Sodium Carboxymethyl Starch Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437811 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Sodium Carboxymethyl Starch Market Size

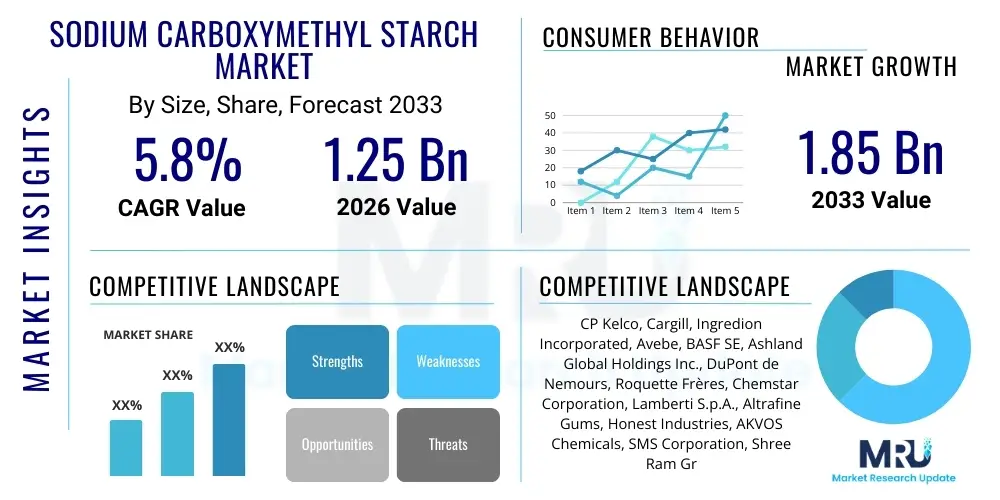

The Sodium Carboxymethyl Starch Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at $1.25 Billion in 2026 and is projected to reach $1.85 Billion by the end of the forecast period in 2033.

Sodium Carboxymethyl Starch Market introduction

Sodium Carboxymethyl Starch (SCMS), often synthesized through the reaction of starch with monochloroacetic acid in an alkaline medium, is a crucial anionic derivative characterized by its high viscosity, excellent water retention capabilities, and superior biodegradability compared to synthetic polymers. This versatility positions SCMS as a vital excipient, binder, and disintegrant across various industries. Derived primarily from natural sources such as corn, potato, or tapioca starch, SCMS offers functional benefits including efficient thickening and stabilization, making it an indispensable component in formulated products.

Major applications of SCMS span critical sectors, with the pharmaceutical industry utilizing it extensively as a superdisintegrant to enhance drug dissolution rates and bioavailability. In the food industry, SCMS acts as a thickener, stabilizer, and moisture retainer in products ranging from processed meats to frozen desserts. Furthermore, the burgeoning industrial sector, particularly textiles and papermaking, relies on SCMS for sizing, coating, and viscosity control due to its non-toxic nature and effectiveness in aqueous systems. The expanding utility across diverse applications underscores its foundational importance in modern manufacturing processes.

The primary driving factors propelling the growth of the SCMS market include the increasing demand for sustainable and bio-based ingredients, regulatory pressures favoring natural alternatives over synthetic polymers, and the rapid expansion of the generic and specialty pharmaceutical markets globally. SCMS offers a sustainable profile, aligning with global environmental, social, and governance (ESG) objectives. Coupled with advancements in chemical modification techniques leading to tailored viscosity and substitution levels, the market is poised for sustained growth as industries seek high-performance, cost-effective, and environmentally friendly raw materials.

Sodium Carboxymethyl Starch Market Executive Summary

The Sodium Carboxymethyl Starch (SCMS) market exhibits robust growth driven primarily by escalating demand from the pharmaceutical and food and beverage sectors, focusing on enhanced product performance and sustainable sourcing. Key business trends include capacity expansion by established manufacturers in Asia Pacific, particularly China and India, aiming to meet high-volume demand while optimizing production costs. Furthermore, strategic partnerships and mergers among starch derivatives producers and specialized excipient suppliers are increasing, consolidating technological expertise and streamlining global supply chains. The drive towards high-purity, tailor-made SCMS grades for specialized drug formulations represents a significant commercial focus for market leaders, ensuring differentiation in a competitive landscape.

Regionally, Asia Pacific maintains its dominance, spurred by rapid industrialization, burgeoning population growth, and substantial investments in the food processing and healthcare infrastructure. North America and Europe, while mature, demonstrate steady demand, particularly for pharmaceutical-grade SCMS, characterized by stringent quality control and regulatory compliance standards. These regions are also pioneers in adopting advanced enzymatic modification technologies to produce highly functional SCMS variants. Latin America and the Middle East and Africa are emerging as high-potential markets, fueled by improving economic conditions and increased foreign direct investment in manufacturing capabilities, translating into higher consumption of starch derivatives in packaging and textile applications.

Segment trends reveal that the pharmaceutical grade segment, specifically for use as superdisintegrants, commands the highest value share due to the premium pricing associated with high purity and regulatory approvals, exhibiting the fastest growth rate. The food grade segment follows closely, driven by global trends favoring processed and convenience foods, where SCMS is essential for texture stabilization and moisture retention. In terms of raw material sourcing, potato and corn starch derivatives remain predominant, but market interest is growing in alternative sources like tapioca and wheat starch, offering differentiated performance characteristics and catering to diverse consumer preferences regarding feedstock origin.

AI Impact Analysis on Sodium Carboxymethyl Starch Market

Common user questions regarding the impact of Artificial Intelligence (AI) on the Sodium Carboxymethyl Starch (SCMS) market center on operational efficiency, new product development speed, and sustainability optimization. Users frequently inquire about how AI can predict optimal reaction parameters during the etherification process to maximize purity and yield, thus minimizing resource wastage. Key themes include the application of Machine Learning (ML) in predictive maintenance for specialized reactors and drying equipment, minimizing costly downtime. Concerns also revolve around AI’s role in automating quality control checks, particularly spectroscopic analysis for monitoring degree of substitution (DS) and viscosity, ensuring regulatory compliance with minimal human intervention. Expectations are high that AI will significantly accelerate the identification and optimization of novel SCMS variants with enhanced performance characteristics, such as tailored hydration rates for specific drug delivery systems or improved shear stability for industrial slurries.

- AI-driven optimization of starch modification reaction kinetics, leading to maximized yield and precise control over the degree of substitution (DS).

- Machine Learning algorithms deployed for predictive quality assurance, flagging minor deviations in viscosity or purity during continuous manufacturing.

- Enhanced supply chain predictability and risk mitigation through AI analysis of feedstock commodity prices (e.g., corn, potato starch) and logistics network optimization.

- Accelerated discovery and formulation of novel SCMS derivatives through computational chemistry and high-throughput screening simulations.

- Automated monitoring systems utilizing computer vision to ensure compliance with GMP standards in processing facilities, particularly in high-purity pharmaceutical grades.

- Optimization of energy consumption in drying and milling processes via deep learning models, contributing to lower operating costs and improved environmental sustainability.

DRO & Impact Forces Of Sodium Carboxymethyl Starch Market

The Sodium Carboxymethyl Starch (SCMS) market dynamics are governed by a complex interplay of Drivers, Restraints, and Opportunities (DRO), collectively shaping the competitive landscape through various Impact Forces. Key drivers include the exponential growth in the pharmaceutical industry, particularly generic drug manufacturing, which relies heavily on SCMS as a highly efficient and cost-effective excipient. Furthermore, global consumer preference shifting towards natural, clean-label ingredients is fueling demand for bio-derived polymers like SCMS over synthetic alternatives in the food and cosmetic sectors. This environmental shift mandates continuous innovation in sustainable sourcing and processing techniques to maintain market relevance.

However, the market faces significant restraints, notably the high volatility and unpredictable fluctuation in the prices of primary raw materials, such as corn and potato starch, which are susceptible to climatic conditions and global agricultural policies. Stringent regulatory hurdles, particularly for pharmaceutical-grade SCMS requiring complex and expensive certifications (like USP/EP standards), restrict market entry for smaller players and necessitate continuous investment in quality control infrastructure. The primary functional constraint is the potential availability of substitute natural polymers, such as Guar Gum derivatives and Carboxymethyl Cellulose (CMC), which compete aggressively on price and performance in specific industrial applications.

Opportunities abound through technological advancements focused on developing super-functional SCMS derivatives with specific molecular weights and higher purity levels tailored for advanced drug delivery systems (e.g., controlled release). Geographical expansion into untapped markets in Southeast Asia and Latin America offers substantial potential for increasing production capacity and market penetration. The major impact forces acting on the market, derived from Porter's Five Forces analysis, indicate moderate to high bargaining power of suppliers due to feedstock concentration, high barriers to entry due to regulatory compliance and capital intensity, and moderate threat of substitutes, necessitating continuous product differentiation and cost efficiency among existing market participants.

The increasing focus on sustainable manufacturing practices, driven by global ESG criteria, is becoming a paramount impact force. Companies that can demonstrate a reduced carbon footprint during SCMS production and ensure ethical sourcing of raw materials are gaining a significant competitive advantage, particularly in procurement processes mandated by major multinational corporations. Furthermore, intellectual property protection surrounding specialized modification processes, such as cross-linking and grafting techniques that enhance stability and performance, solidifies the market position of technologically advanced firms against the increasing threat of generic alternatives.

Segmentation Analysis

The Sodium Carboxymethyl Starch (SCMS) market is comprehensively segmented based on its application, grade, and raw material source, reflecting the diverse requirements of the end-user industries. The segmentation by grade is critical, distinguishing between industrial grades, which focus primarily on cost efficiency and bulk usage in textiles and paper, and high-purity technical and pharmaceutical grades, which require stringent quality control and command premium pricing. Understanding these distinctions allows manufacturers to tailor production capacity and optimize R&D efforts toward the highest-growth, highest-value segments. The primary function of SCMS—whether as a thickener, binder, or superdisintegrant—also dictates the required specifications, influencing pricing and distribution strategies across regions.

Segmentation by raw material source is essential as it dictates the inherent molecular structure and functional characteristics of the resultant SCMS. Corn and potato starches are dominant, offering different viscosity profiles and stability characteristics. Potato starch derivatives, known for their higher phosphorus content and superior pasting behavior, are often preferred in specific food applications, while corn starch derivatives are valued for their broad availability and cost-effectiveness in industrial applications. Analyzing the geographical availability and pricing fluctuations of these source materials is integral to forecasting segment growth and operational viability.

- By Grade:

- Pharmaceutical Grade

- Food Grade

- Industrial Grade (Technical Grade)

- By Application:

- Pharmaceuticals (Disintegrants, Binders, Excipients)

- Food and Beverages (Thickening Agent, Stabilizer, Fat Replacer)

- Textiles (Sizing Agents, Printing Thickeners)

- Paper Industry (Wet-end Additives, Coating Agents)

- Adhesives and Binders

- Personal Care and Cosmetics

- By Raw Material Source:

- Corn Starch

- Potato Starch

- Tapioca Starch

- Wheat Starch

- Others (Rice, etc.)

Value Chain Analysis For Sodium Carboxymethyl Starch Market

The value chain for the Sodium Carboxymethyl Starch (SCMS) market commences with the upstream analysis, which involves the sourcing and processing of core agricultural raw materials, primarily corn, potato, and tapioca starch. This stage is highly dependent on agricultural yields, commodity market volatility, and specialized starch extraction technologies. Key players in this segment are often large agricultural processors or starch manufacturers who supply purified native starch to chemical derivative producers. The efficiency and cost structure at this stage significantly influence the final product cost and market competitiveness. Securing stable, high-quality starch feedstock is paramount, leading SCMS manufacturers to establish long-term contracts or integrate backward to mitigate supply risk.

The core manufacturing stage involves the critical process of etherification, where starch reacts with monochloroacetic acid under controlled alkaline conditions. This capital-intensive step requires specialized reaction vessels, precise temperature control, and purification equipment to achieve the desired degree of substitution (DS) and purity (especially for pharmaceutical grades). Manufacturers invest heavily in proprietary processing technologies and rigorous quality control protocols (like ISO, GMP) to meet specific end-user specifications. Optimization of wastewater treatment and byproduct utilization (e.g., sodium chloride) is also crucial for cost management and environmental compliance within this production segment.

The downstream analysis focuses on distribution channels and end-user engagement. SCMS is typically distributed through a mix of direct and indirect channels. Direct distribution is common for large-volume industrial users (e.g., major textile mills, pharmaceutical giants) where technical support and customized specifications are required. Indirect distribution leverages regional specialty chemical distributors and agents, particularly in fragmented markets or for catering to smaller end-users across diverse applications like cosmetics and adhesives. Effective logistics management, specializing in handling bulk chemical shipments and specialized packaging for high-purity grades, is essential to maintain product integrity until it reaches the final buyer. The efficiency of the distribution network directly impacts lead times and regional pricing disparities.

Sodium Carboxymethyl Starch Market Potential Customers

The potential customer base for Sodium Carboxymethyl Starch (SCMS) is diverse, spanning multiple regulated industries where it serves non-negotiable functional roles, predominantly as an excipient, thickener, or binder. Major end-users are large pharmaceutical companies, especially those engaged in the production of generic tablets and capsules, relying on SCMS (known as Sodium Starch Glycolate in high-purity form) for its superior ability to accelerate the disintegration of solid dosage forms, thereby ensuring rapid drug release and enhancing patient compliance. These buyers operate under stringent regulatory guidelines (FDA, EMA) and prioritize suppliers capable of providing extensive documentation, traceability, and batch consistency, often requiring dual-source qualification to mitigate supply chain risks.

The food and beverage industry represents another critical cluster of potential customers, including multinational corporations specializing in processed foods, dairy substitutes, and convenience meals. These companies utilize SCMS primarily for viscosity control, texturization, and moisture management in products like sauces, gravies, frozen items, and baked goods. Procurement decisions in this sector are driven by considerations of cost-effectiveness, compatibility with other ingredients, and adherence to food safety standards (e.g., Kosher, Halal certifications, and specific E-number classifications). The demand here is often high-volume and sensitive to price fluctuations in comparison to the pharmaceutical segment.

Industrial applications constitute the remaining significant customer base. This includes large paper and pulp manufacturers who use SCMS as a surface sizing agent to improve paper strength and printing characteristics, and textile manufacturers who employ it as a binder or sizing agent for warp yarns to reduce breakage during weaving. Other niche buyers are paint and coating formulators, and manufacturers of specific household adhesives. These buyers generally focus on technical performance specifications, such as stability under high shear and solution clarity, and tend to procure industrial-grade SCMS through well-established, indirect distribution channels facilitated by regional chemical distributors, prioritizing reliable supply and competitive bulk pricing.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.25 Billion |

| Market Forecast in 2033 | $1.85 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | CP Kelco, Cargill, Ingredion Incorporated, Avebe, BASF SE, Ashland Global Holdings Inc., DuPont de Nemours, Roquette Frères, Chemstar Corporation, Lamberti S.p.A., Altrafine Gums, Honest Industries, AKVOS Chemicals, SMS Corporation, Shree Ram Group, China National Starch, Henan Xingwang Chemical, Hebei YAXING Chemical Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Sodium Carboxymethyl Starch Market Key Technology Landscape

The key technology landscape surrounding the Sodium Carboxymethyl Starch (SCMS) market is defined by advancements aimed at enhancing process efficiency, controlling the degree of substitution (DS) precisely, and ensuring ultra-high purity, especially for specialized applications like fast-dissolving oral films and sophisticated tablet matrices. The primary synthesis method remains the slurry process or the use of organic solvent/aqueous media for etherification using monochloroacetic acid. Recent technological progress has focused on continuous manufacturing processes rather than traditional batch systems, utilizing specialized reactor designs—such as high-shear mixers and twin-screw extruders—to improve reaction uniformity, reduce processing time, and lower energy consumption. Optimization techniques often involve advanced statistical process control (SPC) and real-time monitoring of pH and temperature to stabilize the reaction environment and maximize conversion yield while minimizing undesirable side reactions leading to byproducts.

A major focus area is the development of functionalized or cross-linked SCMS derivatives, primarily known in the pharmaceutical context as Sodium Starch Glycolate (SSG). Cross-linking technologies involve introducing secondary chemical bridges (e.g., using epichlorohydrin or phosphorus oxychloride) into the starch polymer network to limit solubility while dramatically enhancing water uptake and swelling capacity. This process transformation requires sophisticated understanding of polymer chemistry to control the extent and type of cross-linking, which directly determines the performance characteristics, such as swelling volume and disintegration efficiency. The drive for specific performance mandates the continuous refinement of these chemical modification techniques, requiring significant investment in R&D and pilot plant validation before commercial scale-up.

Furthermore, the integration of advanced analytical techniques plays a crucial technological role. High-performance liquid chromatography (HPLC), nuclear magnetic resonance (NMR) spectroscopy, and gel permeation chromatography (GPC) are essential for accurately characterizing the molecular weight distribution, degree of substitution, and assessing the presence of trace impurities in pharmaceutical-grade SCMS. This technological requirement ensures compliance with stringent pharmacopeial standards (USP, EP, JP). Companies are also exploring green chemistry principles, developing solvent-free or supercritical fluid processes for synthesis and purification, aiming to reduce reliance on organic solvents, decrease waste generation, and align production with evolving environmental regulatory mandates and corporate sustainability objectives.

Regional Highlights

The global Sodium Carboxymethyl Starch (SCMS) market demonstrates significant regional disparities in both consumption and production capacity, primarily dictated by pharmaceutical manufacturing concentration, food consumption patterns, and industrialization rates. Asia Pacific (APAC) dominates the market share due to its status as a global manufacturing hub for generic pharmaceuticals and textiles, coupled with large, rapidly expanding food processing industries. Countries like China and India benefit from abundant, cost-effective feedstock (corn and potato starch) and lower operational costs, enabling them to lead global production. The rising disposable incomes and changing dietary preferences toward convenience foods further cement APAC’s position as the primary consumption driver. Investments in modernizing manufacturing facilities to meet global quality standards are steadily increasing across the region.

North America and Europe represent mature, high-value markets characterized by stringent regulatory oversight and a preference for high-purity, specialized SCMS grades. In these regions, consumption is heavily skewed towards the pharmaceutical sector, where SCMS is utilized in advanced drug delivery formulations and biologics manufacturing, demanding strict compliance with GMP guidelines and comprehensive supplier vetting. Innovation, particularly in developing novel cross-linked starch derivatives and utilizing sustainable sourcing, is concentrated here. European markets are particularly sensitive to environmental legislation, favoring SCMS producers who adhere to comprehensive sustainability reporting and maintain minimized environmental impact during processing.

Latin America (LATAM) and the Middle East and Africa (MEA) are poised for substantial future growth. LATAM's expansion is driven by increasing domestic pharmaceutical production and growing demand from the oil and gas sector, where SCMS is sometimes used as a drilling fluid additive. The MEA region, particularly the Gulf Cooperation Council (GCC) countries, is investing heavily in food security initiatives and domestic manufacturing, creating fresh opportunities for industrial and food-grade SCMS imports and localized production. However, these regions often face challenges related to establishing sophisticated regulatory frameworks and ensuring reliable access to high-quality feedstock, necessitating reliance on imports from established APAC and European suppliers.

- Asia Pacific (APAC): Dominates market size and volume; driven by pharmaceutical (generic drugs), textiles, and large food processing sectors; China and India are major producers and consumers.

- North America: High-value market focused on pharmaceutical-grade SCMS (Sodium Starch Glycolate); stringent quality standards; emphasis on advanced excipient technologies and sustainability.

- Europe: Mature market with strong regulatory influence (EMA); demand concentrated in specialized food ingredients and high-purity pharma products; leaders in green chemistry application in starch modification.

- Latin America (LATAM): Emerging growth market; increasing pharmaceutical manufacturing base; growing usage in processed foods and industrial adhesives.

- Middle East and Africa (MEA): High growth potential driven by urbanization, investments in domestic food and beverage production, and localized industrial infrastructure development.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Sodium Carboxymethyl Starch Market.- CP Kelco

- Cargill Incorporated

- Ingredion Incorporated

- Avebe U.A.

- BASF SE

- Ashland Global Holdings Inc.

- DuPont de Nemours, Inc.

- Roquette Frères S.A.

- Chemstar Corporation

- Lamberti S.p.A.

- Altrafine Gums

- Honest Industries

- AKVOS Chemicals

- SMS Corporation

- Shree Ram Group

- China National Starch Holdings Limited

- Henan Xingwang Chemical Co., Ltd.

- Hebei YAXING Chemical Co., Ltd.

- Shandong Jinyang Chemical Co., Ltd.

- Tate & Lyle PLC

Frequently Asked Questions

Analyze common user questions about the Sodium Carboxymethyl Starch market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Sodium Carboxymethyl Starch (SCMS) and its primary function in pharmaceuticals?

SCMS is an anionic starch derivative synthesized through etherification, commonly used as a superdisintegrant (often referred to as Sodium Starch Glycolate or SSG) in tablets and capsules to accelerate the breakdown of solid dosage forms upon contact with water, enhancing drug release and bioavailability.

How does the raw material source (e.g., potato vs. corn starch) affect the final SCMS product quality?

The raw material source dictates intrinsic properties; potato starch yields SCMS with generally higher viscosity and different swelling characteristics due to the granule size and amylopectin content, while corn starch offers broader availability and cost-effectiveness for industrial applications.

Which geographical region holds the largest market share for SCMS and why?

Asia Pacific (APAC) holds the largest market share, driven by its massive manufacturing capabilities in generic pharmaceuticals and textiles, along with readily available, low-cost starch feedstock, supporting high-volume production and consumption.

What are the main regulatory challenges facing SCMS manufacturers, especially for pharmaceutical grades?

Manufacturers of pharmaceutical-grade SCMS must adhere strictly to Good Manufacturing Practices (GMP) and meet pharmacopeial standards (USP, EP). Challenges include rigorous validation, impurity profiling, ensuring batch-to-batch consistency, and maintaining extensive regulatory documentation for global market access.

Is Sodium Carboxymethyl Starch considered a sustainable or bio-based ingredient?

Yes, SCMS is classified as a bio-based ingredient derived from renewable agricultural sources (starch). Its appeal lies in its high biodegradability compared to synthetic petroleum-based polymers, aligning strongly with current global sustainability trends and clean-label initiatives in the food sector.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager