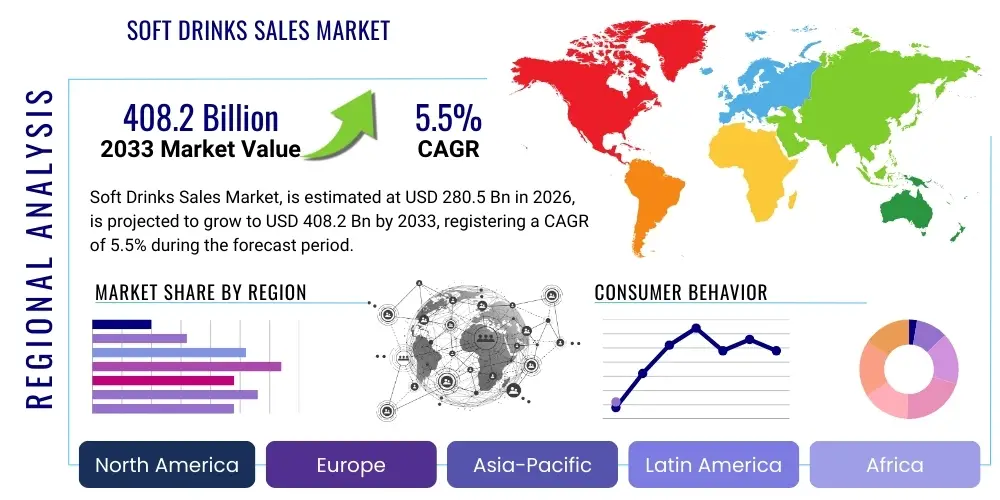

Soft Drinks Sales Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431373 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Soft Drinks Sales Market Size

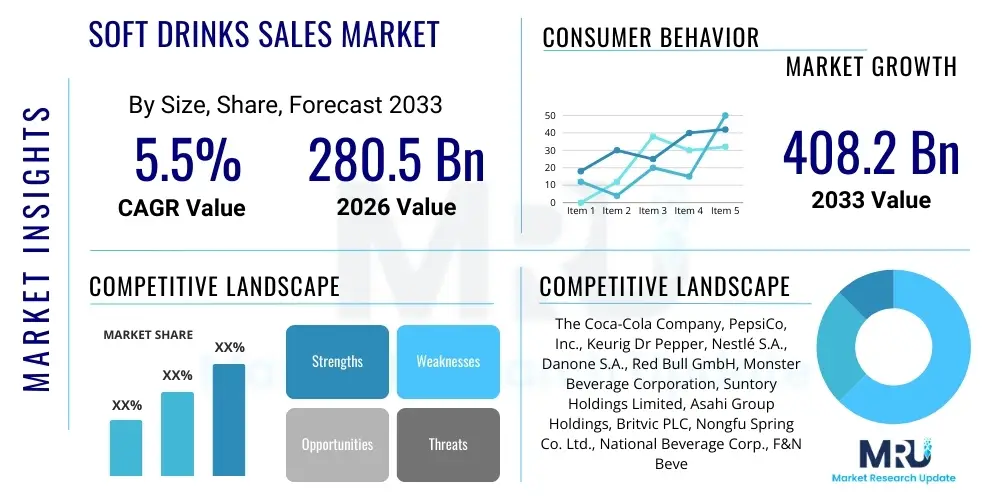

The Soft Drinks Sales Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.5% between 2026 and 2033. The market is estimated at USD 280.5 Billion in 2026 and is projected to reach USD 408.2 Billion by the end of the forecast period in 2033. This robust expansion is primarily driven by increasing urbanization, rising disposable incomes in emerging economies, and the continuous innovation in product offerings, particularly in the functional and low-sugar segments. The shift towards healthier alternatives and sustainable packaging solutions represents both a challenge and a significant opportunity for market players seeking long-term growth and consumer loyalty across diverse global demographics.

Soft Drinks Sales Market introduction

The Soft Drinks Sales Market encompasses the consumption and sale of non-alcoholic, often carbonated, beverages, including categories such as carbonated soft drinks (CSDs), bottled water, ready-to-drink (RTD) teas and coffees, fruit juices and nectars, and functional beverages like energy and sports drinks. These products serve as major refreshment sources globally, catering to diverse consumer preferences regarding flavor, nutritional content, and convenience. The market is characterized by high brand loyalty, extensive distribution networks spanning retail outlets, foodservice, and vending machines, and intense competition among multinational corporations and local producers who continuously introduce novel flavors and formats to capture market share. The core objective of this sector remains delivering convenient hydration and flavor experiences to a mass consumer base.

Major applications of soft drinks extend across daily consumption, social gatherings, quick refreshment breaks, and functional needs such as post-workout recovery or energy enhancement. The primary benefits associated with these products include convenient hydration, quick energy provision (especially in sugar-containing drinks), and the availability of specialized nutritional benefits in functional categories. For instance, sports drinks aid electrolyte replenishment, while fortified juices offer essential vitamins. The market structure relies heavily on efficient cold chain management and widespread retail penetration to ensure accessibility and optimal consumption experience for consumers across various socio-economic groups and geographic locations.

Driving factors propelling market growth include rapid globalization and Westernization of dietary habits, particularly in the Asia Pacific and Latin American regions, leading to increased adoption of packaged beverages. Furthermore, continuous investment in flavor innovation, such as tropical and botanical infusions, keeps the product portfolios engaging. Crucially, the demand for health-and-wellness products has spurred the proliferation of low-calorie sweeteners, natural ingredients, and functional additives, enabling manufacturers to mitigate the negative perception associated with traditional sugary drinks and capture the growing demographic focused on preventative health and overall well-being. This responsiveness to shifting consumer trends is central to sustained market expansion.

Soft Drinks Sales Market Executive Summary

The Soft Drinks Sales Market is undergoing a significant transformation, driven by fundamental shifts in consumer health consciousness and global sustainability imperatives. Key business trends indicate a strategic pivot by major industry players towards portfolio diversification, emphasizing water-based products, natural fruit juices, and functional beverages enriched with vitamins, probiotics, or adaptogens, moving away from high-sugar CSDs. Geographically, while established markets like North America and Europe continue to prioritize premiumization and health-focused innovations (e.g., sparkling water and craft sodas), rapid volume growth is concentrated in Asia Pacific and Latin America, where expanding middle classes and younger populations exhibit increasing demand for packaged convenience. This regional dynamic requires tailored product strategies, including varying pack sizes and localized flavor profiles, often leveraging robust e-commerce channels.

Segmentation trends highlight the rapid ascent of the functional beverage category, particularly energy drinks and cognitive enhancers, which are increasingly marketed beyond traditional athlete demographics to encompass students and office workers seeking performance benefits. Conversely, the traditional CSD segment faces volume stagnation in developed markets but retains high profitability through strategic pricing and limited-edition flavor releases. Packaging trends show a decisive shift toward sustainability, with massive investments in recycled PET (rPET), aluminum cans, and glass, driven by both regulatory pressures and strong consumer preference for eco-friendly choices. Furthermore, the ready-to-drink coffee and tea segments are experiencing significant growth, blurring the lines between traditional soft drinks and the coffee shop experience, particularly through cold brew and specialty dairy alternatives.

Overall, the market remains highly competitive, necessitating substantial investment in supply chain resilience, digital marketing, and sophisticated consumer analytics. Successful market penetration relies on optimizing distribution channels, particularly integrating with quick-commerce platforms and utilizing predictive demand forecasting to manage seasonal fluctuations effectively. Companies that effectively balance consumer demand for low-sugar, functional attributes with compelling flavor profiles, while simultaneously demonstrating commitment to environmental stewardship through packaging innovations and water neutrality efforts, are poised to achieve market leadership and sustainable growth throughout the forecast period. The industry’s future is intrinsically linked to its ability to innovate responsibly and quickly adapt to evolving global health regulations.

AI Impact Analysis on Soft Drinks Sales Market

User inquiries regarding AI's impact on the Soft Drinks Sales Market frequently center on personalization, supply chain optimization, and predictive demand forecasting. Consumers and industry stakeholders are concerned with how AI can revolutionize flavor development—asking if algorithms can create the next blockbuster beverage—and how automation will affect manufacturing efficiency and reduce waste. Key themes include utilizing machine learning (ML) for hyper-targeted marketing campaigns, understanding real-time consumer sentiment across social media platforms, and deploying predictive maintenance in complex bottling operations to minimize downtime. Furthermore, there is significant interest in AI's role in inventory management, specifically addressing the volatility introduced by rapid retail shifts and last-mile delivery demands, ensuring that specific products are stocked efficiently where and when consumer interest peaks. The collective expectation is that AI will unlock significant operational efficiencies and enable an unprecedented level of personalized product interaction.

AI is fundamentally transforming the R&D and manufacturing segments of the soft drinks industry. In product development, sophisticated algorithms analyze millions of data points related to existing flavor preferences, ingredient interactions, and regional consumption habits to suggest novel flavor combinations that have a high probability of market success, drastically shortening the innovation cycle. This data-driven approach allows for rapid prototyping of customized or limited-edition beverages tailored to extremely niche demographic groups or specific geographical micro-markets. On the operational side, AI-powered systems are crucial for optimizing complex global supply chains. They predict potential disruptions, such as raw material shortages or transport delays, allowing companies to dynamically adjust sourcing and logistics plans, thereby enhancing resilience and reducing operational costs associated with expedited shipping or stockouts.

Beyond product creation and supply chain management, AI significantly enhances customer engagement and retail strategy. Machine learning models interpret purchasing patterns from loyalty programs, e-commerce platforms, and smart vending machines to offer highly personalized promotions and product recommendations, significantly boosting conversion rates and customer lifetime value. In retail execution, AI provides prescriptive analytics for shelf placement optimization in physical stores, guiding field sales teams on ideal product mix and display configuration based on real-time sales data and local shopper behavior. This ability to integrate and act upon massive streams of structured and unstructured data across the entire value chain—from sourcing ingredients to final consumer consumption—establishes AI as an indispensable tool for achieving competitive differentiation and navigating the increasingly fragmented consumer beverage landscape.

- AI-driven flavor profile generation accelerates new product development, minimizing failure rates.

- Predictive demand forecasting optimizes inventory levels and reduces spoilage across cold chains.

- Machine Learning (ML) enhances targeted digital marketing campaigns based on hyper-segmented consumer behavior.

- Computer vision systems improve quality control on bottling lines, identifying defects instantly.

- AI facilitates supply chain resilience by modeling risk scenarios and suggesting dynamic logistical routing.

- Personalized beverage recommendations are delivered through smart vending machines and e-commerce platforms.

- Natural Language Processing (NLP) analyzes social media sentiment for real-time brand feedback and crisis management.

DRO & Impact Forces Of Soft Drinks Sales Market

The Soft Drinks Sales Market is shaped by a complex interplay of drivers (D), restraints (R), and opportunities (O), which collectively exert significant impact forces on industry profitability and strategic direction. A primary driver is the pervasive demand for convenience and on-the-go consumption, fueled by increasingly busy urban lifestyles globally, which elevates the appeal of single-serve packaged beverages. This is powerfully counterbalanced by major restraints, most notably increasing health scrutiny from consumers and regulators regarding high sugar content, leading to the implementation of sugar taxes and mandatory nutritional labeling in key markets. However, this restraint concurrently creates a major opportunity for innovation in natural, low-calorie, and functional ingredients, allowing companies to premiumize their offerings and address the preventative health movement. The overall impact forces necessitate a delicate balancing act between maintaining high-volume profitability in traditional segments and aggressive diversification into healthier, sustainable alternatives.

Specific market opportunities are heavily concentrated in emerging economies, particularly in Southeast Asia and Africa, where rapid population growth, rising middle-class disposable income, and inadequate tap water infrastructure drive robust demand for safe, packaged drinking water and flavored soft drinks. Furthermore, the opportunity exists in leveraging advanced packaging technologies to meet evolving sustainability demands, specifically focusing on achieving circular economy goals through 100% recycled or biodegradable materials, which enhances brand reputation and aligns with global Environmental, Social, and Governance (ESG) criteria. A significant restraint, however, is the volatility in commodity prices—sugar, aluminum, and fuel—which impacts manufacturing costs and margins, requiring sophisticated hedging strategies and optimized procurement practices to maintain price stability for the consumer.

The collective impact forces mandate substantial shifts in operational strategy. Competitive intensity is heightened not only by direct rivals but also by adjacent categories, such as specialty coffee and artisanal kombucha, forcing incumbent soft drink giants to acquire or rapidly develop niche brands. The regulatory environment acts as a consistent pressure point, driving compliance costs and necessitating transparency in ingredient sourcing and manufacturing processes. Successfully navigating these impact forces requires high capital investment in R&D for natural sweeteners and functional additives, coupled with aggressive investment in distribution infrastructure, especially cold chain logistics, to reach remote or underdeveloped retail markets efficiently and ensure product quality integrity from production to the point of purchase.

Segmentation Analysis

The Soft Drinks Sales Market is comprehensively segmented based on product type, packaging, distribution channel, and ingredient composition, reflecting the multifaceted ways consumers purchase and consume these beverages. Product segmentation reveals a shift away from traditional Carbonated Soft Drinks (CSDs) toward health-centric categories like bottled water (still and sparkling), energy and sports drinks (functional), and ready-to-drink (RTD) tea and coffee. Packaging innovation, driven by convenience and sustainability, differentiates segments like aluminum cans versus rPET bottles. Analyzing these segments is crucial for understanding specific consumer behaviors, enabling manufacturers to tailor production volumes and marketing strategies to the most profitable and fastest-growing market niches while phasing out or repositioning stagnant product lines.

- By Product Type:

- Carbonated Soft Drinks (CSD)

- Bottled Water (Still, Sparkling, Flavored)

- Juices and Nectars

- Functional Beverages (Energy Drinks, Sports Drinks)

- Ready-to-Drink (RTD) Tea and Coffee

- Others (Syrups, Concentrates, Health Shots)

- By Flavor Type:

- Cola

- Citrus

- Non-citrus Fruit

- Non-fruit (e.g., Tea, Coffee, Herbal)

- By Packaging Type:

- Bottles (PET, Glass)

- Cans (Aluminum)

- Cartons/Aseptic Packaging

- By Distribution Channel:

- On-Trade (Foodservice, Vending, Hospitality)

- Off-Trade (Supermarkets, Hypermarkets, Convenience Stores)

- E-commerce/Online Retail

- By Sweetener Type:

- Sugar (Sucrose)

- Artificial Sweeteners (Aspartame, Sucralose)

- Natural Sweeteners (Stevia, Monk Fruit, Erythritol)

Value Chain Analysis For Soft Drinks Sales Market

The Soft Drinks value chain is extensive and capital-intensive, starting with raw material procurement and culminating in complex distribution to the final consumer. Upstream analysis involves securing high-quality water sources, essential raw materials like sweeteners (sugar or alternatives), flavors, preservatives, and packaging components (PET resin, aluminum, and glass). Efficient procurement and risk management of volatile commodity inputs are paramount at this stage. Core manufacturing processes involve water purification, batch mixing, carbonation, hot or cold filling, capping, labeling, and quality control. These processes demand advanced machinery and often utilize centralized, high-volume bottling plants optimized for economies of scale, requiring continuous investment in automation and predictive maintenance technologies to ensure consistent quality and safety standards are met globally.

The midstream focuses on converting manufactured products into readily accessible consumer goods. Logistics and warehousing play a critical role, particularly the implementation of cold chain solutions to maintain the integrity of perishable products like juices and specific functional drinks. Distribution channel analysis separates direct distribution (e.g., to large retail chains or institutional buyers) and indirect distribution, which heavily relies on third-party wholesalers, distributors, and logistics partners to penetrate smaller, independent retailers, vending operators, and the vast foodservice sector. The complexity arises from managing the high frequency of stock replenishment and optimizing route planning for millions of retail touchpoints.

Downstream activities involve marketing, sales, and retail execution, directly interfacing with the end consumer. Direct sales channels, such as brand-owned e-commerce sites or direct vending machine operations, offer greater control over pricing and data collection but require significant digital infrastructure investment. Indirect channels leverage the extensive reach of supermarkets, convenience stores, and Horeca (Hotel, Restaurant, Catering), where success depends on strong shelf presence, promotional activity, and effective trade marketing spend. Furthermore, digital engagement via social media and personalized advertising is increasingly crucial for driving consumer demand and maintaining brand relevance in a crowded market where consumers are constantly seeking novel and tailored hydration solutions. Effective management of this integrated chain, leveraging data for demand forecasting, is key to sustained market success.

Soft Drinks Sales Market Potential Customers

The potential customers for the Soft Drinks Sales Market are highly diverse, encompassing nearly all demographic segments globally, but can be broadly categorized into distinct user groups based on consumption motivation and product type. The largest segment remains the mass market consumer seeking general refreshment and hydration, primarily purchasing bottled water and mainstream CSDs through off-trade channels like supermarkets and convenience stores. However, a rapidly growing and high-value segment is the health-conscious consumer, typically aged 25-45, residing in developed urban centers, who actively seeks out premium, functional beverages, including fortified waters, kombucha, low-sugar energy drinks, and cold-pressed juices, often prioritizing organic or natural ingredients and sustainable packaging. These buyers are willing to pay a premium for perceived health benefits and ethical production.

Another critical potential customer base includes institutional buyers and the entire foodservice sector, categorized as on-trade customers. This includes restaurants, cafes, hotels, catering services, and large corporate campuses that purchase soft drinks in bulk or specialized fountain formats. These customers prioritize consistent supply, competitive pricing, and brand availability that aligns with their clientele’s expectations. Furthermore, the youth demographic (15-25 years old) remains a primary consumer of energy drinks and highly flavored CSDs, driven by social trends, digital marketing influence, and the pursuit of energy for sports or studying. Targeting this group requires high engagement through digital media and sponsorship of cultural events and esports.

The shift towards e-commerce also highlights a distinct customer profile: the digitally savvy shopper who prioritizes convenience and bulk purchase delivery, often opting for subscription services for bottled water or routine household beverage supplies. Understanding these varied segments allows soft drink manufacturers to customize product formulations, packaging sizes, pricing strategies, and marketing communications. Successful companies analyze purchasing behavior across all channels—identifying, for example, the professional athlete seeking optimal recovery drinks versus the busy parent seeking quick, healthy hydration options for children—to ensure maximum market penetration and tailored consumer value propositions that drive repeat purchases and build brand loyalty in highly competitive segments.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 280.5 Billion |

| Market Forecast in 2033 | USD 408.2 Billion |

| Growth Rate | 5.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | The Coca-Cola Company, PepsiCo, Inc., Keurig Dr Pepper, Nestlé S.A., Danone S.A., Red Bull GmbH, Monster Beverage Corporation, Suntory Holdings Limited, Asahi Group Holdings, Britvic PLC, Nongfu Spring Co. Ltd., National Beverage Corp., F&N Beverages Manufacturing Sdn Bhd, Arizona Beverages, Fever-Tree Drinks PLC, Ocean Spray Cranberries, Inc., Refresco Group B.V., Rockstar Inc., Lucozade Ribena Suntory, Vita Coco. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Soft Drinks Sales Market Key Technology Landscape

The Soft Drinks Sales Market is increasingly reliant on advanced technological integration across manufacturing, packaging, and distribution to maintain quality, reduce operational costs, and meet sustainability goals. In manufacturing, critical technologies include Ultra High-Temperature (UHT) processing and aseptic filling systems, which are essential for extending the shelf life of perishable products like juices and RTD dairy alternatives without compromising nutritional value or requiring excessive refrigeration. High-speed, fully automated bottling and canning lines incorporating robotics and Computer Vision Systems (CVS) are standard, ensuring precise ingredient measurement, minimal contamination risk, and rapid throughput necessary for mass production. Water purification remains a fundamental technology, utilizing advanced reverse osmosis (RO) and nanofiltration systems to guarantee the highest water quality, a cornerstone of any beverage product. Furthermore, the adoption of digital twin technology is emerging, allowing manufacturers to simulate and optimize entire production facilities before physical deployment, enhancing efficiency gains.

Packaging technology is evolving rapidly, driven by environmental mandates. Key innovations include the development and scaling of plant-based packaging materials (bio-PET), barrier technologies that extend shelf life while utilizing thinner materials, and sophisticated recycling infrastructure improvements, particularly chemical recycling techniques for breaking down complex plastics into reusable monomers. Smart packaging, incorporating QR codes, Near Field Communication (NFC) tags, or sensory technologies, is also gaining traction, enabling advanced track-and-trace capabilities for supply chain transparency and providing consumers with instantaneous product information, including sourcing, nutritional content, and recycling instructions. This commitment to smart, sustainable packaging not only reduces the industry’s environmental footprint but also provides valuable data collection points throughout the product lifecycle.

Distribution and logistics are heavily optimized by technologies such as the Internet of Things (IoT) and advanced analytics. IoT sensors are deployed extensively in cold chain logistics to monitor temperature and humidity in real-time, ensuring product integrity during transport and storage, which is particularly vital for temperature-sensitive functional drinks. Route optimization software, powered by sophisticated algorithms, minimizes fuel consumption and delivery times, directly impacting profitability and carbon emissions. Furthermore, the integration of Enterprise Resource Planning (ERP) systems with Manufacturing Execution Systems (MES) allows for seamless data flow from the shop floor to the executive level, enabling real-time decision-making regarding production schedules, inventory management, and alignment with rapidly changing retail demands. These technological pillars are essential for operational excellence and maintaining a competitive edge in the highly dynamic global soft drinks market.

Regional Highlights

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region, driven by explosive population growth, rapid urbanization, and increasing disposable incomes, particularly in China, India, and Southeast Asian nations. The region shows high demand for packaged water due to perceived issues with tap water quality, alongside a strong cultural acceptance of RTD tea and coffee. Major global players are aggressively localized product portfolios, introducing region-specific flavors (e.g., lychee, mango) and investing heavily in cold chain and last-mile distribution infrastructure to capture the vast, fragmented rural and semi-urban markets.

- North America: This is a mature market characterized by intense competition and a significant focus on health and premiumization. The CSD segment is shrinking, offset by massive growth in sparkling water, enhanced flavored water, and functional beverages (e.g., energy shots, cognitive drinks). Innovation centers on natural and zero-calorie sweeteners, sustainable packaging mandates (rPET utilization), and high-value e-commerce distribution channels, demanding sophisticated digital engagement and transparent labeling from key players.

- Europe: Growth in Europe is constrained by strict environmental regulations, pervasive sugar taxation, and consumer preference shifts toward local, artisanal, and highly natural products. The market is defined by rapid adoption of aluminum canning, stringent targets for plastic reduction, and strong performance in the functional and low-alcohol/no-alcohol segments. Western European nations (Germany, UK, France) emphasize premium, craft sodas and high-quality juices, while Eastern Europe offers stronger volume growth potential.

- Latin America (LATAM): LATAM remains a vital volume driver, particularly for mainstream CSDs, although health concerns and taxation are starting to influence consumption patterns, notably in Mexico and Brazil. The market is characterized by a strong presence of large pack sizes and robust, traditional distribution methods. Increasing disposable incomes are fueling the demand for aspirational products like global energy drink brands and premium bottled water, requiring manufacturers to balance affordability with growing premiumization trends.

- Middle East and Africa (MEA): This region offers divergent dynamics. The Middle East demonstrates high per capita consumption of soft drinks, fueled by climate and consumer affluence, favoring CSDs and specialized flavored waters. Africa presents long-term growth opportunities driven by rapid urbanization and large youth populations, but market entry requires overcoming infrastructural challenges related to logistics, reliable power supply, and affordable product pricing to reach low-income consumers effectively.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Soft Drinks Sales Market.- The Coca-Cola Company

- PepsiCo, Inc.

- Keurig Dr Pepper

- Nestlé S.A.

- Danone S.A.

- Red Bull GmbH

- Monster Beverage Corporation

- Suntory Holdings Limited

- Asahi Group Holdings

- Britvic PLC

- Nongfu Spring Co. Ltd.

- National Beverage Corp.

- F&N Beverages Manufacturing Sdn Bhd

- Arizona Beverages

- Fever-Tree Drinks PLC

- Ocean Spray Cranberries, Inc.

- Refresco Group B.V.

- Rockstar Inc.

- Lucozade Ribena Suntory

- Vita Coco

Frequently Asked Questions

Analyze common user questions about the Soft Drinks Sales market and generate a concise list of summarized FAQs reflecting key topics and concerns.What key factors are driving the growth of the functional beverage segment?

The growth is primarily driven by heightened consumer awareness regarding preventative health, fitness trends, and the desire for enhanced mental and physical performance. Functional beverages, including sports drinks, energy drinks, and fortified waters with vitamins, probiotics, or adaptogens, cater to specific wellness needs, offering perceived benefits beyond basic hydration.

How is regulatory pressure, such as sugar taxes, impacting the market?

Sugar taxes and stringent nutritional labeling requirements are forcing manufacturers to reformulate products by reducing sugar content or replacing it with natural, low-calorie alternatives like Stevia and Monk Fruit. This regulation accelerates portfolio diversification towards zero-sugar CSDs and non-taxable categories like bottled water, fundamentally reshaping traditional product offerings.

What is the most significant trend in soft drink packaging?

Sustainability is the most significant trend, specifically the rapid transition toward 100% recycled PET (rPET) plastic, increased reliance on aluminum cans due to their high recyclability rate, and the exploration of plant-based packaging solutions. Consumers and regulators increasingly demand circular economy solutions to minimize environmental waste associated with single-use packaging.

Which geographical region offers the highest growth potential for soft drink sales?

Asia Pacific (APAC) offers the highest future growth potential, driven by vast consumer bases, rapid economic expansion, increasing urbanization, and low penetration rates of packaged beverages in numerous sub-regions. Key markets like India and Southeast Asia present substantial opportunities for both established brands and localized products.

How is the rise of e-commerce affecting traditional soft drink distribution channels?

E-commerce is revolutionizing distribution by enabling direct-to-consumer (D2C) models and driving bulk purchases, particularly for heavy products like bottled water. This shift requires sophisticated digital supply chains, optimized last-mile delivery logistics, and specific packaging designed to withstand shipping, complementing traditional off-trade retail channels like supermarkets.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager