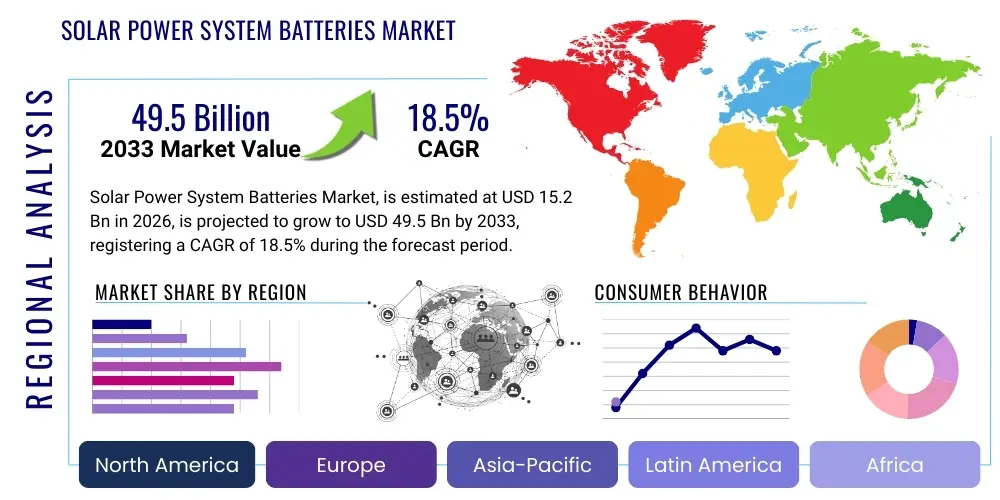

Solar Power System Batteries Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437849 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Solar Power System Batteries Market Size

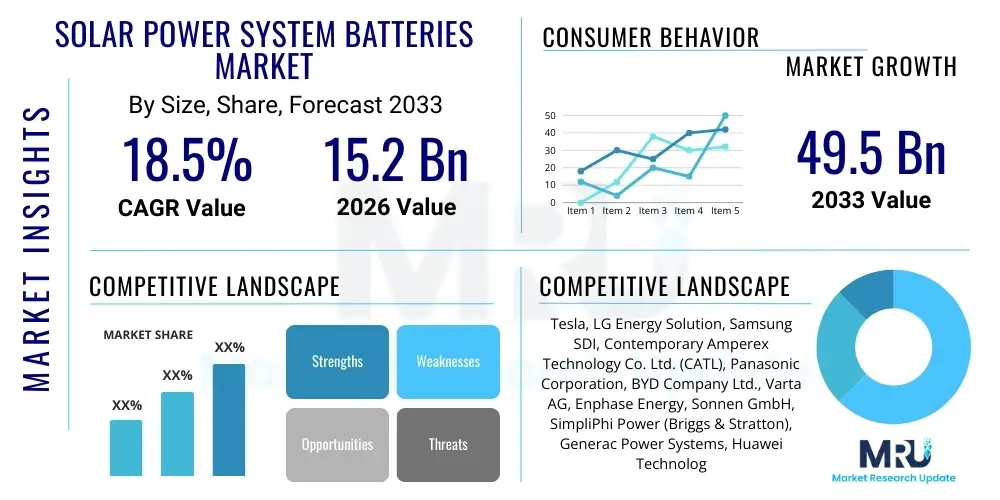

The Solar Power System Batteries Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% between 2026 and 2033. The market is estimated at USD 15.2 Billion in 2026 and is projected to reach USD 49.5 Billion by the end of the forecast period in 2033.

Solar Power System Batteries Market introduction

The Solar Power System Batteries Market encompasses the development, manufacturing, and distribution of energy storage solutions specifically designed to integrate with photovoltaic (PV) systems. These batteries are crucial for ensuring grid stability, optimizing self-consumption of solar energy, and providing reliable power during periods of low sunlight or grid outages. The core product includes various battery chemistries, primarily Lithium-ion (Li-ion), but also increasingly Flow batteries and advanced Lead-Acid variants, tailored for residential, commercial, industrial (C&I), and utility-scale solar installations. The rapid global shift towards renewable energy sources and supportive governmental policies, such as feed-in tariffs and tax credits, are fundamentally driving the adoption of integrated solar battery solutions across diverse geographies.

Major applications of solar power system batteries include peak shaving, load shifting, backup power provision in off-grid or weak-grid locations, and increasing the overall resilience and self-sufficiency of energy users. For residential consumers, these batteries maximize the utility of self-generated solar power by storing surplus electricity generated during the day for use at night, reducing dependence on high-cost grid electricity. In the C&I sector, battery storage minimizes demand charges and facilitates greater operational efficiency by ensuring continuous power supply for critical processes, thereby providing significant economic benefits and mitigating risks associated with volatile energy prices and infrastructure downtime.

The primary benefits of integrating battery storage with solar systems involve enhanced energy independence, reduced carbon footprint, and improved economic returns on solar investments. Driving factors for market expansion include the decreasing cost of battery technology, particularly Li-ion, regulatory mandates favoring grid modernization, and accelerating urbanization coupled with increasing electrification needs in developing economies. Furthermore, the growing frequency of extreme weather events necessitating robust backup power solutions contributes significantly to the sustained high demand for reliable, long-duration solar battery systems.

Solar Power System Batteries Market Executive Summary

The Solar Power System Batteries Market is characterized by vigorous competition and rapid technological innovation, primarily focused on improving energy density, cycle life, and safety features of storage devices. Key business trends include the vertical integration of battery manufacturers with solar system installers and the proliferation of "Battery-as-a-Service" (BaaS) models, offering consumers and businesses flexible financing and operational solutions. Strategic mergers, acquisitions, and partnerships aimed at securing raw material supply chains (such as lithium and cobalt) and expanding geographical reach are defining the current competitive landscape. Furthermore, the market is seeing a major trend towards smart battery management systems (BMS) integrated with sophisticated software platforms to optimize charging/discharging cycles based on real-time electricity pricing and usage patterns, enhancing overall system profitability.

Regionally, the market exhibits strong growth across Asia Pacific, driven by ambitious national renewable energy targets in China, India, and Australia, coupled with increasing accessibility of solar energy in remote, unelectrified areas. North America and Europe demonstrate mature market conditions, focused less on initial adoption and more on replacing aging infrastructure, optimizing grid interaction through virtual power plants (VPPs), and meeting stringent residential energy independence standards. Policy stability in regions like Western Europe and select US states provides predictable long-term investment incentives, cementing their position as leaders in advanced battery deployment and recycling initiatives.

Segment trends indicate that Lithium-ion batteries dominate the market due to their superior performance metrics, though solid-state batteries are rapidly emerging as a disruptive technology offering enhanced safety and energy density. The residential segment is expected to maintain the highest CAGR, spurred by decreasing installation costs and rising consumer awareness regarding energy security. Conversely, the utility-scale segment, while smaller in volume, demands larger, more durable battery stacks, leading to increasing investments in non-Li-ion chemistries like Flow batteries, suitable for multi-hour energy storage requirements crucial for large-scale grid stabilization projects.

AI Impact Analysis on Solar Power System Batteries Market

Common user questions regarding AI's influence on the Solar Power System Batteries Market typically center on optimization efficiency, predictive maintenance capabilities, and the role of AI in grid management and battery longevity. Users frequently inquire about how AI can maximize the utilization of stored solar energy, whether AI integration leads to substantial cost savings, and the ethical implications of autonomous energy trading driven by algorithms. Based on this analysis, the key themes include the potential for AI to transition storage systems from passive backups to active, intelligent grid assets. Concerns revolve around data security, the complexity of implementing sophisticated AI models into legacy systems, and the precise return on investment (ROI) derived from these advanced analytical tools. Users generally expect AI to deliver significant improvements in forecasting accuracy and battery health management, ultimately reducing operational expenditures and prolonging asset life.

Artificial Intelligence is revolutionizing the operation and management of solar battery systems by enabling highly granular and predictive control over energy flow. AI algorithms leverage vast datasets encompassing weather patterns, consumer behavior, and fluctuating grid prices to calculate the optimal time for a battery to charge, discharge, or remain dormant. This predictive capability moves beyond simple rule-based control, ensuring that stored energy is always deployed to maximize financial returns, either by avoiding peak utility charges or participating in demand response programs. Consequently, AI integration enhances the economic viability of solar storage systems, making them more attractive to a broader range of consumers and investors seeking rapid payback periods.

Beyond optimization, AI profoundly impacts the operational lifespan and reliability of solar batteries through advanced diagnostic and prognostic maintenance. Machine learning models analyze real-time performance data—such as temperature variances, voltage drifts, and cycle history—to identify subtle anomalies that precede catastrophic failure. This allows operators to schedule preventative maintenance precisely when needed, rather than relying on fixed schedules, thereby reducing unexpected downtime and maximizing availability. Furthermore, AI contributes significantly to the safety profile of battery installations by actively monitoring thermal runaway risks and instantly isolating faulty cells, a critical capability as battery installations scale to utility size.

- AI-driven optimization of charge/discharge cycles based on dynamic electricity pricing.

- Enhanced predictive maintenance and fault detection increasing battery longevity and safety.

- Improved solar generation forecasting accuracy, leading to better resource planning.

- Facilitation of Virtual Power Plants (VPPs) through aggregated, intelligent battery control.

- Real-time load management and grid stabilization via autonomous decision-making.

- Streamlined integration with smart home energy management systems (HEMS).

- Automated energy trading and participation in ancillary services markets.

DRO & Impact Forces Of Solar Power System Batteries Market

The dynamics of the Solar Power System Batteries Market are shaped by powerful drivers and systemic restraints, balanced by substantial long-term opportunities, all coalescing to create significant market impact forces. Key drivers include accelerating decarbonization goals set by global governments, which necessitate reliable energy storage to stabilize intermittent solar generation. Simultaneously, major restraints such as the volatility of raw material prices (e.g., lithium, nickel, cobalt) and regulatory hurdles associated with grid interconnection standards impede seamless market expansion. However, the opportunity landscape is broad, focusing on developing advanced battery chemistries (like solid-state and sodium-ion) and expanding storage deployment into underserved industrial and microgrid sectors, promising high future growth potential. These interacting factors create an environment where cost reduction and safety improvements are paramount competitive forces.

Drivers: The increasing global appetite for energy independence, particularly in regions prone to power outages or with high residential electricity tariffs, is a primary growth engine. Government subsidies, tax incentives, and mandated storage targets in key economies (such as Germany, California, and Australia) directly stimulate consumer adoption and utility investment. Furthermore, the exponential decline in PV installation costs has made solar energy economically superior to fossil fuel alternatives, driving the need for corresponding storage solutions to ensure 24/7 reliability. The market is also heavily driven by corporate sustainability commitments (ESG criteria), pushing large commercial entities to invest in on-site solar storage systems.

Restraints: Significant capital investment required for large-scale battery projects remains a major impediment, particularly for smaller commercial enterprises. Supply chain disruptions, exacerbated by geopolitical tensions and intense competition for critical mineral resources, introduce cost uncertainty and project delays. Safety concerns, specifically related to thermal runaway and fire risk in high-density Li-ion installations, necessitate expensive mitigation technologies and stringent regulatory compliance, which can slow down deployment. Additionally, the lack of standardized regulatory frameworks across different jurisdictions creates complexities for manufacturers operating globally, hindering mass market penetration and standardization.

Opportunities: The development of second-life applications for electric vehicle (EV) batteries presents a massive opportunity to lower the cost of stationary storage and improve resource efficiency. Advancements in energy management software, utilizing AI and machine learning for optimized asset utilization, unlock new revenue streams through participation in demand response and frequency regulation services. The push toward decentralized energy systems (microgrids) in remote locations or islands offers a captive market for integrated solar and storage solutions. Finally, governmental focus on establishing robust domestic manufacturing and recycling infrastructure promises to stabilize supply chains and reduce reliance on international sourcing, fostering sustainable long-term growth.

Segmentation Analysis

The Solar Power System Batteries Market is comprehensively segmented based on technology, connectivity, application, and end-user, reflecting the diverse requirements across the energy ecosystem. Technology segmentation differentiates the market based on chemistry, recognizing the trade-offs between energy density, cycle life, cost, and safety. Connectivity segments address whether the battery system is connected directly to the grid or operates independently in off-grid scenarios, which dictates the complexity and regulatory compliance needed. Application and end-user segmentation clearly delineate the distinct needs of residential users seeking backup power versus utilities demanding long-duration, high-power systems for grid management.

The dominance of Lithium-ion batteries (specifically LiFePO4 and NMC) remains evident across most segments due to their high performance and falling prices. However, emerging segments like Flow batteries (e.g., Vanadium redox flow) are gaining traction in utility and C&I applications where physical size is less constrained, and the priority is long-duration storage (4+ hours). The end-user analysis confirms the residential sector as the fastest growing volume market, driven by consumer concerns over rising electricity costs and power reliability, whereas the utility sector remains the largest consumer in terms of installed capacity.

Understanding these segments is crucial for strategic market entry, allowing manufacturers to tailor their product offerings—from compact, aesthetically pleasing residential units to large, containerized utility solutions. Furthermore, the off-grid segment, particularly in emerging markets in Africa and Southeast Asia, requires rugged, lower-cost solutions with minimal maintenance, driving innovation in simplified battery management and remote monitoring technologies tailored for harsh environments and limited technical oversight.

- By Technology:

- Lithium-ion Batteries (LiFePO4, NMC)

- Lead-Acid Batteries (Advanced VRLA, Flooded)

- Flow Batteries (Vanadium Redox Flow, Zinc-Bromine)

- Other Advanced Batteries (Solid-State, Sodium-ion)

- By Connectivity:

- On-Grid Systems (Grid-Tied with Storage)

- Off-Grid Systems (Stand-Alone Solar Power Systems)

- By Application:

- Backup Power

- Load Shifting & Peak Shaving

- Frequency Regulation

- Self-Consumption Optimization

- By End-User:

- Residential

- Commercial & Industrial (C&I)

- Utility-Scale

- Microgrids & Off-Grid Stations

Value Chain Analysis For Solar Power System Batteries Market

The value chain of the Solar Power System Batteries Market is extensive, starting from the extraction of critical raw materials through to final deployment and eventual recycling. The upstream segment is heavily focused on mining and refining essential minerals such as lithium, cobalt, nickel, and graphite, an area characterized by geopolitical concentration and significant supply chain risks. Manufacturers in the midstream then focus on cell and module assembly, where proprietary technology and mass production efficiencies determine cost competitiveness. The downstream segment involves system integrators, distributors, and installers who add significant value through customized system design, software integration (BMS and energy management systems), and physical installation, representing the primary interface with the end-customer.

Distribution channels in this market are bifurcated into direct sales for utility-scale projects, where manufacturers often bid directly on large tenders, and indirect sales prevalent in the residential and small C&I sectors. For residential markets, the primary route involves original equipment manufacturers (OEMs) selling to solar installers or specialized energy distribution wholesalers, who then package the battery with the PV system. Online channels and large retail home improvement stores are increasingly becoming relevant for standardized, smaller capacity residential storage systems. The selection of the channel is often dependent on the complexity of the installation; more complex, grid-interactive systems typically require expert integrator involvement.

The value chain culminates with the long-term service provision and end-of-life management, which is becoming critically important. Recycling and repurposing operations, often mandated by environmental regulations, close the loop, enhancing sustainability and mitigating future raw material dependencies. Upstream analysis focuses on securing stable supply contracts and implementing ethical sourcing practices, while downstream success hinges on high-quality customer service, swift installation times, and effective long-term performance guarantees, distinguishing service providers in a highly competitive installation landscape.

Solar Power System Batteries Market Potential Customers

The end-user base for Solar Power System Batteries is exceptionally diverse, reflecting the universal need for reliable, cost-effective, and sustainable energy storage. Primary potential customers include homeowners (residential sector) seeking energy independence and reduced utility bills, particularly those living in regions with high solar irradiation and favorable net metering policies or frequent grid disturbances. These homeowners are often driven by desire for self-sufficiency and resilience against power outages, making backup capability a critical buying factor. They typically purchase systems through local solar installers who offer integrated PV and storage packages.

A second major customer group is the Commercial and Industrial (C&I) sector, ranging from small businesses and retail chains to large manufacturing plants and data centers. C&I customers prioritize peak shaving—reducing electricity consumption during high-cost peak demand periods—and ensuring power quality for sensitive equipment. For this segment, the buying decision is heavily influenced by immediate financial ROI derived from demand charge reduction and the mitigation of business interruption risk, often involving complex energy service agreements (ESAs) or direct capital expenditure on multi-megawatt installations.

The largest volume purchasers in terms of capacity are electric utilities and independent power producers (IPPs), which deploy massive, grid-connected battery energy storage systems (BESS). These buyers utilize batteries for system-wide services such as frequency regulation, voltage support, renewable energy firming, and deferred transmission/distribution infrastructure upgrades (non-wire alternatives). Their purchasing process is typically characterized by lengthy procurement cycles, stringent technical specifications, and reliance on long-term performance contracts with specialized system integrators and battery manufacturers capable of providing robust, utility-grade hardware and software solutions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 15.2 Billion |

| Market Forecast in 2033 | USD 49.5 Billion |

| Growth Rate | 18.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Tesla, LG Energy Solution, Samsung SDI, Contemporary Amperex Technology Co. Ltd. (CATL), Panasonic Corporation, BYD Company Ltd., Varta AG, Enphase Energy, Sonnen GmbH, SimpliPhi Power (Briggs & Stratton), Generac Power Systems, Huawei Technologies Co., Ltd., Eguana Technologies Inc., Exide Technologies, Saft (TotalEnergies), Northvolt, Alevo (part of CEFC), Narada Power Source Co., Ltd., GNB Industrial Power (Exide Technologies), and Aquion Energy. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Solar Power System Batteries Market Key Technology Landscape

The technological landscape of the Solar Power System Batteries Market is defined by intense innovation aimed at overcoming the limitations of current battery chemistries, primarily focusing on improving energy density, longevity, and intrinsic safety. Lithium Iron Phosphate (LiFePO4) technology currently dominates the residential and C&I sectors, favored over Nickel Manganese Cobalt (NMC) due to its superior thermal stability, longer cycle life, and lower material cost, despite its slightly lower energy density. Continuous research is optimizing cell design and manufacturing processes to maximize performance and further reduce the dollar-per-kilowatt-hour cost, making storage solutions increasingly accessible to average consumers. This incremental improvement ensures Li-ion's central role for the near-to-mid-term forecast period.

A crucial technological trend involves the maturation of non-lithium alternatives designed for specific use cases, particularly utility-scale applications requiring extremely long discharge durations. Flow batteries, which store energy in external liquid electrolytes, offer decoupled power and energy capacities, making them ideal for multi-hour energy shifting and high-cycle applications without degradation concerns inherent in solid-state electrodes. Although currently burdened by larger footprints and lower energy density, their superior safety, scalability, and reliance on earth-abundant materials position them as potential disruptors in the long-duration storage segment, attracting significant investment from government agencies and utility operators seeking sustainable alternatives.

Furthermore, the focus is shifting heavily toward integrated system intelligence. Advanced Battery Management Systems (BMS) are incorporating predictive analytics and machine learning to manage thermal profiles, optimize cell balancing, and diagnose degradation mechanisms in real-time, thereby extending the effective lifespan of the battery asset far beyond previous technological capabilities. Standardization efforts, such as module size and communication protocols, are also key to ensuring interoperability across different solar and inverter systems, simplifying installation, and reducing system integration costs for installers and end-users globally. Finally, solid-state battery technology, while currently nascent in stationary storage, represents the next frontier, promising higher energy density and eliminating the use of volatile liquid electrolytes, which could fundamentally transform system design and safety standards by 2033.

Regional Highlights

The regional analysis reveals distinct market maturity and growth drivers across major global territories, with Asia Pacific exhibiting the most dynamic growth due to massive infrastructure development and supportive government mandates. China and India are leading installation capacity, driven by ambitious national goals to increase renewable penetration and address power reliability issues in rapidly urbanizing areas. Australia, characterized by high residential solar adoption rates and high electricity costs, boasts the highest penetration of household battery storage per capita globally. The APAC region benefits from lower manufacturing costs and aggressive governmental procurement, securing its position as the engine of market expansion.

North America, particularly the US market (led by California, Texas, and New York), remains a key revenue generator, characterized by high utility-scale deployment aimed at grid modernization and resilience improvements. Residential growth here is heavily influenced by state-level incentives, time-of-use tariffs, and the increasing frequency of weather-related power outages (e.g., hurricanes, wildfires) which elevate the value proposition of backup power. The European market, highly mature and regulated, focuses on maximizing self-consumption and enabling Virtual Power Plants (VPPs) to integrate distributed energy resources seamlessly into the grid. Germany, the UK, and Italy are pivotal, emphasizing decentralized energy solutions and stringent sustainability standards, driving demand for premium, long-cycle-life batteries.

Latin America and the Middle East & Africa (MEA) represent high-potential, emerging markets. Latin America’s growth is fueled by off-grid systems in remote areas and utility-scale projects leveraging abundant solar resources (e.g., Chile and Brazil). In MEA, the lack of extensive, reliable grid infrastructure drives demand for microgrids and off-grid solutions, particularly in rural electrification projects across sub-Saharan Africa. While capital accessibility remains a challenge, international development aid and targeted government programs focused on energy access are gradually accelerating the deployment of integrated solar battery systems in these crucial regions.

- Asia Pacific (APAC): Highest volume market driven by China and India’s renewable targets; strong residential adoption in Australia and Japan due to high utility rates and grid instability. Focus on domestic manufacturing and cost reduction.

- North America: Leading revenue contributor; growth spurred by grid modernization investments (utility-scale BESS) and robust state-level residential incentives (e.g., SGIP in California). Emphasis on resilience and smart grid integration.

- Europe: Mature market focusing on VPP development, self-consumption maximization, and adherence to strict environmental and recycling standards (e.g., Battery Directive). Germany and the UK are core innovation hubs.

- Latin America: Emerging market with strong potential for off-grid applications in remote areas and large-scale solar project firming in resource-rich countries. Adoption influenced by local financing availability.

- Middle East & Africa (MEA): High growth potential for decentralized energy solutions and microgrids addressing energy access and remote power needs. Early utility-scale projects linked to sovereign wealth fund investments in renewable energy infrastructure (e.g., UAE, Saudi Arabia).

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Solar Power System Batteries Market.- Tesla Inc.

- LG Energy Solution Ltd.

- Samsung SDI Co., Ltd.

- Contemporary Amperex Technology Co. Ltd. (CATL)

- Panasonic Corporation

- BYD Company Ltd.

- Varta AG

- Enphase Energy Inc.

- Sonnen GmbH (Shell subsidiary)

- SimpliPhi Power (Briggs & Stratton)

- Generac Power Systems Inc.

- Huawei Technologies Co., Ltd.

- Eguana Technologies Inc.

- Exide Technologies

- Saft (TotalEnergies SE)

- Northvolt AB

- Alevo (part of CEFC)

- Narada Power Source Co., Ltd.

- GS Yuasa International Ltd.

- Hitachi Chemical Co., Ltd.

- Kokusai Electric Corporation

- Dynapower Company LLC

- Kokam Co., Ltd.

- Fluence Energy (Siemens and AES JV)

- EOS Energy Enterprises, Inc.

- Redflow Limited

Frequently Asked Questions

Analyze common user questions about the Solar Power System Batteries market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the current growth of the Solar Power System Batteries Market?

The primary driver is the accelerating need for energy resilience and self-consumption optimization, coupled with the rapid decline in Lithium-ion battery manufacturing costs. Government incentives promoting renewable energy integration further solidify market expansion across residential and utility sectors.

Which battery chemistry currently dominates the market for solar storage systems?

Lithium-ion batteries, specifically the Lithium Iron Phosphate (LiFePO4) variant, dominate the market due to their excellent energy density, extended cycle life, and high safety profile compared to traditional Lead-Acid and earlier Lithium-ion chemistries (like NMC) for stationary applications.

How does the integration of AI benefit solar battery system efficiency?

AI significantly enhances efficiency by utilizing predictive analytics to forecast solar generation and consumption patterns. This enables highly optimized charging and discharging cycles based on real-time grid prices and weather, maximizing economic returns and extending the battery's operational lifespan.

What are the key differences between on-grid and off-grid solar battery systems?

On-grid systems are connected to the utility network and primarily focus on load shifting, peak shaving, and selling surplus energy back to the grid. Off-grid systems are isolated, serving as the sole power source, and are designed for maximum reliability and self-sufficiency, often requiring more robust components.

What is the projected Compound Annual Growth Rate (CAGR) for the Solar Power System Batteries Market?

The Solar Power System Batteries Market is projected to experience robust growth, anticipating a Compound Annual Growth Rate (CAGR) of 18.5% over the forecast period from 2026 to 2033, reflecting strong global demand and technological advances in energy storage.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager