Solar Battery Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432746 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Solar Battery Market Size

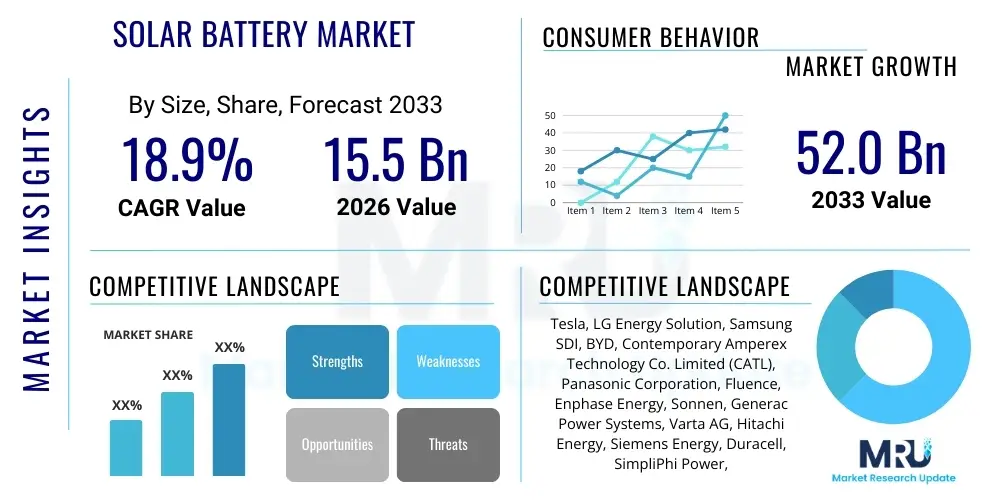

The Solar Battery Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.9% between 2026 and 2033. The market is estimated at USD 15.5 Billion in 2026 and is projected to reach USD 52.0 Billion by the end of the forecast period in 2033. This significant expansion is primarily driven by the global imperative for decarbonization, coupled with substantial governmental incentives aimed at promoting renewable energy integration and achieving self-sufficiency in power generation for residential, commercial, and utility sectors. The decreasing cost of lithium-ion technology, paired with advancements in energy density, further propels market uptake across developed and emerging economies.

Solar Battery Market introduction

The Solar Battery Market encompasses systems designed to store electrical energy generated by photovoltaic (PV) solar panels, enabling consumers and grid operators to utilize solar power during periods of low sunlight or high demand. These batteries, predominantly based on lithium-ion chemistry (such as Nickel Manganese Cobalt (NMC) or Lithium Iron Phosphate (LFP)), serve as critical components in decentralized energy systems. Their primary function is load shifting, backup power provision, and optimization of self-consumption, significantly enhancing the reliability and economic viability of solar installations globally.

Major applications of solar batteries span three critical sectors: residential installations, where they ensure energy independence and resilience during grid outages; commercial and industrial (C&I) settings, used for demand charge management and increased self-sufficiency; and utility-scale projects, where they provide essential grid services such as frequency regulation and peak shaving. The versatility of these storage solutions allows them to be deployed in both off-grid (standalone) and grid-tied configurations, addressing diverse energy security needs across various geographic locations and regulatory environments.

Key driving factors fueling market growth include rapidly falling solar panel costs, supportive regulatory frameworks like feed-in tariffs and tax credits, and growing consumer awareness regarding environmental sustainability and energy resilience. Benefits derived from solar battery adoption include reduced electricity bills, decreased reliance on fluctuating utility prices, lower carbon emissions, and enhanced power quality and stability for the overall grid infrastructure. Furthermore, the increasing integration of smart home technologies and energy management systems is optimizing battery performance and maximizing return on investment for end-users.

Solar Battery Market Executive Summary

The Solar Battery Market is undergoing rapid transformation, marked by robust business trends driven by technological maturation, increased manufacturing scalability, and fierce competition leading to price compression. Key business trends include the convergence of residential solar PV installations with integrated home energy management platforms, providing seamless control over generation and consumption. Furthermore, utility companies are transitioning from traditional grid architectures toward decentralized models, heavily investing in large-scale battery storage to manage renewable intermittency and enhance system reliability, thereby expanding the utility segment substantially over the forecast period.

Regionally, Asia Pacific maintains market dominance due to aggressive renewable energy targets set by nations like China, India, and Australia, coupled with supportive policies facilitating mass deployment. North America and Europe are characterized by high adoption rates driven by high electricity tariffs, strong incentives (like the US Investment Tax Credit), and frequent extreme weather events necessitating robust backup power solutions. Emerging markets in Latin America and MEA are accelerating deployment, particularly in regions requiring energy access and minimizing transmission losses, offering significant future growth potential.

Segmentation trends highlight the overwhelming prevalence of Lithium-Ion technology due to its superior energy density and cycle life, although alternative chemistries like Flow Batteries and Sodium-Ion are gaining traction for niche, long-duration storage applications. The residential segment is expected to witness the highest volume growth, capitalizing on consumer demand for energy independence, while the utility segment will lead in terms of capacity deployed. Integration trends show a clear shift towards hybrid inverter systems that manage both solar generation and battery charging efficiently, simplifying installation and optimizing performance for installers and end-users alike.

AI Impact Analysis on Solar Battery Market

Common user questions regarding the impact of Artificial Intelligence (AI) on the Solar Battery Market frequently revolve around optimizing battery performance, predicting maintenance needs, and improving grid integration efficiency. Users are keenly interested in how AI can extend battery lifespan by optimizing charge/discharge cycles based on usage patterns and weather forecasts, thereby maximizing the investment value. Concerns also center on the role of AI in decentralized energy management systems (DEMS) and Virtual Power Plants (VPPs), specifically asking how machine learning algorithms coordinate thousands of individual battery units to provide reliable grid support services, manage peak shaving autonomously, and ensure stable renewable energy penetration. The core expectation is that AI will move the market beyond passive storage toward active, intelligent energy management.

- AI-driven optimization of battery charging and discharging patterns based on real-time grid conditions, weather forecasts, and dynamic pricing, maximizing economic returns and extending cycle life.

- Predictive maintenance analytics using machine learning to monitor battery health degradation, detect anomalies early, and schedule proactive repairs, minimizing downtime and enhancing safety.

- Implementation of sophisticated Demand Response (DR) programs, where AI algorithms automatically adjust household or commercial loads and battery usage in response to utility signals, balancing supply and demand.

- Integration of solar battery units into Virtual Power Plants (VPPs) via AI, enabling aggregated distributed energy resources (DERs) to participate effectively in wholesale energy markets and provide essential grid services.

- Enhanced forecasting accuracy for solar generation and energy consumption, leading to more efficient sizing and operation of solar battery storage systems.

- Development of autonomous energy management systems (AEMS) utilizing deep learning to ensure optimal energy flow between solar panels, batteries, loads, and the main grid in complex microgrid environments.

DRO & Impact Forces Of Solar Battery Market

The Solar Battery Market is propelled by powerful drivers centered on the imperative for climate action, robust governmental support mechanisms, and the tangible economic benefits derived from energy storage. Restraints, primarily related to upfront system costs and the complexities associated with regulatory approvals and standardization across different jurisdictions, temper the overall growth rate. Significant opportunities exist in the transition towards long-duration storage technologies, expanding into emerging markets lacking reliable grid infrastructure, and further integrating battery systems with electric vehicle charging ecosystems. These factors collectively exert significant impact forces shaping the trajectory of the market.

Major driving forces include the decreasing Levelized Cost of Electricity (LCOE) for solar PV paired with storage, mandatory renewable portfolio standards (RPS) in developed nations, and technological advancements improving energy density and safety features of lithium-ion cells. Additionally, the increasing frequency of grid instabilities caused by extreme weather events drives consumer demand for resilient backup power, especially in residential and critical infrastructure segments. The proliferation of digital technologies that enable granular control and monitoring further acts as a powerful catalyst for adoption.

However, the market faces headwinds from volatility in raw material prices (particularly lithium, cobalt, and nickel), which can impact manufacturing costs and consumer prices. Safety concerns related to thermal runaway and fire risks in high-density batteries necessitate stringent safety protocols and regulatory oversight, potentially slowing deployment speed in some regions. The limited life cycle of some battery chemistries and the necessity for robust recycling infrastructure also present long-term challenges that require technological and policy solutions to overcome.

Segmentation Analysis

The Solar Battery Market is meticulously segmented across various dimensions, including Chemistry, Connection Type, Application, Installation Location, and Capacity Range, reflecting the diverse requirements of end-users ranging from small residential systems to massive utility-scale storage projects. The analysis of these segments is crucial for understanding specific market dynamics, identifying high-growth niches, and tailoring product development strategies. The dominance of Lithium-Ion technology across most segments underscores its current maturity and performance advantage, while the growing divergence between front-of-the-meter (FTM) and behind-the-meter (BTM) applications dictates the requisite battery capacity and functionality.

- By Chemistry:

- Lithium-Ion (Li-ion)

- Lithium Nickel Manganese Cobalt (NMC)

- Lithium Iron Phosphate (LFP)

- Lead-Acid

- Flow Batteries (Vanadium Redox, Zinc-Bromine)

- Others (e.g., Sodium-Ion, Solid-State)

- Lithium-Ion (Li-ion)

- By Application:

- Residential

- Commercial & Industrial (C&I)

- Utility-Scale

- By Connection Type:

- On-Grid (Grid-Tied)

- Off-Grid (Stand-Alone)

- By Installation Location:

- Behind-the-Meter (BTM)

- Front-of-the-Meter (FTM)

Value Chain Analysis For Solar Battery Market

The Solar Battery Market value chain begins with the critical upstream activities of raw material extraction and refinement, particularly focused on core components like lithium, cobalt, nickel, graphite, and electrolyte solvents. Geopolitical factors significantly influence this stage, as the concentration of these resources in specific regions necessitates complex global supply chain management and strategic partnerships to ensure continuity and competitive pricing. Rigorous material processing and purification are essential to meet the demanding specifications required for high-performance and safety-certified battery cells, setting the foundational cost structure and performance limits for the entire product.

The midstream segment involves the highly sophisticated processes of cell manufacturing, module assembly, and battery pack integration. Cell manufacturing is capital-intensive and requires high technological expertise to ensure uniformity, safety, and longevity. Subsequently, these cells are packaged into modules and finally into robust battery packs, which include critical Balance of System (BOS) components such as Battery Management Systems (BMS), thermal management systems, and enclosures. The BMS, often incorporating advanced AI features, is arguably the most crucial technological component, managing charge optimization, monitoring state-of-charge, and preventing hazardous operating conditions.

Downstream activities focus on distribution, installation, and post-sales servicing. Distribution channels utilize a mix of direct sales to large utility and commercial clients, and indirect channels relying on specialized wholesalers, solar installers, and certified system integrators for the residential market. The complexity of installation requires skilled labor and adherence to strict local electrical and safety codes. After-market services, including performance monitoring, warranty claims, and eventual recycling or repurposing of battery components, form the final, increasingly important loop of the value chain, driven by sustainability targets and circular economy principles.

Solar Battery Market Potential Customers

The primary end-users and buyers of solar battery solutions can be broadly categorized into three distinct segments: residential homeowners seeking energy autonomy; commercial and industrial enterprises focused on operational efficiency; and utility companies striving for grid stability and renewable energy integration. Each customer group exhibits unique purchasing drivers, capacity requirements, and integration complexities. Understanding these diverse needs is essential for manufacturers and service providers to effectively target their offerings and maximize market penetration.

Residential customers represent a high-volume market segment driven primarily by motivations such as enhanced energy security (backup during power outages), economic savings through peak shaving and optimized self-consumption, and environmental consciousness. Their purchasing decisions are heavily influenced by government incentives (e.g., tax credits, rebates), brand reputation, warranty length, and the ease of integration with existing or new solar PV systems. This group typically prefers lower capacity systems (5 kWh to 20 kWh) that are aesthetically pleasing and require minimal user intervention.

Commercial and Industrial (C&I) clients utilize solar batteries for strategic energy management purposes, predominantly focusing on reducing high demand charges incurred during peak operating hours. For large businesses, reliability and maximizing the return on investment (ROI) through sophisticated energy arbitrage are paramount. This segment requires medium to large-scale deployments (50 kWh to multi-MWh systems) and necessitates robust integration with facility energy management systems. Utility companies and Independent Power Producers (IPPs), conversely, purchase utility-scale battery storage (10 MWh to hundreds of MWh) for grid stabilization, deferring transmission upgrades, and integrating vast amounts of intermittent solar and wind generation, where performance metrics like response time, power output, and system reliability are the decisive purchasing factors.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 15.5 Billion |

| Market Forecast in 2033 | USD 52.0 Billion |

| Growth Rate | 18.9% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Tesla, LG Energy Solution, Samsung SDI, BYD, Contemporary Amperex Technology Co. Limited (CATL), Panasonic Corporation, Fluence, Enphase Energy, Sonnen, Generac Power Systems, Varta AG, Hitachi Energy, Siemens Energy, Duracell, SimpliPhi Power, Eguana Technologies, Lockheed Martin, Leclanché, Northvolt, Exide Technologies |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Solar Battery Market Key Technology Landscape

The Solar Battery Market technology landscape is predominantly defined by advancements in lithium-ion chemistry, which has achieved market supremacy due to its high energy density, efficiency, and decreasing cost curve. Within the Li-ion segment, two main chemistries compete: Lithium Nickel Manganese Cobalt (NMC) and Lithium Iron Phosphate (LFP). NMC cells offer superior energy density, making them preferred for applications where space and weight are highly constrained, such as residential installations requiring high power output. LFP, conversely, provides enhanced safety characteristics, longer cycle life, and lower material costs, making it increasingly favored for stationary storage, especially in large-scale commercial and utility projects where the slightly lower energy density is a negligible trade-off for improved fire resistance and durability. The continuous refinement of cell packaging and thermal management systems for both chemistries remains a critical focus area for manufacturers.

Beyond traditional Li-ion, significant research and development efforts are focused on next-generation storage solutions designed to address the limitations of current technology, particularly concerning long-duration storage needs. Flow Batteries, specifically Vanadium Redox Flow Batteries (VRFBs), represent a mature alternative gaining traction in the utility sector. Flow batteries decouple power and energy capacity, allowing them to store large amounts of energy for extended periods (4 to 10+ hours). Although they have a larger footprint and lower energy density compared to Li-ion, their non-degrading electrolyte, exceptional cycle life, and inherent safety features make them highly viable for utility and large C&I applications requiring long-duration flexibility and minimal replacement cycles over a twenty-year operational life.

Emerging technologies, including Solid-State Batteries (SSBs) and Sodium-Ion (Na-ion) batteries, are poised to disrupt the market. SSBs promise drastically improved safety (eliminating flammable liquid electrolytes), higher energy density, and faster charging capabilities, though commercial scaling remains a challenge. Na-ion batteries are particularly exciting due to their reliance on abundant and low-cost raw materials (sodium), potentially offering a cheaper, if slightly less energy-dense, alternative to lithium, specifically targeting cost-sensitive, high-volume stationary storage markets. The overall technology landscape is moving towards chemistry diversification, tailoring specific solutions to the unique performance and duration requirements of residential, commercial, and utility applications, driven by continuous innovation in material science and system integration.

Regional Highlights

- Asia Pacific (APAC):

The APAC region is the undisputed leader in the global solar battery market, accounting for the largest share in terms of both manufacturing capacity and deployment. This dominance is primarily driven by massive governmental investments in renewable energy infrastructure, rapid industrialization, and high population density requiring distributed energy solutions. Countries such as China, South Korea, and Japan host the world’s largest battery manufacturing facilities, benefiting from economies of scale and sophisticated supply chain ecosystems. China, in particular, leads globally in the production of lithium-ion batteries and is aggressively deploying storage solutions to manage its ambitious solar and wind targets, often integrating large-scale storage directly into utility transmission infrastructure to stabilize the grid and manage curtailment risks.

Beyond manufacturing, demand in emerging economies like India and Southeast Asia is accelerating due to critical needs for rural electrification, grid resilience, and managing peak demand in rapidly growing metropolitan areas. Australia serves as a key high-adoption market for residential BTM batteries, supported by high electricity costs and state-level incentives, positioning it as a mature testing ground for residential virtual power plant concepts. The region's reliance on coal and its transition towards cleaner energy sources necessitate substantial battery storage deployment to ensure system reliability during the energy transition.

Regulatory support across APAC, including mandatory energy storage targets and favorable long-term power purchase agreements (PPAs) for storage projects, further solidifies its market position. The dense population and prevalence of microgrids, especially in island nations and remote areas, also drive the demand for robust off-grid solar battery solutions that ensure energy access independent of centralized grid infrastructure, favoring solutions with proven durability and low maintenance requirements. This intense focus on both supply-side manufacturing and demand-side deployment ensures that APAC will remain the fastest-growing and largest regional market throughout the forecast period.

- North America (NA):

North America represents a highly lucrative market characterized by high consumer awareness, significant purchasing power, and favorable federal and state-level regulatory policies. The market is primarily concentrated in the United States, driven heavily by the Investment Tax Credit (ITC) and localized incentives in high-electricity cost states like California, Texas, and New York. The US residential sector shows robust growth, fueled by the rising frequency of severe weather events (hurricanes, wildfires) that emphasize the need for reliable backup power, particularly through integrated solar-plus-storage solutions. The commercial and industrial segments are rapidly adopting batteries for demand charge reduction, capitalizing on complex time-of-use tariffs to optimize operational expenditures.

The utility segment in North America is seeing colossal growth, with numerous multi-hundred megawatt-hour projects being commissioned, especially in the US Southwest, to address grid intermittency issues stemming from high solar penetration. Regulatory advancements, such as FERC Order 2222, are enabling distributed energy resources (DERs) including batteries, to participate more actively in wholesale energy markets, driving investment into large-scale front-of-the-meter (FTM) storage. Canada, while slower in adoption compared to the US, is seeing increasing interest in storage solutions to integrate renewable energy into its vast, geographically dispersed grid, particularly in provinces with strong climate action plans.

Technology adoption in North America leans heavily towards high-performance Lithium-Ion NMC and LFP chemistries, supported by rigorous product safety and certification standards. The market is highly competitive, dominated by major international players and innovative local technology providers, often focusing on integrated hardware and software solutions that leverage AI for enhanced system performance and grid interaction. The continuous legislative push towards a cleaner energy mix and grid modernization initiatives guarantees sustained high growth rates for the entire North American solar battery ecosystem.

- Europe:

Europe stands as a mature and highly developed market for solar batteries, characterized by strong environmental mandates, high retail electricity prices, and well-established decentralized energy infrastructure. Germany leads European adoption, particularly in the residential sector, benefiting from declining feed-in tariffs that incentivize homeowners to maximize self-consumption using storage. The market in the UK, Italy, and Spain is accelerating, driven by the need to optimize solar generation assets and participate in flexibility markets, offering grid services through aggregation platforms.

The European market places a high emphasis on sustainability and product lifecycle management, driving demand for batteries with long warranties, clear end-of-life recycling plans, and ethically sourced raw materials. The regulatory environment, particularly the EU’s emphasis on renewable energy directives and decarbonization goals, provides a clear, long-term policy foundation supporting market expansion across all application segments. Flow batteries and other long-duration storage technologies are increasingly being evaluated for regional grid balancing needs and seasonal energy storage requirements.

Commercial deployment in Europe focuses heavily on energy management systems integrated with EV charging infrastructure, leveraging batteries to manage high charging loads without requiring expensive grid upgrades. Furthermore, the push towards establishing local microgrids and energy communities, particularly in Northern Europe, relies heavily on localized battery storage to ensure energy resilience and local energy trading capabilities. The maturity of the installer base and advanced digital grid infrastructure facilitate rapid deployment and integration of behind-the-meter storage across the continent.

- Latin America (LA):

The Latin American solar battery market is emerging rapidly, offering significant growth potential stemming from two key factors: high solar irradiance and chronic grid instability across many countries. Brazil and Chile are primary market drivers, with Brazil focusing on distributed generation and net metering policies that encourage residential and commercial PV installation alongside storage. Chile is heavily investing in large-scale solar projects in the Atacama region and requires utility-scale battery storage to ensure power transmission stability over long distances to major consumption centers.

Grid reliability issues in several nations necessitate the deployment of off-grid and hybrid solar battery systems, particularly in remote mining operations and agricultural areas where grid connection is non-existent or unreliable. The region faces challenges related to economic volatility and reliance on foreign technology imports, but declining global battery prices are improving affordability. Investment from international development banks and private equity into sustainable energy infrastructure is crucial for accelerating storage deployment in this region.

The C&I segment is focusing on using solar batteries to mitigate high operational costs associated with diesel generation and unreliable utility power quality. Regulatory environments are gradually maturing, moving towards clear frameworks that recognize and remunerate the value of storage, which is expected to unlock further private and utility investments, especially in Mexico and Colombia, positioning Latin America as a high-potential future growth hub.

- Middle East and Africa (MEA):

The MEA region presents a diverse market landscape where demand is driven by centralized mega-projects in the Gulf Cooperation Council (GCC) nations and essential energy access initiatives across Africa. GCC countries, led by the UAE and Saudi Arabia, are undertaking monumental solar PV projects coupled with massive battery storage to diversify their energy mix away from fossil fuels and meet aggressive clean energy targets. These utility-scale projects are defining the global benchmark for low-cost solar-plus-storage solutions, utilizing sophisticated FTM systems for stability and peak power delivery.

In the African sub-continent, the market is characterized by a strong demand for small-scale, decentralized solar home systems (SHS) that include batteries, providing basic electricity access to millions in off-grid communities. Pay-as-you-go models are highly successful here, driving uptake of durable, affordable storage solutions, often based on LFP or enhanced lead-acid chemistries due to cost constraints. Furthermore, telecommunication towers across Africa rely heavily on solar PV and battery backup to maintain consistent operation, forming a significant commercial application.

Investment into resilient infrastructure is a major trend, aiming to replace diesel generators and improve power quality in key economic zones. While geopolitical factors and financial constraints pose ongoing challenges, the immense solar resource potential and the foundational need for reliable electricity position the MEA region for substantial, policy-driven growth in both centralized and decentralized solar battery deployments over the coming decade.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Solar Battery Market.- Tesla

- LG Energy Solution

- Samsung SDI

- BYD

- Contemporary Amperex Technology Co. Limited (CATL)

- Panasonic Corporation

- Fluence

- Enphase Energy

- Sonnen (Shell subsidiary)

- Generac Power Systems

- Varta AG

- Hitachi Energy

- Siemens Energy

- Duracell

- SimpliPhi Power (A Generac Company)

- Eguana Technologies

- Lockheed Martin

- Leclanché

- Northvolt

- Exide Technologies

Frequently Asked Questions

Analyze common user questions about the Solar Battery market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected Compound Annual Growth Rate (CAGR) for the Solar Battery Market?

The Solar Battery Market is projected to exhibit a robust Compound Annual Growth Rate (CAGR) of 18.9% between 2026 and 2033, driven primarily by favorable regulatory policies, decreasing technology costs, and increasing global demand for energy resilience and sustainable power solutions across all sectors.

Which battery chemistry dominates the solar storage market and why?

Lithium-Ion (Li-ion) chemistry currently dominates the solar storage market, primarily due to its high energy density, superior efficiency, long cycle life, and continuous cost reductions achieved through mass production and technological refinement, although Lithium Iron Phosphate (LFP) variants are rapidly gaining market share due to enhanced safety features.

How does solar battery storage contribute to grid stability?

Solar battery storage enhances grid stability by providing essential ancillary services, including frequency regulation, voltage support, and black start capabilities. It manages the intermittency of solar generation through instantaneous energy release (smoothing PV output) and participates in peak shaving, reducing strain on transmission infrastructure during high-demand periods.

What is the key difference between Behind-the-Meter (BTM) and Front-of-the-Meter (FTM) installations?

BTM installations are typically smaller, residential or commercial systems located on the customer's side of the utility meter, primarily used for self-consumption optimization and backup power. FTM installations are large, utility-scale systems connected directly to the transmission grid, used by grid operators for bulk energy storage, grid stability, and transmission asset deferral.

What role does Artificial Intelligence (AI) play in optimizing solar battery performance?

AI significantly optimizes solar battery performance by implementing predictive maintenance, forecasting energy generation and consumption with high accuracy, and autonomously managing charge/discharge cycles based on dynamic electricity tariffs and real-time grid conditions, thereby maximizing the system's economic return and extending its operational lifespan.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Solar Battery Chargers Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- LED Solar Simulator Market Statistics 2025 Analysis By Application (Solar Battery Production, Scientific Research), By Type (AAA Class, ABA Class), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager