Software Dedicated Hardware Device Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439389 | Date : Jan, 2026 | Pages : 248 | Region : Global | Publisher : MRU

Software Dedicated Hardware Device Market Size

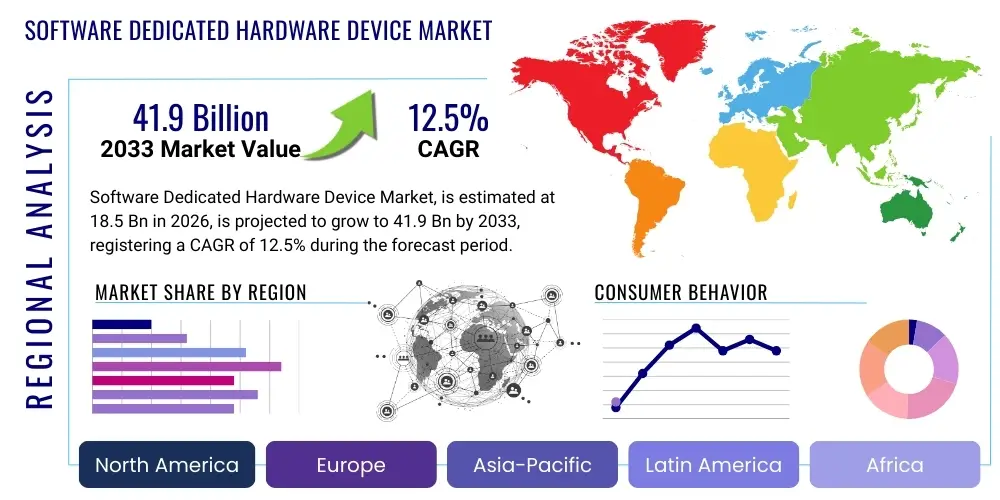

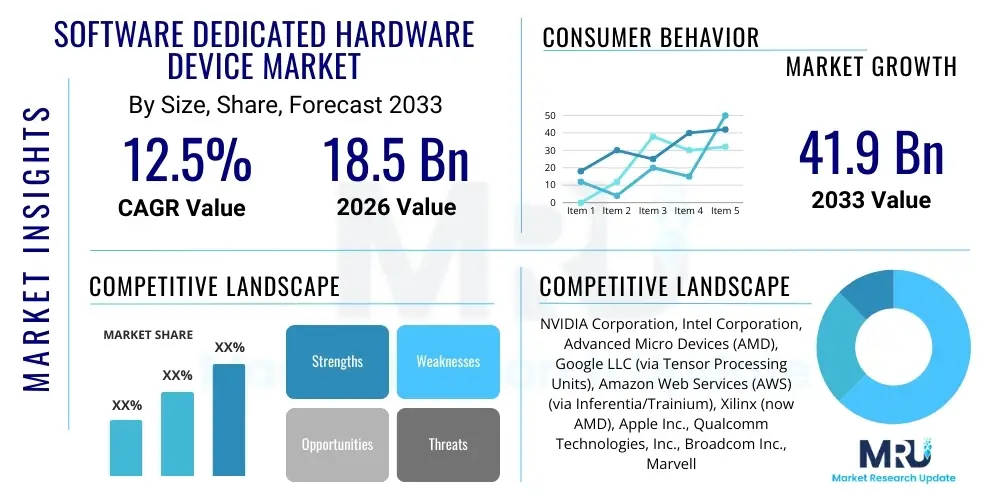

The Software Dedicated Hardware Device Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.5% between 2026 and 2033. The market is estimated at USD 18.5 Billion in 2026 and is projected to reach USD 41.9 Billion by the end of the forecast period in 2033.

Software Dedicated Hardware Device Market introduction

The Software Dedicated Hardware Device Market encompasses a rapidly evolving sector focused on specialized hardware components and systems meticulously engineered to optimize the execution and performance of specific software applications or functions. These devices are custom-built or highly optimized to deliver superior efficiency, speed, and power consumption compared to general-purpose hardware when running their intended software. This market spans a wide array of solutions, from application-specific integrated circuits (ASICs) designed for AI/ML acceleration to specialized edge computing devices and advanced network processing units (NPUs).

The core product description within this market includes a diverse range of hardware platforms, such as custom silicon, Field-Programmable Gate Arrays (FPGAs), System-on-Chips (SoCs), and highly optimized Graphics Processing Units (GPUs) or Tensor Processing Units (TPUs) that are configured explicitly for data-intensive or real-time software workloads. Major applications for these devices are found across critical industries including artificial intelligence (AI) and machine learning (ML), Internet of Things (IoT) ecosystems, high-performance computing (HPC), data centers, automotive advanced driver-assistance systems (ADAS), telecommunications infrastructure, and industrial automation.

The benefits derived from adopting software-dedicated hardware devices are substantial, primarily manifesting as significant improvements in computational efficiency, reduced latency, lower power consumption, and enhanced security for specific tasks. These advantages translate into faster data processing, real-time analytics capabilities, prolonged battery life for edge devices, and robust protection against cyber threats. The market's growth is fundamentally driven by the escalating demand for high-performance computing across various sectors, the proliferation of AI and ML applications requiring specialized acceleration, the expansion of the IoT landscape necessitating efficient edge processing, and the relentless pursuit of energy efficiency in data centers and cloud infrastructure, all of which push the boundaries of conventional hardware capabilities.

Software Dedicated Hardware Device Market Executive Summary

The Software Dedicated Hardware Device Market is experiencing robust expansion, propelled by the pervasive digitalization across industries and the escalating requirements for specialized processing power. Current business trends indicate a strong shift towards domain-specific architectures (DSAs) and purpose-built silicon, moving away from monolithic general-purpose computing. Companies are increasingly investing in custom chip development to gain competitive advantages in areas like AI inference, data analytics, and real-time processing, leading to strategic partnerships between semiconductor manufacturers and software developers. The market is also characterized by intense innovation in chip design, packaging technologies, and software-hardware co-design methodologies, driving down costs per operation and improving performance benchmarks. Furthermore, the rise of cloud-to-edge computing paradigms is fostering demand for heterogeneous computing environments where dedicated hardware devices play a pivotal role in distributed processing architectures.

From a regional perspective, North America and Asia Pacific currently dominate the market, primarily due to significant investments in advanced technologies like AI, IoT, and 5G infrastructure. North America benefits from a strong presence of leading technology giants and an established ecosystem for R&D and innovation in custom silicon. Meanwhile, the Asia Pacific region, particularly China, South Korea, and Japan, is witnessing rapid adoption driven by large-scale manufacturing capabilities, government initiatives promoting digital transformation, and a booming consumer electronics market. Europe is also a significant player, with growing focus on industrial automation and automotive applications, pushing the need for robust, low-latency dedicated hardware. Latin America, the Middle East, and Africa are emerging markets, showing considerable potential with increasing digitalization efforts and infrastructure development, particularly in telecommunications and smart city initiatives.

Segmentation trends within this market highlight the increasing dominance of Application-Specific Integrated Circuits (ASICs) and System-on-Chips (SoCs) due to their unparalleled efficiency for specific tasks, especially in AI/ML and edge computing. FPGAs continue to hold relevance for their reconfigurability and rapid prototyping capabilities, catering to niche applications requiring flexibility. The market is also seeing a surge in demand for solutions tailored for data centers, driven by the need to accelerate complex workloads such as deep learning training and inference. The automotive sector is a critical growth segment, with dedicated hardware essential for autonomous driving and in-vehicle infotainment systems. The IoT segment is vast and diverse, with specialized low-power hardware becoming indispensable for sensor fusion, local data processing, and connectivity management. Overall, the market is fragmenting into highly specialized niches, each demanding optimized hardware-software synergy.

AI Impact Analysis on Software Dedicated Hardware Device Market

The profound impact of Artificial Intelligence (AI) on the Software Dedicated Hardware Device Market is a central theme dominating user questions and market discussions. Users frequently inquire about how AI is accelerating the demand for specialized hardware, what new types of devices are emerging to support AI workloads, and the implications for power consumption, performance, and cost. There is significant interest in understanding the role of ASICs, FPGAs, and GPUs specifically optimized for AI inference and training, alongside concerns about the challenges associated with developing and integrating such complex hardware. Users are keenly observing how AI's continuous evolution, particularly in areas like generative AI and large language models (LLMs), will shape future hardware requirements, pushing the boundaries of what dedicated devices can achieve in terms of speed, efficiency, and scalability while addressing ethical implications and security vulnerabilities inherent in AI systems.

- AI drives exponential demand for high-performance, energy-efficient dedicated hardware, particularly for inference at the edge and complex model training in data centers.

- The emergence of custom AI accelerators (e.g., Google TPUs, NVIDIA's specialized Tensor Cores) highlights the necessity of purpose-built silicon for optimal AI workload execution.

- AI necessitates hardware capable of managing massive datasets, parallel processing, and low-latency computations, leading to innovations in memory architecture and interconnects.

- Increased complexity of AI models, including generative AI and LLMs, demands adaptable and scalable dedicated hardware solutions with enhanced processing capabilities and memory bandwidth.

- AI integration pushes the boundaries for hardware-software co-design, optimizing entire stacks for specific AI frameworks and algorithms, ensuring maximum efficiency and performance.

- Focus on edge AI processing for real-time decision-making, reducing reliance on cloud connectivity and addressing privacy and security concerns by keeping data local.

- The need for robust security features in dedicated hardware to protect AI models and data from adversarial attacks and ensure ethical AI deployment.

DRO & Impact Forces Of Software Dedicated Hardware Device Market

The Software Dedicated Hardware Device Market is significantly influenced by a dynamic interplay of drivers, restraints, and opportunities that collectively shape its growth trajectory and competitive landscape. A primary driver is the accelerating pace of digital transformation across industries, compelling enterprises to seek specialized computing solutions for tasks ranging from real-time analytics to complex AI model execution. The pervasive adoption of Artificial Intelligence and Machine Learning applications, particularly at the edge and within data centers, creates an insatiable demand for hardware capable of high-performance, energy-efficient processing. Furthermore, the relentless growth of the Internet of Things (IoT) ecosystem necessitates dedicated, low-power hardware for sensor data processing and localized intelligence, while the expansion of 5G networks fuels requirements for specialized network processing units that can handle massive data throughput with minimal latency. These factors, combined with increasing focus on energy efficiency and sustainability in computing, collectively act as powerful growth engines for the market.

Despite these strong tailwinds, the market faces several notable restraints. The inherently high initial research and development costs associated with designing and manufacturing custom silicon or highly optimized hardware can be prohibitive for smaller players and may lead to longer product development cycles. The rapid pace of technological obsolescence is another significant challenge, as dedicated hardware designed for current software versions may quickly become outdated with new algorithmic advancements or architectural shifts, requiring frequent upgrades and significant capital expenditure. Moreover, complex global supply chains and geopolitical uncertainties can introduce volatility in component availability and pricing, impacting production timelines and market stability. The steep learning curve and specialized expertise required for hardware-software co-design also act as a barrier to entry for many organizations, limiting broader adoption.

Nevertheless, numerous opportunities abound for innovation and market expansion. The continuous evolution of AI, especially in areas like generative AI and personalized intelligence, presents a fertile ground for developing next-generation dedicated accelerators. The expansion of edge computing across diverse industries, from smart factories to autonomous vehicles, opens up new avenues for purpose-built, rugged, and low-power hardware devices. Custom silicon designed for specific industry verticals, such as healthcare, finance, or aerospace, can offer unparalleled performance advantages and create niche markets. Furthermore, advancements in chip manufacturing technologies, such as advanced packaging and heterogeneous integration, promise to reduce costs and increase performance, making dedicated hardware more accessible. The growing emphasis on data privacy and security also creates opportunities for hardware-level security features and trusted execution environments within dedicated devices, differentiating offerings and adding significant value. These opportunities, coupled with ongoing digital transformation efforts, position the market for substantial long-term growth.

Segmentation Analysis

The Software Dedicated Hardware Device Market is comprehensively segmented to provide a detailed understanding of its diverse components and application areas. This segmentation allows for precise market analysis, identifying key growth drivers, challenges, and opportunities across various product types, technological approaches, end-use applications, and geographical regions. Understanding these distinct segments is crucial for stakeholders to develop targeted strategies, optimize product development, and capture specific market shares within this dynamic and specialized hardware landscape.

- By Type

- Application-Specific Integrated Circuits (ASICs)

- Field-Programmable Gate Arrays (FPGAs)

- System-on-Chips (SoCs)

- Graphics Processing Units (GPUs - specialized for compute)

- Central Processing Units (CPUs - with specialized extensions)

- Network Processing Units (NPUs)

- Digital Signal Processors (DSPs)

- By Technology

- Artificial Intelligence (AI) Accelerators

- Edge Computing Hardware

- High-Performance Computing (HPC) Hardware

- Quantum Computing Hardware (Emerging)

- Neuromorphic Computing Hardware

- Secure Enclave Processors

- By Application

- Artificial Intelligence & Machine Learning

- Training

- Inference

- Generative AI

- Edge Computing & IoT

- Smart Cities

- Industrial IoT

- Consumer IoT

- Connected Vehicles

- Data Centers & Cloud Computing

- Hyperscale Data Centers

- Enterprise Data Centers

- Automotive

- ADAS (Advanced Driver-Assistance Systems)

- Autonomous Driving

- Infotainment Systems

- Telecommunications

- 5G Infrastructure

- Network Function Virtualization (NFV)

- Software-Defined Networking (SDN)

- Industrial Automation

- Robotics

- Process Control

- Predictive Maintenance

- Healthcare

- Medical Imaging

- Diagnostics

- Personalized Medicine

- Aerospace & Defense

- Consumer Electronics

- Artificial Intelligence & Machine Learning

- By End-User

- Enterprises (Small, Medium, Large)

- Cloud Service Providers

- Government & Public Sector

- Research & Academia

- Telecommunication Service Providers

- Automotive Manufacturers

- Industrial Manufacturers

- By Region

- North America

- Europe

- Asia Pacific (APAC)

- Latin America

- Middle East & Africa (MEA)

Value Chain Analysis For Software Dedicated Hardware Device Market

The value chain for the Software Dedicated Hardware Device Market is intricate and multi-layered, beginning with upstream activities focused on foundational technologies and extending through various stages of design, manufacturing, and distribution to reach the end-user. The upstream segment primarily involves intellectual property (IP) providers, semiconductor material suppliers (e.g., silicon wafers, rare earth metals), and design tool vendors (EDA software). These players provide the critical raw materials and sophisticated software environments necessary for designing highly complex dedicated hardware, including core CPU/GPU IP, specialized accelerators, and memory technologies. Innovations at this stage, such as novel transistor architectures or advanced packaging techniques, significantly influence the performance and cost-effectiveness of the final product. Research and development institutions, universities, and dedicated R&D labs also play a crucial upstream role in pioneering new concepts and fundamental technologies that will eventually find their way into commercial products.

Moving further along the chain, the core manufacturing and assembly stages are critical. This involves semiconductor foundries (fabs) that fabricate the chips based on designs provided by fabless semiconductor companies. These foundries require immense capital investment and highly specialized expertise to produce integrated circuits with billions of transistors. Following fabrication, packaging and testing companies assemble the chips into final components, ensuring their reliability and performance. This midstream segment also includes original device manufacturers (ODMs) and original equipment manufacturers (OEMs) who integrate these dedicated hardware devices into larger systems, such as servers, edge appliances, automotive control units, or industrial robots. Software developers and firmware engineers are also integrated at this stage, working closely with hardware designers to ensure optimal software-hardware synergy and compatibility, leveraging the dedicated capabilities of the hardware effectively.

The downstream analysis focuses on the distribution channels and end-user engagement. Dedicated hardware devices are distributed through a mix of direct and indirect channels. Direct channels involve semiconductor companies selling directly to large enterprise customers, hyperscale cloud providers, or major automotive manufacturers who have the technical capabilities to integrate these components into their systems. This approach allows for closer collaboration, customization, and technical support. Indirect channels, on the other hand, include a network of distributors, value-added resellers (VARs), system integrators (SIs), and online marketplaces. These intermediaries provide broader market reach, logistics support, and often offer bundled solutions that include software, services, and integration support to a wider range of smaller and medium-sized enterprises. Post-sales support, maintenance, and ongoing software updates are also critical aspects of the downstream value chain, ensuring the long-term functionality and customer satisfaction with these specialized hardware solutions, further demonstrating the complex interplay between hardware providers, software developers, and diverse distribution networks in reaching the ultimate end-users.

Software Dedicated Hardware Device Market Potential Customers

The Software Dedicated Hardware Device Market caters to a broad spectrum of potential customers, essentially encompassing any industry or organization that requires specialized, high-performance, or energy-efficient computing for specific software workloads. At the forefront are large enterprises and hyperscale cloud service providers who manage vast data centers and operate complex AI/ML models, demanding custom accelerators to optimize computational efficiency and reduce operational costs associated with power consumption. These customers include technology giants, financial institutions running high-frequency trading algorithms, and research organizations conducting advanced scientific simulations, all seeking to gain a competitive edge through superior processing capabilities. The continuous expansion of data storage and processing needs in cloud environments further solidifies these entities as prime buyers, often collaborating directly with semiconductor manufacturers for custom designs.

Another significant segment of potential customers includes manufacturers in the automotive industry, particularly those developing Advanced Driver-Assistance Systems (ADAS) and fully autonomous vehicles. These applications require real-time processing of massive sensor data with extreme reliability and low latency, making software-dedicated hardware indispensable for safety-critical functions. Similarly, industrial automation companies and robotics manufacturers are key buyers, integrating specialized processors into their systems for precise control, predictive maintenance, and real-time operational analytics in smart factories and connected industrial environments. Telecommunications companies, especially those deploying 5G infrastructure, also represent a crucial customer base, relying on network processing units (NPUs) and other dedicated hardware to manage high bandwidth, low-latency communication, and network function virtualization.

Furthermore, the widespread proliferation of the Internet of Things (IoT) has opened up a massive market for software-dedicated hardware devices among diverse end-users. This includes smart city initiatives requiring efficient processing for traffic management and public safety, consumer electronics companies developing smart home devices and wearables with on-device AI capabilities, and healthcare providers leveraging dedicated hardware for medical imaging analysis, diagnostics, and personalized medicine. Even smaller and medium-sized enterprises (SMEs) are increasingly becoming potential customers as specialized hardware solutions become more accessible and integrated into off-the-shelf edge devices, allowing them to deploy AI and advanced analytics without extensive in-house hardware expertise. This diverse demand landscape underscores the critical role of software-dedicated hardware in driving innovation and efficiency across virtually every modern sector.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 18.5 Billion |

| Market Forecast in 2033 | USD 41.9 Billion |

| Growth Rate | 12.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | NVIDIA Corporation, Intel Corporation, Advanced Micro Devices (AMD), Google LLC (via Tensor Processing Units), Amazon Web Services (AWS) (via Inferentia/Trainium), Xilinx (now AMD), Apple Inc., Qualcomm Technologies, Inc., Broadcom Inc., Marvell Technology, Inc., Renesas Electronics Corporation, NXP Semiconductors N.V., Samsung Electronics Co., Ltd., MediaTek Inc., Huawei Technologies Co., Ltd. (Ascend Processors), Cerebras Systems, Graphcore, Groq, SambaNova Systems, Tenstorrent. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Software Dedicated Hardware Device Market Key Technology Landscape

The technological landscape of the Software Dedicated Hardware Device Market is characterized by relentless innovation aimed at maximizing computational efficiency, minimizing power consumption, and enabling new capabilities for highly specialized software applications. A cornerstone of this landscape is the advancement in semiconductor fabrication processes, including smaller nanometer nodes (e.g., 5nm, 3nm) and advanced packaging techniques like chiplets and 3D stacking (e.g., HBM - High Bandwidth Memory). These innovations allow for the integration of more transistors, greater memory bandwidth, and heterogeneous compute elements within a single device, significantly boosting performance for data-intensive workloads while keeping the physical footprint compact. The use of FinFET and Gate-All-Around (GAA) transistor architectures is crucial for enhancing power efficiency and performance scaling, directly impacting the capabilities of dedicated hardware.

Beyond fundamental silicon technology, the market is heavily reliant on specialized processor architectures designed for specific workloads. Artificial Intelligence (AI) accelerators, including Tensor Processing Units (TPUs), Neural Processing Units (NPUs), and highly optimized Graphics Processing Units (GPUs) with dedicated AI cores, form a critical part of this landscape. These processors incorporate specialized instruction sets and parallel processing capabilities to efficiently execute deep learning training and inference tasks. Furthermore, the rise of custom Application-Specific Integrated Circuits (ASICs) designed from the ground up for particular algorithms or industry-specific applications offers unparalleled performance and power efficiency for dedicated software functions, often found in high-volume or mission-critical deployments like autonomous vehicles or hyperscale data centers, delivering bespoke solutions for specific software demands.

Another crucial technological trend involves the development of powerful System-on-Chips (SoCs) that integrate multiple processing units (CPU, GPU, DSP, NPU), memory, and I/O interfaces onto a single die, creating highly integrated and efficient platforms for edge computing and embedded systems. These SoCs are often paired with robust hardware-level security features, such as trusted execution environments, secure boot, and cryptographic accelerators, to protect sensitive data and AI models at the device level. The evolution of interconnect technologies, such as PCIe Gen5/Gen6, CXL (Compute Express Link), and proprietary high-speed interfaces, also plays a vital role in enabling seamless communication between dedicated hardware components and host systems, facilitating the creation of powerful, scalable, and disaggregated computing architectures. These advancements collectively underscore a paradigm shift towards tailored hardware solutions that are tightly coupled with software requirements, driving performance and efficiency to unprecedented levels across diverse applications.

Regional Highlights

- North America: A dominant market, fueled by major technology companies, significant R&D investments in AI, HPC, and cloud infrastructure, and a robust ecosystem for semiconductor design and innovation. The presence of leading chip manufacturers and cloud service providers drives high adoption rates.

- Europe: Growing steadily, particularly strong in industrial automation, automotive, and telecommunications sectors. Focus on edge computing for manufacturing and smart city initiatives, alongside increasing investment in AI research and sovereign cloud capabilities.

- Asia Pacific (APAC): The fastest-growing region, driven by rapid digitalization, extensive manufacturing capabilities, massive investments in 5G, AI, and IoT infrastructure in countries like China, Japan, South Korea, and India. Large consumer electronics market and government support for local semiconductor industries contribute significantly.

- Latin America: An emerging market with increasing digitalization efforts across sectors like finance, telecommunications, and smart cities. Growing adoption of cloud services and IoT solutions is stimulating demand for dedicated hardware, albeit from a lower base.

- Middle East & Africa (MEA): Demonstrating considerable potential with ongoing smart city projects, significant investments in digital infrastructure, and diversification of economies away from oil. Development in telecommunications and data center infrastructure is a key driver for specialized hardware adoption.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Software Dedicated Hardware Device Market.- NVIDIA Corporation

- Intel Corporation

- Advanced Micro Devices (AMD)

- Google LLC (via Tensor Processing Units)

- Amazon Web Services (AWS) (via Inferentia/Trainium)

- Xilinx (now AMD)

- Apple Inc.

- Qualcomm Technologies, Inc.

- Broadcom Inc.

- Marvell Technology, Inc.

- Renesas Electronics Corporation

- NXP Semiconductors N.V.

- Samsung Electronics Co., Ltd.

- MediaTek Inc.

- Huawei Technologies Co., Ltd. (Ascend Processors)

- Cerebras Systems

- Graphcore

- Groq

- SambaNova Systems

- Tenstorrent

Frequently Asked Questions

Analyze common user questions about the Software Dedicated Hardware Device market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are Software Dedicated Hardware Devices?

Software Dedicated Hardware Devices are specialized computing components or systems engineered to efficiently execute specific software applications or functions, offering superior performance, lower power consumption, and reduced latency compared to general-purpose hardware for their intended tasks.

What drives the growth of this market?

The market's growth is primarily driven by the surging demand for AI/ML acceleration, the expansion of edge computing and IoT ecosystems, increasing reliance on high-performance computing, the rollout of 5G networks, and the overarching need for greater energy efficiency in data centers and cloud infrastructure.

How does AI impact Software Dedicated Hardware?

AI significantly impacts this market by creating an immense demand for purpose-built silicon (ASICs, specialized GPUs/NPUs) optimized for AI training and inference, pushing innovations in hardware-software co-design, and driving the development of edge AI capabilities.

What are the main types of dedicated hardware devices?

The primary types include Application-Specific Integrated Circuits (ASICs), Field-Programmable Gate Arrays (FPGAs), System-on-Chips (SoCs), specialized Graphics Processing Units (GPUs), Network Processing Units (NPUs), and Digital Signal Processors (DSPs, often integrated into SoCs).

Which industries are the key adopters of these devices?

Key adopting industries include artificial intelligence and machine learning, edge computing, IoT, data centers and cloud computing, automotive (ADAS, autonomous driving), telecommunications (5G infrastructure), and industrial automation.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager