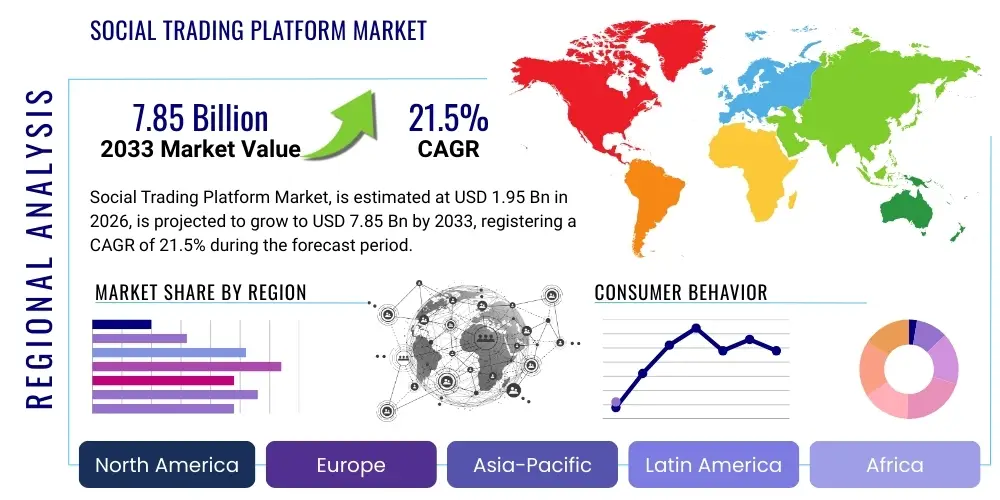

Social Trading Platform Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437209 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Social Trading Platform Market Size

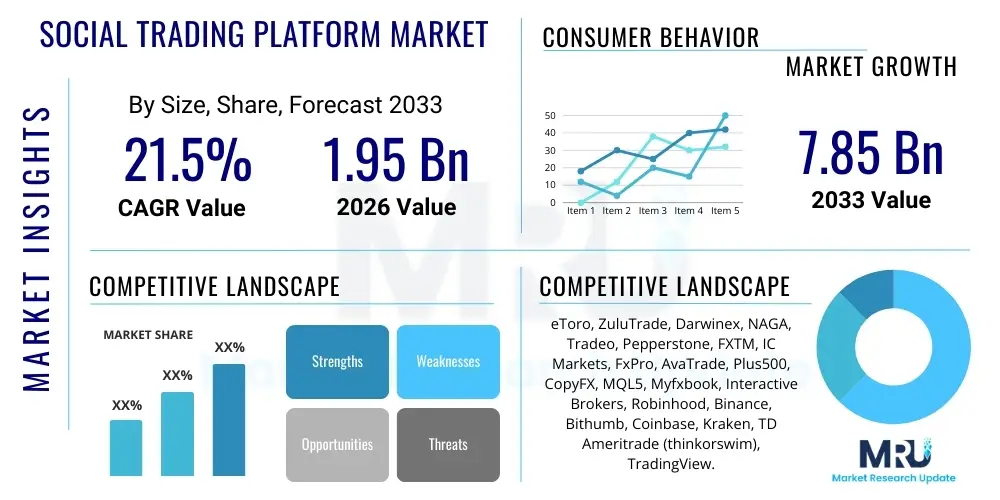

The Social Trading Platform Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 21.5% between 2026 and 2033. The market is estimated at $1.95 Billion in 2026 and is projected to reach $7.85 Billion by the end of the forecast period in 2033.

Social Trading Platform Market introduction

The Social Trading Platform Market encompasses specialized online environments that enable investors to observe, analyze, and replicate the trading strategies of experienced peers or professional traders. These platforms fundamentally merge financial trading with social networking capabilities, offering features such as leaderboards, discussion forums, copy trading, and automated portfolio mirroring. The primary products include web-based platforms and mobile applications designed to facilitate transparent information exchange regarding trading decisions across various asset classes, predominantly Forex, stocks, and increasingly, cryptocurrencies. The core product description involves providing infrastructure for peer-to-peer investment transparency, fostering a collaborative yet competitive environment for wealth generation, thereby democratizing access to sophisticated trading strategies previously reserved for institutional investors or high-net-worth individuals.

Major applications of social trading platforms span retail investing, financial education, and automated portfolio management. Retail investors utilize these systems to overcome limitations related to market knowledge, time commitment, and emotional biases, relying on the collective intelligence and proven track records of top-performing traders. The key benefits derived from these platforms include enhanced transparency regarding market performance, lower entry barriers for new traders, risk diversification through exposure to multiple strategies, and significantly improved learning curves. Furthermore, the inherent social elements provide psychological support and timely feedback loops, differentiating these platforms from traditional brokerage services. The ecosystem fosters a community where performance data is public, driving both accountability for strategy providers and informed decision-making for followers.

Driving factors propelling the rapid growth of this market include the global surge in retail investor participation, particularly among millennials and Generation Z, who are digitally native and prioritize transparent, community-driven financial tools. The continuous improvements in mobile trading technology, combined with the increasing accessibility of high-speed internet, further lower operational friction. Regulatory environments are gradually adapting to and standardizing requirements for these Fintech innovators, boosting user confidence. Moreover, the inherent desire for passive income generation and the compelling marketing around successful 'star traders' make social trading an attractive alternative to traditional wealth management vehicles, fueling substantial adoption across emerging and mature economies alike.

Social Trading Platform Market Executive Summary

The Social Trading Platform Market is undergoing a rapid evolution characterized by increased integration of advanced technology, regulatory scrutiny, and geographic expansion. Current business trends indicate a strong focus on enhancing user experience through mobile optimization and the incorporation of sophisticated AI tools for risk management and strategy performance analysis. Platforms are shifting from simple copy trading mechanisms toward providing holistic financial ecosystems that integrate educational content, proprietary research, and access to a wider array of assets, particularly decentralized finance (DeFi) instruments and fractional shares. Competition is intensifying, forcing established players to innovate continuously while specialized niche platforms focusing solely on asset classes like commodities or indices are also emerging, leading to market fragmentation and higher standards for technological robustness and security. The monetization models are diversifying beyond performance fees and spread markups to include subscription services for premium insights and data analytics.

Regional trends reveal that the Asia Pacific (APAC) region, specifically countries like India, Southeast Asia, and China (where regulatory conditions permit), is demonstrating the fastest growth owing to a large, young, and tech-savvy population combined with rising disposable incomes and a strong affinity for mobile-first financial solutions. North America and Europe, while being mature markets, maintain dominance in terms of market value, driven by sophisticated regulatory frameworks (like MiFID II and CFTC guidelines) and the presence of major financial hubs. These mature regions emphasize regulatory compliance and institutional integration. Furthermore, Latin America is showing promising signs of acceleration, fueled by local Fintech proliferation and the necessity for alternative wealth-building tools amidst currency volatility, positioning it as a critical growth frontier for platform providers.

Segment trends underscore the dominance of the Cryptocurrencies application segment, which has experienced explosive adoption due to high volatility and 24/7 trading cycles, making expert guidance invaluable. In terms of platform type, Copy Trading remains the most popular and highest-revenue generating segment because of its ease of use and automated execution capabilities, appealing particularly to novice investors seeking passive exposure to complex strategies. Cloud-based deployment is the universally preferred mode due to its scalability, low operational cost, and capacity to handle massive real-time data flow necessary for instantaneous trade execution mirroring. This trend dictates that infrastructure investment must prioritize resilience and ultra-low latency, ensuring seamless replication regardless of geographical location or market condition, fundamentally impacting the required technological stack.

AI Impact Analysis on Social Trading Platform Market

Common user inquiries concerning the impact of Artificial Intelligence (AI) on social trading platforms revolve around questions of algorithmic trustworthiness, the transparency of AI-driven trading strategies, and how machine learning might personalize risk profiles and improve performance prediction accuracy. Users frequently express concern about whether AI will replace human star traders entirely or merely serve as a tool for amplification, seeking reassurance regarding the robustness of automated risk management tools during black swan events. Key expectations center on AI's ability to filter out noise from social sentiment data, identify fraudulent or consistently underperforming strategies early, and provide hyper-personalized educational pathways. The overriding themes indicate a desire for enhanced safety, superior execution quality, and predictive capabilities that reduce dependence on purely historical data analysis, transforming social trading from a reliance on observed human performance to a synergy between human judgment and computational power.

AI's influence is fundamentally reshaping the competitive landscape by introducing sophisticated capabilities that traditional social features lack. Specifically, AI algorithms are being employed to analyze vast datasets encompassing market movements, historical strategy performance, social sentiment indicators, and individual follower risk tolerance. This analytical depth allows platforms to provide much more nuanced matching between strategy providers and followers, moving beyond simple return metrics to incorporate factors like drawdowns, volatility, and trading style consistency. This shift enhances user retention by minimizing follower exposure to unexpected strategy deviations and maximizing the probability of sustained, risk-adjusted returns, elevating the quality and reliability of the overall service offering provided by the platforms.

Moreover, AI is critical for maintaining regulatory compliance and detecting manipulative activities within the social trading environment. Machine learning models can monitor discussion forums and trade execution patterns in real-time to identify instances of 'pumping and dumping,' excessive risk-taking, or coordinated malicious activity. By automating these compliance and surveillance functions, platforms can scale their operations globally while minimizing regulatory exposure and building greater trust among their user base. The future trajectory suggests that AI will become the foundational layer for personalized trade execution, adaptive leverage recommendations, and sophisticated portfolio optimization engines that autonomously adjust to dynamic market conditions and evolving follower goals.

- AI-driven risk scoring and personalized strategy matching for followers.

- Automated market sentiment analysis using Natural Language Processing (NLP) on discussion forums.

- Enhanced algorithmic monitoring for regulatory compliance and fraud detection.

- Development of proprietary AI trading bots offered as copyable strategies.

- Real-time portfolio rebalancing and optimization based on predictive market shifts.

- Improved educational resources and guided trading paths customized by user skill level.

- Optimization of trade execution latency and slippage reduction through machine learning.

- Predictive analytics to forecast the sustainability and reliability of 'star trader' performance.

DRO & Impact Forces Of Social Trading Platform Market

The Social Trading Platform Market is primarily driven by the democratization of finance, facilitated by widespread internet access and the cultural shift towards transparent investment processes, while restrained by persistent regulatory uncertainty across various jurisdictions, particularly regarding the categorization and oversight of "strategy providers." Opportunities abound in expanding asset class coverage, such as tokenized real-world assets and specialized derivative products, and through geographic penetration into untapped emerging markets where financial literacy demands easy-to-use platforms. These forces exert a significant impact: the pressure to innovate technologically is high (Driver), yet operational complexity due to varying international regulations limits rapid scaling (Restraint). The compelling force of market education and financial inclusion serves as a powerful Opportunity, encouraging the development of user-friendly interfaces and robust risk disclosure mechanisms, ultimately shaping the velocity and direction of market growth.

Key drivers include the dramatic rise in mobile device penetration, making trading accessible 24/7, and the strong network effects inherent in social platforms; as more successful traders join, the platform's value proposition strengthens for followers, creating a virtuous cycle of growth. Furthermore, the inherent transparency of social trading, where performance history is verifiable, builds necessary trust, a crucial element in financial technology adoption. Conversely, significant restraints involve the inherent risk associated with capital loss—especially when inexperienced followers mirror high-risk strategies—leading to reputational damage and potential regulatory intervention. The dependency on reliable data feeds and the pervasive threat of cybersecurity breaches also necessitate substantial continuous investment, acting as a brake on immediate profit maximization.

The impact forces are substantial, pushing the market toward greater standardization and institutional acceptance. The force of regulatory compliance compels platforms to adopt sophisticated KYC/AML procedures and clear risk disclosures, transforming the industry from a wild frontier into a structured financial service provider. Competitive forces drive technological integration, necessitating platforms to offer superior analytics, lower trading costs, and more reliable infrastructure to maintain market share. The enduring opportunity lies in leveraging blockchain technology to enhance transparency and security, potentially solving some of the inherent trust issues associated with centralized performance reporting, thereby unlocking new segments of conservative investors previously hesitant to engage with social trading models. Furthermore, the ability to seamlessly integrate with traditional banking and asset management services represents a major avenue for future strategic expansion.

Segmentation Analysis

The Social Trading Platform Market is segmented primarily based on Type (e.g., Copy Trading, Mirror Trading), Application (asset classes traded), and Deployment Model (Cloud vs. On-Premise). Understanding these segments is crucial for strategic market positioning, as each segment caters to a distinct investor demographic with unique risk appetites and technological requirements. Copy Trading, for instance, targets passive investors seeking immediate, automated replication, while discussion forums appeal more to active learners and collaborative traders. The dominance of the Forex and Cryptocurrency segments in the Application breakdown reflects the high volatility and frequent trading cycles characteristic of these asset classes, which derive the most immediate benefit from shared expert insights.

Detailed analysis of the Type segment shows that Mirror Trading, which allows replication based on algorithmic rules rather than specific human traders, is gaining traction among institutional or high-frequency retail traders who prefer systematically back-tested strategies. In contrast, the application segment of traditional Stocks and Indices, although growing slower than crypto, remains highly lucrative due to the immense volume of long-term capital managed in these areas. Platform providers are focusing R&D efforts on creating specialized tools that enhance the usability and safety within these diverse segments, ensuring that risk management protocols are appropriately tailored whether a user is following a high-leverage Forex strategy or a diversified blue-chip stock portfolio.

The deployment segment confirms the market’s reliance on robust, scalable, and globally accessible infrastructure. Cloud-Based platforms dominate overwhelmingly, driven by the necessity for real-time data synchronization, cross-regional execution capabilities, and ease of mobile access. On-Premise solutions are almost exclusively limited to highly regulated, specialized institutional investors or proprietary trading desks that require absolute control over data sovereignty and execution environments, but this segment represents a negligible share of the overall social trading market. The continuous need for integration with various third-party brokers and liquidity providers further reinforces the preference for flexible, API-driven cloud architectures.

- Type:

- Copy Trading

- Mirror Trading

- Pattern Trading

- Discussion Forums

- Application:

- Forex

- Stocks and Indices

- Commodities

- Cryptocurrencies

- Deployment:

- Cloud-Based

- On-Premise

- End-User:

- Retail Investors

- Institutional Investors

Value Chain Analysis For Social Trading Platform Market

The value chain for the Social Trading Platform Market begins with the upstream component providers, primarily comprising technology infrastructure vendors, data providers, and liquidity providers. Infrastructure vendors supply the core cloud computing, API connectivity, and cybersecurity solutions necessary for platform operation. Data providers deliver real-time pricing feeds, historical market data, and often analytical tools that platforms license to ensure accurate trade execution and performance tracking. Liquidity providers, typically large banks or prime brokers, enable the platforms to source the necessary capital and execute trades efficiently on behalf of the users. The quality and reliability of these upstream inputs directly determine the platform’s performance, latency, and overall trust factor, making relationships with tier-one data and liquidity sources critical.

The core midstream activities involve the platform operators themselves, who focus on software development, user interface design, regulatory compliance, and community management. Platform operators aggregate the liquidity and data, build the proprietary social networking layer (including leaderboards, communication tools, and copy execution algorithms), and perform ongoing maintenance and security audits. Marketing and customer acquisition, often relying heavily on affiliate networks and performance advertising, also constitute a major part of the midstream value proposition. Differentiation at this stage relies heavily on the uniqueness of the trading tools offered, the depth of regulatory licenses held, and the quality of the strategy providers attracted to the platform, as these elements dictate user flow and stickiness.

Downstream activities involve distribution channels and the end-users. The primary distribution channels are direct-to-consumer via web platforms and mobile apps, supplemented by indirect partnerships with independent introducing brokers (IBs) or financial influencers who market the platform to their networks. End-users (retail and increasingly institutional investors) are the ultimate beneficiaries and revenue generators. The efficiency of the platform’s connection to banking systems for deposits and withdrawals, and the seamless integration of trading technology (e.g., MT4/MT5 compatibility), are key downstream considerations. A well-optimized value chain ensures low execution costs, high data integrity, and a superior end-user experience, which is paramount for sustainable market growth and retaining both star traders and followers.

Social Trading Platform Market Potential Customers

The primary potential customers and end-users of social trading platforms are segmented into two major categories: Retail Investors and a nascent but growing segment of Institutional Investors. Retail investors form the dominant user base, typically comprising novice traders seeking guidance, time-constrained professionals looking for passive income streams, and digitally native younger generations who prefer collaborative and transparent financial engagement. These users value ease of use, low entry costs, and the ability to mitigate risk by following strategies proven by others. Their adoption is catalyzed by financial democratization and the availability of fractional share trading and micro-investing features, making the platforms accessible across diverse economic spectrums globally. Marketing efforts are thus highly focused on demonstrating verifiable performance and simplifying complex investment decisions.

Within the retail category, a distinct sub-segment consists of experienced traders or 'strategy providers' themselves. While they are content creators rather than mere consumers, they are customers in the sense that they utilize the platform’s tools and infrastructure to monetize their expertise, often receiving performance fees or rebates. Platforms must therefore tailor their services, offering advanced analytical tools, secure intellectual property protection for their strategies, and lucrative remuneration models to attract and retain these high-value creators, as the quality and quantity of successful strategy providers directly correlate with the platform's overall market attractiveness and follower engagement.

Institutional investors, including hedge funds, family offices, and registered investment advisors (RIAs), represent a crucial future growth segment. While traditional institutions remain cautious due to regulatory hurdles and preference for proprietary control, they are increasingly exploring social trading models for diversification, specifically Mirror Trading or customized white-label solutions. They use these platforms to deploy tactical strategies in niche markets (e.g., volatile crypto pairs) or to test new algorithmic strategies using the social feedback loop for validation. This segment demands enterprise-grade security, dedicated API access for integration into existing portfolio management systems, and stringent adherence to global compliance standards, requiring platforms to invest heavily in robust institutional-grade infrastructure.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.95 Billion |

| Market Forecast in 2033 | $7.85 Billion |

| Growth Rate | 21.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | eToro, ZuluTrade, Darwinex, NAGA, Tradeo, Pepperstone, FXTM, IC Markets, FxPro, AvaTrade, Plus500, CopyFX, MQL5, Myfxbook, Interactive Brokers, Robinhood, Binance, Bithumb, Coinbase, Kraken, TD Ameritrade (thinkorswim), TradingView. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Social Trading Platform Market Key Technology Landscape

The technology landscape of the Social Trading Platform Market is defined by the integration of low-latency trading infrastructure, advanced data analytics, and scalable cloud computing architecture. Crucial components include sophisticated Application Programming Interfaces (APIs) that facilitate seamless communication between the platform, various brokerage houses, and liquidity providers, ensuring that copied trades are executed instantaneously with minimal slippage. High-frequency data streams require robust message queuing systems and distributed databases capable of handling millions of transactions and updates per second globally. The core of the platform relies on proprietary copy trading engines built on microservices architecture, guaranteeing high availability and fault tolerance, essential traits for maintaining user trust in automated execution processes across volatile markets.

Furthermore, technologies enabling the 'social' aspect are equally important. This includes real-time communication tools, robust content filtering systems using machine learning to moderate discussion forums, and sophisticated user interface (UI) and user experience (UX) design focused on mobile responsiveness and intuitive navigation. A critical technological investment area is in algorithmic trading modules. Platforms are increasingly integrating Machine Learning (ML) models not only for risk assessment and performance prediction but also for optimizing the automated execution of complex multi-leg strategies. The utilization of AI algorithms allows platforms to offer 'smart copying' features that dynamically adjust the size of a copied trade based on the follower's specific risk tolerance or capital availability, moving beyond simple proportional mirroring.

The emerging technological frontier involves leveraging Distributed Ledger Technology (DLT) or blockchain for enhanced transparency and security. While not yet universally adopted, several platforms are exploring using blockchain to immutably record strategy performance metrics and trade history, thereby eliminating the potential for data manipulation and significantly boosting investor confidence. Security infrastructure, encompassing multi-factor authentication, advanced encryption standards for client data (GDPR/CCPA compliance), and continuous penetration testing, is non-negotiable. The overall technological environment dictates a platform’s ability to scale quickly, manage systemic risk, and comply with rapidly evolving global financial regulations, making continuous technological investment a core competitive differentiator in this highly dynamic market sector.

Regional Highlights

The global Social Trading Platform Market exhibits significant regional variations in growth drivers, regulatory maturity, and user adoption rates, necessitating highly localized market strategies for platform providers seeking global dominance. North America, encompassing the United States and Canada, represents a high-value market characterized by robust regulatory oversight from bodies like the SEC and FINRA, leading to higher barriers to entry but also establishing a strong foundation of trust among users. Adoption is driven by sophisticated retail investors seeking advanced analytical tools and API integration with existing investment accounts, particularly focused on stock and options trading. Platforms must prioritize compliance and institutional-grade technology to succeed here.

Europe stands as a mature but intensely competitive market, primarily governed by MiFID II regulations, which mandates transparency and investor protection. Key centers such as the UK, Germany, and Cyprus (a major licensing hub) have large pools of experienced Forex and CFD traders. The region is a leader in Copy Trading and Mirror Trading segment adoption. The trend here focuses on pan-European integration, offering localized language support, and navigating the complexities of varying tax laws across the EU member states. Innovation is spurred by the need to integrate social elements seamlessly within highly regulated environments, often leading to partnerships with established banking institutions.

Asia Pacific (APAC) is projected to be the fastest-growing region during the forecast period. This explosive growth is fueled by massive populations with increasing digital literacy, high mobile penetration, and a cultural affinity for social networking integrated with financial tools. Countries like India, Indonesia, and Vietnam show immense potential due to their young, underbanked populations actively seeking alternative investment avenues, particularly in cryptocurrencies and local stock exchanges. Challenges include fragmented regulatory frameworks and the necessity of tailoring platforms to specific national languages and payment infrastructures, demanding highly adaptive and localized operational models from market players.

Latin America (LATAM) represents a highly promising emerging market, characterized by economic volatility which drives demand for accessible, high-yield investment platforms. Brazil and Mexico are leading the charge, supported by a boom in local Fintech development. Social trading appeals strongly here as a solution to high inflation and currency depreciation, offering a mechanism to invest in global assets. Platforms must address the challenge of lower average transaction sizes and higher operational risk due to less established financial infrastructure, requiring innovative solutions for risk management and micro-transaction handling.

The Middle East and Africa (MEA) region is developing steadily, driven primarily by the technologically advanced Gulf Cooperation Council (GCC) countries which are actively diversifying their economies away from oil. Regulatory clarity in financial hubs like Dubai and Abu Dhabi is attracting international platforms. Adoption in the broader African continent is accelerating, underpinned by mobile money penetration and a growing awareness of global investment opportunities. The market demands platforms that comply with Sharia finance principles in certain jurisdictions, requiring specialized product offerings and compliance mechanisms related to interest and leverage.

- North America: Focus on regulatory compliance, high volume stock/options trading, mature retail investor base.

- Europe: High adoption of copy/mirror trading, driven by MiFID II transparency requirements, strong focus on Forex and CFDs.

- Asia Pacific (APAC): Fastest growth rate, powered by mobile-first young populations, high cryptocurrency adoption, and need for localized services.

- Latin America (LATAM): High demand due to economic volatility, burgeoning Fintech ecosystem, and focus on accessing global assets.

- Middle East and Africa (MEA): Growth concentrated in GCC states, driven by economic diversification and demand for Sharia-compliant trading solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Social Trading Platform Market.- eToro

- ZuluTrade

- Darwinex

- NAGA

- Tradeo

- Pepperstone

- FXTM

- IC Markets

- FxPro

- AvaTrade

- Plus500

- CopyFX

- MQL5

- Myfxbook

- Interactive Brokers

- Robinhood

- Binance

- Bithumb

- Coinbase

- Kraken

- TradingView

- TD Ameritrade (thinkorswim)

Frequently Asked Questions

Analyze common user questions about the Social Trading Platform market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected Compound Annual Growth Rate (CAGR) for the Social Trading Platform Market?

The Social Trading Platform Market is projected to exhibit a robust Compound Annual Growth Rate (CAGR) of 21.5% during the forecast period spanning 2026 to 2033, driven by increasing global retail participation and technological advancements.

How does AI technology enhance safety and performance on social trading platforms?

AI technology enhances safety by utilizing sophisticated machine learning models for real-time risk scoring, fraud detection, and regulatory compliance monitoring. Performance is improved through personalized strategy matching and predictive analytics that optimize portfolio adjustments dynamically.

Which geographic region currently dominates the social trading platform market in terms of value?

North America and Europe currently dominate the social trading platform market in terms of market value, owing to their mature financial infrastructure, high regulatory compliance standards, and large pools of high-net-worth retail investors.

What are the primary differences between Copy Trading and Mirror Trading in this market?

Copy Trading involves replicating the live, specific trades executed by a chosen human strategy provider, focusing on their real-time decisions. Mirror Trading, conversely, often involves replicating an entire algorithmic or system-based strategy based on predefined rules, requiring less dependence on human judgment.

What are the major restraints hindering the growth of the Social Trading Platform Market?

The primary restraints include ongoing regulatory uncertainty across various international jurisdictions regarding investor protection rules, the inherent risk of capital loss associated with automated copying, and continuous vulnerability to sophisticated cybersecurity threats.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager