Soft Tissue Allografts Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439154 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Soft Tissue Allografts Market Size

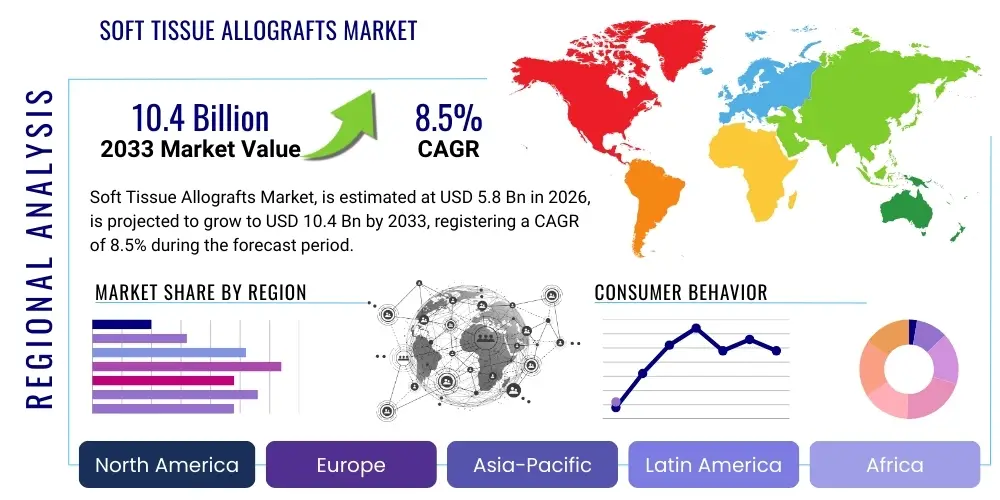

The Soft Tissue Allografts Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 5.8 Billion in 2026 and is projected to reach USD 10.4 Billion by the end of the forecast period in 2033.

Soft Tissue Allografts Market introduction

The Soft Tissue Allografts Market encompasses biological materials, derived from human donors, used to replace, repair, or reconstruct damaged soft tissues, including skin, tendons, ligaments, and fascia. These allografts serve as vital scaffolding that facilitates the body's natural healing and integration processes. Key products include dermal allografts for burn and wound care, meniscus allografts for knee reconstruction, and tendon allografts utilized extensively in sports medicine and orthopedic procedures, particularly for anterior cruciate ligament (ACL) reconstruction. The essential advantage of using allografts is the elimination of the need for a second surgical site to harvest autograft material, significantly reducing patient morbidity, operation time, and post-operative pain. Furthermore, the standardization and availability of allograft tissue via tissue banks provide readily accessible options for complex surgical reconstructions, making them a preferred choice in high-volume settings such as trauma centers and specialized orthopedic clinics across North America and Europe. This broad applicability across multiple surgical disciplines cements soft tissue allografts as indispensable components of modern regenerative medicine and reconstructive surgery.

Major applications driving the demand for soft tissue allografts include orthopedic surgery, dental procedures, wound management, and neurosurgery. In orthopedics, the increased incidence of sports-related injuries, particularly among athletes and the aging population engaging in physical activity, generates substantial demand for tendon and ligament replacements. Dental applications primarily involve guided tissue regeneration (GTR) and guided bone regeneration (GBR) procedures, utilizing connective tissue matrix allografts for periodontal defect repair and implant preparation. The benefits associated with these products are substantial, revolving around superior biomechanical strength, biological compatibility, and reduced immunological rejection risks compared to synthetic alternatives. Advanced tissue processing techniques, such as supercritical carbon dioxide sterilization and terminal sterilization methods, ensure product safety and integrity, addressing historical concerns regarding disease transmission and graft viability, thereby increasing surgeon confidence and patient acceptance globally. This focus on safety and efficacy is crucial for maintaining market growth momentum.

The market is significantly driven by several macro-environmental factors, notably the global demographic shift towards an older population segment, which is inherently more susceptible to degenerative soft tissue injuries and joint disorders requiring surgical intervention. Concurrently, technological advancements in tissue banking and preservation, including improved cryopreservation protocols and development of decellularized tissue matrices, enhance the quality and shelf-life of allografts. Regulatory environments, particularly in developed economies, are becoming more streamlined for tissue products, facilitating faster market entry for innovative products, provided strict safety standards are met. Moreover, the increasing awareness and adoption of minimally invasive surgical techniques, which are often complemented by the use of processed allografts, contribute to market expansion. Healthcare expenditure increases in emerging economies, coupled with improved access to advanced surgical care, further support the robust growth trajectory projected for the soft tissue allografts market through 2033, reinforcing its critical role in trauma and reconstructive healthcare.

Soft Tissue Allografts Market Executive Summary

The Soft Tissue Allografts Market is characterized by intense competition and rapid technological innovation focused on improving graft integration and reducing rejection rates. Key business trends include the consolidation of tissue banks and allograft processors to achieve economies of scale and better control the supply chain, from donor screening to final product sterilization. There is a noticeable trend towards the development of specialized, pre-sized, and pre-shaped grafts tailored for specific anatomical sites, which streamlines surgical procedures and reduces operative time. Furthermore, strategic partnerships between large medical device corporations and specialized biotechnology firms are crucial for leveraging advanced tissue engineering techniques, such as incorporating growth factors or developing bio-enhanced matrices, driving the premium segment of the market. Investment in automated processing systems is also a major theme, aiming to standardize quality and increase production throughput while adhering to stringent international regulatory guidelines, ultimately optimizing business models for sustained profitability.

Regional trends indicate North America currently dominates the market due to its highly sophisticated healthcare infrastructure, high prevalence of sports injuries, substantial reimbursement policies for reconstructive surgeries, and the presence of major market players and well-established tissue banking organizations. However, the Asia Pacific (APAC) region is projected to exhibit the highest CAGR during the forecast period. This accelerated growth in APAC is attributed to rapidly improving healthcare access, increasing disposable incomes leading to higher patient expenditure on premium treatments, and the expanding adoption of Westernized medical practices, particularly in countries like China, India, and South Korea. European markets maintain steady growth, driven by an aging population and a strong emphasis on tissue quality and regulatory compliance, particularly under the EU Tissue and Cells Directive (EUTCD), which sets high standards for procurement and processing, fostering trust among healthcare providers and stimulating consistent demand.

Segment trends reveal that the 'Dental' application segment is experiencing significant expansion, propelled by the rising global demand for dental implants and periodontal reconstruction procedures, which frequently utilize connective tissue allografts. Within the product type segment, 'Tendons' remain the dominant category due to their extensive use in knee, shoulder, and ankle reconstruction, particularly related to ACL and rotator cuff repairs, which represent some of the most common orthopedic procedures worldwide. The end-user segment is dominated by Hospitals and Ambulatory Surgical Centers (ASCs). ASCs are increasingly becoming preferred venues for less complex orthopedic and dental procedures due to cost-effectiveness and efficiency, driving their market share growth. Future segment growth is expected to pivot towards bio-enhanced grafts that offer better biological integration and accelerated healing, integrating concepts from regenerative medicine into traditional allograft structures, thus setting the stage for the next wave of product innovation and market penetration.

AI Impact Analysis on Soft Tissue Allografts Market

User queries regarding the impact of Artificial Intelligence (AI) on the Soft Tissue Allografts Market primarily focus on improving donor matching efficiency, enhancing tissue quality assessment during processing, and optimizing surgical planning for graft placement. Key concerns revolve around whether AI can reduce graft rejection rates and predict long-term outcomes more accurately than traditional clinical assessment. Users are particularly keen on understanding how machine learning algorithms can analyze complex biological and demographic data to maximize the utility and safety of donated tissue. The consensus expectation is that AI integration, particularly in image analysis of tissue structures and predictive modeling of patient compatibility, will lead to significant advancements in personalized regenerative medicine, ensuring the highest quality allograft reaches the most suitable recipient, ultimately leading to better clinical success rates and improved operational throughput in tissue banks.

AI is poised to revolutionize the operational aspects of tissue banking, starting with rigorous donor eligibility screening. Machine learning models can process vast amounts of medical history, lab results, and demographic data far faster than human analysts, identifying potential risks or contraindications with greater precision, thereby improving the safety profile of available tissue inventory. Furthermore, in the processing phase, computer vision algorithms applied to microscopy images can assess cellular viability, density, and structural integrity of the tissue matrix, ensuring only the highest quality grafts proceed to sterilization and distribution. This automated quality control reduces batch variability, minimizes waste, and provides an auditable, quantifiable measure of product quality, which is crucial for regulatory compliance and building clinical trust in advanced allograft products.

In the clinical setting, AI assists surgeons through advanced pre-operative planning. Utilizing patient-specific imaging (MRI, CT scans), AI algorithms can simulate different graft sizes and placements, optimizing fit and biomechanical function before the surgery commences, which is particularly critical in complex ligament reconstruction or meniscus transplantation. Predictive analytics, leveraging long-term patient follow-up data, will allow institutions to identify factors contributing to graft failure or success, providing invaluable feedback loops to improve tissue processing protocols and surgical techniques. While initial adoption requires significant investment in data infrastructure and training, the long-term benefits in reducing revision surgeries and improving patient outcomes solidify AI's role as a transformative technology in the soft tissue allografts ecosystem, bridging the gap between tissue science and personalized surgical medicine.

- AI enhances donor eligibility screening and risk assessment using large dataset analysis.

- Machine learning algorithms optimize tissue processing by improving quality control and consistency.

- Computer vision accurately assesses cellular viability and structural integrity of processed grafts.

- AI-driven predictive analytics assist surgeons in personalized pre-operative planning and graft sizing.

- Implementation of AI reduces human error and variability in the tissue banking supply chain.

DRO & Impact Forces Of Soft Tissue Allografts Market

The Soft Tissue Allografts Market is profoundly influenced by a complex interplay of Drivers, Restraints, and Opportunities (DRO). Major drivers include the increasing global prevalence of orthopedic conditions, such as ligament and tendon injuries, significantly fueled by active lifestyle trends and an aging population base worldwide. The inherent advantages of allografts, such as the avoidance of donor-site morbidity associated with autografts, directly contribute to their rising adoption, particularly in complex or repeat reconstructive surgeries. Simultaneously, significant investments in research and development, aimed at improving tissue biocompatibility and introducing bio-enhanced grafts loaded with growth factors or stem cells, are continually expanding the clinical utility of these products. These forces collectively create a strong foundation for sustained market expansion, particularly as healthcare systems worldwide prioritize high-quality, efficient surgical solutions that minimize patient recovery time.

Restraints, however, pose significant challenges to the market's trajectory. The most critical restraint is the stringent and often complex regulatory landscape governing tissue procurement, processing, and distribution, which varies considerably across countries and necessitates extensive compliance costs and time for market entry. High product costs associated with specialized processing and sterilization techniques, coupled with varying or insufficient reimbursement policies in certain regions, can limit patient access and adoption, especially in price-sensitive emerging markets. Furthermore, the inherent risk, albeit low, of disease transmission or immunological response remains a constant concern that requires continuous monitoring, specialized tissue preparation, and robust communication strategies to maintain surgeon and patient confidence in allograft safety. Addressing these challenges necessitates unified global regulatory standards and scalable, cost-effective processing technologies.

Opportunities for market players are abundant, primarily centered around technological innovation and geographic expansion. The development of advanced decellularized matrices, offering superior integration and reduced immunogenicity, represents a substantial opportunity for premiumization and market penetration into more sensitive applications. Exploring novel applications beyond traditional orthopedics, such as cosmetic surgery, peripheral nerve repair, and advanced wound care, provides new revenue streams. Geographically, significant untapped potential lies within emerging markets in the Middle East, Africa, and specific parts of Asia Pacific, where improving healthcare infrastructure and rising medical tourism present lucrative avenues for market penetration. Finally, leveraging bioprinting and 3D scaffold technologies to customize allograft substitutes offers a long-term strategic opportunity to revolutionize personalized soft tissue reconstruction, pushing the boundaries of current regenerative capabilities.

Segmentation Analysis

The Soft Tissue Allografts Market is meticulously segmented based on product type, application, and end-user, providing a granular view of market dynamics and growth potential across various dimensions. Understanding these segmentations is critical for stakeholders to tailor their product development, marketing, and distribution strategies effectively. The segmentation reflects the diverse range of clinical needs, from specialized orthopedic reconstruction to routine dental procedures, each utilizing distinct graft types processed according to specific functional requirements. The market analysis reveals strong growth in specialized segments driven by technological advances and expanding surgical indications, moving away from generalized matrices toward highly specified, optimized tissue forms.

Segmentation by product type is crucial, defining the biological composition and intended biomechanical function of the graft, including bone marrow-derived matrices, tendons, ligaments, cartilage, and specialized dermal allografts. Tendon and ligament grafts dominate the revenue share due to their extensive use in high-volume sports medicine surgeries like ACL repair. Segmentation by application highlights the key clinical areas of usage, encompassing orthopedic, dental, wound care, and neurological surgeries. The rapid growth in dental applications, driven by periodontal procedures and implantology, signifies a major expansion area beyond the traditional orthopedic focus. End-user segmentation focuses on the point of consumption—Hospitals, Ambulatory Surgical Centers (ASCs), and Specialty Clinics—reflecting shifting preferences for outpatient surgical settings due to cost efficiencies and streamlined services.

Strategic analysis of these segments indicates that the future growth trajectory will be heavily influenced by bio-enhanced grafts within the product type category and the continued proliferation of ASCs within the end-user category. Manufacturers are increasingly investing in products that facilitate minimally invasive techniques, thereby aligning with the preference of ASCs. Furthermore, the convergence of soft tissue allografts with adjacent technologies, such as synthetic scaffolds or absorbable fixation devices, will create hybrid product categories, enhancing versatility and improving long-term clinical outcomes across all application segments, particularly in complex reconstructive cases where high mechanical integrity and rapid biological integration are paramount considerations for surgical success.

- By Product Type:

- Cartilage Allografts

- Tendon Allografts (ACL, Achilles, Patellar)

- Ligament Allografts

- Dermal Allografts (Acellular Dermal Matrix)

- Fascia Allografts

- Meniscus Allografts

- Other Connective Tissue Matrices

- By Application:

- Orthopedic & Trauma Surgery (Sports Medicine)

- Dental Surgery (Periodontics, Implantology)

- Wound and Burn Management

- Neurosurgery

- Plastic and Reconstructive Surgery

- By End-User:

- Hospitals

- Ambulatory Surgical Centers (ASCs)

- Specialty Clinics (Orthopedic and Dental)

Value Chain Analysis For Soft Tissue Allografts Market

The value chain for the Soft Tissue Allografts Market is highly specialized and requires stringent regulatory oversight at every stage, commencing with upstream activities focused on donor selection and tissue procurement. Upstream analysis involves establishing robust relationships with organ procurement organizations (OPOs) and tissue recovery agencies to ensure a consistent supply of high-quality donor tissue. Critical activities at this stage include comprehensive donor screening (medical history, infectious disease testing) and aseptic tissue recovery, which are fundamental to product safety and regulatory compliance. The effectiveness of the upstream process dictates the quality and volume of raw material entering the processing pipeline, making ethical procurement and rigorous screening the primary value-add components early in the chain, minimizing costly reprocessing or rejection downstream.

Midstream activities involve sophisticated processing and manufacturing by specialized tissue banks or commercial processors. This stage is crucial for enhancing the functional properties of the allograft, minimizing immunogenicity, and ensuring sterility. Key processes include cleaning, decellularization, sterilization (e.g., electron beam or gamma irradiation), and cryopreservation or freeze-drying. Technology used in this segment, such as advanced decellularization techniques, significantly determines the final product's quality, integration potential, and shelf life. Strict quality management systems (QMS) and adherence to guidelines set by bodies like the FDA or EATB are non-negotiable, adding substantial value through verified safety and efficacy. High operational efficiency and technological leadership in processing are competitive differentiators in the midstream segment.

Downstream analysis focuses on distribution channels and end-user engagement, encompassing direct and indirect distribution strategies. Due to the biological and often time-sensitive nature of allografts, maintaining a robust cold chain logistics network is paramount for product integrity, especially for cryopreserved tissues. Direct distribution models are often utilized by large multinational firms to maintain strict control over inventory and customer relationships, particularly with major hospital groups and trauma centers. Indirect distribution, leveraging specialized medical distributors or regional agents, is essential for penetrating geographically diverse or niche markets, such as standalone dental clinics or smaller ASCs. Successful downstream strategy requires effective sales training for complex surgical products and strong collaborations with surgeons (the end-user decision-makers) to ensure correct product usage and feedback, maximizing clinical value and market penetration.

Soft Tissue Allografts Market Potential Customers

The primary end-users and potential customers for soft tissue allografts are institutions and professionals specializing in reconstructive, regenerative, and orthopedic procedures requiring the replacement or augmentation of damaged biological structures. The largest customer base resides within the hospital sector, particularly large academic medical centers and Level I trauma centers, which handle high volumes of complex cases, including multi-ligament knee reconstructions and extensive burn treatments, often requiring immediate availability of diverse allograft types. These institutions prioritize reliable supply chains, comprehensive product portfolios, and regulatory compliance from their tissue suppliers to manage critical patient care efficiently and safely, representing the backbone of current allograft consumption.

Ambulatory Surgical Centers (ASCs) represent the fastest-growing customer segment, particularly for planned orthopedic surgeries, such as common ACL repairs, rotator cuff reconstructions, and elective dental procedures. ASCs are increasingly favored for cost-effectiveness and faster patient turnaround compared to inpatient hospital settings. This segment demands products optimized for minimally invasive techniques, packaged for immediate use, and supported by just-in-time inventory management. The rising number of outpatient procedures, driven by healthcare cost containment initiatives and improvements in surgical techniques, solidifies ASCs as critical high-volume purchasers expected to drive significant market growth, particularly for pre-shaped and standardized tendon and meniscus grafts, reflecting a shift toward efficiency in surgical care delivery.

Beyond traditional orthopedic and hospital settings, specialized clinics focusing on dentistry (periodontists and oral surgeons) and wound care represent key niche customers with expanding needs. Dental clinics require dermal and connective tissue matrices for soft tissue grafting procedures related to periodontitis and pre-implant site preparation. Similarly, dedicated wound care centers utilize large-format dermal allografts for chronic non-healing ulcers and complex skin defects. These specialty customers require highly focused product training and evidence of long-term integration success, valuing specialized grafts that offer consistent biological performance. Targeting these diverse end-users requires manufacturers to maintain varied product lines and tailored educational content specific to each clinical application and required expertise level.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 5.8 Billion |

| Market Forecast in 2033 | USD 10.4 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Arthrex, Inc., Zimmer Biomet, Stryker Corporation, Becton, Dickinson and Company (BD), MTF Biologics, AlloSource, RTI Surgical, Inc., Integra Lifesciences, LifeNet Health, Orthofix Medical Inc., Aziyo Biologics, CryoLife, Inc., Xtant Medical, CONMED Corporation, Lattice Biologics Ltd., NuVasive, Inc., Ossur, Musculoskeletal Transplant Foundation, SurGenTec, and Covalon Technologies Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Soft Tissue Allografts Market Key Technology Landscape

The technological landscape of the Soft Tissue Allografts Market is dominated by advanced tissue processing and preservation techniques designed to maximize graft safety, mechanical integrity, and biological viability while minimizing immunogenicity. Decellularization technology represents a cornerstone, involving sophisticated methods to remove cellular components from donor tissue, thereby eliminating the major source of immune response without compromising the structural extracellular matrix (ECM) integrity. Various chemical, enzymatic, and physical methods are employed for decellularization, and the ongoing innovation focuses on achieving more complete cell removal while retaining crucial growth factors and native collagen structure. This technological refinement directly influences clinical outcomes, as a less immunogenic and structurally sound graft integrates more rapidly and effectively into the recipient's body, reducing the risk of rejection and failure.

Sterilization and preservation technologies are equally critical, ensuring the allografts are safe for implantation and possess extended shelf lives, facilitating global distribution and inventory management. Terminal sterilization methods, such as low-dose gamma irradiation or electron beam processing, are utilized to achieve sterility assurance levels (SALs) without critically damaging the biomechanical properties of the tissue. Furthermore, innovations in preservation, including advanced cryopreservation protocols using specialized cryoprotectants and controlled-rate freezers, allow for the long-term banking of viable, cellularized allografts like meniscus tissue. For acellular grafts, freeze-drying (lyophilization) is widely used, offering ambient temperature storage and simplifying logistics. The continuous pursuit of sterilization methods that maintain maximum tissue integrity post-processing is a major area of R&D investment, crucial for overcoming current limitations related to mechanical weakening induced by high-level irradiation.

The integration of biotechnology elements, such as growth factor loading and surface modification, marks the frontier of innovation in the technology landscape. Bio-enhanced allografts are being developed by incorporating exogenous growth factors (e.g., BMPs, VEGF) or scaffolding materials that promote cellular ingrowth and vascularization upon implantation, accelerating the host tissue remodeling process. Tissue banking companies are increasingly adopting automation and robotic systems for processing and packaging, which not only increase throughput but also significantly reduce the risk of human contamination and variability, ensuring standardized product quality. These technological advancements, from highly controlled processing environments to the creation of hybrid scaffolds incorporating synthetic polymers and biological matrices, are essential for driving clinical adoption across more complex surgical indications, setting the standard for next-generation regenerative medicine products that offer superior integration and patient outcomes.

Regional Highlights

- North America (Dominance and Innovation Hub): North America holds the largest market share, driven by a high prevalence of sports-related injuries, particularly in the U.S., sophisticated healthcare infrastructure, and favorable reimbursement scenarios for expensive reconstructive procedures. The region is a key hub for technological innovation, with numerous major tissue banks and medical device companies constantly introducing advanced, bio-enhanced allografts and implementing rigorous quality standards, such as those mandated by the FDA, ensuring high product safety and surgeon confidence.

- Europe (Stringent Regulation and Steady Growth): The European market maintains steady and substantial growth, primarily influenced by an aging population necessitating joint and soft tissue reconstruction. Growth is supported by highly regulated environments under directives like the European Tissue and Cells Directive (EUTCD), which ensures quality control. Major markets like Germany, the UK, and France show strong demand, particularly for high-quality orthopedic and dental allografts, with a growing focus on standardized, certified products sourced from established European tissue banks.

- Asia Pacific (APAC) (Fastest Growth Trajectory): APAC is projected to register the highest Compound Annual Growth Rate (CAGR). This exponential growth is fueled by rapidly improving healthcare expenditure, increasing awareness of advanced surgical treatments, and expanding medical infrastructure in populous countries such as China, India, and Japan. Economic development and rising rates of medical tourism also contribute significantly, as regional healthcare providers increasingly adopt Western standards and advanced allograft products to meet the rising demand for sophisticated orthopedic and aesthetic procedures.

- Latin America (Emerging Adoption and Market Potential): Latin America represents an emerging market characterized by increasing healthcare investments and a growing number of specialized surgical centers. Market adoption is gradual, often constrained by economic factors and less formalized regulatory frameworks compared to North America or Europe. However, demand for trauma and orthopedic allografts is steadily rising, presenting opportunities for international vendors focusing on establishing robust distribution networks and localized clinical education programs.

- Middle East and Africa (MEA) (Niche Growth driven by High-End Care): The MEA region exhibits growth concentrated in affluent countries (UAE, Saudi Arabia) where high-quality medical services and medical tourism are prioritized. Investment in large private hospitals facilitates the adoption of advanced soft tissue allografts for reconstructive and aesthetic purposes. The remaining parts of the region show nascent growth, driven primarily by humanitarian aid and targeted government healthcare initiatives focused on improving basic surgical care access and utilizing cost-effective standardized allograft solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Soft Tissue Allografts Market.- Arthrex, Inc.

- Zimmer Biomet

- Stryker Corporation

- Becton, Dickinson and Company (BD)

- MTF Biologics (Musculoskeletal Transplant Foundation)

- AlloSource

- RTI Surgical, Inc.

- Integra Lifesciences

- LifeNet Health

- Orthofix Medical Inc.

- Aziyo Biologics

- CryoLife, Inc.

- Xtant Medical

- CONMED Corporation

- Lattice Biologics Ltd.

- NuVasive, Inc.

- Ossur

- SurGenTec

- Covalon Technologies Ltd.

- MiMedx Group, Inc.

Frequently Asked Questions

Analyze common user questions about the Soft Tissue Allografts market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the growth of the Soft Tissue Allografts Market?

Market growth is primarily driven by the rising global incidence of sports-related injuries, an aging population prone to degenerative tissue disorders, the avoidance of donor-site morbidity inherent in autografts, and continuous technological advancements in tissue processing that enhance graft safety and viability, particularly in the orthopedic and dental sectors.

How does the use of allografts differ from autografts in surgical reconstruction?

Allografts (donor tissue) are ready-to-use biological matrices that eliminate the need for a second surgical site for tissue harvesting, significantly reducing patient pain, surgical time, and recovery complexity associated with autografts (patient's own tissue). While autografts are considered the gold standard for full biological integration, allografts offer superior quantity availability and reduced morbidity, especially in multi-ligament or revision surgeries.

Which application segment holds the largest share in the Soft Tissue Allografts Market?

The Orthopedic & Trauma Surgery segment holds the largest market share, predominantly driven by high-volume procedures such as Anterior Cruciate Ligament (ACL) reconstruction, rotator cuff repair, and complex tendon repairs, where high-quality tendon and ligament allografts are essential components for restoring joint stability and function.

What major regulatory hurdles impact the commercialization of soft tissue allografts?

The commercialization process is heavily impacted by stringent and geographically varied regulatory requirements concerning donor screening, infectious disease testing, tissue processing validation, and sterilization methods. Compliance with bodies like the FDA (U.S.) and EATB/EUTCD (Europe) requires significant investment in quality management systems and extensive documentation to ensure product safety and traceability.

What key innovations are expected to shape the future of the allografts market?

Future growth will be shaped by the development of bio-enhanced grafts incorporating growth factors or stem cell components to accelerate biological integration, the adoption of advanced decellularization techniques to minimize immune rejection, and the integration of Artificial Intelligence (AI) in tissue quality assessment and optimal donor matching for personalized surgical outcomes.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager