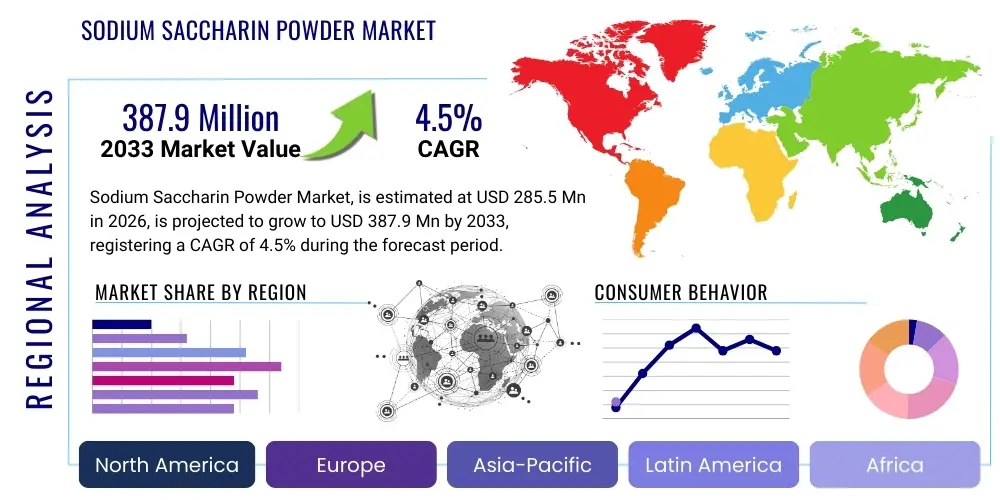

Sodium Saccharin Powder Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436827 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Sodium Saccharin Powder Market Size

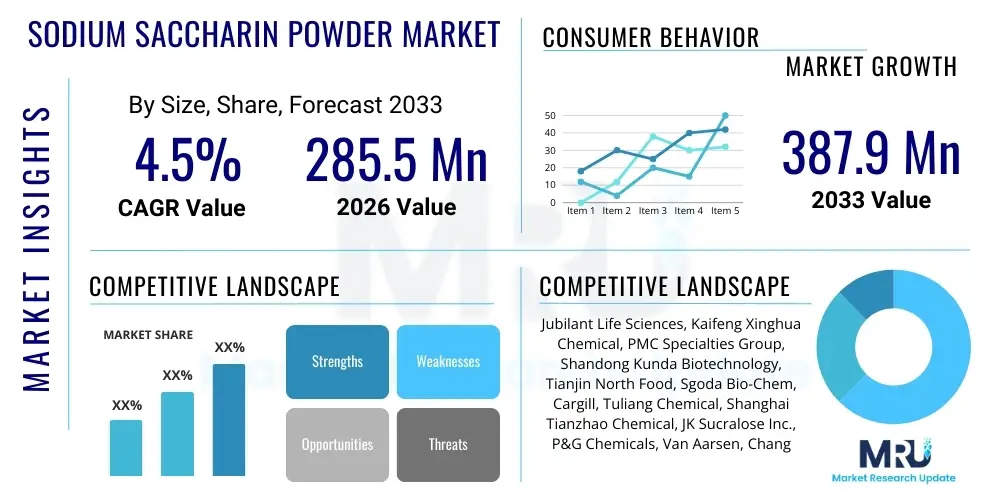

The Sodium Saccharin Powder Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.5% between 2026 and 2033. The market is estimated at $285.5 Million in 2026 and is projected to reach $387.9 Million by the end of the forecast period in 2033.

Sodium Saccharin Powder Market introduction

Sodium Saccharin is an artificial, non-nutritive sweetener that is approximately 200 to 700 times sweeter than sucrose (table sugar). It is synthesized primarily from toluene or phthalic anhydride, yielding a white crystalline powder known for its intense sweetening power, long shelf life, and high stability under heating, which makes it suitable for various industrial processes. Chemically, it is the sodium salt of saccharin, widely utilized in the food and beverage industry as a low-calorie alternative to sugar, addressing the rising global demand for products aimed at weight management and diabetes control. Its extensive use is facilitated by its relatively low production cost and consistent availability across diverse geographical regions.

The product's application spectrum extends significantly beyond food and beverages. In the pharmaceutical sector, Sodium Saccharin is critical for masking the unpleasant bitter tastes of medications, particularly in liquid formulations, chewable tablets, and oral care products like toothpaste and mouthwash. Furthermore, its functional properties are exploited in electroplating processes, where it acts as a brightener in nickel and cobalt plating solutions, ensuring smooth, lustrous finishes on metal components. This diversification across industrial applications shields the market from volatility concentrated solely within the food processing segment, ensuring stable, sustained demand.

Driving factors for market expansion include escalating health consciousness globally, leading to increased consumption of diet and sugar-free products. Regulatory bodies, while maintaining strict oversight on acceptable daily intake (ADI) levels, generally recognize Sodium Saccharin as safe, bolstering consumer and manufacturer confidence. The market benefits substantially from high demand in developing economies, particularly in Asia Pacific, where population growth and increasing disposable incomes translate into higher consumption of processed and packaged foods requiring artificial sweeteners for cost optimization and enhanced flavor profiles.

Sodium Saccharin Powder Market Executive Summary

The Sodium Saccharin Powder market demonstrates resilience driven by strong demand from the processed food and pharmaceutical industries, positioning it for steady growth over the forecast period. Business trends indicate a strategic focus on purity and particle size variation (mesh size) customization to meet highly specific requirements in specialized applications such as electroplating and tableting, moving beyond standard bulk food applications. Manufacturers are investing in advanced purification techniques to ensure compliance with stringent international food safety and pharmaceutical grade standards (e.g., USP, BP, EP), mitigating risks associated with regulatory scrutiny and maintaining competitive differentiation based on quality assurance and supply chain integrity.

Regionally, Asia Pacific (APAC) stands as the dominant market, serving as both the largest production hub, primarily centered in China and India, and the fastest-growing consumption region, fueled by massive population bases and the rapid expansion of domestic food processing sectors. North America and Europe, characterized by mature markets, exhibit growth primarily driven by regulatory-backed mandates for sugar reduction in packaged goods and increased utilization in health supplements. Future growth opportunities are heavily contingent upon manufacturers successfully navigating evolving regulatory landscapes regarding labeling and maximum permissible usage levels in specific food categories across disparate global jurisdictions, ensuring market access.

Segment trends highlight the 40-80 Mesh size category experiencing robust demand, offering a balance of solubility and cost-effectiveness suitable for both beverages and baked goods. Within applications, the food and beverage segment retains the largest market share, while the pharmaceutical sector is projected to register the fastest growth due to the rising global geriatric population and the associated increase in prescription medication usage requiring taste modification. Competition remains intense, emphasizing cost efficiency and backward integration to secure stable raw material supply, particularly toluene derivatives, which are subject to petrochemical price fluctuations.

AI Impact Analysis on Sodium Saccharin Powder Market

Common user questions regarding AI's impact on the Sodium Saccharin Powder market frequently revolve around how artificial intelligence can enhance safety compliance, optimize complex synthesis processes, and accelerate the discovery of novel, potentially superior, low-calorie alternatives. Users are particularly keen on understanding AI's role in predictive quality control (forecasting impurities before batch completion) and streamlining vast, complex supply chain logistics, especially given the global nature of raw material sourcing and distribution. The key themes summarized from these inquiries underscore expectations for AI to drive down operational costs, improve product purity consistency, and provide sophisticated analytical tools for regulatory adherence monitoring, ultimately leading to greater efficiency and enhanced consumer safety assurances across the value chain.

AI deployment is strategically focused on enhancing the traditionally labor-intensive and chemistry-dependent manufacturing processes inherent to artificial sweetener production. For example, machine learning algorithms can analyze real-time sensor data from reactors (temperature, pressure, pH, reagent ratios) during the Remsen-Fahlberg synthesis process, identifying optimal reaction parameters that maximize yield and minimize the formation of unwanted byproducts, thereby boosting throughput efficiency and reducing waste. This precision manufacturing approach is crucial for high-volume, low-margin products like Sodium Saccharin.

Furthermore, the integration of AI platforms into market research and consumer trend analysis allows manufacturers to dynamically adjust production schedules and mesh size specifications based on granular demand forecasts derived from vast datasets, including social media sentiment and point-of-sale data. This capability facilitates proactive inventory management and reduces obsolescence risks. AI-driven predictive maintenance in manufacturing facilities also minimizes costly downtime, ensuring the continuous, reliable supply of Sodium Saccharin powder to end-user industries worldwide, solidifying its competitive edge against newer, often more expensive, high-intensity sweeteners.

- Enhanced Process Optimization: AI algorithms predict optimal reaction conditions in chemical synthesis, maximizing yield and purity.

- Predictive Quality Control: Machine learning identifies potential impurity spikes in real-time, preventing off-spec batches.

- Supply Chain Resilience: AI models optimize global logistics, inventory levels, and demand forecasting, especially concerning volatile raw material inputs like toluene.

- Regulatory Compliance Monitoring: Automated systems track evolving global food and pharmaceutical standards, ensuring product formulations remain compliant.

- R&D Acceleration: AI tools screen potential molecular structures for next-generation sweeteners or synergistic blends, though Sodium Saccharin production itself is mature.

DRO & Impact Forces Of Sodium Saccharin Powder Market

The dynamics of the Sodium Saccharin market are shaped by a complex interplay of public health drivers, strict regulatory frameworks, competitive substitutes, and ongoing technological refinements in synthesis. The primary driver remains the pervasive trend toward sugar reduction and calorie control, fueled by rising rates of obesity and diabetes globally, creating sustained demand for low-calorie alternatives. However, this growth is perpetually restrained by continuous public and regulatory scrutiny regarding the long-term health implications of artificial sweeteners, leading to periodic restrictions on acceptable daily intake (ADI) limits in certain regions. Opportunities lie in expanding its usage into emerging applications, such as nutraceuticals and complex industrial formulations, alongside geographical market penetration in rapidly industrializing economies.

Impact forces dictate that competitive intensity remains high, primarily due to direct competition from other established high-intensity sweeteners like Sucralose, Aspartame, and Stevia derivatives, which often command a premium but offer different taste profiles and natural sourcing appeal (in the case of Stevia). The low-cost production structure of Sodium Saccharin, particularly in Asia, acts as a stabilizing force, ensuring its continued preference in cost-sensitive bulk applications. Environmental concerns related to chemical synthesis and the push for greener chemistry are beginning to influence sourcing and manufacturing decisions, prompting manufacturers to explore more sustainable production methodologies or alternative raw material sources to mitigate future regulatory risks.

Furthermore, regulatory changes in key consuming regions, such as the European Union and North America, frequently act as both a driver (when favorable toward sugar reduction initiatives) and a restraint (when new studies question safety or labeling requirements are tightened). The market's stability is inherently tied to global petrochemical markets, as primary raw materials are derived from petroleum products. Successful market players must therefore possess robust hedging strategies and diversified supply chains to buffer against raw material price volatility, ensuring stable pricing and reliable delivery to maintain long-term contracts with major food and beverage manufacturers.

Segmentation Analysis

The Sodium Saccharin Powder market is segmented primarily based on mesh size, which dictates solubility and flow characteristics, and by application, which reflects the end-user industry demand. Mesh size classifications (e.g., 8-12 Mesh, 20-40 Mesh, 40-80 Mesh, and 100 Mesh or finer) are crucial for specific industrial processes. For instance, the finer powders (100 Mesh) are highly desirable in pharmaceutical tableting and powdered beverage mixes where smooth dissolution and homogeneity are paramount. Conversely, larger crystal sizes (8-12 Mesh) might be preferred in certain industrial applications, such as electroplating, where flowability and non-dusting properties are important for precise dosing and minimized workplace hazard.

The application segmentation clearly illustrates the market's reliance on the Food & Beverage sector, which consumes the vast majority of produced volume. Within F&B, categories such as diet soft drinks, packaged sweets, preserved fruits, and bakery items are major consumers. The Pharmaceutical segment follows closely, driven by the need for palatable dosage forms, especially for children and the elderly. The market also derives niche, yet stable, demand from specialized industries like Animal Feed, where it enhances palatability to encourage intake, and the Cosmetics and Personal Care sector, where it sweetens products like lip balms and toothpastes.

Geographically, market segmentation reveals disparities in consumption patterns and production capacities. Asia Pacific dominates manufacturing capacity and is rapidly increasing consumption, while North America and Europe prioritize high-purity, USP/EP-grade material due to stringent quality control standards. Understanding these segment-specific requirements, especially the correlation between mesh size requirements and geographical regulatory adherence, is vital for manufacturers developing targeted marketing and distribution strategies across the globe, ensuring products meet precise customer specifications.

- By Mesh Size:

- 8-12 Mesh (Coarse)

- 20-40 Mesh

- 40-80 Mesh (Standard/Intermediate)

- 100 Mesh (Fine Powder)

- By Application:

- Food & Beverage Industry (Diet Soft Drinks, Baked Goods, Confectionery)

- Pharmaceutical Industry (Tablets, Syrups, Oral Care)

- Cosmetics & Personal Care (Toothpaste, Mouthwash, Lip Products)

- Electroplating Industry (Nickel Brighteners)

- Animal Feed

- By Grade:

- Food Grade

- Pharmaceutical Grade (USP/BP/EP)

- Industrial Grade

Value Chain Analysis For Sodium Saccharin Powder Market

The value chain for Sodium Saccharin Powder begins with the upstream sourcing of raw chemical precursors, primarily toluene and derivatives, which are sourced from the petrochemical industry. This phase is capital-intensive and subject to global oil and gas price volatility, directly influencing manufacturing costs. The subsequent stage involves complex chemical synthesis, typically utilizing the Remsen-Fahlberg method, which requires specialized reaction vessels, high-pressure equipment, and strict environmental controls for managing chemical byproducts. Efficiency in this manufacturing step, particularly optimizing yield and minimizing waste streams, is crucial for cost leadership.

The midstream process focuses on purification, crystallization, and particle size reduction (milling and sieving) to meet specific mesh size requirements (e.g., 40-80 Mesh for standard food use). Quality assurance and regulatory compliance testing are integrated at this stage to certify the product meets specific grading standards (e.g., Food Grade, USP, or Industrial Grade). Given the global commodity nature of Sodium Saccharin, manufacturers strive for continuous process improvements and backward integration into raw material supply to maintain competitive pricing and ensure robust supply stability, which is often a prerequisite for securing major long-term contracts.

Downstream activities encompass warehousing, global distribution, and sales, utilizing both direct and indirect distribution channels. Direct sales are common for large-volume purchases by major multinational food and pharmaceutical corporations seeking tailored technical support and guaranteed supply. Indirect distribution relies on global chemical distributors and specialized ingredient brokers who manage smaller orders and provide regional logistical expertise, especially in emerging markets. The final link is the end-user (e.g., beverage bottlers, pharmaceutical tablet manufacturers, or electroplating firms), where the functional properties of the powder are utilized. Regulatory compliance remains a persistent concern across all channels, requiring detailed documentation and traceability throughout the supply chain.

Sodium Saccharin Powder Market Potential Customers

The primary and largest segment of potential customers for Sodium Saccharin powder resides within the processed Food and Beverage industry, specifically companies involved in producing diet and low-calorie soft drinks, powdered drink mixes, table-top sweeteners, and various processed foods like canned fruits and baked goods. These customers value Sodium Saccharin for its cost-effectiveness, stability under heat, and long shelf life, making it an ideal bulk sweetener for mass-produced items where cost control is a dominant factor. Demand from this sector is highly sensitive to consumer trends favoring reduced sugar intake and government health initiatives.

A second major customer base includes pharmaceutical companies and nutraceutical manufacturers. These buyers demand high-purity, often Pharmaceutical Grade (USP/EP) Sodium Saccharin to ensure efficacy, safety, and regulatory approval for human ingestion. Their purchasing decisions are primarily driven by quality certifications, consistency, and the ability of the sweetener to effectively mask the bitter taste profiles of active pharmaceutical ingredients (APIs) in oral formulations, such as pediatric syrups and chewable tablets. Suppliers must demonstrate rigorous quality management systems and transparent documentation to secure these contracts.

Other significant potential customers include specialized industrial users, such as electroplating firms requiring the industrial grade product to function as a brightener in metal finishing operations (particularly nickel plating), and manufacturers of personal care products, including major toothpaste and mouthwash brands. These customers require consistent supply and specific technical specifications regarding particle size and impurity levels tailored to their unique chemical processes. The diverse application base necessitates that suppliers offer a wide range of product grades and technical support to cater effectively to these distinct industrial requirements.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $285.5 Million |

| Market Forecast in 2033 | $387.9 Million |

| Growth Rate | 4.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Jubilant Life Sciences, Kaifeng Xinghua Chemical, PMC Specialties Group, Shandong Kunda Biotechnology, Tianjin North Food, Sgoda Bio-Chem, Cargill, Tuliang Chemical, Shanghai Tianzhao Chemical, JK Sucralose Inc., P&G Chemicals, Van Aarsen, Changzhou Xingguang Chemical, SPI Pharma, Suzhou Hope Chemical, Hefei Fengle Seed Co., Salvi Chemical Industries, Spectrum Chemical Mfg. Corp., Merck KGaA, Vitasweet Co. Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Sodium Saccharin Powder Market Key Technology Landscape

The production of Sodium Saccharin powder is overwhelmingly reliant on established chemical synthesis methods, primarily the Remsen-Fahlberg process, which uses toluene as the starting material. Although this technology is mature, ongoing technological advancements focus less on radical changes to the core reaction pathway and more on process intensification, yield optimization, and continuous flow chemistry approaches to improve efficiency and reduce the environmental footprint. Modern facilities integrate sophisticated computerized control systems to monitor reaction kinetics in real-time, ensuring optimal conversion rates and minimizing energy consumption associated with the large-scale exothermic reactions involved in sulfonamide formation.

Post-synthesis purification technology is crucial, defining the final product grade and its suitability for sensitive applications like pharmaceuticals. Key techniques include advanced crystallization, membrane filtration, and activated carbon treatment, designed to meticulously remove trace impurities, notably O-Toluenesulfonamide (o-TSA) and p-Toluenesulfonamide (p-TSA), which are strictly regulated contaminants. Investment in these purification technologies directly correlates with a manufacturer’s ability to serve the high-value Pharmaceutical Grade market segment, where purity standards far exceed those required for standard food applications, thereby offering a significant competitive advantage based on quality and regulatory compliance assurance.

Furthermore, technology related to powder handling and customization, specifically micronization and controlled crystallization techniques, plays a vital role. Manufacturers use specialized milling and sieving equipment to produce the required mesh sizes (e.g., 40-80 Mesh or ultrafine 100 Mesh) with extremely narrow particle size distributions. This precision in particle engineering is critical for applications demanding high dissolution rates, such as powdered beverage mixes, or specific density requirements for precise tablet compression in the pharmaceutical industry. The ability to consistently deliver customized physical product attributes is a key technological differentiator in this commodity-driven market.

Regional Highlights

- Asia Pacific (APAC): APAC is the largest market both in terms of production volume and consumption value. The region, particularly China and India, serves as the global manufacturing hub due to lower operational costs and established chemical infrastructure. Consumption is driven by rapid urbanization, increasing disposable incomes, and the massive scale of the domestic packaged food and beverage industries. Strict environmental regulations in China, however, occasionally impact supply stability, leading to price volatility.

- North America: A mature market characterized by high consumer awareness regarding health and wellness, driving significant demand for sugar-free and diet products. The market growth here is supported by high-value applications in pharmaceuticals and premium food formulations. North American consumers and regulators demand high purity standards (USP grade), positioning quality over cost as the primary purchasing factor.

- Europe: The European market maintains stable growth, influenced heavily by the European Food Safety Authority (EFSA) regulations, which strictly govern permitted usage levels (ADI) and labeling requirements. The focus is increasingly shifting towards "clean label" products, challenging artificial sweeteners, yet Sodium Saccharin remains essential for specific cost-sensitive and high-stability applications. Germany and the UK are key consumers in the pharmaceutical sector.

- Latin America: This region presents high growth potential, driven by rising health concerns related to high sugar consumption and the expanding presence of multinational food and beverage companies. Brazil and Mexico are primary markets, where Sodium Saccharin is widely used in mass-market soft drinks and confectionery products due to its cost advantage.

- Middle East and Africa (MEA): Growth in MEA is moderate but accelerating, particularly in Gulf Cooperation Council (GCC) countries, spurred by government initiatives to combat diabetes and obesity. Demand is heavily concentrated in the soft drinks sector and is often met through imports, making logistics and import tariffs crucial cost factors for market penetration.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Sodium Saccharin Powder Market.- Jubilant Life Sciences

- Kaifeng Xinghua Chemical Co., Ltd.

- PMC Specialties Group, Inc.

- Shandong Kunda Biotechnology Co., Ltd.

- Tianjin North Food Co., Ltd.

- Sgoda Bio-Chem Co., Ltd.

- Cargill, Incorporated

- Tuliang Chemical Co., Ltd.

- Shanghai Tianzhao Chemical Co., Ltd.

- JK Sucralose Inc.

- P&G Chemicals

- Van Aarsen International BV

- Changzhou Xingguang Chemical Co., Ltd.

- SPI Pharma Inc.

- Suzhou Hope Chemical Co., Ltd.

- Hefei Fengle Seed Co., Ltd.

- Salvi Chemical Industries Ltd.

- Spectrum Chemical Mfg. Corp.

- Merck KGaA

- Vitasweet Co. Ltd.

Frequently Asked Questions

Analyze common user questions about the Sodium Saccharin Powder market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the demand for Sodium Saccharin Powder globally?

The primary factor driving global demand is the accelerating consumer shift towards low-calorie and sugar-free dietary choices, directly fueled by rising global rates of chronic diseases such as obesity and Type 2 diabetes, requiring effective sugar substitutes in mass-market food and beverages.

Which mesh size segment of Sodium Saccharin is most commonly used in the Food and Beverage industry?

The 40-80 Mesh size segment is the most widely utilized in the Food and Beverage industry. This size offers an optimal balance between solubility, cost-effectiveness, and handling characteristics suitable for compounding into liquid formulations, powdered drink mixes, and various baked goods.

How do regulatory restraints, such as ADI limits, impact the Sodium Saccharin market growth?

Regulatory restraints, specifically the establishment of conservative Acceptable Daily Intake (ADI) levels by bodies like the FDA and EFSA, impose limits on the permissible concentration in consumer products, thereby capping the total potential market volume and necessitating careful formulation by food manufacturers to maintain compliance.

Is Sodium Saccharin used in industrial applications outside of food and pharmaceuticals?

Yes, Sodium Saccharin has a significant, albeit niche, industrial application as a brightener agent in the electroplating industry, particularly in nickel and cobalt plating baths, where it ensures a smooth, highly lustrous finish on metallic components.

Which geographical region dominates the global production of Sodium Saccharin Powder?

The Asia Pacific region, primarily driven by production capacities in China and India, dominates the global manufacturing and supply of Sodium Saccharin Powder due to the presence of large-scale chemical industries and highly cost-competitive operational structures.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager