Sodium Persulfate Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433425 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Sodium Persulfate Market Size

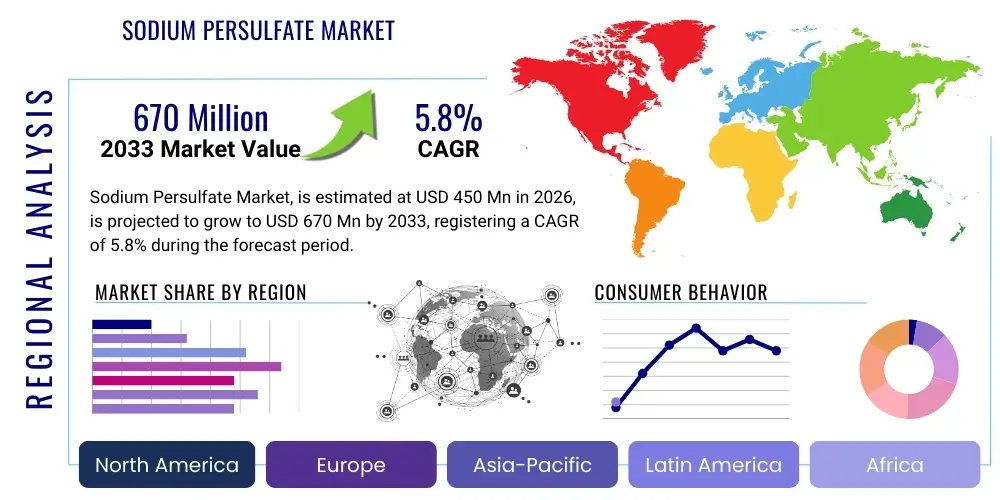

The Sodium Persulfate Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 670 Million by the end of the forecast period in 2033.

Sodium Persulfate Market introduction

Sodium persulfate (Na2S2O8) is a highly versatile and powerful oxidizing agent characterized by its excellent stability and high solubility in water. It is primarily manufactured through the anodic oxidation of a cold aqueous solution of sodium sulfate and ammonium persulfate. Its robust oxidizing properties make it indispensable across numerous industrial sectors, serving critical functions such as polymerization initiation, etching, cleaning, and environmental remediation. The primary market adoption is driven by its effectiveness in initiating emulsion polymerization for synthetic polymers like polyacrylates, polyvinyl chloride (PVC), and synthetic rubber, which are foundational materials in construction, automotive, and packaging industries.

The market trajectory is significantly influenced by the accelerating demand from the electronics sector, where sodium persulfate is employed as a micro-etching agent in the production of printed circuit boards (PCBs) and semiconductors. Furthermore, its role as a bleach accelerator and desizing agent in the textile industry, combined with its emerging application in soil and groundwater remediation (In-Situ Chemical Oxidation - ISCO), provides robust growth avenues. As environmental regulations tighten globally, particularly concerning the degradation of organic pollutants, the demand for effective and reliable oxidizers like sodium persulfate is expected to see sustained growth, especially in developing economies focusing on industrial wastewater treatment infrastructure.

Key benefits driving its market prominence include its relatively safe handling profile compared to other strong oxidizers, long shelf life, and high efficiency in polymerization processes, ensuring excellent batch consistency and superior polymer quality. Driving factors encompass the expansion of construction and automotive industries requiring high-performance polymers, the relentless miniaturization and complexity in the electronics manufacturing domain, and mandatory environmental compliance requiring advanced oxidation techniques for environmental cleanup projects worldwide.

Sodium Persulfate Market Executive Summary

The Sodium Persulfate Market is poised for stable growth, propelled by robust business trends centered on the expansion of high-tech manufacturing and stringent environmental mandates. Key segments, including polymer manufacturing and electronics etching, demonstrate high consumption rates, supported by the global shift towards advanced materials and complex circuitry. The market dynamics are currently characterized by increasing operational efficiency required to mitigate raw material price fluctuations, particularly electricity costs associated with the electrochemical production process. Manufacturers are increasingly focusing on vertical integration and geographical proximity to major end-use hubs to optimize supply chain logistics and enhance responsiveness to demanding industrial schedules, signifying a maturity phase coupled with focused innovation in application-specific formulations.

Regional trends indicate that the Asia Pacific (APAC) region maintains its dominance, primarily due to the massive concentration of electronics manufacturing, textile production, and rapid infrastructure development, particularly in China, South Korea, and India. North America and Europe, while growing at a slower pace, exhibit a strong focus on high-value applications, particularly in advanced water treatment and sophisticated semiconductor manufacturing, driven by strict regulatory standards regarding material purity and industrial discharge. Segment trends highlight the rising significance of the environmental segment, where sodium persulfate-based ISCO techniques are gaining traction as a cost-effective and environmentally acceptable alternative for legacy contamination sites, promising above-average growth compared to traditional polymerization applications.

In summary, the market outlook remains positive, underpinned by continuous expansion in end-user industries and evolving technological applications. Strategic considerations for market participants involve investing in sustainable production methods to reduce the high energy costs inherent in electrolysis and developing specialized, high-purity grades to meet the demanding specifications of the semiconductor and pharmaceutical industries. Navigating the competitive landscape requires a dual strategy: scale optimization in bulk segments and niche product development focused on environmental solutions and advanced electronics etching, ensuring resilience against economic cycles affecting commodity chemical pricing.

AI Impact Analysis on Sodium Persulfate Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Sodium Persulfate Market typically revolve around operational efficiency, supply chain stability, and the potential for AI-driven material discovery or process optimization. Common concerns focus on how smart manufacturing systems can mitigate the high energy consumption of the electrochemical synthesis process and predict demand fluctuations in highly cyclical end-user sectors like electronics and construction. There is significant interest in utilizing AI and machine learning (ML) to enhance quality control during polymerization reactions, ensuring precise initiation times and minimizing batch variations, thereby reducing waste and improving final product consistency. Furthermore, users often question the role of predictive analytics in managing the sourcing and pricing volatility of precursor chemicals and optimizing complex global logistics networks for high-volume chemical shipments.

- AI-driven optimization of electrolytic cell parameters to minimize energy consumption and maximize conversion yield during sodium persulfate synthesis, addressing one of the primary cost restraints.

- Predictive maintenance schedules for high-capital equipment (e.g., rectifiers, chillers) used in chemical manufacturing, reducing unexpected downtimes and increasing plant utilization rates.

- Machine learning algorithms applied to polymerization reaction control, optimizing initiator dosage and temperature profiles based on real-time feedback to achieve desired molecular weight distributions and polydispersity indices.

- Enhanced forecasting of demand across diverse end-use sectors (textiles, electronics, water treatment), leading to more accurate production planning and inventory management, mitigating risks associated with chemical storage.

- Automation and robotic integration in packaging, labeling, and quality assurance processes, particularly for high-purity grades required in semiconductor fabrication, ensuring minimal human contamination risks.

- AI utilization in environmental remediation modeling, predicting the required sodium persulfate concentration and injection strategy for effective In-Situ Chemical Oxidation (ISCO) of complex contaminated plumes.

DRO & Impact Forces Of Sodium Persulfate Market

The Sodium Persulfate market is dynamically shaped by powerful drivers, systemic restraints, and significant emerging opportunities, collectively influencing its growth trajectory and competitive intensity. The primary driver stems from the consistent expansion of the polymer industry, particularly the production of specialty emulsions and high-performance engineering plastics where sodium persulfate acts as an essential, high-purity initiator. Concurrently, the increasing stringency of global environmental protection laws mandates better wastewater treatment and encourages the remediation of industrial contamination sites, creating a compelling opportunity for persulfates in advanced oxidation processes (AOPs), specifically ISCO. The impact forces are also heavily swayed by technological advancements in microelectronics, which necessitate specialized, contaminant-free etchants, pushing innovation in product purity and formulation stability.

However, the market faces notable restraints, chiefly concerning the high energy intensity of the manufacturing process, which relies heavily on electrolysis, making production costs susceptible to fluctuating electricity prices. Furthermore, while sodium persulfate is relatively safe, its classification as an oxidizing agent necessitates strict handling, transportation, and storage protocols, adding logistical complexity and cost. Opportunities lie in developing greener production technologies, potentially utilizing renewable energy sources for electrolysis, and expanding into niche markets such as the oil and gas industry for fracturing fluid additive applications and specialized pharmaceutical synthesis. The development of stabilized, proprietary formulations designed for enhanced effectiveness in specific low-temperature or high-pH environments presents a clear path for market differentiation and premium pricing.

Impact forces dictate that competitive rivalry is moderate to high, driven by the presence of large global chemical manufacturers and regional specialists competing on both price (bulk commodity grades) and quality (specialty grades). Supplier power is moderate, influenced by the availability of key raw materials like sulfuric acid and sodium hydroxide, while buyer power is high in commodity segments due to numerous supplier options. The threat of substitutes is low to moderate; while alternatives like potassium persulfate or hydrogen peroxide exist for certain applications, sodium persulfate maintains a favorable cost-performance ratio and stability profile for its core markets. Overall market profitability is sustained by the non-negotiable requirement for high-purity initiators and etchants in crucial industrial processes.

Segmentation Analysis

The Sodium Persulfate Market is primarily segmented based on Grade Type, Application, and Geography, providing a multi-faceted view of consumption patterns and market potential. Grade segmentation distinguishes between Standard Grade and High Purity Grade, with the latter catering specifically to demanding applications such as semiconductor manufacturing and advanced pharmaceuticals where trace metal contamination must be strictly controlled. Application analysis reveals dominant usage areas including polymerization, electronics etching, water treatment, and textiles. Understanding these segments is crucial for manufacturers to tailor production capabilities and marketing strategies, focusing on the specialized requirements of each industry—from high volume, price-sensitive polymer production to low-volume, high-specification microelectronics applications.

The Polymerization segment remains the largest consumer, driven by continuous demand for coatings, adhesives, and synthetic elastomers across construction and automotive sectors. However, the fastest-growing segment is anticipated to be Water and Environmental Treatment, reflecting global regulatory pressures and investment in infrastructure for cleaning contaminated sites and municipal water supplies. Geographic segmentation highlights the dichotomy between high-growth, manufacturing-intensive regions (APAC) and mature markets focused on environmental compliance and high-technology production (North America and Europe). Detailed segmentation analysis allows stakeholders to allocate R&D resources effectively, targeting formulations that maximize performance in specific application niches, such as non-caking sodium persulfate for powder polymerization or highly stable solutions for long-distance environmental delivery.

- By Grade Type:

- Standard Grade

- High Purity Grade (Electronic/Semiconductor Grade)

- By Application:

- Polymerization Initiator (Emulsion polymerization for PVC, Polyacrylates, Synthetic Rubber)

- Electronics (Etching Printed Circuit Boards, Cleaning/Descaling)

- Water and Environmental Treatment (In-Situ Chemical Oxidation - ISCO)

- Textile Industry (Desizing, Bleach Activator)

- Cosmetics and Personal Care (Hair Bleaching and Coloring)

- Oil and Gas (Fracturing Fluid Additives)

- Pulp and Paper

- By Region:

- North America (U.S., Canada, Mexico)

- Europe (Germany, UK, France, Italy, Spain)

- Asia Pacific (China, Japan, India, South Korea)

- Latin America (Brazil, Argentina)

- Middle East and Africa (South Africa, Saudi Arabia)

Value Chain Analysis For Sodium Persulfate Market

The value chain for the Sodium Persulfate Market is characterized by a concentrated upstream segment and a highly diversified downstream application base. Upstream activities involve the procurement of critical raw materials, primarily sulfuric acid, sodium hydroxide, and electricity, the latter being the most significant input due to the highly energy-intensive electrochemical manufacturing process. Key suppliers include industrial chemical providers and utility companies. Manufacturing involves specialized infrastructure for anodic oxidation, requiring significant capital investment and adherence to stringent safety and environmental regulations. Optimization at this stage focuses heavily on energy efficiency and maintaining the high purity levels necessary for advanced downstream uses.

Midstream activities involve processing, crystallization, drying, and packaging of the final sodium persulfate product in various forms (powder, granular, or stabilized solution). Distribution channels are critical, handling a high-volume product classified as a hazardous oxidizing agent. Direct distribution is common for large industrial buyers (e.g., major polymer producers) who require just-in-time delivery and technical support. Indirect distribution utilizes specialized chemical distributors and regional agents, particularly for smaller quantity sales to niche applications like cosmetics or local water treatment facilities. The choice of channel depends on the required grade purity, volume, and geographical distance, ensuring compliance with international chemical transport regulations.

Downstream analysis focuses on the end-user applications. The market is highly leveraged by the construction, automotive, and electronics industries. Polymer producers utilize the chemical for initiation, while electronic manufacturers require it for etching. The final product cost significantly influences downstream profitability, especially in commodity segments like bulk textile treatment. The shift toward environmental applications is adding a new layer to the value chain, requiring technical service providers who specialize in environmental engineering and site remediation to integrate the chemical effectively into complex cleanup projects. Overall, value creation is maximized by controlling energy input costs and achieving superior product purity for high-margin segments.

Sodium Persulfate Market Potential Customers

The potential customer base for sodium persulfate is expansive and highly diversified, spanning multiple foundational industrial sectors globally. The primary and most substantial buyers are major polymerization manufacturers who rely on sodium persulfate as a crucial initiator for producing a wide array of synthetic materials, including PVC, styrene-butadiene rubber (SBR) latex, and acrylic emulsions used in paints, adhesives, and coatings. These customers prioritize high quality, consistent supply, and competitive pricing due to the volume of chemical consumed and its direct impact on polymer properties such as molecular weight and stability. Long-term supply contracts are common among these large-scale industrial purchasers.

Another high-value customer group consists of electronics and semiconductor manufacturers. These buyers demand ultra-high purity grades (Electronic Grade) of sodium persulfate for precision etching of copper circuitry on printed circuit boards (PCBs) and cleaning of silicon wafers. For these applications, the absence of metallic impurities is non-negotiable, driving premium pricing and requiring specialized logistical and packaging standards. Environmental engineering firms and government agencies tasked with soil and groundwater remediation also represent a burgeoning customer segment, utilizing the chemical for In-Situ Chemical Oxidation (ISCO) to break down volatile organic compounds (VOCs) and persistent organic pollutants (POPs) on contaminated sites, valuing efficacy and regulatory acceptance.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 670 Million |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | E. I. du Pont de Nemours and Company, PeroxyChem, AkzoNobel N.V., United Initiators GmbH, Mitsubishi Gas Chemical Company, Ltd., Shandong Haili Chemical Industry Co., Ltd., Fuji Persulfate Co., Ltd., Changzhou Tronly Chemical Co., Ltd., Hebei Jiheng Chemical Co., Ltd., Yecheng Chemical Co., Ltd., S.P.S. Chemical Corporation, Adeka Corporation, Arkema SA, Solvay S.A., MGC Pure Chemicals Ltd., Shanxi Jiafeng Chemical Co., Ltd., Anhui Zhenxin Chemical Co., Ltd., Jiangsu Sanmu Group Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Sodium Persulfate Market Key Technology Landscape

The manufacturing technology for sodium persulfate is fundamentally rooted in the electrochemical synthesis process, involving the anodic oxidation of ammonium persulfate or sodium sulfate solutions. Modern technological advancements focus less on radical changes to the core chemistry and more on optimizing operational parameters, improving energy efficiency, and ensuring the production of ultra-high purity material. Key technological shifts include the development of advanced electrode materials and specialized cell designs, such as high-efficiency membrane cell technology, which minimizes side reactions and reduces the overall voltage requirement, thereby directly addressing the high energy cost restraint inherent in the electrolysis process. Furthermore, sophisticated process control systems are being integrated to monitor current density, temperature, and pH in real-time, ensuring optimal conversion rates and batch consistency, which is vital for specialty chemical consumers.

Beyond synthesis, technological innovations are critical in the purification and crystallization phases. Producing electronic-grade sodium persulfate requires advanced crystallization techniques, such as continuous cooling crystallization, coupled with rigorous filtering and ion exchange processes to eliminate trace metal contaminants (e.g., Fe, Cu, Ni) down to parts per billion (ppb) levels. This ultra-purification technology is a major competitive differentiator, enabling suppliers to access the lucrative semiconductor market. Packaging technology also plays a crucial role; the use of moisture-resistant, non-reactive liners and advanced sealing techniques is necessary to maintain the chemical integrity and stability of the oxidizing agent during long-term storage and challenging transit conditions across diverse climate zones.

In application technology, significant developments are observed in the environmental sector. Research is focused on developing proprietary activators (e.g., chelated iron or heat) that enhance the radical generation capability of sodium persulfate in ISCO applications, allowing for more effective and targeted remediation of recalcitrant contaminants in complex soil and groundwater matrices. Furthermore, micro-dosing and stabilization technologies are emerging to facilitate safer and more precise application in specific industrial processes like oilfield chemical injection or delicate cosmetic formulations. The integration of continuous flow chemistry techniques is also being explored by smaller specialty chemical producers to improve reaction control and scalability for niche, high-value custom formulations.

Regional Highlights

- Asia Pacific (APAC): APAC is the dominant and fastest-growing region in the Sodium Persulfate market, characterized by immense manufacturing capacity in electronics, textiles, and construction materials. China, serving as the global hub for PCB manufacturing and polymer production, drives colossal demand for both standard and high-purity grades. The rapid industrialization and urbanization across India and Southeast Asian nations are fueling demand for polymers (paints, coatings, adhesives) and wastewater treatment chemicals. Regulatory enforcement regarding industrial pollution is tightening across the region, especially in established manufacturing zones, pushing demand for effective ISCO technologies for site remediation, further cementing APAC's leadership.

- North America: The North American market is mature but highly sophisticated, marked by high consumption of specialty and electronic-grade sodium persulfate. The demand is primarily driven by the robust semiconductor industry in the U.S. and the increasing adoption of advanced oxidation processes for environmental remediation projects under EPA oversight. While polymerization demand is steady, the focus is on high-performance materials rather than bulk commodities. The region also exhibits strong technological leadership in developing novel applications, particularly in oil and gas production (enhanced oil recovery chemicals) and advanced material synthesis, supporting premium pricing for innovative formulations.

- Europe: Europe represents a stable market where growth is heavily influenced by stringent environmental protection standards and a mature chemical manufacturing base. Key drivers include the textile finishing industry and specialized polymer manufacturing in countries like Germany and Italy. Environmental applications, driven by EU directives on water quality and soil contamination cleanup (e.g., REACH regulations), constitute a significant and growing market segment. European manufacturers often emphasize sustainable and energy-efficient production processes, aligning with regional green economy goals, and positioning the market toward high-value, environmentally compliant chemical solutions.

- Latin America (LATAM) & Middle East and Africa (MEA): These emerging regions show promising growth potential. LATAM demand is linked to infrastructure projects and commodity chemical manufacturing, particularly in Brazil and Mexico. MEA market expansion is tied to industrial diversification efforts in the GCC countries and increasing investment in oil andfield chemical services. While currently smaller in volume compared to APAC or North America, these regions offer untapped potential, especially as local governments address growing needs for reliable municipal water treatment and basic industrial chemical production self-sufficiency.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Sodium Persulfate Market.- E. I. du Pont de Nemours and Company (DuPont)

- PeroxyChem (now part of Evonik Industries AG)

- AkzoNobel N.V.

- United Initiators GmbH

- Mitsubishi Gas Chemical Company, Ltd. (MGC)

- Shandong Haili Chemical Industry Co., Ltd.

- Fuji Persulfate Co., Ltd.

- Changzhou Tronly Chemical Co., Ltd.

- Hebei Jiheng Chemical Co., Ltd.

- Yecheng Chemical Co., Ltd.

- S.P.S. Chemical Corporation

- Adeka Corporation

- Arkema SA

- Solvay S.A.

- MGC Pure Chemicals Ltd.

- Shanxi Jiafeng Chemical Co., Ltd.

- Anhui Zhenxin Chemical Co., Ltd.

- Jiangsu Sanmu Group Co., Ltd.

- BASF SE

- Kemira Oyj

Frequently Asked Questions

Analyze common user questions about the Sodium Persulfate market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary applications driving the demand for High Purity Grade Sodium Persulfate?

The primary driver for High Purity Grade Sodium Persulfate is the electronics industry, specifically for use as a precision etching agent in the manufacturing of Printed Circuit Boards (PCBs) and semiconductor components. These applications require extremely low levels of metallic impurities (ppb level) to prevent defects and ensure the reliability of microelectronic circuitry, justifying its premium pricing segment.

How does the energy consumption of manufacturing processes impact the market price of sodium persulfate?

Sodium persulfate is produced via an energy-intensive electrochemical process (electrolysis). This means that fluctuations in global or regional electricity costs directly and significantly influence the cost of production. High energy costs act as a major restraint, compelling manufacturers to invest in more energy-efficient cell technologies and potentially relocate production to regions with subsidized or lower-cost power sources to maintain competitive pricing.

What is the role of Sodium Persulfate in environmental remediation, and why is this segment growing?

Sodium persulfate is crucial in environmental remediation through In-Situ Chemical Oxidation (ISCO). It acts as a powerful oxidant when activated, generating sulfate radicals that effectively degrade persistent organic pollutants (POPs) and volatile organic compounds (VOCs) in contaminated soil and groundwater. This segment is growing rapidly due to increasingly strict global environmental regulations and the need for cost-effective, long-lasting solutions for cleaning up legacy industrial sites.

Which region dominates the global sodium persulfate consumption, and what factors contribute to this dominance?

The Asia Pacific (APAC) region dominates the market consumption, primarily driven by massive industrial scale in China and South Korea. Key contributing factors include the largest global base for electronics manufacturing (requiring etchants), extensive polymer production for regional infrastructure, and booming textile and chemical processing industries, all of which utilize sodium persulfate as a foundational chemical.

Are there significant substitutes for sodium persulfate in its core applications, and how does its performance compare?

While alternatives like potassium persulfate and ammonium persulfate exist, sodium persulfate is often preferred for large-scale industrial applications due to its higher solubility and lower cost relative to potassium salts. Hydrogen peroxide can substitute in some oxidation processes, but sodium persulfate generally offers superior stability and controlled radical release kinetics, making it the preferred and most reliable initiator in emulsion polymerization and a robust agent in ISCO.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager