Sodium Propionate Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432514 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Sodium Propionate Market Size

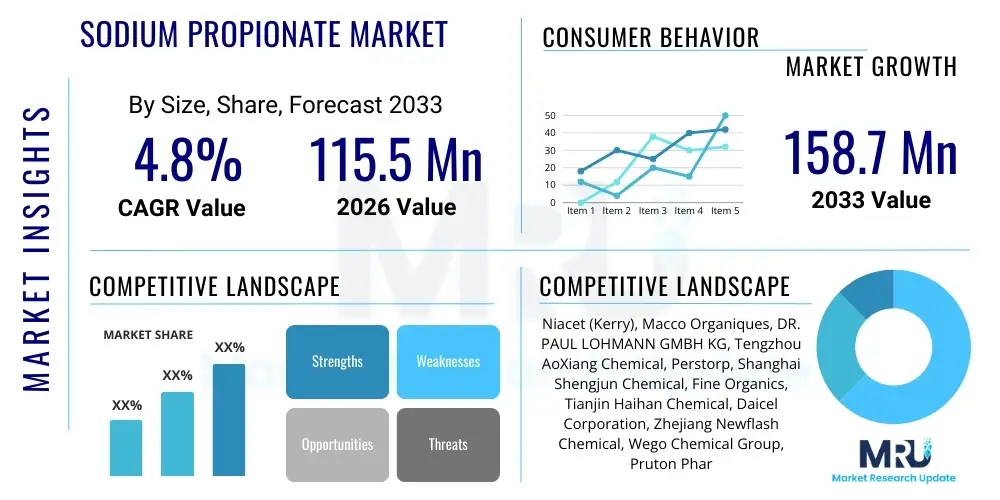

The Sodium Propionate Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 115.5 Million in 2026 and is projected to reach USD 158.7 Million by the end of the forecast period in 2033. This consistent growth trajectory is primarily underpinned by the increasing global demand for preserved food products with extended shelf lives, driven by evolving consumer lifestyles and urbanization trends. Sodium propionate, recognized globally as E281, plays a critical role in inhibiting the growth of mold and certain bacteria, making it indispensable in bakery and dairy sectors, which form the bedrock of its consumption.

The market expansion is significantly influenced by stringent food safety regulations imposed by governmental bodies across key regions, mandating effective preservation techniques to mitigate microbial spoilage and waste. Furthermore, the rising adoption of sodium propionate in the animal feed industry to prevent mold contamination, which can be detrimental to livestock health and feed efficacy, contributes substantially to the overall market valuation. The stability and cost-effectiveness of sodium propionate compared to alternative preservatives position it as a preferred choice for manufacturers operating across various price points.

Sodium Propionate Market introduction

Sodium Propionate (C3H5NaO2) is the sodium salt of propionic acid, utilized extensively across multiple industries as a potent preservative, primarily functioning as an antimicrobial agent. It is a highly effective food additive (E281 in Europe) recognized for its ability to inhibit the growth of mold, rope bacteria, and other spoilage microorganisms, especially in bakery products and cheeses, where moisture content and pH levels necessitate robust preservation methods. Its product description emphasizes its white crystalline solid form, high solubility, and low toxicity profile when used within established regulatory limits, making it a safe and essential ingredient in modern food production and preservation systems designed to maximize food security and minimize economic losses due to spoilage.

Major applications of sodium propionate span the food and beverage industry, particularly in bread, pastries, processed cheeses, and other baked goods, where it significantly extends shelf life without imparting undesirable flavor characteristics when correctly dosed. Beyond human consumption, a crucial market segment is the animal feed industry, where it is added to feed rations and silos to prevent the development of harmful molds, thereby safeguarding feed nutritional value and livestock well-being. The inherent benefits of using sodium propionate include superior mold inhibition, effective performance across a moderate pH range (typically pH 5.0 to 6.5), and its status as a cost-effective solution for preventing microbial deterioration. These attributes are directly driving factors propelling market growth, alongside increasing consumer demand for packaged, ready-to-eat foods that require robust preservation measures for extended distribution cycles and convenience.

Sodium Propionate Market Executive Summary

The Sodium Propionate market is characterized by stable yet moderate growth, dictated primarily by business trends focusing on expanding global supply chains and increasing penetration into emerging economies, particularly in the Asia Pacific region where cold chain infrastructure is rapidly developing, necessitating higher preservative usage. Key business trends include capacity expansion by major manufacturers focusing on high-purity grades required for pharmaceutical and specialized food applications, alongside a slight shift towards natural alternatives driven by consumer clean-label demands, although sodium propionate maintains dominance due to its efficacy and price point. Regional trends indicate that North America and Europe remain mature, high-value markets with stringent regulatory frameworks governing preservative use, while APAC, led by China and India, exhibits the highest growth rate driven by population density, rising disposable income, and the rapid expansion of organized retail and commercial baking operations.

Segment trends reveal that the Food & Beverages segment, specifically the bakery and processed cheese sectors, remains the largest application area, commanding the majority market share. Within product types, the powder form dominates due to ease of handling, blending, and stability in dry ingredient mixes, favored over the liquid form. Furthermore, the function segment highlights the sustained demand for sodium propionate as a dedicated mold inhibitor, particularly critical in high-moisture bakery products during summer months or in humid climates. Overall, the market outlook is positive, supported by continuous demand from foundational industries like baked goods and animal nutrition, counterbalanced by regulatory scrutiny and minor competition from organic acids such as calcium propionate and sorbates, forcing manufacturers to focus on operational efficiencies and consistent product quality to maintain competitive advantage in established markets.

AI Impact Analysis on Sodium Propionate Market

User queries regarding the impact of Artificial Intelligence (AI) on the Sodium Propionate market often center on optimizing manufacturing processes, enhancing supply chain efficiency, and predicting demand fluctuations. Key themes analyzed include how AI can refine chemical synthesis routes to reduce production costs, the role of machine learning in quality control (ensuring precise purity levels mandated by regulatory bodies), and using predictive analytics to forecast mold growth patterns in specific environmental conditions, thereby optimizing usage dosage in food formulations. Users are concerned about whether AI integration will significantly lower manufacturing barriers, potentially increasing competition, and expect AI to contribute to sustainability by minimizing waste through enhanced inventory and demand planning. The overall expectation is that AI will not fundamentally alter the preservative's chemistry or function but will revolutionize the operational efficiency and downstream application precision within the sodium propionate value chain, offering manufacturers substantial competitive advantages through cost optimization and improved consistency.

- AI-driven optimization of chemical synthesis pathways for propionic acid production, leading to reduced energy consumption and improved yield purity.

- Predictive modeling utilizing machine learning algorithms to forecast regional demand for sodium propionate based on seasonal weather patterns, regulatory changes, and consumer purchasing trends, enhancing inventory management.

- Integration of AI in quality control systems for real-time monitoring of sodium propionate batches, ensuring compliance with strict food and pharmaceutical grade standards (e.g., heavy metal testing and purity checks).

- Implementation of smart supply chain logistics, using AI for routing optimization and risk assessment, minimizing delays and ensuring timely delivery to large-scale bakery and feed production facilities.

- AI-assisted formulation tools for food scientists, recommending optimized dosage levels of sodium propionate based on ingredient profile, water activity, and desired shelf life, reducing overuse and supporting clean-label initiatives.

DRO & Impact Forces Of Sodium Propionate Market

The market dynamics for Sodium Propionate are significantly influenced by a blend of persistent driving factors (D), inherent restraining challenges (R), and substantial expansion opportunities (O), collectively shaping the impact forces. The primary drivers revolve around the non-negotiable need for extended shelf life in packaged goods, especially in the vast global bakery sector, coupled with the critical requirement for mold prevention in stored animal feed, which supports global livestock industries. Restraints include the persistent regulatory pressure favoring "clean label" ingredients, which sometimes leads large food manufacturers to explore alternative, natural preservatives, alongside the inherent market maturity in developed economies, limiting high-CAGR growth. Opportunities arise from pharmaceutical applications, expanding rapidly due to its use as a mold inhibitor in liquid medications and specialized medical feeds, and penetrating underserved markets in Africa and South America where industrial food production is accelerating.

The interplay of these factors creates powerful impact forces on market participants. Regulatory acceptance of sodium propionate (E281/GRAS status) serves as a potent positive force, ensuring its continued use, while fluctuating raw material prices, particularly for propionic acid, introduce an external constraining force impacting manufacturer margins. The shift in consumer preference toward natural food elements exerts a moderating force, compelling producers to focus on high-purity, minimum-dosage formulations. Ultimately, the dominant force remains the economic necessity of preventing food and feed wastage, positioning sodium propionate as an essential input chemical resisting severe disruption despite minor competition from natural alternatives, ensuring stable, albeit moderate, demand growth across the forecast period.

Segmentation Analysis

The Sodium Propionate Market is strategically segmented based on application, physical form (type), and functional use, allowing for precise market analysis tailored to specific industrial needs. The dominant segmentation is by Application, which highlights the varying demand volumes and purity requirements across sectors, with Food & Beverages consuming the largest volume due to the universal appeal and necessity of preserved baked goods. The Type segmentation (Powder vs. Liquid) reflects processing preferences of end-users; powder is preferred for dry mixes and stability, while liquid is utilized in specific automated dosing systems. Functional segmentation underscores its core utility as a potent mold inhibitor and preservative, differentiating its primary role from secondary uses like anti-caking or flavor enhancement, providing clarity on the chemical's primary value proposition across all target markets.

Detailed analysis of the Application segment reveals strong demand stability in the bakery sub-segment, encompassing traditional breads, tortillas, and sweet baked items, where sodium propionate is crucial for controlling Bacillus subtilis (rope) and mold growth under typical shelf conditions. The Animal Feed segment is increasingly important, driven by larger commercial farming operations requiring reliable, high-volume feed preservation to optimize feed conversion rates and animal health. Within the Type segment, the crystalline powder form consistently leads the market due to its superior handling characteristics, longer shelf stability, and suitability for integration into dry industrial processes, although the liquid form appeals to specific dairy and pharmaceutical manufacturers that require high dispersion uniformity and minimal dust exposure during formulation. This multi-faceted segmentation structure helps stakeholders benchmark performance, identify high-growth sub-segments, and tailor product offerings, such as specialized feed-grade versus ultra-high purity food-grade sodium propionate.

- By Application:

- Food & Beverages (Bakery Products, Processed Cheese, Confectionery, Other Food Products)

- Animal Feed (Poultry Feed, Cattle Feed, Pet Food, Swine Feed)

- Pharmaceuticals

- Cosmetics and Personal Care

- Other Industrial Uses (e.g., Fungicide in stored grains)

- By Type:

- Powder (Crystalline/Granular)

- Liquid/Aqueous Solution

- By Function:

- Preservative and Mold Inhibitor

- Anti-caking Agent

- Flavoring Agent

Value Chain Analysis For Sodium Propionate Market

The value chain for the Sodium Propionate market commences with the upstream analysis, centered on the procurement and processing of key raw materials, primarily propionic acid, which is synthesized predominantly through petrochemical routes (e.g., ethylene or synthesis gas derivatives) or, less commonly, bio-based fermentation processes. The supply stability and cost of these precursors significantly dictate the final manufacturing cost of sodium propionate. Key upstream suppliers include major chemical and petrochemical companies. Following raw material procurement, the manufacturing stage involves the neutralization of propionic acid with a sodium source (like sodium hydroxide or sodium carbonate), followed by drying, grinding, and quality control checks to ensure the product meets specific purity and particle size standards required for food or pharmaceutical applications. This stage requires significant capital investment in specialized chemical reactors and drying equipment, making process efficiency a critical competitive differentiator for manufacturers.

The downstream analysis focuses on the distribution and end-user consumption. Distribution channels are highly structured, relying heavily on specialized chemical distributors and agents, particularly for reaching small and medium-sized bakery operations globally, while large multinational food and feed corporations often purchase directly from major producers. The direct channel offers better price control and integration but requires extensive logistics infrastructure, favored by top-tier suppliers like Niacet (Kerry). The indirect distribution channel, leveraging regional distributors, is essential for market penetration into geographically diverse and regulatory-complex regions. End-users, spanning food production, animal nutrition, and pharmaceuticals, utilize the product for its preservative qualities. Effectiveness in the downstream segment relies heavily on maintaining product integrity during transit and providing consistent, high-purity material, ensuring seamless integration into complex industrial manufacturing processes, thereby connecting raw material quality to final consumer protection via robust distribution networks.

Sodium Propionate Market Potential Customers

Potential customers for Sodium Propionate are diverse yet concentrated primarily within industries requiring robust and reliable microbial control to ensure product longevity and safety. The largest customer base resides within the Commercial Bakery Sector, including large industrial bakeries that produce packaged bread, rolls, and pastries for mass retail, along with smaller artisanal shops focused on regional distribution, all depending on E281/sodium propionate to prevent mold and extend shelf life from a few days to several weeks. Another significant cohort of buyers comprises Animal Feed Manufacturers, encompassing producers of poultry, swine, and dairy feed concentrates, who utilize sodium propionate as a critical fungicidal agent to protect stored feedstuffs from mold deterioration, thereby safeguarding animal health and optimizing feed efficiency metrics.

Beyond food and feed, pharmaceutical companies represent a high-value customer segment, utilizing sodium propionate as a preservative in certain medications, particularly liquid formulations or specialized dietary supplements where mold inhibition is paramount to drug stability and safety. Additionally, major Processed Dairy Producers, focusing on items like processed cheese slices and spreads, rely on its anti-mold capabilities. These end-users prioritize quality, consistency, and compliance with stringent purity standards (e.g., USP or FCC grades). The purchasing decisions of these potential customers are heavily influenced by regulatory approvals, price stability, and the ability of the supplier to guarantee consistent, contaminant-free batches suitable for their specific high-volume, sensitive manufacturing environments.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 115.5 Million |

| Market Forecast in 2033 | USD 158.7 Million |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Niacet (Kerry), Macco Organiques, DR. PAUL LOHMANN GMBH KG, Tengzhou AoXiang Chemical, Perstorp, Shanghai Shengjun Chemical, Fine Organics, Tianjin Haihan Chemical, Daicel Corporation, Zhejiang Newflash Chemical, Wego Chemical Group, Pruton Pharma, Barentz, T&L Chemical, Loba Chemie, Impextraco NV, ADM, Novozymes, Eastman Chemical Company, Kemin Industries. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Sodium Propionate Market Key Technology Landscape

The key technology landscape surrounding the Sodium Propionate market is primarily focused on optimizing the chemical synthesis and subsequent purification processes rather than developing fundamentally new applications for the established preservative. Manufacturing technology centers on the highly efficient neutralization of propionic acid, commonly achieved using batch reactors, followed by spray drying or crystallization techniques to produce high-purity, free-flowing powder grades necessary for modern food applications. Recent technological advancements emphasize continuous processing methodologies over traditional batch synthesis, aimed at improving scalability, reducing energy consumption per unit of product, and ensuring ultra-consistent particle size distribution, which is crucial for uniform blending in large-scale food manufacturing operations, thereby increasing reliability and reducing operational costs for major producers globally.

Furthermore, technology related to raw material sourcing is evolving, with growing interest in sustainable or bio-based propionic acid production through microbial fermentation of renewable feedstock, contrasting with conventional fossil fuel-derived synthesis. While still niche, this biotechnological route is gaining traction, driven by consumer demand for bio-sourced ingredients and corporate sustainability mandates, potentially leading to premium-priced "natural" sodium propionate in the future. On the quality assurance front, advanced spectroscopic techniques (e.g., FTIR and HPLC) are integrated into the production line for real-time contaminant detection and purity analysis, ensuring adherence to rigorous international standards such as Food Chemicals Codex (FCC) and European Pharmacopoeia (EP). These technological upgrades are essential for market differentiation and maintaining competitive edge in a commodity-driven chemical sector.

Regional Highlights

- North America: North America holds a significant share of the Sodium Propionate market, characterized by highly industrialized food manufacturing, strict regulatory frameworks (FDA’s GRAS status for sodium propionate), and high consumer demand for convenience foods with long shelf lives. The region, particularly the United States, hosts major commercial bakeries and large-scale feed mills that drive consistent, high-volume consumption. Market maturity here dictates that growth is steady, focusing on high-quality supply chain integration and minimal-dose, high-efficacy formulations. The emphasis on advanced animal nutrition and livestock performance further solidifies the demand for feed-grade sodium propionate, ensuring robust market stability.

- Europe: Europe represents a mature but complex market, heavily influenced by the European Food Safety Authority (EFSA) regulations regarding food additive E281. While usage is well-established, particularly in Mediterranean and Northern European bakery traditions, the region faces strong pressure from the clean-label movement, prompting some manufacturers to explore natural alternatives. However, the sheer volume of processed foods and the advanced pharmaceutical industry, where sodium propionate serves specialized preservative roles, maintain strong baseline demand. The market landscape is competitive, with manufacturers focusing on providing high-specification grades and securing long-term contracts with major food processors across Germany, France, and the UK.

- Asia Pacific (APAC): The APAC region is projected to exhibit the highest Compound Annual Growth Rate (CAGR) during the forecast period. This rapid expansion is fueled by explosive population growth, fast-paced urbanization, and a corresponding shift from traditional, daily-prepared foods to packaged, industrially produced goods. Countries like China and India are experiencing massive growth in organized retail and commercial baking operations, significantly boosting the demand for preservatives like sodium propionate to cope with diverse climate conditions and expanding distribution networks. Furthermore, the region’s booming aquaculture and livestock sectors are driving massive requirements for feed preservation, making APAC the key focus area for capacity expansion by global sodium propionate producers.

- Latin America (LATAM): The LATAM market is characterized by moderate growth, driven by increasing foreign investment in the food processing sector and the modernization of bakery and convenience food production, particularly in Brazil and Mexico. Economic volatility and varying regulatory enforcement across countries present challenges, but the underlying demand for cost-effective shelf-life extension is strong, especially in countries dealing with hot and humid climates where microbial spoilage rates are high. The poultry and swine industries represent a vital consumption segment in this region, utilizing sodium propionate extensively in feed to minimize spoilage during storage and distribution.

- Middle East and Africa (MEA): The MEA region is currently a smaller but emerging market, with pockets of high growth in the Gulf Cooperation Council (GCC) nations due to increased import dependency on processed foods and the establishment of sophisticated, industrial bakeries. In Africa, the market is highly fragmented, but urbanization and improving food safety standards are slowly driving consumption. Regulatory harmonization remains a hurdle, yet the extreme climatic conditions necessitate highly effective preservatives, positioning sodium propionate as an essential solution for local food security efforts and mitigating post-harvest losses, particularly in flour and baked products within rapidly expanding urban centers.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Sodium Propionate Market.- Niacet (Kerry)

- Macco Organiques

- DR. PAUL LOHMANN GMBH KG

- Tengzhou AoXiang Chemical

- Perstorp

- Shanghai Shengjun Chemical

- Fine Organics

- Tianjin Haihan Chemical

- Daicel Corporation

- Zhejiang Newflash Chemical

- Wego Chemical Group

- Pruton Pharma

- Barentz

- T&L Chemical

- Loba Chemie

- Impextraco NV

- ADM

- Novozymes

- Eastman Chemical Company

- Kemin Industries

Frequently Asked Questions

Analyze common user questions about the Sodium Propionate market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of sodium propionate in food preservation?

Sodium propionate's primary function is to act as a potent antimicrobial and antifungal agent, specifically inhibiting the growth of mold and certain bacteria, such as rope bacteria (Bacillus subtilis), in food products. It is particularly effective in baked goods (breads, pastries) and processed cheeses, functioning best in mildly acidic conditions (pH 5.0 to 6.5) to extend shelf life and prevent economic losses due to spoilage, making it a critical component of industrialized food supply chains globally.

How is the demand for sodium propionate segmented across major applications?

Demand is primarily segmented into Food & Beverages and Animal Feed. The Food & Beverages sector, dominated by the bakery industry, accounts for the largest share due to the necessity of mold inhibition in commercial bread production. The Animal Feed segment is the second largest, driven by large-scale livestock operations requiring feed concentrates to be protected against fungal contamination to maintain nutritional integrity and safeguard animal health, ensuring high-quality, mold-free rations.

Are there regulatory limitations or concerns regarding the use of sodium propionate?

Sodium propionate is generally recognized as safe (GRAS) by the FDA in the US and listed as E281 in the EU, meaning it is widely approved within specified maximum limits. Concerns are minimal regarding toxicity at approved levels, but regulatory bodies strictly control dosage based on food category. The primary market restraint is the growing consumer preference in some developed regions for 'clean label' products, which occasionally prompts manufacturers to seek natural alternatives, although sodium propionate remains the cost-effective and highly reliable standard.

Which geographical region is expected to drive the highest growth in the Sodium Propionate market?

The Asia Pacific (APAC) region, specifically emerging economies like China and India, is expected to exhibit the highest Compound Annual Growth Rate (CAGR). This acceleration is driven by rapid urbanization, increasing consumption of packaged and processed foods, expansion of industrial-scale commercial bakeries, and significant growth in the organized animal feed manufacturing sectors, necessitating greater volumes of chemical preservatives to ensure food safety and stability across vast and complex supply chains.

What raw materials are essential for manufacturing sodium propionate and how do they impact market costs?

The primary essential raw material is propionic acid, which is typically synthesized from petrochemical sources such as ethylene or synthesis gas. This propionic acid is then neutralized with a sodium source (e.g., sodium hydroxide). Fluctuations in the global oil and gas markets directly influence the cost of petrochemical feedstock, leading to volatility in propionic acid prices, which in turn significantly impacts the final manufacturing costs and profit margins for sodium propionate producers operating within this commodity chemical market.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager