Solder Paste Flux Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432742 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Solder Paste Flux Market Size

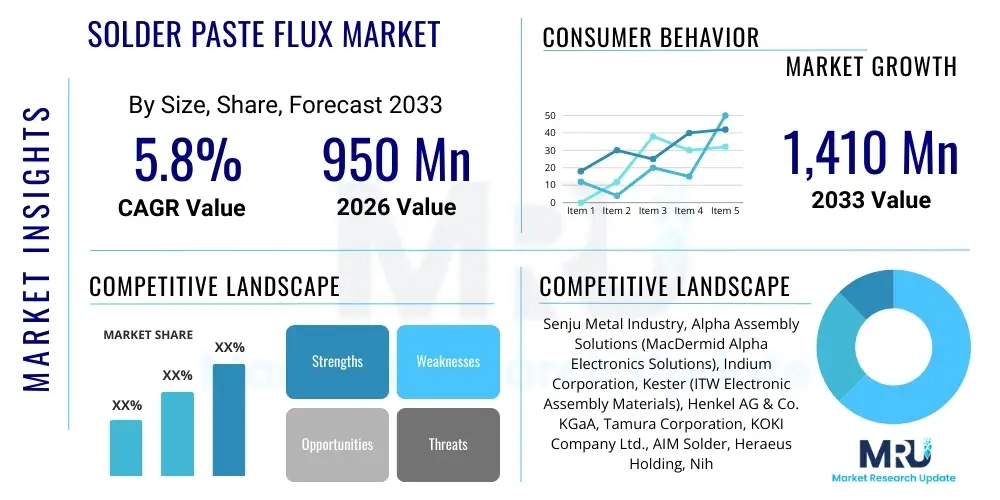

The Solder Paste Flux Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 950 million in 2026 and is projected to reach USD 1,410 million by the end of the forecast period in 2033.

Solder Paste Flux Market introduction

The Solder Paste Flux Market is foundational to the modern electronics manufacturing industry, serving as a critical component in joining electronic components to Printed Circuit Boards (PCBs). Solder paste, which is a viscous mixture of powdered metal solder and flux, facilitates the soldering process by cleaning the metal surfaces of oxides, preventing re-oxidation during heating, and ensuring superior wetting characteristics for reliable electrical and mechanical connections. The primary function of the flux component is to chemically prepare the surfaces for soldering, enhancing the flow and spread of the molten solder alloy across the joint interface. This material is indispensable across various high-technology sectors due to the increasing demand for smaller, more complex, and densely populated electronic devices, requiring highly reliable interconnects.

The product portfolio within this market includes diverse formulations such as no-clean, water-soluble, and rosin-based fluxes, each tailored to specific application requirements, environmental regulations, and subsequent cleaning protocols. No-clean fluxes, for instance, are gaining significant traction due to their ability to leave benign residues that do not require post-soldering cleaning, offering cost efficiencies and reducing the environmental footprint associated with chemical cleaning agents. Major applications span the consumer electronics sector, including high-end smartphones and computing devices, the rapidly expanding automotive electronics segment encompassing Advanced Driver-Assistance Systems (ADAS) and electric vehicle (EV) battery management systems, and specialized applications in aerospace and medical devices where reliability is paramount.

Market growth is significantly driven by the accelerating trend of miniaturization in electronic components and the widespread adoption of Surface Mount Technology (SMT), which demands fine pitch soldering capabilities and high-throughput manufacturing processes. Furthermore, the global shift towards lead-free soldering alloys, mandated by environmental directives like Restriction of Hazardous Substances (RoHS), necessitates the continuous development of specialized, high-performance fluxes capable of achieving optimal results at higher processing temperatures. The benefits offered by advanced fluxes include improved joint reliability, reduced defects, increased production yields, and compliance with stringent environmental and safety standards globally, positioning solder paste flux as a core enabling technology for the digital transformation.

Solder Paste Flux Market Executive Summary

The Solder Paste Flux Market exhibits robust growth driven primarily by structural shifts in global electronics manufacturing and the technological evolution of end-user industries. Business trends point towards increased investment in R&D focusing on ultra-low residue and halogen-free flux formulations, catering to the sophisticated demands of 5G infrastructure, IoT devices, and high-performance computing. Key manufacturers are focusing on integrating advanced chemical formulations that improve stencil life, reduce voiding, and maintain stability during high-speed printing processes, critical elements for maximizing production efficiency in modern SMT lines. Furthermore, strategic collaborations between flux manufacturers and major electronics assembly providers are becoming common to co-develop custom solutions optimized for new generation semiconductor packaging and complex multi-layer PCBs, solidifying technological competitive advantages in a rapidly evolving supply chain.

Regional trends indicate a dominant market presence for the Asia Pacific (APAC) region, largely fueled by established electronics manufacturing hubs in China, Taiwan, South Korea, and emerging centers in Southeast Asia. This region not only accounts for the majority of global PCB production but also witnesses intense competition and rapid adoption of advanced soldering technologies. North America and Europe, while possessing slower manufacturing growth rates, focus heavily on high-reliability, specialized applications (aerospace, defense, medical), driving demand for premium, highly certified flux products, especially those adhering to stringent quality standards like automotive AEC-Q100. The geopolitical landscape and supply chain resilience are encouraging modest nearshoring and diversification efforts outside of traditional centers, which might redistribute production capacity and influence localized flux demand over the forecast period.

Segmentation trends highlight the increasing dominance of the no-clean flux segment, preferred for its operational efficiency and minimal environmental impact, overshadowing traditional rosin-based formulations in high-volume production. Within application segments, the automotive electronics sector is emerging as a significant high-growth area, necessitated by the proliferation of sensing equipment, control units, and power electronics required for electric vehicles and autonomous driving systems, demanding fluxes that ensure high thermal stability and long-term reliability under harsh operational conditions. The continuous drive toward miniaturization also strengthens the demand for ultrafine powder solder paste fluxes, often requiring particle sizes T5 and smaller, to accommodate increasingly tight component pitches and complex pad geometries on state-of-the-art PCBs.

AI Impact Analysis on Solder Paste Flux Market

Common user questions regarding AI's impact on the Solder Paste Flux Market frequently revolve around process optimization, quality assurance, and material science innovation. Users are keen to understand how AI-driven machine vision systems are enhancing solder paste inspection and ensuring defect-free deposition, thus reducing the reliance on traditional inspection methods. Furthermore, there is significant interest in how predictive modeling and machine learning algorithms can optimize soldering profiles (reflow oven settings) for specific flux types and PCB designs, minimizing defects such as voiding and insufficient wetting, which are costly production failures. Users also anticipate AI's role in accelerating the R&D cycle for new flux formulations by simulating material interactions and long-term reliability performance under varied stress conditions, ultimately shortening time-to-market for specialized, high-performance flux products designed for emerging applications like quantum computing and high-frequency communication.

- AI-driven machine vision systems significantly enhance automated solder paste inspection (SPI), ensuring precise volume and alignment before component placement, drastically reducing printing defects.

- Predictive maintenance algorithms analyze data from SMT equipment (printers, dispensers, reflow ovens) to optimize stencil cleaning cycles and monitor flux performance degradation over time, improving throughput.

- Machine learning models are employed in materials science R&D to simulate and predict the optimal chemical composition and rheological properties of new flux formulations for lead-free alloys.

- AI optimizes reflow soldering profiles based on PCB layout and specific flux characteristics, minimizing thermal stress and maximizing joint reliability across high-mix, low-volume manufacturing environments.

- Smart manufacturing integration uses real-time data analysis to adjust dispensing parameters and printing pressure, ensuring consistent flux application despite environmental fluctuations on the production floor.

DRO & Impact Forces Of Solder Paste Flux Market

The Solder Paste Flux Market dynamics are shaped by powerful forces encompassing technological drivers, regulatory restraints, and substantial opportunities arising from global industrial shifts. Key drivers include the exponential growth in demand for complex, high-density PCBs across consumer electronics and the critical need for highly reliable interconnections in mission-critical applications such as automotive safety systems and aerospace avionics. Simultaneously, the market faces significant restraints, notably the increasing complexity and costs associated with complying with strict global environmental regulations, such as the push toward zero-halogen and ultra-low volatile organic compound (VOC) content in flux formulations, which challenge traditional chemical development processes. Opportunities are abundant, specifically in developing tailored flux solutions for novel packaging technologies like System-in-Package (SiP) and heterogeneous integration, alongside capitalizing on the immense projected growth of 5G infrastructure deployment and the pervasive rollout of IoT devices globally. These elements collectively dictate the trajectory and competitive landscape of the solder paste flux industry.

The primary driving factor remains the relentless pace of electronic device innovation, particularly the trend toward smaller feature sizes and higher component density, which necessitates finer pitch solder printing and robust anti-slump capabilities from the flux vehicle. This demand pushes manufacturers to invest heavily in specialized rheology modifiers and activators to maintain print consistency and reliability under tight tolerance requirements. Restraints are compounded by raw material volatility and supply chain disruptions, impacting the cost and availability of key chemical components necessary for flux production, alongside the difficulty in balancing high performance (cleaning oxides) with the stringent requirement for benign, electrically safe residues, particularly for no-clean formulations used in high-impedance circuits. The high capital expenditure required for sophisticated dispensing and printing equipment optimized for modern fluxes also acts as a barrier to entry for smaller manufacturers in emerging markets, subtly concentrating technology adoption among major industry players.

Opportunities are specifically centered around addressing advanced thermal management challenges in power electronics, where fluxes must withstand high operating temperatures and maintain joint integrity over extended lifecycles in harsh environments like engine compartments or charging infrastructure. Moreover, the accelerating transition to Electric Vehicles (EVs) creates massive demand for specialized fluxes optimized for robust soldering of power modules, inverters, and battery connections, often involving different solder alloys and thicker copper layers than standard consumer applications. The impact forces indicate that technological superiority (the ability to develop reliable, environmentally compliant, and highly printable flux) is the primary determinant of market share, outweighing purely cost-driven competition, especially in high-reliability market segments where product failure is unacceptable. Consequently, the interplay between environmental pressures and technological necessity defines the market's evolution.

- Drivers: Miniaturization of electronic components; Global expansion of SMT adoption; Rapid growth in automotive electronics (EVs, ADAS); Increased demand for high-reliability military and aerospace applications; Rollout of 5G and IoT infrastructure requiring complex PCBs.

- Restraints: Stringent environmental regulations (RoHS, REACH) mandating zero-halogen and low-VOC content; Volatility in raw material costs; Technical challenges in achieving low-voiding and excellent wetting with lead-free, high-temperature alloys; Requirement for specialized handling and storage (refrigeration) of sensitive formulations.

- Opportunity: Development of ultra-low residue and water-soluble fluxes tailored for new flux-on-chip and advanced packaging techniques; Untapped potential in high-power applications (renewable energy inverters); Expanding manufacturing footprint in emerging economies; Integration of AI and data analytics for process optimization using flux performance data.

- Impact Forces: High switching cost for manufacturers changing flux formulations; Regulatory adherence as a critical market entry barrier; Performance-driven selection in high-reliability sectors; Strong correlation between flux quality and final product yield/reliability.

Segmentation Analysis

The Solder Paste Flux Market is comprehensively segmented based on product type, flux chemistry, printing methodology, and final application, providing a granular view of market dynamics and specialized demand pockets. Product segmentation primarily distinguishes between no-clean, water-soluble, and rosin-based fluxes, reflecting varied requirements for post-soldering cleaning processes and environmental standards. Further chemical classification divides the market based on the presence of halogens (halogenated vs. halogen-free), a critical distinction driven by environmental legislation and performance demands in sensitive electronics. The operational segments are defined by dispensing method, including stencil printing, dispensing, and jetting, which correlate directly with the complexity and volume of the manufacturing operation. Analyzing these segments reveals shifting preferences, particularly the accelerated migration towards halogen-free, no-clean formulations that facilitate high-volume, cost-effective, and environmentally compliant manufacturing across APAC and other major production centers.

- By Product Type:

- No-Clean Flux

- Water-Soluble Flux

- Rosin-Based Flux (RMA, RA)

- By Flux Chemistry:

- Halogen-Free Flux

- Halogenated Flux

- By Solder Alloy Type:

- Lead-Free Solder Paste Flux (SAC alloys)

- Lead Solder Paste Flux (Sn/Pb)

- By Application Method:

- Stencil Printing

- Dispensing

- Jetting (Micro-dispensing)

- By End-User Industry:

- Consumer Electronics (Smartphones, Tablets, Laptops)

- Automotive Electronics (ADAS, Infotainment, Power Control)

- Industrial Electronics (Automation, Power Supplies)

- Telecommunications (5G Infrastructure, Networking Equipment)

- Medical Devices

- Aerospace and Defense

Value Chain Analysis For Solder Paste Flux Market

The value chain for the Solder Paste Flux Market begins with the upstream sourcing of crucial raw materials, which include chemical activators (organic acids, amines), rheology modifiers (thickeners, stabilizers), and solvents (glycols, alcohols). Suppliers specializing in high-purity chemicals are integral to the consistency and performance of the final flux product. The midstream involves specialized chemical manufacturers who blend these raw materials with metal powder (for solder paste flux) under strict quality control, ensuring precise particle size distribution (e.g., Type 3, Type 4, Type 5 powders) and consistent viscosity. This manufacturing stage requires significant chemical expertise and often proprietary formulation knowledge to achieve specific desired properties like tackiness, shelf life, and reflow performance. The quality of upstream inputs directly determines the reliability of the electronic interconnections made downstream.

The downstream distribution channels are multifaceted, catering to a global network of electronics manufacturing service (EMS) providers, Original Equipment Manufacturers (OEMs), and contract manufacturers. Distribution primarily occurs through specialized chemical distributors and agents who manage complex logistical requirements, including refrigerated storage and temperature-controlled transport, necessary to maintain the integrity of the flux. Direct sales are often reserved for large, strategic OEM accounts or customized formulations where close technical support is required. Indirect channels, using regional distributors, are vital for servicing the fragmented market of smaller assembly houses, especially in high-growth areas of Asia Pacific. The final consumption occurs at the SMT production line, where the flux is applied via stencil printing or specialized dispensing techniques, followed by component placement and reflow soldering, making the technical support provided by the channel partners a critical factor in the overall value proposition.

Solder Paste Flux Market Potential Customers

The primary customers and end-users of Solder Paste Flux are organizations engaged in the assembly and manufacturing of electronic devices, spanning from high-volume consumer goods to highly specialized industrial and military hardware. Key potential customers include large multinational Electronics Manufacturing Service (EMS) providers, such as Foxconn, Flextronics, and Jabil, which execute mass production of PCBs for various OEMs globally and require vast quantities of highly consistent, high-yield solder flux. Original Equipment Manufacturers (OEMs) specializing in specific verticals, such as automotive Tier 1 suppliers (Continental, Bosch) and aerospace contractors, are crucial customers due to their demand for ultra-reliable, certified flux formulations that meet stringent quality and performance standards under extreme operating conditions. Furthermore, smaller, specialized contract manufacturers focused on prototyping, medical devices, or defense systems represent a valuable segment that prioritizes technical support and custom formulations over pure cost.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 950 million |

| Market Forecast in 2033 | USD 1,410 million |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Senju Metal Industry, Alpha Assembly Solutions (MacDermid Alpha Electronics Solutions), Indium Corporation, Kester (ITW Electronic Assembly Materials), Henkel AG & Co. KGaA, Tamura Corporation, KOKI Company Ltd., AIM Solder, Heraeus Holding, Nihon Superior Co. Ltd., Inventec Performance Chemicals, Fusion Inc., ENEOS Holdings, Plenge Electronic GmbH, Solder Chemistry, Qualitek International, Ku Ping Enterprise Co., Fine Solder Industries, Tongfang Electronic New Material. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Solder Paste Flux Market Key Technology Landscape

The Solder Paste Flux Market is characterized by continuous innovation centered on improving material reliability, enhancing process window flexibility, and meeting strict environmental mandates. A key technological focus is the development of next-generation, ultra-low residue, zero-halogen no-clean fluxes, engineered to minimize potential electro-chemical migration (ECM) and maximize insulation resistance in high-density, sensitive circuits without requiring post-reflow cleaning. These advanced formulations require sophisticated chemical engineering to maintain high activation power (for oxide removal) while ensuring the residues are inert and electrically benign. Furthermore, significant effort is dedicated to improving the rheological properties of solder pastes, enabling consistent print performance for fine pitch components (down to 0.3mm and below), and improving resistance to slumping and drying on the stencil over long production runs, which is critical for maximizing SMT line uptime and yield in high-volume production facilities.

Another crucial technological area involves developing specialized fluxes optimized for high-temperature lead-free alloys, particularly those containing bismuth or silver-tin-copper (SAC) variants, which are necessary for compliance with global environmental regulations. These fluxes must overcome challenges related to poorer wetting characteristics and increased dross formation associated with higher reflow temperatures, necessitating high thermal stability and optimized activator systems. The development of fluxes for micro-dispensing and jetting technologies represents an emerging landscape, particularly for advanced semiconductor packaging and precision applications where traditional stencil printing is inadequate. This technology requires extremely low viscosity and highly stable flux formulations capable of precise, non-contact deposition, often used in complex 3D integration or System-in-Package (SiP) assembly.

The integration of advanced analytical tools, such as sophisticated thermal analysis and real-time process monitoring, is also becoming a standard technology requirement for flux manufacturers to validate performance and consistency. Manufacturers utilize techniques like Differential Scanning Calorimetry (DSC) and Thermo-Gravimetric Analysis (TGA) to precisely characterize flux behavior during the reflow process, ensuring that the material activates and cleans effectively across the specified temperature range. Moreover, the industry is increasingly adopting fluxes designed specifically for vapor phase soldering and selective soldering techniques, requiring unique activation chemistries to ensure performance compatibility with these specialized, sometimes high-vacuum or localized, heating environments. These technological advancements collectively drive better throughput, reduced environmental impact, and superior joint reliability, directly addressing the core needs of modern electronics manufacturing.

Regional Highlights

- Asia Pacific (APAC): APAC dominates the global Solder Paste Flux Market, serving as the world's primary manufacturing hub for electronics, semiconductors, and PCBs. Countries like China, South Korea, Taiwan, and Japan host massive production capacities, driving overwhelming demand for high-volume, reliable flux solutions. The region is characterized by rapid adoption of new SMT technologies and aggressive price competition, though the shift towards higher-value manufacturing, such as 5G equipment and advanced semiconductor packaging (e.g., in Taiwan and South Korea), simultaneously drives demand for premium, high-performance, halogen-free fluxes. Regulatory harmonization efforts across the region, especially regarding lead-free transitions, further shape market demand, ensuring the region remains the critical growth engine for flux consumption globally.

- North America: North America represents a mature yet high-value market, focusing heavily on specialized, high-reliability applications in the aerospace, defense, medical device, and high-performance computing sectors. Demand here is less volume-driven and more quality-driven, favoring fluxes that adhere to rigorous military specifications (Mil-Spec) and strict medical device compliance standards, often requiring comprehensive certification and full traceability. The resurgence in localized semiconductor manufacturing, driven by government incentives and supply chain resilience concerns, is expected to spur modest growth, particularly in advanced flux formulations suitable for innovative packaging techniques and high-frequency communication electronics.

- Europe: The European market is characterized by stringent environmental regulations (REACH, RoHS) and a strong focus on the automotive and industrial electronics sectors. European manufacturers prioritize highly stable, zero-halogen, and ultra-low residue fluxes to comply with environmental directives and meet the demanding reliability requirements of automotive components, particularly those used in Electric Vehicle (EV) battery management systems and autonomous driving sensors. Germany, France, and the UK are key markets, showing robust demand for high-performance fluxes used in complex industrial automation equipment and specialized power electronics modules, requiring thermal stability and long-term durability.

- Latin America (LATAM): The LATAM region, led by manufacturing activity in Mexico and Brazil, serves largely as a regional assembly and export center, particularly for consumer electronics and automotive components targeting the North American market. Market growth is stable, driven by foreign direct investment in manufacturing facilities. Demand often leans towards cost-effective, proven flux technologies, although increasing local production of complex automotive parts is gradually elevating the requirement for advanced, higher-specification flux formulations that align with global automotive quality standards.

- Middle East and Africa (MEA): The MEA region remains a nascent market for advanced Solder Paste Flux, with demand primarily concentrated in infrastructure projects (telecommunications, energy), defense, and limited local electronics assembly in countries like Israel and the UAE. Growth prospects are tied to broader economic diversification and government investments in smart city infrastructure and localized high-tech manufacturing, potentially driving demand for specialized fluxes used in ruggedized equipment capable of operating under harsh climatic conditions. The market currently relies heavily on imports from Europe and Asia Pacific, with price sensitivity often dictating purchasing decisions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Solder Paste Flux Market.- Senju Metal Industry

- Alpha Assembly Solutions (MacDermid Alpha Electronics Solutions)

- Indium Corporation

- Kester (ITW Electronic Assembly Materials)

- Henkel AG & Co. KGaA

- Tamura Corporation

- KOKI Company Ltd.

- AIM Solder

- Heraeus Holding

- Nihon Superior Co. Ltd.

- Inventec Performance Chemicals

- Fusion Inc.

- ENEOS Holdings

- Plenge Electronic GmbH

- Solder Chemistry

- Qualitek International

- Ku Ping Enterprise Co.

- Fine Solder Industries

- Tongfang Electronic New Material

- Creative Materials Inc.

Frequently Asked Questions

Analyze common user questions about the Solder Paste Flux market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between No-Clean and Water-Soluble Solder Paste Flux?

No-Clean fluxes leave minimal, non-corrosive, electrically safe residues that do not require washing, optimizing production cost and speed. Water-Soluble fluxes use organic acids that are highly active and must be completely removed using deionized water after reflow to prevent long-term corrosion or circuit failure.

How is the move toward lead-free soldering impacting flux formulation technology?

The transition to lead-free alloys (like SAC) necessitates fluxes with higher thermal stability and increased activation strength to ensure proper wetting at elevated reflow temperatures, simultaneously requiring formulations that minimize voiding and dross formation during the harsher thermal cycle.

Which end-user segment is projected to show the highest growth rate for solder paste flux demand?

The Automotive Electronics segment, driven by the explosive growth of Electric Vehicles (EVs), sophisticated Advanced Driver-Assistance Systems (ADAS), and complex power control modules, is projected to demonstrate the highest incremental demand for high-reliability, thermally robust solder paste fluxes.

What are the critical performance characteristics manufacturers look for in modern solder paste flux?

Critical performance characteristics include superior stencil printing consistency (rheology), extended stencil life, low voiding capability, high electrical reliability (low ECM risk), and full compliance with zero-halogen and low-VOC environmental regulations.

What role does the powder size (T-type) play in modern SMT assembly using solder paste flux?

Solder powder size (e.g., Type 4, Type 5) is crucial for fine pitch printing and miniaturization. Smaller powder sizes (T5 and higher) are necessary to accurately deposit solder paste onto increasingly tighter pad geometries (below 0.4mm pitch) without bridging or slumping, ensuring reliable interconnections in high-density PCBs.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager