Sodium Cocoyl Isethionate Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435359 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Sodium Cocoyl Isethionate Market Size

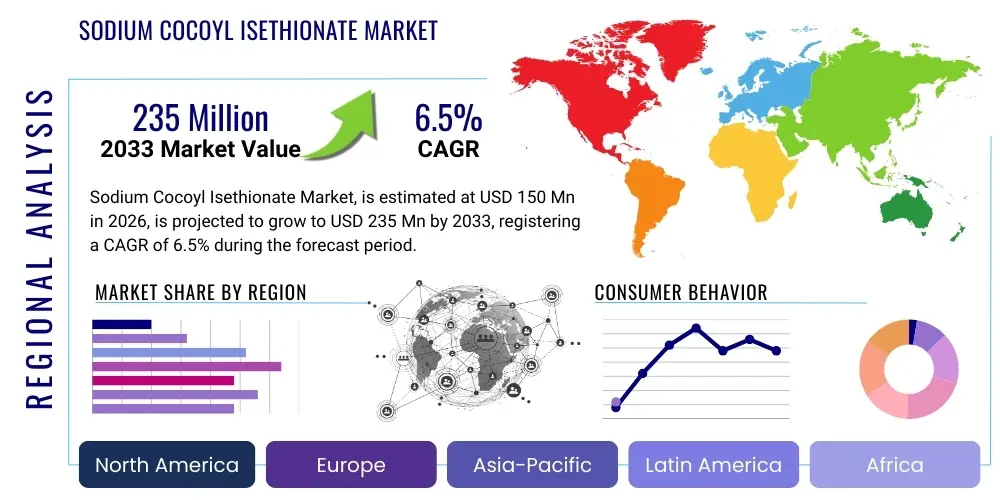

The Sodium Cocoyl Isethionate Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 150 million in 2026 and is projected to reach USD 235 million by the end of the forecast period in 2033. This robust expansion is primarily driven by the escalating consumer demand for mild, sulfate-free, and skin-friendly personal care formulations across major global economies.

Sodium Cocoyl Isethionate Market introduction

Sodium Cocoyl Isethionate (SCI) is a high-performance, anionic surfactant derived from coconut fatty acids and isethionic acid. It is widely recognized in the personal care industry for its exceptional mildness, rich, creamy foam structure, and excellent moisturizing properties, positioning it as a preferred alternative to traditional sulfate-based surfactants like Sodium Lauryl Sulfate (SLS). SCI is instrumental in producing premium cleansing products that address consumer concerns regarding skin irritation and dryness, often associated with harsh chemicals. Its superior performance profile allows formulators to create high-quality, gentle products that maintain efficacy.

The product is typically available in various forms, including powder, flakes, and noodles, facilitating its incorporation into a diverse range of cosmetic formulations. Major applications span across shampoos, body washes, facial cleansers, shaving creams, and particularly, solid format personal care products such as shampoo bars and cleansing bars. The versatility of SCI, combined with its favorable environmental profile—as it is derived from renewable sources—makes it a central component in the burgeoning "clean beauty" and sustainable cosmetic movements. The chemical structure provides high detergency while minimizing the stripping of natural oils, crucial for maintaining skin and hair health.

Driving factors for the SCI market expansion include the significant global shift towards sulfate-free products, increasing consumer awareness regarding ingredient transparency, and the massive growth in the solid cosmetic segment, which favors SCI due to its physical form and high active surfactant matter concentration. Furthermore, continuous innovation in synthesis technologies is improving the purity and ease of use of SCI, thereby broadening its application scope in sensitive skincare lines and baby products. Regulatory bodies are also increasingly scrutinizing traditional surfactants, further accelerating the adoption of milder alternatives like SCI.

Sodium Cocoyl Isethionate Market Executive Summary

The Sodium Cocoyl Isethionate market is characterized by strong growth fueled by compelling business trends focused on consumer preference for natural, mild, and sustainable ingredients. Key business strategies involve vertical integration among manufacturers to secure consistent supplies of coconut oil derivatives and significant investment in R&D to develop ultra-pure grades of SCI, particularly those with improved handling characteristics such as lower dusting powder forms. The transition from liquid to solid formulations is a primary market trend, driving up demand for high-concentration surfactant noodles and flakes. Companies are also prioritizing supply chain resilience and ethical sourcing practices to meet stringent corporate sustainability goals and consumer expectations for environmentally conscious products.

Regionally, Asia Pacific (APAC) stands out as the most dominant market, driven by rapid urbanization, increasing disposable incomes, and the widespread adoption of multi-step skincare routines that require mild cleansing agents. Europe follows closely, underpinned by strict regulatory frameworks promoting "green" ingredients and a highly mature clean beauty segment, particularly in Germany and the UK, where solid cosmetic formats are exceptionally popular. North America also shows substantial growth, largely attributed to prominent branding campaigns by leading consumer packaged goods (CPG) companies that emphasize "natural" and "sulfate-free" product differentiation, specifically targeting sensitive skin demographics.

Segment trends indicate that the hair care application segment, particularly solid shampoo bars, exhibits the highest growth rate, due to the convenience and eco-friendly attributes of waterless formulations. In terms of form, the SCI noodle/pellet segment retains the largest market share, as this format is easier for industrial mixers to handle and incorporate into solid bars with minimal dusting and processing heat required. Looking ahead, the rise of customized cosmetic formulations and specialized products for sensitive skin and scalp conditions will further solidify SCI’s position as a premium foundational surfactant across all major personal care categories.

AI Impact Analysis on Sodium Cocoyl Isethionate Market

User inquiries regarding AI's influence on the SCI market center around how digital technologies can optimize the complex synthesis process, predict consumer adoption rates for new solid format products, and enhance supply chain visibility for coconut-derived raw materials. Users frequently ask about AI's role in green chemistry R&D—specifically, if AI can accelerate the development of cleaner, higher-yield manufacturing routes for SCI, potentially reducing manufacturing costs which remain a key constraint. Furthermore, there is significant interest in how machine learning algorithms analyze social media sentiment and purchasing data to predict which regional markets will prioritize mild surfactants like SCI over traditional sulfates, enabling manufacturers to fine-tune marketing and inventory strategies effectively.

AI’s influence is profound across the entire value chain, starting from predictive modeling of raw material volatility (coconut oil prices) which allows manufacturers to hedge against supply chain shocks. In formulation science, generative AI tools are used to quickly simulate and test thousands of mild surfactant combinations, optimizing for factors like foam stability, rinse-off characteristics, and compatibility with conditioning agents, significantly speeding up time-to-market for new products utilizing SCI. Quality control is also revolutionized, as AI-powered vision systems monitor the consistency and purity of SCI powder and noodles during production, identifying deviations far more rapidly than traditional manual inspection methods, ensuring stringent compliance with cosmetic grade standards.

Moreover, AI platforms are being utilized to enhance the customization experience for end-users. Direct-to-consumer cosmetic brands leverage AI to recommend personalized formulations, often featuring SCI as a base, ensuring the product matches the user’s specific skin sensitivity and environmental concerns. This data-driven personalization strategy increases brand loyalty and validates the market demand for premium, mild ingredients. The deployment of AI in logistics also optimizes transportation routes for bulky raw materials and finished SCI products, contributing to reduced carbon emissions, aligning perfectly with the sustainable image of SCI.

- AI optimizes SCI synthesis routes, focusing on yield improvement and waste reduction via predictive chemical modeling.

- Machine learning analyzes global consumer data, accurately forecasting demand spikes for sulfate-free, solid cosmetic formats.

- Predictive maintenance programs powered by AI minimize downtime in complex esterification reactor systems used for SCI production.

- Generative AI assists formulators in rapid screening of SCI compatibility with novel conditioning polymers and natural extracts.

- AI-driven supply chain transparency tracks the ethical and sustainable sourcing of coconut oil feedstock.

DRO & Impact Forces Of Sodium Cocoyl Isethionate Market

The Sodium Cocoyl Isethionate market dynamics are governed by a complex interplay of increasing demand for mild, sustainable ingredients (Drivers), challenges related to higher production costs and formulation complexity (Restraints), and significant expansion opportunities presented by the burgeoning solid cosmetic movement and regulatory shifts (Opportunities). The primary driving force remains the pervasive consumer shift away from perceived harsh surfactants towards gentle, derived-from-nature alternatives, a trend heavily amplified by dermatologist recommendations and 'clean beauty' advocacy. However, the relatively complex, multi-step synthesis of SCI, compared to cheaper petrochemical-derived surfactants, inherently results in higher manufacturing costs, posing a significant restraint, particularly in price-sensitive emerging markets.

Impact forces shape the competitive landscape and market adoption trajectory. The competitive intensity among existing manufacturers (like Clariant and Innospec) is moderately high, leading to continuous innovation aimed at improving product purity and dispersibility. Buyer power is substantial, driven by large multinational CPG companies demanding bulk quantities at competitive prices while maintaining strict quality specifications. Threat of substitutes remains a key force; while SCI is superior in mildness, other mild surfactants like Sodium Cocoyl Glycinate and other amino acid surfactants present viable, albeit niche, alternatives. Supplier power is also a factor, particularly regarding coconut fatty acid derivatives, whose pricing is subject to agricultural commodity market volatility, affecting overall production margins.

Opportunities are strongly concentrated in regulatory harmonization efforts across regions which favor milder chemicals, opening up new export markets. Furthermore, the exponential growth of the zero-waste and waterless beauty concepts globally creates a perfect niche for SCI, which performs optimally in high-solid bar formats. Manufacturers who invest in scalable, cost-effective synthesis methods and secure sustainable raw material sourcing channels are best positioned to capitalize on these macro-environmental shifts, transforming current restraints into future competitive advantages. This strategic alignment across environmental, regulatory, and consumer trends is critical for sustained market leadership in the SCI sector.

Segmentation Analysis

The Sodium Cocoyl Isethionate market is comprehensively segmented based on its physical Form, the specific Application in personal care products, and the geographical region. Analyzing the market through these lenses provides critical insights into manufacturing preferences, consumer behavior, and competitive strategies. Segmentation by form is vital, as it dictates the ease of incorporation into final products: powder forms offer maximum surface area for blending in dry mixes but present dusting issues, while noodle and flake forms are preferred for melt-and-pour solid bars due to their physical robustness and reduced dust. The market’s dependence on specialized manufacturing capabilities means that suppliers often specialize in one or two primary forms of SCI to meet specific end-user demands across various formulation needs.

Application segmentation reveals the core drivers of demand. While hair care, encompassing both liquid shampoos and solid shampoo bars, traditionally accounts for the largest share due to the strong consumer push for sulfate-free shampoos, the body care segment (especially premium mild body washes and sensitive skin soaps) is rapidly gaining ground. Facial cleansing formulations represent a high-value niche segment, leveraging SCI's exceptional mildness for products targeted at sensitive or compromised skin barriers. Understanding this application mix is crucial for manufacturers to tailor product specifications, such as optimizing SCI for low pH stability required in many facial toners or specialized cleansing gels.

Regional segmentation highlights disparities in market maturity and regulatory impact. Mature markets in Europe and North America drive demand for high-purity, premium SCI grades used in established "clean label" brands. Conversely, high growth in APAC is fueled by the sheer volume of consumers entering the middle class and adopting mass-market mild personal care products. This segmented approach ensures that marketing and supply chain efforts are precisely aligned with localized regulatory requirements and prevailing consumer sentiments regarding sustainability and ingredient efficacy.

- By Form:

- Powder

- Noodle/Pellet

- Flakes

- By Application:

- Hair Care (Shampoos, Conditioners, Hair Cleansing Bars)

- Body Care (Body Washes, Bar Soaps, Bath Gels)

- Facial Cleansing (Cleansing Foams, Facial Washes)

- Baby Care Products

- Shaving Creams and Gels

- By End-Use Industry:

- Consumer Goods Manufacturers (CPG)

- Cosmetic & Personal Care Brands (Independent and Multinational)

- Detergent Manufacturing (Niche applications)

- By Grade:

- Cosmetic Grade

- Industrial Grade (Limited use)

Value Chain Analysis For Sodium Cocoyl Isethionate Market

The value chain for Sodium Cocoyl Isethionate begins with the upstream analysis, centered around the sourcing and processing of raw materials, primarily coconut oil derivatives (coconut fatty acids) and sodium isethionate. The stability and ethical sourcing of coconut oil are paramount, often requiring complex certification and traceability measures, particularly as sustainability mandates grow. Key challenges upstream include price volatility of agricultural commodities and ensuring a consistent supply of high-purity fatty acids suitable for the subsequent chemical synthesis steps. Manufacturers must often enter into long-term contracts with regional processors in Southeast Asia to mitigate supply risks and maintain competitive pricing for the precursor chemicals.

The central phase involves the sophisticated chemical synthesis, typically an esterification reaction between the coconut fatty acids and sodium isethionate. This process is complex, demanding specialized high-pressure, high-temperature reactors and subsequent purification steps (neutralization, spray drying, or flaking) to produce the various marketable forms (powder, noodles, flakes). This manufacturing step adds significant value due to the specialized technology and high energy consumption required to achieve cosmetic-grade purity. Efficiency gains in this stage, such as the use of continuous flow chemistry, are critical for reducing overall production costs and making SCI more price-competitive against sulfate alternatives.

Downstream analysis focuses on the distribution channels and end-user incorporation. Distribution primarily relies on specialized chemical distributors who handle global logistics, regulatory documentation, and small-batch supplies for artisanal and small-to-midsize cosmetic manufacturers (indirect channel). Direct sales are maintained for large multinational CPG companies requiring massive bulk quantities under customized specifications. End-users incorporate SCI into various formulations, focusing on balancing its foaming and mildness characteristics with other ingredients. The product's success is ultimately determined by its performance in the final consumer product, making technical support and formulation guidance provided by SCI manufacturers an essential part of the downstream value proposition.

Sodium Cocoyl Isethionate Market Potential Customers

Potential customers for Sodium Cocoyl Isethionate are predominantly clustered within the personal care and cosmetics manufacturing sectors, ranging from large multinational Consumer Packaged Goods (CPG) corporations to niche, direct-to-consumer clean beauty brands and specialized private label manufacturers. The primary target demographic consists of companies actively transitioning their product lines to sulfate-free, mild, and natural-derived formulations in response to growing consumer health concerns and regulatory pressures. Specifically, manufacturers of high-end, premium personal hygiene products are significant buyers, as SCI delivers the desired luxurious, creamy lather and gentle cleansing properties necessary to justify premium pricing.

A second major customer segment includes companies specializing in environmentally friendly and solid-format cosmetics, such as shampoo bar manufacturers, solid body wash producers, and solid cleansing stick makers. These companies rely heavily on the high active matter and solid-state capabilities of SCI noodles and flakes to create concentrated, waterless products that align with zero-waste philosophies. Additionally, specialized pharmaceutical and baby care manufacturers represent a growing niche, utilizing ultra-pure, low-irritant grades of SCI for formulations targeting extremely sensitive skin, where the mildness of the surfactant is a non-negotiable requirement for product safety and effectiveness.

Finally, chemical compounding firms and raw material distributors also serve as critical intermediaries, purchasing SCI in bulk from primary manufacturers and selling smaller, tailored quantities to regional cosmetic labs and independent formulators. These customers often require technical data, regulatory compliance certifications (e.g., COSMOS, ECOCERT), and formulation advice, emphasizing the need for comprehensive support from the core SCI producers. The demand profile of these potential customers consistently prioritizes sustainability credentials, regulatory adherence, and exceptional mildness above mere cost efficiency.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 150 Million |

| Market Forecast in 2033 | USD 235 Million |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Clariant AG, Innospec Inc., Galaxy Surfactants Ltd., Taiwan NJC Corporation, BASF SE, Kao Corporation, Stepan Company, Sino-Japan Chemical Co. Ltd., Henkel AG & Co. KGaA, AkzoNobel NV (now Nouryon), Spec-Chem Industry Inc., JEEN International Corporation, Vink Chemicals GmbH & Co. KG, Croda International Plc, Lonza Group AG, Evonik Industries AG, Solvay S.A., Res Pharma Industriale S.p.A., Global-7 Inc., Tensio-Chemic S.A. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Sodium Cocoyl Isethionate Market Key Technology Landscape

The technology landscape for Sodium Cocoyl Isethionate production is continuously evolving, driven by the dual goals of reducing manufacturing costs and enhancing the purity and performance characteristics of the final product. Traditional SCI synthesis involves a high-temperature, pressurized esterification reaction, which can be challenging to control and often results in residual impurities like fatty acids or unreacted materials, affecting the final product’s mildness and transparency in solution. Current technological advancements are focused on refining this esterification process, primarily through the adoption of catalysts and solvent-free reaction techniques to minimize waste and energy consumption, aligning with green chemistry principles. The optimization of these reaction parameters is critical for improving the yield of high-active matter SCI, which is highly sought after by formulators for concentrated products.

A significant area of innovation lies in the downstream processing and physical presentation of SCI. Manufacturers are increasingly utilizing specialized spray-drying and granulation technologies to produce highly uniform, non-dusting powders and stable, dense noodles or pellets. These technological improvements address key handling challenges faced by cosmetic formulators, such as the tendency of fine SCI powders to cause respiratory irritation during large-scale mixing. Advanced drying techniques also ensure optimal moisture content, critical for maintaining the stability and long shelf- life of SCI before its incorporation into solid bar formulations. Furthermore, research is ongoing into continuous flow synthesis reactors, which offer better control over reaction kinetics, enhanced safety, and the potential for greater scale-up efficiency compared to traditional batch processing methods.

Another crucial technological development involves quality assurance and analysis. High-Performance Liquid Chromatography (HPLC) and Mass Spectrometry (MS) techniques are increasingly employed to rigorously monitor the purity profile, ensuring minimal presence of undesirable byproducts and free fatty acids. This heightened analytical precision allows manufacturers to certify premium grades of SCI specifically for sensitive skin and hypoallergenic product lines, thereby commanding a higher market price. Integrating IoT sensors and AI in manufacturing facilities allows for real-time monitoring of reactor conditions and energy usage, enabling proactive adjustments that optimize resource efficiency and maintain stringent quality controls across large-volume production cycles.

Regional Highlights

Asia Pacific (APAC) is projected to dominate the Sodium Cocoyl Isethionate market in terms of volume and exhibits the highest growth rate during the forecast period. This dominance is attributed to several macroeconomic factors, including the burgeoning middle class in India and China, who are increasingly investing in sophisticated personal care routines. The concept of "K-Beauty" and "J-Beauty," which emphasizes gentle, hydrating, and multi-step cleansing, has driven unprecedented demand for mild surfactants like SCI in both facial and body care products. Furthermore, many of the world's primary SCI manufacturing facilities and raw material sources (coconut oil) are concentrated in Southeast Asia, facilitating cost-effective production and supply chain responsiveness within the region. Local manufacturers are rapidly scaling up capacity to meet both domestic consumption and export demands.

Europe represents the second largest market, characterized by mature consumer demand and stringent regulatory environments that favor natural and sustainable ingredients. European consumers exhibit a high preference for eco-friendly packaging and waterless formulations, making SCI the ideal foundational surfactant for the thriving shampoo bar and solid cosmetic sectors in countries like the UK, Germany, and France. The influence of EU regulations, such as REACH compliance and the push for palm oil alternatives (which SCI often substitutes or complements), continually accelerates the transition away from traditional sulfate surfactants. European markets prioritize high-purity, premium-priced grades of SCI certified by bodies like ECOCERT or COSMOS, showcasing a strong focus on ingredient quality and transparency.

North America is a major growth region, primarily driven by strong marketing campaigns focusing on 'sulfate-free,' 'paraben-free,' and 'gentle cleansing' claims by leading cosmetic giants. The high prevalence of sensitive skin conditions and allergies among North American consumers has amplified the need for non-irritating surfactants in both premium and mass-market products. The rapid adoption of direct-to-consumer models and customized cosmetic services also contributes significantly, with many brands using SCI as a core ingredient to offer personalization based on skin sensitivity. While domestic manufacturing capacity is present, North America often imports specialized forms of SCI from Asian and European producers to meet diverse formulation requirements.

Latin America (LATAM) and Middle East & Africa (MEA) are emerging markets for SCI. Growth in LATAM is driven by increasing disposable income, particularly in Brazil and Mexico, leading to greater consumer spending on personal grooming products. In the MEA region, the demand is concentrated in high-income Gulf Cooperation Council (GCC) countries, where luxury personal care brands are popular, and consumers seek premium, gentle ingredients. These regions are characterized by a growing awareness of ingredient safety and a gradual shift away from cost-centric formulations towards quality and mildness attributes, offering long-term expansion potential for SCI suppliers.

- APAC: Leading market share due to localized raw material sourcing, rapid market urbanization, and high adoption rates of K-Beauty standards emphasizing gentle cleansers.

- Europe: Strong growth driven by robust regulatory support for green chemistry and overwhelming consumer demand for solid, zero-waste personal care products.

- North America: Growth fueled by massive marketing efforts promoting sulfate-free claims and increasing specialization in products tailored for sensitive skin types.

- LATAM & MEA: Emerging markets characterized by increasing urbanization, rising disposable incomes, and growing consumer education regarding mild cosmetic ingredients.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Sodium Cocoyl Isethionate Market.- Clariant AG

- Innospec Inc.

- Galaxy Surfactants Ltd.

- Taiwan NJC Corporation

- BASF SE

- Kao Corporation

- Stepan Company

- Sino-Japan Chemical Co. Ltd.

- Henkel AG & Co. KGaA

- Nouryon (formerly AkzoNobel NV)

- Spec-Chem Industry Inc.

- JEEN International Corporation

- Vink Chemicals GmbH & Co. KG

- Croda International Plc

- Lonza Group AG

- Evonik Industries AG

- Solvay S.A.

- Res Pharma Industriale S.p.A.

- Global-7 Inc.

- Procter & Gamble (P&G) (As major end-user and internal producer)

Frequently Asked Questions

Analyze common user questions about the Sodium Cocoyl Isethionate market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Sodium Cocoyl Isethionate (SCI) and why is it preferred over sulfates?

SCI is an anionic surfactant derived from coconut fatty acids, known for producing a rich, creamy lather while maintaining exceptional mildness. It is preferred over traditional sulfates (like SLS or SLES) because it is non-irritating, gentle on the skin and scalp, and aligns with the growing consumer demand for natural-derived and sulfate-free personal care formulations, making it ideal for sensitive skin and hair.

What are the primary applications driving the growth of the SCI market?

The primary growth drivers are applications in sulfate-free hair care, including liquid shampoos and especially solid shampoo bars. Significant demand also comes from premium body care products, sensitive skin facial cleansers, and baby care formulations, where its low irritation potential and excellent performance in solid formats are highly valued by formulators.

Which forms of SCI are most commercially relevant and why?

The most commercially relevant forms are the noodle/pellet and flake formats. These physical forms contain high active surfactant matter and are crucial for the manufacturing of solid cosmetic products (like cleansing bars), offering superior handling properties, minimizing dusting during formulation, and providing structural integrity to the finished solid bar.

How does the sustainability profile of SCI influence market adoption?

SCI's favorable sustainability profile, derived from renewable coconut oil, significantly influences market adoption, particularly in Europe and North America. It supports clean beauty claims, zero-waste initiatives (when used in solid bars), and offers better biodegradability compared to many petrochemical-derived surfactants, aligning with crucial environmental, social, and governance (ESG) standards for CPG companies.

What major market restraints affect the global expansion of SCI?

The primary restraint is the higher manufacturing cost of SCI compared to established, lower-cost sulfate surfactants. The complex, multi-step synthesis process requires specialized high-pressure equipment, resulting in higher unit economics, which can limit its adoption in price-sensitive mass-market segments globally, especially in competition with cheaper alternatives.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager