Soft Magnetic Core Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433514 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Soft Magnetic Core Market Size

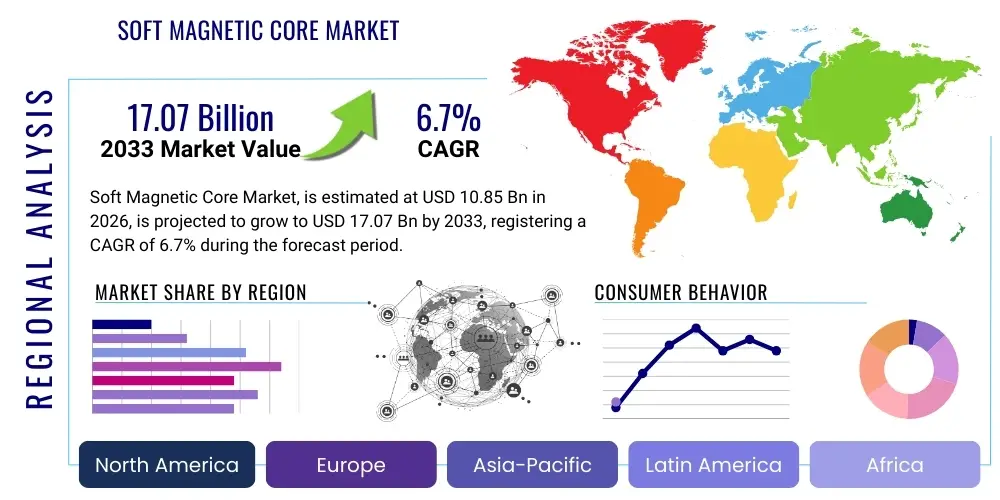

The Soft Magnetic Core Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.7% between 2026 and 2033. The market is estimated at USD 10.85 Billion in 2026 and is projected to reach USD 17.07 Billion by the end of the forecast period in 2033.

Soft Magnetic Core Market introduction

Soft magnetic cores are essential components manufactured from materials like ferrites, silicon steel, iron powder, and amorphous/nanocrystalline alloys, characterized by low coercivity and high permeability, allowing them to be easily magnetized and demagnetized. These properties minimize energy loss, making them crucial for efficient power conversion and signal processing. The fundamental application lies in concentrating magnetic flux lines to enhance inductive coupling, enabling optimal performance in electrical devices ranging from small consumer electronics to large industrial power systems. The growing demand for energy efficiency standards globally, coupled with the rapid proliferation of electric vehicles (EVs) and renewable energy infrastructure, drives the necessity for advanced soft magnetic materials capable of operating at higher frequencies and temperatures with minimal core losses.

The primary applications of soft magnetic cores span across power electronics, telecommunications, and automotive sectors. In power electronics, they are indispensable for constructing high-efficiency transformers, inductors, and chokes used in power supplies, inverters, and converters. For the automotive industry, particularly in EVs, these cores are vital for DC-DC converters, on-board chargers, and motor magnetics, requiring materials with exceptional thermal stability and saturation flux density. Furthermore, the expansion of 5G networks and data centers mandates specialized soft magnetic cores for filtering and energy storage, emphasizing the shift toward materials like amorphous and nanocrystalline alloys due to their superior performance characteristics compared to traditional ferrites or silicon steel.

Key benefits derived from employing high-quality soft magnetic cores include enhanced energy efficiency, reduced component size and weight, improved operational frequency capabilities, and superior thermal management. Driving factors propelling this market include global electrification trends, stringent energy efficiency regulations (e.g., EU Ecodesign Directive), massive investments in smart grids and renewable energy infrastructure (solar inverters and wind turbine generators), and the continuous innovation in material science leading to the development of ultra-low loss core materials. These factors collectively cement soft magnetic cores as non-negotiable components in the transition towards a digitized and sustainable energy economy.

Soft Magnetic Core Market Executive Summary

The Soft Magnetic Core Market is experiencing robust growth driven predominantly by the paradigm shift towards electrification in the transportation sector and the integration of renewable energy sources into the existing power grid infrastructure. Business trends indicate a strong focus on advanced materials such as nanocrystalline and amorphous cores, which offer superior performance necessary for high-frequency, high-power-density applications, pushing manufacturers to invest heavily in specialized production capabilities and automation. Regional trends highlight Asia Pacific (APAC) as the dominant and fastest-growing region, fueled by massive electronics manufacturing bases in China, Taiwan, and South Korea, coupled with aggressive EV adoption policies. North America and Europe also show significant uptake, driven by stringent energy efficiency mandates and revitalization of smart grid technologies. Segment-wise, the Ferrite Core segment maintains the largest market share due to its cost-effectiveness and versatility across consumer electronics, while the Amorphous and Nanocrystalline segment is poised for the fastest CAGR, primarily due to its pivotal role in high-efficiency transformer and EV component manufacturing, signaling a strong market preference for performance over traditional cost considerations in critical infrastructure.

AI Impact Analysis on Soft Magnetic Core Market

Users frequently inquire about how Artificial Intelligence (AI) and machine learning (ML) are optimizing the design and production of soft magnetic cores, particularly focusing on predicting material performance under various operational stresses and enhancing quality control. Common user questions revolve around AI’s ability to accelerate the discovery of novel high-performance magnetic materials, improve core loss modeling accuracy, and optimize complex winding geometries for transformers and inductors used in AI hardware like servers and data centers. The consensus themes indicate a high expectation for AI to significantly shorten the R&D cycle for new core materials, enabling rapid customization based on application-specific frequency and temperature requirements. Furthermore, AI is expected to revolutionize production efficiency through predictive maintenance, real-time quality assurance, and minimizing waste in highly automated ferrite and powder metallurgy processing plants, thereby ensuring the supply chain can meet the escalating demands of high-performance computing infrastructure.

- AI-driven simulation optimizes core geometry and material composition, reducing core loss calculations from months to minutes, accelerating product development.

- Machine learning algorithms predict the long-term magnetic aging and performance degradation of cores, crucial for reliability in automotive and aerospace applications.

- AI enhances quality control in manufacturing by detecting micro-defects during sintering or annealing processes, improving batch consistency and yield rates for advanced materials.

- Predictive maintenance using AI monitors production equipment health, minimizing downtime in high-volume production of ferrite and silicon steel laminations.

- AI facilitates the design of compact and efficient power management circuits (PMICs) and filters utilizing optimized soft magnetic cores for AI servers and high-density data centers.

- Use of generative design models to explore novel magnetic material combinations previously unattainable through traditional trial-and-error R&D methods.

DRO & Impact Forces Of Soft Magnetic Core Market

The Soft Magnetic Core Market growth is primarily driven by the massive global push toward electrification and sustainable energy systems, requiring cores capable of managing high power density and high frequency operations (Drivers). However, the market faces significant hurdles due to the highly capital-intensive nature of advanced material production, requiring complex sintering, annealing, and rolling processes, coupled with volatile raw material pricing, especially for key elements like nickel, iron, and specialized additives (Restraints). Opportunities lie in the burgeoning applications of 800V architecture in Electric Vehicles (EVs) and the massive requirement for magnetic components in offshore wind energy systems and solid-state transformers (Opportunities). The competitive landscape is shaped by the need for superior energy efficiency mandates (Impact Forces), forcing core manufacturers to continuously innovate and push the boundaries of materials science to achieve lower core losses and higher operational temperatures, thereby influencing market entry barriers and pricing strategies across all segments.

A key driver is the accelerated adoption of Electric Vehicles (EVs) worldwide. EV powertrains rely heavily on high-performance soft magnetic materials in traction motors, inverters, and charging systems (both on-board and off-board). These applications demand low-loss cores operating at high frequencies to minimize heat generation and maximize efficiency and range. This demand specifically favors nanocrystalline and high-grade ferrite cores. Furthermore, the global proliferation of consumer electronics, including smartphones, laptops, and IoT devices, requires miniature, high-efficiency power inductors and transformers, sustaining the volume demand for standard and specialized ferrite cores, especially in Asia Pacific, which is the epicenter of electronics manufacturing.

Conversely, significant restraints hinder optimal market performance. The scarcity and price volatility of key raw materials, such as iron, nickel, cobalt, and rare earth elements used in certain high-end amorphous alloys, pose consistent supply chain challenges and pressure on profit margins. Additionally, the development and commercialization of new soft magnetic materials are characterized by long lead times and high R&D costs, making it difficult for smaller players to compete with established giants who possess proprietary material synthesis technologies and large-scale, automated production facilities. The technical challenge of achieving ultra-low core losses while maintaining high saturation flux density at high temperatures represents a persistent technical barrier that manufacturers must continuously address through material innovation.

Segmentation Analysis

The Soft Magnetic Core market is meticulously segmented based on Material, Application, and End-Use Industry, reflecting the diverse and highly technical requirements of modern electrical systems. The Material segmentation, including Ferrite, Silicon Steel, Iron Powder, and Amorphous/Nanocrystalline, dictates performance characteristics like operating frequency and core loss, directly influencing application suitability. Ferrites dominate in high-frequency, low-power consumer electronics, while Silicon Steel remains essential for large, low-frequency power transformers and motors. Application segmentation clarifies the end use, whether in power converters, induction systems, or signal processing components. Lastly, the End-Use Industry segmentation, primarily focusing on Automotive, Renewable Energy, and Industrial, demonstrates the large-scale investment areas driving customized core solutions, particularly the explosive growth in electric vehicle magnetics and high-voltage grid components.

- By Material:

- Ferrite Cores

- Silicon Steel Cores (Grain-oriented and Non-grain-oriented)

- Iron Powder Cores

- Amorphous and Nanocrystalline Cores

- By Application:

- Transformers (Power, Distribution, Signal)

- Inductors and Chokes

- Electromagnets

- Sensors and Actuators

- Electric Motors and Generators

- By End-Use Industry:

- Automotive (Electric Vehicle Components)

- Consumer Electronics

- Renewable Energy (Solar and Wind Inverters)

- Industrial (Power Supplies, Automation)

- Telecommunications and Data Centers

Value Chain Analysis For Soft Magnetic Core Market

The value chain for the Soft Magnetic Core Market begins with upstream activities involving the sourcing and processing of essential raw materials, primarily iron ore, silicon, nickel, and specialized additives like manganese, zinc, and rare earths. This stage is critical as the purity and precise ratio of these inputs directly determine the final magnetic properties. Key players at the upstream level include specialized metallurgy companies and chemical processors. The subsequent stage involves core manufacturing, encompassing complex processes such as powder metallurgy for ferrites and iron powder cores, specialized rolling and annealing for silicon steel laminations, and rapid solidification techniques for amorphous and nanocrystalline ribbons. High capital expenditure and proprietary technology ownership are characteristics of this middle stage, where core design optimization and precision processing are paramount.

The midstream focuses on component integration and processing. Core manufacturers often supply components (toroids, E-cores, rods) to winding and assembly specialists, who then produce finished inductive components like transformers, chokes, and inductors tailored to specific frequency and power requirements. This stage often includes stringent testing and qualification processes, particularly for automotive and aerospace grade components, where reliability is non-negotiable. Distribution channels are bifurcated, involving direct sales to large OEMs (Original Equipment Manufacturers) in the automotive and industrial sectors, and indirect sales through specialized electronic component distributors who cater to smaller manufacturers and aftermarket service providers, offering inventory management and technical support.

Downstream activities involve the final end-use integration across diverse sectors. Direct distribution is common for high-volume, custom-designed cores destined for Tier 1 EV suppliers or major renewable energy system integrators. Indirect channels leverage extensive distributor networks (e.g., Arrow, Avnet) to reach smaller electronics firms and ensure broad market accessibility. The increasing complexity of modern power electronics mandates close collaboration between the core material producer and the end-user design engineer to ensure the component meets specific system-level thermal and performance objectives. This collaborative approach highlights the transition of soft magnetic core provision from a commodity sale to a specialized engineering service.

Soft Magnetic Core Market Potential Customers

Potential customers for soft magnetic cores represent a highly diverse group spanning critical infrastructure, high-technology manufacturing, and consumer product sectors, driven by the universal need for efficient power management and signal integrity. Primary end-users include Electric Vehicle (EV) and hybrid vehicle manufacturers (OEMs like Tesla, BYD, Volkswagen) who require high-performance, heat-tolerant cores for traction inverters, DC-DC converters, and on-board chargers. The Renewable Energy sector, comprising solar inverter manufacturers (e.g., Huawei, SMA Solar) and wind turbine producers, constitutes a major buying segment, prioritizing efficiency and reliability for large-scale energy conversion applications. Industrial machinery and automation companies use these cores extensively in high-frequency switch-mode power supplies (SMPS) and industrial drives, demanding rugged, stable components for continuous operation.

The largest volume buyers often originate from the Consumer Electronics and Telecommunications segments. Major electronics manufacturers (e.g., Samsung, Apple, Foxconn) require millions of miniaturized ferrite cores annually for power adapters, smart devices, and high-frequency communication modules. Furthermore, the rapid build-out of 5G infrastructure and massive data centers necessitate high-density power delivery components, making companies specializing in network equipment (e.g., Cisco, Ericsson) and server power management (e.g., Delta Electronics, Lite-On) key customers who primarily procure amorphous and high-frequency ferrite cores to minimize energy losses and maximize server efficiency. These buyers often prioritize long-term supply contracts and customized material development partnerships.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 10.85 Billion |

| Market Forecast in 2033 | USD 17.07 Billion |

| Growth Rate | 6.7% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | TDK Corporation, VACUUMSCHMELZE GmbH & Co. KG (VAC), Proterial (formerly Hitachi Metals), Sumitomo Metal Mining Co., Ltd., Magnetics (Spang & Company), Toshiba Materials Co., Ltd., MMG (MinebeaMitsumi Group), Acme Chip Corporation, Ferroxcube, JFE Steel Corporation, Samwha Electric Co., Ltd., Delta Electronics, Inc., Epcos (TDK Group), Pioneer Material Precision Technology Co., Ltd., Dongbu Steel, Suzhou Dajing Electronic Co., Ltd., Haining Lianxing Magnet Technology Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Soft Magnetic Core Market Key Technology Landscape

The technology landscape of the Soft Magnetic Core Market is rapidly evolving, driven by the necessity for materials capable of high-frequency operation and minimized core losses, essential for maximizing efficiency in modern power electronics. A pivotal technological shift involves the transition from traditional grain-oriented silicon steel (GOES) used in large power transformers toward advanced amorphous and nanocrystalline materials. Amorphous metals, produced via rapid solidification of molten alloys, exhibit superior magnetic properties (low coercivity and high permeability) compared to conventional crystalline materials, making them ideal for high-efficiency distribution transformers and specific EV components. Nanocrystalline materials further refine this technology, utilizing controlled heat treatments to achieve ultra-fine grain structures, resulting in exceptionally low core losses at very high frequencies (up to 1 MHz), crucial for telecommunications filters and resonant converters.

Another crucial technological focus is on enhancing powder metallurgy techniques for specialized ferrite and iron powder cores. Manufacturers are leveraging advanced particle size control, surface modification, and optimized annealing processes to produce Soft Magnetic Composites (SMCs). SMCs allow for complex 3D magnetic flux paths, enabling highly compact and efficient components for motor stators and high-density inductors, particularly vital in space-constrained automotive and aerospace applications. Furthermore, the push towards wide-bandgap semiconductors (SiC and GaN) in power electronics necessitates magnetic cores that can withstand the associated higher switching frequencies and temperatures. This requirement is driving research into high-temperature, high-saturation ferrite formulations and protective surface coatings to ensure long-term reliability.

Innovation also includes manufacturing process optimization utilizing additive manufacturing (3D printing) for prototyping complex magnetic components, although large-scale commercial application is still emerging. Core loss modeling and simulation technologies, increasingly integrated with AI, are essential tools, allowing engineers to accurately predict component performance under extreme operational conditions before physical prototyping. Overall, the technology trajectory emphasizes material synthesis and processing advancements aimed at delivering lower losses, higher thermal stability, and increased saturation flux density, ensuring the magnetic components remain the critical enabler for efficiency in the rapidly electrifying world.

Regional Highlights

- Asia Pacific (APAC): APAC commands the largest share of the Soft Magnetic Core Market and is projected to exhibit the highest growth rate during the forecast period. This dominance is attributed to the presence of large-scale electronics manufacturing hubs in China, Taiwan, and South Korea, coupled with robust government support for Electric Vehicle manufacturing and renewable energy deployment (especially solar energy) in countries like China and India.

- North America: The region is characterized by high investment in advanced aerospace, defense, and data center infrastructure, driving demand for high-performance amorphous and nanocrystalline cores. Strict energy efficiency regulations and the rapid modernization of the power grid (smart grid technologies) propel the demand for high-efficiency distribution transformers utilizing advanced core materials.

- Europe: Europe is a key market, primarily driven by stringent environmental standards and a massive transition towards EV production, particularly in Germany and France. The region is a leader in industrial automation and precision machinery, demanding highly reliable and efficient cores for industrial motors and power supplies.

- Latin America (LATAM): Growth in LATAM is more moderate but steady, centered around industrial expansion and infrastructure projects. The market focuses primarily on silicon steel cores for energy transmission and distribution networks, with nascent growth in consumer electronics manufacturing in Mexico and Brazil.

- Middle East and Africa (MEA): The MEA market growth is stimulated by large-scale power generation and desalination projects, requiring robust transformer cores. Investment in renewable energy, especially large solar farms in the UAE and Saudi Arabia, is driving localized demand for efficient magnetic components.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Soft Magnetic Core Market.- TDK Corporation

- VACUUMSCHMELZE GmbH & Co. KG (VAC)

- Proterial (formerly Hitachi Metals)

- Sumitomo Metal Mining Co., Ltd.

- Magnetics (Division of Spang & Company)

- Toshiba Materials Co., Ltd.

- MMG (MinebeaMitsumi Group)

- Acme Chip Corporation

- Ferroxcube

- Dongbu Steel

- Pioneer Material Precision Technology Co., Ltd.

- JFE Steel Corporation

- Samwha Electric Co., Ltd.

- Delta Electronics, Inc.

- Epcos (TDK Group)

- Suzhou Dajing Electronic Co., Ltd.

- Haining Lianxing Magnet Technology Co., Ltd.

- Jiangsu Changsheng Electric Appliance Co., Ltd.

- Guangzhou Amorphous Technology Co., Ltd.

- Advanced Technology & Materials Co., Ltd. (AT&M)

Frequently Asked Questions

Analyze common user questions about the Soft Magnetic Core market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between ferrite cores and amorphous cores?

Ferrite cores are ceramic compounds suited for high-frequency applications but possess lower saturation flux density. Amorphous cores, made from metallic glass ribbons, offer significantly lower core loss and higher permeability at high frequencies, making them superior for high-efficiency power conversion systems like EV chargers and high-end solar inverters.

How is the Electric Vehicle (EV) industry influencing demand for soft magnetic cores?

The EV industry is the dominant growth driver, necessitating cores for traction inverters, on-board chargers, and DC-DC converters. This application requires materials (like nanocrystalline and high-grade ferrites) capable of operating reliably at high temperatures and high switching frequencies (driven by SiC/GaN adoption) to minimize component size and maximize system efficiency and driving range.

Which material segment currently holds the largest market share and why?

The Ferrite Core segment holds the largest volume market share due to its cost-effectiveness, widespread use in consumer electronics (power supplies, filters), and suitability for various low to medium-power, high-frequency applications, ensuring its dominance across the massive electronics manufacturing base in Asia.

What are Soft Magnetic Composites (SMCs) and their major advantages?

Soft Magnetic Composites (SMCs) are powder cores where insulated iron particles are molded into complex shapes, offering isotropic magnetic properties and highly versatile 3D flux path management. Their major advantages include reduced eddy current losses and the ability to fabricate complex geometries, optimizing performance in high-efficiency electric motor stators and compact inductors.

Which key technical specifications are most critical for soft magnetic cores used in renewable energy applications?

In renewable energy (solar and wind inverters), the most critical specifications are ultra-low core loss across the operating temperature range, high saturation flux density to handle fluctuating power outputs, and exceptional long-term thermal stability to ensure reliability over the 20+ year lifespan of the energy infrastructure.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager