SOFC And SOEC Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433632 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

SOFC And SOEC Market Size

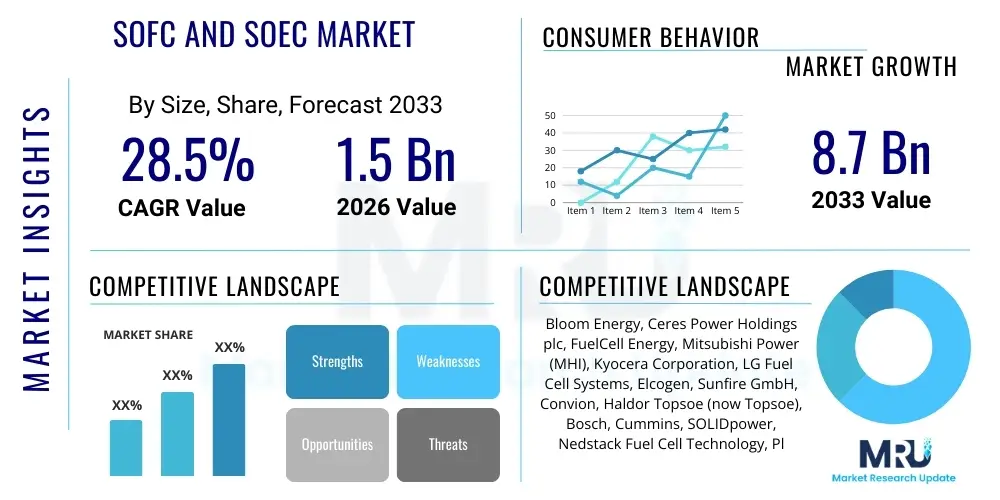

The SOFC And SOEC Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 28.5% between 2026 and 2033. The market is estimated at USD 1.5 Billion in 2026 and is projected to reach USD 8.7 Billion by the end of the forecast period in 2033.

SOFC And SOEC Market introduction

The Solid Oxide Fuel Cell (SOFC) and Solid Oxide Electrolysis Cell (SOEC) market represents a critical component of the global energy transition towards decarbonization. SOFC technology converts chemical energy directly into electrical energy with high efficiency, utilizing various fuels such as natural gas, biogas, or hydrogen. Its high operating temperature (600°C–1000°C) allows for fuel flexibility and cogeneration capabilities, making it highly attractive for decentralized power generation, industrial combined heat and power (CHP) systems, and auxiliary power units (APUs) in transportation. The primary appeal lies in its extremely low emissions profile and scalability, addressing the growing demand for sustainable and reliable energy sources, particularly in data centers and remote grid applications.

Conversely, Solid Oxide Electrolysis Cells (SOECs) operate in reverse mode, converting electrical energy and heat into chemical energy, primarily focusing on highly efficient production of green hydrogen from water steam. SOEC systems boast significantly higher electrical-to-hydrogen conversion efficiencies compared to conventional low-temperature electrolysis technologies (like PEM or alkaline), largely because the high operating temperature reduces the electrical energy requirement for the reaction. The increasing global regulatory focus on hydrogen economies—especially in Europe and Asia Pacific—is providing unprecedented momentum for SOEC adoption, positioning it as a foundational technology for industrial-scale green hydrogen production, vital for sectors such as fertilizer production, refining, and synthetic fuels.

The market growth is fundamentally driven by stringent climate goals requiring the phasing out of fossil fuels and the concurrent technological advancements that are lowering the manufacturing costs and increasing the durability of SOFC and SOEC stacks. Key driving factors include supportive government policies, such as carbon pricing mechanisms and subsidies for clean energy adoption, substantial private and public sector investment in hydrogen infrastructure development, and the inherent benefits of the technology, including high efficiency (up to 80% combined heat and power efficiency for SOFCs) and fuel versatility. Major applications span stationary power generation, clean transportation (marine and rail APUs), and critical industrial processes requiring high-purity hydrogen, cementing their dual roles in both energy supply and clean fuel production.

SOFC And SOEC Market Executive Summary

The SOFC and SOEC market is undergoing a transformative period marked by increasing commercialization and strategic partnerships aimed at scaling up production capacity. Current business trends indicate a strong shift towards modular and integrated solutions, allowing for easier deployment in varied environments, from micro-grids to large industrial facilities. The primary commercial focus for SOFC remains on distributed generation and combined heat and power (CHP) solutions, particularly targeting industrial end-users seeking enhanced energy resilience and reduced operational costs. Concurrently, the SOEC segment is characterized by large pilot projects and gigawatt-scale manufacturing initiatives, heavily backed by government funding focused on achieving competitive green hydrogen costs, often integrated with nuclear or renewable energy sources to maximize efficiency.

Regionally, the market dynamics are polarized, reflecting varying degrees of regulatory support and energy transition maturity. Europe leads in SOEC adoption due to ambitious hydrogen strategies (e.g., the European Hydrogen Strategy), significant research funding, and favorable regulatory environments promoting hydrogen deployment in industry and mobility. North America, while strong in SOFC deployment (especially in California and the US Northeast for data center backup and distributed power), is rapidly accelerating its SOEC investments under initiatives like the Hydrogen Hubs program. The Asia Pacific region, led by Japan, South Korea, and China, is focused on deploying SOFCs for residential and commercial stationary power (e.g., Ene-Farm program in Japan) and is emerging as a critical manufacturing base for low-cost stack components, capitalizing on expansive industrial capacity and robust R&D spending.

Segmentation trends highlight the increasing dominance of the planar SOFC design due to its manufacturing simplicity and power density, although tubular designs maintain relevance in specific high-reliability niche applications. In terms of application, stationary power generation remains the largest segment for SOFC, driven by the need for reliable, continuous power. However, the fastest-growing segment is green hydrogen production, fueled entirely by the surging demand for SOEC technology. Industrial end-users, encompassing chemical processing, steel manufacturing, and heavy transport, represent the most critical customer base for both technologies, leveraging SOFC for resilient power and SOEC for sustainable feedstock production, driving market volume and long-term investment cycles.

AI Impact Analysis on SOFC And SOEC Market

User queries regarding the intersection of Artificial Intelligence (AI) and the SOFC/SOEC market commonly focus on performance optimization, predictive maintenance, and materials discovery acceleration. Key themes revolve around how AI can resolve current technological hurdles, such as stack degradation prediction, system stability under dynamic load changes, and speeding up the sluggish R&D cycle for novel electrolyte and electrode materials. Users are particularly interested in seeing AI applied to real-time diagnostics to prevent catastrophic failure in high-temperature environments, thus extending system lifespan and reducing the cost of ownership. Expectations are high that sophisticated machine learning algorithms will unlock unprecedented levels of efficiency and reliability, making these clean energy systems economically competitive against conventional fossil fuel power generation, ultimately streamlining their path to mass market adoption and minimizing downtime associated with complex, high-heat operations.

- AI-driven Predictive Maintenance: Utilizing sensor data and machine learning to forecast stack degradation, failure points, and optimal operating windows, reducing unplanned downtime by up to 30%.

- Real-time System Optimization: AI algorithms adjust fuel flow, temperature, and current density dynamically to maintain peak efficiency and stability across varying electrical loads and fuel compositions.

- Accelerated Materials Informatics: Applying deep learning and generative models to screen millions of potential ceramic materials, accelerating the discovery of novel, high-performance electrolytes and interconnects for improved durability and lower operating temperatures.

- Enhanced Control Systems: Developing robust AI-enabled control architectures for integrated SOFC-SOEC reversible systems, maximizing energy management efficiency during grid fluctuations and mode switching (fuel cell vs. electrolyzer).

- Manufacturing Quality Assurance: Implementing computer vision and machine learning for defect detection during the high-precision manufacturing of ceramic layers, ensuring stack quality and consistency at mass production scale.

DRO & Impact Forces Of SOFC And SOEC Market

The SOFC and SOEC market is shaped by a powerful confluence of drivers (D), restraints (R), and opportunities (O), creating distinct impact forces. The primary driver is the accelerating global imperative for deep decarbonization and energy security, which mandates high-efficiency, non-combustion-based energy conversion technologies. This is coupled with the inherent technological benefits, such as high electrical and thermodynamic efficiency, reduced greenhouse gas emissions, and fuel flexibility (SOFCs can utilize hydrogen, natural gas, methanol, or ammonia), positioning them favorably in comparison to internal combustion engines and conventional electrolysis. Furthermore, significant governmental support, particularly targeted subsidies and R&D funding in major economies like the US, EU, and Asia, acts as a crucial propellant, mitigating initial high capital expenditures and stimulating commercialization efforts.

However, significant restraints impede faster market penetration. The most critical constraint is the high upfront capital cost associated with SOFC and SOEC systems, primarily driven by expensive raw materials (e.g., platinum group metals used in certain components) and complex, high-temperature manufacturing processes required for ceramic stacks. Durability and long-term reliability remain technical challenges; the high operating temperatures lead to thermal stress, material degradation, and potential cracking or delamination, limiting the operational lifespan compared to conventional gas turbines. Moreover, the lack of established, standardized large-scale hydrogen infrastructure necessary to fully support ubiquitous SOEC deployment and SOFC operation on pure hydrogen poses a logistical hurdle, particularly for mobility and large industrial applications requiring significant volumes.

The key market opportunity lies in the rapid development of the green hydrogen economy, where SOECs are positioned as the most thermodynamically efficient method for producing hydrogen, especially when waste heat is available. This opens up massive markets in steel manufacturing, ammonia production, and synthetic fuel creation. Another substantial opportunity is the integration of reversible solid oxide cells (R-SOCs), which can switch efficiently between power generation (SOFC mode) and energy storage/fuel production (SOEC mode), offering superior grid balancing and energy resilience solutions. The market is also presented with opportunities in remote and off-grid power markets and the surging demand for reliable, uninterrupted power in data centers, which are increasingly seeking clean, high-efficiency power generation options to meet their growing computational demands while adhering to corporate sustainability mandates.

Segmentation Analysis

The SOFC and SOEC market is segmented across multiple dimensions to reflect technological variations, end-use applications, and operational requirements. Analysis across these segments provides a detailed view of market penetration, identifying fast-growing niches and established strongholds. Key segmentation factors include cell design (planar vs. tubular), system type (SOFC, SOEC, R-SOC), and major end-use sectors, with commercial and industrial power generation historically dominating the SOFC landscape, while industrial feedstock production and grid balancing are rapidly becoming the primary segments for SOEC technology. Understanding these segment dynamics is crucial for strategic investment and product development, especially as manufacturers pivot towards higher-volume, standardized modular units to drive down costs.

- By Type:

- Solid Oxide Fuel Cell (SOFC)

- Solid Oxide Electrolysis Cell (SOEC)

- Reversible Solid Oxide Cell (R-SOC)

- By Application:

- Stationary Power Generation (Distributed and Auxiliary Power)

- Transportation (APUs for Marine and Rail)

- Hydrogen/Syngas Production (Industrial Feedstock)

- Data Centers and Critical Infrastructure

- By End-Use Industry:

- Commercial

- Industrial (Chemicals, Refineries, Steel)

- Residential (Micro-CHP Systems)

- Military/Defense

- By Configuration:

- Planar SOFC/SOEC

- Tubular SOFC/SOEC

Value Chain Analysis For SOFC And SOEC Market

The value chain for SOFC and SOEC technology is intricate, starting with complex upstream sourcing of highly specialized materials and concluding with system integration and energy services delivery downstream. Upstream analysis focuses heavily on the procurement and processing of ceramic powders (e.g., Yttria-stabilized Zirconia (YSZ) for electrolytes, doped lanthanum manganite (LSM) for cathodes) and metal interconnects (ferritic stainless steel). The core value addition occurs during the manufacturing of the cell stacks, which requires highly specialized, high-temperature processes such as tape casting, screen printing, and sintering. Suppliers of high-purity ceramic powders and sophisticated manufacturing equipment, often specialized in advanced ceramics, hold significant leverage in the upstream segment, dictating material quality and cost stability crucial for mass production scalability.

Midstream activities involve stack assembly, system integration, and the manufacture of peripheral balance-of-plant (BOP) components, including heat exchangers, fuel processors, and power electronics. System integrators face the challenge of managing the high operating temperatures and ensuring thermal cycling resilience. The complexity of the system integration, especially for larger industrial applications and R-SOC setups, requires expertise in thermodynamics, electrochemistry, and control software. Distribution channels are bifurcated: direct channels are utilized for large industrial and utility-scale projects, involving direct contracts with EPC firms or utility companies; indirect channels are leveraged for residential and small commercial systems, relying on energy service companies (ESCOs) and specialized distributors who handle localized installation and maintenance.

Downstream analysis centers on the final consumption and service provision. Potential customers, including power utilities, heavy industrial operators (steel, ammonia), and data center providers, purchase the integrated systems for decentralized power or hydrogen production. The service component, including maintenance contracts and long-term performance guarantees, is highly critical due to the technical complexity of the units. Success in the downstream market is increasingly determined by the total cost of ownership (TCO), necessitating continuous improvements in stack lifespan and efficiency. Direct sales provide system developers maximum control over installation and commissioning, while robust indirect channels are essential for market penetration into standardized residential or small commercial applications, ensuring broader access to the technology.

SOFC And SOEC Market Potential Customers

The potential customer base for SOFC and SOEC technologies is broad, spanning sectors where energy efficiency, reliability, and clean operation are paramount. For SOFCs, the primary target markets are commercial buildings and industrial facilities that require constant, high-quality power and heat (CHP), such as hospitals, universities, and specialized manufacturing plants. A rapidly emerging, high-value customer segment is the data center industry, which demands highly resilient power sources with minimal latency and strict sustainability criteria. These buyers prioritize systems offering high electrical efficiency and independence from volatile utility grids, favoring SOFCs over diesel generators for backup and prime power applications due to their superior environmental performance.

For SOECs, the customer profile is heavily skewed towards large industrial entities involved in chemical processing, refining, and metal production. Companies requiring large volumes of green hydrogen as a feedstock—for example, ammonia producers seeking to decarbonize fertilizer manufacturing or steelmakers transitioning to hydrogen-based direct reduction of iron (DRI) processes—are the most critical buyers. Energy storage companies and utilities also represent significant potential customers, utilizing SOECs to convert surplus renewable electricity into storable hydrogen, effectively acting as an advanced form of seasonal or long-duration energy storage critical for grid stability in high-renewables scenarios.

Additionally, specialized niche markets provide further sales avenues. The transportation sector, particularly marine shipping and rail, utilizes SOFCs as auxiliary power units (APUs) to reduce emissions and improve fuel economy compared to conventional diesel generators. Military and defense sectors are also adopting SOFC technology for silent, robust, and reliable power generation in remote or forward operating bases. The diverse array of potential customers underscores the technology's versatility, but successful market penetration requires tailored product offerings—from small residential CHP units to multi-megawatt industrial hydrogen farms—to address the specific energy, cost, and operational requirements of each end-user group, emphasizing scalability and modular design.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.5 Billion |

| Market Forecast in 2033 | USD 8.7 Billion |

| Growth Rate | 28.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Bloom Energy, Ceres Power Holdings plc, FuelCell Energy, Mitsubishi Power (MHI), Kyocera Corporation, LG Fuel Cell Systems, Elcogen, Sunfire GmbH, Convion, Haldor Topsoe (now Topsoe), Bosch, Cummins, SOLIDpower, Nedstack Fuel Cell Technology, Plug Power, Reverion GmbH, ZEEP Power, Pukkel. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

SOFC And SOEC Market Key Technology Landscape

The SOFC and SOEC market is defined by continuous innovation in high-temperature electrochemistry and material science aimed at improving longevity and reducing operational costs. A critical technological focus is on developing materials that can tolerate reduced operating temperatures (moving from 1000°C towards 600°C–800°C, often termed intermediate-temperature SOFCs/SOECs). Lowering the operational temperature allows for the use of less expensive metallic interconnects instead of ceramics, significantly reducing manufacturing costs and enhancing robustness against thermal cycling, which is essential for dynamic load applications. Advances in electrolyte materials, particularly the transition from standard YSZ to doped ceria-based electrolytes (e.g., Scandia Stabilized Zirconia or Gadolinium Doped Ceria), are crucial for achieving these lower operating temperatures while maintaining acceptable ionic conductivity.

Another dominant technological trend is the transition towards manufacturing large, multi-stack modules tailored for gigawatt-scale hydrogen production (SOEC) and multi-megawatt stationary power (SOFC). This scaling requires highly automated and continuous manufacturing processes, moving away from batch production methods. Specific technologies, such as plasma spraying and advanced printing techniques (e.g., inkjet printing for catalyst layers), are being developed to create thinner, more consistent, and performance-optimized cell components at high throughput. Furthermore, the development of robust sealing technologies is paramount, as maintaining gas separation integrity in high-temperature ceramic stacks over thousands of operating hours is a primary challenge impacting overall system reliability and lifetime.

The integration of Reversible Solid Oxide Cells (R-SOCs) represents a significant technological convergence point, utilizing the same fundamental stack architecture to operate in fuel cell mode (power generation) or electrolysis mode (fuel production). This requires sophisticated power electronics and advanced control algorithms capable of managing rapid and efficient mode switching, enabling these systems to act as highly versatile energy assets for grid management. Research is heavily focused on optimizing the electrodes to efficiently handle both anodic and cathodic reactions, often involving composite materials with tailored nanostructures to resist degradation during frequent electrochemical reversal. The eventual commercial success of both SOFC and SOEC hinges on achieving a target lifespan exceeding 40,000 hours and a significant reduction in system degradation rates to less than 0.5% per 1,000 hours.

Regional Highlights

Regional dynamics in the SOFC and SOEC market are strongly tied to governmental energy policies, existing industrial infrastructure, and the maturity of renewable energy penetration. Europe, driven by the EU's ambitious Green Deal and dedicated hydrogen strategies, currently leads in SOEC deployment. Countries such as Germany and the Netherlands are aggressively funding large-scale SOEC pilot projects, aiming to establish regional hydrogen valleys to support industrial decarbonization and mobility. The continent’s strong emphasis on Combined Heat and Power (CHP) also provides a fertile market for highly efficient, natural gas-fueled SOFC systems in decentralized industrial and commercial settings. Supportive regulatory frameworks, including carbon border adjustment mechanisms (CBAM), further incentivize the adoption of these clean technologies.

North America, particularly the United States, is a key market for both technologies, distinguished by strong investment in large-scale SOFC deployment for critical applications. Companies like Bloom Energy dominate the market for data center power solutions and industrial microgrids, leveraging their technology's high electrical efficiency and resilience. The recent establishment of Hydrogen Hubs across the US, funded by the Department of Energy, is significantly boosting the deployment of SOECs, aiming to establish localized green hydrogen production infrastructure. Canada is also focusing on SOFCs for remote and off-grid power solutions where reliable, modular systems are necessary to replace expensive, polluting diesel generators, leveraging its vast natural gas and potential hydrogen resources.

The Asia Pacific (APAC) region is characterized by immense market potential, driven primarily by energy security concerns and rising industrial energy demand. Japan and South Korea have been pioneers in residential micro-CHP (SOFC) deployment, supported by direct government incentives (e.g., the Ene-Farm program). China is rapidly emerging as a major manufacturing powerhouse, focusing on scaling up low-cost SOFC components and system integration, backed by national strategic initiatives for fuel cell development. This region’s high growth rate is fueled by both large stationary power demands (SOFC) and the colossal industrial need for decarbonization pathways (SOEC) in its heavy industry sectors, making it the most complex and competitive regional market for both technology types.

- North America (US & Canada): Strongest market for SOFC stationary power, driven by data center resilience and microgrid development. Rapid scale-up of SOEC via federally funded Hydrogen Hubs.

- Europe (Germany, Netherlands, UK): Global leader in SOEC adoption due to ambitious hydrogen policies and governmental funding for industrial decarbonization. Focus on intermediate-temperature SOFCs for CHP.

- Asia Pacific (Japan, South Korea, China): Early adopter of residential SOFC (Japan & Korea). China drives large-scale manufacturing capacity and component cost reduction efforts, focusing on both stationary power and industrial hydrogen production.

- Middle East & Africa (MEA): Emerging market primarily focused on SOEC for green hydrogen export and integration with vast solar energy resources, leveraging hydrogen for decarbonizing petrochemical operations.

- Latin America: Developing market with opportunities for SOFCs in resource extraction operations and off-grid locations, leveraging natural gas reserves for efficient power generation.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the SOFC And SOEC Market.- Bloom Energy

- Ceres Power Holdings plc

- FuelCell Energy

- Mitsubishi Power (MHI)

- Kyocera Corporation

- LG Fuel Cell Systems

- Elcogen

- Sunfire GmbH

- Convion

- Topsoe (formerly Haldor Topsoe)

- Robert Bosch GmbH

- Cummins Inc.

- SOLIDpower

- Nedstack Fuel Cell Technology

- Plug Power Inc.

- Reverion GmbH

- C-Power

- Intelligent Energy

- Delphi Technologies (BorgWarner)

- Doosan Fuel Cell

Frequently Asked Questions

Analyze common user questions about the SOFC And SOEC market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between SOFC and SOEC technology?

SOFC (Solid Oxide Fuel Cell) converts chemical energy (fuel) directly into electrical power and heat, operating as a highly efficient power generator. SOEC (Solid Oxide Electrolysis Cell) performs the reverse reaction, converting electrical power and heat into chemical energy, primarily producing high-ppurity hydrogen from steam. Both technologies utilize the same fundamental ceramic stack architecture but serve opposite functions in the energy supply chain.

What are the main technical hurdles limiting the mass adoption of SOFC and SOEC systems?

The core technical hurdles include high manufacturing costs driven by specialized materials and processes, and limited stack durability. High operating temperatures cause thermal stresses and material degradation, leading to shorter operational lifespans than competing technologies. Reducing the operating temperature (Intermediate Temperature SOFC/SOEC) and improving thermal cycling robustness are critical areas of R&D focus to enhance reliability and lower capital expenditure.

How are SOFC and SOEC technologies contributing to the global hydrogen economy?

SOEC technology is pivotal for the green hydrogen economy because it offers the highest electrical-to-hydrogen conversion efficiency among electrolysis technologies, especially when integrated with industrial waste heat or nuclear power. SOFCs support the transition by providing highly efficient, decentralized power that can utilize hydrogen or hydrogen-rich fuels, enabling reliable distributed power without carbon emissions.

Which sectors are the largest current and future consumers of SOFC and SOEC products?

Currently, the stationary power sector, particularly commercial facilities, industrial microgrids, and data centers, are the largest consumers of SOFCs due to their demand for reliable, high-efficiency CHP. For SOECs, the future growth is overwhelmingly driven by the industrial sector, including chemical manufacturers, steel producers, and utility companies focusing on large-scale green hydrogen production as a sustainable industrial feedstock and energy storage mechanism.

What role does AI play in improving the performance and longevity of Solid Oxide systems?

AI is crucial for SOFC/SOEC optimization by enabling predictive maintenance, forecasting material degradation, and adjusting system parameters (temperature, flow rates) in real-time to maintain peak efficiency under dynamic conditions. Machine learning is also accelerating materials discovery, identifying more robust and cost-effective ceramic compositions capable of extended life and operation at lower temperatures.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager