Solar Cell Metal Paste Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434186 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Solar Cell Metal Paste Market Size

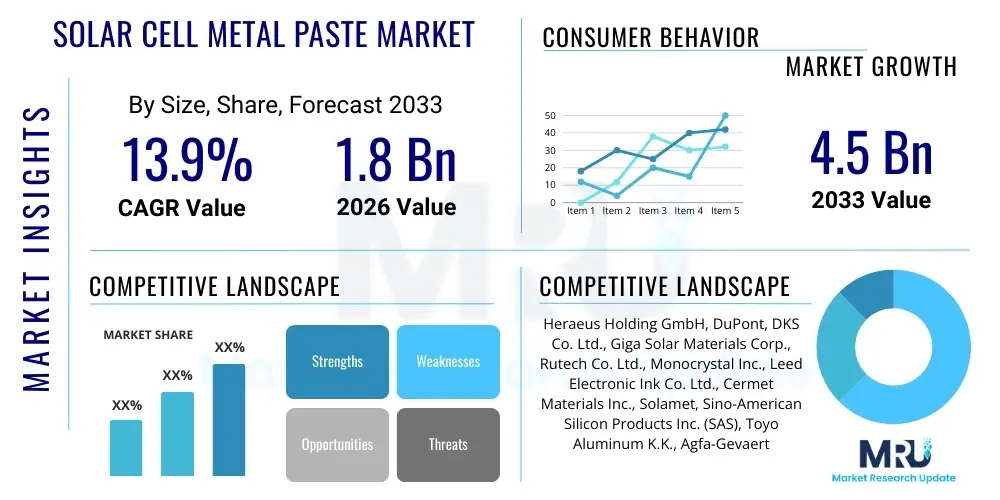

The Solar Cell Metal Paste Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 13.9% between 2026 and 2033. The market is estimated at USD 1.8 Billion in 2026 and is projected to reach USD 4.5 Billion by the end of the forecast period in 2033.

Solar Cell Metal Paste Market introduction

The Solar Cell Metal Paste Market encompasses the specialized conductive materials, primarily silver and aluminum formulations, essential for creating the electrical contacts and electrodes on photovoltaic (PV) cells. These pastes are crucial for efficiently extracting the generated electrical current from the silicon wafer. Their composition and performance directly impact the efficiency, durability, and manufacturing cost of solar modules, positioning them as a critical enabling technology within the rapidly expanding renewable energy sector. The core function involves screen-printing these viscous materials onto the silicon wafer and firing them at high temperatures (or low temperatures for advanced cells like HJT) to form ohmic contacts.

Major applications of metal pastes span various cell architectures, including Passivated Emitter and Rear Cell (PERC), Tunnel Oxide Passivated Contact (TOPCon), and Heterojunction (HJT) technologies. The shift towards higher efficiency cell designs necessitates the continuous innovation of metal paste formulations, demanding ultra-fine line printing capabilities, improved adhesion, and reduced contact resistance. The benefits derived from high-performance metal pastes include enhanced conversion efficiency of the solar module, prolonged operational life, and greater power output per unit area, directly contributing to lower Levelized Cost of Electricity (LCOE).

The market is primarily driven by aggressive global solar capacity additions, favorable government policies promoting renewable energy adoption, and intense competitive pressures among manufacturers to achieve marginal gains in cell efficiency. Furthermore, technological transitions, particularly the mass migration from standard Aluminum Back Surface Field (BSF) and established PERC technologies to advanced N-type cells like TOPCon, are generating sustained demand for specialized, high-conductivity silver pastes capable of meeting stringent performance requirements for passivation layers and ultra-thin metallization fingers. This technological push is a central element fueling market growth.

Solar Cell Metal Paste Market Executive Summary

The Solar Cell Metal Paste Market is experiencing a significant strategic shift, primarily driven by the transition from traditional P-type wafer technology to highly efficient N-type architectures, notably TOPCon and HJT. This transition mandates the use of highly specialized silver pastes, including low-temperature silver paste necessary for HJT cells, and high-conductivity silver pastes optimized for TOPCon structures. Key business trends involve intense research and development focused on replacing expensive silver with cost-effective alternatives, such as plated copper or hybrid materials, although silver remains the dominant material due to its unmatched conductivity and processing stability in current large-scale production environments. Supply chain stabilization and geopolitical factors affecting the price volatility of key raw materials, especially silver powder, remain critical business challenges influencing profitability and pricing strategies across the sector.

Geographically, the Asia Pacific (APAC) region, spearheaded by China, maintains undisputed dominance in terms of both consumption and production capacity, reflecting the concentration of the global solar manufacturing ecosystem in this area. Regional trends indicate robust growth in Southeast Asia and India as manufacturing shifts accelerate, driven by lower operational costs and increasing domestic solar installation targets. Europe and North America are also witnessing growth, primarily fueled by the local establishment of cell manufacturing facilities aiming for supply chain resilience and compliance with local content requirements, thereby increasing regional demand for paste suppliers with localized production or strong logistical capabilities.

In terms of segment trends, the Application segment shows the most dynamic evolution, with pastes designed specifically for TOPCon and HJT rapidly gaining market share against those for conventional PERC cells. The Type segment is characterized by the continued supremacy of silver paste, especially for front-side metallization, while aluminum paste maintains its role in back-side metallization for traditional P-type cells. The future trajectory involves the commercialization of specialized conductive inks and pastes capable of utilizing alternative metallization techniques like dispensing or laser-induced doping, promising further cost reduction and efficiency gains in the medium to long term, thus fundamentally reshaping the competitive landscape.

AI Impact Analysis on Solar Cell Metal Paste Market

Common user questions regarding AI’s impact on the Solar Cell Metal Paste Market often center on optimizing complex paste formulations, improving the precision of the screen-printing process, and predicting raw material price fluctuations (particularly silver). Users frequently inquire about how AI can accelerate the R&D cycle for novel low-cost, high-performance materials and how machine learning (ML) models can be integrated into Quality Control (QC) systems to detect microscopic defects in metallization patterns in real-time. The collective expectation is that AI will introduce unprecedented levels of process control and efficiency, minimizing material wastage and accelerating the development of next-generation pastes capable of supporting sub-100-micron finger widths and supporting the demanding requirements of advanced cell technologies like tandem or perovskite cells, thereby securing a competitive edge for manufacturers embracing smart manufacturing.

- AI optimization of paste rheology and viscosity parameters for high-speed, fine-line screen printing.

- Predictive modeling of silver powder purity and performance based on input material properties.

- Machine learning algorithms enhancing Quality Control (QC) by identifying microscopic metallization defects on PV cells.

- Accelerated R&D and screening of novel, non-silver conductive materials using AI-driven simulation platforms.

- Supply chain resilience achieved through AI-powered forecasting of critical raw material price volatility.

- Optimization of furnace firing profiles and curing temperatures to maximize paste adhesion and conductivity.

DRO & Impact Forces Of Solar Cell Metal Paste Market

The market is critically balanced by robust drivers, significant restraints, and clear opportunities, creating powerful impact forces. Key drivers include the overwhelming global demand for solar energy installations, fueled by climate goals and decreasing LCOE of solar power, which naturally escalates the requirement for metal pastes. Simultaneously, relentless technological advancements in solar cell design, pushing for higher efficiencies (e.g., from PERC to TOPCon and HJT), necessitate specialized, high-performance pastes, thereby maintaining high value in the market. The fundamental restraint, however, is the significant volatility and high cost of silver, the primary raw material, which compels manufacturers to continuously seek cheaper alternatives, potentially delaying the universal adoption of ultra-high-performance silver pastes.

Major opportunities are concentrated in the development and commercialization of lead-free and low-temperature curing pastes. Low-temperature pastes are essential for temperature-sensitive cell structures like HJT and thin-film technologies, opening up new, high-growth application segments. Furthermore, the push towards establishing localized, resilient solar supply chains outside of traditional APAC centers offers diversification opportunities for specialized regional paste suppliers. The prevailing impact force is the fierce competition among PV manufacturers, which puts immense pressure on metal paste suppliers to deliver efficiency gains at stable or decreasing costs, forcing suppliers to invest heavily in nanotechnology and process innovation to improve paste performance without proportional increases in material expenditure.

The synergy between technological advancements and cost reduction pressures dictates the market's trajectory. While the demand for silver remains high due to performance needs, the sustainability drive creates opportunities for innovative copper-based or hybrid paste systems. These dynamic forces ensure that the market for solar cell metal paste remains highly competitive, innovation-intensive, and closely tied to global macroeconomic trends, renewable energy policies, and raw material supply chain dynamics. The ability of key players to manage raw material risk while continuously delivering efficiency breakthroughs defines their long-term competitive success.

Segmentation Analysis

The Solar Cell Metal Paste Market segmentation provides crucial insights into product specialization and end-user adoption patterns. Segmentation is primarily based on the conductive material used (Type), the specific function on the cell (Function), and the technological architecture of the solar cell (Application). The Type segment is dominated by silver paste, which is vital for front-side metallization due to its superior conductivity, despite its high cost. However, the market is actively developing cost-effective silver-aluminum blends and exploring copper-based alternatives, which are poised to disrupt the back-side paste market currently held by aluminum.

The Application segment is undergoing the most rapid transformation, transitioning heavily toward pastes compatible with advanced N-type cell structures, particularly TOPCon and HJT. This shift is driving demand for new formulations optimized for specific processes, such as ultra-fine line printing required for maximizing light capture and the low-temperature curing necessary to protect the intrinsic materials in HJT cells. The performance differentiation required by these technologies creates premium opportunities for suppliers who can meet stringent material science requirements and demonstrate consistent, repeatable performance gains under mass production conditions.

Furthermore, segmentation by Function highlights the specialized requirements for front-side versus back-side pastes. Front-side pastes require the highest conductivity and fine-line capabilities, demanding premium silver formulations. In contrast, back-side pastes historically relied on aluminum for the back surface field effect; however, advanced cells require highly specialized silver or silver-aluminum pastes for reliable contact formation and improved electrical properties. Understanding these distinct functional demands is essential for market players tailoring their product portfolios to capture growth in specific high-value segments.

- Type:

- Silver Paste

- Aluminum Paste

- Silver Aluminum Paste

- Copper Paste

- Other Conductive Pastes (e.g., Lead-free formulations)

- Application:

- PERC (Passivated Emitter and Rear Cell)

- TOPCon (Tunnel Oxide Passivated Contact)

- HJT (Heterojunction Technology)

- BSF (Back Surface Field)

- Emerging Technologies (e.g., Perovskite, Tandem Cells)

- Function:

- Front Side Silver Paste

- Back Side Aluminum Paste

- Back Side Silver/Silver-Aluminum Paste

- Busbar Pastes

- Cell Generation:

- First Generation (Wafer-based)

- Second Generation (Thin Film)

- Third Generation (e.g., Perovskite, Dye-sensitized)

Value Chain Analysis For Solar Cell Metal Paste Market

The value chain for solar cell metal paste is highly sophisticated and dominated by material science, starting with the upstream sourcing of ultra-pure metallic powders, primarily silver. Upstream analysis involves a few specialized chemical and metallurgical companies that produce nano-sized silver and aluminum particles, which are the fundamental raw materials dictating the final paste’s conductivity and rheological properties. The purity, particle size distribution, and morphology of these powders are critical determinants of the solar cell's eventual performance, making the supplier base highly specialized and concentrated. Fluctuations in global commodity markets, particularly silver prices, exert significant pressure upstream, impacting production costs and requiring advanced hedging strategies by paste manufacturers.

The core manufacturing stage involves proprietary blending processes where the metallic powder is mixed with glass frits, organic vehicles (solvents and polymers), and specialized additives to create the functional paste. This mid-stream process requires specialized expertise in chemical engineering and formulation science to ensure the paste possesses the required characteristics for screen printing (viscosity, thixotropy) and subsequent firing (adhesion, contact resistance). Paste manufacturers, who are often large multinational chemical corporations or specialized material science companies, hold significant intellectual property related to their glass frit compositions and organic vehicle systems, providing them with a competitive moat against new entrants.

Downstream distribution typically occurs through direct sales channels to large, integrated solar cell and module manufacturers (Original Equipment Manufacturers - OEMs). Due to the technical nature and high volume required, indirect distribution through third-party distributors is less common but exists for smaller manufacturers or emerging regional markets. The relationship between the paste supplier and the solar cell producer is often symbiotic, involving extensive collaborative R&D to tailor paste performance for specific production lines and cell architectures. Efficiency gains are often achieved through minor adjustments in paste composition or firing profiles, emphasizing the need for robust technical support and a close supplier-customer relationship throughout the entire product lifecycle.

Solar Cell Metal Paste Market Potential Customers

Potential customers for solar cell metal paste are primarily large-scale, integrated photovoltaic (PV) cell and module manufacturers globally, often referred to as tier-one players. These manufacturers, characterized by high production volumes and continuous optimization of cell efficiency, are the largest buyers, demanding substantial quantities of highly consistent and performance-verified pastes. Their purchasing decisions are driven by strict requirements concerning paste rheology for high-speed printing, ultra-low contact resistance, long-term durability, and, critically, the achieved efficiency gains in real-world production lines. They often engage in multi-year contracts and require extensive technical support during product qualification.

A second significant customer base includes specialized solar cell producers who focus on niche markets such as high-efficiency bifacial modules, custom-sized cells, or specialized thin-film applications. These buyers often require tailored paste formulations that standard products cannot provide, leading to opportunities for boutique or highly innovative paste suppliers. For instance, manufacturers focusing on Heterojunction (HJT) cells are exclusive buyers of low-temperature curing pastes, representing a high-value, fast-growing segment where performance and specific material compatibility outweigh initial cost considerations.

Furthermore, research institutions, university laboratories, and pilot lines involved in developing next-generation PV technologies, such as tandem cells (Perovskite-on-Silicon), constitute potential, albeit smaller, customers. While their volumes are low, these entities are vital for validating the performance of experimental pastes, particularly those exploring alternative materials like copper or novel organic conductive materials. Engaging with this customer segment allows paste suppliers to position their technology for future commercialization, securing early mover advantage in emerging material science fields within the photovoltaic sector. The purchasing power remains concentrated among the top ten global PV manufacturers who dictate technology adoption trends.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.8 Billion |

| Market Forecast in 2033 | USD 4.5 Billion |

| Growth Rate | 13.9% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Heraeus Holding GmbH, DuPont, DKS Co. Ltd., Giga Solar Materials Corp., Rutech Co. Ltd., Monocrystal Inc., Leed Electronic Ink Co. Ltd., Cermet Materials Inc., Solamet, Sino-American Silicon Products Inc. (SAS), Toyo Aluminum K.K., Agfa-Gevaert NV, Shoei Chemical Inc., Exxelia Group, Noritake Co. Limited, Wuxi Utmost Technology Co. Ltd., Shanghai Huahong Technology Co. Ltd., PV Crystalox Solar PLC, ENF Technology Co. Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Solar Cell Metal Paste Market Key Technology Landscape

The current technology landscape in the solar cell metal paste market is defined by several core innovations aimed at increasing electrical conductivity while minimizing material usage, primarily due to the high cost of silver. A central technological focus is the development of ultra-fine line printing pastes. As cell efficiency increases, the metallization fingers on the front side of the solar cell must become thinner—approaching 30-micron widths—to reduce shading and maximize light absorption without sacrificing electrical output. This requires paste formulations with extremely stable rheology (viscosity and flow properties) and precise particle size control (nanotechnology) to ensure consistent, defect-free deposition during high-speed screen-printing processes.

Another crucial technological development is the proliferation of low-temperature curing (LTC) pastes, primarily demanded by Heterojunction (HJT) solar cells. HJT cells utilize amorphous silicon layers that cannot withstand the high firing temperatures (typically 750-850 degrees Celsius) required for conventional PERC or BSF pastes. LTC pastes, which cure effectively at temperatures below 250 degrees Celsius, necessitate the use of different glass frits and organic binders that activate at lower heat levels while still ensuring strong adhesion and optimal ohmic contact with the silicon wafer surface. This technological divergence separates the market into two distinct processing streams, requiring specialized R&D efforts from leading paste suppliers.

Furthermore, the drive for sustainability and regulatory compliance is accelerating the transition toward lead-free paste formulations across all cell types. Traditional pastes often contained lead-bearing glass frits, which are being phased out in response to global environmental regulations (like RoHS compliance). Paste manufacturers are innovating non-lead-based glass systems that provide comparable etching capability and contact formation properties during firing, ensuring long-term module reliability without compromising cell performance. The convergence of nanotechnology for particle optimization, sophisticated rheology control for fine-line printing, and advancements in lead-free glass frit chemistry defines the technological competitive arena in this market, impacting both cost and efficiency outputs dramatically.

Regional Highlights

The Asia Pacific (APAC) region stands as the undisputed global powerhouse for the Solar Cell Metal Paste Market, driven primarily by China, which accounts for the vast majority of global solar cell production capacity. China’s centralized and technologically advanced PV supply chain not only consumes the largest volume of paste but also dictates material performance standards and pricing trends globally. Regional growth is further supported by rapidly expanding manufacturing bases in Southeast Asian countries (like Vietnam, Thailand, and Malaysia) and India, as global supply chains diversify, seeking favorable trade conditions and proximity to end-use markets. This high concentration ensures that APAC remains the primary innovation hub and consumption center for conductive pastes.

Europe and North America represent high-value markets experiencing renewed growth, largely catalyzed by political mandates aimed at enhancing energy independence and establishing domestic manufacturing capabilities. In Europe, the focus on sustainable, high-efficiency technology drives demand for premium, often lead-free, pastes compatible with TOPCon and HJT cells, even though total volume remains significantly lower than APAC. Government subsidies and initiatives like the European Green Deal are encouraging local PV manufacturing, providing opportunities for specialized paste suppliers to partner with nascent European cell producers, emphasizing supply chain transparency and regional sourcing.

North America is demonstrating robust potential, influenced by policies such as the Inflation Reduction Act (IRA) in the US, which heavily incentivizes domestic production of solar components. This legislation is directly stimulating the establishment or expansion of local solar cell manufacturing plants, creating a significant, localized demand center for metal pastes. While historically reliant on imports, the region is transitioning toward a more integrated, local supply chain, requiring paste manufacturers to invest in North American distribution and potentially localized production facilities to meet the stringent domestic content requirements established by government purchasing programs, ensuring a predictable, yet capacity-constrained, growth trajectory.

- Asia Pacific (APAC): Dominates consumption and production; highly concentrated market driven by China; rapid growth in India and Southeast Asia (Vietnam, Thailand) due to supply chain diversification and large domestic installation goals.

- Europe: Focus on high-efficiency, premium, and lead-free pastes; growth driven by energy security mandates and supportive policies aiming to re-shore PV manufacturing capabilities.

- North America: Emerging rapid growth market supported by governmental legislation (IRA) promoting domestic solar cell manufacturing; increasing requirement for localized sourcing and resilient supply chains.

- Latin America & Middle East/Africa (MEA): Smaller, emerging markets; growth tied to specific large-scale utility projects and localized assembly operations, focusing primarily on cost-effective, established PERC paste technologies.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Solar Cell Metal Paste Market.- Heraeus Holding GmbH

- DuPont

- DKS Co. Ltd.

- Giga Solar Materials Corp.

- Rutech Co. Ltd.

- Monocrystal Inc.

- Leed Electronic Ink Co. Ltd.

- Cermet Materials Inc.

- Solamet

- Sino-American Silicon Products Inc. (SAS)

- Toyo Aluminum K.K.

- Agfa-Gevaert NV

- Shoei Chemical Inc.

- Exxelia Group

- Noritake Co. Limited

- Wuxi Utmost Technology Co. Ltd.

- Shanghai Huahong Technology Co. Ltd.

- PV Crystalox Solar PLC

- ENF Technology Co. Ltd.

- Kaihong Electronic Material Technology Co. Ltd.

Frequently Asked Questions

Analyze common user questions about the Solar Cell Metal Paste market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the demand for Solar Cell Metal Paste?

The primary factor is the unprecedented global demand for solar photovoltaic installations, coupled with the mandatory technological shift towards higher-efficiency N-type solar cells (like TOPCon and HJT), which require specialized, high-performance silver pastes for optimal current collection.

How is the market addressing the high cost and volatility of silver?

The market is actively addressing silver cost through focused R&D on fine-line printing techniques to minimize paste consumption per cell, and by exploring cost-effective alternatives such as copper-based pastes and hybrid silver-aluminum formulations for less critical metallization applications.

Which solar cell technology currently dictates the demand for specialized pastes?

Tunnel Oxide Passivated Contact (TOPCon) and Heterojunction (HJT) technologies are dictating specialized demand. HJT cells specifically require innovative Low-Temperature Curing (LTC) silver pastes to protect their temperature-sensitive amorphous silicon layers during processing.

What role does the Asia Pacific region play in the global Metal Paste Market?

The Asia Pacific region, particularly China, is the dominant global hub, holding the largest share of both solar cell manufacturing capacity and paste consumption. It is the core center for material innovation, pricing, and high-volume production scaling globally.

What is the significance of lead-free formulations in the market?

Lead-free formulations are critical for meeting evolving global environmental regulations (such as European RoHS directives) and enhancing the overall sustainability profile of solar modules, representing a growing compliance and performance requirement for next-generation pastes.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager