Solar Control Window Films Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433333 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Solar Control Window Films Market Size

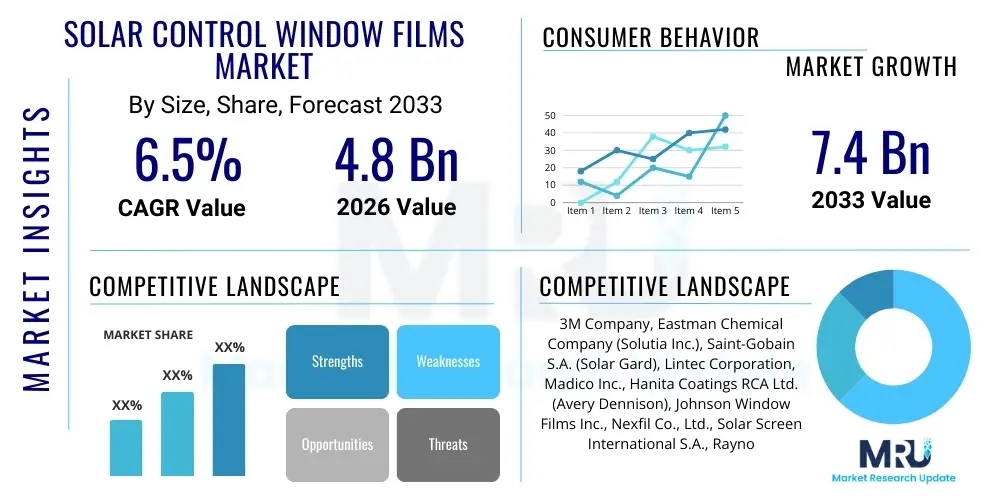

The Solar Control Window Films Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 4.8 Billion in 2026 and is projected to reach USD 7.4 Billion by the end of the forecast period in 2033. This substantial growth trajectory is underpinned by increasing global focus on energy efficiency in the building and automotive sectors, driven by stringent governmental regulations aimed at reducing carbon footprints and enhancing sustainable infrastructure. The continuous evolution of film technology, incorporating advanced materials like nanoparticles and selective spectral coatings, contributes significantly to market expansion by offering superior heat rejection and UV protection capabilities without compromising visible light transmission. Investment in advanced manufacturing techniques, particularly in the Asia Pacific region, is further accelerating the availability and affordability of high-performance solar control solutions.

Market expansion is also heavily influenced by demographic shifts and urbanization trends, leading to increased construction activities globally. In commercial sectors, the need to manage rising operational costs, primarily related to heating, ventilation, and air conditioning (HVAC) systems, positions solar control window films as a cost-effective, retrofit solution. The residential segment is witnessing strong adoption due to heightened consumer awareness regarding health hazards associated with prolonged UV exposure and the desire for improved indoor comfort. Furthermore, the automotive sector uses these films extensively to reduce cabin temperatures, enhance driver comfort, and protect interior materials from degradation, aligning with the growing demand for premium and technologically advanced vehicle accessories. The integration of smart film technologies that allow dynamic control over solar heat gain represents a future growth avenue that will maintain market momentum throughout the forecast period.

Solar Control Window Films Market introduction

Solar control window films are sophisticated, multi-layered polyester or plastic sheets applied to glass surfaces to manage the amount of solar radiation penetrating windows. These films are engineered to selectively reject specific wavelengths of the solar spectrum, primarily ultraviolet (UV) light, visible light, and infrared (IR) heat. The core objective of these products is to enhance energy efficiency by reducing solar heat gain, thus minimizing reliance on air conditioning systems, while simultaneously providing glare reduction and protection against harmful UV rays. Modern solar control films incorporate cutting-edge materials, such as metals (for reflectivity), dyes (for absorption), and ceramic nanoparticles, which allow for spectral selectivity—meaning they can reject significant heat (IR) while maintaining high levels of visible light transmission (VLT). This technological duality ensures optimal indoor comfort and aesthetic appeal, making them integral components in sustainable building design and automotive manufacturing.

The major applications of solar control window films span across the architectural, automotive, and marine industries. In the architectural sector, they are crucial for both new construction and retrofitting existing commercial buildings, government facilities, and residential complexes seeking LEED certification or enhanced energy performance. For the automotive industry, these films are vital for improving fuel efficiency by reducing air conditioning load, protecting vehicle interiors from sun damage, and increasing occupant privacy and safety. Key benefits derived from the deployment of these films include substantial energy savings, protection of furnishings and artifacts from fading, improved visual comfort by reducing glare, and enhanced glass safety through splinter retention in case of breakage. These benefits collectively serve as primary driving factors for market adoption, coupled with stringent environmental regulations promoting sustainable energy solutions worldwide.

Driving factors for the market are multifold, encompassing energy conservation mandates, technological innovations, and escalating consumer demand for comfort and safety. The increasing cost of electricity and natural gas motivates building owners to seek passive cooling solutions, making window films a highly attractive investment with short payback periods. Furthermore, ongoing research and development focusing on durable, aesthetically pleasing, and highly efficient products, such as sputtered metal films and spectrally selective coatings, continually broadens the application scope. The robust growth in construction activities, particularly in emerging economies, further solidifies the demand base for these energy-saving window solutions, ensuring sustained market growth across all geographical regions.

- Key Product Description Attributes: Multi-layered polymer construction, UV rejection exceeding 99%, variable Visible Light Transmission (VLT), spectral selectivity, superior solar heat gain coefficient (SHGC) reduction, availability in reflective, non-reflective, and ceramic formulations, pressure-sensitive adhesive backing for installation.

- Major Applications Driving Demand: Commercial office buildings seeking energy optimization, residential properties enhancing comfort and UV protection, automotive aftermarket and OEM segments for vehicle heat management, institutional buildings like schools and hospitals prioritizing energy conservation, governmental and military facilities requiring enhanced security and privacy.

- Primary Market Benefits: Significant reduction in cooling costs (HVAC load), extended lifespan of interior furnishings and artwork due to minimized UV exposure, improved occupant comfort and productivity via glare control, increased safety from glass shattering, adherence to green building standards and certifications (e.g., LEED).

- Crucial Driving Factors: Rising global energy prices, increasing governmental push for building energy efficiency standards (e.g., EU Energy Performance of Buildings Directive), rapid growth in global vehicle production and consumer demand for tinted windows, advancements in nano-ceramic and selective coating technologies, growing public awareness concerning skin cancer and UV protection.

Solar Control Window Films Market Executive Summary

The Solar Control Window Films Market is characterized by robust growth, primarily propelled by global urbanization, stringent energy efficiency mandates, and technological advancements focusing on highly selective spectral coatings. Business trends indicate a strong shift towards premium products, specifically ceramic and nano-technology films, which offer exceptional heat rejection characteristics without significantly darkening the glass—addressing the aesthetic concerns often associated with traditional reflective films. Strategic mergers, acquisitions, and strong vertical integration across the value chain, from raw material supply (polyester film manufacturing) to final installation services, are prominent strategies employed by key industry players to consolidate market share and ensure quality control. Furthermore, the development of specialized films targeting specific climates, such as extremely hot desert environments or regions with high solar intensity, allows companies to effectively tailor their offerings, boosting overall market penetration and profitability margins.

Regional trends highlight the Asia Pacific (APAC) region as the fastest-growing market, driven by massive infrastructure investments, booming automotive sales, and rapid industrialization in countries such as China, India, and Southeast Asian nations. North America and Europe maintain dominance in terms of adopting highly advanced and regulated products, benefiting from established green building codes and high consumer purchasing power focused on sustainable living solutions. Segment trends show that the Architectural application segment holds the largest market share due to the vast surface area available for film application in commercial and residential buildings, while the automotive segment registers strong growth, particularly in the aftermarket sector driven by consumer customization and regulatory compliance concerning window tinting levels. The focus on high-performance films, especially those designed for insulating glass units (IGUs) in curtain wall systems, represents a key avenue for market value generation.

Overall, the market remains moderately fragmented, with a few large global players controlling significant intellectual property and distribution networks, alongside numerous smaller regional installers and private label providers. The market outlook is highly positive, underpinned by continuous product innovation aimed at enhancing durability, ease of installation, and multi-functional capabilities, such as combining solar control with security and privacy features. The increasing adoption of Building Information Modeling (BIM) and digital specification tools allows architects and engineers to accurately model the energy savings derived from film application, further integrating these solutions into large-scale commercial projects and ensuring sustainable market expansion across diverse economic landscapes.

- Business Trends: Increased focus on nano-ceramic and spectrally selective films; Vertical integration by major manufacturers; Growth in service contracts focused on large-scale commercial retrofits; Expansion of specialized training programs for professional installers; Emphasis on sustainable, low-VOC (Volatile Organic Compound) film adhesives and materials.

- Regional Trends: APAC exhibiting the highest growth due to rapid construction and rising automotive demand; North America leads in technological adoption and premium product usage; Europe driven by stringent decarbonization and energy performance regulations (EPBD); Latin America shows potential through infrastructure development; MEA focusing on extreme climate heat management solutions.

- Segments Trends (Material Type): Polyester-based films remain dominant by volume; Nano-ceramic films show the fastest growth rate driven by high-performance demand; Metallized films are popular for high heat rejection in specific commercial applications; Dyed films are primarily utilized in the low-cost automotive aftermarket sector.

- Segments Trends (Application): Architectural segment maintains largest market share (Commercial leading Residential); Automotive aftermarket segment shows continuous, consumer-driven growth; OEM adoption gaining traction, especially in luxury and electric vehicles; Increasing demand for specialized safety and security films combining solar control features for governmental assets.

AI Impact Analysis on Solar Control Window Films Market

Common user questions regarding the impact of Artificial Intelligence (AI) on the Solar Control Window Films Market frequently revolve around optimizing film performance selection, improving manufacturing efficiency, and enhancing distribution logistics. Users are keen to know how AI can assist in predicting solar heat gain patterns based on specific geographic locations, building orientation, and local climate data, thereby recommending the optimal film type (e.g., spectrally selective vs. reflective) to maximize energy savings for a given structure. There is also significant interest in leveraging AI for quality control during the lamination and coating processes, ensuring uniformity and minimizing material waste, a critical factor given the high-precision nature of nano-ceramic film manufacturing. Consumers and industry professionals alike are exploring the potential of AI-driven tools to personalize product recommendations, making the complex choice of VLT, SHGC, and IR rejection characteristics simple and reliable through predictive analytics.

The key themes emerging from this analysis summarize concerns about integrating AI into traditional manufacturing workflows and the expectation that AI will revolutionize the customization and installation process. Users anticipate AI algorithms will be crucial in designing smart window solutions where solar control films interact dynamically with building management systems (BMS). For instance, AI could analyze real-time energy consumption data, adjust smart electrochromic or thermochromic films (if integrated), and provide predictive maintenance alerts for film degradation or potential adhesive failure. Expectations are high that AI will lead to a drastic reduction in installation errors by using computer vision for precise cutting and fitting of films to complex window geometries, especially in large architectural projects, thereby improving project turnaround times and reducing labor costs associated with rework. This integration of digital intelligence is seen as necessary to meet the increasing demand for precision and efficiency in high-performance building materials.

Ultimately, the influence of AI is expected to move beyond simple product recommendation towards holistic energy ecosystem management. By analyzing vast datasets related to material stress, environmental factors, and long-term performance metrics, AI models can inform R&D efforts, accelerating the development of next-generation films that are more durable, self-cleaning, or capable of generating minor amounts of solar power. Furthermore, AI-powered chatbots and virtual consultants are beginning to streamline the pre-sales process, answering highly technical questions instantaneously and guiding clients through the specification process, ensuring that the right product is selected for the right application, thereby bolstering client satisfaction and driving higher-value sales across the commercial segment.

- AI in Predictive Performance Modeling: Utilizing machine learning algorithms to predict Solar Heat Gain Coefficient (SHGC) and U-Value changes based on film type, glass substrate, and climate zone, optimizing energy savings projections.

- AI in Manufacturing Optimization: Employing computer vision and deep learning for real-time defect detection during film coating and lamination, enhancing quality control, minimizing raw material wastage, and improving throughput uniformity.

- AI in Supply Chain Management: Using predictive analytics to forecast material demand fluctuations (e.g., PET film, adhesive resins) based on construction project pipelines and regional weather patterns, ensuring optimal inventory levels and minimizing logistical delays.

- AI in Customized Product Recommendation: Developing sophisticated recommendation engines that analyze user requirements (aesthetic, regulatory, energy saving targets) and building specifications (orientation, window type) to suggest the most cost-effective and highest-performing film solution.

- AI in Smart Film Integration: Facilitating the seamless communication and control between dynamic solar control films (e.g., electrochromic) and Building Management Systems (BMS) through intelligent feedback loops to optimize daylight harvesting and energy consumption dynamically.

- AI in Automated Installation and Cutting: Utilizing robotic systems and AI-guided cutting equipment to achieve high-precision film cutting for complex architectural glass, drastically reducing manual errors and installation time in large commercial projects.

- AI in Market Trend Analysis: Deploying natural language processing (NLP) tools to analyze social media, construction tender documents, and regulatory changes, providing real-time market intelligence for strategic product development and geographical expansion.

DRO & Impact Forces Of Solar Control Window Films Market

The dynamics of the Solar Control Window Films market are significantly shaped by a confluence of accelerating drivers, structural restraints, and compelling opportunities, all contributing to distinct impact forces. The primary driver is the pervasive global mandate for energy conservation, stemming from international agreements and national policies pushing for net-zero carbon buildings. This driver is amplified by the sheer effectiveness of high-performance films in reducing cooling loads, offering immediate and measurable energy savings. Another crucial force is the technological leap in material science, particularly the development of nano-ceramic technology, which overcomes previous aesthetic limitations (excessive reflectivity or darkness) and expands adoption into high-end residential and architectural projects where visibility and appearance are paramount. These drivers exert a high impact force, characterized by sustained, long-term market influence, compelling building owners and automobile manufacturers to integrate solar control solutions aggressively.

However, the market faces significant restraints that temper its growth rate. The foremost restraint is the relatively high initial cost associated with premium, spectrally selective films compared to standard glass treatments or traditional tinting, often leading price-sensitive consumers or small enterprises to opt for lower-quality alternatives. A secondary constraint is the lack of standardized installation quality and long-term performance guarantees across the highly fragmented installer base, which can lead to premature film degradation (e.g., bubbling, peeling) and subsequent negative consumer perceptions about product longevity and reliability. Furthermore, stringent regulatory hurdles concerning VLT levels in the automotive segment across various jurisdictions limit the application scope and necessitate diverse product portfolios, increasing complexity and compliance costs for manufacturers. These restraints represent moderate to high impact forces, requiring industry initiatives focusing on consumer education, installer certification, and warranty standardization to mitigate their negative effects.

Compensating for these restraints are substantial opportunities, chiefly centered around the massive potential in the retrofit market. A significant portion of existing commercial and residential buildings globally lacks modern energy-efficient glazing, presenting a lucrative, untapped market for solar control film retrofits—a much more cost-effective solution than full window replacement. The rise of specialized, multi-functional films that offer combined benefits—such as security/shatter resistance, privacy, and solar control—further opens up niche markets in high-security environments and governmental infrastructure. The impact forces stemming from these opportunities are high and anticipatory, driven by economic incentives (utility rebates, tax credits for energy upgrades) and ongoing technological maturity, which promises durable, aesthetically versatile, and increasingly smart (switchable) film solutions that will maintain market momentum into the next decade.

- Drivers (D):

- Increasing global mandates for building energy efficiency (e.g., BREAM, LEED, governmental energy directives).

- Rising energy costs globally necessitating passive cooling solutions and HVAC load reduction.

- Technological advancements in nano-ceramic and selective spectral coatings offering superior performance and aesthetics.

- Growing consumer awareness regarding the health risks associated with excessive UV radiation exposure.

- Expansion of the automotive aftermarket driven by customization and aesthetic preferences for tinting.

- Favorable governmental tax credits and utility rebate programs for energy-saving building upgrades.

- Restraints (R):

- High initial upfront investment required for premium, high-performance solar control films compared to conventional solutions.

- Lack of standardized installation quality leading to performance inconsistency and reduced film lifespan.

- Strict regulations on Visible Light Transmission (VLT) in automotive applications across different regions.

- Consumer skepticism regarding long-term film durability, adhesion, and clarity maintenance.

- Competition from advanced glazing technologies, such as low-emissivity (Low-E) glass and triple-pane windows, in new construction.

- Opportunities (O):

- Vast untapped potential in the retrofitting of existing commercial and residential building stock worldwide.

- Development and commercialization of multi-functional films offering combined solar control, safety/security, and privacy features.

- Emergence of dynamic, switchable (smart) solar control technologies (electrochromic and thermochromic films).

- Increased adoption in specialized transport sectors (marine, aerospace, public transit systems).

- Expansion into emerging economies (APAC, Latin America) experiencing rapid urbanization and construction booms.

- Impact Forces Analysis:

- High Impact: Energy efficiency mandates, technological innovation in ceramics, retrofit market size.

- Medium Impact: Initial cost of premium films, automotive VLT regulations, consumer awareness growth.

- Low Impact: Competition from standard Low-E glass (primarily affects new construction market share).

Segmentation Analysis

The Solar Control Window Films Market is strategically segmented based on crucial parameters including Material Type, Application, End-User, and geographical region, allowing for a detailed examination of market dynamics and opportunity areas. Material segmentation is vital as it dictates performance characteristics and price points; the key materials include Polyester (PET) based films, which form the base structure, segmented further into Dyed, Metallized, Ceramic, and Hybrid films. Ceramic films, utilizing nano-technology, are the fastest-growing segment due to their superior spectral selectivity and non-reflective aesthetic appeal. Application segmentation distinguishes between Architectural (commercial and residential buildings) and Automotive, recognizing the vastly different regulatory and performance requirements for each sector, with the Architectural segment consistently holding the dominant market share due to large volume requirements for commercial facades.

Further segment refinement involves classifying the market by End-User, primarily focusing on commercial, residential, and transport industries. The commercial end-user segment, comprising office spaces, retail outlets, and institutional facilities, is a key revenue generator due to the high energy savings potential and large-scale applicability. Regional segmentation provides critical insight into demand variations driven by climate, economic development, and local regulatory frameworks, positioning Asia Pacific as the primary growth engine while North America and Europe lead in high-value product consumption. Analyzing these segments helps stakeholders tailor their product offerings, marketing strategies, and distribution channels to effectively penetrate diverse market niches and maximize profitability within the competitive landscape.

- By Material Type:

- Dyed Films

- Metallized Films (Sputtered/Vacuum Coated)

- Ceramic Films (Nano-technology)

- Hybrid Films (Dye/Metal combinations)

- Other Films (e.g., UV-only films, Specialty Polymer blends)

- By Application:

- Architectural (Building Applications)

- Commercial Buildings (Offices, Retail, Hospitality)

- Residential Buildings (Homes, Apartments)

- Institutional Buildings (Schools, Hospitals, Government)

- Automotive

- OEM (Original Equipment Manufacturer)

- Aftermarket (Consumer Installation)

- Marine and Aerospace

- By End-User:

- Commercial Sector

- Residential Sector

- Transport Sector (Road, Rail, Sea, Air)

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America

- Middle East & Africa (MEA)

Value Chain Analysis For Solar Control Window Films Market

The value chain for the Solar Control Window Films Market is intricate, spanning from the chemical and materials industry upstream to specialized installation services downstream. The upstream segment is dominated by manufacturers of polyethylene terephthalate (PET) film, the primary base material, along with suppliers of specialized coatings, dyes, metals, and nano-ceramic particles. Quality control and technological differentiation at this stage are paramount, as the uniformity and quality of the PET substrate and the sputtering/coating materials directly impact the final film performance (e.g., clarity, UV rejection, durability). Key activities include PET film extrusion, adhesive formulation (pressure-sensitive acrylic adhesives being common), and the sophisticated process of metallization or ceramic particle incorporation, often requiring high-vacuum environments and significant capital investment, establishing high barriers to entry.

The core segment involves the conversion and manufacturing of the final solar control film product, where raw PET is coated, laminated into multi-layer structures, and cut into large master rolls. Manufacturers typically operate large-scale facilities, utilizing advanced cleanroom technology and precision slitting machinery. Distribution channels are highly varied, encompassing both direct and indirect routes. Direct distribution is common for large commercial architectural projects where manufacturers deal directly with major contracting firms or national retrofit specialists. Indirect channels involve a layered approach, utilizing national distributors, regional wholesalers, and specialized authorized dealers/installers, particularly prevalent in the fragmented automotive aftermarket and residential segments. The effectiveness of the indirect channel hinges on maintaining a standardized training and certification process to ensure installation quality, which is critical for product success.

Downstream activities are dominated by professional installation services, often performed by highly trained, certified film applicators. Installation quality is recognized as a non-negotiable component of the product's overall value proposition, as poor installation negates performance benefits and voids warranties. Post-sale services, including cleaning recommendations and warranty processing, finalize the value chain. This downstream concentration on specialized labor means that market growth is often constrained by the availability of skilled installers, particularly in rapidly expanding emerging markets. Effective management of the value chain, focusing on supply reliability upstream and service quality downstream, is crucial for companies aiming for sustained market leadership and customer retention in both the architectural and automotive sectors.

- Upstream Analysis: Sourcing of high-grade PET resin and film; Supply of specialized raw materials (e.g., proprietary metal alloys for sputtering, nano-ceramic powders, specialized dyes); Manufacturing of pressure-sensitive adhesives; Technological R&D focused on coating chemistry and layering techniques.

- Core Manufacturing: Multi-layer lamination of PET films; High-precision sputtering or chemical vapor deposition (CVD) for coating application; Dyeing and color stabilization processes; Slitting and converting large master rolls into marketable product widths; Rigorous quality assurance testing (e.g., scratch resistance, spectral performance).

- Distribution Channel:

- Direct Channel: Sales to large Architectural firms, major commercial property owners, and national automotive OEM accounts; often involves long-term procurement contracts.

- Indirect Channel: Utilization of regional master distributors, wholesale suppliers, and an extensive network of independent, authorized dealer-installers; essential for penetrating residential and automotive aftermarket segments.

- Downstream Analysis: Professional film installation services (architectural and automotive); Warranty services and customer support; Aftermarket sales of maintenance and cleaning products; End-user consumption across commercial, residential, and transport segments.

Solar Control Window Films Market Potential Customers

The potential customers for Solar Control Window Films are highly diversified across multiple sectors, united by the common need for improved energy efficiency, enhanced security, and superior occupant comfort. The primary segment is the commercial building sector, including large corporate offices, retail complexes, and hotel chains, which seek significant reductions in operating expenditures related to HVAC systems. These customers prioritize films with high-performance characteristics, long warranties, and non-disruptive installation processes suitable for occupied spaces. Energy consultants, facility managers, and commercial property owners are the key decision-makers in this segment, driven by return-on-investment (ROI) calculations based on projected energy savings and compliance with sustainability benchmarks (e.g., LEED certification requirements).

The second major group consists of residential homeowners and residential developers. Homeowners are motivated primarily by increased indoor comfort, UV protection for expensive furnishings, and glare reduction, often opting for aesthetically neutral or nano-ceramic films that do not dramatically alter the home’s exterior appearance. Developers, particularly those focusing on high-end, energy-efficient housing, integrate these films to differentiate their properties and meet increasingly stringent local energy codes. The growth in smart homes and sustainable living consciousness is significantly influencing purchasing decisions within this segment, leading to demand for higher-priced, premium products that offer measurable long-term value and health benefits associated with comprehensive UV protection.

A third significant customer segment is the automotive industry, encompassing both Original Equipment Manufacturers (OEMs) and the vast aftermarket consumer base. OEMs use solar control glass treatments in luxury and electric vehicles to manage thermal load and increase battery efficiency, treating it as a standard feature. The aftermarket, however, drives volume, comprising individual vehicle owners seeking privacy, personalization, and temperature control, often regulated by specific state or national VLT laws. Furthermore, institutional buyers—including government agencies, military facilities, and educational institutions—represent a niche yet critical customer base, often requiring specialized, multi-functional safety and security films that combine solar control with blast mitigation or forced entry resistance capabilities, thereby merging energy performance objectives with crucial security mandates.

- Commercial Sector Buyers: Facility management companies (for corporate parks), commercial real estate owners (REITs), hos

Report Attributes Report Details Market Size in 2026 USD 4.8 Billion Market Forecast in 2033 USD 7.4 Billion Growth Rate 6.5% CAGR Historical Year 2019 to 2024 Base Year 2025 Forecast Year 2026 - 2033 DRO & Impact Forces - Energy Efficiency Mandates (Driver)

- High Initial Cost of Premium Films (Restraint)

- Vast Architectural Retrofit Market (Opportunity)

- Technological Advancements in Nano-Ceramics (Driver)

Segments Covered - By Material Type (Dyed, Metallized, Ceramic, Hybrid)

- By Application (Architectural: Commercial, Residential; Automotive: OEM, Aftermarket)

- By End-User (Commercial Sector, Residential Sector, Transport Sector)

Key Companies Covered 3M Company, Eastman Chemical Company (Solutia Inc.), Saint-Gobain S.A. (Solar Gard), Lintec Corporation, Madico Inc., Hanita Coatings RCA Ltd. (Avery Dennison), Johnson Window Films Inc., Nexfil Co., Ltd., Solar Screen International S.A., Rayno Window Film, Global Window Films, Geoshield Window Film, Motoshield Pro, Continental Window Film Inc., SunTek Films, V-KOOL International Pte Ltd., Garware Hi-Tech Films Limited, Reflectiv, Bekaert Specialty Films, ASWF (American Standard Window Film). Regions Covered North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) Enquiry Before Buy Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy Solar Control Window Films Market Key Technology Landscape

The technology landscape of the Solar Control Window Films Market is characterized by continuous material science innovation aimed at enhancing spectral selectivity and film durability while improving aesthetic integration. The foundational technology remains the biaxially-oriented polyethylene terephthalate (PET) film, which provides the necessary clarity and dimensional stability. However, differentiation primarily occurs in the coating processes. Sputtering, a highly precise vacuum deposition technique, allows manufacturers to apply ultra-thin layers of metals (like silver, nickel, and titanium) onto the PET substrate, creating highly reflective films that excel at heat rejection but often come with an associated mirror-like external appearance. Advanced sputtering methods now enable multi-layer deposition of varying materials to fine-tune the spectral response, maximizing IR rejection while minimizing visible light reflectivity.

A significant technological shift involves the transition toward nano-ceramic coating technology. Ceramic films utilize tiny, non-conductive, and non-metallic nanoparticles (often titanium nitride or specialized metal oxides) infused into the film’s adhesive or substrate layers. This technology represents a crucial advancement because it offers exceptional infrared (IR) heat rejection—often exceeding 90%—without using traditional metals. This avoids potential issues like signal interference (for GPS, cellular devices, and radio) and maintains a natural, low-reflectivity appearance, making them highly desirable for luxury automotive applications and aesthetically sensitive architectural projects. The challenge lies in ensuring the uniform dispersion and stability of these nanoparticles across large film areas during the high-speed manufacturing process, a constraint that drives ongoing material science research and process optimization.

Further innovation is focused on developing multi-functional films that integrate solar control with other essential properties. For instance, combining pressure-sensitive adhesives with thicker PET layers creates safety and security films capable of retaining shattered glass fragments, mitigating hazards from accidents or blasts, while specialized UV stabilizers ensure the longevity and performance of the film under harsh solar exposure. Moreover, the burgeoning field of smart or dynamic glazing is starting to influence the film market, with electrochromic film technology allowing users to electronically switch the film’s tint and corresponding solar heat gain coefficient on demand. Although currently more expensive than traditional passive films, dynamic control systems represent the future direction for high-value architectural applications seeking ultimate control over energy management and daylighting strategies, forcing traditional film manufacturers to invest in these cutting-edge, integrated solutions.

- Sputtering Technology: High-vacuum process for applying metallic or ceramic atoms onto PET film; essential for producing reflective and spectrally selective performance films; enables precise multi-layer coating structures for specific wavelength rejection profiles.

- Nano-Ceramic Infusion: Incorporation of microscopic, non-metallic ceramic particles (e.g., TiO2, Indium Tin Oxide) into the film matrix; provides superior IR rejection (up to 95%) without signal interference or high reflectivity; currently the fastest-growing material segment.

- Lamination and Adhesive Chemistry: Development of advanced, pressure-sensitive acrylic adhesives (PSAs) that offer long-term clarity, minimal outgassing (low VOC), enhanced scratch resistance, and robust adhesion necessary for extended outdoor exposure.

- Multi-functional Composite Films: Layering solar control coatings onto thicker, more durable PET substrates (4-14 mil thickness) to achieve combined benefits of heat rejection, UV protection, and security/shatter resistance, targeting institutional and high-risk environments.

- Switchable Film Technology (Electrochromic/Thermochromic): Emerging technologies allowing the film's solar control properties (opacity or tint) to be dynamically adjusted in response to electrical input or temperature changes, providing active energy management capabilities and signaling future market convergence with smart building technologies.

Regional Highlights

- Asia Pacific (APAC): APAC represents the largest and fastest-growing market globally, driven primarily by massive urbanization, rapidly expanding middle-class income, and colossal infrastructure projects in China, India, and Southeast Asia. The region benefits from high solar intensity, necessitating effective passive cooling solutions in both residential and commercial sectors. Government initiatives promoting energy-efficient construction (e.g., India's Energy Conservation Building Code) and the booming automotive manufacturing base solidify APAC's dominance. The competitive landscape is characterized by both domestic manufacturers offering cost-effective dyed and hybrid films and increasing demand for premium ceramic products supplied by international firms.

- North America (NA): North America holds a significant market share, characterized by high consumer awareness, strict energy efficiency building codes, and a mature retrofit market. Demand is strong for high-performance, spectrally selective films driven by tax incentives and utility rebates for energy-saving commercial upgrades. The U.S. remains the largest consumer, particularly in states with hot climates (e.g., California, Texas, Florida). The region is a leader in adopting specialized safety and security films, especially for governmental and educational facilities. The automotive aftermarket is highly robust, heavily influenced by consumer trends and a well-established network of professional installers.

- Europe: The European market is mature and highly regulated, focused heavily on sustainability and compliance with directives such as the Energy Performance of Buildings Directive (EPBD). Growth is steady, driven by the retrofitting of aging building stock and stringent governmental commitments to decarbonization and net-zero goals. Germany, France, and the UK are key contributors. European consumers often prioritize high VLT films that allow maximum natural light while controlling heat, favoring advanced non-reflective ceramic and selective sputtering technologies. Regulatory standards regarding fire safety and material sustainability are particularly high in this region, influencing product formulation and material selection.

- Latin America (LA): Latin America presents strong emerging market potential, fueled by expanding construction sectors in countries like Brazil, Mexico, and Chile, coupled with favorable climatic conditions requiring solar heat management. The market is often price-sensitive, initially favoring basic dyed films, but a growing trend towards energy conservation is accelerating the adoption of metallized and hybrid films in new commercial developments. Market penetration is closely tied to economic stability and foreign investment in infrastructure, providing a moderately paced growth trajectory with significant long-term upside potential across the transport and residential segments.

- Middle East & Africa (MEA): The MEA region, particularly the Gulf Cooperation Council (GCC) countries, exhibits exceptionally high demand for solar control solutions due to extreme ambient temperatures and intense solar radiation. The necessity to reduce immense cooling loads in architectural structures drives the market, favoring films with the highest possible Solar Heat Gain Coefficient (SHGC) reduction properties, often utilizing highly reflective metallized films in commercial towers. Large-scale construction projects and governmental mandates for building energy performance in countries like UAE and Saudi Arabia are the primary market drivers. Africa’s growth is nascent but promising, focused initially on basic comfort and UV protection needs in residential and automotive applications across major economic hubs.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Solar Control Window Films Market, highlighting their strategic initiatives, product portfolios, R&D investments, and geographical presence.- 3M Company

- Eastman Chemical Company (Solutia Inc.)

- Saint-Gobain S.A. (Solar Gard)

- Lintec Corporation

- Madico Inc.

- Hanita Coatings RCA Ltd. (Avery Dennison)

- Johnson Window Films Inc.

- Nexfil Co., Ltd.

- Solar Screen International S.A.

- Rayno Window Film

- Global Window Films

- Geoshield Window Film

- Motoshield Pro

- Continental Window Film Inc.

- SunTek Films

- V-KOOL International Pte Ltd.

- Garware Hi-Tech Films Limited

- Reflectiv

- Bekaert Specialty Films

- ASWF (American Standard Window Film)

Frequently Asked Questions

Analyze common user questions about the Solar Control Window Films market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between ceramic and metallic solar control window films?

Ceramic films utilize nano-technology particles to reject infrared (IR) heat non-reflectively and do not interfere with electronic signals (GPS, cell phones). Metallic films use vacuum-sputtered metals for high heat rejection but achieve this through reflectivity, which may cause a mirrored appearance and potential signal disruption. Ceramic films are typically premium-priced and aesthetically preferred for applications requiring low reflectivity and high performance.

How significant are the energy savings achieved by installing solar control window films in commercial buildings?

Solar control window films can significantly reduce energy consumption, typically resulting in 10% to 30% savings on annual cooling costs in commercial buildings, depending on climate zone, film type, and existing glazing. By dramatically lowering the Solar Heat Gain Coefficient (SHGC), these films reduce the workload on HVAC systems, offering a favorable return on investment (ROI), often within two to five years, making them a financially viable energy retrofit solution.

What factors determine the expected lifespan and durability of installed window films?

The lifespan of high-quality solar control films typically ranges from 10 to 15 years, influenced primarily by film quality (material composition, adhesive integrity), proper professional installation, and environmental exposure. Premature failure (e.g., bubbling or peeling) is often linked to poor adhesion, extreme UV exposure, incorrect application to the glass type, or the use of improper cleaning agents which compromise the protective hard coat layer.

Are there regulatory limitations or restrictions concerning the tint darkness (VLT) for automotive window films?

Yes, Visible Light Transmission (VLT) is strictly regulated for automotive applications, varying significantly by state or country. Regulations often specify minimum VLT levels for front side windows and the windshield to ensure driver visibility and safety. Compliance is critical; vehicle owners must select films that meet the specific legal VLT requirements for their jurisdiction to avoid fines and ensure vehicle roadworthiness, making regulatory compliance a key purchasing decision factor.

How do solar control films contribute to green building certifications like LEED?

Solar control films contribute to green building certifications, particularly LEED (Leadership in Energy and Environmental Design), by improving energy efficiency (Energy & Atmosphere category), enhancing indoor environmental quality through daylighting control and glare reduction (IEQ), and reducing material consumption compared to full window replacement. Their application earns credits by documenting measurable reductions in peak energy demand and overall energy usage, supporting the building’s sustainability profile.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager