Sodium Methanethiolate Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431991 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Sodium Methanethiolate Market Size

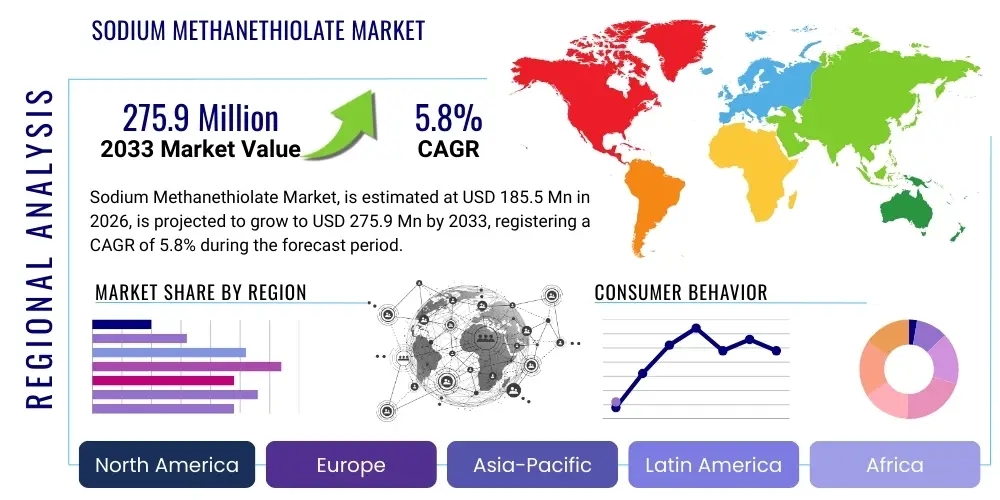

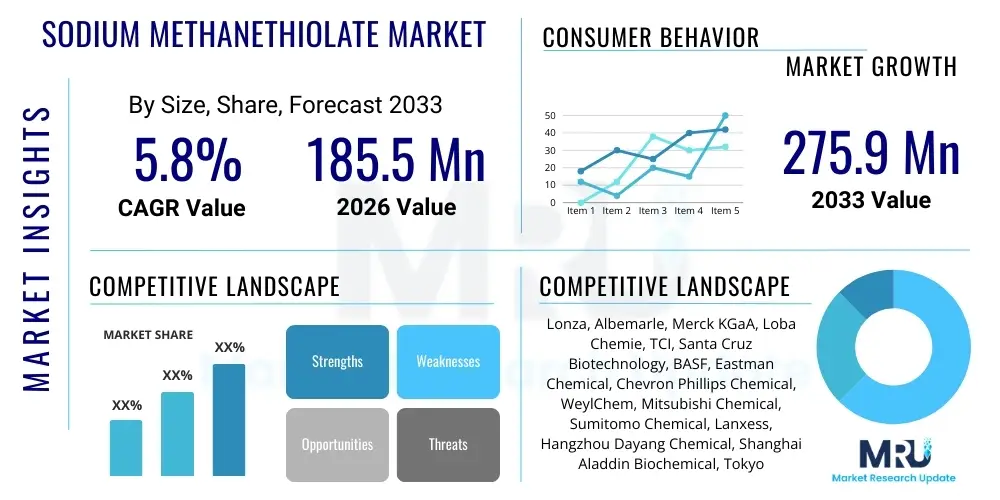

The Sodium Methanethiolate Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 185.5 Million in 2026 and is projected to reach USD 275.9 Million by the end of the forecast period in 2033.

Sodium Methanethiolate Market introduction

Sodium Methanethiolate (SMT), often referred to as sodium methyl mercaptide, is a critical organosulfur compound characterized by its high reactivity and specialized utility as a nucleophilic reagent in organic synthesis. It is a salt derived from methanethiol, typically supplied as a solid powder or a solution in water or organic solvents. The primary industrial importance of SMT stems from its application as a key intermediate in the production of complex chemical structures, particularly those involving methylation via a sulfur atom. Its robust chemical properties make it irreplaceable in processes requiring selective thiolation or the formation of thioethers. The global market is intrinsically linked to the performance of downstream industries such as pharmaceuticals, agricultural chemicals, and various specialty chemical sectors, where SMT’s unique chemical functionality provides necessary building blocks for final product formulation.

Product Description involves understanding SMT as a versatile chemical agent used extensively for its capacity to introduce methylthio groups into organic molecules. Industrially, SMT is manufactured through the reaction of methanethiol with sodium hydroxide or sodium metal. The quality and purity of SMT are paramount, especially when destined for high-value applications like drug synthesis, as impurities can significantly affect reaction yields and final product specifications. Major applications span the synthesis of fungicides, herbicides, specific veterinary medicines, and critical pharmaceutical intermediates. For instance, it is a precursor in synthesizing methionine and certain heterocyclic compounds essential for therapeutic drugs. The demand profile is highly inelastic in specialized applications, ensuring steady revenue streams driven by regulatory approval cycles of end-products.

The core benefits of utilizing Sodium Methanethiolate lie in its efficiency as a methylation and thiolation agent, offering high selectivity under controlled reaction conditions, which minimizes undesirable side reactions common with other sulfur reagents. This selectivity aids in increasing the yield and purity of complex organic molecules, reducing processing costs, and improving manufacturing efficiency for high-end chemicals. Driving factors propelling market expansion include the exponential growth in global demand for advanced agrochemicals required to enhance crop yield amidst diminishing arable land, alongside the continuous innovation and increasing R&D investment within the pharmaceutical sector for new drug discovery and generic manufacturing, both of which rely heavily on specialized sulfur-containing intermediates like SMT. Furthermore, technological advancements in synthetic chemistry allowing safer handling and transportation of SMT solutions are also contributing significantly to market accessibility and growth potential across various geographies, particularly in Asia Pacific where manufacturing output is rapidly increasing.

Sodium Methanethiolate Market Executive Summary

The Sodium Methanethiolate market is experiencing robust expansion driven primarily by structural shifts in global manufacturing toward specialized chemicals and increasing focus on high-efficiency, targeted agrochemicals. Business Trends indicate a consolidation among key producers focused on vertical integration, ensuring stable sourcing of raw materials like methanethiol, while also emphasizing high-purity grades required by stringent pharmaceutical manufacturing standards (cGMP). There is a notable trend towards adopting safer handling technologies and solvent-free reaction techniques to mitigate environmental and safety risks associated with methanethiol derivatives. Companies are increasingly investing in continuous flow reactors to enhance safety and throughput, moving away from traditional batch processes for bulk chemical production.

Regional Trends show that the Asia Pacific (APAC) region, spearheaded by China and India, dominates the volume segment of the market due to massive agrochemical production capacity and competitive manufacturing costs. However, North America and Europe retain leadership in the value segment, driven by the strong presence of major pharmaceutical innovators and a higher demand for premium, customized SMT solutions used in patented drug synthesis. Regulatory landscapes in developed regions, while posing compliance challenges, also ensure a demand floor for high-quality, traceable SMT products, stimulating innovation in cleaner synthesis methods. Conversely, market growth in Latin America and the Middle East & Africa (MEA) is accelerating, fueled by expanding agricultural sectors and increased local pharmaceutical manufacturing initiatives.

Segmentation trends highlight the increasing dominance of the high-purity grade segment, particularly within the application category of pharmaceuticals and fine chemicals, demanding stricter quality control and lower impurity profiles. The Agrochemicals segment remains the largest volume consumer, utilizing standard-grade SMT for large-scale production of herbicides and insecticides. Within segments, end-user demand is polarizing: bulk manufacturers seek cost efficiency and large-scale supply contracts, while specialty manufacturers prioritize supplier reliability, technical support, and strict batch-to-batch consistency. This dual demand structure necessitates that market participants offer diversified product portfolios, ranging from high-concentration aqueous solutions to customized anhydrous forms, optimizing delivery logistics based on end-user requirements and regulatory restrictions.

AI Impact Analysis on Sodium Methanethiolate Market

User queries regarding AI's influence on the Sodium Methanethiolate market primarily revolve around how computational efficiency can accelerate drug and agrochemical discovery utilizing SMT, questions concerning predictive maintenance for complex chemical reactors handling corrosive and high-pressure reactions, and the optimization of supply chain logistics for hazardous materials. Users are highly interested in AI-driven tools that minimize the production of toxic byproducts and enhance the overall sustainability of organosulfur chemistry. The consensus theme is that while SMT production itself is highly traditional, its application domains—drug and crop protection R&D—are being fundamentally transformed, thereby changing the demand requirements for SMT specifications, delivery timelines, and associated technical documentation. There is significant expectation that AI will help mitigate the inherent risks of working with methanethiol derivatives by improving process control and safety protocols, offering predictive insights into potential reactor failures or off-spec material generation.

- AI-enhanced synthetic route planning accelerates the identification of optimal chemical pathways utilizing SMT, reducing discovery time for novel agrochemicals and pharmaceuticals.

- Machine learning algorithms optimize reaction parameters (temperature, pressure, catalyst load) in SMT production, leading to higher yields and reduced energy consumption.

- Predictive maintenance models for high-pressure and corrosion-prone chemical reactors minimize downtime and enhance the safety profile of SMT manufacturing facilities.

- AI-driven supply chain optimization forecasts demand fluctuations more accurately, improving inventory management for volatile raw materials and ensuring just-in-time delivery of SMT to end-users.

- Computational chemistry simulations, powered by AI, model the behavior of SMT in biological systems, aiding in the design of more effective and safer drug candidates.

- Automated quality control systems use computer vision and spectroscopy analysis to rapidly verify the purity of pharmaceutical-grade SMT batches, far exceeding manual capabilities.

- AI assists in navigating complex global chemical regulations by rapidly cross-referencing material safety data and regional restrictions for the transport and storage of SMT.

- Robotics and autonomous systems, guided by AI, are being implemented for the handling and sampling of hazardous SMT solutions, improving worker safety and precision.

DRO & Impact Forces Of Sodium Methanethiolate Market

The Sodium Methanethiolate market dynamics are dictated by a balanced interplay of strong industry drivers, significant regulatory and logistical restraints, and emerging opportunities in specialized synthesis, all coalescing to define the direction of market expansion. The primary drivers include the consistent global growth of the population, which mandates increased efficiency in agriculture leading to higher utilization of selective, advanced agrochemicals that rely on SMT intermediates. Additionally, the flourishing pharmaceutical sector, particularly the focus on new molecular entities (NMEs) and the rapid expansion of generic drug manufacturing in Asia, provides a foundational demand structure for high-purity SMT. These factors are reinforced by the chemical's irreplaceable functional role as a specialized reagent in thiolation reactions, where substitutes are often less efficient or more costly to implement.

Conversely, the market faces considerable restraints rooted primarily in the inherent characteristics of methanethiol chemistry. Sodium Methanethiolate, being a derivative of methanethiol, presents significant challenges related to handling, storage, and transportation due to its potent, noxious odor, toxicity, and flammability. Strict environmental, health, and safety (EHS) regulations globally, especially those governing the emission of sulfur compounds, impose high compliance costs on manufacturers, limiting market entry for smaller players and requiring substantial investment in enclosed systems and scrubber technology. Furthermore, the volatility in the prices and supply of key precursors, such as methanol and sulfur sources, introduces an element of unpredictability in manufacturing costs, pressuring profit margins for commodity-grade producers.

Opportunities for growth are concentrated in the development of cleaner, greener synthesis routes for SMT, utilizing biocatalysis or continuous flow chemistry to minimize waste and enhance safety, addressing key regulatory pressures. The rise of tailored medicine and specialized chemistry demands high-value, low-volume SMT derivatives and customized solutions, offering premium pricing potential compared to bulk commodity chemicals. The expanding focus on research in niche applications, such as specialized materials science and polymer chemistry where organosulfur compounds impart unique properties, also opens new avenues for market penetration. These impact forces—ranging from essential end-user demand (drivers) to high regulatory hurdles (restraints) and technological advancements (opportunities)—collectively shape the competitive landscape and guide strategic investment decisions, emphasizing quality, safety, and supply chain robustness as paramount factors for sustained market leadership.

Segmentation Analysis

The Sodium Methanethiolate market segmentation provides a detailed framework for understanding the diverse applications and product specifications demanded by various end-use industries. Segmentation is primarily based on Product Purity Grade (crucial for distinguishing between pharmaceutical and industrial usage), Application (defining the end-use sector), and Region (identifying major consumption and production hubs). This structural breakdown allows market participants to tailor their marketing and operational strategies, focusing on specific segments where their technological expertise or cost advantage provides a competitive edge. The complexity of the chemical compound and its sensitive nature necessitate stringent quality control, making the Purity Grade a defining characteristic for market valuation.

The Application segmentation highlights the reliance of the agrochemical sector for volume demand, primarily in the synthesis of fungicides and herbicides like thiodicarb and certain triazole derivatives. In contrast, the Pharmaceutical segment, though consuming lower volume, commands significantly higher pricing due to the necessity of high-purity, traceable materials mandated by regulatory bodies like the FDA and EMA for human medicinal products. The specialty chemical segment includes diverse uses in materials science, catalysts, and unique chemical processes, offering steady growth potential driven by specialized R&D. Analyzing these segments reveals a market bifurcated into a high-volume, low-margin segment (agrochemicals) and a low-volume, high-margin segment (pharmaceuticals), dictating distinct supply chain requirements and manufacturing protocols for each type of producer.

- By Purity Grade:

- Standard Grade (Industrial/Agrochemical Use)

- High Purity Grade (Pharmaceutical/Fine Chemical Use)

- By Form:

- Aqueous Solution

- Solid/Anhydrous Powder

- Solution in Organic Solvents

- By Application:

- Agrochemicals (Herbicides, Fungicides, Insecticides)

- Pharmaceuticals (Intermediates, APIs)

- Specialty Chemicals and Materials (Catalyst Preparation, Polymer Modifiers)

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East & Africa (MEA)

Value Chain Analysis For Sodium Methanethiolate Market

The value chain for the Sodium Methanethiolate market is fundamentally organized around the processing of basic raw materials into highly specialized chemical intermediates. Upstream analysis focuses heavily on the procurement and handling of critical raw materials: Methanethiol (the most hazardous component, requiring specialized logistics and storage) and Sodium Hydroxide (or Sodium Metal). Reliability and cost-effectiveness at the upstream stage are crucial, as fluctuations in natural gas prices (a primary feedstock for Methanethiol production) directly influence the final cost of SMT. Major chemical producers often integrate backward to control the production of Methanethiol, mitigating supply chain risks and ensuring quality consistency, a necessity for subsequent high-purity synthesis steps. Specialized manufacturers focus on the chemical reaction process, which requires specialized, corrosion-resistant equipment and rigorous safety protocols due to the toxic nature of the reactants.

The midstream involves the core manufacturing process of SMT, including synthesis, purification, stabilization, and formulation (e.g., creating specific concentrations of aqueous or organic solutions). This stage is capital-intensive, driven by the need for advanced containment technologies and process control systems to manage hazardous waste streams and maintain high purity levels, especially for pharmaceutical grades. The market structure here is highly consolidated, with a few global players dominating due to the steep regulatory barriers and technical expertise required. Packaging and transportation also form a critical midstream component, demanding specialized containers (DOT/ADR compliant) and carriers certified for handling Class 2.3 toxic gases and related chemical derivatives, significantly adding to the operational costs.

Downstream analysis centers on the utilization of SMT by end-user industries. The distribution channel is bifurcated: Direct sales are common for large pharmaceutical and major agrochemical companies that require bulk, tailored contracts and direct technical support. Indirect distribution utilizes specialized chemical distributors who manage warehousing and localized supply for smaller fine chemical producers and research institutions. The final end-users, such as major drug formulation plants or large agrochemical mixing facilities, integrate SMT as a functional component into their proprietary synthesis processes. The value added at the downstream stage is realized through the successful incorporation of SMT into high-value final products, confirming the essential role of this intermediate. Overall, the value chain emphasizes stringent regulatory compliance and robust logistical infrastructure as key determinants of profitability, connecting volatile raw material supply to highly demanding specialty application markets.

Sodium Methanethiolate Market Potential Customers

Potential customers for Sodium Methanethiolate are primarily large-scale chemical synthesis operators across three major industrial verticals: pharmaceuticals, agrochemicals, and specialized fine chemicals. In the pharmaceutical sector, key buyers include major multinational pharmaceutical companies and large Contract Manufacturing Organizations (CMOs) that utilize SMT as a vital building block for active pharmaceutical ingredients (APIs), particularly those containing sulfhydryl groups or methylthio linkages, essential in anti-infectives, antivirals, and certain oncological drugs. These customers prioritize high purity (98%+) and strict adherence to cGMP standards, requiring comprehensive certification and batch traceability from their SMT suppliers. Their procurement is highly centralized and governed by long-term supply agreements ensuring quality consistency over the lifecycle of a patented drug or generic manufacturing process.

The agrochemical industry represents the largest volume segment of SMT consumption. Buyers include global leaders in crop protection chemicals, such as Bayer, Syngenta, and Corteva, which need large quantities of standard-grade SMT for the synthesis of popular herbicides (e.g., selective weed killers) and fungicides (e.g., compounds targeting specific fungal strains). These customers focus heavily on competitive pricing, large-batch reliability, and efficient logistics for bulk deliveries, often negotiating annual supply tenders. The demand here is cyclical, heavily influenced by agricultural seasons and regulatory approvals for new pesticide formulations, necessitating flexible manufacturing capacity from SMT producers.

Lastly, the specialty chemicals and materials sector forms a crucial, albeit diverse, customer base. This includes manufacturers specializing in polymer additives, unique catalysts for polymerization reactions, and odorants for natural gas (although less common than other thiols, SMT derivatives are sometimes used). These buyers often require SMT in smaller, customized forms, such as specific concentrations in specialized solvents, to meet niche application needs. Research and development laboratories, both academic and industrial, also constitute a smaller but consistently demanding customer group, requiring technical-grade SMT for experimental synthesis and process development, reflecting the continuous innovation required in organosulfur chemistry.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 185.5 Million |

| Market Forecast in 2033 | USD 275.9 Million |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Lonza, Albemarle, Merck KGaA, Loba Chemie, TCI, Santa Cruz Biotechnology, BASF, Eastman Chemical, Chevron Phillips Chemical, WeylChem, Mitsubishi Chemical, Sumitomo Chemical, Lanxess, Hangzhou Dayang Chemical, Shanghai Aladdin Biochemical, Tokyo Chemical Industry (TCI), Arkema S.A., Shandong Luyue Chemical, Nanjing Chemlin Chemical Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Sodium Methanethiolate Market Key Technology Landscape

The technology landscape for the Sodium Methanethiolate market is heavily influenced by the need for enhanced safety, efficiency, and environmental compliance, moving away from historical, high-risk batch processes. A primary technological focus involves the implementation of highly contained, closed-loop systems for the synthesis and handling of methanethiol (the precursor), ensuring minimal atmospheric release of hazardous sulfur compounds. Modern manufacturing facilities utilize advanced scrubbing technology and thermal oxidizers to effectively manage fugitive emissions, thereby meeting increasingly stringent global air quality standards. Process control technology, incorporating real-time monitoring of temperature, pressure, and pH, is crucial for optimizing reaction yield and preventing dangerous runaway reactions inherent in thiol chemistry. Furthermore, specialized inert gas blanketing systems are utilized during storage and transfer to maintain product stability and enhance operational safety.

A significant trend in modern chemical manufacturing impacting SMT is the adoption of continuous flow chemistry (CFC). Unlike traditional batch reactors which pose high risks when dealing with highly exothermic or sensitive reactions like SMT synthesis, CFC allows for precise control over reaction kinetics in smaller volumes, significantly improving safety parameters and product consistency. This technology facilitates rapid scale-up and reduces the overall footprint of the production unit. For high-purity SMT destined for pharmaceuticals, ultra-purification technologies, including fractional distillation and advanced crystallization techniques, are employed to remove residual solvents, heavy metals, and unreacted precursors, ensuring the final product meets rigorous pharmacological standards. Innovation also extends to the development of safer delivery methods, such as utilizing microencapsulation or producing stabilized, high-concentration solutions that are less volatile and easier to transport and dose.

Furthermore, research into catalytic methods represents a long-term strategic technology area. Developing more selective and efficient catalysts for the introduction of sulfur-containing groups reduces the need for stoichiometric amounts of highly reactive SMT, contributing to sustainability and cost reduction in downstream applications. The integration of advanced computational fluid dynamics (CFD) modeling helps in designing more efficient reactor geometries and optimizing mixing parameters, especially relevant when dealing with multi-phase reactions involving SMT solutions. Finally, the move towards digitalization and Industry 4.0 principles, integrating sensors and IoT devices across the manufacturing pipeline, enables better data collection, predictive quality assurance, and automated regulatory compliance reporting, essential for maintaining global market competitiveness and operational excellence in this specialized chemical sector.

Regional Highlights

- Asia Pacific (APAC): APAC stands as the dominant region in terms of production volume and the fastest-growing market globally, primarily driven by China and India. This rapid growth is underpinned by large-scale, cost-competitive manufacturing capabilities, particularly for agrochemical intermediates. The region benefits from lower operational overheads and government support for chemical industrial parks. However, the quality gap between industrial-grade SMT (high volume) and pharmaceutical-grade SMT (lower volume) remains a key distinguishing factor. Increasing domestic consumption of pharmaceuticals in populous countries further fuels localized high-purity SMT demand.

- North America: North America, led by the United States, represents a high-value market segment. Demand is heavily concentrated in the specialty chemical and innovative pharmaceutical sectors, focusing on high-purity and customized SMT solutions. Stringent environmental regulations and high labor costs necessitate reliance on automated production and advanced process technologies (like continuous flow), often resulting in premium pricing. Key demand drivers include active R&D in new drug discovery and a mature, sophisticated agrochemical market demanding specialized, selective molecules.

- Europe: Similar to North America, Europe is characterized by a strong emphasis on high-quality and sustainable production practices, heavily influenced by REACH regulations. The market is primarily value-driven, catering to leading fine chemical manufacturers and established pharmaceutical hubs in countries like Germany, Switzerland, and Ireland. Innovation focus lies in green chemistry routes for SMT synthesis and sophisticated waste management. Demand growth is steady, supported by consistent investment in proprietary chemistry and the rigorous requirements of European medicinal agencies.

- Latin America (LATAM): LATAM is an emerging market with significant potential, tied directly to the expansion of its agricultural output, particularly in Brazil and Argentina. Demand for SMT is predominantly driven by the need for bulk agrochemicals to support large-scale commodity crops (soy, corn). Local manufacturing is growing, reducing reliance on imports, although high-purity materials are still often sourced from North America or Europe. Market expansion is sensitive to regional economic stability and shifts in commodity crop prices.

- Middle East & Africa (MEA): The MEA region represents the smallest current market share, with demand concentrated in specific areas like South Africa and the Gulf Cooperation Council (GCC) states. Growth is largely opportunistic, linked to infrastructure projects and nascent pharmaceutical manufacturing initiatives, particularly in addressing regional health challenges. Logistics and supply chain complexities remain significant challenges, with most SMT consumed being imported for local formulation activities, indicating potential for future localized production if chemical manufacturing investment continues.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Sodium Methanethiolate Market.- Lonza Group AG

- Albemarle Corporation

- Merck KGaA

- Loba Chemie Pvt. Ltd.

- Tokyo Chemical Industry Co., Ltd. (TCI)

- Santa Cruz Biotechnology, Inc.

- BASF SE (Indirect raw material supply and derivatives)

- Eastman Chemical Company

- Chevron Phillips Chemical Company LLC

- WeylChem Group of Companies

- Mitsubishi Chemical Corporation

- Sumitomo Chemical Co., Ltd.

- Lanxess AG

- Hangzhou Dayang Chemical Co., Ltd.

- Shanghai Aladdin Biochemical Polytron Technologies Ltd.

- Arkema S.A.

- Shandong Luyue Chemical Co., Ltd.

- Nanjing Chemlin Chemical Co., Ltd.

- Finorchem Limited

- Avantor Performance Materials, LLC

Frequently Asked Questions

Analyze common user questions about the Sodium Methanethiolate market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Sodium Methanethiolate primarily used for?

Sodium Methanethiolate (SMT) is primarily utilized as a versatile and reactive nucleophilic intermediate in complex organic synthesis, predominantly for manufacturing specialized agrochemicals, such as herbicides and fungicides, and high-value pharmaceutical active ingredients (APIs).

What are the key safety and environmental challenges in SMT production?

The main challenges involve managing the precursor, methanethiol, which is highly toxic, flammable, and possesses an extreme odor. Production requires closed-loop systems, advanced scrubbing technologies, and strict adherence to global Environmental, Health, and Safety (EHS) regulations to prevent emissions and manage hazardous waste streams efficiently.

How does the purity grade of Sodium Methanethiolate affect its market value?

Purity grade directly correlates with market value. High Purity Grade (typically 98%+), required for pharmaceutical synthesis and fine chemicals, commands a significant premium over Standard Grade SMT used in bulk agrochemical manufacturing, due to stricter quality control, certification, and lower tolerance for impurities.

Which geographical region dominates the volume consumption of SMT?

The Asia Pacific (APAC) region, driven by extensive agrochemical production capacity, particularly in China and India, dominates the global volume consumption of standard-grade Sodium Methanethiolate, reflecting the high demand from the massive regional agricultural sector.

What emerging technologies are influencing the future of SMT manufacturing?

The market is increasingly influenced by continuous flow chemistry (CFC) for safer, high-efficiency synthesis and the integration of AI and digitalization for predictive maintenance, process optimization, and enhanced regulatory compliance in handling hazardous organosulfur compounds.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager