Sodium Metabisulfite Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431755 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Sodium Metabisulfite Market Size

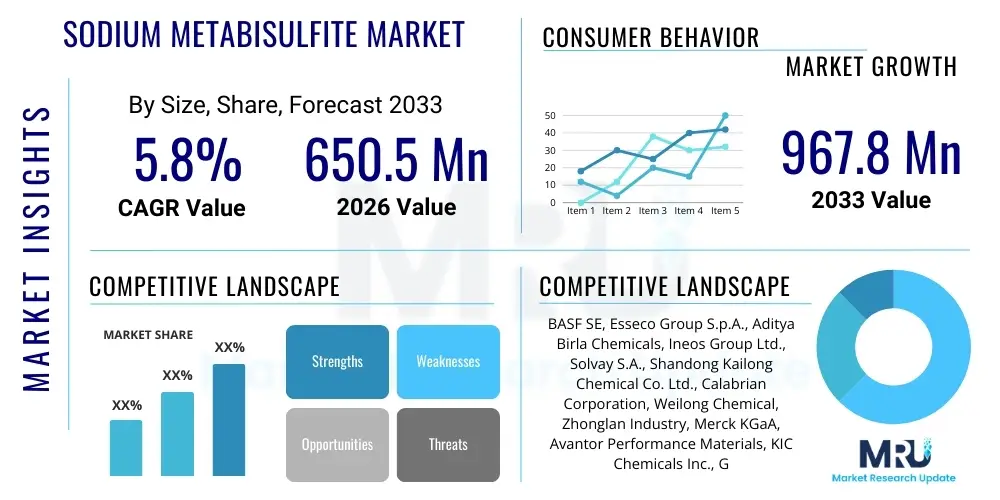

The Sodium Metabisulfite Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 650.5 Million in 2026 and is projected to reach USD 967.8 Million by the end of the forecast period in 2033.

Sodium Metabisulfite Market introduction

The Sodium Metabisulfite (SMBS) market encompasses the production, distribution, and consumption of this versatile inorganic compound, chemically represented as Na2S2O5. Recognized primarily for its strong reducing capabilities, SMBS is indispensable across a broad spectrum of industrial applications, ranging from water purification and chemical processing to food and beverage preservation. Its inherent stability in dry form, coupled with the property of releasing sulfur dioxide (SO2) when dissolved in water, makes it a preferred and cost-effective source for sulfite ions, essential for numerous chemical reactions. The compound’s utility as an antioxidant and preservative is particularly valued in the food industry, where it significantly extends the shelf life of products by inhibiting oxidative degradation and microbial growth, fulfilling the critical demand generated by modern supply chains and urbanization. The primary market strength of SMBS lies in its dual functionality—serving both as a critical ingredient in large-scale industrial processes, such as mining and textile bleaching, and as a specialized additive in consumer-facing sectors, ensuring sustained, diversified demand globally.

The production of Sodium Metabisulfite is typically achieved through the reaction of sodium hydroxide (caustic soda) or sodium carbonate with sulfur dioxide gas, followed by subsequent crystallization and drying stages. This manufacturing process requires stringent control over reaction conditions to yield the high-purity grades required for sensitive applications, such as pharmaceutical formulations and photographic chemicals. SMBS is characterized by its white, crystalline powder appearance and pungent sulfurous odor. Major applications include its extensive use in municipal water treatment plants for dechlorination following the primary disinfection phase, mitigating the environmental impact and toxicity of residual chlorine before discharge. Furthermore, in the context of global mining operations, particularly gold cyanidation, SMBS acts as a detoxifying agent, neutralizing residual cyanide, thereby addressing crucial environmental compliance requirements.

The market growth is fundamentally driven by robust industrial expansion in emerging economies and increasingly rigorous global standards for water quality and food safety. The compound’s benefits, including high efficacy, relatively low cost, and ease of handling compared to gaseous sulfur dioxide, solidify its market position. However, regulatory scrutiny, especially concerning sulfur dioxide residues in specific food categories, necessitates ongoing innovation in application techniques and grade purity improvements. Despite these regulatory challenges, the pervasive requirement for reliable reductants and preservatives across construction chemicals, pulp and paper manufacturing, and the burgeoning shale gas industry (where it is used as an oxygen scavenger in fracturing fluids) guarantees continuous market relevance. Strategic market participants are focusing on optimizing logistics and improving energy efficiency in production to maintain competitive pricing and secure large-volume contracts from key industrial consumers.

Sodium Metabisulfite Market Executive Summary

The Sodium Metabisulfite market is poised for steady, moderate growth throughout the forecast period, driven primarily by persistent demand from the water treatment and food preservation sectors, which collectively account for the largest share of consumption volume. Key business trends include a strategic shift towards Asia Pacific, particularly China and India, which are rapidly expanding their industrial base, including vast textile and paper manufacturing facilities, alongside significant investments in municipal infrastructure, thereby elevating demand for industrial-grade SMBS. Furthermore, intense competition among major producers is leading to a focus on operational efficiency and the development of specialized, high-purity grades required by premium end-users like the pharmaceutical and photographic industries, commanding higher profit margins. Vertical integration strategies, where manufacturers control raw material sourcing (sulfur dioxide generation), are becoming common to mitigate volatile input costs and ensure supply reliability, a critical factor for large-scale procurement contracts. The market also observes consolidation, as larger chemical conglomerates acquire smaller specialized producers to gain access to niche markets and regional distribution networks, optimizing global market reach and reducing logistical overheads.

Regional trends indicate that while North America and Europe maintain stable, mature markets with demand primarily driven by stringent environmental regulations necessitating dechlorination and wastewater management solutions, the APAC region exhibits the fastest expansion rate. This rapid growth in APAC is underpinned by burgeoning population density, resulting in increased food processing activities, and substantial government spending on industrial safety and environmental protection mandates. Conversely, supply chain vulnerabilities, exacerbated by recent geopolitical tensions and fluctuating energy prices, pose short-term challenges, particularly for energy-intensive production processes in European facilities. Latin America, propelled by its substantial mining sector, particularly in countries like Chile and Peru, remains a crucial market for technical-grade SMBS used in ore processing and cyanide detoxification. Manufacturers are increasingly tailoring their product grades and packaging to meet the specific climate and logistical requirements of diverse global markets, ensuring product stability and regulatory adherence.

Segmentation trends highlight the dominance of the industrial grade segment, largely due to high-volume usage in water treatment, textile dyeing, and pulp and paper production, characterized by lower purity requirements but massive consumption scales. However, the food grade segment, while smaller in volume, is expected to demonstrate superior value growth rates, driven by the increasing complexity of processed foods and beverages and the global shift towards extended shelf life solutions. Application diversification is also evident, with SMBS increasingly utilized in the oil and gas sector for corrosion control and in the construction industry as a component in certain concrete admixtures. Producers are strategically investing in R&D to optimize the physical characteristics of their products, such as flowability and dissolution rates, to improve handling and efficacy for specific end-user applications. This strategic focus on granular segment requirements ensures maximized penetration across varied industrial landscapes, securing the market's long-term profitability.

AI Impact Analysis on Sodium Metabisulfite Market

User queries regarding AI's influence in the Sodium Metabisulfite sector primarily focus on optimizing complex, energy-intensive chemical synthesis, enhancing quality control for high-purity grades, and streamlining global supply chain dynamics. A central theme is the application of Machine Learning (ML) models for predictive maintenance of high-pressure reactors and absorption towers, aiming to reduce unplanned downtime which severely impacts bulk chemical production economics. Concerns are often raised about the initial high investment required for integrating AI and IoT sensors into legacy manufacturing infrastructure. Users also seek information on how AI algorithms can analyze real-time plant data—such as temperature, flow rates, and reactant concentrations—to adjust parameters automatically, ensuring maximal conversion efficiency of sulfur dioxide and caustic soda, thereby lowering overall energy consumption and minimizing waste generation. The consensus suggests AI will not alter the fundamental chemistry of SMBS but will significantly revolutionize operational resilience, product consistency, and environmental compliance monitoring, especially concerning SO2 emission management at the manufacturing sites.

- AI-driven optimization of synthesis processes to maximize yields and reduce thermal energy consumption.

- Predictive maintenance analytics deployed on reactors and crystallizers, minimizing catastrophic equipment failure.

- Enhanced quality control using ML for real-time spectroscopic analysis, ensuring compliance with strict food and pharmaceutical grade standards.

- Supply chain optimization through AI forecasting models, improving inventory management of raw materials (sulfur sources) and finished goods distribution.

- Automated environmental monitoring systems leveraging AI to track and regulate SO2 emissions for regulatory compliance.

- Simulation models powered by AI to develop safer and more efficient material handling protocols for hazardous components.

DRO & Impact Forces Of Sodium Metabisulfite Market

The Sodium Metabisulfite market is governed by a robust set of impact forces where the core drivers, significant restraints, and clear opportunities continuously reshape market strategy. The primary driving force remains the pervasive global need for effective water treatment solutions, particularly the crucial step of dechlorinating wastewater and potable water sources. This requirement is non-negotiable for public health and environmental protection, providing a foundational, resilient demand base. Secondly, the rapidly expanding global food industry, necessitating effective, approved preservatives to manage complex logistics and ensure product safety across long supply chains, further solidifies demand. Conversely, the market faces significant restraints, chiefly regulatory pressure stemming from concerns over sulfite allergies and health implications, leading to stricter labeling requirements and the search for SMBS alternatives in certain food segments, particularly in developed regions like the EU and North America. Furthermore, the high volatility in the pricing and supply of key raw materials, specifically sulfur and sodium hydroxide, introduces cost unpredictability, impacting manufacturer profitability and strategic planning.

Opportunities in the market center around technological advancements and geographical expansion. A major opportunity lies in the burgeoning application of SMBS in the hydrometallurgical sector, specifically in the detoxification of cyanide used in gold mining, a process gaining importance as lower-grade ores are processed globally, necessitating efficient and safe residue management. Another promising avenue involves the increasing demand for high-purity, low-heavy-metal SMBS grades tailored for the expanding pharmaceutical industry, where it is used as an antioxidant excipient. These specialized applications offer superior profit margins compared to bulk industrial grades. The impact forces matrix highlights that while substitution risks in the food sector pose a structural threat, the indispensable nature of SMBS in critical industrial processes—such as water treatment and the manufacture of chemical intermediates—provides strong inertia against decline. Market participants must strategically balance high-volume, low-margin industrial contracts with targeted expansion into specialized, high-margin end-uses to mitigate regulatory risks associated with mass consumption segments.

The overall impact forces analysis reveals that the market sensitivity to environmental and health regulations is exceptionally high; a sudden regulatory shift away from sulfites in food preservation, though unlikely across all categories, could significantly dampen growth rates in that segment. However, the sheer volume demand generated by industrial necessities—like the pulp and paper industry using SMBS for bleaching and the photographic industry maintaining its requirement for specialized developers—provides insulation. Strategic focus must be placed on improving the sustainability profile of SMBS production, potentially leveraging carbon capture technologies related to SO2 handling, to preemptively address future environmental scrutiny. The balance between capitalizing on high-growth emerging markets (APAC) and maintaining stable revenues from mature, highly regulated markets (Europe) defines the current competitive landscape. Successful market penetration relies on robust regional distribution networks capable of managing SMBS's shelf-life constraints and adherence to diverse national quality standards.

Segmentation Analysis

The Sodium Metabisulfite market is comprehensively segmented based on its Purity Grade, End-Use Industry, and Region, reflecting the diverse requirements of its numerous applications. The purity grade segmentation distinguishes between Technical/Industrial Grade and Food/Pharmaceutical Grade, where the latter commands a significant price premium due to stricter manufacturing controls concerning trace heavy metals and overall purity level. The segmentation by end-use industry is the most critical for revenue forecasting, with water treatment and food and beverage preservation consistently dominating market share, followed closely by the textile, pulp and paper, and mining industries. Analyzing these segments reveals varying growth trajectories: the mining and food processing segments are expected to show accelerated growth, whereas established industries like textiles might see more stable, moderate expansion in developed regions. Geographic segmentation is crucial, identifying APAC as the primary volume driver, while North America and Europe lead in consumption of specialized, high-purity products due to their advanced pharmaceutical and environmental sectors. This detailed segmentation allows producers to tailor production specifications and pricing strategies effectively.

- By Purity Grade:

- Industrial Grade

- Food Grade

- Pharmaceutical Grade

- Photographic Grade

- By End-Use Industry:

- Water Treatment (Dechlorination, Oxygen Scavenging)

- Food and Beverage (Preservative, Antioxidant in Wine, Dried Fruits)

- Chemical and Pharmaceutical Manufacturing (Reducing Agent, Excipient)

- Mining and Metallurgy (Cyanide Detoxification, Flotation Agent)

- Pulp and Paper (Bleaching Agent, De-inking)

- Textile Industry (Dyeing, Bleaching)

- Photography (Fixer component)

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Sodium Metabisulfite Market

The value chain for Sodium Metabisulfite commences with the upstream analysis, which focuses critically on the procurement and preparation of primary raw materials: sodium hydroxide (caustic soda) or sodium carbonate, and sulfur or sulfur dioxide gas. The cost structure of SMBS is highly sensitive to fluctuations in global commodity prices for these inputs, particularly caustic soda, which is produced via the highly energy-intensive chlor-alkali process. Upstream logistics are complex, involving the secure transportation and storage of corrosive materials (sodium hydroxide solution) and hazardous gas precursors (SO2). Efficiency in the upstream segment dictates production costs, making long-term supply contracts and backward integration crucial strategies for large manufacturers. Geographically, manufacturing is often situated close to sulfur refineries or major chlor-alkali production hubs to minimize transportation costs and ensure continuous supply, contributing significantly to regional cost disparities across the global market.

Midstream activities involve the chemical synthesis, purification, crystallization, and packaging of the SMBS product. This phase requires significant capital investment in reaction vessels, absorption columns, and drying equipment, maintained under stringent quality control protocols, especially for food and pharmaceutical grades which must comply with international standards like FCC (Food Chemical Codex) or USP (United States Pharmacopeia). Process optimization is key here, involving continuous efforts to improve energy efficiency in drying and to minimize SO2 emissions during the reaction. The output is differentiated into various mesh sizes and purities, influencing subsequent pricing and application suitability. Manufacturers typically employ highly specialized packaging, such as air-tight drums or bulk bags, to maintain product stability, as SMBS can degrade when exposed to moisture and air. Quality assurance in the midstream defines the product’s market competitiveness and access to sensitive end-use applications.

The downstream segment involves distribution, sales, and end-user consumption. Distribution channels are highly fragmented, ranging from direct sales to large industrial customers (water treatment, mining giants) to indirect distribution through specialized chemical distributors and regional agents who handle smaller volumes required by food processors or textile mills. Direct sales offer greater price control and relationship management for strategic accounts, while indirect channels provide wider geographical reach and logistical solutions for fragmented demand. Due to SMBS’s chemical properties (potential decomposition), distribution requires careful management of storage conditions and turnover rates. The end-user utilization feedback loop is essential for product innovation, particularly concerning application performance (e.g., dissolution rates in water treatment) and compliance with localized environmental discharge permits. The effectiveness of the indirect channel, particularly in emerging APAC markets, is paramount for securing market penetration and responding quickly to fluctuating regional demand profiles.

Sodium Metabisulfite Market Potential Customers

The potential customer base for Sodium Metabisulfite is highly diversified, spanning multiple core industrial and consumer-facing sectors, underscoring the compound's broad utility as a reducing agent, preservative, and antioxidant. Primary high-volume buyers are municipal and industrial water treatment facilities globally. These entities rely on technical-grade SMBS for large-scale dechlorination, which is a mandatory regulatory step following the disinfection of public water supplies. The procurement process in this sector is often driven by long-term government contracts and tenders, focusing heavily on bulk pricing, supply reliability, and adherence to established public health safety standards. The sustained growth of urbanization and industrialization directly correlates with the expansion of this customer segment, particularly in emerging economies where infrastructure development is accelerating.

Another major category of potential customers includes large-scale food and beverage manufacturers, including wineries, brewing companies, and producers of processed commodities such as dried fruits and frozen vegetables. These customers demand Food Grade SMBS, placing utmost importance on purity, certifications (like ISO 22000), and consistency, as the additive directly interacts with edible products. For instance, in the wine industry, SMBS is critical for controlling fermentation and preventing oxidation, making winemakers perennial, specialized customers. The pharmaceutical industry represents a smaller but high-value customer segment, requiring Pharmaceutical Grade SMBS for use as an excipient or an antioxidant in injectable solutions and formulations, where compliance with Pharmacopeia standards (USP/EP) is non-negotiable and requires stringent supplier audits.

The third significant group comprises mining companies (primarily gold and silver extraction), and chemical/textile processors. Mining operators use SMBS as a key reagent for detoxifying cyanide waste streams before environmental discharge, making it an essential operational expenditure driven by environmental compliance mandates. Textile mills, particularly those involved in dyeing cotton and wool, utilize SMBS for bleaching and preparing fibers. These industrial buyers are highly price-sensitive for bulk orders but require consistent quality and robust technical support. Expanding into these specific industrial applications, particularly in regions rich in mining activity (e.g., South America, South Africa), represents strategic opportunities for manufacturers aiming to diversify away from reliance solely on the competitive food preservation sector, ensuring a balanced portfolio of end-users.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 650.5 Million |

| Market Forecast in 2033 | USD 967.8 Million |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | BASF SE, Esseco Group S.p.A., Aditya Birla Chemicals, Ineos Group Ltd., Solvay S.A., Shandong Kailong Chemical Co. Ltd., Calabrian Corporation, Weilong Chemical, Zhonglan Industry, Merck KGaA, Avantor Performance Materials, KIC Chemicals Inc., Grasim Industries Limited, TCI Chemicals (India) Pvt. Ltd., Wuxi City Yutong Chemical Co. Ltd., Lianyungang Jinhai Chemical Co., Marsing & Co., Shakti Chemicals, Wenzhou Hairun Chemical Co. Ltd., Jining Hongda Chemical Co. Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Sodium Metabisulfite Market Key Technology Landscape

The manufacturing technology for Sodium Metabisulfite fundamentally relies on the reaction between sulfur dioxide and an alkali source, primarily sodium hydroxide or sodium carbonate. While the basic chemical synthesis process—often utilizing the absorption of SO2 gas into an alkali solution, followed by controlled crystallization and drying—remains consistent, the key technological landscape evolution focuses on process intensification, energy efficiency improvements, and achieving ultra-high purity grades. Modern technological advancements include implementing continuous crystallization techniques over batch methods, which significantly enhances product consistency, reduces production cycle times, and minimizes energy variability. Furthermore, advanced filtration and purification systems, such as membrane separation and multi-stage washing, are critical technologies deployed to eliminate trace contaminants, particularly heavy metals, which are unacceptable in food and pharmaceutical applications. These technological investments are mandatory for manufacturers targeting compliance with rigorous international regulatory bodies.

A crucial area of technological focus is environmental management and process safety, driven by the need to handle and utilize sulfur dioxide, a hazardous chemical. Manufacturers are increasingly adopting closed-loop systems and highly efficient SO2 absorption towers to maximize material usage and minimize atmospheric emissions, aligning with tightening global pollution control standards. Furthermore, the drying phase, which is energy-intensive, is being optimized through the adoption of advanced fluidized bed dryers or vacuum drying technologies, which operate at lower temperatures or require less processing time, directly contributing to lower operational expenditures and a reduced carbon footprint per ton of SMBS produced. The integration of advanced process control systems (APCS), often leveraging PLC and DCS technology, allows for precise monitoring and automated adjustment of parameters like pH, temperature, and concentration, ensuring optimal reaction kinetics and minimizing human error in handling volatile inputs.

The packaging technology also constitutes a relevant part of the landscape, directly affecting the product's shelf life and stability. Since SMBS is prone to decomposition upon contact with moisture and air, leading to loss of efficacy and caking, specialized packaging materials are necessary. Technological trends here involve the use of multi-layer barrier films, specialized high-density polyethylene (HDPE) liners, and moisture-absorbing sachets within bulk packaging to maintain the dry, crystalline structure. Innovations in nano-filtration technology are also being explored in high-end purification steps to ensure that trace organic impurities, often derived from raw materials, are effectively removed, thus future-proofing the product against anticipated stricter standards in food preservation and pharmaceutical excipient quality. Overall, the technological landscape is characterized by evolution in process control, sustainable manufacturing practices, and precision purification to meet increasingly fragmented and demanding purity requirements across end-user markets.

Regional Highlights

Regional dynamics play a crucial role in shaping the Sodium Metabisulfite market, influenced by varying industrialization rates, environmental regulations, and consumption patterns in food processing. Asia Pacific (APAC) currently holds the largest market share and is projected to exhibit the highest growth rate during the forecast period. This dominance is attributable to massive infrastructural development, particularly in China and India, leading to substantial growth in water treatment projects and robust expansion in textile, paper, and food processing industries. The relatively lower cost of labor and less stringent, though rapidly evolving, environmental regulations in parts of APAC historically favored bulk chemical manufacturing, establishing the region as a major global production hub. Demand in APAC is largely driven by industrial-grade SMBS volume.

North America and Europe represent mature markets characterized by stable demand and high standards for product quality, particularly in the pharmaceutical and food preservation segments. In these regions, consumption is heavily regulated; for instance, European regulations strictly limit sulfite levels in wine and certain foodstuffs, driving demand for specialized, high-purity grades that allow for precise dosage control. The North American market benefits significantly from high consumption in the shale gas industry (as an oxygen scavenger) and the highly developed municipal water infrastructure, ensuring consistent demand for high-volume technical grade SMBS for dechlorination purposes. Market growth in these regions is less volume-driven and more value-driven, focusing on specialized applications and compliance solutions.

Latin America (LATAM) and the Middle East & Africa (MEA) constitute smaller but rapidly expanding markets. LATAM's market is highly dependent on its extensive mining sector (Chile, Peru), where SMBS is indispensable for cyanide detoxification, ensuring environmental compliance in mining operations. MEA market growth is spurred by rapid urbanization, necessitating infrastructure upgrades, including new municipal water treatment facilities, and expansion of local food processing capabilities. However, market penetration in MEA faces challenges related to logistics, political instability, and inconsistent quality control standards compared to mature regions. Manufacturers targeting LATAM must prioritize logistics tailored for remote mining sites, while MEA strategies require strong local partnerships to navigate diverse regulatory landscapes and distribution hurdles.

- Asia Pacific (APAC): Dominates market share; rapid urbanization and industrial growth driving high demand for water treatment and textile applications; major global manufacturing base.

- North America: Stable, mature market; high demand from water treatment and the oil & gas industry (shale); focus on high-purity, specialized grades and robust environmental compliance.

- Europe: Value-driven market; stringent food safety regulations influence SMBS grade requirements; strong consumption in chemical synthesis and specialized industrial niches.

- Latin America (LATAM): Growth heavily reliant on the mining sector, specifically cyanide detoxification in mineral processing; infrastructural development contributing to stable water treatment demand.

- Middle East and Africa (MEA): Emerging market characterized by increasing investment in water infrastructure and expanding regional food processing industry; faces logistical and regulatory harmonization challenges.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Sodium Metabisulfite Market.- BASF SE

- Esseco Group S.p.A.

- Aditya Birla Chemicals

- Ineos Group Ltd.

- Solvay S.A.

- Shandong Kailong Chemical Co. Ltd.

- Calabrian Corporation (A wholly owned subsidiary of Ineos)

- Weilong Chemical

- Zhonglan Industry

- Merck KGaA

- Avantor Performance Materials

- KIC Chemicals Inc.

- Grasim Industries Limited

- TCI Chemicals (India) Pvt. Ltd.

- Wuxi City Yutong Chemical Co. Ltd.

- Lianyungang Jinhai Chemical Co.

- Marsing & Co.

- Shakti Chemicals

- Wenzhou Hairun Chemical Co. Ltd.

- Jining Hongda Chemical Co. Ltd.

Frequently Asked Questions

Analyze common user questions about the Sodium Metabisulfite market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Sodium Metabisulfite primarily used for in large industrial volumes?

Sodium Metabisulfite (SMBS) is predominantly used in industrial volumes for water treatment, specifically as a dechlorination agent to neutralize residual chlorine in municipal and industrial effluent before discharge, ensuring environmental compliance and mitigating toxicity.

How do purity grades affect the market dynamics of Sodium Metabisulfite?

Purity grades segment the market into high-volume, lower-margin Industrial Grade (used in water and textiles) and lower-volume, higher-margin Food/Pharmaceutical Grades. Strict purity requirements in food and pharma necessitate specialized, expensive manufacturing processes, significantly influencing pricing and supplier selection.

What is the main environmental regulation challenge facing SMBS manufacturers?

The primary environmental challenge is managing the safe production and handling of sulfur dioxide (SO2), the key precursor. Manufacturers must invest heavily in closed-loop systems and scrubbing technologies to meet increasingly stringent air quality regulations regarding SO2 emissions from chemical plants globally.

Which geographical region is currently driving the highest growth in the SMBS market?

Asia Pacific (APAC), led by countries like China and India, is driving the highest market growth due to rapid industrialization, expansion of municipal water infrastructure, and flourishing textile and food processing sectors requiring vast quantities of bulk industrial and food-grade SMBS.

Is Sodium Metabisulfite facing substitution threats in the food and beverage industry?

Yes, SMBS faces substitution threats, particularly in developed markets where consumer awareness of sulfite sensitivities is high. While alternatives like ascorbic acid are used, SMBS remains highly effective and cost-efficient, maintaining its indispensable role in key applications like wine production and dried fruit preservation.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager