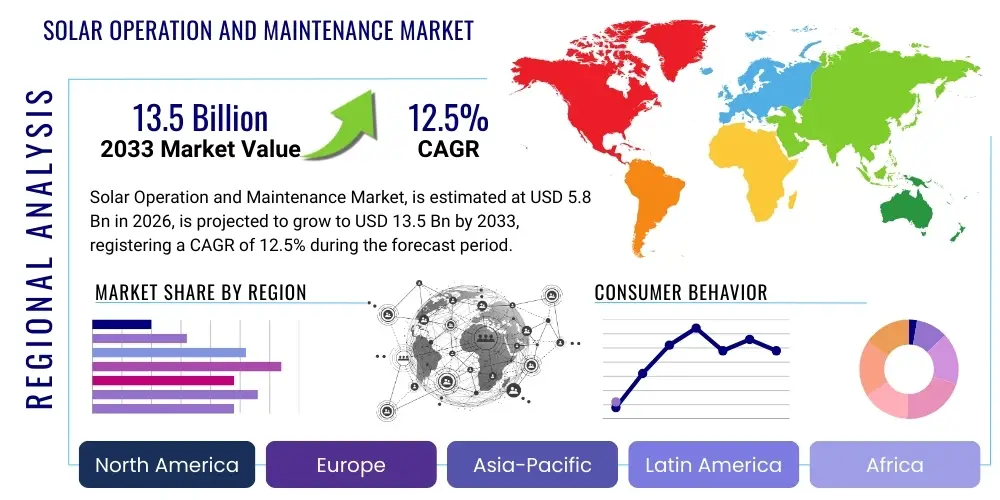

Solar Operation and Maintenance Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435217 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Solar Operation and Maintenance Market Size

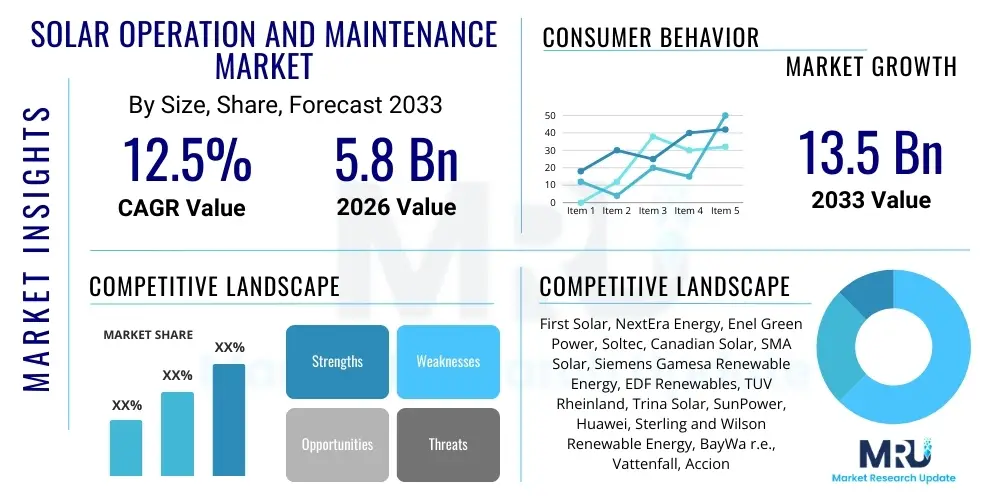

The Solar Operation and Maintenance Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.5% between 2026 and 2033. The market is estimated at $5.8 Billion USD in 2026 and is projected to reach $13.5 Billion USD by the end of the forecast period in 2033. This robust growth trajectory is primarily fueled by the continued global expansion of utility-scale and distributed solar photovoltaic (PV) installations, which necessitate specialized O&M services to ensure optimal energy yield and longevity of assets. The increasing complexity of solar arrays, coupled with stringent regulatory requirements for performance monitoring and reliability, drives the demand for advanced maintenance solutions.

Market expansion is also significantly influenced by technological advancements in predictive maintenance, utilizing artificial intelligence (AI) and machine learning (ML) to preemptively identify potential equipment failures. Owners of large solar farms are increasingly shifting from traditional corrective maintenance models to proactive, data-driven approaches. This transition reduces downtime, lowers operational costs over the asset lifespan, and maximizes the return on investment (ROI). Furthermore, the trend toward portfolio optimization across geographically dispersed solar assets requires sophisticated, centralized O&M management platforms, contributing substantially to market valuation growth.

Solar Operation and Maintenance Market introduction

The Solar Operation and Maintenance (O&M) Market encompasses all services required to ensure the continuous, reliable, and efficient operation of solar photovoltaic (PV) systems throughout their expected lifespan, typically 25 to 30 years. These services range from routine preventive cleaning and inspection to complex corrective repairs, performance monitoring, and asset management optimization. The product—or rather, the service package—is crucial for maximizing energy production (kWh output) and maintaining the asset’s performance ratio (PR). Major applications include utility-scale solar farms, commercial and industrial (C&I) rooftop installations, and increasingly, residential systems managed through specialized aggregated service models. The primary benefit realized by stakeholders, including independent power producers (IPPs) and financiers, is the maximization of financial returns and the minimization of unforeseen operational risks.

Driving factors for this market include the global surge in renewable energy capacity additions, particularly in the solar sector, stimulated by favorable government policies and decreasing hardware costs. As the installed base matures, the need for sophisticated O&M becomes paramount to mitigate degradation and system losses. Technological innovations, such as the deployment of automated cleaning robots, advanced monitoring hardware (drones, thermal imaging), and SCADA (Supervisory Control and Data Acquisition) systems, further enhance service quality and efficiency. The market is also driven by stringent Power Purchase Agreements (PPAs) that penalize underperformance, compelling asset owners to invest in high-quality O&M contracts to meet contractual obligations and maintain grid stability.

Solar Operation and Maintenance Market Executive Summary

The Solar O&M Market is characterized by a strong convergence of digital transformation and operational necessity. Business trends highlight a significant consolidation among O&M service providers, with larger players offering vertically integrated services—from remote monitoring to physical site maintenance—to capture market share across diverse geographic regions. There is a discernible shift towards long-term service agreements (LTSAs) that incorporate performance guarantees and penalty clauses, aligning the incentives of service providers and asset owners. Furthermore, cybersecurity for remote monitoring systems is emerging as a critical component of O&M contracts, reflecting the increasing digitization of energy infrastructure management.

Regionally, Asia Pacific (APAC) remains the fastest-growing market due to massive government-backed solar capacity targets in countries like China and India, focusing heavily on utility-scale projects. North America and Europe, while more mature, are driving innovation, particularly in predictive maintenance and sophisticated asset management software, fueled by aging infrastructure and high labor costs necessitating automation. Segment trends indicate that the predictive service type, utilizing machine learning algorithms to forecast component degradation (e.g., inverter failure or panel microcracks), is gaining substantial traction over traditional time-based preventive maintenance. The utility segment dominates in terms of contract value due to the sheer size and complexity of utility-scale assets, though the C&I sector shows promising growth fueled by self-consumption models and energy resilience demands.

AI Impact Analysis on Solar Operation and Maintenance Market

User queries regarding AI's impact on Solar O&M frequently revolve around cost reduction, accuracy in fault detection, and the future role of human technicians. Common concerns address the reliability of AI models in diverse environmental conditions and the necessary upfront investment in smart sensors and data infrastructure. The primary expectation is that AI will revolutionize maintenance schedules, shifting from manual inspections to highly efficient, automated monitoring that maximizes system uptime. Users are keenly interested in how AI processes massive streams of data from SCADA systems, weather forecasts, and component performance logs to predict failures, optimize cleaning cycles based on soiling rates, and adjust energy production forecasts in real time.

The integration of Artificial Intelligence and Machine Learning (ML) is fundamentally transforming the Solar O&M landscape by enabling truly proactive asset management. AI algorithms analyze vast datasets generated by solar plants to identify subtle anomalies indicative of impending component failure long before traditional methods can detect them. This capability allows service providers to schedule maintenance precisely when needed, minimizing system downtime and reducing unnecessary operational expenses associated with fixed-interval maintenance routines. This technological shift not only enhances the performance ratio of solar assets but also significantly improves the overall efficiency of maintenance logistics, allowing technicians to be deployed only for high-priority, imminent issues.

- AI-powered predictive fault detection enhances monitoring accuracy, identifying anomalies in current-voltage curves or thermal signatures.

- Machine learning optimizes performance ratio (PR) by correlating operational data with environmental variables (soiling, temperature, humidity).

- Automated scheduling and work order generation improve technician efficiency and logistical planning across large portfolios.

- Natural Language Processing (NLP) aids in analyzing warranty claims and technical documentation for faster issue resolution.

- Drone and aerial inspection data processed via deep learning models automatically categorize and quantify panel defects (e.g., microcracks, hot spots).

- Optimized energy forecasting driven by AI reduces grid instability risks and improves trading strategies for asset owners.

DRO & Impact Forces Of Solar Operation and Maintenance Market

The market dynamics are governed by a robust interplay of Drivers (D), Restraints (R), Opportunities (O), and potent Impact Forces. Key drivers include the massive global increase in solar PV installations, the necessity for performance optimization under competitive PPA environments, and the decreasing cost of sophisticated monitoring hardware. Restraints primarily encompass the high initial capital expenditure required for advanced monitoring technologies (SCADA, proprietary software), the shortage of highly skilled O&M technicians capable of managing complex digitized systems, and regulatory hurdles concerning data ownership and privacy. Significant opportunities lie in developing niche markets such as floating solar O&M, specializing in hybrid systems (solar plus storage), and scaling autonomous maintenance solutions like robotic cleaning and drone surveying.

The major impact forces shaping this market involve technological disruption and financial optimization pressures. The continuous advancement of diagnostic technologies—from advanced satellite imagery analysis to distributed sensor networks—is compelling market players to rapidly adopt new operational protocols or risk becoming obsolete. Concurrently, the pressure to drive down the Levelized Cost of Energy (LCOE) mandates constant efficiency improvements in O&M costs. Regulatory consistency and the standardization of O&M contracts and performance metrics across different regions also exert significant influence, fostering a more transparent and competitive global market environment. These forces collectively propel the market towards consolidation and technological specialization.

Segmentation Analysis

The Solar Operation and Maintenance Market is intricately segmented based on service type, component, end-user, and location, providing a comprehensive view of revenue generation across various operational parameters. Understanding these segmentations is critical for O&M providers to tailor service offerings to specific customer needs, whether focusing on high-volume utility contracts or specialized residential maintenance packages. The primary segments reflect the evolution of O&M practices, moving from simple physical checks to complex digital asset management. Geographical segmentation remains crucial, as maintenance requirements (e.g., frequency of cleaning due to soiling) vary dramatically based on climate and regulatory environment.

The largest segment by revenue continues to be the utility-scale sector, owing to the large physical size of assets and the complexity of grid connection requirements, which demand dedicated, full-scope O&M contracts. However, the fastest-growing segment is predictive maintenance services, capitalizing on the integration of big data and AI for proactive fault management. Component-wise segmentation highlights that inverter maintenance, given its crucial role in energy conversion and its relatively high failure rate compared to static modules, commands a significant portion of O&M spending. This detailed market breakdown allows stakeholders to accurately benchmark performance, identify underserved niches, and formulate strategic investment plans focused on high-growth areas like advanced data analytics and specialized component servicing.

- Service Type: Preventive Maintenance, Corrective Maintenance, Predictive Maintenance, Asset Management Services

- Component: Inverters, Solar Modules, Balance of System (BoS), Wiring and Cables

- End-User: Utility-Scale, Commercial & Industrial (C&I), Residential

- Location: Ground-Mounted, Rooftop, Floating Solar

Value Chain Analysis For Solar Operation and Maintenance Market

The value chain of the Solar O&M market is primarily focused on service delivery optimization, integrating hardware manufacturing outcomes with operational necessities. The upstream segment involves the suppliers of specialized O&M tools, including monitoring hardware (sensors, meters, data loggers), diagnostic equipment (thermal cameras, I-V curve tracers), and advanced software platforms (SCADA, asset performance management systems). These suppliers often dictate the technological limits and efficiency potential of the services rendered downstream. Key upstream relationships involve long-term procurement contracts with sensor and inverter manufacturers, ensuring rapid access to replacement parts and diagnostic protocols.

The downstream segment is dominated by the service providers themselves, which can be Original Equipment Manufacturers (OEMs), Independent Service Providers (ISPs), or captive in-house teams of large asset owners. Distribution channels for O&M services are predominantly direct, involving long-term, comprehensive service agreements (CSAs) between the asset owner and the O&M provider. Indirect channels, while less common, involve third-party aggregators or consulting firms that manage the procurement and oversight of O&M contracts. The shift towards digitization means that data analytics and remote monitoring centers act as crucial hubs, connecting upstream technology to efficient downstream operational execution, thereby driving value creation through efficiency rather than just manual labor.

Solar Operation and Maintenance Market Potential Customers

The primary customer base for Solar O&M services comprises organizations and entities that own or operate solar photovoltaic assets requiring professional maintenance to guarantee high performance and financial viability. These end-users are highly sensitive to performance ratio (PR) deviations and downtime, as energy production loss directly impacts revenue streams. The most significant segment consists of Independent Power Producers (IPPs) and Utilities (including investor-owned, public, and municipal utilities) that manage vast portfolios of utility-scale solar farms. These entities require comprehensive, full-scope O&M contracts often spanning ten to twenty years.

Other vital customer segments include institutional investors and private equity funds specializing in renewable energy infrastructure. These financial stakeholders require high-quality O&M and detailed performance reporting (Asset Management) to assure the viability of their investments and meet the requirements of debt providers. Furthermore, large commercial and industrial (C&I) entities that own significant rooftop or ground-mounted arrays for self-consumption represent a growing customer group, demanding customized O&M solutions that prioritize rapid corrective action and minimal disruption to business operations. Residential O&M, often managed indirectly through installation companies or third-party aggregators, focuses heavily on ensuring system longevity and maximizing consumer satisfaction.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $5.8 Billion USD |

| Market Forecast in 2033 | $13.5 Billion USD |

| Growth Rate | 12.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | First Solar, NextEra Energy, Enel Green Power, Soltec, Canadian Solar, SMA Solar, Siemens Gamesa Renewable Energy, EDF Renewables, TUV Rheinland, Trina Solar, SunPower, Huawei, Sterling and Wilson Renewable Energy, BayWa r.e., Vattenfall, Acciona Energía, ABB, ReNew Power, Rays Power Infra, Greencat Renewables |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Solar Operation and Maintenance Market Key Technology Landscape

The technology landscape for Solar O&M is rapidly evolving, driven by the necessity for automation, enhanced data accuracy, and remote capabilities. Central to this evolution are advanced monitoring technologies, primarily relying on centralized SCADA systems coupled with sophisticated Asset Performance Management (APM) software. These platforms integrate data from thousands of sensors, weather stations, and inverters to provide real-time performance ratio analysis and immediate fault alerts. The adoption of cloud computing is essential for managing the massive influx of data generated by multi-gigawatt portfolios, enabling rapid processing and accessibility for decentralized O&M teams.

Furthermore, robotics and autonomous systems represent a critical technological advancement in reducing labor intensity and improving quality. Automated cleaning robots (especially prevalent in dusty, water-scarce regions) drastically reduce soiling losses and water consumption. Concurrently, Unmanned Aerial Vehicles (UAVs or drones) equipped with thermal and visual cameras conduct rapid, large-scale inspections. The imagery collected is then processed using computer vision and AI algorithms to pinpoint subtle defects like microcracks or thermal hot spots with unprecedented speed and precision, reducing the need for manual, time-consuming ground inspections. These technologies transition O&M from reactive troubleshooting to highly efficient, predictive diagnostics, fundamentally lowering the LCOE.

Regional Highlights

- Asia Pacific (APAC): APAC is the global leader in terms of installed solar capacity and consequently dominates the O&M market volume. Key countries like China, India, and Japan drive demand, particularly for large utility-scale farm O&M. The market is highly competitive, characterized by cost-sensitive service contracts and a rapid uptake of automated cleaning solutions due to high dust accumulation and labor cost volatility. Investment focus is high on domestic O&M providers leveraging local supply chains and strong governmental support for grid integration.

- North America (NA): North America, led by the United States, represents a mature market characterized by high regulatory standards and a strong focus on predictive maintenance technologies. High labor costs necessitate investment in automation (drone inspections, sophisticated software). The market sees significant demand for complex contracts incorporating cybersecurity protocols and specialized asset management for hybrid solar-plus-storage projects.

- Europe: European O&M markets, particularly in Germany, Spain, and Italy, are characterized by aging solar fleets (installed during the early 2010s boom). This maturity drives demand for high-quality repowering, performance optimization, and stringent component replacement services. The region leads in standardizing O&M contracts and prioritizing sustainability metrics within asset management.

- Latin America (LATAM): LATAM is a rapidly emerging market driven by large solar installations in Chile, Brazil, and Mexico. The O&M market here faces logistical challenges due to remote site locations and diverse climatic zones. Demand is strong for reliable remote monitoring and specialized preventative maintenance to counter high irradiation and environmental stress.

- Middle East and Africa (MEA): This region, especially the UAE and Saudi Arabia, is defined by extreme environmental conditions (high temperatures, sandstorms). O&M services are critically focused on dealing with severe soiling, utilizing waterless or automated cleaning technologies, and highly robust monitoring systems designed for desert environments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Solar Operation and Maintenance Market.- First Solar

- NextEra Energy

- Enel Green Power

- Soltec

- Canadian Solar

- SMA Solar

- Siemens Gamesa Renewable Energy

- EDF Renewables

- TUV Rheinland

- Trina Solar

- SunPower

- Huawei

- Sterling and Wilson Renewable Energy

- BayWa r.e.

- Vattenfall

- Acciona Energía

- ABB

- ReNew Power

- Rays Power Infra

- Greencat Renewables

- Alten Energías Renovables

- Moxie Solar

- 365 Pronto

- Ingeteam

- GCL System Integration

- Lightsource BP

- Fotowatio Renewable Ventures (FRV)

- O&M Solar Services

- RES Group

- Sunrun

- TotalEnergies

- Wartsila

- Leeward Renewable Energy

Frequently Asked Questions

Analyze common user questions about the Solar Operation and Maintenance market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected growth rate (CAGR) for the Solar O&M Market?

The Solar O&M Market is projected to experience robust growth at a Compound Annual Growth Rate (CAGR) of 12.5% between 2026 and 2033. This growth is driven by increasing global solar capacity and the technological shift towards predictive maintenance models.

How does Predictive Maintenance differ from traditional O&M methods?

Predictive Maintenance (PdM) uses AI and machine learning to analyze real-time performance data, forecasting component failure before it occurs. This contrasts with traditional Preventive Maintenance (scheduled checks) and Corrective Maintenance (fixing after failure), minimizing downtime and maximizing asset performance ratio (PR).

Which region dominates the Solar O&M market in terms of volume?

The Asia Pacific (APAC) region currently dominates the Solar O&M market in terms of installed capacity and contract volume, primarily due to massive utility-scale deployments in countries like China and India. However, North America leads in the adoption of high-tech automation and advanced software solutions.

What is the most significant technological challenge facing solar farm O&M providers?

A significant technological challenge is effectively managing and interpreting the massive volume of diverse data generated by multi-gigawatt solar portfolios, requiring scalable cloud-based SCADA systems and advanced AI algorithms for accurate, real-time fault identification and performance optimization.

Who are the primary end-users of specialized Solar O&M services?

The primary end-users are Independent Power Producers (IPPs), large utilities, financial institutions owning renewable energy assets, and large Commercial and Industrial (C&I) entities. These groups prioritize maximized energy yield and rigorous contractual compliance through long-term service agreements.

The continuous refinement of operational strategies within the solar sector is fundamentally reliant on sophisticated O&M practices. The market’s trajectory is inextricably linked to the global energy transition, where solar PV plays a central role in decarbonization efforts. As system efficiencies improve, the marginal gains achieved through superior maintenance become increasingly valuable, directly impacting the profitability of multi-million dollar assets. This emphasis on performance optimization necessitates advanced analytical tools that can swiftly identify and remediate subtle system degradations. The integration of advanced sensor technology, often embedded directly within inverters and modules, provides granular data essential for these high-fidelity analyses.

Furthermore, regulatory environments worldwide are increasingly mandating higher standards for grid stability and renewable energy integration. This regulatory pressure forces O&M providers to offer services that ensure predictable power output and rapid response to grid curtailment signals. Consequently, asset management services, encompassing reporting, compliance, and warranty management, are becoming integral components of O&M contracts, moving beyond mere physical repair. The complexity of these requirements favors large, integrated service providers capable of deploying global expertise and standardized protocols across diverse regional portfolios. This market consolidation is a critical trend reshaping the competitive landscape.

Innovation in robotic maintenance systems, particularly for module cleaning and vegetation control, is a key driver of efficiency in geographically challenging locations. For instance, in arid regions, autonomous cleaning robots drastically reduce reliance on scarce water resources and high labor costs associated with manual cleaning, yielding significant improvements in energy harvest. In contrast, in temperate zones, predictive analytics focused on inverter health and degradation mapping using unmanned aerial vehicles (UAVs) provides the highest value. These technological differentiators dictate provider selection and influence pricing structures across various market segments. The convergence of IT and operational technology (OT) is creating new capabilities, such as Digital Twins of solar assets, allowing for highly accurate simulation and optimization of maintenance scenarios before physical intervention is required, ensuring maximal operational efficiency and minimal risk.

The financial structure of the Solar O&M market is witnessing a shift towards performance-based pricing models. Rather than fixed monthly fees, many contracts now tie a portion of the payment to the achievement of specified performance ratios (PR) or uptime guarantees. This alignment of financial incentives drives accountability and encourages O&M providers to invest in cutting-edge technologies that improve efficiency. The demand for transparent and verifiable performance metrics, often audited by third-party technical advisors, further validates the importance of advanced monitoring and data integrity within the overall service offering.

Crucially, the skill gap within the O&M workforce represents a persistent restraint. Modern solar systems require technicians proficient not only in electrical and mechanical tasks but also in data science, networking, and software troubleshooting. Addressing this gap requires substantial investment in training and certification programs focused on next-generation solar asset management tools, including proficiency with SCADA systems, AI interfaces, and specialized robotic equipment operation. Companies that successfully bridge this knowledge gap gain a significant competitive advantage in delivering high-quality, efficient maintenance services globally.

Opportunities are expanding in niche areas such as floating solar PV (FIPV) O&M, which presents unique challenges related to water-based logistics, corrosion protection, and mooring system maintenance. Similarly, the growing adoption of battery energy storage systems (BESS) co-located with solar farms creates a burgeoning demand for hybrid O&M services that require expertise in both PV and electrochemistry, optimizing the joint operation and maintenance of these integrated assets. These specialized segments promise higher margins and require distinct technical competencies, appealing to O&M providers looking for strategic differentiation beyond standard utility-scale services.

The impact of cybersecurity on remote O&M services cannot be overstated. As solar assets become highly interconnected elements of smart grids, the vulnerability to cyberattacks increases. O&M contracts increasingly include rigorous IT security requirements, focusing on intrusion detection, data encryption, and robust access control for remote diagnostic portals. Asset owners are demanding compliance with industry-specific security standards, transforming cybersecurity expertise into a fundamental prerequisite for major O&M contracts, particularly in sensitive utility and defense-related projects.

The technological evolution includes the standardization of communication protocols, allowing for easier integration of different equipment vendors within a single monitoring platform. This move away from proprietary systems enhances interoperability, simplifies data aggregation, and reduces the long-term cost associated with managing heterogeneous solar fleets. Open-source data platforms and shared diagnostic libraries further accelerate the adoption of advanced analytics by providing a foundation upon which smaller or regional O&M providers can build customized, cost-effective solutions.

Furthermore, the emphasis on sustainability extends to O&M practices. Demand is increasing for environmentally conscious operations, including the use of low-impact cleaning methods, responsible waste management (especially for aging components like inverters and modules), and minimizing the carbon footprint associated with maintenance logistics. Providers demonstrating strong Environmental, Social, and Governance (ESG) performance in their O&M services are increasingly favored by institutional investors, reflecting the broader market trend towards sustainable infrastructure investment.

The commercial and industrial (C&I) segment is driving innovation in decentralized O&M models. Often characterized by smaller, scattered systems and demanding uptime requirements, C&I contracts require highly localized and rapid-response maintenance teams. Digital tools, such as mobile apps providing augmented reality assistance for field technicians, are proving invaluable in efficiently guiding repairs and minimizing truck rolls. This segment's growth underscores the market's need for versatile, scalable O&M solutions adaptable to various system sizes and geographical densities.

The competitive dynamics are highly fragmented globally, though consolidation is accelerating. Original Equipment Manufacturers (OEMs), such as major inverter and module suppliers, leverage their product knowledge to offer specialized O&M packages. Simultaneously, large Independent Power Producers (IPPs) are increasingly forming in-house O&M capabilities or acquiring specialized service firms to achieve greater control over asset performance and operational costs, thereby shifting the balance of power within the service procurement ecosystem.

Regional market maturity dictates the service mix. In regions with newer installations (like the Middle East), the focus is on intensive preventive measures to mitigate environmental stress. Conversely, in mature markets (like Germany), O&M is increasingly focused on technical asset management, performance ratio optimization, and large-scale component replacement (repowering) to extend the economic life of assets beyond their initial expected service windows.

The development of regulatory frameworks supporting standardized O&M reporting, particularly concerning system outages and energy curtailment events, is vital for market transparency. Reliable, standardized performance data allows financial stakeholders to accurately assess risk and value solar assets, facilitating smoother project financing and secondary market transactions. This push for standardization reinforces the market's professionalization and reliance on formalized service protocols.

The market is observing a push for modular and easily replaceable components designed for enhanced maintainability, reducing the complexity and duration of corrective maintenance tasks. This focus on "design for O&M" at the manufacturing level directly impacts service costs and asset uptime, creating tighter integration between the manufacturing and service supply chains. Collaborative efforts between O&M specialists and equipment designers are becoming more common to improve product reliability and serviceability.

Furthermore, the emergence of energy trading and optimization services linked with O&M contracts represents a significant value-add opportunity. Providers who can integrate accurate production forecasting (informed by O&M data) with energy market participation strategies help asset owners maximize revenue from power sales. This comprehensive approach, combining technical maintenance with financial asset management, defines the next generation of high-value O&M offerings.

The role of satellite monitoring and aerial imagery is gaining prominence in preliminary fault detection for vast, remote solar farms. Analyzing changes in land use or environmental factors around the site, along with large-scale panel degradation mapping, allows O&M teams to prioritize site visits efficiently, reducing travel costs and improving resource allocation across geographically dispersed assets. This macro-level surveillance complements the micro-level sensor data provided by SCADA systems.

Finally, the longevity and warranty obligations associated with solar assets necessitate robust data archiving and documentation practices within O&M services. Detailed logging of all maintenance activities, performance deviations, and environmental incidents is crucial for validating warranty claims against equipment manufacturers, protecting the financial interests of asset owners over the long term. Data integrity and secure storage solutions are therefore indispensable components of modern O&M contract deliverables.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager