Soft Touch Laminating Films Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431792 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Soft Touch Laminating Films Market Size

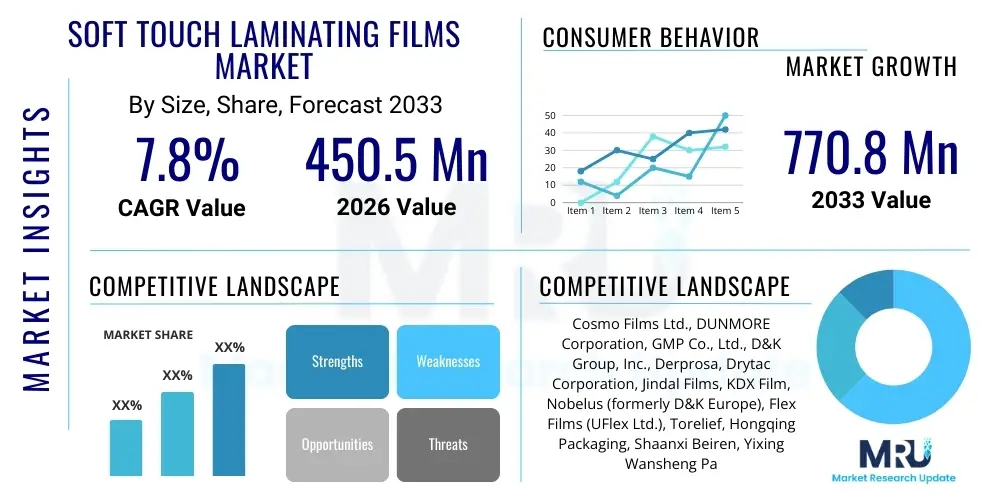

The Soft Touch Laminating Films Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 450.5 million in 2026 and is projected to reach USD 770.8 million by the end of the forecast period in 2033. This substantial growth is fundamentally driven by the increasing demand for premium, visually appealing, and haptically distinct packaging and graphic arts applications across various end-use industries, particularly luxury goods, high-end printing, and specialty packaging sectors. The aesthetic superiority and enhanced durability offered by soft touch films are key differentiators fostering rapid adoption.

The market expansion is further supported by technological advancements in film manufacturing, leading to improved adhesion characteristics, scratch resistance, and environmental sustainability. Manufacturers are increasingly utilizing bio-based and recyclable materials to meet growing consumer preference and regulatory pressures for eco-friendly products, which is opening up new avenues for market penetration. Geographically, Asia Pacific is anticipated to be the fastest-growing region, fueled by expanding print and packaging industries in emerging economies such as China and India, coupled with rising disposable incomes driving demand for luxury consumer goods that utilize these premium finishes.

Soft Touch Laminating Films Market introduction

The Soft Touch Laminating Films Market encompasses specialized polymer films designed to provide a distinctive velvety, suede-like texture when applied to printed materials or packaging surfaces. These films not only enhance the aesthetic and tactile appeal of the substrate but also offer superior protection against moisture, abrasion, fingerprints, and general wear and tear, thereby extending the product lifecycle. Soft touch films are typically manufactured from materials like Polypropylene (PP), Polyethylene Terephthalate (PET), and Nylon, coated with advanced lacquers to achieve the characteristic luxurious feel, making them a preferred choice for high-end graphic arts, rigid boxes, book covers, and luxury brand packaging.

Major applications of these films span the commercial printing industry, including brochures, business cards, corporate presentations, and premium menus, as well as the packaging sector, particularly for cosmetics, electronics, and liquor boxes where product differentiation through sensory experience is crucial. Key benefits include excellent clarity, non-yellowing properties, enhanced scratch resistance compared to standard matte laminations, and the ability to significantly boost the perceived quality and value of the finished product. The driving factors behind market growth are the pervasive trend toward premiumization across consumer goods, the rising emphasis on shelf appeal to influence purchasing decisions, and the continuous innovation in printing technologies demanding sophisticated lamination solutions.

Soft Touch Laminating Films Market Executive Summary

The Soft Touch Laminating Films Market demonstrates strong growth momentum, primarily influenced by shifting business trends towards experiential marketing and premium brand positioning. Companies across sectors, from personal care to sophisticated electronics, are prioritizing haptic differentiation, recognizing that the tactile sensation imparted by soft touch films directly impacts brand perception and consumer engagement. Segment trends highlight that thermal lamination films dominate due to ease of application and efficiency in high-volume production, while films based on PET and BOPP materials maintain significant market shares due to their structural integrity and cost-effectiveness. Furthermore, the increasing adoption of digital printing technologies necessitates compatible lamination solutions, boosting the demand for soft touch films specifically formulated for optimal adhesion on digitally printed substrates.

Regionally, Asia Pacific is emerging as the engine of future growth, spurred by rapid urbanization, proliferation of luxury consumer markets, and the relocation or expansion of global printing and packaging hubs into countries within the region. North America and Europe, while mature, maintain high demand due to established high-end consumer packaged goods (CPG) markets and stringent quality expectations for printed media. Strategic alliances among film manufacturers and large-scale printing converters are prevalent, focusing on supply chain optimization and the introduction of specialty films, such as anti-microbial or high-slip variants, to capture niche market requirements. Environmental responsibility also forms a crucial element of the current landscape, pushing companies toward developing biodegradable and recyclable soft touch formulations to achieve sustainable differentiation.

AI Impact Analysis on Soft Touch Laminating Films Market

Common user questions regarding AI's influence often center on optimizing the manufacturing process, improving quality control, and forecasting demand volatility within the laminating films sector. Users frequently ask if AI can reduce material waste, predict equipment failures, or tailor film properties (like texture consistency and adhesion strength) based on real-time data input from printing presses. The core themes revolve around efficiency gains, predictive maintenance, and the role of intelligent automation in complex film coating and slitting operations. Users expect AI to stabilize production costs and enhance customization capabilities, especially for highly specific premium applications where color matching and tactile uniformity are paramount for brand integrity. This focus underscores the industry's need for smart integration to handle the specialized requirements of soft touch finishes.

AI is beginning to integrate into the film production workflow primarily through advanced machine vision systems and predictive analytics. Machine learning algorithms analyze vast datasets related to material composition, extruder temperature, coating thickness, and curing times to ensure flawless film consistency, which is critical for achieving the uniform, velvety finish characteristic of soft touch products. Furthermore, AI-powered supply chain management systems are enhancing responsiveness to fluctuating demands in the specialty printing market, enabling manufacturers to optimize inventory levels of raw materials like BOPP resins and specialty lacquers, thereby reducing lead times and minimizing the risk of overstocking or stockouts of specialized soft touch variants. These applications promise a significant leap in operational efficiency and product quality assurance, mitigating common issues such as surface blemishes or inconsistent tactile response.

- AI-driven predictive maintenance optimizes coating and slitting machinery, reducing unexpected downtime and ensuring consistent film quality.

- Machine learning algorithms enhance quality control by identifying microscopic defects and texture inconsistencies in real-time, critical for premium finishes.

- Demand forecasting models, powered by AI, allow manufacturers to align production schedules precisely with fluctuating seasonal trends in luxury packaging.

- AI can optimize raw material blending and extrusion processes, minimizing waste of specialized polymers and high-cost soft touch lacquers.

- Smart automation facilitates customization of film roll sizes and surface treatments, catering efficiently to specific client printing requirements.

DRO & Impact Forces Of Soft Touch Laminating Films Market

The dynamics of the Soft Touch Laminating Films Market are shaped by a complex interplay of drivers, restraints, and opportunities. The primary driver is the pervasive trend of 'premiumization' in consumer goods, where brands seek superior aesthetics and sensory engagement to differentiate products in crowded markets. This is coupled with the expansion of the digital printing market, which requires high-quality, specialty films compatible with various toners and inks. Conversely, the market faces restraints such as the relatively higher cost of soft touch films compared to standard laminations, which limits their adoption in cost-sensitive, large-volume applications. Furthermore, volatility in the prices of raw materials, particularly polymer resins and specialized coating chemicals, poses continuous pricing pressure on manufacturers. The impact forces indicate strong leverage from consumer preferences and brand marketing strategies, while economic stability and regulatory landscapes pertaining to packaging sustainability also exert considerable influence on market trajectory.

Significant opportunities lie in the development and commercialization of bio-degradable or compostable soft touch films, aligning with global shifts toward sustainable packaging solutions, potentially unlocking access to highly regulated markets like the European Union. Furthermore, technological innovations in scratch-resistant soft touch coatings and anti-fingerprint properties present strong growth avenues, enhancing the functionality beyond mere aesthetics. Key impact forces include the increasing sophistication of retail packaging design, which demands tactile elements for shelf differentiation, and the stringent quality requirements of luxury sectors. The long-term market sustainability hinges on manufacturers' ability to continuously innovate film chemistries to reduce cost barriers while maintaining the premium haptic experience and addressing environmental concerns effectively.

Segmentation Analysis

The Soft Touch Laminating Films Market is comprehensively segmented based on material type, lamination process, and end-use application, providing detailed insights into consumption patterns and market potential. Material segmentation, which includes BOPP, PET, and Nylon, reflects the primary composition base influencing film durability and cost structure. The lamination process division separates the market into thermal and wet lamination, each catering to different operational scales and substrate types. The largest segments by application include luxury packaging, commercial printing, and labels, illustrating the film's crucial role in high-value printed media and retail presentation. This granular segmentation aids stakeholders in targeting specific industry needs, whether optimizing for high-speed thermal lamination in the book publishing sector or specialized wet lamination techniques in custom rigid box manufacturing for high-end cosmetics.

Biaxially Oriented Polypropylene (BOPP) films currently dominate the market due to their cost-effectiveness, excellent clarity, and adaptability to high-speed lamination, making them the default choice for general commercial printing and standard packaging. However, Polyethylene Terephthalate (PET) films are gaining traction, especially in applications requiring superior heat resistance, dimensional stability, and enhanced durability, such as electronic manuals and high-quality rigid boxes. Thermal lamination is the preferred process worldwide, favored for its convenience, clean application (eliminating adhesives), and reduced setup time, driving its dominance across mid-to-large-scale converters. Conversely, wet lamination remains essential for specialized, thicker substrates or materials sensitive to heat, particularly within niche graphic arts segments. The luxury packaging segment remains the highest value consumer, leveraging soft touch finishes to signify premium quality and generate a tactile connection with discerning consumers.

- Material Type:

- BOPP (Biaxially Oriented Polypropylene)

- PET (Polyethylene Terephthalate)

- Nylon

- Others (PVC, Polyethylene)

- Lamination Process:

- Thermal Lamination (Hot Lamination)

- Wet Lamination (Cold Lamination)

- Application:

- Luxury Packaging (Cosmetics, Liquor, Electronics)

- Commercial Printing (Brochures, Magazines, Business Cards)

- Book Covers and Publications

- Labels and Tags

- Other Graphic Arts

- End-Use Industry:

- Food and Beverage

- Cosmetics and Personal Care

- Electronics

- Publishing and Media

- Pharmaceuticals

Value Chain Analysis For Soft Touch Laminating Films Market

The value chain for soft touch laminating films initiates with upstream activities involving the sourcing of raw materials, primarily polymer resins (PP, PET) and specialized chemical components necessary for the soft-touch coating (lacquers, matte agents, and adhesives). Key resin manufacturers supply these materials to film producers who execute the complex processes of extrusion, orientation, coating application, and curing to create the finished film rolls. Midstream activities involve film converting, where jumbo rolls are slit into desired widths and lengths, often incorporating corona treatment to prepare the surface for enhanced adhesion, ensuring the consistency of the tactile finish. This stage is critical for maintaining quality standards and minimizing defects before distribution.

Downstream analysis focuses on the distribution channels, which are typically segmented into direct sales to large-scale printing and packaging companies, and indirect distribution through specialized regional distributors or packaging wholesalers who serve smaller converters and commercial printers. These converters apply the film using either thermal or wet lamination equipment onto substrates, producing the final consumer products, such as rigid boxes, book jackets, or high-end brochures. The final stage involves the end-use industries—luxury brands, publishers, and food manufacturers—who purchase the finished laminated goods. Direct sales channels are preferred for high-volume, established relationships, offering better technical support, while indirect channels provide wider market reach and necessary regional warehousing capabilities.

Soft Touch Laminating Films Market Potential Customers

Potential customers for soft touch laminating films primarily constitute entities within the high-end printing, luxury goods, and specialized packaging sectors that prioritize brand image, tactile quality, and product protection. The largest consumer base includes commercial printing houses and packaging converters specializing in producing folding cartons, rigid boxes, and premium collateral for global brands. These end-users demand films with high scratch resistance and flawless surface uniformity to ensure their clients' premium image is perfectly conveyed. The cosmetics and personal care industry represents a highly lucrative segment, leveraging the luxurious feel of the films to justify higher price points and enhance perceived product value on the shelf.

Furthermore, major publishers utilize soft touch films extensively for specialized book covers, annual reports, and high-quality educational materials where durability and aesthetic appeal are prerequisites for market acceptance. Electronics manufacturers and luxury beverage companies (e.g., wine and spirits) also constitute significant buyers, applying the films to protect and premiumize product manuals, warranty cards, and outer packaging. These customers are driven not only by aesthetics but increasingly by functional requirements, seeking films that offer specific characteristics such as anti-microbial surfaces or enhanced resistance to harsh handling environments, further solidifying the film’s necessity in the upscale consumer market.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450.5 million |

| Market Forecast in 2033 | USD 770.8 million |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Cosmo Films Ltd., DUNMORE Corporation, GMP Co., Ltd., D&K Group, Inc., Derprosa, Drytac Corporation, Jindal Films, KDX Film, Nobelus (formerly D&K Europe), Flex Films (UFlex Ltd.), Torelief, Hongqing Packaging, Shaanxi Beiren, Yixing Wansheng Packaging Materials Co., Ltd., Suzhou Jinfeng Coating Film Co., Ltd., Skandor, Transilwrap Company, Inc., Mondi plc, Taghleef Industries (Ti), GBC (General Binding Corporation). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Soft Touch Laminating Films Market Key Technology Landscape

The core technology underpinning the Soft Touch Laminating Films Market involves sophisticated film extrusion and co-extrusion processes combined with specialized chemical coating formulations. Biaxially Oriented Polypropylene (BOPP) films are produced using a sequential or simultaneous stretching process to enhance mechanical strength and barrier properties. The defining technological element is the application of proprietary soft touch lacquers, often polyurethane-based or silicone-modified coatings, which are applied inline or offline via high-precision gravure or reverse gravure coating methods. Advances in coating chemistry focus heavily on achieving a consistent, low-gloss matte finish that mimics the velvety feel while simultaneously embedding functional characteristics such as anti-scratch agents and fingerprint resistance to ensure longevity and maintain aesthetics under frequent handling.

Current technological innovations are concentrated on enhancing sustainability and operational efficiency. The development of high-speed thermal lamination films with low-temperature activation adhesives is a critical trend, allowing converters to process materials faster while reducing energy consumption and minimizing the risk of heat damage to sensitive substrates like digitally printed materials. Furthermore, the industry is seeing increasing investment in solvent-free and water-based coating technologies for the soft touch layer, directly addressing regulatory pressures regarding VOC emissions and worker safety, particularly in European and North American markets. These advancements require significant capital investment in highly regulated cleanroom environments and precision coating machinery to ensure the uniform application necessary for the high-quality soft touch effect.

Regional Highlights

- Asia Pacific (APAC): The APAC region is poised to exhibit the highest growth rate during the forecast period, primarily driven by rapid industrialization, massive growth in the printing and packaging sectors, and burgeoning middle-class populations in China, India, and Southeast Asian nations. The region is characterized by significant manufacturing capacity, attracting global investments in lamination film production. Demand is particularly robust in the luxury packaging segment for cosmetics and high-end electronics, where brands extensively utilize soft touch finishes to signify premium status. Government initiatives promoting sustainable packaging are also pushing regional film manufacturers towards developing eco-friendly soft touch alternatives, albeit at a slightly slower pace than in Western economies, focusing mainly on cost-effective BOPP solutions.

- North America: North America represents a mature yet highly quality-conscious market, dominated by the demand for high-performance soft touch films with excellent durability and scratch resistance. The market here is characterized by early adoption of technological advancements, particularly in digital printing compatibility and specialized coating solutions. Key demand drivers include the large presence of global publishing houses, high-end commercial printers, and a sophisticated consumer goods industry demanding premium presentation for retail products. Environmental compliance is strict, fueling strong demand for recyclable PET-based soft touch films and certified sustainable lamination options. Price sensitivity is lower compared to APAC, allowing for widespread adoption of higher-cost, specialized products.

- Europe: Europe is a vital market, especially due to stringent environmental regulations and a strong emphasis on design and brand identity, particularly in countries like Germany, France, and Italy, which house major luxury fashion and cosmetic headquarters. European converters prioritize films that offer verifiable sustainability credentials, such as FSC-certified substrates and solvent-free coatings, alongside the desirable soft-touch effect. The high competitive density in commercial printing and the widespread use of thermal lamination processes ensure consistent demand. The European market also shows a strong preference for Nylon-based films in specific applications requiring superior matte characteristics and heat resistance.

- Latin America (LATAM): The LATAM market is experiencing steady growth, driven by expanding local printing industries and increasing foreign investment in consumer packaged goods manufacturing, particularly in Brazil and Mexico. The adoption rate of soft touch films is accelerating as local brands seek to emulate the premium packaging standards set by multinational competitors. While cost remains a significant consideration, leading to higher consumption of budget-friendly BOPP soft touch films, urbanization and rising incomes are slowly creating pockets of demand for high-end luxury packaging that justifies the specialized film costs, offering a substantial long-term growth opportunity.

- Middle East and Africa (MEA): The MEA region, particularly the Gulf Cooperation Council (GCC) countries, is an emerging market characterized by significant luxury consumption and infrastructure development. High net worth individuals and a growing tourism sector contribute to substantial demand for premium packaging across cosmetics, jewelry, and high-end food products. The market growth is largely concentrated around urban centers and trade hubs. Challenges include logistical complexities and reliance on imported films, but increasing localized printing and converting capabilities are expected to drive market volume, focusing initially on standard soft touch thermal films suitable for rigid box manufacturing.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Soft Touch Laminating Films Market.- Cosmo Films Ltd.

- DUNMORE Corporation

- GMP Co., Ltd.

- D&K Group, Inc.

- Derprosa (Taghleef Industries)

- Drytac Corporation

- Jindal Films

- KDX Film (Suzhou KDX Composite Material Co., Ltd.)

- Nobelus (formerly D&K Europe)

- Flex Films (UFlex Ltd.)

- Torelief

- Hongqing Packaging Materials Co., Ltd.

- Shaanxi Beiren Printing Machinery Co., Ltd. (Film division)

- Yixing Wansheng Packaging Materials Co., Ltd.

- Suzhou Jinfeng Coating Film Co., Ltd.

- Skandor GmbH

- Transilwrap Company, Inc. (Coveris Advanced Coatings)

- Mondi plc

- Avery Dennison Corporation (Specialty Films Division)

- Mitsubishi Polyester Film, Inc.

Frequently Asked Questions

Analyze common user questions about the Soft Touch Laminating Films market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary advantages of soft touch laminating films over traditional matte films?

Soft touch laminating films offer superior tactile quality, providing a luxurious, velvety feel that significantly enhances perceived product value. They also typically demonstrate better scratch resistance and lower light reflectivity than conventional matte finishes, minimizing glare and fingerprint visibility for a premium aesthetic.

Which material type is most commonly used for soft touch films, and why?

Biaxially Oriented Polypropylene (BOPP) is the most commonly utilized base material due to its excellent balance of cost-effectiveness, clarity, tear resistance, and compatibility with high-speed lamination processes, making it highly suitable for large-volume commercial printing applications.

How do soft touch films address sustainability concerns in the packaging industry?

Manufacturers are increasingly developing soft touch films based on eco-friendly polymers like biodegradable BOPP or incorporating recyclable PET, and are shifting towards solvent-free or water-based coating systems to reduce VOC emissions, aligning the product with global sustainability mandates and consumer demand.

Is thermal or wet lamination preferred for applying soft touch films?

Thermal lamination is generally preferred for soft touch films as it offers faster processing speeds, cleaner application without external adhesives, and ease of use in high-volume production environments, ensuring consistent bonding, especially on substrates used in publishing and folding carton manufacturing.

In which end-use sector is the demand for soft touch laminating films currently highest?

The Luxury Packaging sector, particularly for cosmetics, premium beverages, and high-end electronics, exhibits the highest demand. These industries prioritize the haptic experience and visual distinction provided by soft touch films to reinforce brand exclusivity and command premium pricing.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Soft Touch Laminating Films Market Statistics 2025 Analysis By Application (Luxury Packaging, Paperboard Packaging), By Type (Polypropylene PP, PET, Others), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Soft Touch Laminating Films Market Statistics 2025 Analysis By Application (Luxury Packaging, Label, Graphic Advertising Banners, High End Stationery Products), By Type (BOPP Film, PET Film), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager