decentralized Identity Projects (e.g., ENS, Civic), Various Darknet Marketplace Operators, Specialized Digital Asset Brokerage Firms, AI Account Farming Automation Providers (e.g., Follower Factory, InstaGrow Solutions), Digital Identity Verification Services, Major VPN Providers (Used for IP obfuscation), Cryptocurrency Exchanges, Specialized Account Auction Houses (e.g., Fameswap), Advanced Botting Software Developers, Secure Messaging Platforms (Telegram, Signal), Digital Marketing Consulting Firms, Ad Targeting Agencies. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Social Platform Account Transaction Market Key Technology Landscape

The technology landscape underpinning the Social Platform Account Transaction Market is characterized by a reliance on highly sophisticated automation, anonymization tools, and increasingly, decentralized ledger systems. Key technologies driving supply include advanced botting software utilizing machine learning to emulate human behavioral patterns, allowing for the autonomous creation and cultivation of aged, high-credibility accounts without human intervention. This automation often involves complex IP rotation services (VPNs, proxy networks) to prevent geolocation-based security flags and ensure the accounts appear to be geographically diverse and organically managed. Furthermore, the use of virtual machines and dedicated server infrastructure facilitates the management of thousands of accounts simultaneously, providing the scale necessary for large-volume transactions that fuel the low-to-mid tier market segments.

In the transactional sphere, the market heavily relies on secure and anonymous payment rails, with cryptocurrencies, particularly stablecoins and privacy coins, dominating settlement processes. This is necessitated by the inherent illegality or policy violation associated with most transactions, requiring participants to bypass traditional banking systems that might flag suspicious activity. Escrow services, whether centralized (operated by brokers) or decentralized (using smart contracts on blockchains), are essential technologies that mitigate counterparty risk, releasing funds only upon successful account transfer and buyer verification of the asset's health, ensuring a level of trust in a trustless environment.

Crucially, the future technology trajectory points toward the integration of Decentralized Identity (DID) solutions and verifiable credentials. While platform providers primarily focus on utilizing AI/ML for forensic analysis and fraud detection (a technology designed to restrain the market), DID technologies offer the potential for accounts to be verifiably owned and transferred through a transparent ledger, potentially legitimizing the transfer process for high-value corporate assets and establishing an auditable chain of custody. This intersection of robust security mechanisms and decentralized ownership protocols will be pivotal in defining the legal boundaries and operational efficiency of the Social Platform Account Transaction Market over the forecast period.

Regional Highlights

The global Social Platform Account Transaction Market displays pronounced regional differentiation in both supply dynamics and demand maturity, fundamentally reflecting varying economic and regulatory environments.

- North America: Represents the largest demand market by value, characterized by high purchasing power and a mature digital marketing industry. Transactions here often involve high-tier, verified accounts sought by major brands and sophisticated agencies for immediate impact and high-stakes campaigns. The emphasis is on high-quality, engagement-heavy accounts, commanding premium pricing.

- Europe: Similar to North America in terms of demand for high-quality assets, but faces stricter regulatory scrutiny, particularly concerning data privacy (GDPR implications on account transfers) and disinformation laws. The market focuses on boutique brokers specializing in localized influence and demographic-specific audiences across key EU member states.

- Asia Pacific (APAC): Dominates the market in terms of supply volume, particularly from countries like India, the Philippines, and Vietnam, where specialized account farming operations can leverage lower overhead costs and large, skilled digital workforces. APAC also exhibits high internal demand, particularly for mobile-first platforms like TikTok and local equivalents, driving substantial transaction volumes for both domestic and international use.

- Latin America (LATAM): An emerging growth region characterized by rapidly increasing internet penetration and smartphone adoption. The market here is growing swiftly, driven by local influencers and small businesses seeking to establish digital presence quickly. Transactions often involve mid-tier accounts and frequently utilize local payment methods alongside cryptocurrencies.

- Middle East and Africa (MEA): A complex region where demand is highly concentrated in politically sensitive and economically robust markets (GCC countries). Transactions are often high-value but low volume, driven by strategic communication needs, either corporate or governmental. Security and anonymity are paramount in this region due to heightened regulatory monitoring of online activity.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Social Platform Account Transaction Market.- Meta Platforms Inc. (Platform Owner and Primary Regulator)

- ByteDance Ltd. (TikTok - Platform Owner and Primary Regulator)

- X Corp. (Platform Owner and Primary Regulator)

- Google LLC (YouTube, Platform Owner)

- Escrow.com (Traditional Escrow Services)

- Binance Holdings Ltd. (Crucial Payment Facilitator via Cryptocurrency)

- Telegram Messenger (Key Communication and Brokerage Channel)

- Decentralized Identity Foundation (Developing underlying identity standards)

- Fameswap (One of the prominent public brokerage marketplaces)

- PlayerUp (Specialized Gaming Account Marketplace)

- NordVPN (A leader in IP obfuscation technology utilized by farmers)

- ExpressVPN (Provider of IP rotation services)

- Hydra Market (Historical Darknet Marketplace Facilitator)

- Digital Asset Brokerage Firms (Various specialized gray market entities)

- Automated Account Generation Software Developers

- Digital Verification Service Providers (DVS)

- Cybersecurity and Threat Intelligence Firms (Tracking illicit trade)

- Stripe (Indirect payment infrastructure provider, often targeted)

- Reddit (Platform for niche account trading communities)

- Signal Foundation (Encrypted communication for high-value transactions)

Frequently Asked Questions

Analyze common user questions about the Social Platform Account Transaction market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary risks associated with purchasing a social platform account?

The main risk is immediate or delayed account deactivation by the platform provider, as nearly all major social media platforms strictly prohibit the transfer or sale of user accounts under their Terms of Service (ToS). Purchased accounts often face high scrutiny from AI-powered fraud detection systems due to anomalous activity changes, resulting in permanent loss of the asset and investment.

How is the value of a social media account determined in this transaction market?

Account value is determined by a complex combination of factors, including follower count, follower quality (low bot percentage), historical engagement rates, niche specialization, age of the account, verification status (blue checkmark), and the platform on which the account resides. Accounts with genuine, high-activity engagement command significantly higher premiums than those with farmed, inactive followers.

What is the role of cryptocurrency in the Social Platform Account Transaction Market?

Cryptocurrency is pivotal as the preferred settlement mechanism, offering anonymity and instant transfer capabilities crucial for gray and black market transactions. Cryptocurrencies mitigate the risk of financial institutions flagging payments for illegal activity, ensuring secure and irreversible funds transfer upon successful delivery of the digital asset.

Are account transfers ever considered legitimate business activities?

Yes, while technically violating platform ToS, account transfers are often deemed legitimate business activities during mergers, acquisitions, or divestitures involving digital brands or intellectual property. In these cases, the account is treated as a business asset, although the transfer usually requires complex legal agreements and technical workarounds to avoid platform detection.

How does AI impact the sustainability and security of purchased accounts?

AI creates a dual challenge: it enhances the supply side by making account farming scalable and realistic, but it simultaneously threatens the security of purchased assets. Platform AI systems continuously learn to detect behavioral anomalies linked to ownership transfer, reducing the longevity of acquired accounts and increasing the necessity for sophisticated cloaking techniques post-purchase to ensure sustainability.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager