Sodium PCA Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437628 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Sodium PCA Market Size

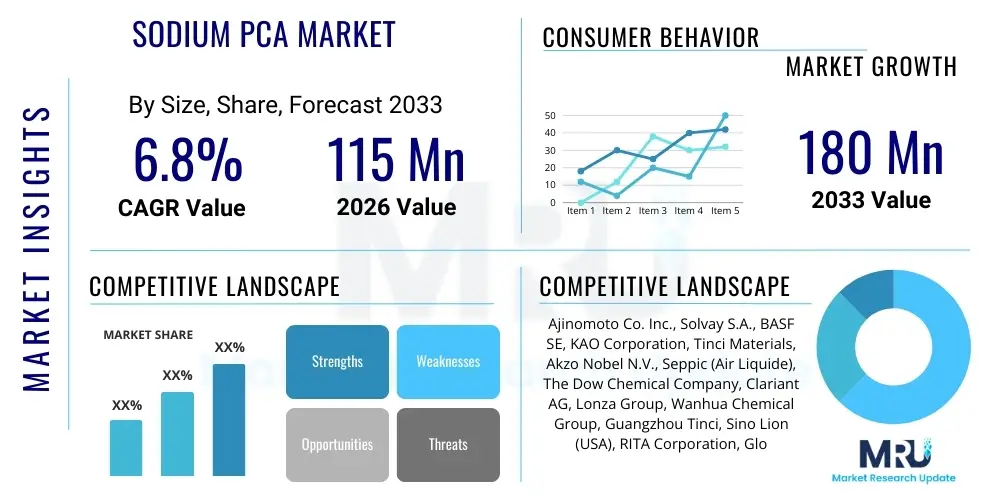

The Sodium PCA Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 115 Million in 2026 and is projected to reach USD 180 Million by the end of the forecast period in 2033.

Sodium PCA Market introduction

The Sodium PCA (Sodium Pyrrolidone Carboxylate) market encompasses the global trade and utilization of this naturally occurring derivative of amino acids, prominently used across the cosmetic and personal care industries. Functioning as a high-performance humectant, Sodium PCA is recognized for its superior moisturizing capabilities, effectively mimicking the Natural Moisturizing Factors (NMF) found in human skin. This intrinsic compatibility drives its widespread adoption in premium skincare and haircare formulations designed to combat dryness, enhance elasticity, and maintain barrier function. The primary applications span moisturizing creams, anti-aging serums, shampoos, and conditioners, catering to consumer demand for natural, high-efficacy ingredients.

The core benefits of Sodium PCA include exceptional hydration retention, non-irritating nature, and its role in reinforcing the skin's lipid barrier, distinguishing it from synthetic alternatives. Its versatility allows formulators to use it across various pH levels and product types. Major driving factors propelling the market include the burgeoning consumer awareness regarding skin health and hydration, the trend toward clean label ingredients derived from natural sources (often derived from glutamic acid), and the robust growth of the global anti-aging product segment where moisturizing agents are fundamental components for product success and claim validation.

Sodium PCA Market Executive Summary

The Sodium PCA market demonstrates strong resilience and growth, underpinned by significant shifts in consumer preferences favoring functional, safe, and naturally-derived ingredients. Business trends indicate a focus on process optimization, particularly in fermentation and synthesis methods, aimed at improving purity grades and reducing production costs to meet escalating demand from emerging economies. Companies are strategically investing in capacity expansion and backward integration to secure raw material supply, especially concerning glutamic acid sources. Furthermore, strategic alliances between ingredient suppliers and large cosmetic manufacturers are crucial for developing specialized, high-concentration applications and accelerating time-to-market for innovative personal care products.

Regionally, Asia Pacific (APAC) stands as the dominant growth engine, driven by massive consumption in China, India, and South Korea, coupled with rapidly expanding domestic cosmetic manufacturing bases and high demand for anti-pollution skincare solutions. North America and Europe, while mature, exhibit steady growth fueled by the premiumization trend and stringent regulatory mandates encouraging the use of biocompatible ingredients. Segment trends highlight the dominance of the cosmetics and skincare application segment, where Sodium PCA is integral to moisturizing product lines. The liquid form segment maintains market leadership due to ease of incorporation into aqueous formulations, although the powdered form is gaining traction for high-concentration dry blends and shipment efficiency, catering to specialized industrial uses and export markets.

AI Impact Analysis on Sodium PCA Market

Common user questions regarding AI's impact on the Sodium PCA market center primarily on three areas: optimizing ingredient formulation, enhancing supply chain transparency, and predicting consumer acceptance of new products containing novel moisturizing complexes. Users are concerned about whether AI can accelerate the discovery of better delivery systems for Sodium PCA and how it can help manage the volatility associated with raw material sourcing. Key themes revolve around leveraging machine learning for personalized skincare recommendations (where Sodium PCA acts as a foundational hydrating agent) and using predictive analytics to optimize inventory management, ensuring a stable supply in the face of fluctuating global trade conditions.

The implementation of Artificial Intelligence (AI) tools fundamentally transforms ingredient R&D and supply chain dynamics within the Sodium PCA market. AI algorithms are increasingly employed to analyze complex biological data related to skin hydration mechanisms, enabling formulators to precisely tailor concentrations of Sodium PCA for maximal efficacy and compatibility with other active ingredients. This data-driven approach significantly reduces the time and cost associated with traditional trial-and-error product development. Furthermore, AI-powered demand forecasting provides sophisticated insights into market consumption patterns, allowing suppliers to proactively manage manufacturing schedules and inventory levels, thereby mitigating risks of stockouts or oversupply, ultimately stabilizing pricing and availability across the highly competitive personal care sector.

- AI-driven optimization of Sodium PCA synthesis processes, leading to higher purity and yield.

- Predictive modeling of consumer trends, informing cosmetic brands on optimal concentrations for new product launches.

- Enhanced supply chain visibility and risk management using machine learning for global sourcing of glutamic acid precursors.

- Personalized skincare formulation algorithms recommending customized Sodium PCA concentrations based on user skin profiles and environmental data.

- Automated quality control systems utilizing computer vision to ensure consistency in the physical characteristics of the manufactured Sodium PCA product.

DRO & Impact Forces Of Sodium PCA Market

The Sodium PCA market is highly influenced by a convergence of intrinsic growth drivers, manageable restraints, and substantial market opportunities, all shaped by overarching impact forces. The primary drivers are the escalating global demand for effective moisturizing and anti-aging products, coupled with the consumer shift towards naturally-derived, biocompatible ingredients. Restraints primarily involve the high cost associated with producing high-purity, cosmetic-grade Sodium PCA, especially when derived through fermentation processes, and the presence of cost-effective, albeit less efficacious, synthetic humectant alternatives such as Glycerin. However, the market is rife with opportunities stemming from the potential expansion into pharmaceutical applications, particularly dermatological treatments, and the untapped potential in developing nations with rapidly modernizing beauty standards.

Impact forces actively shaping this market include stringent regulatory frameworks in regions like the EU and North America emphasizing ingredient safety and origin transparency, which inherently favors the well-documented profile of Sodium PCA. Furthermore, technological innovation in green chemistry and biotechnology is crucial, enabling more sustainable and efficient production methods. The balance between consumer preferences for natural ingredients and the need for cost-effective mass production defines the competitive landscape. If the drivers (such as clean label trends) outweigh the restraints (such as production costs), the overall market trajectory remains robustly positive throughout the forecast period, leveraging the positive impact force of increasing disposable income in key developing markets.

Segmentation Analysis

The Sodium PCA market is comprehensively segmented based on its Purity Grade, Formulation (Form), and diverse End-Use Applications, providing a granular view of market dynamics and commercial viability across various industrial sectors. This segmentation allows for precise market sizing and strategic targeting, reflecting differences in pricing, regulatory compliance, and performance requirements specific to each category. The purity grade dictates the suitability for highly sensitive applications, such as medical-grade cosmetics, while the form (liquid versus powder) influences manufacturing processes and logistics for end-user companies. Application segmentation highlights the dominance of personal care but also points toward niche growth areas in pharmaceuticals and specialized industrial lubricants, where Sodium PCA's stability and moisturizing properties are valuable assets.

The market structure is highly dependent on the intersection of these segments. For instance, high-purity liquid Sodium PCA is predominantly consumed by high-end cosmetic manufacturers in North America and Europe, demanding stringent quality standards and easy integration into water-based serums. Conversely, standard-grade Sodium PCA powder finds application in price-sensitive markets or in solid formats like bath bombs or pressed powders, offering logistical benefits through reduced weight and volume during international shipping. Understanding these cross-segment dynamics is essential for market participants seeking competitive advantages through product differentiation and focused market penetration strategies.

- By Purity Grade: Cosmetic Grade, Pharmaceutical Grade, Industrial Grade

- By Form: Liquid, Powder

- By Application: Skin Care, Hair Care, Cosmetics, Pharmaceuticals, Others (Industrial)

Value Chain Analysis For Sodium PCA Market

The value chain for the Sodium PCA market begins with the upstream sourcing and processing of raw materials, primarily glutamic acid, often derived through fermentation of carbohydrate sources like molasses or starch. Key upstream activities involve high-purity fermentation, isolation, and initial refinement of the precursor, followed by the specific chemical synthesis process to convert the L-Glutamic acid into PCA (Pyrrolidone Carboxylic Acid) and finally neutralizing it to form Sodium PCA. Efficiency in this stage, particularly minimizing waste and optimizing conversion yield, directly impacts the final product cost and environmental footprint. Major suppliers of glutamic acid and specialized chemical synthesis providers form the core of the upstream segment, demanding high technical expertise and quality control.

Midstream processing involves specialized chemical manufacturers who perform the final purification, quality testing, and formulation of Sodium PCA into cosmetic or pharmaceutical grade specifications, adjusting for liquid or powder forms. Distribution channels are bifurcated into direct and indirect routes. Direct sales typically involve large-volume transactions between the manufacturer and multinational cosmetic giants, ensuring strict confidentiality and customized supply agreements. The indirect route utilizes an extensive network of regional chemical distributors and specialized ingredient traders who provide localized inventory, technical support, and smaller batch sizes to small and medium-sized cosmetic enterprises (SMEs).

Downstream activities center on the end-use formulators and manufacturers in the personal care, cosmetic, and pharmaceutical industries, where Sodium PCA is incorporated as a functional active ingredient. The efficiency of the distribution network is crucial here, as timely delivery and technical documentation (certifications, safety data sheets) are paramount for the continuity of the downstream manufacturing process. The final step involves retail and consumer sales, where product labeling and marketing play a vital role in educating consumers about the moisturizing benefits derived from Sodium PCA. The complexity of the value chain necessitates tight integration and collaboration between raw material providers and end-product manufacturers to maintain quality control from source to consumer.

Sodium PCA Market Potential Customers

The primary customer base for Sodium PCA consists of entities across the personal care and pharmaceutical manufacturing sectors who seek high-efficacy, biocompatible humectants for their product formulations. Within the personal care domain, this includes large multinational corporations specializing in mass-market and luxury skincare (creams, lotions, serums), hair care (shampoos, conditioners, styling products), and color cosmetics (foundations, primers). These large-scale buyers prioritize consistency in purity grade, supply reliability, and competitive pricing, often demanding Pharmaceutical or high-end Cosmetic Grade Sodium PCA to meet internal quality benchmarks and regulatory requirements in developed markets like the EU and Japan.

Secondary but rapidly growing customer segments include specialized manufacturers of derma-cosmetics and clinical skincare lines. These buyers require the highest purity levels (Pharmaceutical Grade) for products targeting sensitive skin conditions, often partnering with dermatologists for product validation and endorsements. Furthermore, nutraceutical companies and, to a lesser extent, industrial chemical users (for specialized anti-static or moisturizing agents in materials science) represent niche, yet valuable, customer groups. The expanding B2C artisanal and clean-beauty market also provides fertile ground for smaller customers seeking ethically sourced, natural ingredients, often relying on specialized distributors for flexible supply chains and small-volume purchasing options.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 115 Million |

| Market Forecast in 2033 | USD 180 Million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Ajinomoto Co. Inc., Solvay S.A., BASF SE, KAO Corporation, Tinci Materials, Akzo Nobel N.V., Seppic (Air Liquide), The Dow Chemical Company, Clariant AG, Lonza Group, Wanhua Chemical Group, Guangzhou Tinci, Sino Lion (USA), RITA Corporation, Global Seven Inc., Alfa Chemistry, Spectrum Chemical Manufacturing Corp., MakingCosmetics Inc., Liyuan Chemical, Chemsino. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Sodium PCA Market Key Technology Landscape

The technological landscape of the Sodium PCA market is fundamentally driven by advancements in biotechnology, specifically focused on enhancing the purity and sustainability of the production process. The primary method involves the conversion of L-Glutamic acid (often generated through microbial fermentation) into Pyrrolidone Carboxylic Acid (PCA) and subsequent neutralization. Key technological innovations center around optimizing the fermentation strains and conditions to maximize glutamic acid yield and reduce residual impurities, thus ensuring compliance with stringent cosmetic and pharmaceutical standards. Furthermore, continuous process manufacturing and membrane separation technologies are being integrated to improve separation efficiency and lower energy consumption compared to traditional batch synthesis methods, resulting in a more cost-competitive final product.

A secondary area of technological focus involves formulation science and delivery systems. Advances in nano-encapsulation and liposomal technology are being applied to Sodium PCA to enhance its stability and penetration efficacy within topical formulations. These advanced delivery systems ensure that the humectant properties are released slowly and effectively into the deeper epidermal layers, maximizing hydration benefits and extending the product's functional lifespan. Research and development efforts are also concentrated on creating highly synergistic blends of Sodium PCA with other NMF components (such as ceramides and hyaluronic acid) to create patented moisturizing complexes that offer superior clinical performance and strong marketing claims for finished goods manufacturers, driving premiumization within the beauty industry.

Regional Highlights

Geographically, the Sodium PCA market exhibits distinct consumption patterns and growth trajectories across major global regions. Asia Pacific (APAC) holds the dominant market share and is projected to demonstrate the fastest growth rate during the forecast period. This dominance is attributed to several key factors: the presence of burgeoning, large populations with increasing disposable income, a strong cultural emphasis on skincare, particularly in nations like South Korea and Japan which are global leaders in cosmetic innovation, and the rapid expansion of domestic manufacturing capabilities in China and India. The high environmental stress (pollution, extreme weather) prevalent in many APAC urban centers further drives the demand for barrier-repair and high-hydration products containing Sodium PCA.

North America and Europe represent mature markets characterized by high product quality expectations, stringent regulatory oversight (favoring natural and safe ingredients), and a strong preference for premium and high-performance anti-aging products. In these regions, market growth is primarily fueled by product innovation, the clean beauty movement, and the increasing adoption of multifunctional cosmetic formulations. Manufacturers in Europe, guided by REACH regulations, focus heavily on supply chain transparency and sustainable sourcing of Sodium PCA precursors. Meanwhile, Latin America (LATAM) and the Middle East & Africa (MEA) are emerging regions offering significant untapped potential, driven by urbanization and the growing influence of Western beauty standards, leading to a gradual but steady increase in demand for advanced personal care ingredients.

- Asia Pacific (APAC): Dominant market share; highest growth due to massive consumer base, proliferation of local cosmetic brands, and high demand for specialized hydrating and anti-pollution formulations in countries like China, India, and South Korea.

- North America: Mature market focusing on premiumization, clean beauty trends, and high adoption rates in professional and medical-grade skincare segments, with strong regulatory emphasis on ingredient safety.

- Europe: Characterized by strict adherence to sustainable sourcing and high-quality standards (driven by EU regulations); steady demand concentrated in anti-aging and natural cosmetic lines, particularly in Germany and France.

- Latin America (LATAM): Emerging market with growth spurred by increasing middle-class income and rising awareness of personal grooming and skin health, driving initial adoption of performance ingredients.

- Middle East & Africa (MEA): Growth potential centered on major urban centers (GCC countries and South Africa); driven by luxury cosmetics and specific needs related to desert climates requiring intense hydration solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Sodium PCA Market.- Ajinomoto Co. Inc.

- Solvay S.A.

- BASF SE

- KAO Corporation

- Tinci Materials

- Akzo Nobel N.V.

- Seppic (Air Liquide)

- The Dow Chemical Company

- Clariant AG

- Lonza Group

- Wanhua Chemical Group

- Guangzhou Tinci

- Sino Lion (USA)

- RITA Corporation

- Global Seven Inc.

- Alfa Chemistry

- Spectrum Chemical Manufacturing Corp.

- MakingCosmetics Inc.

- Liyuan Chemical

- Chemsino

Frequently Asked Questions

Analyze common user questions about the Sodium PCA market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Sodium PCA and how does it function in skincare?

Sodium PCA (Sodium Pyrrolidone Carboxylate) is a naturally occurring humectant and a critical component of the skin's Natural Moisturizing Factor (NMF). It functions by attracting and binding water molecules from the environment to the skin, significantly improving hydration, maintaining skin barrier integrity, and enhancing elasticity, making it highly effective for dry or aging skin formulations.

Which application segment accounts for the largest share in the Sodium PCA market?

The Skin Care application segment consistently holds the largest market share. Sodium PCA is widely used in high-performance moisturizing creams, lotions, and serums due to its superior efficacy as a humectant compared to traditional alternatives, aligning with global consumer trends toward intense hydration and anti-aging solutions.

Is Sodium PCA considered a natural or clean label ingredient?

Yes, Sodium PCA is generally considered a natural or naturally-derived ingredient. It is synthesized from L-Glutamic acid, an amino acid often sourced through the fermentation of renewable resources like sugar or starch. This origin strongly aligns with the growing clean beauty and green chemistry movements, favoring its adoption over synthetic alternatives.

What major factors are driving the growth of the Sodium PCA market, particularly in Asia Pacific?

The growth is primarily driven by the increasing consumer awareness of skin barrier function, the robust expansion of the anti-aging market globally, and the strong consumer demand for natural-source ingredients. In APAC, high population density, rising disposable incomes, and the sophisticated local cosmetic industry significantly accelerate market adoption.

How do the liquid and powder forms of Sodium PCA differ in terms of usage and market trend?

Liquid Sodium PCA is the traditional and dominant form, valued for its ease of incorporation into aqueous cosmetic formulations. Powder Sodium PCA, however, is gaining popularity due to logistics benefits (lower shipping weight) and its use in concentrated, dry or solid product formats, such as pressed powders or bath products, offering greater formulation flexibility for specialized applications.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager