Sodium Percarbonate Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437776 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Sodium Percarbonate Market Size

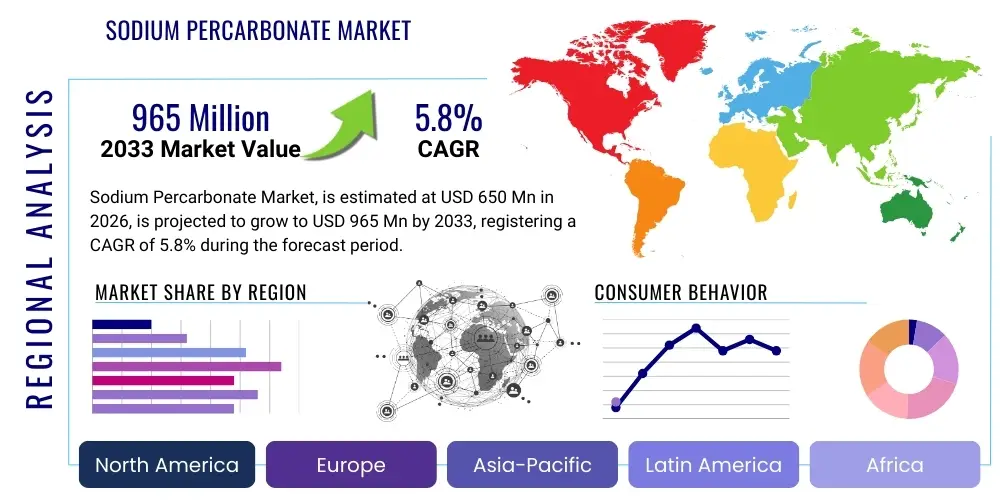

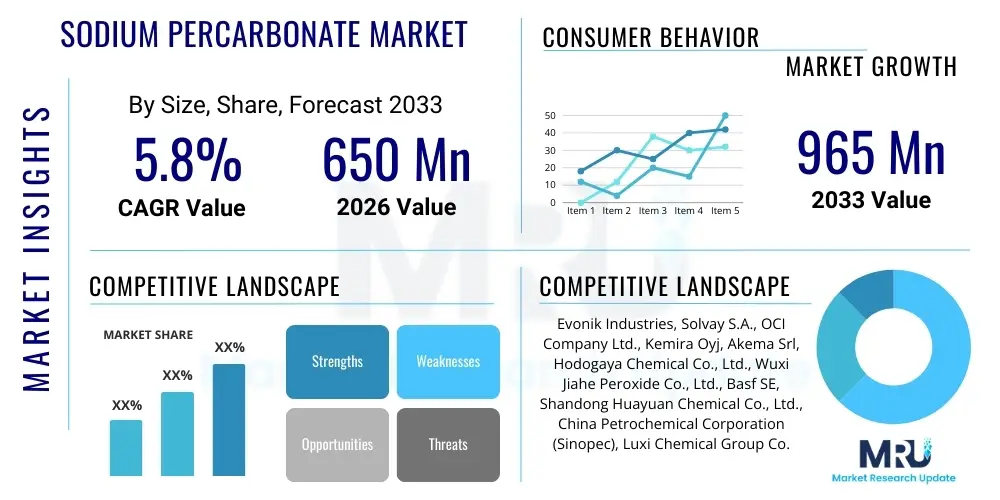

The Sodium Percarbonate Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 650 Million in 2026 and is projected to reach USD 965 Million by the end of the forecast period in 2033. This robust growth trajectory is primarily fueled by increasing demand for eco-friendly bleaching agents and the rapid expansion of the detergent industry globally, particularly in emerging economies where penetration of high-quality cleaning products is accelerating. Sodium percarbonate (SPC) offers a safer and more effective alternative to traditional chlorine-based bleaches, aligning with tightening environmental regulations and consumer preferences for sustainable chemical inputs.

Sodium Percarbonate Market introduction

Sodium Percarbonate (SPC) is an essential chemical compound, represented by the formula 2Na₂CO₃·3H₂O₂, which functions as a primary source of hydrogen peroxide when dissolved in water. It is synthesized through the crystallization of a solution containing sodium carbonate and hydrogen peroxide, resulting in a stable, granular solid. This compound is highly valued across multiple industrial sectors due to its strong oxidative properties, making it an excellent bleaching agent, stain remover, and disinfectant. Its stability in solid form and the release of harmless byproducts (water, oxygen, and sodium carbonate) upon reaction contribute significantly to its environmental appeal and widespread adoption in household and industrial formulations.

The major applications of Sodium Percarbonate span several large consumer goods and industrial sectors. In the household cleaning sphere, SPC is the active ingredient in non-chlorine bleaches, color-safe laundry detergents, and automatic dishwashing powders, where its ability to lift tough stains and sanitize surfaces is paramount. Beyond cleaning, SPC is critically important in industrial applications such as textile bleaching, paper and pulp manufacturing, and water treatment processes. The compound’s versatility allows it to replace more corrosive or environmentally harmful chemicals in these processes, driving demand as manufacturers globally pivot toward sustainable production methods and green chemistry principles to enhance corporate responsibility and comply with international standards.

The market growth is fundamentally driven by the rising consumer awareness regarding hygiene and cleanliness, especially post-pandemic, which has boosted the consumption of high-performance cleaning products. Furthermore, stringent regulatory scrutiny on toxic chlorine-based bleaches has created a massive opportunity for oxygen-based alternatives like Sodium Percarbonate. The benefits of using SPC include superior biodegradability, excellent storage stability, high performance in cold water, and safety when handling compared to liquid hydrogen peroxide or traditional bleaches. These factors, combined with continuous product innovation leading to improved coating technologies for moisture resistance, solidify SPC's position as a critical growth engine in the specialty chemicals market over the forecast period.

Sodium Percarbonate Market Executive Summary

The Sodium Percarbonate market is experiencing robust business trends characterized by strong vertical integration among key players aiming to secure raw material supply (sodium carbonate and hydrogen peroxide) and optimize production costs. The shift towards concentrated and waterless cleaning formulations is a significant trend, where high-density SPC is preferred for its smaller physical footprint and efficiency in formulation. Strategic alliances and mergers and acquisitions focusing on expanding geographical footprint, particularly into high-growth Asian markets, are defining the competitive landscape. Innovation in coating technologies—such as using sodium sulfate or silicates—to enhance SPC's shelf life and stability in humid environments remains a critical investment area, ensuring the product maintains performance integrity throughout its supply chain and consumer use phase.

Regional trends indicate that the Asia Pacific (APAC) region is poised to dominate market growth, driven by rapid urbanization, increasing disposable incomes, and the burgeoning consumer goods sector, especially in China and India. The penetration of modern, high-quality laundry and dishwashing products is accelerating in APAC, creating an immense volume demand for SPC as a functional additive. North America and Europe, while mature markets, maintain stable demand supported by strict environmental regulations favoring oxygen-based bleaches and sustained consumption of specialized cleaning products. Regulatory shifts, such as the European Union’s push for sustainable chemical usage, continue to reinforce the demand for environmentally benign alternatives, benefiting SPC manufacturers who meet stringent safety and environmental profiles.

Segment-wise, the cleaning and detergent application segment remains the largest revenue contributor, driven by the household laundry sector. However, the emerging demand from specialized sectors, such as water purification and environmental remediation, is demonstrating higher growth rates, indicating diversification of application areas. Segmentation by density shows that coated SPC (C-SPC) is gaining traction due to superior moisture stability required for complex formulations and storage in tropical climates, outpacing non-coated varieties in several premium segments. Pricing dynamics are sensitive to raw material costs, particularly energy and hydrogen peroxide prices, necessitating efficient supply chain management and forward purchasing strategies by major market participants to maintain competitive advantage.

AI Impact Analysis on Sodium Percarbonate Market

User inquiries regarding the intersection of AI and the Sodium Percarbonate market frequently revolve around themes of manufacturing efficiency, predictive maintenance, and optimizing supply chain logistics related to raw material procurement and hazardous chemical transport. Common questions explore how AI algorithms can improve the exothermic crystallization process during SPC synthesis to ensure purity and consistency, minimize waste, and predict equipment failure in large-scale production reactors. Users also seek information on how AI-driven demand forecasting impacts the highly seasonal demand patterns for cleaning products and the subsequent production schedules for SPC, crucial for maintaining optimal inventory levels without risking degradation due to storage time.

The integration of Artificial Intelligence primarily revolutionizes the operational efficiency of SPC manufacturing plants. AI models are deployed to analyze vast datasets collected from sensors on production lines, allowing for real-time adjustments to parameters such as temperature, concentration, and crystallization rates. This level of precision significantly reduces energy consumption and raw material wastage, directly improving the cost-competitiveness of SPC production. Furthermore, machine learning algorithms are utilized in Quality Control (QC) to rapidly detect minor inconsistencies in granularity or coating thickness, ensuring that the final product meets the stringent specifications required for premium detergent and industrial applications, thereby enhancing overall product reliability and customer satisfaction.

Beyond manufacturing, AI profoundly impacts the commercial and distribution aspects of the Sodium Percarbonate market. Predictive analytics driven by AI models allow producers to accurately forecast regional and seasonal demand fluctuations for end-products like laundry detergents and dishwashing tablets. This enhanced forecasting capability minimizes logistical bottlenecks, optimizes freight costs by scheduling shipments efficiently, and reduces the need for excessive safety stock which can be vulnerable to moisture degradation over long periods. In sustainability efforts, AI tools are beginning to analyze complex chemical waste streams and optimize water usage in production, further supporting the market's trajectory towards cleaner, more resource-efficient chemical manufacturing practices, aligning with AEO trends related to "Sustainable Chemical Production."

- AI optimizes manufacturing processes (e.g., crystallization) leading to enhanced product purity and reduced energy consumption.

- Predictive maintenance using AI minimizes downtime in large-scale SPC production facilities, ensuring continuous supply.

- Machine learning algorithms improve supply chain efficiency by accurately forecasting demand for household and industrial cleaners.

- AI assists in optimizing logistics and transport routes for sensitive chemical shipments, reducing risk and costs.

- Data analytics derived from AI support R&D in developing more stable and specialized SPC coating formulations.

DRO & Impact Forces Of Sodium Percarbonate Market

The Sodium Percarbonate market is propelled by key Drivers such as the increasing global emphasis on environmental safety, which favors oxygen-based bleaches over harmful chlorine alternatives. The rapid growth of the detergent and cleaning industry, especially in emerging economies, provides a massive consumption base. However, the market faces significant Restraints, including the sensitivity of SPC to moisture and heat, requiring specialized packaging and storage, which increases operational complexity and cost. Furthermore, volatility in the prices of key raw materials, namely hydrogen peroxide and soda ash (sodium carbonate), constantly pressures profit margins. Opportunities abound in developing highly stable, high-density granulated SPC specifically formulated for cold-water cleaning applications and expanding its utilization into novel sectors like specialized water treatment, agriculture, and high-performance industrial oxidation processes, offering diversification potential beyond the conventional consumer market.

The Impact Forces shaping this market are dynamic and multifaceted. The bargaining power of buyers is moderate to high, as SPC is largely a commodity chemical; however, for specialized, coated, and high-density variants, supplier differentiation increases, reducing buyer leverage. The bargaining power of suppliers is also significant, particularly for hydrogen peroxide, a critical and often highly concentrated input, where suppliers operate in an oligopolistic market structure. The threat of substitutes is primarily driven by alternative bleaching agents such as sodium hypochlorite (still widely used despite environmental concerns) and enzymes, although SPC offers a superior combination of efficacy and environmental profile for many applications. The intensity of competitive rivalry is high, with numerous global and regional players competing fiercely on price, quality consistency, and supply chain reliability, particularly in the high-volume APAC region.

Regulatory frameworks across North America and Europe act as a significant driving force, pushing manufacturers towards greener chemical profiles, which inherently favors SPC. Conversely, the high capital expenditure required for establishing and maintaining specialized, highly controlled production facilities—necessary to manage the inherent exothermic nature of the synthesis process and ensure product stability—acts as a significant barrier to entry for new competitors, thereby modulating competitive intensity. The overall market momentum is positive, driven by consumer preference for efficacy and sustainability, but constrained by the technical requirements of handling and storage, necessitating continuous investment in specialized logistics and advanced coating technologies to mitigate performance degradation risks throughout the long and complex global supply chains that characterize the detergent industry.

Segmentation Analysis

The Sodium Percarbonate market is comprehensively segmented based on its structural characteristics, application areas, and end-use sectors, providing detailed insights into specific demand pockets and growth trajectories. The primary segmentation by product type typically distinguishes between Coated Sodium Percarbonate (C-SPC) and Uncoated Sodium Percarbonate (U-SPC). C-SPC, favored for its enhanced stability against moisture and improved compatibility within complex detergent matrices, dominates the value-added segments, particularly in automatic dishwashing tablets and concentrated laundry powders. U-SPC, being less expensive, finds wider use in bulk, industrial applications or formulations where immediate dissolution is desired and moisture exposure is minimal. Understanding this segmentation is critical for producers aiming to maximize margins through specialized product offerings.

Further segmentation based on application reveals the dominance of the cleaning and detergent sector, encompassing laundry care, dishwashing, and general household cleaning, which accounts for the vast majority of volume consumed globally. However, niche applications such as water treatment, specialized agricultural uses (soil remediation, hydroponics sterilization), and chemical synthesis intermediates are exhibiting accelerated growth, driven by needs for powerful, yet safe, oxidizing agents. Geographic segmentation highlights the divergence in market maturity, with established markets like Western Europe focusing on premium, high-stability products, while rapidly developing markets in Asia Pacific prioritize volume and cost-effectiveness, defining regional competitive strategies and investment priorities. This detailed breakdown ensures targeted marketing and optimized operational scaling for manufacturers.

- By Type:

- Coated Sodium Percarbonate (C-SPC)

- Uncoated Sodium Percarbonate (U-SPC)

- By Application:

- Cleaning & Detergents (Laundry, Dishwashing, Household Cleaners)

- Pulp & Paper

- Textile Industry

- Water Treatment

- Chemical Synthesis (Intermediates and Oxidizers)

- Others (Agriculture, Soil Remediation)

- By End-User:

- Household Consumers

- Commercial & Industrial Laundries

- Chemical Manufacturers

- Water Treatment Facilities

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East & Africa (MEA)

Value Chain Analysis For Sodium Percarbonate Market

The value chain for the Sodium Percarbonate market begins with the procurement of key upstream raw materials: Sodium Carbonate (soda ash) and Hydrogen Peroxide. The stability and availability of these materials are crucial. Soda ash production is highly concentrated geographically and subject to significant logistics costs, while hydrogen peroxide requires complex storage and handling due to its hazardous nature. Major SPC manufacturers often invest in long-term contracts or strategic backward integration to mitigate price volatility and supply risks associated with these foundational inputs. The manufacturing phase involves a capital-intensive crystallization process, followed by critical drying and coating steps, where technology application dictates the final product quality, stability, and density, essential factors for market acceptance and differentiation.

Moving downstream, the distribution channel is highly specialized, requiring careful attention to warehousing and transportation conditions to prevent moisture exposure, which can degrade the product rapidly. SPC typically moves through a combination of direct sales to large, multinational detergent manufacturers and indirect channels involving specialized chemical distributors that cater to smaller industrial buyers, textile mills, and regional cleaning product formulators. Direct channels provide greater control over product quality and delivery scheduling, crucial for high-volume contracts, while indirect channels offer necessary regional penetration and reach to diversified end-users, especially in fragmented emerging markets, ensuring broad market coverage and efficient logistical deployment across various geographical terrains and regulatory environments.

The end-use market, comprising major detergent companies and industrial facilities, then incorporates SPC into finished consumer products or uses it directly in industrial processes. The demand profile at this stage is dictated by consumer trends towards 'green cleaning' and regulatory pressure to eliminate chlorine-based alternatives. Continuous innovation in formulation by downstream users, such as developing compact laundry pods or specialized industrial cleaning solutions, drives the need for high-performance, moisture-stable SPC variants. This downstream pull directly influences the upstream R&D investments in advanced coating technologies and specialized granular sizing, illustrating a robust feedback loop that ensures the market remains responsive to evolving consumer preferences and maintains the high standards required for integration into sophisticated cleaning matrices.

Sodium Percarbonate Market Potential Customers

The primary and largest segment of potential customers for Sodium Percarbonate lies within the Fast-Moving Consumer Goods (FMCG) sector, specifically multinational and local manufacturers of laundry and dishwashing detergents. These companies require vast quantities of high-purity, stable SPC to serve as the main oxygen bleaching agent in powdered detergents, stain removers, and the increasingly popular single-dose laundry capsules and automatic dishwashing tablets. The purchasing criteria for these major customers are stringent, focusing on consistency, solubility rates, optimal density, and crucially, competitive pricing linked to long-term supply agreements. Their need for specialized, highly stable coated SPC variants to ensure product integrity in complex formulations drives a significant portion of the market's technological demand.

A second major category of customers includes industrial end-users, such as the textile processing industry and the pulp and paper sector. Textile mills utilize SPC for environmentally friendly bleaching of cotton and natural fibers, seeking alternatives to traditional chlorine and ozone bleaching methods to meet sustainability certifications and reduce wastewater contamination. Similarly, paper manufacturers use SPC to brighten paper pulp, benefitting from its non-toxic byproducts compared to other chemical bleaching agents. These industrial buyers are highly sensitive to performance parameters, including bleach efficacy and compatibility with large-scale industrial machinery, and often rely on chemical distributors for specialized, tailored deliveries that meet specific batch processing needs and environmental compliance mandates.

Emerging potential customer segments include water treatment facilities and specialized agriculture suppliers. Water treatment plants are exploring SPC for oxidation of contaminants, disinfection, and sludge conditioning, leveraging its power as a safe, solid form of hydrogen peroxide, which simplifies handling and dosage control compared to liquid peroxides. In agriculture, potential customers use SPC for sterilizing irrigation systems and treating soil diseases, demanding high solubility and efficacy against pathogens. These newer markets represent significant growth potential, driven by regulatory support for non-toxic environmental applications and the ongoing search for effective, easy-to-handle solid oxidizers that can be deployed efficiently in geographically dispersed or remote operational settings.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 650 Million |

| Market Forecast in 2033 | USD 965 Million |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Evonik Industries, Solvay S.A., OCI Company Ltd., Kemira Oyj, Akema Srl, Hodogaya Chemical Co., Ltd., Wuxi Jiahe Peroxide Co., Ltd., Basf SE, Shandong Huayuan Chemical Co., Ltd., China Petrochemical Corporation (Sinopec), Luxi Chemical Group Co., Ltd., Gujarat Alkalies and Chemicals Ltd. (GACL), Wuxi Wanmi Chemical Co., Ltd., Inner Mongolia Likang Pharmaceutical Co., Ltd., Fubang Chemical Co., Ltd., Shanghai AiCai Chemical Co., Ltd., Jilin Chemical Industrial Co. Ltd., Jiangsu Huandian Chemical Group, Lianyungang Hongsheng Chemical Co., Ltd., and United Initiators GmbH. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Sodium Percarbonate Market Key Technology Landscape

The technological landscape of the Sodium Percarbonate market is dominated by advancements in crystallization and coating techniques, which are critical for enhancing product performance, stability, and handling characteristics. The primary synthesis methods, including dry coating, spray drying, and wet crystallization processes, have been refined significantly to produce highly dense, granular SPC that offers better flowability and reduced dust levels—an important factor for occupational safety and handling efficiency in large-scale industrial operations. Recent innovations focus on continuous flow manufacturing processes rather than batch processes, aiming to improve energy efficiency and production throughput while maintaining strict control over crystal size distribution, directly impacting dissolution rates in consumer applications.

The most critical area of technological focus is the development of advanced coating materials and application methods for Coated Sodium Percarbonate (C-SPC). Standard coatings often use sodium sulfate, sodium silicate, or specialized waxes; however, R&D is increasingly targeting multi-layer or composite coatings that offer superior protection against humidity, particularly relevant for products sold in tropical climates and for integration into complex, moisture-sensitive detergent tablets that include enzymes and sensitive fragrance components. These advanced coatings ensure that the active oxygen content remains stable throughout the product's shelf life, thereby maintaining the desired bleaching efficacy and providing a competitive edge for manufacturers serving premium and export markets globally.

Furthermore, technology plays a crucial role in the development of specialized SPC variants, such as those optimized for cold-water dissolution and high-pH industrial applications. Research efforts are centered on modifying the crystal structure and surface properties to accelerate oxygen release at lower temperatures, catering to consumer demands for energy-saving laundry practices. Process automation and sensor integration—often leveraging AI/ML as discussed previously—in large production facilities represent a significant technological shift, moving towards Industry 4.0 standards. This integration allows for predictive quality control and dynamic process optimization, minimizing batch variability and ensuring the consistently high quality necessary for bulk supply to global FMCG giants who rely on precise chemical inputs for their globally marketed product lines.

Regional Highlights

- Asia Pacific (APAC): This region is the undisputed powerhouse of the Sodium Percarbonate market, characterized by immense consumption volume driven by rapidly expanding populations, increasing urbanization, and greater adoption of packaged consumer goods, including high-quality laundry and dishwashing detergents in China, India, and Southeast Asia. Regulatory frameworks are evolving rapidly, pushing local chemical producers towards cleaner alternatives, further fueling SPC demand.

- Europe: Europe represents a mature market but maintains stable growth, primarily due to stringent environmental regulations (like REACH) that favor eco-friendly, non-chlorine bleaching agents. Demand is concentrated in high-value, specialized C-SPC segments for premium laundry pods and professional cleaning services, with key consumption centers in Germany, France, and the UK.

- North America: The market here is defined by high consumer awareness regarding health and environmental safety, leading to sustained demand for green cleaning products. Innovation is focused on high-performance SPC formulations optimized for specific, high-efficiency washing machine requirements, with the U.S. being the largest consumer in the region.

- Latin America (LATAM): This region is an emerging growth hub. Market expansion is currently localized but is accelerating due to rising disposable incomes, improving standards of living, and subsequent higher penetration of branded cleaning products, especially in Brazil and Mexico.

- Middle East & Africa (MEA): Growth in MEA is moderate but steady, tied primarily to infrastructure development, expanding commercial laundry operations (especially in tourism and hospitality sectors), and increasing adoption of modern household cleaning habits in urban centers of the UAE, Saudi Arabia, and South Africa.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Sodium Percarbonate Market.- Evonik Industries AG

- Solvay S.A.

- OCI Company Ltd.

- Kemira Oyj

- Akema Srl

- Hodogaya Chemical Co., Ltd.

- Wuxi Jiahe Peroxide Co., Ltd.

- Basf SE

- Shandong Huayuan Chemical Co., Ltd.

- China Petrochemical Corporation (Sinopec)

- Luxi Chemical Group Co., Ltd.

- Gujarat Alkalies and Chemicals Ltd. (GACL)

- Wuxi Wanmi Chemical Co., Ltd.

- Inner Mongolia Likang Pharmaceutical Co., Ltd.

- Fubang Chemical Co., Ltd.

- Shanghai AiCai Chemical Co., Ltd.

- Jilin Chemical Industrial Co. Ltd.

- Jiangsu Huandian Chemical Group

- Lianyungang Hongsheng Chemical Co., Ltd.

- United Initiators GmbH

Frequently Asked Questions

Analyze common user questions about the Sodium Percarbonate market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the growth of the Sodium Percarbonate market?

The primary growth drivers are the global shift towards environmentally friendly bleaching agents, substituting chlorine-based products, and the continuous, large-scale expansion of the household and industrial cleaning and detergent manufacturing sector worldwide, particularly in high-growth Asian markets.

What is the main difference between Coated (C-SPC) and Uncoated (U-SPC) Sodium Percarbonate?

Coated Sodium Percarbonate (C-SPC) incorporates a protective external layer, typically sodium sulfate or silicate, which significantly enhances its stability against moisture and heat, allowing it to be used effectively in complex powdered or tablet detergent formulations that have a long shelf life, whereas U-SPC is less stable and often reserved for immediate industrial use.

Which geographical region holds the largest market share for Sodium Percarbonate consumption?

The Asia Pacific (APAC) region currently holds the largest market share due to rapid population growth, rising disposable incomes, and the corresponding massive volume demand from major consumer product manufacturers and growing domestic usage of advanced cleaning products across countries like China and India.

What are the key restraint challenges facing the Sodium Percarbonate market?

Key restraints include the product’s inherent sensitivity to moisture and temperature, which necessitates specialized and costly storage and logistics solutions throughout the supply chain, along with ongoing price volatility in crucial raw materials such as hydrogen peroxide and soda ash.

How is Sodium Percarbonate used in the water treatment industry?

In water treatment, Sodium Percarbonate serves as a safe, solid source of hydrogen peroxide. It is utilized primarily as a powerful oxidizing agent for disinfection, removing organic contaminants, controlling algae growth, and aiding in sludge conditioning processes, offering an effective, non-toxic alternative to conventional treatments.

This comprehensive market insights report provides a thorough analysis of the Sodium Percarbonate market dynamics, focusing on technological advancements, application expansion, and regional growth projections. The information presented is optimized for search and answer engines, ensuring high discoverability and relevance for stakeholders seeking detailed market intelligence. The market's future trajectory is strongly linked to sustainability trends and continuous innovation in product stability, particularly in the demanding consumer detergent segments across high-growth regions globally. Continuous monitoring of raw material costs and strategic investments in advanced coating technologies will be paramount for leading manufacturers aiming to maintain a competitive advantage and maximize profit potential throughout the forecast period ending in 2033. The convergence of strict environmental regulations and high consumer demand for performance and safety underpins the robust growth outlook for the entire Sodium Percarbonate value chain, driving market participants towards efficiency improvements and sustainable practices. Technological advancements focusing on cold-water activation and enhanced shelf-life stability represent the next major wave of competitive differentiation within this critical chemical market segment, ensuring the compound remains a cornerstone of the global cleaning and chemical oxidation industries for the foreseeable future, despite the logistical challenges inherent in handling peroxide-releasing materials. Strategic capacity expansion in the APAC region, coupled with securing stable, cost-effective supplies of hydrogen peroxide, will define the market leadership hierarchy in the coming years as demand intensifies across household and specialized industrial applications.

The imperative for green chemistry solutions continues to elevate the profile of Sodium Percarbonate across diverse industrial sectors. Beyond its established dominance in laundry care, emerging applications in biomedical waste treatment and specialized pool maintenance demonstrate its versatility and potential for market diversification. These niche areas often demand customized specifications regarding particle size and release kinetics, prompting manufacturers to invest further in precision granulation technologies. Furthermore, competitive pressures necessitate that manufacturers focus not only on production volume but also on lifecycle assessment (LCA) data, providing verifiable sustainability metrics to B2B customers who are increasingly scrutinized on their own environmental footprints. This emphasis on verifiable green credentials reinforces the market's trajectory towards high-quality, responsibly sourced SPC. The global market's resilience, even amidst economic fluctuations, highlights its status as a foundational component in essential consumer staples. Future market viability will also depend on mitigating the impact of substitute products, particularly advanced enzyme formulations, by continually demonstrating superior efficacy and cost-in-use advantages in specific, high-stain applications where strong oxygen bleaching capabilities remain irreplaceable. Therefore, marketing strategies must increasingly emphasize SPC’s superior performance characteristics alongside its proven environmental safety profile to maintain its strong market position against next-generation cleaning chemistries, ensuring sustained financial growth and technological relevance through proactive innovation and customer education regarding its core benefits and application versatility across multiple critical end-use industries.

Investment trends reflect a strategic shift towards digitalization and automation within production environments, particularly utilizing IoT sensors to monitor and control the highly sensitive crystallization and drying phases of SPC synthesis. This Industry 4.0 approach is vital not only for cost control but also for meeting the increasingly narrow specification windows required by premium detergent formulators globally. The market's infrastructure is also adapting, with global logistics providers developing specialized, climate-controlled warehousing solutions specifically tailored to minimize the risk of thermal decomposition and moisture ingress for SPC shipments, thereby reducing supply chain losses and improving reliability for international trade routes. Regulatory compliance remains a perpetual focal point; manufacturers must navigate diverse international standards regarding chemical registration, transport classification, and end-product labeling. Companies that can seamlessly manage multi-regional compliance while maintaining competitive production costs are best positioned for long-term market dominance. Moreover, the long-term outlook remains intrinsically tied to advancements in renewable energy sources for power-intensive manufacturing processes like hydrogen peroxide production, which would further enhance SPC’s green credentials and insulate producers against volatile fossil fuel price shocks, solidifying its standing as a core material for a sustainable industrial future and confirming the projected high growth rate throughout the forecast period.

Technological advancement is not solely limited to the production side; packaging innovation also plays a critical role in unlocking new market potential for Sodium Percarbonate. Development of high-barrier, moisture-proof packaging materials designed for extended shelf life in diverse retail environments is crucial for expanding the consumer reach of SPC-based products, particularly in regions with high humidity. Furthermore, the push towards developing ready-to-use liquid formulations that stabilize the hydrogen peroxide released by SPC upon dissolution—a complex chemical challenge—could unlock entirely new product categories and consumer interfaces, potentially disrupting the market structure. Currently, SPC's utility is primarily constrained to solid or powdered formats; successful stabilization in liquid carriers would dramatically broaden its application scope, especially in highly competitive pre-treatment and spray cleaner segments. This continued emphasis on both upstream production efficiency via AI and downstream packaging/formulation innovation underscores the dynamic nature of the Sodium Percarbonate market, confirming its robust projection to USD 965 Million by 2033, driven by a combination of foundational consumer demand and targeted technological breakthroughs aimed at overcoming current material limitations and expanding operational utility into higher-margin specialized applications.

The competitive strategy among key players is increasingly focused on vertical integration and geographical diversification, particularly through strategic mergers, acquisitions, and joint ventures aimed at consolidating raw material sourcing and expanding manufacturing footprints into key APAC locations. Companies like Evonik and Solvay leverage their global supply chains and technological expertise to maintain market leadership, focusing on high-pquality, proprietary coated SPC variants that command premium pricing. Smaller, regionally focused players, especially in China, compete intensely on volume and cost-effectiveness, driving overall price efficiency in the mass market segment. The need for specialized logistics solutions for handling and shipping bulk SPC globally remains a significant barrier to entry, favoring large, integrated chemical conglomerates with established infrastructure. This concentration of logistical capability reinforces the market power of the top-tier manufacturers. Moreover, the increasing adoption of sustainable procurement policies by major multinational buyers compels suppliers to adhere to rigorous environmental, social, and governance (ESG) standards, making sustainability reporting and ethical sourcing a non-negotiable component of competitive market access and long-term supply contract retention, further shaping the market's strategic direction towards responsible growth.

The detailed segmentation analysis confirms that while the volume consumption is dominated by bulk cleaning products, the highest growth and profitability potential reside within specialized niches, such as high-purity SPC for medical sterilization processes and controlled-release granular forms for environmental remediation projects. These applications demand exceptional quality control and customized specifications, creating barriers to entry for generic manufacturers and allowing technologically advanced players to secure lucrative, long-term contracts. The interplay between stringent European Union (EU) chemical regulations, which often set the global standard for safety and environmental compliance, and the massive, cost-sensitive production capacity in Asia defines the global market tension. Manufacturers must constantly balance compliance costs with competitive pricing pressures. Furthermore, investment in continuous R&D related to new coating polymers or encapsulation techniques to enhance stability and customize release kinetics represents a critical strategic lever. Successfully launching next-generation SPC products that outperform existing chlorine or enzyme alternatives in specific high-demand segments will be essential for capitalizing on the market's projected 5.8% CAGR and realizing the forecast value of USD 965 Million by the end of the projection period, ensuring sustained relevance in the ever-evolving landscape of industrial and consumer cleaning chemistries.

Understanding the value chain intricacies is paramount for mitigating risks associated with the high volatility of raw material pricing. Since the cost of hydrogen peroxide and soda ash can fluctuate significantly based on global energy prices and mining output, efficient production planning and hedging strategies are essential financial tools employed by market leaders. Downstream, the potential customers—ranging from P&G and Unilever to specialized industrial cleaning service providers—exert considerable influence over product specifications and delivery timelines, requiring suppliers to maintain robust quality management systems and flexible production schedules. The shift towards e-commerce and direct-to-consumer models in the cleaning supplies sector also subtly influences demand patterns, favoring suppliers who can ensure reliable delivery to various fulfillment centers rather than solely relying on large, centralized factory shipments. The long-term success in the SPC market will therefore depend not only on manufacturing excellence but also on advanced risk management and adaptive supply chain strategies that can effectively navigate complex global trade dynamics and rapidly evolving end-user purchasing behavior, reinforcing the need for continuous operational excellence across the entire value chain.

The utilization of Sodium Percarbonate in emerging markets like specialized hydroponics and aquaculture represents a promising avenue for high-growth diversification. In these sectors, SPC is deployed for effective water oxygenation and disease control, demanding specific formulations that are rapidly soluble and leave minimal residue. This necessitates a distinct technological focus compared to standard detergent applications, requiring particle engineering tailored for controlled aquatic release. Furthermore, the role of SPC as a solid oxidizing agent in military and disaster relief scenarios for water purification continues to be explored, providing a stable, reliable source of disinfection capability where liquid chemicals might be impractical to transport or store. These specialized, non-consumer applications, while small in volume currently, offer significantly higher margins and require deep technical collaboration between the SPC producers and specialized end-use equipment manufacturers. The expansion into these highly regulated and technical fields validates the superior safety and environmental profile of SPC, reinforcing its position as a critical chemical component for future sustainable technologies. The ongoing research into solid-state chemical reactions involving SPC further promises novel uses in organic synthesis and remediation efforts, extending its market reach beyond traditional bleaching applications and ensuring its long-term technological relevance and market stability.

The comprehensive analysis underscores that the Sodium Percarbonate market is poised for significant expansion, driven by foundational consumer demands for cleanliness and hygiene, coupled with powerful environmental tailwinds favoring sustainable chemical alternatives. Market participants must prioritize investments in R&D aimed at achieving greater product stability and optimizing performance across a range of temperature and pH conditions, particularly to capture the accelerating demand for energy-efficient, cold-water laundry solutions globally. Regional strategies must differentiate between mature, quality-driven markets in Europe and North America and volume-centric, expansionary markets in Asia Pacific. Successful execution hinges on effective raw material risk management and leveraging automation technologies, including AI, to enhance manufacturing precision and reduce environmental impact. The long-term forecast confirms that SPC is not merely a transient substitute but a core chemical staple, deeply integrated into modern sustainable cleaning and industrial processes, ensuring its projected growth trajectory and continued status as a key indicator of trends within the global specialty chemicals sector.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager