Solar Diesel Hybrid Power Systems Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438846 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Solar Diesel Hybrid Power Systems Market Size

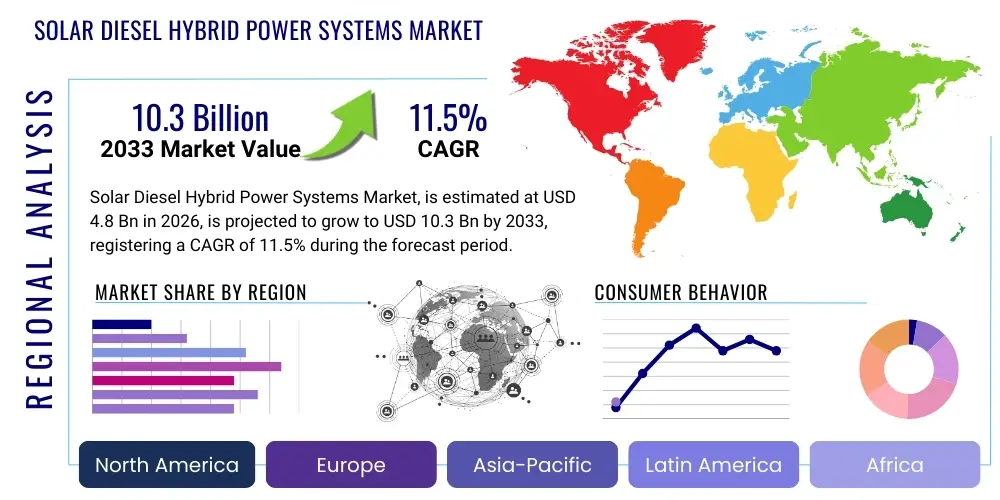

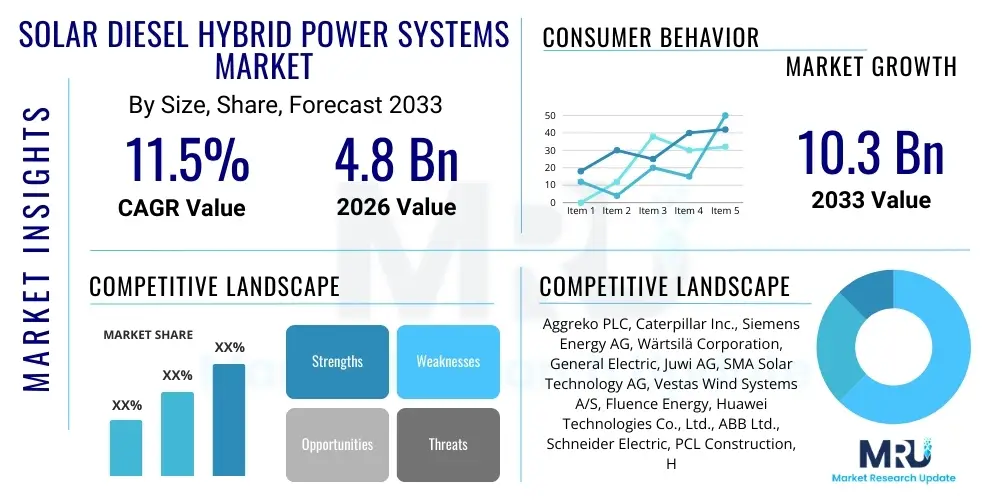

The Solar Diesel Hybrid Power Systems Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.5% between 2026 and 2033. The market is estimated at USD 4.8 Billion in 2026 and is projected to reach USD 10.3 Billion by the end of the forecast period in 2033. This growth trajectory is fundamentally driven by the increasing global emphasis on decarbonization, energy security, and the necessity for reliable power generation in remote, off-grid, and weak-grid environments where conventional grid infrastructure is either unreliable or non-existent. The declining cost parity of photovoltaic (PV) technology coupled with stringent environmental regulations governing diesel emissions catalyzes the market expansion, positioning hybrid solutions as the optimal blend of resilience and sustainability for industrial, commercial, and telecommunications applications.

Solar Diesel Hybrid Power Systems Market introduction

The Solar Diesel Hybrid Power Systems Market encompasses integrated energy generation solutions that combine solar photovoltaic (PV) technology with conventional diesel generators. This synergy allows end-users to maximize fuel efficiency, reduce operational costs, and lower carbon footprint while ensuring continuous, reliable power supply. These systems are predominantly utilized in mining operations, remote villages, telecommunication tower sites (telecom backhaul), commercial establishments, and industrial facilities that require constant, high-quality power independent of the national grid or as supplementary power to stabilize grid fluctuations. The core product integrates PV panels, power conditioning units, intelligent energy management systems (EMS), and often battery storage, working harmoniously with existing or new diesel gensets.

The primary application of solar diesel hybrids is addressing the massive energy gap in regions characterized by poor infrastructure or high cost of grid extension. By displacing significant diesel consumption during daylight hours, these systems offer a rapid return on investment, particularly in areas with high diesel transportation and operational costs. Furthermore, the inherent redundancy provided by the diesel component ensures power availability even during periods of low solar irradiation, a crucial factor for mission-critical applications like hospitals or data centers. The market is evolving rapidly, moving beyond basic PV-genset setups towards highly sophisticated microgrid architectures incorporating advanced energy storage technologies.

Key benefits driving market adoption include substantial reduction in fuel expenditure, decreased maintenance requirements for diesel generators due to lower runtime, and compliance with corporate sustainability goals (ESG). Driving factors are anchored in escalating diesel prices, supportive government policies promoting renewable energy integration, and advancements in power electronics and control systems that enable seamless transition and optimal performance management between the solar array, battery bank, and diesel generator. The continuous improvement in PV efficiency and declining battery costs further solidify the economic case for deploying these resilient hybrid solutions across diverse industrial sectors globally.

Solar Diesel Hybrid Power Systems Market Executive Summary

The Solar Diesel Hybrid Power Systems Market is characterized by robust growth driven primarily by the transition towards cleaner and more resilient energy sources in sectors historically reliant on expensive, high-emission diesel power. Business trends indicate a strong move towards modular and containerized hybrid solutions, significantly reducing installation time and complexity, thereby making deployment faster and more cost-effective, particularly in time-sensitive projects like mining exploration camps and temporary telecommunication installations. Strategic partnerships between PV suppliers, diesel generator manufacturers, and specialized energy management software providers are crucial for delivering integrated, turnkey solutions that meet sophisticated power quality requirements. Investment flows are heavily directed towards integrating advanced lithium-ion battery storage, which optimizes system performance by managing intermittency and maximizing solar penetration, substantially reducing the dependency on diesel runtime.

Regionally, Asia Pacific (APAC) currently dominates the market due to extensive electrification efforts, rapid expansion of telecommunication infrastructure, and significant industrial and mining activities in countries like India, Indonesia, and Australia, many of which operate in off-grid or weak-grid areas. North America and Europe are showing accelerated adoption, focusing on hybrid solutions for grid resiliency, peak shaving, and ensuring uninterrupted power supply for critical infrastructure. The Middle East and Africa (MEA) region presents immense potential, particularly in powering remote telecom towers and providing stable electricity access to rural communities, aided by supportive governmental initiatives aimed at reducing reliance on subsidized diesel fuel and increasing renewable energy capacity targets. Latin America, characterized by demanding mining operations and isolated communities, is also rapidly scaling up hybrid deployments.

Segment trends reveal that the Off-Grid Segment remains the largest user base, where solar diesel hybrids provide essential power access. However, the Grid-Connected Segment is experiencing the fastest growth, as utilities and industrial consumers utilize these systems for fuel hedging, mitigating high electricity tariffs during peak hours, and providing reliable backup power. Component-wise, the Energy Management Systems (EMS) segment is witnessing substantial technological advancements, integrating machine learning algorithms for predictive maintenance and optimized operational scheduling, ensuring the highest possible solar fraction while maintaining required reliability levels. The market structure remains highly competitive, with differentiation based on system integration capabilities, efficiency, and long-term service agreements offered to maintain complex hybrid setups in challenging operational environments.

AI Impact Analysis on Solar Diesel Hybrid Power Systems Market

User queries regarding AI's influence in the Solar Diesel Hybrid Power Systems Market predominantly revolve around optimizing energy flow, predictive maintenance, and enhancing operational efficiency in highly complex hybrid microgrids. Users seek to understand how AI algorithms can maximize the Solar Penetration Ratio (SPR) while maintaining stringent power quality standards, especially concerning load forecasting and battery state-of-charge management. Key concerns include the necessity for reliable data acquisition infrastructure in remote locations and the standardization of AI models across various hardware platforms (PV inverters, gensets, battery management systems). Expectations are high for AI to autonomously manage dispatch decisions, minimize diesel runtime, and forecast equipment failures, fundamentally transforming system operation from reactive control to predictive and adaptive management, thereby driving down overall Levelized Cost of Energy (LCOE).

- AI-Driven Energy Management Systems (EMS) for optimal power dispatch.

- Predictive maintenance analytics reducing unexpected diesel generator downtime.

- Real-time load forecasting to maximize solar energy harvesting efficiency.

- Enhanced battery State-of-Charge (SOC) management and life extension.

- Automated fault detection and diagnostics in complex hybrid architectures.

- Optimization of diesel generator start/stop cycles, minimizing fuel consumption.

- Machine learning for dynamic pricing integration in grid-connected systems.

- Improved weather forecasting models influencing proactive solar curtailment decisions.

- Adaptive control strategies adjusting power flows based on environmental conditions.

- Seamless integration and communication standardization across multi-vendor components.

- Digital twinning of hybrid sites for scenario planning and performance benchmarking.

- Autonomous microgrid operation reducing the need for human intervention in remote areas.

- Advanced anomaly detection safeguarding critical infrastructure from operational deviations.

- Optimized component sizing and configuration during the system design phase using prescriptive analytics.

- Streamlined regulatory compliance reporting through AI-generated operational summaries.

DRO & Impact Forces Of Solar Diesel Hybrid Power Systems Market

The market dynamics are governed by powerful drivers, necessitating rapid technological evolution and deployment, offset by specific operational restraints, yet presenting significant growth opportunities that impact long-term market valuation. The primary drivers include the escalating volatility and high cost associated with diesel fuel globally, particularly in remote regions, which significantly enhances the financial viability of solar substitution. Furthermore, increasing regulatory pressures and strict corporate ESG mandates push large industrial players, especially in mining and manufacturing, toward cleaner, hybrid solutions to demonstrate commitment to decarbonization and reduce greenhouse gas emissions associated with auxiliary power generation. Advancements in power conversion technology and the maturity of intelligent control systems also act as substantial drivers by improving system efficiency and reliability.

Restraints, however, pose significant challenges to widespread adoption. The high initial capital expenditure (CAPEX) required for integrating the solar array, battery storage, and sophisticated EMS components remains a major barrier, especially for small and medium enterprises. Operational complexities, including the need for specialized technical expertise for system installation, integration, and ongoing maintenance in harsh, remote environments, also limit market penetration in certain geographies. Furthermore, grid stability and regulatory uncertainty regarding the interconnection standards for hybrid systems in certain emerging markets can decelerate project development, forcing developers to navigate fragmented and evolving policy landscapes, adding cost and risk to projects.

Opportunities for growth are abundant, particularly centered around the burgeoning demand for reliable power in the global telecommunications sector (powering 5G infrastructure expansion in rural areas) and the vast, largely untapped market of diesel-reliant islands and remote communities seeking energy independence and resiliency. Technological innovation in battery storage, specifically solid-state and flow batteries, promises to further enhance the solar fraction and extend system autonomy. The shift towards 'as-a-service' models (Power Purchase Agreements - PPAs and Energy Service Agreements - ESAs) mitigates the high upfront CAPEX restraint, transferring operational risk and making hybrid power economically accessible to a wider customer base, thus exerting a positive impact force on market growth. The convergence of decentralized generation, storage, and intelligent management forms a powerful impact force, positioning hybrid systems as the cornerstone of future decentralized microgrids.

Segmentation Analysis

The Solar Diesel Hybrid Power Systems Market is comprehensively segmented based on its components, operational mode, power rating, and primary end-use application, allowing for a detailed understanding of market dynamics across diverse deployment scenarios. Component segmentation highlights the technological reliance on power control units and advanced energy management software, while segmentation by operational mode differentiates systems deployed in off-grid locations, where they serve as the sole source of power, from grid-connected setups used primarily for peak shaving, energy arbitrage, or backup resiliency. These segmentations are crucial as system design parameters, component requirements, and regulatory compliance differ significantly depending on the mode of operation and the capacity requirements of the target application.

Power rating segmentation allows market players to focus on products tailored for small-scale applications (e.g., residential or small telecom sites, typically <100 kW), medium-scale industrial facilities (100 kW to 1 MW), and large-scale mining operations or utility-scale microgrids (>1 MW), each requiring specialized solutions for voltage management and power quality. The fastest growth is observed in the high-power rating segment, driven by large-scale industrial consumers seeking substantial diesel displacement. End-use segmentation clearly defines the primary demand drivers, with the mining, telecom, and commercial sectors dominating adoption due to their critical need for uninterrupted, reliable, and cost-effective power supply in often challenging, isolated geographical locations, solidifying the market’s structure.

- By Component:

- PV Modules

- Diesel Generator Sets

- Power Conditioning Units (Inverters/Converters)

- Energy Storage Systems (Batteries)

- Energy Management Systems (EMS) and Software

- Balance of System (BOS) Components

- By Operational Mode:

- Off-Grid

- Grid-Connected

- Mini-Grid/Microgrid

- By Power Rating:

- Below 100 kW

- 100 kW – 1 MW

- Above 1 MW

- By End-Use Application:

- Mining & Construction

- Telecommunications

- Commercial & Retail

- Healthcare Facilities

- Data Centers

- Utilities & Independent Power Producers (IPPs)

- Military & Defense

- Remote Communities/Residential

Value Chain Analysis For Solar Diesel Hybrid Power Systems Market

The value chain for solar diesel hybrid systems is complex, spanning raw material sourcing to final operational maintenance, involving multiple specialized entities. Upstream analysis focuses on the manufacturing and supply of core components, including PV cell fabrication, diesel engine assembly, and advanced battery manufacturing (e.g., lithium-ion cells). Key suppliers leverage economies of scale in component production, emphasizing quality control and technological innovation to improve efficiency and longevity. The competitive advantage upstream is often determined by access to critical raw materials, efficient manufacturing processes, and R&D capabilities in power electronics and energy storage chemistry, which directly impact the final system cost and performance metrics.

Midstream activities involve system integration, engineering, procurement, and construction (EPC). This stage is critical, requiring specialized expertise in electrical engineering to seamlessly integrate disparate technologies (solar inverters, diesel gensets, battery management systems) under a unified Energy Management System (EMS). System integrators play a pivotal role in customizing solutions to specific site conditions and load profiles. Distribution channels are varied, involving direct sales to large industrial customers (e.g., mining companies), partnerships with telecom operators, and reliance on indirect distribution through local electrical contractors and renewable energy project developers who provide regional access and localized installation services, particularly in developing economies.

Downstream activities center on operational maintenance and asset management. Given the remote location of many hybrid installations (especially telecom towers and mining sites), robust long-term service agreements (LTSAs) and remote monitoring capabilities are crucial for ensuring high uptime and system reliability. Direct channels involve large EPC firms or specialized O&M providers maintaining the assets, often leveraging AI-powered remote diagnostics. Indirect channels include local maintenance subcontractors managed under the umbrella of the system integrator. The ability to offer competitive financing mechanisms, such as PPAs, strongly influences downstream market penetration, shifting the emphasis from CAPEX procurement to long-term operational excellence and guaranteed power delivery.

Solar Diesel Hybrid Power Systems Market Potential Customers

The primary customers for Solar Diesel Hybrid Power Systems are organizations and communities requiring continuous, reliable power outside the purview of a stable electrical grid or seeking to mitigate high operational costs associated with conventional diesel generation. Major industrial end-users include the mining sector, which operates high-load, continuous machinery in some of the most remote and diesel-dependent locations globally, making the substitution of solar energy highly economic. Telecommunication companies represent another crucial customer segment, rapidly deploying hybrid systems to power thousands of off-grid or poor-grid cellular tower sites, where fuel logistics represent a major operational burden and cost center, driving the shift towards sustainable power solutions.

Beyond these industrial giants, commercial establishments such as large retail centers, remote resort hotels, and agricultural processing plants located in areas with unreliable utility supply constitute significant potential buyers. These entities prioritize power quality and continuity to avoid operational losses, leveraging hybrid systems for backup power and peak shaving, effectively reducing demand charges and protecting sensitive electronic equipment from voltage fluctuations. The increasing regulatory push for green building certifications and corporate social responsibility (CSR) initiatives further motivates these commercial buyers to invest in sustainable energy infrastructure.

Finally, governmental agencies, utility providers, and Independent Power Producers (IPPs) serving remote islands, military bases, and rural communities are becoming major purchasers. For these groups, hybrid systems offer a pathway to achieving universal energy access goals and enhancing national security through energy independence. These customers often seek large-scale microgrid solutions, requiring comprehensive planning, robust financing models (often subsidized or backed by international development banks), and long-term performance guarantees, reflecting their strategic importance in the context of national infrastructure development and energy equity mandates across the developing world.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.8 Billion |

| Market Forecast in 2033 | USD 10.3 Billion |

| Growth Rate | 11.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Aggreko PLC, Caterpillar Inc., Siemens Energy AG, Wärtsilä Corporation, General Electric, Juwi AG, SMA Solar Technology AG, Vestas Wind Systems A/S, Fluence Energy, Huawei Technologies Co., Ltd., ABB Ltd., Schneider Electric, PCL Construction, Heliocentris Energiesysteme GmbH, Alpha Power Solutions, Vergnet, Danvest Energy A/S, Delta Electronics, Inc., Rolls-Royce Holdings plc, Wartsila SAM Electronics GmbH. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Solar Diesel Hybrid Power Systems Market Key Technology Landscape

The technological landscape of the Solar Diesel Hybrid Power Systems Market is centered on achieving optimized integration and maximizing the solar penetration fraction (SPF) while maintaining exceptional power quality. The core innovation lies in the advanced Energy Management Systems (EMS), which utilize proprietary algorithms to predict load requirements, forecast solar generation, and strategically manage the state-of-charge of battery storage systems. These intelligent control units are crucial for minimizing diesel engine runtime, reducing wear and tear, and ensuring that the solar PV system provides power as the primary source, only invoking the diesel genset when necessary to meet peak demand or during extended periods of low solar irradiation. Furthermore, advancements in bidirectional inverters and power electronics facilitate seamless and rapid transfer between solar, storage, and diesel sources, crucial for sensitive loads.

The continuous decline in the cost and improvement in the energy density of battery storage technology, predominantly Lithium-ion, is fundamentally reshaping system architecture. Modern hybrid systems are increasingly designed around a "solar-plus-storage-plus-diesel" model, where the battery acts as a critical buffer, smoothing out solar intermittency and allowing the diesel generator to run more efficiently at its optimal load point (or even shut down completely during daylight hours), a concept known as "genset off." This technological shift addresses the historical operational constraint where diesel engines had to run inefficiently at partial loads to manage solar fluctuations, greatly enhancing overall system efficiency and reducing maintenance overheads associated with light-loading operation.

Beyond the core generation components, the deployment of modular and containerized solutions is a major technological trend simplifying logistics and installation in remote sites. These plug-and-play modules integrate PV inverters, battery banks, power distribution equipment, and the EMS within standardized shipping containers, significantly reducing on-site construction time and improving reliability through factory-controlled assembly. Furthermore, the incorporation of Internet of Things (IoT) sensors and satellite communication links enables real-time monitoring and remote diagnostics, allowing operators to preemptively identify maintenance needs and optimize performance parameters from a centralized control center, thus ensuring high availability and robust security across geographically dispersed assets.

Regional Highlights

- Asia Pacific (APAC): APAC is the largest and fastest-growing market globally, fueled by exponential growth in telecommunications (4G/5G expansion), aggressive infrastructure development, and widespread energy access deficits in South and Southeast Asia. Countries like India, Indonesia, and Australia see massive deployments in mining, island electrification, and telecom tower power solutions. Government initiatives in countries like the Philippines and Indonesia to transition remote communities away from costly diesel imports further incentivize hybrid deployment. The region’s vast geographical span necessitates highly customized, robust, and cost-effective hybrid solutions suitable for diverse climatic and logistical challenges, driving localized manufacturing and component sourcing.

- North America: Adoption in North America is driven less by base-load off-grid power and more by critical infrastructure resiliency, peak shaving, and mitigating rising utility rates. Customers include industrial parks, data centers, and military facilities seeking high levels of power security against grid failures (especially due to extreme weather events). The market focuses on high-quality integration, advanced microgrid controllers, and regulatory compliance, particularly leveraging hybrid systems in states with aggressive renewable energy mandates and incentives for energy storage adoption.

- Europe: Europe emphasizes environmental compliance and smart grid integration. The market sees significant adoption in commercial and industrial settings utilizing hybrids for self-consumption maximization and reducing carbon taxes. Specialized applications include temporary power for construction sites and large events, as well as powering isolated research stations or remote island tourism infrastructure. High grid stability and dense population generally limit purely off-grid demand, focusing the market on grid-support and redundancy applications.

- Middle East and Africa (MEA): This region offers immense potential due to high solar irradiation levels and extensive reliance on diesel generation for remote mining, oil and gas operations, and widespread telecom network coverage. Africa’s need for rural electrification and the logistical challenges of transporting diesel across vast, underdeveloped road networks make solar diesel hybrids an economically compelling solution for achieving energy equity. Supportive policies aimed at reducing fuel subsidies are accelerating project deployment, often funded through international development aid and private sector investment focusing on scalable mini-grids.

- Latin America: The market is substantially influenced by the large-scale, isolated operations of the mining sector (Chile, Peru, Brazil) which require enormous, reliable power supplies far from established grids. Furthermore, providing essential electricity to remote indigenous communities and supporting oil extraction operations in isolated territories drives demand. The economic viability of hybrids is extremely high here due to the elevated cost of diesel transport over difficult terrain, making the robust integration of solar and storage a key competitive differentiator for large EPC contractors.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Solar Diesel Hybrid Power Systems Market.- Aggreko PLC (UK)

- Caterpillar Inc. (USA)

- Siemens Energy AG (Germany)

- Wärtsilä Corporation (Finland)

- General Electric (USA)

- Juwi AG (Germany)

- SMA Solar Technology AG (Germany)

- Vestas Wind Systems A/S (Denmark)

- Fluence Energy (USA)

- Huawei Technologies Co., Ltd. (China)

- ABB Ltd. (Switzerland)

- Schneider Electric (France)

- PCL Construction (Canada)

- Heliocentris Energiesysteme GmbH (Germany)

- Alpha Power Solutions (South Africa)

- Vergnet (France)

- Danvest Energy A/S (Denmark)

- Delta Electronics, Inc. (Taiwan)

- Rolls-Royce Holdings plc (UK) (Power Systems/MTU)

- Wartsila SAM Electronics GmbH (Germany)

- OutBack Power Technologies (USA)

- Doosan Heavy Industries & Construction (South Korea)

- Toshiba Corporation (Japan)

- Kohler Co. (USA)

- Yanmar Holdings Co., Ltd. (Japan)

- Cummins Inc. (USA)

- Ingeteam S.A. (Spain)

- TBEA Co., Ltd. (China)

- FIMER S.p.A. (Italy)

Frequently Asked Questions

Analyze common user questions about the Solar Diesel Hybrid Power Systems market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary economic benefit of adopting Solar Diesel Hybrid Power Systems?

The primary economic benefit is the substantial reduction in operational expenditure (OPEX) achieved by maximizing solar energy utilization, which drastically minimizes diesel fuel consumption and subsequently lowers maintenance costs associated with reduced generator runtime, leading to a favorable return on investment (ROI).

How does the Energy Management System (EMS) function in a hybrid setup?

The EMS is the intelligence center that continuously monitors load demand, solar output, battery state, and diesel generator performance. It uses algorithms to predict power needs and autonomously dispatch the most cost-effective source—solar, storage, or diesel—to ensure seamless power quality and maximize the solar penetration ratio.

Are Solar Diesel Hybrid Systems only suitable for off-grid applications?

No, while highly effective off-grid, hybrid systems are increasingly utilized in grid-connected settings for critical applications such as peak shaving, demand charge reduction, power redundancy, and providing backup resilience against grid instability or outages, enhancing overall energy security.

What are the main technological challenges in deploying these systems in remote areas?

Key technological challenges include securing reliable communication for remote monitoring (often relying on satellite or cellular networks), ensuring component durability against extreme environmental conditions (temperature, dust), and providing localized technical expertise for complex system integration and maintenance.

Which end-use application drives the highest demand globally for hybrid systems?

Globally, the Telecommunications and Mining & Construction sectors are the primary demand drivers. Telecom requires reliable, dispersed power for remote tower sites, while mining operations need large, continuous power supply far from grid infrastructure, making diesel displacement a critical cost and environmental imperative.

The Solar Diesel Hybrid Power Systems Market represents a dynamic confluence of traditional and renewable energy technologies, addressing the critical global demand for resilient, cost-effective, and environmentally sustainable power generation, particularly in decentralized operational environments. The fundamental shift is driven by stringent environmental standards, coupled with the compelling economic justification offered by avoiding volatile diesel price exposure. As photovoltaic costs continue to fall and battery energy storage technology matures, the economic crossover point where hybrid systems outperform pure diesel generation is rapidly expanding to new applications and geographies. This momentum is further propelled by sophisticated Energy Management Systems (EMS) that employ advanced computational strategies, including artificial intelligence and machine learning, to achieve unparalleled levels of operational efficiency and reliability. These intelligent systems ensure that the maximum possible energy fraction is derived from solar PV, minimizing the runtime of the diesel generator and thereby extending its operational life while simultaneously reducing fuel consumption and associated greenhouse gas emissions. The market is witnessing a strong trend towards modularization and pre-engineered containerized solutions, which dramatically lowers site preparation time and installation risk, making deployment feasible even in the most inaccessible regions of the world. This focus on simplifying logistics and installation is crucial for rapidly scaling up power access in emerging economies where infrastructure gaps persist, especially in the context of expanding mobile and digital connectivity across rural areas, where telecommunication towers remain highly reliant on robust, off-grid power solutions. The value proposition of these hybrid systems is now extending into the developed world, where they are adopted as essential components of modern microgrids for enhanced grid security, peak load management, and ensuring business continuity for critical commercial and industrial operations, such as hospitals, data centers, and manufacturing facilities prone to grid disturbances. Strategic growth opportunities are heavily concentrated in the Asia Pacific and Africa regions, fueled by aggressive electrification targets and the necessity to power large-scale mining and oil & gas extraction activities efficiently. Regulatory harmonization and supportive government policies that incentivize renewable energy integration and offer financial mechanisms, such as Green Bonds and Power Purchase Agreements (PPAs), are pivotal in sustaining this market trajectory. Furthermore, competition is intensifying, leading key players—ranging from traditional diesel engine manufacturers and utility giants to pure-play renewable energy integrators and specialized software providers—to continuously innovate in areas like hydrogen readiness for future fuel diversification and integrating advanced predictive maintenance services, ensuring the long-term viability and attractiveness of solar diesel hybrid power systems as a cornerstone of the future decentralized energy landscape.

The market faces ongoing structural challenges, most notably the requirement for a significant upfront capital investment (CAPEX), which can be a deterrent for smaller businesses despite the promise of substantial long-term operational savings. However, this restraint is being systematically addressed through innovative financing models and the increasing availability of third-party ownership structures (PPA models) that allow end-users to pay only for the power consumed, effectively shifting the financial burden and technical risk away from the consumer. Technological integration remains complex; ensuring seamless communication and control between diverse components—such as solar inverters, battery management systems (BMS), and sophisticated diesel generator controllers—requires highly specialized engineering expertise. This complexity necessitates that market participants focus heavily on standardized, plug-and-play interfaces and robust system commissioning procedures to guarantee optimal performance under challenging conditions. The evolution of battery technology, particularly toward safer, higher-density, and longer-duration storage solutions, is a critical variable that will influence the solar fraction achievable in future hybrid installations. Developments in flow batteries and next-generation lithium chemistries are being closely monitored, as they promise to further reduce the dependency on the diesel component, potentially pushing the solar penetration ratio towards near-total displacement in sunny regions. Geopolitical factors affecting diesel fuel prices and supply chain disruptions for solar PV components and batteries also introduce market volatility, underscoring the necessity for robust supply chain diversification strategies among key system integrators. Ultimately, the Solar Diesel Hybrid Power Systems Market is poised for continued strong expansion, driven by the convergence of economic necessity, sustainability targets, and relentless technological improvements in system intelligence and energy storage capacity, cementing its role as a crucial technology for energy transition and power security globally.

In summary, the transition from pure diesel dependence to highly optimized solar diesel hybrid systems is irreversible, motivated by economic pressure and environmental responsibility. The market structure, while competitive, favors companies that can provide integrated, high-reliability solutions backed by advanced software intelligence and robust maintenance services suitable for harsh operational environments. Future growth will be catalyzed by broader adoption in sectors previously hesitant, such as agriculture and remote healthcare, leveraging the proven track record established in the mining and telecom industries. Policy support, focused on reducing market entry barriers and promoting standardized interconnection rules, will be essential for accelerating deployment speed. The integration of artificial intelligence for predictive failure analysis and autonomous energy management will define the next generation of hybrid power systems, transforming them into self-optimizing, highly resilient power islands capable of providing clean, continuous power anywhere on the globe, irrespective of grid availability or stability. This robust foundation ensures the market's trajectory towards the projected USD 10.3 Billion valuation by 2033, underscoring its pivotal contribution to global decentralized energy supply and climate change mitigation efforts.

The expansion of the market into large-scale utility applications, particularly in emerging markets where governments are moving away from centralized power generation towards distributed mini-grids, represents a major structural shift. Hybrid systems offer a fast track to electrification compared to lengthy and expensive grid extensions, making them a preferred choice for national energy plans aiming for universal energy access targets. This utility-scale adoption demands higher capacity systems, often incorporating complex grid-forming inverters and adherence to stringent utility codes, creating specialized market niches for large industrial players with strong financing capabilities. Furthermore, the emphasis on system lifespan and circular economy principles is growing, pushing manufacturers to design components that are more durable, recyclable, and easily serviceable in remote locations, mitigating the environmental impact associated with equipment disposal. This holistic approach, combining economic viability with environmental stewardship and advanced technological integration, secures the market's long-term relevance and exponential growth potential across all key geographical and application segments.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Solar Diesel Hybrid Power Systems Market Size Report By Type (Solar Diesel Hybrid, Multi-energy Hybrid), By Application (Utilities, Remote Industries, Big Agriculture, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Solar Diesel Hybrid Power Systems Market Statistics 2025 Analysis By Application (Utilities, Remote Industries, Big Agriculture, Others), By Type (Solar Diesel Hybrid, Multi-energy Hybrid), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Solar Diesel Hybrid Power Systems Market Statistics 2025 Analysis By Application (Utilities, Remote Industries, Big Agriculture), By Type (Solar Diesel Hybrid, Multi-energy Hybrid), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager