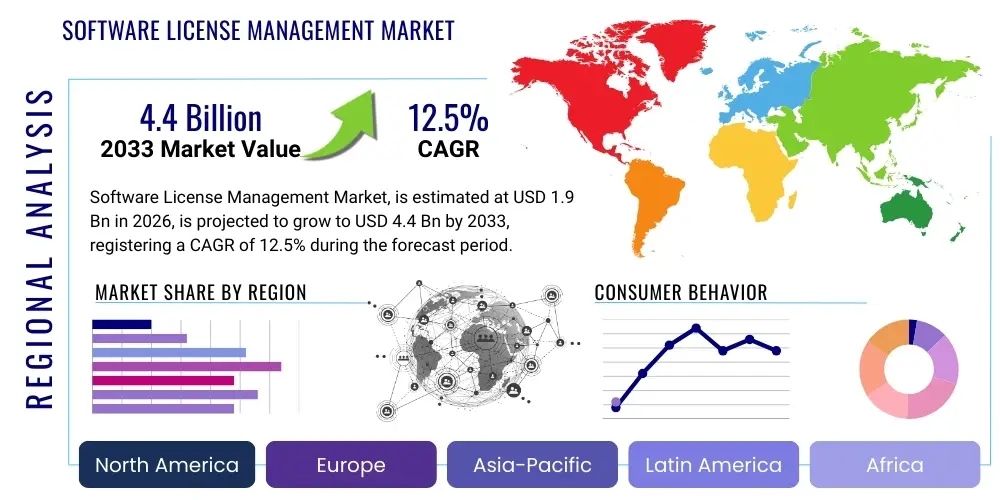

Software License Management Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436027 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Software License Management Market Size

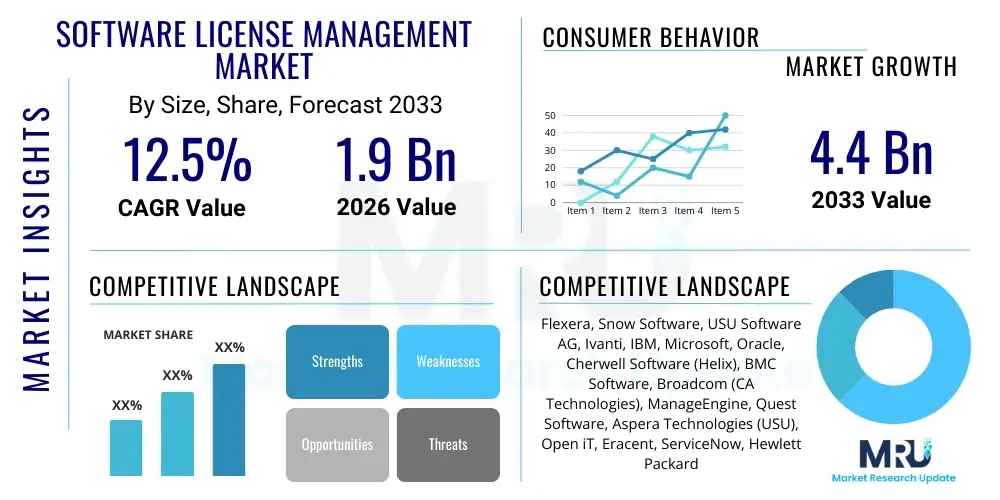

The Software License Management Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.5% between 2026 and 2033. The market is estimated at USD 1.9 Billion in 2026 and is projected to reach USD 4.4 Billion by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the escalating complexity of IT ecosystems across global enterprises, necessitating robust solutions to maintain compliance, optimize expenditure, and mitigate financial risks associated with under- or over-licensing of software assets.

The acceleration of cloud adoption, coupled with hybrid IT environments and the proliferation of subscription-based software models (SaaS), significantly complicates license tracking and adherence. Organizations are increasingly recognizing that manual license management processes are inefficient and prone to audit failures, which can result in severe financial penalties. Consequently, investments in automated and sophisticated SLM platforms that offer real-time visibility, usage tracking, and proactive compliance features are rising globally, fueling the market trajectory toward the forecasted valuation.

Software License Management Market introduction

Software License Management (SLM) refers to the comprehensive set of processes, tools, and practices designed to manage, control, and document the use of purchased software assets within an organization. It ensures that businesses are in compliance with vendor licensing agreements while simultaneously optimizing the deployment and usage of these assets to reduce unnecessary spending. The core function of SLM is to provide complete transparency into the software estate, tracking licenses from procurement through deployment, use, and eventual retirement, thereby protecting the company from financial losses due to non-compliance or inefficient resource allocation.

Major applications of SLM tools span across various organizational sizes and industries, including financial services, healthcare, IT & telecom, and manufacturing. These tools are crucial for managing complex licensing metrics such as concurrent user licenses, core-based licenses, named user licenses, and specialized server licenses. Benefits derived from effective SLM implementation include significant cost reduction through eliminating shelfware and optimizing renewal cycles, improved security by managing unauthorized installations, and enhanced operational efficiency by streamlining IT asset management workflows. The clear visibility provided by SLM platforms empowers IT and procurement departments to make data-driven decisions regarding software portfolios.

The primary driving factors propelling the SLM market include the increasing frequency and intensity of software vendor audits (by major players like Microsoft, Oracle, and SAP), the rapid shift towards complex cloud and hybrid licensing models that demand specialized tracking, and stringent regulatory requirements pertaining to software usage and data security. Furthermore, the global push for digital transformation mandates a foundational infrastructure capable of dynamically managing fluctuating software demands, positioning SLM as an indispensable component of modern IT governance and financial management strategies.

Software License Management Market Executive Summary

The global Software License Management (SLM) market is characterized by robust growth, propelled by the transition from perpetual licenses to subscription-based and hybrid cloud models, which increases the complexity of compliance tracking. Business trends indicate a strong focus on integration of SLM solutions with broader IT Asset Management (ITAM) and Service Management (ITSM) platforms to create a unified view of IT resources. Enterprises are prioritizing Artificial Intelligence (AI) and Machine Learning (ML) enabled SLM tools that offer predictive analytics for identifying potential non-compliance risks and optimizing future purchasing decisions. The competitive landscape is evolving, seeing increased consolidation and strategic partnerships between specialized SLM providers and large enterprise software vendors, aiming to deliver end-to-end IT financial management solutions.

Regionally, North America maintains market dominance due to the high concentration of large enterprises, early adoption of advanced IT governance practices, and a strong regulatory environment driving compliance needs. However, the Asia Pacific (APAC) region is demonstrating the highest growth trajectory, fueled by rapid digitalization, massive infrastructure investments, and the growing maturity of IT sectors in countries like India, China, and Japan, which are aggressively adopting standardized SLM practices to manage rapidly expanding software estates. Europe remains a significant market, influenced heavily by GDPR compliance requirements and stringent vendor auditing activities.

Segment trends highlight the dominance of the software segment, comprising on-premises, cloud, and hybrid deployment models, over the services segment, though professional services such as license optimization consulting are seeing accelerated demand. By deployment, the hybrid model is gaining traction as organizations balance legacy system requirements with new cloud migrations. Furthermore, the market for tools catering to small and medium-sized enterprises (SMEs) is expanding, as even smaller organizations recognize the disproportionately large risks associated with software non-compliance, driving demand for simplified, cloud-based SLM solutions that offer affordability and ease of deployment.

AI Impact Analysis on Software License Management Market

Users are primarily concerned with how AI can simplify the daunting task of managing thousands of software assets across complex hybrid environments, particularly focusing on questions regarding automated license harvesting, predictive compliance auditing, and optimized budget allocation. Key themes revolve around the feasibility of using AI/ML algorithms to analyze historical usage data and automatically predict future licensing needs, thus preventing both expensive "shelfware" (unused licenses) and audit exposure. Concerns often include the accuracy of AI-driven usage data interpretation across diverse vendors and the ethical implications of using AI to potentially limit user access to underutilized software. Expectations are high for AI to transform SLM from a reactive reporting function into a proactive, strategic component of IT financial management, reducing manual effort and ensuring continuous, real-time compliance validation, especially in dynamic, containerized, and serverless computing environments.

- AI enables predictive analytics to forecast future software demand and preemptively adjust license procurement.

- Machine Learning algorithms automate license harvesting by identifying and reclaiming underutilized or dormant software installations.

- Natural Language Processing (NLP) aids in rapidly analyzing complex, voluminous vendor license agreements (EULAs) to ensure real-time compliance matching.

- AI enhances real-time usage monitoring across diverse platforms (cloud, on-premise, virtual), providing instantaneous non-compliance alerts.

- It facilitates automated reconciliation of usage data against purchasing records, minimizing human error in compliance reporting.

- AI-driven optimization recommends the most cost-effective licensing model (e.g., perpetual vs. subscription) based on actual organizational consumption patterns.

DRO & Impact Forces Of Software License Management Market

The Software License Management market is primarily driven by the imperative need for compliance mitigation in the face of increasingly aggressive vendor auditing practices and the financial risks associated with non-compliance, which can lead to fines equating to millions of dollars. Restraints mainly stem from the high initial deployment costs, the steep learning curve associated with sophisticated SLM platforms, and the significant challenges posed by integrating new SLM tools with legacy IT Asset Management systems and highly customized enterprise resource planning (ERP) platforms. However, the market possesses substantial opportunities driven by the rapid global adoption of hybrid cloud models (e.g., Azure Stack, AWS Outposts) and the growing demand for specialized tools to manage complex SaaS licensing, where traditional on-premise SLM tools are insufficient.

Impact forces indicate a high influence from external regulatory factors and competitive vendor landscapes. Regulatory mandates, particularly those concerning data governance and security, necessitate precise software inventory tracking, which inherently requires robust SLM solutions. The proliferation of digital transformation initiatives across industries acts as a major catalyst, forcing organizations to streamline IT operations and financial governance simultaneously. Conversely, the rise of open-source software, while beneficial in some aspects, presents a minor restraint as organizations sometimes view it as a complete substitute for commercial software, potentially reducing immediate SLM demand, although license management for open-source components is also becoming a niche requirement.

The demand for comprehensive SLM suites is escalating rapidly, transforming them from mere inventory tools into strategic enterprise optimization platforms. This shift is particularly evident in large multinational corporations where centralized license governance is essential for managing regional discrepancies and ensuring global contractual consistency. The strong positive impact force exerted by the need for cost optimization—especially during economic uncertainties—reinforces the value proposition of SLM tools, making them critical investments rather than discretionary IT spending.

Segmentation Analysis

The Software License Management market is meticulously segmented across various dimensions, including component (software and services), deployment type (on-premises, cloud, and hybrid), organization size (SMEs and large enterprises), and industry vertical. This granular segmentation helps vendors tailor their offerings to specific pain points, such as the scalability requirements of large enterprises or the cost constraints faced by SMEs. The software component holds the majority share, driven by continuous innovation in platform capabilities, whereas the services segment is witnessing high growth due to the complexity of license optimization requiring expert consultation.

The shift toward cloud and hybrid deployment models is the most significant segmentation trend, eroding the traditional dominance of on-premises solutions. Hybrid deployment, which allows organizations to manage both legacy and cloud licenses seamlessly, is emerging as the preferred choice for multinational corporations. Furthermore, the segmentation by industry highlights accelerated adoption in highly regulated sectors like BFSI (Banking, Financial Services, and Insurance) and Healthcare, where compliance mandates are extremely strict and the financial penalties for non-compliance are severe, demanding specialized vertical-specific SLM solutions.

- Component:

- Software

- Services

- Professional Services

- Managed Services

- Deployment Type:

- On-Premises

- Cloud

- Hybrid

- Organization Size:

- Small and Medium-sized Enterprises (SMEs)

- Large Enterprises

- Industry Vertical:

- Banking, Financial Services, and Insurance (BFSI)

- IT and Telecom

- Healthcare

- Retail and E-commerce

- Manufacturing

- Government and Public Sector

- Others

Value Chain Analysis For Software License Management Market

The value chain of the Software License Management market begins with the upstream activities centered on software development and platform design. This initial stage involves intense research and development by SLM vendors to create robust tools capable of handling diverse vendor licensing schemas (e.g., IBM PVU, Oracle CPU). Key upstream challenges include maintaining compatibility with rapidly evolving operating systems, virtualization technologies, and complex cloud APIs. Specialized SLM vendors focus on developing sophisticated discovery, metering, and reconciliation engine algorithms that form the core intellectual property of the SLM solution.

Midstream activities primarily focus on product integration, distribution, and service delivery. Distribution channels are typically complex, involving both direct sales by large market players (like Flexera, Snow Software) to major enterprises and indirect sales through extensive networks of certified value-added resellers (VARs) and system integrators (SIs). These integrators play a crucial role in customizing the SLM platform to fit the client's specific IT environment. The services component in the midstream includes implementation, configuration, and migration services, ensuring the platform is operational and accurately capturing license data across heterogeneous environments.

Downstream analysis involves the direct interaction with the end-user (the customer) and continuous post-implementation support. This stage is dominated by managed services, wherein vendors or third-party providers take over the day-to-day governance of the client's license portfolio, including continuous optimization, compliance auditing, and renewal management. The downstream effectiveness relies heavily on strong customer education and high-quality technical support, especially concerning evolving licensing terms and complex contract negotiations. Effective downstream services are critical for maximizing customer retention and ensuring the long-term strategic value of the SLM investment.

Software License Management Market Potential Customers

The primary potential customers for Software License Management solutions are organizations that utilize a large volume of commercial software across diverse platforms, particularly those subject to strict compliance requirements and frequent vendor audits. Large enterprises, especially those operating globally, represent the most critical customer segment due to their immense scale, high software spending, and the exponential risk of non-compliance associated with thousands of employees and complex IT infrastructures. These customers seek enterprise-grade solutions that offer comprehensive coverage for major software publishers (Microsoft, Oracle, SAP, IBM, Adobe) and robust reporting capabilities for internal auditing and financial forecasting.

Beyond large corporations, the rapidly expanding segment of Small and Medium-sized Enterprises (SMEs) constitutes a growing base of potential customers. While SMEs have smaller IT budgets, they often face significant compliance challenges relative to their size and typically lack the dedicated in-house expertise required for manual license tracking. This segment is highly receptive to cloud-based, subscription SLM services (SaaS SLM) that offer lower upfront costs, simplified deployment, and automated management features, enabling them to mitigate audit risk without significant capital expenditure.

Specific industry verticals, notably BFSI and Government, are constant high-value customers due to regulatory obligations (e.g., SOX, HIPAA, Basel III) which mandate rigorous control over IT assets and data security. The manufacturing sector also represents substantial potential, driven by the need to manage complex industrial software licenses (CAD/CAM, PLC software) and optimize usage across geographically dispersed production facilities, requiring highly specialized SLM solutions capable of tracking engineering and concurrent user licenses effectively.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.9 Billion |

| Market Forecast in 2033 | USD 4.4 Billion |

| Growth Rate | 12.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Flexera, Snow Software, USU Software AG, Ivanti, IBM, Microsoft, Oracle, Cherwell Software (Helix), BMC Software, Broadcom (CA Technologies), ManageEngine, Quest Software, Aspera Technologies (USU), Open iT, Eracent, ServiceNow, Hewlett Packard Enterprise (HPE), Scalable Software, Raynet GmbH, Xensam. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Software License Management Market Key Technology Landscape

The technology landscape within the Software License Management market is rapidly evolving, driven by the necessity for tools to effectively manage highly dynamic, decentralized, and virtualized IT environments. Central to this evolution is the increasing reliance on agentless discovery and metering technologies. Traditional SLM relied heavily on client-side agents, which often caused deployment friction and performance overhead. Modern solutions utilize advanced network scanning techniques and integration with existing configuration management databases (CMDBs) and virtualization platforms (e.g., VMware, Hyper-V) to accurately identify and track software usage without requiring permanent client-side installations, enhancing scalability and reducing deployment time across large networks.

Furthermore, cloud connectors and API-driven integration are foundational technologies enabling modern SLM platforms to handle the intricacies of SaaS, PaaS, and IaaS licensing. Tools must establish robust, secure connections with major cloud providers (AWS, Azure, Google Cloud) to monitor consumption and allocate resources based on complex usage metrics, such as transactional volume or server uptime, which differ significantly from traditional CPU or named-user licensing. This specialized connectivity ensures accurate reconciliation of cloud billing against license entitlements, a critical requirement for controlling spiraling cloud costs.

The integration of advanced data analytics, including Artificial Intelligence (AI) and Machine Learning (ML), represents the most significant technological leap. These technologies are applied to automate the reconciliation process, analyzing vast datasets of installed software, usage patterns, and contractual obligations to proactively suggest optimization strategies, such as license reallocation or timing of contract renewals. Blockchain technology is also being explored by innovators as a potential solution for creating immutable, transparent records of software entitlements, which could significantly simplify auditing and transferability processes in the future, although its adoption is currently nascent.

Regional Highlights

The global Software License Management market displays significant regional variation in maturity, adoption rates, and regulatory influence. North America, encompassing the US and Canada, currently holds the largest market share. This dominance is attributed to the presence of a vast number of major software publishers, high IT expenditure by large enterprises, and stringent intellectual property protection laws that drive proactive adoption of compliance tools. The region benefits from early adoption of complex IT architectures, including extensive virtualization and cloud integration, which necessitate highly sophisticated SLM solutions. Moreover, the US market is highly competitive and technologically advanced, often serving as the testing ground for new AI-enabled SLM features.

Europe represents the second-largest market, characterized by mature economies and a regulatory environment strongly influenced by data protection regulations like GDPR. European businesses are compelled to invest in robust SLM systems not only for cost optimization but also to maintain accountability for all software accessing customer data. Countries such as the UK, Germany, and France are key contributors, demonstrating high adoption rates driven by persistent vendor auditing activities and the need to manage multinational compliance standards across various jurisdictions within the European Union. The market is increasingly focused on specialized tools for managing SAP and Oracle licenses, given the high prevalence of these vendors in the region.

The Asia Pacific (APAC) region is projected to register the highest Compound Annual Growth Rate (CAGR) during the forecast period. This rapid expansion is fueled by massive digital transformation initiatives in emerging economies like India and China, coupled with increased vigilance against software piracy. While historically slower in adoption, the increasing maturity of IT governance, rising foreign direct investment, and a growing awareness of corporate financial exposure due to non-compliance are accelerating SLM deployment. Furthermore, the region's complexity, involving diverse regulatory landscapes and multiple languages, drives demand for adaptable and scalable cloud-based SLM solutions, making APAC a critical growth engine for the global market.

- North America: Market leader; high enterprise spending; strong driver due to frequent vendor audits (e.g., Microsoft, Oracle); early adoption of advanced ITAM/SLM integration.

- Europe: Second largest market; driven by strict regulatory mandates (e.g., GDPR compliance); strong focus on managing critical enterprise vendor software (SAP, IBM); mature economies demanding cost optimization.

- Asia Pacific (APAC): Highest growth rate; propelled by aggressive digitalization and rapid IT infrastructure expansion; increasing awareness of legal consequences of software piracy; large potential market in emerging economies (China, India, Japan, Australia).

- Latin America (LATAM): Developing market; adoption influenced by multinational presence; focus on basic compliance management and piracy reduction; slower uptake of complex hybrid solutions.

- Middle East & Africa (MEA): Nascent growth; driven by large infrastructure projects (e.g., UAE, Saudi Arabia); focus on government and large oil & gas sectors adopting foundational SLM practices to professionalize IT operations.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Software License Management Market.- Flexera

- Snow Software

- USU Software AG

- Ivanti

- IBM

- Microsoft

- Oracle

- BMC Software

- Broadcom (CA Technologies)

- ManageEngine (Zoho Corporation)

- Quest Software

- Aspera Technologies (USU)

- Open iT

- Eracent

- ServiceNow

- Hewlett Packard Enterprise (HPE)

- Scalable Software

- Raynet GmbH

- Xensam

- Matrix42

Frequently Asked Questions

Analyze common user questions about the Software License Management market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Software License Management (SLM) and why is it critical for modern businesses?

SLM is the set of processes and tools used to track, document, and control software usage relative to vendor agreements. It is critical because it ensures legal compliance, preventing heavy financial penalties from vendor audits, and optimizes IT spending by identifying and eliminating unused or redundant licenses (shelfware).

How does the shift to cloud and hybrid licensing models affect SLM?

The shift dramatically increases complexity. Traditional SLM tools designed for on-premises perpetual licenses struggle with dynamic cloud consumption metrics (e.g., user subscriptions, transactional usage). Modern SLM requires specialized cloud connectors and continuous monitoring to manage compliance and optimize costs across hybrid environments accurately.

What are the biggest financial risks associated with poor SLM practices?

The biggest financial risks are significant, unbudgeted penalties resulting from vendor audits due to non-compliance (under-licensing) and substantial wastage caused by over-licensing and holding unused software assets (shelfware). Poor SLM also leads to inefficient renewal negotiation and increased operational overhead.

How is Artificial Intelligence (AI) transforming license optimization?

AI transforms optimization by using machine learning to analyze historical usage data and predict future needs automatically. This enables proactive license harvesting—automatically reclaiming underutilized licenses—and informs optimal purchase decisions, moving SLM from reactive reporting to strategic financial governance.

Which industries are the primary drivers of demand for SLM solutions?

Highly regulated industries such as Banking, Financial Services, and Insurance (BFSI), Healthcare, and the Government/Public Sector are the primary drivers. These sectors face strict regulatory compliance mandates (like HIPAA, SOX) and require precise control over their vast software portfolios to mitigate legal and security risks.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager