Sodium Tetraborate Decahydrate Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431630 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Sodium Tetraborate Decahydrate Market Size

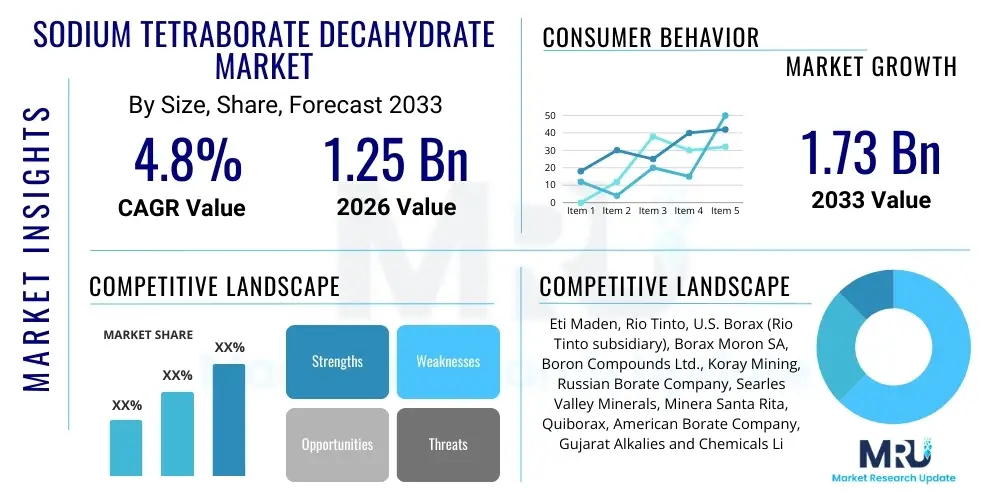

The Sodium Tetraborate Decahydrate Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at $1.25 Billion in 2026 and is projected to reach $1.73 Billion by the end of the forecast period in 2033.

This anticipated growth trajectory is fundamentally driven by the expanding demand for borate compounds across various industrial sectors, notably in the production of fiberglass, ceramics, and detergents. Sodium Tetraborate Decahydrate, commonly known as borax, serves as a crucial raw material, offering unique fluxing, buffering, and fire retardant properties. The increasing global focus on sustainable and effective flame retardants, particularly in construction and textile applications, significantly bolsters the consumption rate of this compound. Furthermore, advancements in agricultural practices, where borates are utilized as essential micronutrients, contribute substantially to market expansion, especially in emerging economies focusing on enhanced crop yield and quality.

Market valuation reflects sustained investment in optimizing refining processes and securing raw material supply, primarily from major borate-producing regions. While the initial valuation in 2026 reflects steady industrial recovery post-global economic shifts, the projected valuation for 2033 accounts for aggressive adoption of Sodium Tetraborate Decahydrate in advanced material science, including specialized glass manufacturing for electronics. Key strategic initiatives by major market players, focused on expanding production capacity and establishing streamlined distribution networks across Asia Pacific and Europe, are pivotal factors supporting the predicted CAGR. Fluctuations in energy costs and regulatory scrutiny concerning boric acid derivatives present minor headwind challenges but are largely mitigated by the compound's irreplaceable functionality in core applications.

Sodium Tetraborate Decahydrate Market introduction

Sodium Tetraborate Decahydrate, commonly known as borax, is a naturally occurring mineral compound and a refined product of boric acid, characterized by its chemical formula Na2B4O7·10H2O. It is a white, odorless, crystalline substance widely recognized for its high solubility in water and alkaline properties. This compound serves as a foundational industrial chemical utilized across diverse sectors including household cleaning, agriculture, metallurgy, and advanced material manufacturing. Major applications span the production of specialty glasses like borosilicate, the formulation of detergents and cleaning agents where it acts as a water softener and buffer, and its critical role in fire-retardant materials, offering enhanced safety profiles. The primary benefits of utilizing Sodium Tetraborate Decahydrate include its efficacy as a pH buffer, its non-toxic nature compared to many alternatives, and its ability to act as a fluxing agent in high-temperature processes. Key driving factors for the market expansion encompass rising global demand for fiberglass insulation, accelerating construction activities in developing nations, and growing utilization in nuclear applications for radiation shielding and control.

The chemical stability and multifaceted utility of Sodium Tetraborate Decahydrate position it as an indispensable ingredient in modern industrial chemistry. Its inherent ability to stabilize formulations and enhance the performance of end-products ensures sustained demand across mature markets in North America and Europe, while simultaneously capturing burgeoning opportunities in rapidly industrializing regions. The product's versatility extends beyond traditional applications; it is increasingly recognized for its use in creating sophisticated ceramic glazes, metallurgical fluxes for welding and brazing, and as an effective insecticide and herbicide in environmentally conscious agricultural practices. Furthermore, the pharmaceutical and cosmetic industries employ high-purity grades of borax for minor buffering and preservation purposes, broadening the spectrum of end-use sectors driving consumption.

Technological innovation surrounding its extraction and purification has led to the availability of various grades tailored for specific industrial requirements, ranging from technical grade for heavy manufacturing to ultra-high purity grades required for sensitive electronics and medical applications. The market dynamics are closely linked to global economic health, particularly the vitality of the construction and automotive sectors, as these are major consumers of fiberglass and specialty glass products where Sodium Tetraborate Decahydrate is essential. Continuous research into sustainable sourcing and closed-loop recycling of borate compounds is emerging as a critical element influencing long-term market sustainability and growth, addressing environmental concerns while securing future raw material supply against potential geological constraints.

Sodium Tetraborate Decahydrate Market Executive Summary

The Sodium Tetraborate Decahydrate market demonstrates robust business trends characterized by strong vertical integration among leading producers, aiming to control raw material supply (boron mineral extraction) and downstream processing into various borate derivatives. Strategic mergers and acquisitions targeting niche application expertise, such as fire retardant formulation or specialty glass manufacturing, are notable. Sustainability initiatives are driving product innovation towards lower energy consumption during processing and developing greener application methods. Regional trends indicate Asia Pacific, particularly China and India, as the fastest-growing regions, fueled by rapid infrastructural development, high demand for insulation materials (fiberglass), and expanding detergent manufacturing bases. North America and Europe maintain stable demand primarily driven by regulatory-mandated fire safety standards and sustained requirements from the nuclear and agricultural sectors. Segment trends highlight the dominant position of the technical grade segment due to its widespread use in glass and ceramics, followed closely by the agricultural segment, which is experiencing accelerated growth due to increasing emphasis on soil health and micronutrient management globally.

Key business imperatives for market participants include navigating geopolitical complexities impacting raw material sourcing, primarily from Turkey and the United States, which are leading global suppliers of boron. Companies are increasingly focused on supply chain resilience and diversification, including establishing redundant production sites or securing long-term supply contracts with diversified mining operations. Furthermore, intense competition mandates continuous process optimization to reduce production costs, ensuring competitiveness against synthetic alternatives or other borate derivatives. The shift towards high-value applications, such as specialized electronics glass and advanced battery components (though indirectly through boric acid derivatives, Sodium Tetraborate Decahydrate serves as a critical precursor), represents a major trend in revenue diversification for established market leaders.

The macroeconomic environment provides a favorable backdrop for market expansion, provided global economic growth remains steady, supporting manufacturing and construction output. Regulatory trends, particularly those pertaining to environmental safety and the classification of boron compounds, require diligent monitoring; while borax is generally safer than some other boron chemicals, compliance with REACH regulations in Europe and similar mandates elsewhere is mandatory. The continuous integration of digital technologies, particularly in inventory management and predictive maintenance of production facilities, is enhancing operational efficiencies, supporting the overall positive momentum projected for the market through 2033. Investment in R&D aimed at developing novel uses for borax, especially in sustainable materials science and next-generation chemical manufacturing, is accelerating, defining future growth vectors.

AI Impact Analysis on Sodium Tetraborate Decahydrate Market

Common user questions regarding AI's impact on the Sodium Tetraborate Decahydrate market frequently center on three key themes: optimization of complex mining and refining operations, enhanced supply chain predictability, and the development of new material formulations leveraging AI-driven research. Users are particularly concerned about how AI can mitigate the inherent variability in borate mineral deposits and improve yield and purity during extraction and crystallization processes. There is high expectation that machine learning algorithms will lead to more efficient energy consumption in high-temperature glass and ceramic manufacturing where borax is used, thereby lowering the environmental footprint. Conversely, users seek clarity on the capital investment required for AI implementation in traditionally resource-intensive industries and the resultant impact on operational staffing and labor skills necessary for future borate production facilities. The overall sentiment is that AI will primarily serve as an optimization tool, enhancing efficiency and quality control rather than fundamentally altering the product itself or its core applications.

- AI-driven optimization of borate mining logistics and extraction yields, minimizing waste.

- Machine learning applied to chemical refining processes to ensure consistent high-purity Sodium Tetraborate Decahydrate output.

- Predictive maintenance schedules for high-wear production equipment, reducing unexpected downtime and improving operational throughput.

- Advanced demand forecasting using AI models to stabilize pricing and inventory levels across volatile global markets.

- Accelerated discovery of novel borate-containing materials, particularly in specialized glass and ceramic formulations, using computational chemistry powered by AI.

- Enhanced quality control systems utilizing computer vision and machine learning for defect detection in fiberglass production lines.

- Optimization of energy usage in calcination and crystallization phases, crucial steps in borax manufacturing.

DRO & Impact Forces Of Sodium Tetraborate Decahydrate Market

The Sodium Tetraborate Decahydrate market is fundamentally driven by escalating demand for fiberglass insulation in construction and automotive lightweighting, its essential role in effective detergent and cleaning product formulations, and increasing global focus on agricultural micronutrient deficiencies (Drivers). However, the market faces significant restraints, primarily regulatory scrutiny and classification of certain boron compounds as Substances of Very High Concern (SVHC) in some regions, potential price volatility stemming from the highly concentrated geographical sourcing (Turkey dominating global supply), and substitution threats from alternative chemicals in less critical applications (Restraints). Opportunities lie in the rapidly expanding electronic display market requiring specialized borosilicate glass, the development of high-performance fire-retardant polymers, and the utilization of borates in advanced energy storage applications (Opportunity). These dynamics are subject to significant Impact Forces, including global construction activity cycles, evolving environmental protection regulations influencing chemical usage, and technological shifts in material science that might create new high-value end-uses or introduce viable, cost-effective substitutes.

Detailed analysis of the market drivers reveals that rapid urbanization in the Asia Pacific region directly translates into massive demand for construction materials, where fiberglass insulation, requiring large volumes of Sodium Tetraborate Decahydrate as a fluxing agent, is essential for energy efficiency. Furthermore, the persistent need for effective, mild cleaning agents globally secures the detergent segment's growth. The agricultural driver is supported by compelling evidence demonstrating that boron supplementation significantly enhances crop resilience and yield, making borax an increasingly vital component in precision farming techniques worldwide. The confluence of these primary drivers ensures a resilient baseline demand, buffering the market against minor economic downturns in single sectors.

Conversely, market growth is consistently challenged by the concentrated supply chain structure. Geopolitical stability in major producing countries is an exogenous variable that can induce significant price spikes and supply disruptions, compelling downstream users to seek alternative sourcing or substitute materials, albeit often at a performance penalty. The regulatory landscape, especially in the EU, remains the most stringent restraint; while Sodium Tetraborate Decahydrate itself is widely used, the classification of related boric acid substances creates market uncertainty and drives extensive compliance costs for producers and end-users alike. Leveraging the inherent opportunities—especially in high-tech glass for modern consumer electronics which requires the compound's unique thermal properties—will be crucial for maintaining high-margin growth trajectories.

- Drivers:

- Increasing global demand for fiberglass insulation in building and construction.

- Growing adoption of borates as essential micronutrients in agricultural practices.

- High efficacy as a fluxing agent in the ceramics and specialty glass industries.

- Expanding utilization in laundry detergents and cleaning formulations as a buffering agent.

- Restraints:

- Stringent regulatory framework and potential toxicity concerns associated with boron compounds in certain jurisdictions (e.g., EU REACH).

- Price volatility and supply concentration risks due to reliance on a few primary mining regions.

- Availability of alternative fluxing and fire-retardant chemicals in select applications.

- Opportunity:

- Development of high-performance materials for advanced electronic displays and thin films.

- Untapped potential in utilizing borates for novel energy storage solutions and lithium-ion batteries.

- Expansion into niche industrial applications requiring specialized fire-retardant characteristics.

- Impact Forces:

- Fluctuations in global construction and automotive manufacturing output.

- Geopolitical stability impacting raw material (boron mineral) supply and trade.

- Technological advancements influencing the manufacturing efficiency of specialty glasses.

- Evolution of environmental, social, and governance (ESG) standards affecting chemical sourcing and processing.

Segmentation Analysis

The Sodium Tetraborate Decahydrate market is strategically segmented based on factors such as grade type, application, and end-use industry, reflecting the compound's wide functional versatility across the industrial landscape. Grade type segmentation separates high-purity pharmaceutical or electronic grade borax from the widely consumed technical grade used in bulk applications like fiberglass and detergents. Application segmentation highlights the primary functions served, such as fluxing, buffering, and flame retardation, while end-use industry segmentation provides insight into major consumption sectors, including glass and ceramics, agriculture, and cleaning formulations. Understanding these segments is crucial for market participants to tailor their product offerings, meet specific regulatory standards unique to each grade and application, and strategically allocate resources toward high-growth vertical markets, particularly specialized electronics and precision agriculture, which demand enhanced purity and customized delivery formats.

- By Grade Type:

- Technical Grade

- Pharmaceutical Grade

- Electronic Grade

- By Application:

- Fluxing Agent

- Buffering Agent

- Fire Retardant

- Insecticide/Herbicide

- Water Softener

- Preservative

- By End-Use Industry:

- Glass and Ceramics

- Detergents and Cleaning Agents

- Agriculture (Fertilizers)

- Metallurgy

- Adhesives and Sealants

- Pharmaceuticals and Cosmetics

- Nuclear Industry

Value Chain Analysis For Sodium Tetraborate Decahydrate Market

The value chain for Sodium Tetraborate Decahydrate is characterized by highly consolidated upstream activities, primarily involving the mining and concentration of boron minerals (like Colemanite or Tincal) from geographically concentrated deposits. This upstream analysis highlights the significant capital investment required for extraction and initial processing, dictating pricing power at this stage. Midstream activities focus on the chemical refining process, where the raw boron compounds are converted into purified products, including Sodium Tetraborate Decahydrate, involving complex crystallization and drying processes. Downstream analysis involves the formulation and integration of the compound into final products, such as specialty glass, detergents, or fertilizers, where numerous smaller, specialized manufacturers operate. The distribution channel is crucial, relying on specialized bulk chemical logistics (rail, sea freight) for indirect sales to large industrial customers and more localized distribution networks for smaller volume sales to detergent manufacturers and agricultural distributors. Direct sales often involve large, integrated borate producers supplying their captive downstream operations or key strategic customers, while indirect channels leverage third-party chemical distributors for broader regional market reach.

Effective management of the value chain is critical for mitigating operational risks, particularly concerning the transportation and storage of bulk chemical commodities. Upstream sustainability practices, including responsible mining techniques and water management, are increasingly scrutinized by downstream buyers concerned with ESG reporting. The cost structure across the value chain is heavily influenced by energy prices, particularly in the refining stage, and transportation costs due to the bulk nature of the product. Optimization efforts are concentrated on improving the yield during the dissolution and crystallization processes to minimize losses and energy input per ton of finished product. The efficiency of the distribution network, given the international trade flows of borates, directly impacts the delivered cost, making strategic partnerships with global logistics providers essential for competitiveness.

The final stage of the value chain, involving the integration into end-use products, introduces significant variability. In the glass industry, borax is consumed in massive quantities, requiring reliable bulk supply. In contrast, pharmaceutical or electronic grades necessitate rigorous purity testing and specialized packaging. The complexity of the downstream market requires producers to maintain flexible production capabilities capable of switching between technical and high-purity grades based on fluctuating demand signals. Digital platforms are beginning to enhance transparency and traceability throughout the supply chain, aiding both compliance and inventory management from mine head to end-user application.

Sodium Tetraborate Decahydrate Market Potential Customers

Potential customers for Sodium Tetraborate Decahydrate are diverse, spanning multiple heavy and light industries, reflective of the compound's broad functional properties as a flux, buffer, and fire retardant. The primary end-users, or buyers, are large multinational companies engaged in the production of fiberglass and borosilicate glass, requiring bulk technical grade material to lower the melting point of silica and enhance glass durability. Another substantial customer segment comprises global manufacturers of household and industrial cleaning products, detergents, and laundry boosters, utilizing borax for its water-softening and cleaning efficacy. Agricultural chemical companies and fertilizer blenders form a rapidly growing customer base, purchasing borax for micronutrient supplementation in soil amendments. Furthermore, specialized manufacturers in the ceramics industry (glazes and enamels), metallurgical operations (fluxes for non-ferrous metal refining), and specific chemical formulators purchasing for fire-retardant applications represent high-value, albeit lower volume, customer segments. These customers typically prioritize supply reliability, consistent purity, and competitive pricing in their procurement decisions, often entering into long-term supply agreements with major producers to ensure continuous operational flow.

Targeting potential customers requires a differentiated approach based on their consumption volume and purity requirements. For the glass and ceramics industry, technical specifications regarding mesh size and impurity levels are paramount, necessitating bulk purchasing logistics. Conversely, the agricultural sector, which often requires granular or finely powdered product for effective blending with other fertilizers, values ease of application and timely regional distribution. Chemical distributors themselves act as critical intermediate customers, especially those specializing in industrial chemicals, serving small-to-medium enterprises that do not have the capacity for direct bulk imports or manufacturing partnerships. The pharmaceutical and electronics industries, while consuming relatively small volumes, demand extremely high-purity grades, making traceability and certification a mandatory requirement for suppliers aiming to secure these premium customer accounts.

Understanding the procurement cycles and sustainability goals of these varied customer groups is essential for market penetration. Large multinational corporations increasingly incorporate ESG criteria into their supplier selection, preferring producers who demonstrate responsible mining and low-carbon processing techniques. Strategic customer relationship management involves not just providing a competitive price, but also offering technical support on optimal usage, such as formulation advice for detergent manufacturers or dissolution techniques for agricultural applications. The future growth of the customer base is anticipated to come predominantly from emerging markets, where rapid industrialization and modernization of agricultural practices are accelerating the need for high-quality, functional chemicals like Sodium Tetraborate Decahydrate.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.25 Billion |

| Market Forecast in 2033 | $1.73 Billion |

| Growth Rate | 4.8% ( CAGR ) |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Eti Maden, Rio Tinto, U.S. Borax (Rio Tinto subsidiary), Borax Moron SA, Boron Compounds Ltd., Koray Mining, Russian Borate Company, Searles Valley Minerals, Minera Santa Rita, Quiborax, American Borate Company, Gujarat Alkalies and Chemicals Limited, Rose Mill Co., Chemsol Inc., Borax Argentina SA |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Sodium Tetraborate Decahydrate Market Key Technology Landscape

The core technology landscape for Sodium Tetraborate Decahydrate remains focused on optimizing the extraction, refining, and purification processes necessary to achieve varying levels of product purity and granulometry. Key technological innovations revolve around enhancing the energy efficiency of the dissolution and crystallization stages, which are the most energy-intensive steps in converting raw borate minerals into the decahydrate form. Advanced flotation and separation techniques are employed upstream to concentrate the raw ore, minimizing transport costs for non-boron waste materials. Midstream, producers are increasingly adopting continuous crystallization processes instead of batch systems, which allows for finer control over crystal size and shape, crucial for specialized end-use applications like fertilizers or ceramic frits. Furthermore, sophisticated drying technologies, often utilizing waste heat recovery, are implemented to reduce moisture content precisely while minimizing the risk of dehydration (conversion to lower hydrates like pentahydrate or anhydrous forms), ensuring product stability and quality during storage and transport. These technological advancements are critical for maintaining competitive pricing and meeting the rising demand for high-purity borax required by the electronics sector.

Beyond manufacturing efficiency, the technological landscape includes advancements in application methods, particularly in agriculture and fire retardancy. Precision farming technologies utilize borax-based micronutrients delivered through slow-release or encapsulated formulations, maximizing nutrient uptake and minimizing environmental run-off. This requires specialized formulation techniques and material science input. In the realm of fire safety, research focuses on developing synergistic fire-retardant systems where Sodium Tetraborate Decahydrate works effectively with other compounds in polymer matrixes, providing enhanced thermal stability and char formation properties. Digitalization is also an emerging technological factor, with advanced sensor technologies and real-time data analytics being integrated into production lines for continuous quality monitoring and predictive analytics, ensuring the consistency of the final product meets stringent industry specifications, especially for glass manufacturing where minute impurities can affect optical clarity and strength.

Addressing environmental concerns is a crucial element of the technological development roadmap. Modern processing facilities are investing in water treatment and recycling technologies to minimize the consumption of fresh water and manage brine discharge, a significant operational challenge in borate refining. Research into alternative energy sources for plant operations, particularly solar thermal or geothermal energy in locations close to the mines, is also gaining traction, aiming to reduce the overall carbon footprint of borax production. These sustainable technology investments are not just about compliance but are increasingly viewed as strategic differentiators in a market sensitive to raw material sourcing ethics and environmental responsibility. The continuous evolution in material handling and packaging technology also ensures safer and more efficient delivery of the product to diverse global markets, maintaining quality from the processing plant to the end-user facility.

Regional Highlights

The global Sodium Tetraborate Decahydrate market exhibits pronounced regional disparities in terms of production and consumption patterns, reflecting differing levels of industrial maturity and resource availability. Asia Pacific (APAC) stands out as the primary engine of demand growth, driven overwhelmingly by expansive infrastructural development, surging construction volumes, and the associated need for fiberglass insulation and specialty glass used in residential and commercial projects. Countries like China and India are major consumers, not only in construction but also in detergent manufacturing and adopting modern agricultural practices that utilize borates as essential micronutrients. The region's competitive manufacturing landscape further fuels the need for cost-effective fluxing agents in ceramics and metallurgy, solidifying APAC's dominant market position.

North America and Europe represent mature, stable markets characterized by high per capita consumption in niche, high-value applications, and strict regulatory environments. North America benefits from domestic borate production capabilities, providing supply security, with demand stemming heavily from specialty glass manufacturing, advanced fire retardancy mandates, and established agricultural sectors requiring consistent micronutrient input. Europe, while facing rigorous regulatory oversight (like REACH), maintains significant demand driven by sophisticated chemical manufacturing, high standards for energy-efficient building materials, and the presence of major automotive glass producers. Demand growth in these regions is generally slower but focused on premium, high-purity grades for advanced technological applications.

Latin America, the Middle East, and Africa (LAMEA) are characterized by developing market dynamics. Latin America, possessing significant agricultural resources, shows promising growth in the fertilizer segment, where borate supplementation is crucial for maximizing output in varied soil types. The Middle East, with ongoing large-scale infrastructure projects, requires borax for construction materials and related industrial applications. Africa represents an emerging market where increasing industrialization and modernization of agriculture are slowly beginning to drive demand, though market penetration remains challenging due to logistical hurdles and fragmented distribution channels. Over the forecast period, strategic investment in local distribution and technical support will be key to unlocking the latent demand in LAMEA.

- Asia Pacific (APAC): Highest growth region due to exponential demand in construction (fiberglass), robust growth in detergent industries, and massive agricultural sector utilization. Key countries include China, India, Japan, and South Korea.

- North America: Stable, mature market defined by strong demand for specialized glass (borosilicate), advanced fire retardant systems, and established domestic production capabilities (U.S. Borax).

- Europe: Demand driven by strict fire safety standards, high-end ceramics production, and significant regulatory focus on product classification and compliance (REACH). Germany, France, and the UK are primary consumers.

- Latin America: Growing agricultural demand for fertilizers and micronutrients, supported by increasing mining and processing activities in countries like Chile and Argentina.

- Middle East and Africa (MEA): Emerging consumer market fueled by large infrastructure projects, especially in the GCC countries, and gradual industrial expansion across South Africa and the Gulf region.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Sodium Tetraborate Decahydrate Market.- Eti Maden

- Rio Tinto

- U.S. Borax (Rio Tinto subsidiary)

- Borax Moron SA

- Boron Compounds Ltd.

- Koray Mining

- Russian Borate Company

- Searles Valley Minerals

- Minera Santa Rita

- Quiborax

- American Borate Company

- Gujarat Alkalies and Chemicals Limited

- Rose Mill Co.

- Chemsol Inc.

- Borax Argentina SA

- Minas de Borax S.A.

- Hengyang Changzheng Chemical Industry Co., Ltd.

- Dalian Jinchen Borax Co., Ltd.

- Suzhou Chemical Group

- BASF SE

Frequently Asked Questions

Analyze common user questions about the Sodium Tetraborate Decahydrate market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary industrial uses driving the demand for Sodium Tetraborate Decahydrate?

The primary uses driving demand are the manufacturing of fiberglass insulation, where it serves as a critical fluxing agent to lower melting temperatures, its role as a buffering and cleaning agent in detergents, and its application as a micronutrient fertilizer in modern agriculture to enhance crop health.

Which geographical region leads in the consumption of Sodium Tetraborate Decahydrate?

The Asia Pacific (APAC) region is the largest and fastest-growing consumer market, primarily due to intense infrastructural development, resulting in high demand from the construction (fiberglass) and large-scale agricultural sectors, particularly in China and India.

What is the main restraint impacting the growth of the borax market?

The primary restraint is the stringent regulatory environment in developed regions, such as the European Union (EU), where certain boron compounds face classification scrutiny under regulations like REACH, leading to potential usage limitations and increased compliance costs for manufacturers and end-users.

How does the Sodium Tetraborate Decahydrate market utilize technology for sustainability?

Technology is utilized for sustainability by implementing advanced process optimization, such as continuous crystallization and waste heat recovery, to significantly reduce the energy consumption during refining. Furthermore, water recycling technologies are employed to minimize water usage and manage brine disposal effectively.

What are the key differences between Technical Grade and Electronic Grade Sodium Tetraborate Decahydrate?

Technical Grade is used in bulk applications like fiberglass and detergents and has lower purity requirements. Electronic Grade requires ultra-high purity, extremely low heavy metal contamination, and specific particle size distribution for use in sensitive electronic manufacturing processes, commanding a significant price premium.

The comprehensive analysis of the Sodium Tetraborate Decahydrate market reveals a foundationally strong industry, inherently tied to global economic cycles, yet offering resilience through its indispensable role across diverse high-growth sectors. Strategic planning must prioritize supply chain stability against geopolitical risks, particularly given the geographical concentration of primary raw material sources. Furthermore, meeting the escalating demand for ultra-high purity grades required by the burgeoning electronics and specialized material science industries will necessitate ongoing investment in advanced refining technologies and rigorous quality assurance protocols. The future growth trajectory is directly linked to the success of market players in navigating complex environmental regulations while capitalizing on the sustainable application opportunities presented in high-efficiency insulation and precision agriculture. Effective market penetration into emerging economies requires localized distribution strategies and technical support tailored to regional industrial needs, ensuring the market continues its projected expansion through the forecast period ending in 2033.

The market for Sodium Tetraborate Decahydrate is poised for evolutionary rather than revolutionary growth. While the core product remains fundamentally unchanged, the methods of production and application are becoming increasingly sophisticated. Innovation is less focused on chemical substitution and more on process optimization and application specificity. The development of specialized delivery systems for agricultural applications, such as micro-encapsulation or slow-release matrices, represents a key technological frontier that promises enhanced performance and reduced environmental impact. Similarly, in the materials sector, research into how borates influence the mechanical and thermal properties of advanced composites and polymers is opening up new revenue streams that demand stringent technical specifications. These high-value niche segments, although smaller in volume compared to fiberglass, offer superior margins and long-term stability, attracting significant R&D investment from leading market participants.

The geopolitical landscape significantly influences the competitive structure, as evidenced by the dominance of certain state-owned entities in boron production. This necessitates robust risk mitigation strategies for international chemical buyers and downstream manufacturers who rely on steady borax supplies. Diversification of sourcing, where possible, or strategic stockpiling are common practices used to buffer against potential supply interruptions caused by political instability or trade disputes. The competitive intensity among the handful of major global borate producers revolves around operational cost leadership, driven by economies of scale in mining and refining, rather than product differentiation, given the commodity nature of technical grade borax. However, differentiation based on purity, consistent quality, and superior customer service remains the decisive factor in the high-purity and pharmaceutical grade segments, where technical expertise and regulatory compliance are non-negotiable prerequisites for market entry and sustained success.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager