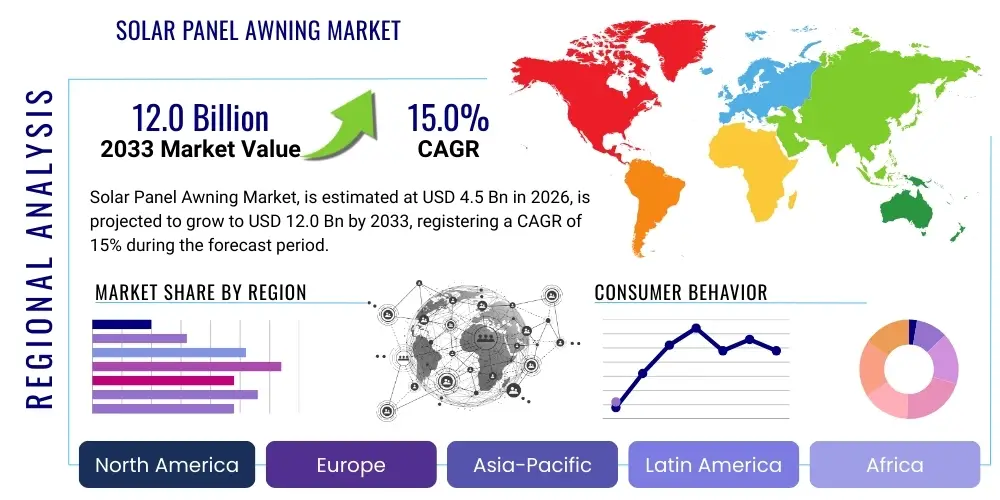

Solar Panel Awning Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437184 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Solar Panel Awning Market Size

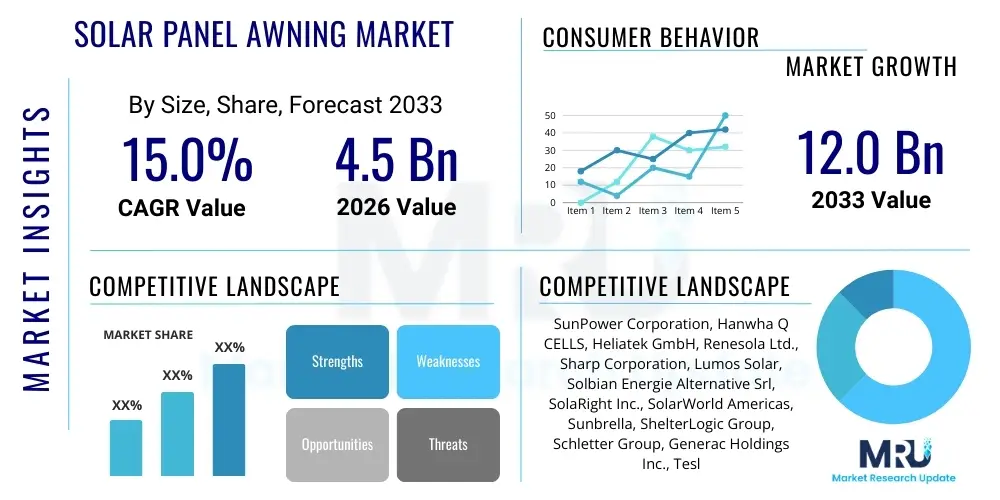

The Solar Panel Awning Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 15.0% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 12.0 Billion by the end of the forecast period in 2033.

Solar Panel Awning Market introduction

The Solar Panel Awning Market encompasses the design, manufacturing, distribution, and installation of solar photovoltaic (PV) modules integrated into shading structures, commonly referred to as awnings or canopies. These innovative structures serve the dual purpose of providing architectural shading for buildings, patios, or parking spaces, while simultaneously generating renewable electricity. The product combines high-efficiency PV cells with aesthetically pleasing and durable structural materials such, as aluminum or high-grade steel, making them a key component in the trend toward building-integrated photovoltaics (BIPV) and decentralized energy generation. The inherent value proposition of solar awnings lies in their ability to monetize non-utilized vertical or overhead spaces, turning passive architectural elements into active power generators, thereby optimizing energy independence and reducing reliance on grid electricity. The increasing demand for sustainable building solutions, coupled with favorable regulatory mandates promoting solar adoption in urban environments, acts as a foundational driver for market expansion.

Major applications of solar panel awnings span across diverse sectors, including residential dwellings seeking sustainable patio covers or carports, commercial establishments requiring shaded customer areas or storefront energy generation, and industrial facilities utilizing large-scale canopy structures for equipment protection and power supply. The versatility of these systems allows for customization in terms of size, shape, transparency, and power output, addressing specific aesthetic and functional requirements across varied installation sites. Key benefits include significant reduction in air conditioning loads due to effective shading, substantial savings on electricity bills, enhanced property aesthetics, and contributing directly to carbon emission reduction goals. Furthermore, solar awnings offer superior protection against environmental elements like rain, harsh sunlight, and UV radiation for the areas they cover, adding tangible non-energy related benefits to the investment case.

Driving factors propelling this market forward are multifaceted, primarily centered around decreasing manufacturing costs of PV technology, increased global commitment to renewable energy transitions, and government incentives such as tax credits and feed-in tariffs designed to accelerate PV adoption. Specifically, the innovation in flexible and thin-film solar technologies is making integration into diverse awning designs more seamless and cost-effective. Urban density and limited rooftop space are forcing property owners to seek alternative surfaces for solar deployment, positioning solar awnings as an ideal, space-efficient solution. Furthermore, the growing consumer awareness regarding climate change and the desire for smart, self-sufficient energy solutions are significantly influencing purchasing decisions in both developed and rapidly developing economies.

Solar Panel Awning Market Executive Summary

The Solar Panel Awning Market is experiencing robust growth fueled by technological advancements in solar cell efficiency and structural lightweighting, making these systems more attractive for both retrofit and new construction projects. Business trends indicate a strong move toward integrated smart features, where awnings are connected to home energy management systems (HEMS) or building energy management systems (BEMS) to optimize power usage, storage, and grid interaction. Key market players are increasingly focusing on strategic collaborations with architectural firms and construction companies to ensure early integration into building design cycles. Furthermore, the market structure is evolving, showing consolidation among module manufacturers and specialized installers, while innovation focuses on modular design to simplify installation processes and reduce overall deployment time and cost. The shift from fixed installations to motorized, retractable awnings is a significant product trend catering to consumer demands for flexibility and aesthetic control.

Regionally, the market exhibits differential growth patterns. North America and Europe, driven by stringent energy efficiency standards, high electricity costs, and established solar incentive programs, dominate in terms of technology adoption and market value. The Asia Pacific region, particularly China and India, is poised for the highest growth rate due to rapid urbanization, increasing energy demand, and governmental pushes for sustainable infrastructure development in commercial and industrial sectors. Latin America and the Middle East and Africa (MEA) represent emerging opportunities, spurred by high solar irradiance levels and a growing need for energy infrastructure development, although growth in these regions often faces challenges related to policy stability and initial capital expenditure requirements. The strategic imperative for companies operating globally is to tailor product offerings—such as resistance to high wind loads or extreme temperatures—to the specific environmental and regulatory landscapes of target regions.

Segment trends reveal that the residential segment, particularly the carport and patio cover applications, remains the largest revenue generator, benefiting directly from consumer enthusiasm for aesthetically pleasing energy solutions. However, the commercial segment, driven by large-scale applications such as solar parking lots (solar carports) for corporate campuses and retail centers, is projected to witness the fastest growth rate. This accelerated commercial adoption is motivated by significant corporate sustainability goals and the ability of large installations to achieve quicker returns on investment (ROI). Technology-wise, monocrystalline silicon panels dominate due to their superior efficiency, but the adoption of thin-film PV in flexible and translucent awnings is increasing, offering design freedom where light filtration is a priority. The integration of battery storage solutions alongside new awning installations is also a prevalent trend, maximizing self-consumption and ensuring energy resilience.

AI Impact Analysis on Solar Panel Awning Market

User inquiries concerning AI's role in the Solar Panel Awning market frequently revolve around questions of dynamic efficiency optimization, predictive maintenance scheduling, and the seamless integration of energy production into smart home ecosystems. Users are keen to understand how AI algorithms can analyze real-time weather data and energy consumption patterns to dynamically adjust retractable awning positions, maximizing both solar gain and shading efficacy simultaneously. Key concerns often address data privacy related to energy consumption tracking and the cost associated with integrating sophisticated AI-driven control systems. Expectations are high regarding the capability of AI to detect micro-cracks or soiling issues on panels preemptively, thereby significantly reducing downtime and improving the long-term system performance and lifespan without human intervention.

The application of Artificial Intelligence introduces revolutionary capabilities, moving solar awnings beyond passive energy generation to active, intelligent energy management structures. AI algorithms are crucial for optimizing the complex interplay between solar energy generation, architectural shading requirements, and structural integrity protection. For instance, AI-powered control systems can predict peak energy demand periods and autonomously prioritize energy storage or grid injection based on tariff structures and real-time utility signals, maximizing economic returns for the owner. This level of optimization is unattainable through traditional fixed or simple sensor-based systems. Moreover, AI facilitates the rapid analysis of vast datasets related to material stress, thermal performance, and shading efficiency across thousands of installed units, leading to faster, more robust design iterations and material selection processes in the manufacturing phase.

Furthermore, AI is fundamentally transforming the maintenance and operational lifespan of solar awning installations. By employing machine learning models to process imagery from drones or integrated sensors, systems can identify anomalies such as dirt buildup patterns, hot spots indicative of cell degradation, or structural shifts caused by high winds. These predictive diagnostics allow maintenance teams to perform targeted interventions before minor issues escalate into costly failures. The integration of AI also enhances the user experience through intuitive control interfaces and personalized energy recommendations, ensuring that the solar awning system operates optimally within the context of the entire smart building infrastructure, solidifying its role as a critical component of the Internet of Energy (IoE).

- AI-driven dynamic shading optimization based on real-time irradiance and internal building temperature.

- Predictive maintenance analytics for early detection of panel degradation, soiling, or structural faults.

- Enhanced energy management system (EMS) integration for intelligent load balancing and battery charge/discharge optimization.

- Machine learning facilitated structural design optimization, minimizing material use while maximizing wind and snow load resistance.

- Automated system fault reporting and diagnosis, significantly reducing diagnostic time and technician dispatch costs.

DRO & Impact Forces Of Solar Panel Awning Market

The Solar Panel Awning Market is subject to a potent mix of Drivers, Restraints, and Opportunities (DRO) that collectively determine its growth trajectory, influenced further by significant Impact Forces. Key drivers include global renewable energy mandates, declining solar component costs, and the increasing trend toward aesthetic and functional integration of PV technology into architecture (BIPV). These factors provide a foundational impetus for growth, especially in urban areas where space utilization is premium. Restraints, however, pose challenges, notably the high initial capital expenditure compared to traditional awnings, the complexity of installation requiring specialized expertise, and aesthetic limitations, which sometimes conflict with historical preservation codes or specific architectural styles. Navigating these restraints requires continued innovation in flexible financing models and aesthetically versatile module designs.

Opportunities in the market are abundant and center primarily on technological advancements and new application development. The ongoing development of lightweight, highly efficient perovskite solar cells promises to reduce the structural load requirements of awnings significantly, opening up possibilities for installations on structures previously unable to support heavy glass panels. Expansion into developing economies with abundant sunshine but insufficient grid infrastructure presents a massive opportunity for solar awnings to serve as decentralized power sources. Furthermore, the integration of advanced features such as LED lighting, integrated heating elements for snow melting, and smart connectivity for automated operation represents avenues for premium product differentiation and increased market penetration in the high-end residential and commercial sectors. Successfully capitalizing on these opportunities will require strategic investment in research and development and targeted geographical expansion.

The impact forces influencing the market are derived from the macroeconomic and geopolitical environment. Regulatory policy shifts, such as changes in net metering policies or the introduction of new building energy codes (e.g., mandates for zero-energy buildings), have a direct and powerful impact on adoption rates. Competition from alternative renewable energy solutions, such as ground-mounted solar farms or conventional rooftop PV, places constant pressure on the cost-effectiveness and differentiation of awning systems. The stability of the global supply chain, particularly for raw materials like polysilicon and aluminum, dictates production costs and market prices. Moreover, consumer preferences regarding sustainability and smart home technology adoption significantly influence the market acceptance and willingness to invest in integrated solar solutions, making consumer education and marketing vital strategic elements.

Segmentation Analysis

The Solar Panel Awning Market segmentation provides a granular view of market dynamics, categorized fundamentally by Type, Application, and Material used in construction. This analysis is critical for manufacturers and stakeholders to tailor product offerings, optimize distribution strategies, and identify high-growth niches. The segmentation by Type, specifically differentiating between Fixed and Retractable systems, highlights the demand spectrum from maximum energy generation (Fixed) to user convenience and aesthetic control (Retractable/Motorized). Application segmentation, covering Residential, Commercial, and Industrial sectors, reveals where the bulk of investment and regulatory focus is directed, emphasizing the divergent requirements for scale, durability, and integration complexity across these end-user groups.

The materials segment is highly relevant as it determines the structural integrity, lifespan, cost, and overall aesthetics of the product. The dominance of Aluminum frames is driven by its lightweight nature and corrosion resistance, essential properties for outdoor architectural elements. Innovations in the use of high-strength polymers and specialty glass for enhanced efficiency and reduced weight are pushing the boundaries of design. Understanding these segment interactions—for instance, high-efficiency monocrystalline panels (Material) deployed in large-scale carports (Application) using fixed structures (Type)—is essential for accurately forecasting market revenues and identifying competitive advantages.

- By Type:

- Fixed Solar Awnings

- Retractable/Motorized Solar Awnings

- Custom/Modular Solar Awning Systems

- By Application/End-Use:

- Residential (Patio Covers, Carports, Balcony Awnings)

- Commercial (Storefronts, Cafeterias, Walkway Canopies)

- Industrial (Loading Docks, Equipment Shelters, Large Solar Carports)

- By Material:

- Aluminum Frame

- Steel Frame

- Polycarbonate/Composite Materials

- By Panel Technology:

- Monocrystalline Silicon

- Polycrystalline Silicon

- Thin-Film PV (Amorphous Silicon, Cadmium Telluride, CIGS)

Value Chain Analysis For Solar Panel Awning Market

The value chain for the Solar Panel Awning Market begins with upstream activities focused on securing high-quality raw materials and specialized components. This stage involves the sourcing of refined silicon for PV cells, high-purity aluminum or steel alloys for structural framing, specialized polymer films for lamination, and sophisticated electronic components like micro-inverters or DC optimizers. Ensuring supply chain resilience and ethical sourcing are paramount, especially given the globalized nature of silicon production. Key players in this upstream segment are dedicated PV cell manufacturers and material suppliers who often operate on large economies of scale, impacting the final cost structure of the awning system. Maintaining stringent quality control for corrosion resistance and structural load-bearing capacity is critical at this initial phase.

Midstream activities encompass the manufacturing, assembly, and integration phase. This involves the specialized fabrication of the structural awning frames, the assembly of solar modules, and the complex integration of the PV modules into the frame structure, often requiring specialized bonding or clamping techniques to ensure durability and weather resistance. Manufacturers must balance structural aesthetics with electrical efficiency. Following production, the logistics of transporting large, often custom-sized, awning systems to the installation site forms a crucial component of the value chain. This requires specialized handling to prevent damage to the glass or PV cells, and efficient inventory management is necessary, particularly for project-based commercial installations.

The downstream segment focuses on market access, installation, and post-sales service, involving direct and indirect distribution channels. Direct channels often include manufacturer-to-customer sales for large commercial projects or specialized BIPV integrators. Indirect channels rely heavily on a network of certified solar installation companies, regional distributors, and authorized dealers who handle local marketing, sales, and complex permitting processes. Installation requires specialized skills related to both construction (structural anchoring and load calculation) and electrical engineering (wiring, interconnection, and commissioning). Post-sales activities, including scheduled maintenance, remote monitoring, and warranty fulfillment, complete the value chain, ensuring system longevity and customer satisfaction, which are vital for reputation building and future sales referrals.

Solar Panel Awning Market Potential Customers

The primary customer base for the Solar Panel Awning Market is broadly segmented into residential owners, commercial enterprises, and industrial entities, each driven by distinct motivating factors. Residential buyers, particularly those owning single-family homes or townhouses with outdoor space, are motivated by a combination of factors: reducing household energy bills, the desire for sustainable lifestyle solutions, and enhancing property value through functional aesthetics, specifically patio covers, carports, or deck shading. These customers often prioritize design integration, ease of use (especially motorized systems), and reliable warranty services, seeking solutions that blend seamlessly into their existing home architecture and smart home ecosystems. Marketing efforts targeting this segment must emphasize return on investment alongside the aesthetic and comfort benefits.

Commercial clients represent a rapidly expanding segment, encompassing retail centers, restaurants, schools, universities, and corporate office parks. Their procurement decisions are fundamentally driven by corporate sustainability initiatives (ESG goals), significant operational cost reduction, and enhancing the customer or employee experience through comfortable, shaded parking or outdoor areas. Large-scale solar carports (which function as sophisticated awnings) are highly attractive to this segment as they utilize existing paved areas for power generation without sacrificing valuable real estate. These buyers require high durability, adherence to stringent safety standards, and robust financing options, such as Power Purchase Agreements (PPAs), to minimize upfront capital outlay. They often work through EPC contractors or specialized energy services companies (ESCOs).

Industrial customers, including manufacturing plants, logistics centers, and large-scale facilities, prioritize maximum power output, reliability under harsh conditions, and compliance with industrial safety regulations. Their applications often involve sheltering sensitive outdoor equipment, covering expansive loading docks, or providing employee shelters. While aesthetics are secondary, structural resilience against extreme weather and integration with existing industrial electrical infrastructure are non-negotiable requirements. The sales cycle for industrial clients is typically longer, involving detailed engineering specifications and a focus on long-term, low-maintenance operational performance, positioning solar awnings as a strategic asset for energy security and operational continuity, offering significant economies of scale.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 12.0 Billion |

| Growth Rate | Insert CAGR 15.0% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | SunPower Corporation, Hanwha Q CELLS, Heliatek GmbH, Renesola Ltd., Sharp Corporation, Lumos Solar, Solbian Energie Alternative Srl, SolaRight Inc., SolarWorld Americas, Sunbrella, ShelterLogic Group, Schletter Group, Generac Holdings Inc., Tesla Inc. (Energy Products), Amerisolar, Grape Solar, Fleximounts, Palram Applications, Sun Shade Experts, Awning Company of America. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Solar Panel Awning Market Key Technology Landscape

The technological landscape of the Solar Panel Awning Market is characterized by continuous innovation in three primary areas: photovoltaic module efficiency, structural material engineering, and smart system integration. Advancements in PV modules are centered around increasing the efficiency of monocrystalline cells, which currently dominate the market due to their high power density, making them ideal for space-constrained awning applications. Furthermore, the growing commercial viability of thin-film technologies, particularly CIGS (Copper Indium Gallium Selenide) and advanced perovskite structures, is pivotal. These newer technologies offer flexibility, light weight, and the ability to be manufactured in translucent formats, allowing for BIPV awnings that still permit natural daylight while generating power, significantly enhancing aesthetic appeal and application versatility.

Structural technology focuses heavily on achieving optimal strength-to-weight ratios and maximizing durability under severe weather conditions. The pervasive use of corrosion-resistant, high-grade aluminum alloys, often treated with specialized finishes, ensures longevity and minimizes maintenance requirements. Crucially, the engineering of retractable and motorized awning systems involves sophisticated linear actuators and control mechanisms that must withstand continuous use and integrate securely with the solar panels without compromising electrical connections. Research efforts are concentrated on modular, prefabricated designs that reduce on-site construction time and complexity, relying on advanced computer-aided design (CAD) and simulation tools to optimize structural load distribution and minimize material waste.

The most transformative technologies involve smart connectivity and control. Modern solar awnings increasingly incorporate Internet of Things (IoT) sensors for real-time monitoring of weather conditions (wind speed, rain, sunlight intensity) and energy output. This data feeds into integrated control units that manage the position of motorized awnings, optimize battery charging cycles, and communicate performance metrics via cloud-based platforms. Furthermore, DC optimization and micro-inverter technology embedded within the awning system are critical for maximizing energy harvest from each panel independently, mitigating the impact of partial shading—a common issue for awning installations—and enhancing overall system safety and resilience against electrical faults.

Regional Highlights

Geographical market analysis reveals that North America, particularly the United States and Canada, constitutes a critical and mature segment of the Solar Panel Awning Market. This region benefits from high consumer awareness, robust state-level incentives (such as solar tax credits and renewable portfolio standards), and a strong architectural trend favoring modern, integrated energy solutions. The demand here is largely driven by both the high-end residential sector seeking sophisticated solar carports and the large commercial sector focused on extensive corporate solar parking lots. Technological adoption is rapid, with strong uptake of smart, AI-driven energy management systems. However, high labor costs and complex permitting processes in certain jurisdictions pose operational challenges.

Europe represents another powerhouse market, led by countries such as Germany, France, and the Netherlands, which have pioneering BIPV policies and strong cultural commitments to climate neutrality. Strict energy efficiency directives for buildings, coupled with attractive feed-in tariffs, have positioned solar awnings as a preferred solution for maximizing solar penetration on existing buildings, especially in dense urban environments. The European market shows a strong preference for aesthetically subtle and highly customizable systems, favoring high-quality materials and streamlined design. Innovation here often focuses on seamlessly integrating PV elements into existing urban landscapes and historical architecture.

The Asia Pacific (APAC) region is forecasted to exhibit the highest growth rate during the forecast period. This rapid expansion is primarily driven by massive infrastructure investments in China, Japan, and South Korea, coupled with the immense, growing energy needs of emerging economies like India and Southeast Asia. Government initiatives focused on large-scale solar deployment, combined with falling production costs stemming from regional manufacturing capabilities, make APAC a volume-driven market. While residential demand is increasing, the commercial and industrial sectors, particularly for large parking structures and factory floor protection, dominate the market share, prioritizing cost-effectiveness and high power output over nuanced aesthetic concerns.

- North America (US & Canada): Mature market focused on high-efficiency, smart integration; strong commercial adoption (carports).

- Europe (Germany, France, Netherlands): Policy-driven growth, emphasis on BIPV, high aesthetic standards, robust demand for specialized retractable systems.

- Asia Pacific (China, India, Japan): Fastest growing market; volume-driven; strong focus on large commercial and industrial applications; key manufacturing hub.

- Latin America (Brazil, Mexico): High solar irradiance potential; growing demand linked to energy independence and reducing reliance on volatile national grids.

- Middle East & Africa (MEA): Emerging market opportunities driven by high solar resources; strategic governmental investments in large-scale renewable projects.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Solar Panel Awning Market.- SunPower Corporation

- Hanwha Q CELLS

- Heliatek GmbH

- Renesola Ltd.

- Sharp Corporation

- Lumos Solar

- Solbian Energie Alternative Srl

- SolaRight Inc.

- SolarWorld Americas

- Sunbrella

- ShelterLogic Group

- Schletter Group

- Generac Holdings Inc.

- Tesla Inc. (Energy Products)

- Amerisolar

- Grape Solar

- Fleximounts

- Palram Applications

- Sun Shade Experts

- Awning Company of America

Frequently Asked Questions

Analyze common user questions about the Solar Panel Awning market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the typical lifespan and maintenance requirement of a solar panel awning?

Solar panel awnings are typically designed for a 25-year lifespan, aligning with standard solar PV module warranties. The integrated structure often lasts longer. Maintenance is low, primarily requiring occasional cleaning of the panels (potentially automated) and routine checks of the structural integrity and electrical connections, minimizing long-term operational costs.

How do solar awnings compare in cost and energy production efficiency to traditional rooftop solar installations?

Solar awnings generally have a higher initial material cost than standard rooftop solar arrays due to the required integrated structural components. However, their efficiency can be optimized as they benefit from better cooling (air circulation below the canopy), which can prevent performance degradation commonly seen in roof-mounted systems, often maximizing the energy yield per square meter.

Are solar panel awnings suitable for high-wind or heavy-snow regions?

Yes, reputable solar panel awnings are structurally engineered to meet specific local building codes for snow load and wind resistance. Commercial-grade systems often use high-strength aluminum or steel to ensure compliance, and motorized systems may include sensors to automatically retract or adjust position during severe weather events for protection.

Can solar panel awnings integrate with existing home energy storage systems and smart grids?

Absolutely. Modern solar awnings are typically inverter-based systems compatible with all major battery storage solutions and home energy management platforms. They function as decentralized generation sources and can be configured for grid-tied operation with net metering or full off-grid autonomy when paired with adequate battery backup capacity.

What types of aesthetics and customization options are available for solar awnings?

Customization is extensive, covering frame materials (aluminum, powder-coated steel), PV technology (opaque mono panels, semi-transparent thin-film cells), and structural design (fixed carports, pergolas, motorized patio covers). Manufacturers offer various colors and finishes to ensure the awning integrates seamlessly with the architectural style of the building, providing both energy function and architectural appeal.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager