Sodium Tripolyphosphate Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435332 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Sodium Tripolyphosphate Market Size

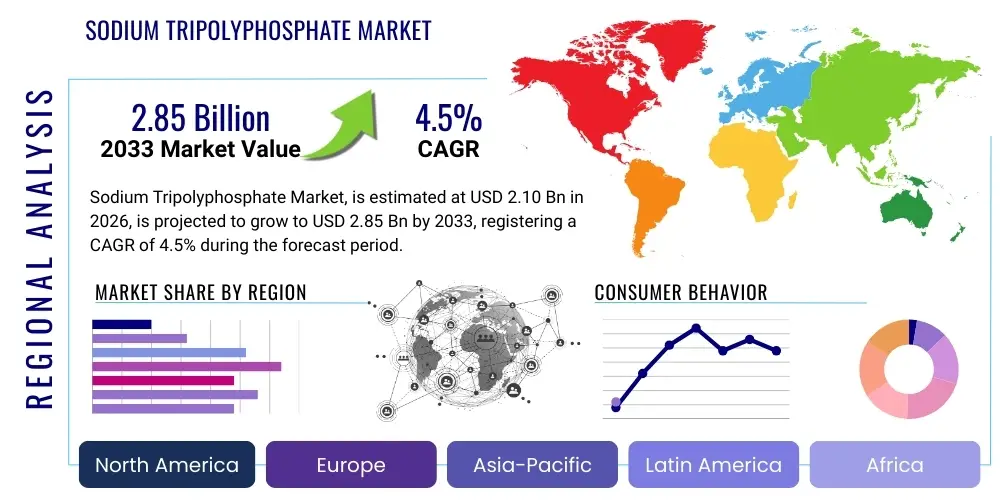

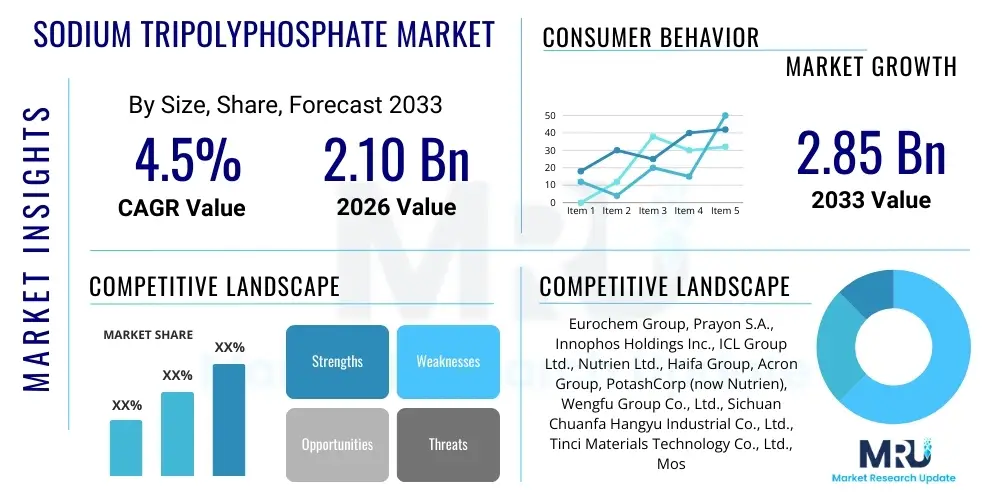

The Sodium Tripolyphosphate Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.5% between 2026 and 2033. The market is estimated at USD 2.10 Billion in 2026 and is projected to reach USD 2.85 Billion by the end of the forecast period in 2033.

Sodium Tripolyphosphate (STPP) remains a crucial industrial chemical characterized by its wide range of applications, predominantly serving as a builder in detergent formulations globally, despite regulatory pressures in developed economies. Its exceptional sequestering properties, coupled with its ability to emulsify fats and peptize dirt particles, solidify its indispensability in industrial cleaning and specialized applications. The market size trajectory is governed by a dual dynamic: robust demand growth in emerging economies driven by rapid urbanization and industrialization, balanced against the ongoing shift towards zeolite and other phosphate alternatives in mature markets due to environmental concerns related to nutrient pollution and eutrophication.

The market expansion is significantly bolstered by the increasing use of STPP in non-detergent sectors, particularly in advanced food processing as an emulsifier and moisture retainer, and in specialized industrial applications such as ceramics manufacturing and water treatment. Technical grade STPP, forming the bulk of the market, sees sustained demand from textile and metal industries where its dispersing capabilities are highly valued for process efficiency and product quality. Strategic investments in optimized production facilities, particularly in the Asia Pacific region, are contributing to stable pricing and supply chain resilience, underpinning the overall steady expansion forecasted through 2033.

Sodium Tripolyphosphate Market introduction

Sodium Tripolyphosphate (STPP), chemically known as Na5P3O10, is a synthetic crystalline compound extensively utilized across multiple industrial sectors due to its potent multifunctional properties. As a polyphosphate derivative, STPP acts primarily as a sequestrant, effectively binding divalent metal ions (like calcium and magnesium) which are detrimental in processes such as laundering and water treatment. Its primary application historically centers around its role as a "builder" in synthetic detergents, where it enhances the cleaning power of surfactants by softening water, aiding in soil suspension, and regulating pH levels. Furthermore, STPP exhibits strong dispersion and binding characteristics, making it valuable in ceramic production, mining, and oil drilling operations.

Beyond cleaning agents, STPP is widely adopted in the food and beverage industry (Food Grade STPP) as a preservative, moisture retention agent, and emulsifier in meats, poultry, and seafood, ensuring texture stabilization and minimizing weight loss during storage and cooking. Its driving factors include the escalating demand for processed foods globally, especially in high-growth economies where convenience foods are gaining traction. However, the market structure is continually adapting to legislative mandates aimed at mitigating environmental impact, prompting innovation toward low-phosphate or phosphate-free formulations, particularly in developed regions. Despite these restraints, the unique chemical efficiency and cost-effectiveness of STPP maintain its market relevance in numerous technical and industrial applications where alternatives often lack equivalent performance characteristics.

Sodium Tripolyphosphate Market Executive Summary

The Sodium Tripolyphosphate market is navigating a complex landscape defined by robust industrial growth in Asia Pacific and regulatory diversification across the West. Business trends indicate a focus on optimizing production processes to enhance energy efficiency and reduce environmental footprints, primarily through technological advancements in phosphorus processing and purification. Leading manufacturers are strategically investing in vertical integration, securing raw material supplies (phosphate rock and phosphoric acid) to stabilize operational costs and mitigate volatility in the global supply chain. Furthermore, there is a distinct trend toward high-purity STPP formulations, specifically catering to the demanding specifications of the food and high-end industrial sectors, offering manufacturers premiumization opportunities despite stagnant growth in traditional commodity detergent markets in some geographies.

Regional trends highlight the Asia Pacific (APAC) region as the dominant market driver, fueled by high population density, rapid industrialization, and sustained demand for economical cleaning products. Conversely, North America and Europe emphasize technical-grade STPP usage in niche applications (metal cleaning, industrial water management) due to stringent environmental regulations restricting its use in household detergents, thereby shifting the regional demand profile. The Middle East and Africa (MEA) region present significant opportunities, characterized by infrastructure development and rising disposable incomes leading to increased consumption of packaged food products that require STPP as a stabilizing agent.

Segmentation trends confirm that the Detergents & Cleaners application segment maintains the largest market share, predominantly driven by industrial and institutional cleaning applications and sustained growth in emerging markets. However, the Food & Beverages segment is projected to exhibit the fastest growth CAGR, reflecting global shifts towards processed and preserved food items. Technical Grade STPP dominates the market volume, necessary for heavy-duty industrial processes, while the Food Grade segment commands higher price points due to the stringent quality and safety standards required for human consumption applications, pushing manufacturers to ensure adherence to global regulatory frameworks like FDA and EFSA standards.

AI Impact Analysis on Sodium Tripolyphosphate Market

Analysis of common user questions related to the influence of Artificial Intelligence (AI) on the STPP market reveals key themes centered on supply chain resilience, manufacturing cost optimization, and predictive regulatory modeling. Users frequently inquire how AI can buffer raw material price volatility (phosphorus, natural gas) and improve yield efficiency in energy-intensive thermal processing methods characteristic of STPP production. There is significant concern regarding the environmental scrutiny faced by phosphates, leading to expectations that AI and Machine Learning (ML) could accelerate research into safer, more sustainable alternatives or optimize current STPP formulations to minimize environmental release. Key user expectations include utilizing AI for highly accurate demand forecasting across geographically fragmented application markets and enhancing quality control systems to ensure consistency, particularly in high-purity food-grade STPP batches, where variations are costly and detrimental to brand reputation.

The implementation of AI/ML technologies is transforming the operational backbone of STPP production, transitioning facilities toward 'smart manufacturing' paradigms. AI-driven predictive maintenance models reduce unplanned downtime, a critical factor given the high heat and pressure required in STPP synthesis, thereby drastically improving asset utilization and extending equipment lifespan. Furthermore, sophisticated algorithms are increasingly being deployed in complex supply chain networks to manage inventory, optimize logistics routing for phosphorus shipments, and dynamically respond to shifts in regional regulatory frameworks that impact demand for phosphate-containing products. This operational efficiency enhancement is crucial for maintaining competitive pricing in a market facing consistent pressure from alternative chemistries.

Moreover, AI is playing a vital role in quality assurance and process chemistry optimization. Machine vision systems and advanced process controls, driven by ML, monitor the crystallization and drying stages of STPP production, ensuring precise particle size distribution and desired solubility characteristics. This level of precision is vital for end-use applications like ceramics and food processing where specific physical properties are mandatory. The data generated through these systems also feeds back into R&D, enabling computational chemistry simulations to explore novel, high-performance phosphate formulations or synergistic blends with other builders and sequestering agents, ultimately aiding market penetration into highly specialized and technically demanding segments.

- AI optimizes STPP production yields and energy consumption in thermal processing.

- Predictive maintenance minimizes operational downtime in high-temperature manufacturing environments.

- Machine learning models enhance global supply chain transparency and raw material procurement strategies.

- AI-driven quality control ensures adherence to stringent purity standards, especially for Food Grade STPP.

- Computational chemistry accelerates R&D for sustainable phosphate alternatives and optimized product formulations.

DRO & Impact Forces Of Sodium Tripolyphosphate Market

The Sodium Tripolyphosphate market dynamics are shaped by strong industrial demand drivers, significant environmental and regulatory restraints, and the potential for technological innovation defining future opportunities. Key drivers include sustained consumption in developing regions for cost-effective detergent formulations, rapid expansion of the global processed food industry requiring effective moisture retainers and emulsifiers, and increased utilization in industrial water treatment to prevent scaling and corrosion. These factors collectively push the market forward, ensuring a stable base demand, particularly for technical grade applications outside of heavily regulated household sectors. However, the primary restraint is the global legislative shift towards non-phosphate detergents due to the environmental impact of phosphates causing eutrophication in waterways, severely limiting growth in traditional high-volume segments across North America and Western Europe.

Opportunities in the market primarily revolve around product differentiation and geographical expansion. The development and commercialization of specialized, high-purity STPP tailored for pharmaceutical or advanced materials applications represents a high-value niche opportunity. Furthermore, manufacturers are exploring opportunities by expanding production capacity and sales networks in regions like Southeast Asia, Latin America, and Africa, which are currently undergoing significant economic and industrial development and where regulatory scrutiny over phosphate usage remains comparatively less stringent than in OECD countries. Strategic partnerships with regional distributors and compliance with local manufacturing standards are crucial for capitalizing on these emerging market demands, balancing the need for growth with global sustainability trends.

The impact forces influencing the market demonstrate high regulatory pressure and moderate substitution threats. The regulatory environment acts as a strong negative force, compelling manufacturers to either innovate or shift geographical focus, thereby fundamentally reshaping market structure. Substitution forces, driven by alternatives like zeolites, silicates, and polycarboxylates, pose a moderate long-term threat, particularly in the detergent sector, though STPP’s superior performance profile often remains preferred in specific industrial contexts. However, the impact force stemming from industrialization and population growth acts as a powerful positive counterbalance, ensuring that the need for efficient cleaning agents, water treatment solutions, and food stabilizers continues to drive necessary volume, solidifying STPP’s role as an essential chemical commodity despite environmental challenges.

Segmentation Analysis

The Sodium Tripolyphosphate (STPP) market is comprehensively segmented based on its grade, primary application, and geographical distribution, allowing for granular market assessment and strategic targeting. The segmentation by grade—Technical Grade and Food Grade—reflects crucial differences in manufacturing purity, cost structure, and end-user specification, with Technical Grade dominating volume consumption across various industrial cleaning, ceramics, and water treatment sectors. Application segmentation reveals the diverse utility of STPP, where its functional benefits are tailored to specific industry needs, ranging from large-scale detergent production to meticulous food stabilization processes. Understanding these segments is vital for manufacturers to allocate resources effectively, comply with varying regulatory requirements, and adapt product characteristics to meet divergent customer demands.

The predominance of Technical Grade STPP is driven by its bulk use in industrial and institutional cleaning products, as well as its essential role in metal finishing and textile processing where its sequestering abilities are critical for process optimization. While this segment faces competition from non-phosphate builders, its cost-effectiveness ensures sustained relevance in many manufacturing economies. Conversely, Food Grade STPP, characterized by extremely high purity and low heavy metal content, serves the rapidly expanding food processing industry. This grade commands a premium price due to the strict quality control and regulatory oversight (such as those imposed by the FDA and EFSA) required for ingredients directly incorporated into human and animal food products, representing a lucrative, high-growth niche within the overall market.

- By Grade:

- Technical Grade

- Food Grade

- By Application:

- Detergents & Cleaners (Household, Industrial & Institutional (I&I))

- Food & Beverages (Meat, Poultry, Seafood Processing; Dairy Products; Beverages)

- Water Treatment (Boiler Water, Cooling Towers)

- Ceramics & Pigments

- Metal Treatment & Electroplating

- Others (Oil Drilling, Mining)

- By Geography:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East & Africa (MEA)

Value Chain Analysis For Sodium Tripolyphosphate Market

The value chain for the Sodium Tripolyphosphate market is intrinsically linked to the phosphorus industry, starting with the mining and processing of phosphate rock, the primary upstream activity. Upstream analysis involves the energy-intensive conversion of phosphate rock into phosphoric acid, typically through the wet process or thermal process. Key players in this stage are large mining and chemical conglomerates that control access to high-quality phosphate deposits, significantly impacting raw material costs and supply stability. Fluctuations in the global price of phosphate rock and the high energy costs associated with thermal processing pose major challenges to STPP manufacturers, necessitating strategic long-term sourcing contracts and efficient process engineering to maintain cost competitiveness in the final product.

The midstream segment involves the actual synthesis of STPP, where manufacturers convert phosphoric acid into STPP via polymerization and calcination. This phase requires sophisticated chemical plants and rigorous quality control, especially for producing Food Grade STPP, which demands exceptionally high purity. Manufacturers often integrate backward into phosphoric acid production to secure supply and manage quality, or they rely on established chemical intermediaries. The focus in the midstream is on process optimization, waste management, and ensuring compliance with varied international standards, which defines the operational efficiency and profitability of STPP production facilities globally.

The downstream segment encompasses distribution channels and end-user consumption. Distribution is bifurcated into direct sales to large industrial consumers (such as global detergent manufacturers and major food processors) and indirect sales through regional chemical distributors and specialized traders serving smaller manufacturers across various sectors like ceramics and textiles. End-users are highly fragmented by application, demanding different grades and delivery formats (powder, granular). Successful market penetration downstream relies heavily on robust logistics infrastructure and specialized technical support to ensure the STPP meets the functional requirements of diverse industrial processes, ranging from high-shear mixing in detergent plants to temperature-sensitive food preservation applications.

Sodium Tripolyphosphate Market Potential Customers

The potential customers for Sodium Tripolyphosphate are diverse, spanning multiple industrial sectors that leverage its unique chelating, dispersing, and buffering capabilities. The largest buyer group comprises manufacturers of household and institutional cleaning products, including laundry detergents, dishwashing powders, and heavy-duty industrial degreasers. These companies rely on STPP as an essential builder to enhance cleaning efficiency by inactivating hard water minerals and suspending soils, making them volume-intensive customers who typically purchase technical grade STPP in large, bulk quantities under long-term supply agreements. Their purchasing decisions are highly influenced by regional regulatory environments regarding phosphate usage and the fluctuating costs of raw materials.

Another major segment of buyers includes food and beverage processors, specifically those engaged in the meat, poultry, and seafood preservation industries. These customers require Food Grade STPP to improve water retention, inhibit spoilage, and maintain the texture and color of perishable goods. Given the sensitivity of food ingredients, these customers prioritize quality, consistency, and compliance with national and international food safety standards (e.g., HACCP, ISO 22000). The growth in global demand for processed and frozen foods directly drives the procurement volume in this segment, emphasizing specialized product specifications and certification from suppliers.

Furthermore, industries involved in water management and materials production represent significant potential customers. Water treatment facilities and industrial plants (boiler water, cooling towers) purchase STPP for scale inhibition and corrosion control. Similarly, ceramic manufacturers utilize STPP as a deflocculant to reduce the viscosity of clay slips, essential for casting and shaping processes. These industrial buyers are primarily focused on the functional performance and cost-efficiency of technical grade STPP, often integrating it directly into continuous production lines, making reliable supply and stable pricing critical factors in their supplier selection process.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 2.10 Billion |

| Market Forecast in 2033 | USD 2.85 Billion |

| Growth Rate | 4.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Eurochem Group, Prayon S.A., Innophos Holdings Inc., ICL Group Ltd., Nutrien Ltd., Haifa Group, Acron Group, PotashCorp (now Nutrien), Wengfu Group Co., Ltd., Sichuan Chuanfa Hangyu Industrial Co., Ltd., Tinci Materials Technology Co., Ltd., Mosaic Co., Chemische Fabrik Budenheim KG, Foskor (Pty) Ltd., Xuzhou Starfire Chemical Co., Ltd., Italmatch Chemicals S.p.A., Simplot Phosphates. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Sodium Tripolyphosphate Market Key Technology Landscape

The technological landscape surrounding Sodium Tripolyphosphate production is primarily focused on enhancing efficiency, improving purity, and mitigating environmental impact associated with phosphorus processing. The core manufacturing processes are either the thermal process (using elemental phosphorus) or the wet process (using phosphoric acid derived from phosphate rock). While the thermal process yields higher purity STPP, often preferred for food and specialty applications, it is extremely energy-intensive. Key technological advancements involve optimizing calcination furnaces and drying techniques to reduce natural gas consumption and associated greenhouse gas emissions, thereby improving the overall sustainability and cost structure of the thermal route.

A significant area of technological focus is the purification of wet-process phosphoric acid (WPA), which is less energy-intensive but typically contains more impurities. Innovations in solvent extraction, crystallization, and membrane filtration technologies are allowing manufacturers to upgrade WPA sufficiently to meet the purity requirements for technical grade and even lower-end food grade STPP, offering a more economically viable and environmentally preferable route for high-volume production. Continuous research is dedicated to improving the conversion yield during the polymerization stage and designing catalysts that can facilitate cleaner, faster reactions, ultimately reducing the need for extensive post-reaction purification steps.

Furthermore, the industry is exploring advanced material handling and crystallization technologies. Controlling the particle size distribution and crystal morphology of STPP is crucial for different applications; for instance, granular STPP is often preferred in automatic dishwashing tablets, while fine powders are necessary for some ceramic slips. Manufacturers are adopting fluid bed granulation and specialized drying equipment integrated with real-time process control (often AI-assisted) to precisely manage these physical characteristics, ensuring product consistency and optimizing performance for specific end-user requirements. This focus on material engineering is key to maintaining market share in high-specification application segments amidst increasing competition from non-phosphate alternatives.

Regional Highlights

- Asia Pacific (APAC): APAC is the dominant market region, characterized by high production capacity, rapid industrialization, and high consumption rates, particularly in China and India. The region benefits from lower manufacturing costs and booming demand for detergents, processed foods, and industrial chemicals. Regulatory scrutiny regarding phosphates is generally less severe or slower to implement compared to Western regions, supporting robust consumption growth in high-volume applications.

- North America: This region exhibits a mature market structure defined by strict environmental policies, especially concerning household detergent phosphates. Demand is concentrated heavily in industrial and institutional (I&I) cleaning, specialized water treatment, and high-purity food preservation applications. The market is driven by technological advancements focusing on efficient formulations and sophisticated supply chain management to serve niche, high-value end-users.

- Europe: Similar to North America, Europe has adopted wide-ranging bans and restrictions on phosphate use in consumer detergents (e.g., EU Detergent Regulation). Consequently, the European market focuses on technical grade STPP for specific industrial processes (textiles, metal finishing, ceramics) and specialized food applications, maintaining stable, albeit restrained, demand. Innovation in sustainable chemistry and efficient recycling of phosphorus is a regional priority.

- Latin America (LATAM): This region offers significant growth potential, driven by rising disposable incomes, urbanization, and expansion of the food processing and agricultural sectors. Brazil and Mexico are key markets with substantial demand for both technical and food-grade STPP, though market penetration is often hindered by infrastructure and supply chain complexities.

- Middle East & Africa (MEA): The MEA region is emerging as a critical growth frontier, bolstered by ongoing infrastructure projects, industrial diversification initiatives (especially in the Gulf Cooperation Council countries), and increasing consumption of packaged foods. Investment in local manufacturing capacity is growing, reducing reliance on imports, and satisfying nascent demand across cleaning and industrial sectors.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Sodium Tripolyphosphate Market.- Eurochem Group

- Prayon S.A.

- Innophos Holdings Inc.

- ICL Group Ltd.

- Nutrien Ltd.

- Haifa Group

- Acron Group

- Wengfu Group Co., Ltd.

- Sichuan Chuanfa Hangyu Industrial Co., Ltd.

- Tinci Materials Technology Co., Ltd.

- Mosaic Co.

- Chemische Fabrik Budenheim KG

- Foskor (Pty) Ltd.

- Xuzhou Starfire Chemical Co., Ltd.

- Italmatch Chemicals S.p.A.

- Simplot Phosphates

- Aditya Birla Chemicals (Thailand) Ltd.

- Hubei Xingfa Chemicals Group Co., Ltd.

- Shandong Jiejing Group Co., Ltd.

- Jingxiang Chemical Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Sodium Tripolyphosphate market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function and market segment of Sodium Tripolyphosphate (STPP)?

STPP's primary function is as a sequestering agent and builder, vital for water softening and soil dispersion. Its largest market segment is Detergents & Cleaners, especially in industrial, institutional, and emerging market household applications, followed by the high-growth Food & Beverages sector where it functions as a preservative and emulsifier.

How do environmental regulations impact the future growth of the STPP market?

Environmental regulations, particularly those aimed at preventing eutrophication, restrain STPP usage in household detergents in North America and Europe, forcing manufacturers to focus on non-detergent technical applications (ceramics, metal treatment) and high-growth emerging economies (APAC, LATAM) where regulatory pressure is currently less severe.

Which grade of STPP dominates the market, and why is Food Grade STPP priced higher?

Technical Grade STPP dominates the market volume due to its extensive use in industrial cleaning and processing applications. Food Grade STPP commands a higher price because its manufacturing requires stringent purification processes to meet strict global safety standards concerning heavy metal and impurity limits, resulting in higher production costs and value.

Which region is expected to drive the largest growth in the STPP market through 2033?

The Asia Pacific (APAC) region is expected to drive the largest absolute growth through 2033, fueled by sustained industrialization, rapid urbanization, high population density, and consistent demand for both cost-effective detergents and processed food ingredients across countries like China, India, and Southeast Asian nations.

What technological advancements are key to maintaining STPP production efficiency and competitiveness?

Key technological advancements include optimizing energy usage in thermal processing, improving the purification efficiency of the wet-process phosphoric acid route, and implementing AI-driven predictive maintenance and quality control systems to ensure product consistency and reduce operational downtime and costs, essential for competing with alternative chemistries.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Sodium Tripolyphosphate Market Size Report By Type (Industrial Grade, Food Grade), By Application (Synthetic Detergent, Synergist for Soap, Water Softener, Tanning Agent for Leather Making, Auxiliary for Dyeing, Water Retention Agent, Quality Improver, PH Regulator, Metal Chelating Agent), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Sodium Tripolyphosphate Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Anhydrous Grade, Hydrate Grade), By Application (Household Cleaning, Food & Beverages, Agriculture, Textile, Pharmaceuticals, Cosmetics, Others), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

- Sodium Tripolyphosphate (STPP) Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Industrial Grade, Food Grade), By Application (Synthetic Detergent, Synergist for Soap, Water Softener, Tanning Agent for Leather Making, Auxiliary for Dyeing, PH Regulator, Metal Chelating Agent, Others), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager