Software Development Outsourcing Services Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435617 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Software Development Outsourcing Services Market Size

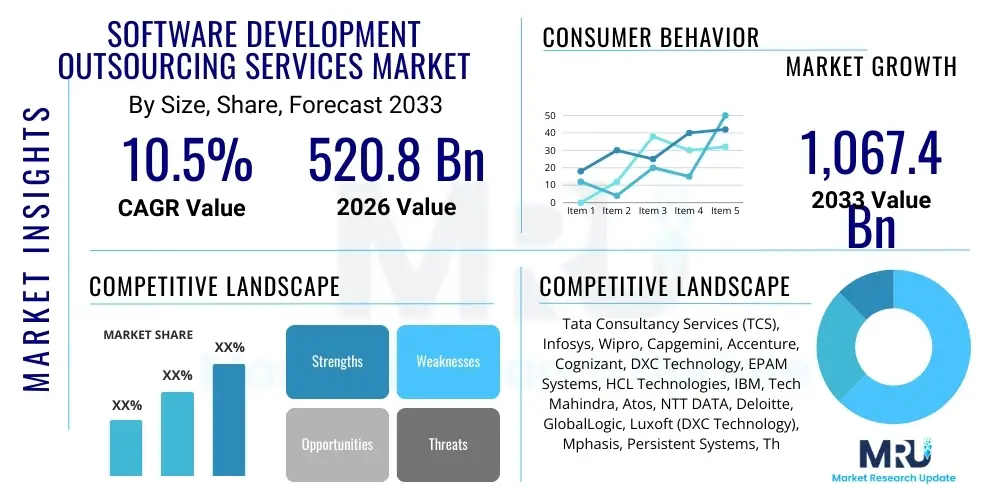

The Software Development Outsourcing Services Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 10.5% between 2026 and 2033. The market is estimated at USD 520.8 Billion in 2026 and is projected to reach USD 1,067.4 Billion by the end of the forecast period in 2033.

Software Development Outsourcing Services Market introduction

The Software Development Outsourcing Services Market encompasses the practice of contracting external organizations, often located offshore or nearshore, to handle specific or complete software development tasks, ranging from initial conceptualization and rigorous architectural design to coding, comprehensive testing, secure deployment, and ongoing maintenance. This robust and dynamic market is fundamentally driven by the pervasive global need for specialized technical expertise that surpasses in-house availability, the critical requirement for superior cost optimization, and the competitive necessity of achieving accelerated time-to-market for digital products and services. Enterprises across a spectrum of industry verticals, including Banking, Financial Services, and Insurance (BFSI), Healthcare, fast-moving Retail, and high-tech Technology sectors, strategically leverage these outsourcing services not merely for transactional efficiency but as a core mechanism to scale operational capacity rapidly, gain immediate access to complex emerging technologies like Artificial Intelligence (AI), Blockchain distributed ledgers, and sophisticated Internet of Things (IoT) frameworks, and critically, to reallocate finite internal resources toward core business competencies and proprietary innovation. The scope of engagement within this market is exceedingly broad, covering bespoke custom application development tailored to unique business processes, large-scale Enterprise Resource Planning (ERP) system modernization and integration, highly specialized mobile application development for consumer and enterprise use, and complex, foundational cloud transformation projects designed to future-proof infrastructure.

The persistent and widening gap between the demand for highly skilled IT professionals and the available supply, particularly in specialized, high-demand domains such as advanced cybersecurity defense mechanisms, cloud-native development mastery, and data science engineering, has elevated outsourcing from a mere tactical cost-saving measure to a strategic imperative integral to modern business continuity and competitive strategy. Modern outsourcing providers offer highly flexible and adaptive engagement models designed to meet varying client needs and risk profiles, including rapid staff augmentation, comprehensive managed services encompassing entire platforms, and dedicated full-cycle development teams embedded virtually within the client’s organization. These services find application across crucial organizational functions: enhancing and maintaining high-performance customer-facing platforms, undertaking the massive technical debt reduction inherent in modernizing aging legacy enterprise systems, and building robust, scalable internal operational tools specifically engineered to facilitate seamless and comprehensive digital transformation initiatives across the entire value chain. The tangible benefits derived from strategic outsourcing are manifold, encompassing substantial reductions in operational and recruitment overhead, demonstrable improvements in project efficiency through adherence to established, globally recognized delivery methodologies (such as Agile and DevOps), and the instantaneous access to vast global talent pools capable of providing true round-the-clock development and support cycles, dramatically shortening project timelines.

A major driving force currently sustaining and accelerating the robust growth trajectory of the outsourcing market is the unprecedented pace of global digitalization, significantly spurred by the widespread adoption of permanent remote work models, the explosive expansion of e-commerce platforms, and the necessity of establishing resilient digital supply chains. This digitalization is coupled with intense, cross-sector competitive pressure that demands organizations not only maintain but continuously advance their technological infrastructure and digital offerings. Furthermore, the global maturation of outsourcing ecosystems, particularly in strategic geographical regions such as India, Eastern Europe (e.g., Poland, Ukraine), and Latin America (e.g., Brazil, Mexico), is a key factor. These hubs are increasingly recognized for offering not only cost advantages but also high-quality service delivery, sophisticated engineering capabilities, and highly favorable economic and political stability, continuously attracting substantial technology investment and rapid adoption from large-scale enterprises based predominantly in North America and Western Europe. Concurrent shifts in global regulatory landscapes, particularly those emphasizing data sovereignty and enhanced security standards, also fundamentally shape the service offerings, compelling leading providers to develop highly specialized compliance expertise and secure delivery frameworks that address these intricate global mandates.

Software Development Outsourcing Services Market Executive Summary

The contemporary Software Development Outsourcing Services Market is characterized by a pivotal, strategic shift away from basic, labor-intensive coding towards highly specialized, intellectual property-centric, and high-value strategic partnerships. Current business trends emphatically underscore a strong enterprise preference for collaborative partnership models explicitly focused on innovation co-creation, particularly in frontier technological areas such as implementation and optimization of sophisticated Artificial Intelligence (AI) solutions, advanced Machine Learning (ML) model development, and comprehensive, secure cloud-native application infrastructure development. Large-scale multinational enterprises are increasingly engaging in strategic vendor consolidation, preferring to work with a smaller number of highly capable, strategically aligned partners who possess the depth and breadth to offer unified, end-to-end digital transformation solutions, rather than managing a decentralized network of fragmented service providers. This intense consolidation trend acts as a powerful catalyst for increased merger and acquisition (M&A) activity among smaller, specialized niche outsourcing firms. These acquisitions are primarily motivated by the need to rapidly expand technological portfolios, acquire specialized geographical market access, and enhance competitive resilience against the established, monolithic industry giants, thereby reshaping the competitive landscape.

Regionally, the market exhibits pronounced asymmetry. North America indisputably maintains its leadership position as the premier consumer of outsourced software development services, a dominance fueled by the region's relentless pace of technological innovation, particularly emanating from major tech hubs, combined with the inherently high labor costs associated with securing highly specialized domestic technical talent. Conversely, the Asia Pacific (APAC) region, spearheaded by the colossal ecosystems in India and China, remains the undisputed global engine for service provision. This position is cemented by leveraging exceptionally vast and deep talent pools, capitalizing on long-established delivery infrastructures, and maintaining economies of scale. Simultaneously, regions like Eastern Europe (acting as a nearshore hub for Western Europe) and Latin America (serving as a strategic nearshore partner for North American clients) are rapidly augmenting their market traction. This growth is largely underpinned by the significant advantages of favorable time zone alignment, a strong emphasis on continuous technical skill upgrading, and increasing cultural proximity, which collectively streamlines high-velocity project execution and enhances collaborative effectiveness. The regional focus in these emerging hubs is demonstrably shifting towards excelling in quality assurance maturity, strict adherence to iterative agile methodologies, and cultivating deep domain expertise within high-growth verticals such as FinTech security and highly regulated HealthTech platforms.

Segmentation trends reveal critical areas of investment and rapid market movement. Services related to sophisticated cloud development, encompassing large-scale migration, continuous optimization, and cloud cost management, alongside specialized managed cybersecurity services, are registering the most exponential growth rates within the entire market ecosystem. This vigorous expansion is a direct reflection of the enterprise-wide, widespread migration of mission-critical workloads onto hyperscale cloud platforms (AWS, Azure, Google Cloud). While Global 2000 large enterprises continue to generate the substantial majority of market revenue due to the scale and complexity of their engagements, the Small and Medium-sized Enterprise (SME) segment is exhibiting an accelerating rate of adoption of outsourced solutions. SMEs are frequently leveraging specialized, agile boutique firms or utilizing rapidly scalable, platform-based freelance development models. This strategy allows them to achieve necessary technical scalability and sophisticated digital capabilities without incurring the prohibitive costs and substantial fixed overhead associated with establishing large internal IT departments, making specialized outsourcing crucial for maintaining competitive parity. From a technological standpoint, the strategic integration of advanced automation tools and the proliferation of low-code/no-code (LCNC) development platforms are fundamentally streamlining service delivery processes, dramatically improving operational efficiency, and strategically enabling providers to reallocate valuable human talent toward more complex, highly creative, and strategically demanding problem-solving tasks.

AI Impact Analysis on Software Development Outsourcing Services Market

The pervasive and rapidly accelerating integration of Artificial Intelligence (AI) into the software development lifecycle represents a paradigm shift for the outsourcing market, raising immediate and complex questions among users and clients. The primary anxieties center on potential large-scale job displacement of junior developers, the optimal and secure implementation rate of highly sophisticated AI-driven coding assistants (such as proprietary models and commercial tools like GitHub Copilot), and the anticipated consequential overhaul of traditional service pricing models. Users urgently seek clarity on how AI tools will redefine the essential skill sets required for outsourced engineering talent—a crucial transition from performing manual, repetitive coding tasks to mastering complex prompt engineering, engaging in high-level system architecture design, and performing rigorous validation of complex problem-solving outcomes generated by AI. Moreover, client organizations are intensely evaluating whether AI’s demonstrated ability to automate substantial portions of repetitive coding and quality assurance will translate directly into significant, mandated cost reductions within service contracts. This pressure threatens to fundamentally disrupt existing, traditional outsourcing pricing structures and is creating a clear competitive divergence between providers who aggressively adopt AI for unprecedented efficiency gains and those who rely heavily on manual, labor-intensive processes, potentially leading to market stratification based on technological capability. The core, pervasive expectation driving strategic client decision-making is that the necessity of AI adoption will mandate continuous upskilling across the entire service delivery chain, fundamentally necessitating a reassessment of traditional quality metrics and delivering dramatic acceleration in project timelines. This ultimately enhances the sophisticated, value-based proposition of specialized, AI-augmented outsourcing partners who can guarantee superior speed and quality outcomes.

The impact of AI extends across the entire project lifecycle, moving beyond just code generation to encompass project management and security auditing. Providers are leveraging sophisticated ML algorithms to predict potential bottlenecks in project timelines, optimize resource allocation across geographically dispersed teams, and dynamically adjust development sprints based on real-time productivity data. This predictive analytics capability allows outsourcing firms to offer clients far more transparent, reliable, and predictable project outcomes, transforming the historically reactive nature of project management into a proactive strategic function. Furthermore, the application of AI in automated security vulnerability scanning and continuous compliance monitoring is rapidly becoming a non-negotiable standard. In an environment of escalating cyber threats and evolving data privacy mandates, AI-driven security tools enable providers to deliver highly secure software faster than traditional manual auditing methods. This technological capability serves as a significant trust differentiator, especially for clients in high-stakes sectors like finance, defense, and healthcare where compliance failure carries severe regulatory and financial penalties.

Consequently, the strategic adoption of AI is fundamentally restructuring the competitive landscape by introducing new axes of differentiation. Firms that aggressively invest in training their workforce in prompt engineering and specialize in developing sophisticated AI governance frameworks are becoming the preferred partners for large-scale enterprise transformation. This means the value in outsourcing is shifting from providing generalized capacity to delivering specialized intelligence and efficiency. Clients are not just buying hours of coding; they are buying guaranteed velocity, quality, and technical foresight augmented by artificial intelligence. This requires outsourcing contracts to evolve from simple labor cost arbitrage models to complex, performance-based agreements that reward the provider for achieving superior business outcomes, such as reduced operational costs for the client or increased customer conversion rates driven by the developed software. The integration of AI therefore acts as a powerful upward pressure on the skill requirements within the outsourcing sector, making technological investment crucial for market survival and leadership.

- AI-Powered Code Generation: Tools automating boilerplate code construction and repetitive functions, potentially reducing development time for standardized modules by up to 30%, which allows human developers to shift their specialized focus to complex architectural design, non-functional requirement validation, and critical integration logic.

- Enhanced Quality Assurance (QA) and Testing: Utilizing AI and Machine Learning models for advanced automated testing, predictive identification of software defects and bugs, and sophisticated predictive maintenance scheduling, thus dramatically improving the overall reliability of the deployed software and significantly reducing the incidence of costly post-launch operational failures.

- Creation of New Service Offerings: Development and deployment of entirely new, highly specialized outsourcing services focused exclusively on the building, secure deployment, maintenance, and continuous optimization of custom Generative AI models, complex machine learning pipelines, and proprietary data science solutions for enterprise clients.

- Optimization and Evolution of Outsourcing Models: A structural transition from traditional time-and-materials pricing structures towards more client-centric, outcome-based, or value-based contractual agreements, accurately reflecting the increased speed, superior quality, and profound efficiency gains directly attributable to internal automation and AI integration.

- Increased Demand for AI Expertise: This technological shift grants a significant competitive advantage to outsourcing firms demonstrating the capability to consistently provide and deploy highly skilled engineering professionals who are deeply proficient in AI/ML engineering principles, advanced prompt engineering techniques, and complex data science methodology.

- Advanced Risk and Compliance Management: Implementation of sophisticated AI-driven tools that assist in the rapid, continuous analysis of code vulnerabilities, automatic security auditing, and ensuring strict adherence to increasingly stringent global regulatory standards and complex data privacy mandates (e.g., European GDPR, US HIPAA, CCPA).

- Talent Up-skilling Imperative: An essential requirement for all outsourcing firms to strategically retrain and up-skill their existing engineering workforce in the effective utilization of AI co-pilot tools, advanced prompt formulation, and sophisticated system auditing and validation techniques to ensure market relevance and maintain service quality in a rapidly automating environment.

- Increased Focus on Data Governance: Outsourcing providers must establish specialized services for managing the data pipelines and quality required to train and operate client-specific AI models, adding a layer of data governance expertise to the traditional software development offering.

- Acceleration of DevOps Implementation: AI tools automate many complex DevOps tasks, such as containerization, scaling decisions, and CI/CD pipeline management, making continuous delivery faster and more reliable, which is a key value proposition for outsourced projects.

DRO & Impact Forces Of Software Development Outsourcing Services Market

The Software Development Outsourcing Services Market operates under the influence of a compelling matrix of Drivers, critical Restraints, and transformative Opportunities (DRO), which collectively function as potent impact forces dictating market evolution and strategic decision-making. A pivotal and overwhelmingly powerful driver is the relentless, accelerating global mandate for comprehensive digital transformation across virtually all industry verticals, forcing incumbent companies to undertake massive, urgent projects to modernize complex legacy IT systems and simultaneously construct entirely new, state-of-the-art digital platforms. This unprecedented technological requirement dramatically exceeds the capacity and specialized skill sets of internal, in-house talent pools in nearly all major developed economies, firmly establishing strategic outsourcing as an indispensable and critical mechanism for securing immediate, specialized expertise in high-demand domains such as scalable cloud infrastructure design, advanced Artificial Intelligence development, and robust, proactive cybersecurity defense. The foundational economic imperative of cost efficiency, primarily achieved through strategic geographic labor arbitrage, coupled with the ability to instantly access scalable resource availability without incurring fixed employment costs, consistently remains a core and foundational catalyst sustaining the vigorous market growth, particularly essential for executing complex, large-scale enterprise projects with demanding budgetary controls.

However, the market growth trajectory is significantly moderated by several complex and interconnected restraints. Foremost among these are the profound concerns related to upholding stringent data security standards and the critical protection of sensitive intellectual property (IP), especially when high-value or proprietary development work is transferred to third-party providers operating under disparate, often less stringent, regulatory and legal environments. Furthermore, the continuous and rapidly increasing complexity introduced by international data sovereignty laws—including highly localized interpretations and enforcement of GDPR across Europe and demanding local data residency requirements across various national jurisdictions—imposes considerable operational, technical, and substantial legal overhead onto cross-border outsourcing agreements, increasing compliance risk. Persistent cultural and linguistic barriers, although continuously minimized by advanced collaboration tools and increased cross-cultural training, still present genuine risks to project adherence, critical communication clarity, and ultimate collaboration success. Mitigating these risks necessitates the implementation of highly sophisticated governance models, mandatory standardized project management methodologies, and robust, multi-layered communication frameworks capable of bridging significant operational distances and cultural nuances effectively.

The most potent opportunities defining the future strategic direction of the outsourcing market revolve around the massive, continued expansion of hyperscale cloud adoption and the correspondingly intense demand for sophisticated, end-to-end cloud professional services. These services encompass complex, zero-downtime migration strategies, continuous cost and performance management, and the optimization of intricate hybrid and multi-cloud environments. Additionally, the development and proliferation of highly specialized vertical expertise—such as outsourcing partners focusing exclusively on highly nuanced MedTech regulatory compliance, complex capital markets low-latency trading systems development, or advanced energy sector grid management software—represents a crucial avenue for high-value service differentiation and premium pricing power. Moreover, the strategic adoption and deep integration of technologies like Robotic Process Automation (RPA) and AI-driven workflow optimization within the internal operations of outsourcing providers themselves offer a powerful dual opportunity: to drastically increase the efficiency, speed, and reliability of service delivery and, concurrently, to solidify a highly competitive market positioning based on demonstrable superior quality and swift time-to-value, rather than simply competing on lower labor cost, thus fundamentally redefining the structure of provider competitiveness.

Segmentation Analysis

The Software Development Outsourcing Services market is meticulously segmented across multiple critical dimensions, including the nature of service provided, the foundational technology utilized, the size of the contracting organization, and the specific vertical industry served, providing crucial, granular insights necessary for understanding complex market dynamics, demand elasticity, and prevailing competitive structures. Segmenting by Service Type is fundamental, providing a delineation of the engagement scope, which ranges extensively from comprehensive, full-lifecycle custom application development projects designed from the ground up to highly focused, specialized activities such as rigorous application testing, critical system maintenance, and essential legacy system modernization. This segmentation accurately reflects the evolution of client needs, moving from simple maintenance to sophisticated strategic transformation mandates.

Analysis by Technology deployed illuminates the foundational platforms and innovative tools driving contemporary development, crucially highlighting the exponential growth and increasing dominance of cloud-native development methodologies, advanced analytics implementations, and sophisticated cybersecurity service offerings. This lens is essential for providers as it dictates the necessary technology investments, talent acquisition strategies, and required certification frameworks. Further segmentation based on Organization Size (SMEs vs. Large Enterprises) and specific Industry Vertical is paramount for providers seeking to refine their strategic offerings. This allows for precise tailoring of solutions that address the unique and often contrasting budgetary constraints, complex regulatory environments (e.g., PCI DSS for BFSI, FDA for HealthTech), and highly specific technical requirements inherent to different customer profiles, thereby ensuring service delivery is maximally relevant, compliant, and targeted effectively.

- By Service Type:

- Custom Application Development

- Application Testing and Quality Assurance (QA)

- Application Maintenance and Support

- System Integration Services

- Cloud Professional Services (Migration, Optimization, FinOps)

- Legacy System Modernization and Re-platforming

- Web and Mobile Application Development

- By Technology Focus:

- Cloud Computing (AWS, Azure, GCP)

- Big Data and Analytics

- Artificial Intelligence (AI) and Machine Learning (ML)

- Internet of Things (IoT) and Edge Computing

- Cybersecurity Software Development

- Blockchain and Distributed Ledger Technology (DLT)

- By Organization Size:

- Small and Medium-sized Enterprises (SMEs)

- Large Enterprises

- By Industry Vertical:

- Banking, Financial Services, and Insurance (BFSI)

- Healthcare and Life Sciences

- Telecommunications and IT

- Retail and E-commerce

- Manufacturing

- Government and Public Sector

- Media and Entertainment

- By Geography:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Software Development Outsourcing Services Market

The value chain for software development outsourcing services begins rigorously with the upstream activities, which are foundational to the capacity and capability of the entire delivery process. These preliminary stages fundamentally involve proactive talent acquisition strategies, continuous high-level skill development and certification, significant capital investment in advanced technology platforms and tools, and the establishment of robust, secure operational infrastructure. Upstream suppliers exert considerable influence, encompassing specialized educational and vocational institutions responsible for cultivating the foundational technical talent pool, major technology vendors supplying essential software development lifecycle (SDLC) tools and enterprise licenses, and critical infrastructure providers ensuring globally stable, high-speed connectivity and maximally secure data centers compliant with international standards. The inherent efficiency and the ultimate quality of the deployed software product are critically dependent on the outsourcing providers' operational dexterity in rapidly scaling specialized, high-demand expertise—such as certified Kubernetes architects, specialized cybersecurity analysts, or advanced AI model trainers—and consistently maintaining adherence to cutting-edge delivery methodologies (DevSecOps, SRE). Consequently, massive investment in continuous training programs, strategic technology partnerships, and rigorous process standardization are indispensable components for achieving and sustaining a competitive advantage at this highly critical initial stage of the value chain.

The central service delivery phase, representing the midstream activities, encompasses the crucial processes of detailed project scoping and governance, sophisticated solution architecture design, the physical coding and development, comprehensive testing protocols, and final deployment procedures. Within this core phase, the strategic choice of the distribution channel fundamentally and decisively impacts the overall effectiveness and successful trajectory of service delivery. Direct engagement remains the most prevalent and strategically preferred model, particularly where large, multinational enterprise clients establish direct, long-term, highly customized contractual relationships with Tier 1 global outsourcing firms. This direct channel facilitates superior real-time communication, enables rigorous project governance tailored to specific client needs, and allows for deep customization of the service delivery approach. Conversely, indirect distribution channels involve sophisticated partnership ecosystems, including specialized technology consulting firms, major system integrators, or niche industry brokers. These intermediaries typically manage the primary client relationship and high-level strategy while strategically subcontracting the actual, detailed software development work to smaller, highly focused Tier 2 or Tier 3 outsourcing firms. This model is predominantly utilized for specialized staff augmentation, highly niche technical requirements, or smaller-scale, fixed-scope projects where the intermediary provides overall risk management and integration expertise.

The downstream analysis concentrates intensely on the final output delivery and the critical, long-term activities of customer relationship and support management, encompassing essential application maintenance, rapid incident response support, and the continuous implementation of new features and updates. Customer satisfaction and, consequently, long-term retention are paramount, and these are often secured through the provision of highly flexible, adaptive engagement models, complete transparency through standardized reporting and performance metrics, and the utilization of effective, multi-channel communication strategies. The chosen distribution channel inherently influences the downstream support structure: clients engaged directly receive highly customized, deeply integrated, and rapid-response support managed by dedicated account teams. In contrast, indirect relationships often entail a layered support mechanism where the intermediary firm assumes responsibility for managing the primary client interface and initial support triage. The successful and strategic conclusion of the outsourcing value chain increasingly necessitates a transition beyond the transactional completion of a single project, evolving to offer specialized strategic advisory services that actively help clients identify and capitalize on new technological opportunities, thereby deeply embedding the provider within the client’s strategic trajectory and cementing long-term, high-value strategic partnerships based on demonstrated results and technical foresight.

Software Development Outsourcing Services Market Potential Customers

The universe of potential customers for Software Development Outsourcing Services is extraordinarily expansive and universally applicable, traversing virtually every major global industry vertical. This widespread demand is driven by the intrinsic need for a modern, resilient digital infrastructure and the unwavering requirement for maintaining a competitive technological edge in a rapidly digitized global economy. Historically and presently, the largest revenue generators within this market are typically large, established multinational enterprises, particularly those anchored within the highly regulated Banking, Financial Services, and Insurance (BFSI) sector. These institutions face continuous, intense regulatory scrutiny and possess vast, complex, mission-critical legacy IT systems that necessitate persistent, large-scale maintenance, urgent security patching, and comprehensive modernization efforts to ensure operational stability and regulatory compliance. Similarly, the rapidly expanding Healthcare and Life Sciences sector is a critical and high-growth segment, driven by the mandate for highly compliant electronic health records (EHR) systems, sophisticated, scalable telemedicine platforms, complex clinical trial management software, and advanced drug discovery modeling tools, all of which demand highly spec

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 520.8 Billion |

| Market Forecast in 2033 | USD 1,067.4 Billion |

| Growth Rate | 10.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Tata Consultancy Services (TCS), Infosys, Wipro, Capgemini, Accenture, Cognizant, DXC Technology, EPAM Systems, HCL Technologies, IBM, Tech Mahindra, Atos, NTT DATA, Deloitte, GlobalLogic, Luxoft (DXC Technology), Mphasis, Persistent Systems, Thoughtworks, Mindtree (L&T Infotech) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Software Development Outsourcing Services Market Key Technology Landscape

The critical technology landscape underpinning the software development outsourcing market is undergoing relentless, rapid evolution, driven fundamentally by the industry-wide mandate for instantaneous cloud-native architectures and the non-negotiable requirements for massive hyperscalability, intrinsic security, and operational resilience. Foundational technological competence is centered around sophisticated DevOps toolchains, which mandate the seamless integration of continuous integration and continuous delivery (CI/CD) pipelines, highly automated testing and quality assurance frameworks, and robust, reliable infrastructure-as-code (IaC) solutions, utilizing tools such as Terraform, Ansible, and Pulumi for standardized deployment. These integrated technologies enable geographically dispersed outsourced teams to design, develop, test, and securely deploy software updates with unprecedented speed, heightened reliability, and adherence to superior security standards. This operational efficiency is fundamentally accelerating the concept of Minimum Viable Product (MVP) delivery and supporting subsequent rapid iterative development cycles, which are absolutely crucial requirements for modern business agility and competitive response. The maturity and integrated efficiency of a provider’s DevOps platform are now primary indicators of their market differentiation.

The most profound and transformative technological advancements impacting both internal operations and client deliverables are unequivocally centered around Artificial Intelligence (AI) and sophisticated Machine Learning (ML) integration. These specialized capabilities are now being strategically integrated into two core areas: internally, where providers utilize AI for optimizing complex processes such as dynamic project management, automated resource allocation based on predictive modeling, and continuous quality assurance monitoring; and externally, where they are delivered as specialized, high-value client services. These external services often involve developing bespoke AI models for advanced predictive analytics, creating highly personalized customer engagement platforms, or handling complex, high-volume data processing tasks, effectively solving high-impact business problems. Furthermore, the rapid proliferation and required expertise in specialized technologies, including enterprise blockchain for supply chain transparency and secure financial ledgers, edge computing infrastructures optimized for scalable Internet of Things (IoT) solutions, and advanced, proactive cybersecurity protocols, necessitate that leading outsourcing providers maintain a diverse and deep bench of highly specialized technical expertise—a talent depth that few individual client organizations can afford or manage to cultivate entirely in-house.

A third major technological shift driving market value is the industry’s strong momentum toward advanced microservices architecture and efficient serverless computing models. These modern architectural paradigms allow outsourced development teams to construct highly decoupled, inherently scalable, and operationally resilient applications that are intentionally independent of specific, underlying infrastructure constraints. This promotes exceptional flexibility and significantly mitigates the client's long-term risk of vendor lock-in, offering greater portability and control. Leading-edge outsourcing firms are demonstrating competitive leadership by making significant, strategic investments in proprietary technology platforms, standardized accelerators, and specialized frameworks that heavily leverage these modern architectural concepts. These offerings provide pre-built, reusable components and standardized deployment frameworks designed explicitly to further minimize development cycle time, enhance overall code quality, and solidify technological competence as the most decisive differentiator in the highly competitive, global outsourcing marketplace, thereby moving the competitive emphasis away from simple labor cost alone.

Regional Highlights

- North America: Dominant consumer market. Driven by high domestic costs, shortage of advanced skills (AI/Cloud), and the need for rapid scaling. Strong adoption of flexible nearshore models to enhance collaborative efficiency and reduce time-to-market. The market requires providers with robust cybersecurity frameworks and deep expertise in regulatory compliance (e.g., SOX, CCPA).

- Asia Pacific (APAC): Global leader in service provision (India, China). Experience significant internal growth in demand due to government-led digital initiatives, especially in emerging economies. Service offerings focus on scale, efficiency, and foundational enterprise IT services, with increasing investment in localized data centers.

- Europe: Highly structured market prioritizing nearshore engagement for linguistic and cultural alignment. Compliance (GDPR, data sovereignty) is a top contractual requirement. Strong demand for specialized software in advanced manufacturing, automotive, and complex financial services, driving partnerships with Eastern European providers.

- Latin America (LATAM): Rapidly consolidating its position as a preferred nearshore hub for North American enterprises. Key advantages include strong English proficiency, shared time zones, and increasing technical sophistication in key markets like Brazil and Mexico, focusing on agile delivery and cloud services for BFSI and retail sectors.

- Middle East and Africa (MEA): Growth heavily underpinned by large-scale, strategic government investment in digital infrastructure (e.g., UAE and Saudi Arabia Vision programs). Demand centers around localized cloud infrastructure development, national cybersecurity platforms, and bespoke smart city technology solutions, requiring significant focus on localization and data residency expertise among providers.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Software Development Outsourcing Services Market.- Tata Consultancy Services (TCS)

- Infosys

- Wipro

- Capgemini

- Accenture

- Cognizant

- DXC Technology

- EPAM Systems

- HCL Technologies

- IBM

- Tech Mahindra

- Atos

- NTT DATA

- Deloitte Digital

- GlobalLogic

- Luxoft (DXC Technology)

- Mphasis

- Persistent Systems

- Thoughtworks

- Mindtree (L&T Infotech)

- Sutherland Global Services

- Ciklum

- Itransition

- SoftServe

Frequently Asked Questions

Analyze common user questions about the Software Development Outsourcing Services market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected growth rate (CAGR) for the Software Development Outsourcing Services Market?

The market is projected to expand at a robust Compound Annual Growth Rate (CAGR) of 10.5% between the forecast period of 2026 and 2033, primarily driven by accelerated digital transformation demands, enterprise cloud migration projects, and persistent global talent shortages in highly specialized IT domains.

How is Artificial Intelligence (AI) influencing the future of software outsourcing?

AI is strategically transforming outsourcing by automating routine coding, testing, and documentation tasks, leading to dramatic increases in project speed and quality. This structural shift compels providers to focus on delivering higher-value services, such as specialized AI model integration, prompt engineering, and complex architectural design, moving away from simple manual labor arbitrage models.

Which regional segment is the largest consumer of software development outsourcing services?

North America consistently remains the dominant consumer market globally, fueled by the region's high pace of technological innovation, significant differences in labor costs for specialized talent, and the urgent, structural need for expertise in cutting-edge cloud infrastructure and advanced data science fields within large US corporations.

What are the primary risks associated with outsourcing software development projects?

The primary strategic risks include heightened concerns related to critical data security breaches and the rigorous protection of intellectual property (IP), potential communication and cultural misalignment issues that can severely impact project governance, and the regulatory complexities associated with adhering to varied international data residency and sovereignty requirements, such as GDPR compliance.

Which industry vertical is showing the fastest adoption of specialized outsourcing services?

The Healthcare and Life Sciences sector is exhibiting accelerated market adoption, driven by the critical and mandatory need for advanced compliant platforms, innovative telemedicine applications, and complex data analytics tools, all while rigorously navigating highly stringent regulatory frameworks like HIPAA and FDA approval processes.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager