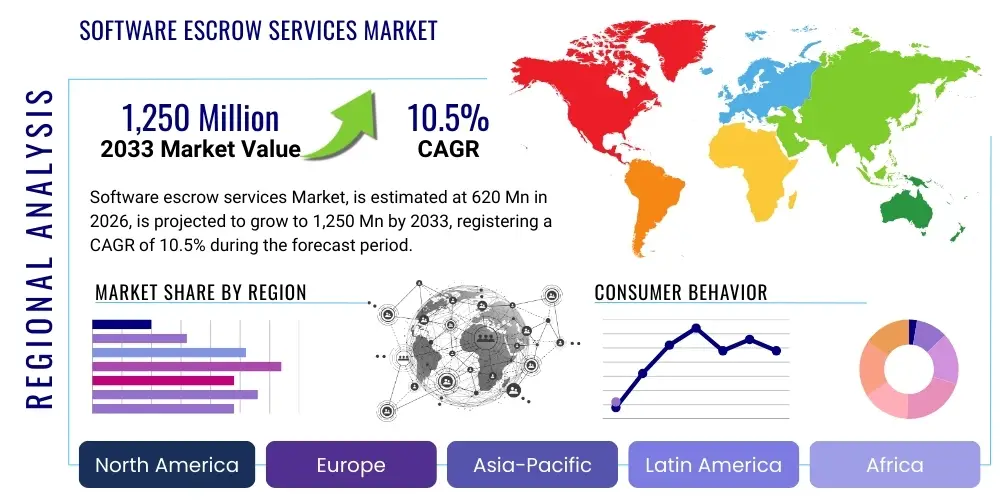

Software escrow services Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439659 | Date : Jan, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Software escrow services Market Size

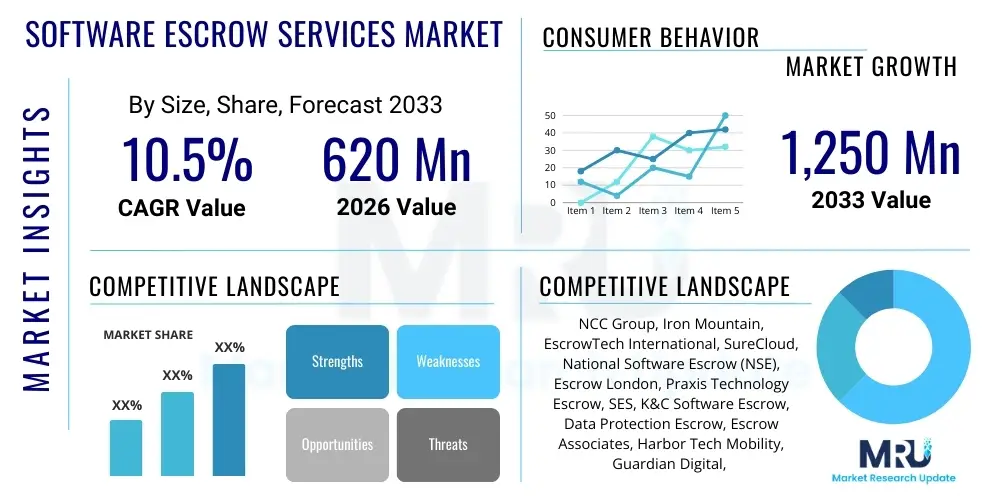

The Software escrow services Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 10.5% between 2026 and 2033. The market is estimated at USD 620 million in 2026 and is projected to reach USD 1,250 million by the end of the forecast period in 2033.

Software escrow services Market introduction

The Software escrow services market encompasses specialized third-party arrangements designed to safeguard critical software source code, data, or digital assets. In these agreements, a neutral third party, the escrow agent, holds the source code and associated documentation on behalf of both the software vendor (depositor) and the end-user (beneficiary). This mechanism primarily serves as a form of insurance, ensuring business continuity for licensees in scenarios where the software vendor might become insolvent, cease operations, or fail to meet contractual obligations regarding maintenance and support. It provides a vital safety net, particularly for enterprises heavily reliant on proprietary software, by guaranteeing access to the underlying code necessary for continued operation, modification, or disaster recovery.

Major applications for software escrow services span across diverse industry verticals, including BFSI (Banking, Financial Services, and Insurance), healthcare, government, IT and telecommunications, and manufacturing, where the reliance on specialized, mission-critical software is paramount. The benefits extend beyond mere access to source code; they include enhanced trust between vendors and licensees, compliance with regulatory requirements, and comprehensive risk mitigation strategies. This service is crucial for protecting intellectual property while fostering secure vendor-client relationships. Driving factors for market growth include the escalating adoption of third-party software across all business sizes, increasing regulatory scrutiny around data security and operational resilience, the complexity of modern software ecosystems, and the growing prevalence of mergers, acquisitions, and vendor bankruptcies that necessitate robust continuity plans.

Software escrow services Market Executive Summary

The Software escrow services market is experiencing robust growth, driven by an accelerating digital transformation globally and an increasing reliance on third-party software solutions, particularly SaaS applications. Business trends highlight a shift towards more comprehensive escrow agreements that include not just source code but also deployment environments, build instructions, and even data, reflecting the complexity of modern cloud-native architectures. The heightened focus on cybersecurity and operational resilience across all sectors also fuels demand, as organizations seek to protect themselves against vendor failures or data breaches. Furthermore, the rising volume of mergers and acquisitions in the tech sector necessitates robust escrow solutions to ensure seamless transitions and uninterrupted software functionality for acquiring entities and their customers.

Regionally, North America and Europe continue to dominate the market due to stringent regulatory frameworks, high levels of technological adoption, and a mature ecosystem of software vendors and corporate licensees. However, the Asia Pacific region is emerging as a significant growth hub, propelled by rapid industrialization, burgeoning IT infrastructure, and a growing number of startups and enterprises adopting advanced software solutions. Within segments, SaaS escrow services are projected to exhibit the fastest growth, directly correlating with the widespread migration of enterprise applications to cloud-based models. Enterprises are increasingly looking for solutions that secure their access to critical SaaS applications and their data, not just on-premise software. This evolution underscores a broader market trend towards holistic digital asset protection and business continuity planning in an increasingly interconnected and volatile technological landscape.

AI Impact Analysis on Software escrow services Market

The advent of Artificial Intelligence (AI) introduces both transformative opportunities and new complexities for the Software escrow services market. Common user questions revolve around how AI can enhance the efficiency and accuracy of escrow verification processes, whether AI-generated code requires different escrow considerations, and if AI itself can act as an escrow agent or a component within the escrow framework. Users also ponder the security implications of AI in managing sensitive intellectual property and the potential for AI-driven analytics to identify risks associated with software vendors. The primary themes emerging from these inquiries highlight a desire for automation in compliance and verification, concerns about the intellectual property of AI-developed software, and the need for new escrow models that accommodate AI-driven development and deployment pipelines, all while maintaining the core tenets of security and trust.

- Enhanced Verification and Auditing: AI can automate and accelerate the verification of deposited source code, ensuring completeness, compile-ability, and adherence to specific contractual requirements, significantly reducing manual effort and potential human error.

- Predictive Risk Analysis: AI-driven analytics can evaluate vendor stability, code health, and potential vulnerabilities more effectively, offering beneficiaries proactive insights into risks that might trigger escrow release conditions.

- Smart Contracts and Blockchain Integration: AI combined with blockchain technology can facilitate self-executing escrow agreements, where release conditions are automatically verified and triggered by predefined, immutable criteria, enhancing transparency and efficiency.

- Protection of AI Intellectual Property: New forms of intellectual property, such as trained AI models, algorithms, and vast datasets, require escrow solutions to safeguard their continuity and prevent loss, expanding the scope of traditional software escrow.

- Automated Compliance Monitoring: AI tools can continuously monitor software licenses, regulatory compliance, and contractual obligations, alerting parties to potential breaches that might necessitate escrow intervention.

- Development of AI-Generated Code Escrow: As AI assists in generating significant portions of software code, specialized escrow services will emerge to handle the unique intellectual property, ownership, and maintenance challenges associated with AI-authored software.

DRO & Impact Forces Of Software escrow services Market

The Software escrow services market is shaped by a complex interplay of drivers, restraints, opportunities, and broader impact forces. Key drivers include the escalating reliance on third-party software and SaaS solutions, which makes business continuity planning indispensable for licensees. Regulatory compliance, particularly in sectors like finance and healthcare (e.g., GDPR, HIPAA, PCI DSS), mandates robust data protection and disaster recovery strategies that software escrow inherently supports. Furthermore, the dynamic M&A landscape within the tech industry fuels demand, as acquiring companies seek to mitigate risks associated with purchased software assets and ensure uninterrupted service for their newly acquired customer bases. Increased awareness among both software vendors and licensees about the benefits of IP protection and operational resilience also serves as a significant market driver.

However, the market faces several restraints. The primary one is the perceived cost and complexity associated with implementing and managing escrow agreements, especially for smaller businesses or those with limited IT budgets. A lack of comprehensive understanding among potential clients regarding the full scope of benefits and the mechanics of escrow services also limits adoption. Some organizations may also perceive the risk of vendor failure as low, leading to complacency. Opportunities within the market are abundant, particularly in expanding into emerging economies where digital transformation is accelerating, and in developing specialized escrow solutions for niche industries or evolving technologies like blockchain and IoT. The increasing sophistication of cyber threats also presents an opportunity for escrow providers to integrate their services within broader cyber resilience and data protection strategies, offering enhanced value propositions. Impact forces, such as the bargaining power of buyers (licensees seeking favorable terms) and suppliers (specialized escrow agents), the threat of new entrants (potentially from legal tech or cybersecurity firms), and intense industry rivalry among existing escrow providers, continually shape the market's competitive landscape and pricing structures.

Segmentation Analysis

The Software escrow services market is comprehensively segmented to provide a detailed understanding of its diverse facets and growth trajectories. This segmentation helps identify key demand patterns, specific client needs, and areas of significant opportunity across various dimensions. Understanding these segments is critical for both service providers tailoring their offerings and businesses seeking appropriate escrow solutions.

- By Type

- Source Code Escrow: Traditional escrow holding software source code.

- SaaS Escrow: Protecting access to cloud-based applications and data.

- Data Escrow: Securing critical datasets independent of application code.

- Verification Services: Ensuring deposited materials are complete and functional.

- Managed Escrow Services: Comprehensive oversight and administration of escrow agreements.

- By End-User

- BFSI (Banking, Financial Services, and Insurance): High regulatory compliance and critical transaction systems.

- IT & Telecommunications: Extensive use of third-party software and cloud infrastructure.

- Healthcare: Strict data privacy (HIPAA) and continuity requirements for patient care systems.

- Government: Mandates for national security and essential public services continuity.

- Manufacturing: Reliance on specialized operational technology (OT) and enterprise resource planning (ERP) systems.

- Retail & E-commerce: Ensuring uninterrupted online operations and payment processing.

- Others (e.g., Education, Media & Entertainment, Energy & Utilities): Diverse software needs.

- By Deployment Model

- On-Premise: Escrow for software installed and run locally.

- Cloud-Based: Escrow for SaaS applications and cloud infrastructure components.

- By Organization Size

- Small and Medium-sized Enterprises (SMEs): Growing awareness and need for business continuity.

- Large Enterprises: Established demand due to extensive software portfolios and regulatory burdens.

Value Chain Analysis For Software escrow services Market

The value chain for Software escrow services involves several key stages and stakeholders, starting from the initial creation of software to its eventual secure deployment and continuous accessibility. Upstream activities primarily involve software developers and vendors who create the intellectual property (IP) and are responsible for depositing the source code and related materials into escrow. This phase also includes legal firms specializing in intellectual property law, who draft or review the escrow agreements, ensuring they are legally sound and protect the interests of all parties. IP specialists and technical auditors are also crucial upstream, preparing the materials for deposit and verifying their completeness and functionality before they enter the escrow agent's custody.

Midstream, the core of the value chain is occupied by the escrow service providers themselves. These entities offer secure storage, verification services, and administrative management of the escrow agreement. They act as neutral third parties, ensuring the integrity and accessibility of the deposited materials under predefined conditions. Their operations involve secure data centers, robust cybersecurity measures, and expert technical teams capable of performing rigorous code verification and release procedures. Downstream activities involve the end-users or beneficiaries of the software, such as corporate licensees, government agencies, or individual subscribers, who rely on the software for their operations. Distribution channels for escrow services can be both direct and indirect. Direct channels involve escrow providers engaging directly with software vendors and end-users. Indirect channels often include partnerships with legal firms, IT consultants, and managed service providers who recommend or integrate escrow services as part of a broader risk management or compliance solution for their clients, thus expanding market reach and specialized advisory support.

Software escrow services Market Potential Customers

The Software escrow services market caters to a broad spectrum of potential customers, all unified by their critical reliance on proprietary software and the need to mitigate risks associated with vendor dependencies. Primarily, the end-users or buyers of these services are software licensees across various industries. This includes large multinational corporations that operate complex, mission-critical systems powered by third-party software, for whom any disruption due to vendor failure could lead to significant financial losses and operational paralysis. Similarly, government agencies, particularly those involved in defense, national security, or essential public services, are prime candidates, given their stringent requirements for operational continuity and data sovereignty.

Beyond large enterprises, small and medium-sized enterprises (SMEs) are an increasingly important customer segment. As SMEs increasingly adopt sophisticated SaaS solutions for core business functions, their vulnerability to vendor insolvency or service disruption grows, making software escrow a vital business continuity tool. Furthermore, any organization that outsources software development or customization, or heavily depends on unique, proprietary applications, represents a potential customer. This includes companies in specialized fields such as aerospace, medical device manufacturing, and energy, where highly customized software is integral to their operations. In essence, any entity where the loss of access to specific software's source code or its continued operation would pose an unacceptable business risk is a prime candidate for software escrow services, highlighting a diverse and expanding customer base driven by digital dependency.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 620 million |

| Market Forecast in 2033 | USD 1,250 million |

| Growth Rate | 10.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | NCC Group, Iron Mountain, EscrowTech International, SureCloud, National Software Escrow (NSE), Escrow London, Praxis Technology Escrow, SES, K&C Software Escrow, Data Protection Escrow, Escrow Associates, Harbor Tech Mobility, Guardian Digital, LJD Business Solutions, Bluegrass Escrow, Code Creators Inc., Global Software Escrow, Securitech, Software Escrow Services Inc., Trustworthy Computing Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Software escrow services Market Key Technology Landscape

The Software escrow services market relies on a sophisticated technological landscape to ensure the utmost security, integrity, and accessibility of critical software assets. Central to this landscape are robust and secure data storage solutions, which often involve geographically dispersed, highly redundant data centers utilizing advanced encryption standards (e.g., AES-256) for data at rest and in transit. Version control systems are also paramount, allowing for precise tracking and management of software deposits, ensuring that the most current and relevant code is always available. Furthermore, secure access protocols, including multi-factor authentication and strict access controls, are crucial for maintaining the confidentiality and integrity of escrowed materials, restricting access only to authorized personnel under specific conditions.

The integration of cloud infrastructure plays an increasingly vital role, particularly for SaaS escrow services, enabling efficient and scalable storage solutions for cloud-native applications and their associated data. Automated verification tools are another critical technological component, capable of independently assessing the completeness, compile-ability, and functionality of deposited code and accompanying documentation, thereby minimizing human error and accelerating the verification process. Emerging technologies like blockchain are also beginning to influence the market, offering potential for enhanced transparency, immutability, and automated execution of escrow agreements through smart contracts. These technological advancements collectively underpin the reliability and trustworthiness of software escrow services, enabling them to meet the evolving demands for digital asset protection and business continuity in a rapidly changing software ecosystem.

Regional Highlights

- North America: This region stands as a dominant force in the Software escrow services market, primarily driven by its mature technology landscape, high adoption rates of third-party software and SaaS, and stringent regulatory compliance requirements across sectors like finance, healthcare, and government. The presence of numerous large enterprises and a strong emphasis on intellectual property protection contribute significantly to its market share.

- Europe: Similar to North America, Europe exhibits a robust market for software escrow services, propelled by comprehensive data protection regulations such as GDPR, which necessitate meticulous data and software management strategies. Countries like the UK, Germany, and the Nordic nations are key contributors, demonstrating high awareness and adoption due to their advanced digital economies and reliance on outsourced IT solutions.

- Asia Pacific (APAC): The APAC region is poised for significant growth, fueled by rapid digital transformation initiatives, increasing cloud adoption, and a burgeoning number of startups and IT enterprises. While awareness is still developing in some areas, countries like Japan, South Korea, Australia, and increasingly India and China, are witnessing accelerated demand as their economies become more digitized and their reliance on software intensifies.

- Latin America: This region represents an emerging market for software escrow services. Growth is steadily driven by expanding internet penetration, increasing foreign investment in technology, and local businesses adopting digital solutions to enhance competitiveness. However, market development can be slower compared to more mature regions due to varying regulatory landscapes and economic conditions.

- Middle East and Africa (MEA): The MEA market is still nascent but shows considerable potential, particularly with government-led digital initiatives and diversification efforts away from traditional oil-based economies. Countries within the GCC (Gulf Cooperation Council) are leading the charge in technology adoption, driving demand for robust software risk mitigation strategies as their digital infrastructures mature.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Software escrow services Market.- NCC Group

- Iron Mountain

- EscrowTech International

- SureCloud

- National Software Escrow (NSE)

- Escrow London

- Praxis Technology Escrow

- SES

- K&C Software Escrow

- Data Protection Escrow

- Escrow Associates

- Harbor Tech Mobility

- Guardian Digital

- LJD Business Solutions

- Bluegrass Escrow

- Code Creators Inc.

- Global Software Escrow

- Securitech

- Software Escrow Services Inc.

- Trustworthy Computing Inc.

Frequently Asked Questions

What is software escrow services and how does it work?

Software escrow is a three-party agreement where a neutral third-party agent holds critical software source code and related materials for a software vendor (depositor) and an end-user (beneficiary). In the event of specific triggers, such as vendor bankruptcy or failure to meet support obligations, the escrow agent releases the materials to the beneficiary, ensuring business continuity. This acts as an insurance policy, protecting the licensee's investment in the software.

Why is software escrow important for businesses?

Software escrow is crucial for businesses because it mitigates significant operational risks. It ensures continued access to critical software in scenarios where the vendor might fail, thereby preventing costly business interruptions, enabling disaster recovery, and safeguarding intellectual property. It builds trust between vendors and licensees and often helps meet regulatory compliance requirements for operational resilience and data protection.

Who typically needs software escrow services?

Any organization that heavily relies on proprietary third-party software, especially for mission-critical operations, is a potential customer. This includes large enterprises, government agencies, and increasingly SMEs across industries like BFSI, healthcare, and manufacturing. Essentially, if your business would be significantly impacted by the loss of access to a software's source code or its continued functionality, you need escrow services.

What are the main types of software escrow services available?

The primary types include Source Code Escrow (the traditional holding of source code), SaaS Escrow (for cloud-based applications and data), Data Escrow (securing critical datasets), and Verification Services (ensuring deposited materials are complete and functional). Managed Escrow Services offer comprehensive administration and oversight for complex agreements.

How does software escrow address the challenges of cloud-based applications (SaaS Escrow)?

SaaS Escrow specifically protects users of cloud-based applications by ensuring access to the SaaS application's source code, associated data, and often the cloud deployment environment. This allows the beneficiary to recreate or migrate the application in case the SaaS provider experiences financial difficulties, service disruptions, or ceases operations, thereby providing continuity for cloud-dependent businesses.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager