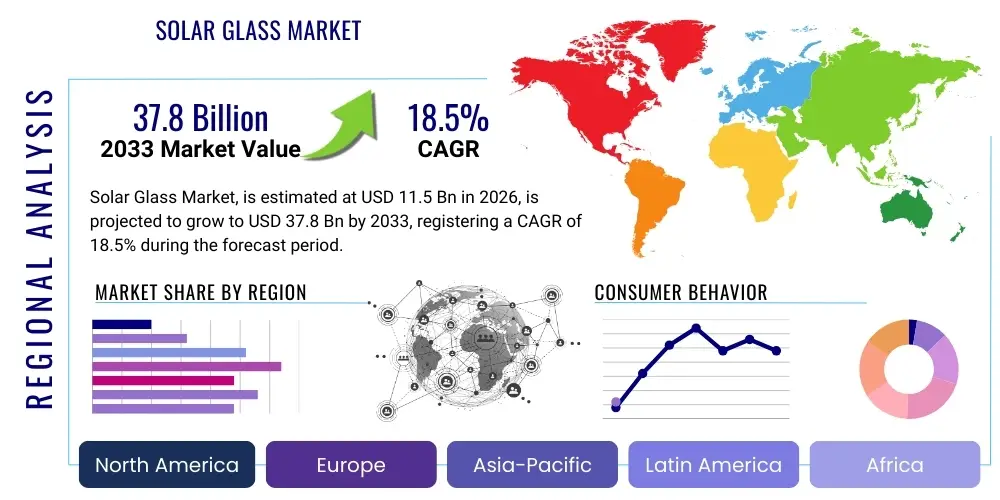

Solar Glass Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435733 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Solar Glass Market Size

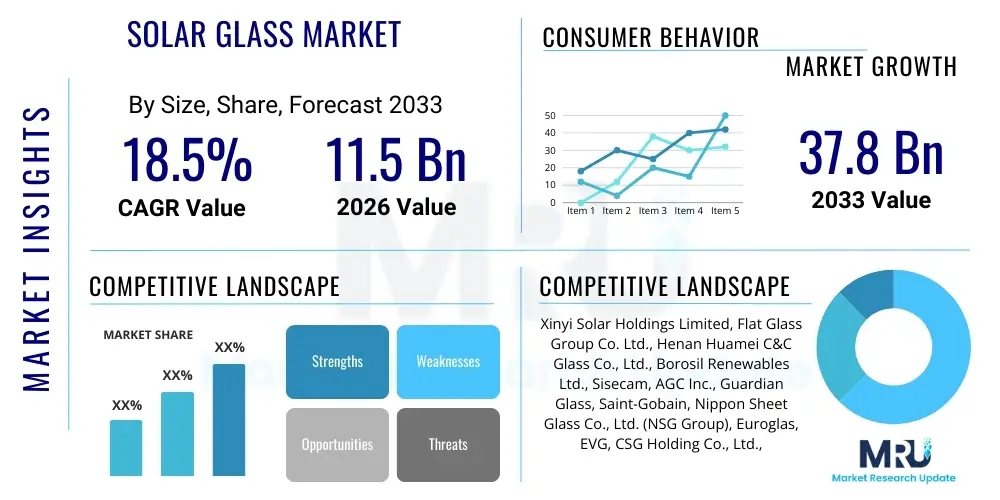

The Solar Glass Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% between 2026 and 2033. The market is estimated at USD 11.5 Billion in 2026 and is projected to reach USD 37.8 Billion by the end of the forecast period in 2033.

Solar Glass Market introduction

The Solar Glass Market encompasses the production, distribution, and utilization of specialized glass products designed specifically for photovoltaic (PV) modules and solar thermal collectors. This essential component serves multiple critical functions: maximizing light transmittance to the solar cells, providing mechanical protection against environmental stresses such as wind, snow, and hail, and ensuring the longevity and durability of the entire solar energy system. The product itself is typically ultra-clear, low-iron tempered glass, often treated with anti-reflective (AR) coatings to minimize surface reflection and enhance energy yield. The shift toward bifacial modules and the increasing integration of photovoltaics into building structures (BIPV) are fundamentally driving innovation within this market segment, focusing on lightweight, high-strength, and aesthetically pleasing glass solutions. The primary application remains utility-scale solar farms, followed by residential and commercial rooftop installations, all demanding high performance and sustained reliability from the encapsulation materials.

Major applications of solar glass extend across the entire solar energy spectrum, ranging from standard crystalline silicon PV panels, which utilize solar glass as a front cover to protect sensitive semiconductor materials, to advanced concentrating solar power (CSP) systems, where specialized mirrors and receivers rely on high-purity glass formulations. The benefits derived from high-quality solar glass are manifold, including increased energy conversion efficiency dueenced to superior light transmission, prolonged operational lifespan of PV modules—often exceeding 25 years—and enhanced resistance to harsh weather conditions and potential-induced degradation (PID). These inherent advantages position solar glass as a cornerstone material in the global transition toward renewable energy sources, underpinning the viability and economic competitiveness of solar power generation globally.

Key driving factors propelling market expansion include aggressive renewable energy targets set by national governments worldwide, particularly in the Asia Pacific and European regions, coupled with significant reductions in the levelized cost of electricity (LCOE) for solar power, making it increasingly competitive with conventional energy sources. Furthermore, technological advancements in solar cell efficiency, such as PERC (Passivated Emitter Rear Cell) and TOPCon (Tunnel Oxide Passivated Contact) architectures, necessitate corresponding improvements in solar glass quality, specifically requiring higher light transmittance and enhanced resistance to moisture and chemical ingress. The burgeoning demand for Building Integrated Photovoltaics (BIPV) systems, which use solar glass as structural architectural elements, represents a substantial high-growth opportunity, diversifying the application base beyond traditional utility infrastructure and stimulating architectural innovation.

Solar Glass Market Executive Summary

The Solar Glass Market is characterized by robust business trends centered on capacity expansion, strategic geographical diversification, and intense competition in pricing driven by the continuous pressure to lower the overall cost of PV module manufacturing. Key manufacturers are focusing on integrating advanced production technologies, such as large-format glass for higher-wattage modules (e.g., 182mm and 210mm wafer sizes) and implementing smart manufacturing principles leveraging Industrial IoT to optimize yield rates and reduce operational costs. The transition toward ultra-thin glass, particularly in flexible and BIPV applications, represents a significant technological pivot, requiring substantial capital investment in specialized glass tempering and coating facilities. Mergers and acquisitions are also common, enabling large players to secure control over the upstream supply chain, specifically access to high-quality silica sand and specialized chemical additives required for ultra-clear glass production, thereby ensuring supply stability and mitigating geopolitical risks related to trade policies affecting material flow.

Regionally, the Asia Pacific (APAC) region, spearheaded by China and India, maintains overwhelming dominance, primarily due to massive domestic solar installation programs and the presence of the world’s largest integrated PV manufacturing ecosystem, covering everything from polysilicon production to module assembly. Europe exhibits strong growth, particularly driven by high environmental standards and supportive feed-in tariff mechanisms, focusing heavily on BIPV applications and high-efficiency modules that require premium solar glass solutions. North America is experiencing accelerated growth due to favorable regulatory environments, such as tax credits and state-level renewable portfolio standards, leading to major capacity announcements for both solar cells and glass manufacturing intended to localize the supply chain and reduce reliance on overseas imports, thereby mitigating tariffs and transportation costs. This global distribution of manufacturing and consumption necessitates sophisticated logistics and quality control standardization across diverse climatic zones, ranging from high humidity tropical areas to arid desert environments.

Segmentation trends highlight the increasing preference for ultra-clear patterned glass, which is optimized for light trapping and maximum anti-reflective performance, over standard float glass in utility-scale projects due to marginal gains in energy yield that translate into significant revenue increases over the project lifecycle. Furthermore, the market for thin-film PV applications, although smaller than crystalline silicon, shows niche growth, driving demand for specialized thin, flexible solar glass or alternative encapsulation materials. The fastest-growing application segment is Building Integrated Photovoltaics (BIPV), which requires laminated and often tinted solar glass that fulfills both aesthetic and structural safety requirements, blending seamlessly into modern architecture. Bifacial technology is also profoundly impacting the segment landscape, requiring dual layers of high-strength, low-iron solar glass, thereby effectively doubling the per-module glass consumption and stimulating demand for stronger, lighter encapsulation solutions to manage increased mechanical loads.

AI Impact Analysis on Solar Glass Market

User inquiries concerning the impact of Artificial Intelligence (AI) on the Solar Glass Market primarily revolve around three central themes: optimizing manufacturing efficiency, enhancing quality control and defect detection during production, and predicting material performance and degradation rates in installed modules. Users are keen to understand how AI-driven predictive maintenance can reduce downtime in capital-intensive glass melting furnaces and how machine learning algorithms can analyze complex data streams—such as chemical composition, thermal stress profiles, and optical homogeneity—to ensure the finished glass meets stringent PV standards. Another major user concern is the use of computer vision and deep learning models for rapid, non-destructive inspection of solar glass for micro-cracks, bubbles, and coating inconsistencies that are often undetectable by conventional methods, thereby safeguarding long-term module reliability.

The application of AI is revolutionizing solar glass manufacturing by enabling real-time adjustments to furnace temperatures, material feeding rates, and annealing processes, minimizing energy consumption and maximizing throughput. AI models analyze historical operational data combined with quality metrics to identify correlations between input variables (raw material purity, environmental temperature) and output characteristics (glass strength, clarity), allowing for proactive intervention before defects occur. This shift from reactive quality checking to predictive process control is crucial for maintaining the exceptionally low defect rates required in the high-volume PV industry. Furthermore, AI facilitates the rapid prototyping and testing of new anti-reflective coating formulations by simulating performance under various spectral conditions and incidence angles, accelerating the material innovation cycle significantly.

In the downstream segment, AI is instrumental in simulating the long-term performance and degradation of solar modules encapsulated with different glass types under specific climatic conditions, aiding project developers in selecting the optimal glass specifications for utility projects in challenging environments. By analyzing satellite imagery, weather patterns, and historical yield data, AI can predict dust accumulation rates and soiling effects on the solar glass surface, optimizing cleaning schedules and ensuring sustained operational efficiency. This integration of AI not only boosts manufacturing yields and quality but also extends the verifiable service life of the solar module itself, contributing directly to lower LCOE and increased investor confidence in solar energy projects reliant on high-performance encapsulation materials.

- AI optimizes furnace energy consumption through predictive thermal modeling.

- Machine learning algorithms enhance quality control by identifying microscopic defects and inhomogeneities in real-time.

- Computer vision systems automate the inspection of anti-reflective coating uniformity and adherence.

- AI-driven simulation accelerates the development and testing of novel low-iron glass compositions.

- Predictive analytics optimize manufacturing schedules, reducing material waste and production downtime.

- AI models correlate raw material purity with final optical performance metrics, ensuring supply chain robustness.

DRO & Impact Forces Of Solar Glass Market

The Solar Glass Market is currently propelled by significant global drivers, primarily the aggressive pursuit of decarbonization goals across major economies, which mandates massive deployment of utility-scale and distributed solar photovoltaic capacity. Governmental subsidies, renewable energy mandates, and the falling production cost of PV modules globally are creating an unprecedented demand for all related components, including high-quality solar glass. The restraint factors predominantly involve the volatile pricing of raw materials, specifically high-purity silica sand and soda ash, which are essential for low-iron glass production. Furthermore, the inherent energy intensity of the glass melting process and the subsequent pressure to transition toward sustainable, less carbon-intensive manufacturing methods present operational challenges and require substantial capital investment in green technology upgrades. The global reliance on a few concentrated production hubs, predominantly in Asia, also poses significant geopolitical risk and supply chain vulnerability, impacting timely material access for international module assemblers seeking localization.

Significant opportunities exist in the development and mass production of specialized glass types that address emerging technological needs. This includes ultra-lightweight, flexible solar glass for integration into non-traditional surfaces, transparent conductive glass for advanced solar cell architectures (like perovskites), and aesthetically pleasing colored or patterned glass required for the booming Building Integrated Photovoltaics (BIPV) sector, which requires materials to function as both a power generator and a structural façade element. Furthermore, the push for bifacial solar modules, which require glass on both the front and back surfaces, inherently doubles the demand for solar glass per megawatt of installation, representing a major volume growth opportunity for manufacturers capable of producing high-strength, thin tempered glass at scale. Opportunities for regional self-sufficiency, driven by governmental incentives in North America and Europe, encourage establishing localized manufacturing capacities, creating new market entry points for domestic players.

The primary impact forces shaping the market are technological shifts toward higher-efficiency module designs (e.g., bifacial, HJT, TOPCon) and increasing regulatory pressure regarding the carbon footprint of industrial processes. The necessity for solar glass to maximize light capture while providing extreme durability against environmental elements, such as corrosive atmospheres and mechanical stress (wind, snow loads), drives continuous innovation in coating technology (anti-reflective, anti-soiling) and glass formulation. Competitive pricing pressure, exacerbated by large-scale Chinese dominance in production, forces manufacturers to constantly improve operational efficiency and leverage economies of scale. Additionally, the longevity requirement of solar farms (often 25-30 years) mandates rigorous quality assurance and traceability systems for solar glass, positioning quality and durability as non-negotiable prerequisites for market success and long-term acceptance by project financiers and utility operators.

Segmentation Analysis

The Solar Glass Market is extensively segmented based on key functional attributes, structural configuration, technology compatibility, and end-use application, providing a granular view of demand distribution and technological trends. The categorization by type differentiates standard float glass used in less demanding applications from advanced ultra-clear patterned glass, which dominates high-performance crystalline silicon modules due to its superior light-trapping capabilities and low-iron composition, ensuring maximum solar transmittance. Technology-wise, the market recognizes distinct requirements for flat plate PV, which is volume-intensive, versus Concentrated PV (CPV) and thin-film technologies that demand specialized glass specifications, such as extremely thin or high-precision curved glass. This structural diversification allows manufacturers to tailor production lines and R&D efforts to specific market niches, optimizing material properties like mechanical strength, optical clarity, and resistance to environmental stress, crucial for maximizing energy yield and ensuring compliance with stringent safety standards for various regional installations.

Segmentation by application reveals the predominant consumption patterns, with utility-scale solar farms being the largest volume consumer, driving demand for cost-efficient, high-durability glass suitable for ground mounting. Residential and Commercial & Industrial (C&I) segments, while smaller in volume, drive demand for aesthetic and safety features, often requiring laminated or aesthetically customized solar glass. The rapidly expanding Building Integrated Photovoltaics (BIPV) segment stands out as the highest value-added niche, requiring solar glass that adheres to architectural codes, thermal insulation standards, and fire safety regulations, simultaneously functioning as both a building envelope material and an energy generator. These distinct application demands necessitate varied glass thicknesses, processing technologies (e.g., tempering, heat strengthening, lamination), and specialized coatings (e.g., anti-reflective, low-emissivity) tailored to meet the specific performance criteria of each end-user environment, ensuring optimized performance and regulatory compliance across diverse installation sites globally.

Further analysis of the material processing segmentation highlights the critical role of tempering processes, which impart necessary mechanical strength to withstand severe weather and handling during installation, particularly important for thin-glass applications and bifacial modules. Anti-reflective (AR) coating technology represents a crucial sub-segment, as the coating directly impacts photon capture efficiency, with advanced multi-layer coatings becoming standard in premium modules. The evolution of encapsulation techniques and the introduction of next-generation cell technologies, such as Heterojunction (HJT) and perovskite cells, demand continual adaptation in solar glass properties, specifically requiring glass that resists moisture ingress and supports the sensitive material structures without inducing stress or degradation. This complex segmentation underscores the sophistication of the solar glass market, where product differentiation is achieved through precise control over chemical composition, surface topography, and post-processing treatments to deliver maximum energy harvesting potential.

- By Type:

- Ultra-Clear Patterned Glass (Textured)

- Low-Iron Float Glass (Smooth)

- Tempered Solar Glass

- Heat-Strengthened Glass

- Thin-Film Solar Glass

- By Technology:

- Crystalline Silicon PV (c-Si)

- Thin Film PV (CdTe, a-Si, CIGS)

- Concentrated Solar Power (CSP)

- By Application:

- Utility-Scale Solar Farms

- Residential Rooftop Installations

- Commercial & Industrial (C&I)

- Building Integrated Photovoltaics (BIPV)

- Solar Thermal Systems

- By End-User:

- Module Manufacturers

- EPC Contractors

- System Integrators

Value Chain Analysis For Solar Glass Market

The Solar Glass Value Chain begins with upstream processes centered on the sourcing and processing of high-purity raw materials, primarily silica sand (high purity, low iron content), soda ash, dolomite, and limestone. Mining and purification of silica sand are critical as the iron content directly affects light transmission and, consequently, module efficiency. These refined materials are then melted in energy-intensive furnaces at extremely high temperatures (around 1,500°C). The initial processing also involves proprietary chemical additions and forming techniques, such as the float process or rolling process, to create the necessary patterned or smooth surface structure characteristic of solar glass. Quality control at this stage focuses on minimizing internal defects like bubbles and achieving precise thickness tolerances and ultra-low iron levels. The cost and energy consumption associated with this upstream segment significantly influence the final product price, establishing barriers to entry for new market participants.

The midstream stage involves sophisticated processing steps crucial for enhancing functionality and durability. This includes annealing, cutting, edge-working, and the critical step of tempering, which imparts high mechanical strength to the glass, making it resistant to impact and thermal shock. Specialized treatments, particularly the application of Anti-Reflective (AR) coatings, occur in this segment. AR coatings, typically applied using chemical vapor deposition or wet chemical methods, minimize surface reflectance and boost light transmittance by several percentage points, significantly increasing the module's power output. Manufacturers strategically locate these processing facilities close to major PV module assemblers to reduce logistics costs associated with transporting fragile glass sheets. Efficient process control and adherence to international standards (e.g., IEC 61215) define competitive advantage at this stage.

The downstream segment encompasses the distribution, integration, and final installation of solar glass within photovoltaic modules. Distribution channels are primarily direct, supplying glass sheets directly to tier-one and tier-two PV module manufacturers who integrate the glass into the final solar panel structure through lamination (typically using EVA or POE encapsulants). Indirect channels involve distributors or specialized glass fabricators who supply customized solar glass products for niche markets such as BIPV or solar thermal systems. Key downstream activities include logistics management of oversized and delicate glass sheets, inventory holding, and just-in-time delivery to assembly lines. Ultimately, the EPC (Engineering, Procurement, and Construction) contractors and system integrators represent the final point of sale, determining the specific demand for different types and specifications of solar glass based on project requirements, climate, and local regulatory standards for installation and building safety.

Solar Glass Market Potential Customers

The primary end-users and buyers of solar glass are photovoltaic module manufacturers, ranging from massive, globally integrated companies (who often produce their own cells and modules) to specialized smaller assemblers focusing on niche products like flexible or custom-sized modules. These manufacturers require solar glass in enormous volumes, demanding strict adherence to quality specifications, especially regarding high light transmission (ultra-clear, low-iron content) and mechanical strength (tempering requirements). Since the glass represents a significant component cost and directly impacts the long-term performance warranty of the module, purchasing decisions are highly sensitive to price, long-term supply agreements, and the supplier's reliability and quality track record. These customers also drive innovation, pushing glass manufacturers for thinner, lighter, and stronger products compatible with emerging high-efficiency cell technologies such as bifacial and HJT structures.

Another significant customer segment includes EPC contractors and system integrators, especially those involved in large-scale utility projects and BIPV installations. While they may not directly purchase raw glass sheets, their procurement specifications dictate the type and quality of modules used, which, in turn, influences the solar glass market. For BIPV applications, architects and construction firms become indirect key buyers. They specify laminated safety glass that meets both architectural aesthetic requirements (color, texture, transparency) and power generation demands. This customer group requires customized, often smaller-batch, high-value glass products that comply with strict building codes, thermal performance standards, and aesthetic integration criteria, moving beyond standard rectangular utility glass specifications to embrace complex shapes and designs.

Emerging potential customers include manufacturers of next-generation solar technologies, such as advanced thin-film developers (e.g., CIGS, Perovskites) and concentrated solar power (CSP) operators. Thin-film technology often requires specialized glass substrates, including transparent conductive oxide (TCO) coated glass, which acts as the front electrode. CSP installations utilize high-precision, low-iron reflective mirror glass and vacuum tube collector glass, demanding extremely durable and highly uniform glass surfaces to efficiently concentrate solar radiation. These niche users, while currently representing a smaller volume share, exert influence over material science innovation in the solar glass sector, pushing for extreme durability, novel coating combinations, and highly specialized thermal stability attributes suitable for high-temperature and high-stress environments specific to CSP operations.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 11.5 Billion |

| Market Forecast in 2033 | USD 37.8 Billion |

| Growth Rate | 18.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Xinyi Solar Holdings Limited, Flat Glass Group Co. Ltd., Henan Huamei C&C Glass Co., Ltd., Borosil Renewables Ltd., Sisecam, AGC Inc., Guardian Glass, Saint-Gobain, Nippon Sheet Glass Co., Ltd. (NSG Group), Euroglas, EVG, CSG Holding Co., Ltd., Kibing Group, Almaden Co., Ltd., Jinko Solar (Glass Division), First Solar (Glass Supply Chain), Qingdao Jinlong Glass Co., Ltd., Dyesol Limited, Taiwan Glass Industry Corporation, Interfloat Corporation |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Solar Glass Market Key Technology Landscape

The core technology underpinning the solar glass market remains the production of ultra-clear, low-iron glass, typically achieved through specialized float or rolling processes that ensure minimal iron oxide content (below 0.015%), thereby maximizing solar transmittance to levels exceeding 92%. A crucial technological differentiator is the surface structure; patterned (textured) glass is commonly used on the solar cell facing side to promote internal reflection and light trapping, enhancing the module efficiency, whereas smooth glass is often preferred for back sheets in bifacial modules or certain thin-film applications. Recent technological focus has shifted toward minimizing glass thickness, moving from 3.2mm to 2.8mm and increasingly to 2.0mm or even 1.6mm, to reduce material cost and module weight, requiring corresponding advancements in chemical strengthening and tempering processes to maintain necessary mechanical load capacity and durability standards crucial for long-term field performance.

Anti-Reflective (AR) coatings represent another pivotal technology area, essential for minimizing light loss due to reflection off the glass surface, especially at high angles of incidence. Current state-of-the-art AR coatings are typically multi-layered, porous structures, often nano-engineered silica or similar compounds, applied via spray, dipping, or chemical vapor deposition (CVD). These coatings are designed not only for high optical performance but also for enhanced durability against abrasion, humidity, and UV exposure. An emerging related technology is the development of Anti-Soiling (AS) coatings, which feature hydrophobic or super-hydrophobic properties to minimize the adhesion of dust and dirt, thus reducing the frequency of cleaning required in arid or dusty environments and maintaining sustained energy output, directly influencing the operational efficiency and maintenance costs of solar farms globally.

Lamination technology is intrinsically linked to solar glass, particularly in BIPV and high-safety applications, where the glass must adhere to strict safety glazing standards. This involves using polymer encapsulants (EVA, POE, or PVB) to bond two sheets of solar glass (or glass and a back sheet) together under vacuum and heat. Technological advances in lamination focus on developing encapsulant materials that are less prone to PID (Potential Induced Degradation) and UV degradation, ensuring robust sealing and protection for the sensitive solar cells. Furthermore, specialized thermal and chemical tempering techniques are continuously being refined to allow for the mass production of large format, ultra-thin, high-strength solar glass required for the latest generation of high-power PV modules, addressing mechanical robustness challenges inherent in using larger, thinner substrates.

Regional Highlights

- Asia Pacific (APAC): APAC, particularly China, dominates the solar glass market in terms of production capacity and consumption. China accounts for the vast majority of global manufacturing capacity, driven by vertical integration within major PV module manufacturers and highly supportive government policies fostering solar deployment. Countries like India, Vietnam, and South Korea are also experiencing significant growth, driven by ambitious domestic renewable energy targets and the relocation of some manufacturing capacity outside of China. APAC’s market is characterized by high volume, intense price competition, and rapid adoption of technological advancements such as bifacial modules and large-format glass, ensuring its continued status as the primary global growth engine and manufacturing hub for the foreseeable future.

- Europe: The European market is a mature, high-value segment characterized by stringent quality standards, a strong focus on sustainability, and robust growth in niche high-end applications like Building Integrated Photovoltaics (BIPV). Demand is driven by aggressive EU climate targets and supportive regulatory frameworks, particularly in Germany, Spain, and the Netherlands. European customers show a distinct preference for high-efficiency modules often utilizing premium solar glass, including thin, aesthetically tailored, and safety-rated laminated glass solutions. The region is increasingly emphasizing localized manufacturing capacity (Made in Europe) to reduce reliance on Asian imports and improve supply chain resiliency, often favoring suppliers who can demonstrate low-carbon manufacturing processes for glass production.

- North America: North America, led by the United States, is experiencing accelerated market expansion fueled by strong utility-scale pipeline growth, favorable tax incentives (such as the Inflation Reduction Act in the US), and a significant push towards domestic content requirements and supply chain localization. While currently reliant on imports for the majority of solar glass, substantial new capacity announcements for solar glass manufacturing are underway in the region, seeking to build integrated domestic PV ecosystems. Demand focuses on ultra-durable, high-reliability glass specifications capable of withstanding diverse and extreme climatic conditions found across the continent, from desert heat to heavy snow loads, prioritizing long-term performance and minimizing degradation risks.

- Middle East and Africa (MEA): This region is emerging as a critical growth area due to massive, planned utility-scale solar projects, particularly in the UAE, Saudi Arabia, and Egypt, aimed at diversifying energy sources and capitalizing on extremely high direct normal irradiance (DNI). The demand here is highly focused on anti-soiling (AS) and highly durable solar glass due to the challenging environmental factors, including high dust levels, sandstorms, and extreme temperatures. Project developers prioritize glass solutions that maintain peak performance with minimal cleaning and possess robust resistance to abrasive wear, driving demand for specialized coatings and high-strength tempered structures.

- Latin America: The market in Latin America, particularly in Brazil, Chile, and Mexico, is expanding rapidly, driven by favorable solar resources and competitive auctions for utility projects. The market currently relies heavily on imports but is witnessing local assembly growth. Key market needs include robust and cost-effective solar glass solutions that can handle high UV exposure and varied seismic activity. The focus remains on standard high-volume utility glass, though specific niche requirements are emerging for distributed generation in densely populated areas.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Solar Glass Market.- Xinyi Solar Holdings Limited

- Flat Glass Group Co. Ltd.

- Henan Huamei C&C Glass Co., Ltd.

- Borosil Renewables Ltd.

- Sisecam

- AGC Inc.

- Guardian Glass

- Saint-Gobain

- Nippon Sheet Glass Co., Ltd. (NSG Group)

- Euroglas

- EVG

- CSG Holding Co., Ltd.

- Kibing Group

- Almaden Co., Ltd.

- Jinko Solar (Glass Division)

- First Solar (Glass Supply Chain)

- Qingdao Jinlong Glass Co., Ltd.

- Dyesol Limited

- Taiwan Glass Industry Corporation

- Interfloat Corporation

Frequently Asked Questions

Analyze common user questions about the Solar Glass market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of low-iron solar glass?

The primary function of low-iron solar glass is to maximize the transmission of sunlight to the photovoltaic cells. Low-iron content reduces light absorption within the glass, increasing overall light transmittance to over 92%, which is crucial for maximizing the energy conversion efficiency and yield of the solar module over its operational lifetime.

How does Anti-Reflective (AR) coating improve solar panel efficiency?

AR coatings are specialized, often nano-engineered surface treatments applied to solar glass that minimize light reflection and scattering off the glass surface. This critical enhancement allows more photons to reach the solar cells, typically boosting the module's power output by 2% to 4%, significantly improving overall system efficiency, especially at oblique light incidence angles.

What are the main segments driving the growth of the Solar Glass Market?

The main segments driving market growth are Utility-Scale Solar Projects, which demand high volumes of durable, cost-effective glass, and the rapidly growing Building Integrated Photovoltaics (BIPV) segment, which requires specialized, laminated, and aesthetically customized solar glass for integration into structural facades and roofs.

What are the key differences between patterned and float solar glass?

Float glass (smooth surface) is often used for back sheets or specific thin-film applications. Patterned solar glass features a textured surface on the cell-facing side which helps trap light, reduce reflection, and scatter incoming radiation more effectively. Patterned glass, typically ultra-clear and tempered, is the dominant choice for high-efficiency crystalline silicon modules.

What role does glass thickness play in modern PV module design?

Glass thickness is decreasing (down to 2.0mm or 1.6mm) to reduce module weight and material costs, which is crucial for balancing cost efficiency and installation logistics. However, thinner glass necessitates advanced tempering and heat-strengthening processes to maintain the required mechanical durability to withstand heavy wind, snow loads, and hail impacts throughout the warranted 25-30 year lifespan.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager