Sodium Formate Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431387 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Sodium Formate Market Size

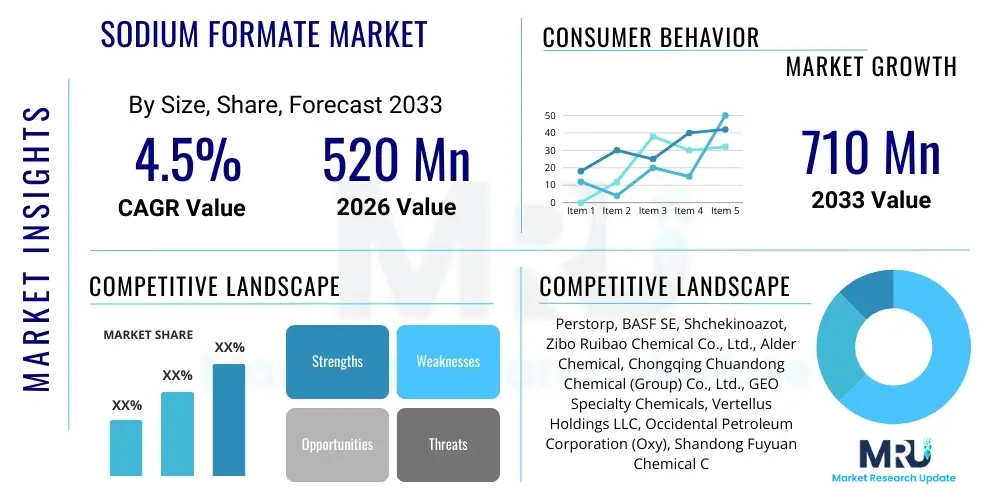

The Sodium Formate Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.5% between 2026 and 2033. The market is estimated at USD 520 Million in 2026 and is projected to reach USD 710 Million by the end of the forecast period in 2033.

Sodium Formate Market introduction

Sodium formate, the sodium salt of formic acid, is a fundamental chemical compound widely utilized across various industrial sectors. This product typically manifests as a white, crystalline powder and is known for its excellent solubility in water and its benign environmental profile, particularly when contrasted with traditional chloride-based salts. Its primary commercial applications span oilfield chemistry, specifically as a component in drilling and completion fluids, and runway de-icing agents due to its effectiveness at low temperatures and reduced corrosive impact on infrastructure.

The core benefits driving market adoption include its high solubility, which allows for concentrated brines used in high-pressure, high-temperature (HPHT) oil and gas drilling operations. Furthermore, in the aviation sector, sodium formate's non-corrosive nature and fast-acting de-icing capabilities make it a preferred choice for airport authorities committed to operational safety and asset preservation. These inherent chemical properties ensure that sodium formate remains a critical ingredient in sustainable industrial processes across diverse end-use industries.

Market expansion is primarily fueled by stringent environmental regulations, particularly in developed economies, pushing industries to adopt biodegradable and less harmful alternatives to conventional chemicals. The accelerating pace of oil and gas exploration, particularly unconventional drilling methods, further bolsters demand for high-density, environmentally friendly completion fluids. Additionally, the consistent need for effective and low-corrosion de-icing solutions in regions experiencing severe winter weather acts as a strong foundational driver for continuous market growth.

Sodium Formate Market Executive Summary

The Sodium Formate Market is characterized by robust growth, propelled primarily by its critical role in oilfield chemicals and environmentally preferred de-icing applications. Current business trends indicate a strong shift towards high-purity grades, particularly demanded by the pharmaceutical and food preservation sectors, although the bulk of consumption remains concentrated in industrial applications such as leather tanning and textile processing. Key strategic focuses for market participants include optimizing production processes to manage raw material volatility (formic acid and caustic soda) and investing in distribution networks to effectively serve the geographically disparate demand for de-icing agents.

Regionally, Asia Pacific (APAC) stands out as the fastest-growing market, largely due to booming industrialization, expanding oil and gas activities in countries like China and India, and increasing textile and leather manufacturing output. North America and Europe maintain significant market share, driven by mature aviation and infrastructure sectors requiring reliable de-icing solutions. However, stringent regulations regarding chemical discharge in Europe necessitate continuous innovation in product grades and life cycle management, further influencing competitive dynamics.

Segment trends reveal that the Oilfield Chemicals application segment holds the dominant market share, capitalizing on the rising global energy demand and the need for specialized drilling fluids that minimize formation damage. Concurrently, the De-icing segment exhibits highly seasonal but consistently strong demand, particularly for runway applications. Looking ahead, the high-purity grade segment, while smaller in volume, is projected to register the highest Compound Annual Growth Rate, spurred by growing adoption in specialty chemical synthesis and regulated consumer product industries.

AI Impact Analysis on Sodium Formate Market

User inquiries regarding AI's influence on the Sodium Formate market often revolve around optimizing complex supply chains, predicting demand seasonality for de-icing products, and enhancing quality control in high-purity manufacturing processes. Key themes observed include concerns about the integration costs of advanced analytics in chemical manufacturing, the capability of AI models to mitigate volatile raw material price fluctuations, and the potential for machine learning to accelerate the discovery of novel, formic acid-derived compounds. Users are keenly interested in how predictive maintenance, powered by AI, can reduce downtime in high-volume production facilities, thereby stabilizing supply and improving overall production efficiency.

The integration of Artificial Intelligence and advanced analytics is set to revolutionize operational efficiencies within the Sodium Formate production lifecycle. In manufacturing, AI algorithms can process real-time sensor data to optimize reaction kinetics, minimizing energy consumption and maximizing yield, which is crucial given the tight profit margins typical in basic chemical production. Furthermore, predictive logistics models can significantly improve the highly variable supply chain, especially for seasonal demands like airport de-icing, by forecasting local weather patterns and coordinating inventory placement accurately, minimizing storage costs and avoiding stockouts.

Beyond production optimization, AI plays an increasingly vital role in quality assurance for specialized grades of sodium formate, particularly those destined for sensitive applications like pharmaceuticals. Machine learning models can analyze spectroscopic data and chromatographic profiles far faster and more accurately than traditional methods, ensuring that stringent purity specifications are consistently met. This capability reduces batch failures, enhances product reliability, and supports market expansion into highly regulated end-use sectors where purity is paramount, thus securing a competitive advantage for early adopters of these smart manufacturing technologies.

- AI optimizes reaction parameters to maximize yield and reduce production costs.

- Predictive modeling enhances demand forecasting, particularly for highly seasonal de-icing applications.

- Machine learning improves raw material sourcing and mitigates price volatility risk.

- AI-driven quality control ensures consistent high purity levels for pharmaceutical and specialty grades.

- Advanced analytics support R&D efforts in formulating new high-density, environmentally benign drilling fluids.

DRO & Impact Forces Of Sodium Formate Market

The Sodium Formate Market is influenced by a dynamic interplay of factors where demand stimulation from environmentally conscious applications significantly outweighs operational constraints, positioning the market for steady expansion. The primary drivers include global mandates pushing for biodegradable and less toxic alternatives in critical sectors like aviation and oil drilling, where the corrosive impact of traditional chlorides is becoming economically unsustainable. However, the market faces headwinds from the inherent volatility in the price and supply of key raw materials, namely formic acid, which is highly dependent on upstream petrochemical cycles.

Restraints largely center on the high costs associated with producing high-purity sodium formate, limiting its adoption in certain price-sensitive industrial applications where cheaper, albeit less environmentally desirable, substitutes are available. Furthermore, the market's reliance on specific industries, especially oilfield chemicals, exposes it to macroeconomic volatility related to crude oil prices and shifts in global energy policies. The seasonal nature of the de-icing business also introduces complexity in inventory management and production scheduling, necessitating flexible operational strategies for major manufacturers.

Opportunities for growth are heavily concentrated in developing advanced, specialized fluids for complex drilling environments, such as deepwater and high-pressure reservoirs, which require dense, non-damaging brine systems. Moreover, the increasing global focus on sustainable chemistry provides manufacturers with an opportunity to market sodium formate as a green substitute, gaining traction in emerging applications like waste water treatment and as a buffer in industrial processing. The key impact forces driving the market forward are regulatory pressures favoring non-toxic chemicals and continuous technological advancements in oil exploration techniques demanding specialized formulation inputs.

Segmentation Analysis

The Sodium Formate Market is meticulously segmented based on Application, Grade, and Function, providing a detailed view of its diverse industrial landscape and consumption patterns. Segmentation by application highlights the dominant roles played by the Oilfield Chemicals and De-icing sectors, which collectively account for the majority of the global market revenue due to high volume requirements and the essential nature of the product in these industries. Grade segmentation distinguishes between industrial standard products used in bulk manufacturing processes and high-purity grades required for specialized, sensitive chemical synthesis or regulated consumer products, reflecting varied market needs regarding quality and price points.

Further analysis of the application segments reveals subtle nuances in growth trajectories; while traditional uses like leather tanning and textile dyeing remain stable, the pharmaceutical and food additive segments are showing promising exponential growth, albeit from a smaller base, driven by increased regulatory scrutiny requiring highly pure, trace-metal-free additives. Understanding these segment-specific growth rates is crucial for manufacturers looking to strategically allocate capital investment towards purification technologies and specialized production lines that cater to high-value end-users.

The structural composition of demand underscores the essential function of sodium formate as both a dense fluid component and an effective buffer or pH regulator. This versatility ensures its continued relevance across multiple sectors, insulating the market somewhat from downturns in any single end-use industry. Future market growth will be heavily contingent on how successfully manufacturers can meet the increasing technical demands of the oilfield sector while simultaneously scaling up high-purity production to capture emerging opportunities in the life sciences domain, thereby maximizing profitability across the entire product portfolio.

- By Application:

- Oilfield Chemicals (Drilling, Completion, and Workover Fluids)

- De-icing (Runway and Road De-icing)

- Leather Tanning and Dyeing

- Textiles and Printing

- Pharmaceuticals and Food Additives

- Others (Chemical Intermediates, Water Treatment)

- By Grade:

- Industrial Grade (Powder, Liquid)

- High Purity Grade

- By Function:

- Buffering Agent

- De-icing Agent

- Stabilizer

Value Chain Analysis For Sodium Formate Market

The value chain for the Sodium Formate Market begins with the upstream procurement of critical raw materials, primarily formic acid and sodium hydroxide (caustic soda). The costs and availability of these inputs are highly sensitive to the global petrochemical market, as formic acid is derived from methanol and carbon monoxide. Therefore, operational efficiency at the upstream stage, including securing long-term supply contracts and managing logistics for bulk chemical transport, is paramount to maintaining competitive pricing for the final product. Manufacturers often employ sophisticated inventory management systems to buffer against raw material price volatility.

The core manufacturing process involves the neutralization of formic acid with sodium hydroxide, followed by crystallization, drying, and packaging, often requiring specialized equipment to achieve high purity, particularly for pharmaceutical and food-grade applications. This midstream phase is characterized by energy-intensive operations, where technological innovation focuses on reducing energy consumption and waste byproducts. Key downstream activities involve distribution and tailored formulation; due to the bulk nature of industrial grades (e.g., de-icing), logistics and proximity to key consumption centers are critical cost components.

Distribution channels for sodium formate are segmented into direct and indirect routes. Large-volume consumers, such as major oilfield service companies and airport authorities, often rely on direct procurement from manufacturers or long-term supply agreements with specialized distributors capable of handling high-volume logistics. Indirect channels involve specialty chemical distributors and regional agents who cater to smaller end-users in textiles, leather, and local chemical synthesis. The efficiency of the downstream segment is defined by seamless product delivery and technical support, especially for customized drilling fluid formulations required by the Oil and Gas sector.

Sodium Formate Market Potential Customers

The primary consumers of sodium formate are diversified across multiple large-scale industrial sectors, reflecting the compound's multifaceted utility. The most significant potential customers are large international Oilfield Service Providers (OSPs) who utilize sodium formate brines extensively in high-density drilling and completion fluids. These OSPs require consistent supply of high-grade material that ensures reservoir protection and operational safety in challenging drilling environments, making product quality and reliability critical purchasing criteria.

Another major customer segment includes Airport Authorities and regional infrastructure maintenance departments in severe winter climate zones. These entities are increasingly mandated to use environmentally friendly, non-chloride de-icing agents to protect runway pavement, aircraft components, and surrounding ecosystems. Their procurement decisions are heavily influenced by regulatory compliance, performance efficacy at extremely low temperatures, and the availability of bulk supply during peak winter seasons, often requiring long-term contracts with guaranteed delivery schedules.

Furthermore, chemical processors in the textile and leather industries represent stable, long-term consumers, utilizing sodium formate as a buffering agent, dye-fixing agent, and reducing agent. New and high-growth potential customers reside in the pharmaceutical synthesis and specialty chemical manufacturing sectors, where sodium formate serves as a crucial intermediate or excipient. These buyers demand stringent quality certifications, traceable supply chains, and superior purity levels, offering manufacturers higher margins in exchange for adherence to rigorous quality standards and regulatory approvals.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 520 Million |

| Market Forecast in 2033 | USD 710 Million |

| Growth Rate | 4.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Perstorp, BASF SE, Shchekinoazot, Zibo Ruibao Chemical Co., Ltd., Alder Chemical, Chongqing Chuandong Chemical (Group) Co., Ltd., GEO Specialty Chemicals, Vertellus Holdings LLC, Occidental Petroleum Corporation (Oxy), Shandong Fuyuan Chemical Co., Ltd., Mitsubishi Gas Chemical Company, Feicheng Acid Chemicals, Changzhou Yuping Chemical Co., Ltd., Dongying City Longxing Chemical Co., Ltd., Chemanol, Acuro Organics Limited, Spectrum Chemical Mfg. Corp., Shandong Jinlu Petrochemical Co., Ltd., Henan Zongheng Chemical Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Sodium Formate Market Key Technology Landscape

The manufacturing process for sodium formate is well-established, primarily revolving around the reaction of formic acid and sodium hydroxide. However, key technological advancements are focused not on the core synthesis, but on purification and crystallization techniques necessary to achieve the ultra-high purity required by specialized end-use markets, such as pharmaceuticals and high-performance electronics. Advanced crystallization methods, including controlled cooling and anti-solvent crystallization, are being deployed to control particle size distribution and minimize inorganic contaminants, essential steps for producers targeting premium segments.

Furthermore, technology related to fluid formulation represents a significant landscape component, particularly in the oilfield sector. Innovations are centered on developing highly stable, high-density formate brines that can withstand extreme downhole temperatures and pressures without degradation. This involves optimizing the molecular interaction between the sodium formate salt and stabilizing polymers or corrosion inhibitors. Research focuses on achieving superior rheological properties that minimize formation damage while maximizing the recoverable density, thereby enhancing the efficiency of deep drilling operations globally.

Another crucial technological area involves waste management and recycling within the production chain. Given the increasing global emphasis on circular economy principles, producers are investing in ion exchange and membrane filtration technologies to efficiently reclaim and reuse process water and chemical byproducts. This not only reduces the environmental footprint but also lowers operational costs associated with raw material consumption and waste disposal. Such process optimization technologies are central to maintaining cost competitiveness and securing regulatory compliance in mature markets.

Regional Highlights

Regional dynamics significantly shape the Sodium Formate Market, dictated primarily by climate, industrial activity, and regulatory environment. North America and Europe currently represent the largest consumers of sodium formate, driven predominantly by high-volume seasonal demand from the aviation de-icing segment, particularly for airport runways, which mandates non-corrosive chemicals. North America also sustains substantial demand from the oil and gas industry, especially in complex, deepwater, and unconventional drilling operations requiring specialized formate brines for enhanced reservoir performance.

Asia Pacific (APAC) is projected to exhibit the fastest growth over the forecast period. This rapid expansion is fueled by accelerating industrialization across India and Southeast Asia, leading to robust growth in traditional end-use sectors like leather tanning, textile dyeing, and basic chemical synthesis. Crucially, the expanding presence of regional and international oil and gas exploration activities, particularly in offshore and difficult terrains, is creating a sustained need for high-performance drilling fluids, positioning APAC as a major manufacturing and consumption hub for industrial grade sodium formate.

The Middle East and Africa (MEA), alongside Latin America, are emerging as key markets, primarily due to heightened focus on energy extraction projects. MEA’s oil and gas sector, characterized by harsh operational conditions and deep wells, relies heavily on high-density formate completion fluids. While the de-icing market is negligible in MEA, the intense demand for high-performance oilfield chemicals compensates, often requiring complex logistical chains to transport the required materials to remote exploration sites efficiently. The long-term growth in these regions is intrinsically tied to global commodity prices for crude oil.

- North America: Dominant market share driven by aviation de-icing and mature oilfield chemical industry. High consumption of both industrial and high-purity grades.

- Europe: Strong demand for eco-friendly de-icing solutions; stringent environmental regulations mandate the use of non-chloride salts. Stable demand from chemical synthesis.

- Asia Pacific (APAC): Fastest-growing region, powered by industrial expansion (textiles, leather) and increased oil and gas exploration activity in countries like China and India.

- Latin America: Growing market driven by oil and gas projects in Brazil and Mexico, increasing the demand for high-density drilling fluids.

- Middle East and Africa (MEA): Significant demand solely from the high-performance oilfield chemicals sector due to challenging drilling environments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Sodium Formate Market.- Perstorp

- BASF SE

- Shchekinoazot

- Zibo Ruibao Chemical Co., Ltd.

- Alder Chemical

- Chongqing Chuandong Chemical (Group) Co., Ltd.

- GEO Specialty Chemicals

- Vertellus Holdings LLC

- Occidental Petroleum Corporation (Oxy)

- Shandong Fuyuan Chemical Co., Ltd.

- Mitsubishi Gas Chemical Company

- Feicheng Acid Chemicals

- Changzhou Yuping Chemical Co., Ltd.

- Dongying City Longxing Chemical Co., Ltd.

- Chemanol

- Acuro Organics Limited

- Spectrum Chemical Mfg. Corp.

- Shandong Jinlu Petrochemical Co., Ltd.

- Henan Zongheng Chemical Co., Ltd.

- Kemira Oyj

Frequently Asked Questions

Analyze common user questions about the Sodium Formate market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary driver for the Sodium Formate Market growth?

The primary driver is the increasing regulatory preference for environmentally non-corrosive and biodegradable chemicals, specifically in critical infrastructure applications such as aviation de-icing and high-density, low-damage oilfield drilling fluids, replacing traditional chloride salts.

How is sodium formate used in the oil and gas industry?

In the oil and gas industry, sodium formate is used to create high-density, low-viscosity brine solutions for drilling, completion, and workover fluids. These formate brines minimize reservoir damage, improve thermal stability, and enhance overall drilling efficiency, particularly in high-pressure, high-temperature (HPHT) wells.

Which geographical region holds the largest market share for sodium formate?

North America currently holds a significant market share, predominantly due to the high volume of consumption in the highly structured aviation de-icing market and robust demand from the region's expansive and technologically advanced oil and gas sector.

What challenges restrain the growth of the sodium formate market?

Key restraints include the price volatility and supply dependency of the primary raw material, formic acid, which is derived from the petrochemical industry. Additionally, the higher cost of sodium formate compared to chloride alternatives limits its adoption in highly price-sensitive industrial uses.

What is the difference between industrial grade and high-purity grade sodium formate applications?

Industrial grade sodium formate is utilized in bulk applications like de-icing, leather tanning, and textile dyeing, where volume and cost are key. High-purity grade is used in specialized fields such as pharmaceutical synthesis, food preservation, and specialty chemical manufacturing, demanding stringent quality control and minimal trace metal content.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager