Solder Paste Inspection (SPI) System Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438651 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Solder Paste Inspection (SPI) System Market Size

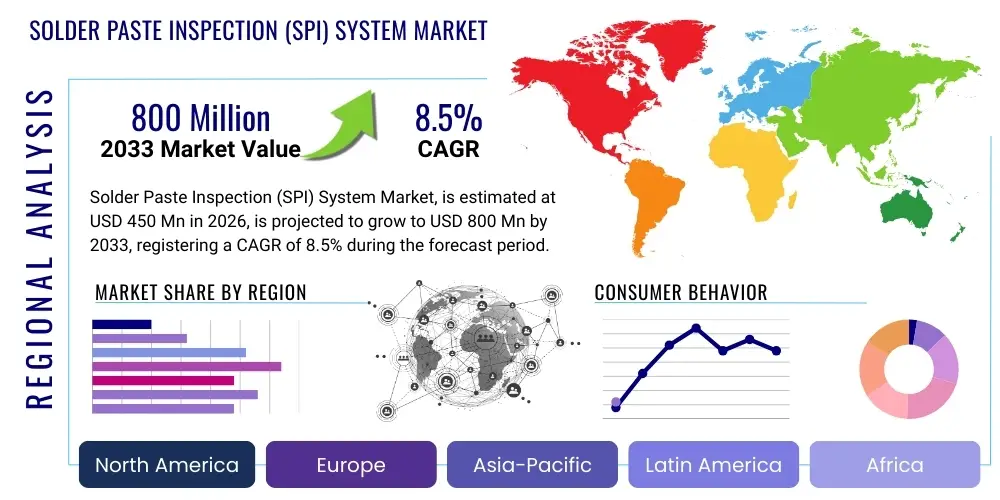

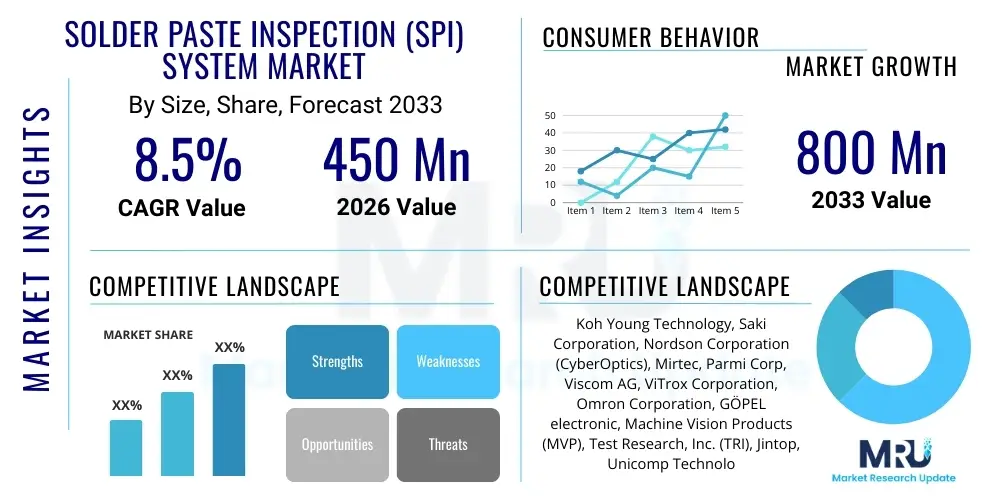

The Solder Paste Inspection (SPI) System Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 800 Million by the end of the forecast period in 2033.

Solder Paste Inspection (SPI) System Market introduction

The Solder Paste Inspection (SPI) System Market encompasses specialized automated optical inspection equipment critical for ensuring quality control in Surface Mount Technology (SMT) processes during the manufacturing of printed circuit boards (PCBs). SPI systems are deployed immediately after the solder paste printing stage, inspecting the volume, area, height, and alignment of the solder paste deposit before component placement. This crucial step directly influences the quality and reliability of the final electronic assembly, as up to 70% of soldering defects are attributable to poor solder paste printing. The primary function of an SPI system is to provide rapid, accurate, and non-contact three-dimensional measurement data, enabling real-time feedback and process optimization for high-volume manufacturing environments.

SPI systems predominantly utilize structured light projection, usually Moiré fringe patterns or laser triangulation, coupled with sophisticated machine vision algorithms to construct a detailed 3D profile of the solder deposits. Product descriptions often highlight high throughput, accuracy down to the micron level, and the integration of advanced software for statistical process control (SPC). Major applications span across high-reliability electronics sectors, including consumer electronics (smartphones, tablets), automotive electronics (ADAS, infotainment systems), industrial automation, medical devices, and aerospace communication systems, where zero-defect manufacturing standards are mandatory. The inherent variability in solder paste properties, stencil quality, and printer alignment necessitates the precision and repeatability offered by modern SPI technology.

The core benefits derived from implementing SPI systems include significant reduction in rework costs, enhanced product reliability, increased manufacturing yield, and optimized line efficiency. Key driving factors accelerating market adoption involve the relentless trend toward electronic miniaturization, characterized by smaller component sizes (01005, 03015) and finer pitch components, which drastically increase the complexity and precision required for solder deposition. Furthermore, the global push towards Industry 4.0 and smart factory automation requires the data integrity and real-time process monitoring capabilities that advanced SPI solutions provide, positioning them as indispensable tools in modern electronics manufacturing.

Solder Paste Inspection (SPI) System Market Executive Summary

The global Solder Paste Inspection (SPI) System Market is poised for robust expansion, driven primarily by escalating demand for sophisticated electronic devices requiring high density interconnects and impeccable solder joint quality. Business trends indicate a strong shift towards 3D SPI systems, which offer superior volumetric measurement accuracy compared to legacy 2D systems, aligning with the stringent quality demands of automotive and medical electronics manufacturers. Strategic partnerships between SPI system providers and specialized SMT equipment distributors are crucial for expanding market reach, particularly in fast-growing manufacturing hubs across Asia Pacific. Furthermore, the competitive landscape is intensifying, characterized by continuous innovation focused on improving measurement speed, integrating AI-driven defect classification, and enhancing interoperability within heterogeneous production lines via standards like the Hermes Standard (IPC-HERMES-9852) and CFX (IPC-2591).

Regional trends reveal that the Asia Pacific (APAC) region, dominated by electronics manufacturing powerhouses like China, South Korea, Taiwan, and Vietnam, remains the largest and fastest-growing market segment due to massive capacity expansion in electronics contract manufacturing (EMS) and original equipment manufacturing (OEM). North America and Europe demonstrate mature markets, emphasizing the replacement of older 2D systems with advanced 3D technologies, particularly within the high-mix, low-volume manufacturing sectors focusing on automotive safety and industrial control systems. Investment in localized technical support and rapid servicing capabilities is a key differentiator for companies seeking dominance in diverse global regions.

Segment trends confirm that the In-line SPI system type dominates the market, essential for high-volume, automated production lines where immediate process feedback is mandatory to minimize throughput interruption. Technologically, the 3D SPI segment is experiencing accelerated growth, largely substituting 2D inspection methods which lack the necessary vertical measurement capabilities required for modern component pitches. Among applications, the Automotive sector is exhibiting the highest growth rate, driven by the proliferation of electric vehicles (EVs) and advanced driver-assistance systems (ADAS), which rely heavily on fault-tolerant electronic control units (ECUs). Manufacturers are prioritizing SPI systems that can handle large PCB formats while maintaining micron-level precision across the entire inspection area, addressing the unique challenges posed by automotive assembly standards.

AI Impact Analysis on Solder Paste Inspection (SPI) System Market

The integration of Artificial Intelligence (AI) and Machine Learning (ML) into Solder Paste Inspection (SPI) systems represents a transformative shift, addressing common user concerns regarding defect classification accuracy, false call rates, and the complexity of process optimization. Common user questions often revolve around whether AI can reliably distinguish between marginal defects and actual failures, how ML models can be trained efficiently for high-mix environments, and the ability of AI to predict printer drift or degradation before it impacts production yield. Users seek AI solutions to move beyond simple threshold-based pass/fail criteria toward contextual defect analysis. They expect AI to reduce the dependence on human operators for tuning sensitivity settings and to improve the efficiency of first-pass yield by providing prescriptive, rather than just descriptive, feedback to the solder printer and the production line.

The impact of AI is primarily observed in enhancing the intelligence and autonomy of SPI systems. AI algorithms, particularly deep learning models, are now employed to analyze complex 3D topographical data generated by the SPI sensors, drastically improving the accuracy of defect detection for subtle issues like bridging, misalignment, or slight solder slump which often challenge traditional rule-based algorithms. This precision minimizes costly false calls (Type 1 errors) while ensuring all critical defects (Type 2 errors) are caught. Furthermore, AI facilitates predictive maintenance and Statistical Process Control (SPC) by correlating SPI results with upstream printing parameters and downstream component placement data, allowing the system to autonomously recommend adjustments to stencil parameters or squeegee pressure, thereby closing the loop on the SMT process control system without human intervention.

Expectations for AI integration include a fully self-optimizing SMT line where the SPI acts as the primary sensory input. Users anticipate that ML models trained on vast quantities of global defect data will provide instant, context-aware decisions, significantly reducing the time required for new product introductions (NPI) and accelerating the ramp-up phase for complex PCBs. The ability of AI to handle the increasing variability in materials (e.g., different solder alloys, low-temperature solders) and component sizes without requiring extensive manual recalibration is a key factor driving adoption. Consequently, AI is transforming SPI systems from simple measuring devices into intelligent, autonomous process control centers, thereby maximizing manufacturing efficiency and upholding zero-defect mandates.

- AI-driven defect classification accuracy enhancement, reducing false call rates.

- Predictive process control via ML models correlating SPI data with printer settings.

- Automated tuning and optimization of measurement thresholds for high-mix production.

- Real-time prescriptive feedback to the solder printer for closed-loop manufacturing.

- Enhanced analysis of complex 3D data, particularly for ultra-fine pitch components.

DRO & Impact Forces Of Solder Paste Inspection (SPI) System Market

The Solder Paste Inspection (SPI) System Market is shaped by significant Drivers, Restraints, and Opportunities (DRO), which collectively form the impact forces guiding its trajectory. The primary driver is the accelerating trend of miniaturization in electronic components (01005 and smaller), demanding highly precise solder deposition which only advanced 3D SPI can reliably verify. Concurrently, increasing quality mandates in high-reliability sectors such as automotive and aerospace, where electronic failures can lead to catastrophic results, necessitate 100% inspection capabilities, thereby driving mandatory SPI adoption. Opportunities are abundant in the integration of SPI systems with broader Industry 4.0 frameworks, utilizing high-speed data transmission and sophisticated analytics for full line optimization, moving beyond simple inspection to true process control. These forces ensure that investments in new, sophisticated SPI technology remain a priority for electronics manufacturers globally.

Restraints primarily revolve around the high initial capital expenditure associated with advanced 3D SPI systems, particularly the high-throughput, high-resolution models, making them a barrier for smaller or low-volume manufacturers. Furthermore, the complexity of calibrating, maintaining, and integrating these systems into legacy manufacturing execution systems (MES) requires specialized technical expertise, which can be scarce in certain geographical markets. The market is also slightly constrained by the extended lifecycles of existing 2D SPI equipment, leading some manufacturers to delay upgrades until absolute necessity forces the transition. Despite these hurdles, the ongoing depreciation of component pitches and the rising cost of rework far outweigh the initial investment concerns for most major global manufacturers.

The combined impact forces confirm a strong market trajectory towards higher technological sophistication. The convergence of quality demands (Driver) and the availability of AI/ML optimization (Opportunity) is creating a compelling proposition for manufacturers. The necessity for closed-loop feedback systems—where the SPI data directly controls the upstream solder printer—is becoming the industry standard, effectively making SPI systems critical nodes in the smart factory ecosystem. This strong reliance on data-driven manufacturing processes solidifies the long-term growth prospects for the market, mitigating the impact of capital cost restraints over time as the total cost of ownership decreases relative to improved yields and defect prevention.

Segmentation Analysis

The Solder Paste Inspection (SPI) System Market segmentation offers a granular view of its structure based on technology, system type, and application industry. The analysis reveals distinct adoption patterns across different manufacturing scales and quality requirements. Technology segmentation distinguishes between legacy 2D measurement methods, which primarily assess area, and the highly dominant 3D methodologies that provide comprehensive volumetric analysis (volume, height, and coplanarity). System type divides the market into high-speed, integrated in-line systems essential for mass production, and flexible off-line systems typically used for sample inspection, NPI, or repair verification. Finally, application segmentation highlights the varying degrees of SPI necessity across demanding sectors like automotive and medical, versus consumer electronics which demands high throughput.

- Technology

- 2D SPI Systems

- 3D SPI Systems

- Type

- In-line SPI Systems

- Off-line SPI Systems

- Application

- Consumer Electronics

- Automotive Electronics

- Industrial Electronics

- Medical Devices

- Aerospace and Defense

- Others (Telecommunications, IoT)

- Field of View (FoV)

- Fixed FoV SPI

- Moving FoV (Scanning) SPI

Value Chain Analysis For Solder Paste Inspection (SPI) System Market

The value chain for the Solder Paste Inspection (SPI) System Market begins with upstream suppliers providing critical high-precision components, including advanced sensor optics (laser projectors, high-resolution cameras), sophisticated hardware components (computing units, dedicated GPUs for image processing), and proprietary software algorithms. These suppliers form the foundation, offering specialized technology that dictates the ultimate performance and accuracy of the inspection systems. Key manufacturers of SPI systems then integrate these specialized components, focusing heavily on R&D to develop proprietary measurement algorithms, user interfaces, and connectivity features crucial for industrial protocols. Success in the upstream segment relies heavily on maintaining intellectual property related to illumination techniques and measurement stability, especially in high-speed applications.

Mid-stream activities are characterized by the manufacturing, assembly, testing, and quality assurance of the final SPI units. This stage includes critical calibration processes to ensure volumetric measurement accuracy and repeatability across varying environmental conditions. The distribution channel plays a pivotal role in reaching the diverse global customer base. Direct distribution is common for high-volume OEMs and complex integration projects, allowing the manufacturer to offer specialized consultation, installation, and post-sales service directly. Indirect distribution involves leveraging specialized electronics manufacturing equipment distributors and system integrators who possess deep regional market knowledge and established relationships with mid-sized and smaller electronics assembly houses, providing localized sales and first-line support.

Downstream activities involve the final implementation and long-term maintenance of the SPI systems at the end-user manufacturing site. Effective post-sales support, including software updates (especially for AI/ML features), hardware calibration services, and rapid spare parts availability, is paramount to minimize production downtime. The value chain is inherently closed-loop in the SMT environment, where the SPI system acts as a feedback mechanism for the upstream solder printer. Successful downstream execution ensures that the data generated by the SPI is accurately utilized by MES and SPC software to drive continuous process improvement, creating a cycle of enhanced efficiency and quality assurance for the end-user (the electronics manufacturer).

Solder Paste Inspection (SPI) System Market Potential Customers

Potential customers for Solder Paste Inspection (SPI) systems are defined by their engagement in high-volume or high-reliability Printed Circuit Board (PCB) assembly using Surface Mount Technology (SMT). The primary buyers are Electronics Manufacturing Services (EMS) providers, such as Foxconn, Jabil, and Flextronics, who require numerous, high-throughput in-line systems to manage diverse client product portfolios and meet stringent quality SLAs. Original Equipment Manufacturers (OEMs) specializing in critical sectors, particularly automotive (Tier 1 suppliers for ECUs, sensing systems) and medical devices (implantable devices, diagnostic equipment), represent highly valuable customers who prioritize measurement precision, repeatability, and comprehensive documentation over outright cost.

Furthermore, specialized manufacturing facilities focusing on industrial controls, telecommunications infrastructure (5G components), and high-performance computing (servers, graphics cards) are key purchasers due to the fine pitch and complexity of their assemblies. These customers demand advanced 3D SPI capabilities to ensure reliability under extreme operating conditions. Smaller and mid-sized contract manufacturers often utilize off-line or refurbished SPI systems, though competitive pressures are increasingly forcing them to invest in entry-level in-line systems to maintain industry competitiveness and secure contracts requiring certified quality processes. The core purchasing decision is consistently driven by the cost of defect prevention versus the cost of rework and warranty claims.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 800 Million |

| Growth Rate | CAGR 8.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Koh Young Technology, Saki Corporation, Nordson Corporation (CyberOptics), Mirtec, Parmi Corp, Viscom AG, ViTrox Corporation, Omron Corporation, GÖPEL electronic, Machine Vision Products (MVP), Test Research, Inc. (TRI), Jintop, Unicomp Technology, Mek Marantz Electronics, ASC International, ViALUX GmbH, Camtek, Pemtron, Gen3 Systems, Kyoritsu Electric. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Solder Paste Inspection (SPI) System Market Key Technology Landscape

The core technology landscape in the Solder Paste Inspection (SPI) market is dominated by non-contact optical measurement techniques, primarily focused on extracting high-precision 3D topographical data. The shift from 2D imaging, which only measures the X-Y dimensions (area and registration), to advanced 3D measurement is the most significant technological development. Modern 3D SPI systems overwhelmingly rely on structured light technology, often utilizing phase-shifting Moiré or laser triangulation methods. These techniques project precise fringe patterns onto the PCB surface, and high-resolution cameras capture the distorted patterns. Algorithms then calculate the Z-axis height profile with micron-level accuracy, enabling precise volumetric measurement of the solder paste deposit, which is critical for identifying defects such as insufficient volume or excessive height.

Further technological advancements include the move towards higher speed and greater automation through enhanced data acquisition rates and parallel processing capabilities. High-speed scanning techniques, coupled with powerful graphics processing units (GPUs), allow systems to maintain high throughput even when inspecting large, complex PCBs with ultra-fine pitch components. Illumination technology is also evolving, with the use of advanced LED light sources and multiple angle illumination to minimize shadowing effects caused by nearby components or uneven board surfaces, thereby improving measurement reliability. This is particularly vital in dual-lane or high-density board environments where clearance is limited and measurement accuracy must be maintained across all regions of the board.

Integration and connectivity represent another pillar of the current technology landscape. Modern SPI systems are built to be Industry 4.0 compliant, featuring open interfaces (like CFX and the Hermes Standard) to facilitate seamless data exchange with upstream solder printers and downstream Automatic Optical Inspection (AOI) systems. This connectivity enables the implementation of closed-loop feedback systems, where the SPI system automatically relays critical offset and parameter data back to the printer for real-time correction, minimizing human intervention. The incorporation of AI/ML algorithms into the inspection software is also a vital technology trend, moving the systems from passive measurement tools to active, intelligent process optimization agents, drastically improving defect classification and reducing the need for continuous manual tuning.

Regional Highlights

The global SPI System Market exhibits distinct growth patterns and adoption characteristics across major geographical regions, influenced by localized manufacturing capacities, technological maturity, and quality regulation standards.

- Asia Pacific (APAC): APAC is the epicenter of global electronics manufacturing, hosting the vast majority of EMS providers and large-scale OEM assembly operations, particularly in China, Taiwan, South Korea, and Vietnam. This region exhibits the highest demand, driven by massive production volumes and continuous capacity expansions, particularly for consumer electronics and increasingly sophisticated automotive electronics manufacturing. Growth here is primarily focused on acquiring high-throughput, fully integrated in-line 3D SPI systems to maximize yield and efficiency.

- North America: This region is characterized by high-mix, low-volume production, focusing heavily on specialized sectors such as aerospace, defense, medical devices, and high-performance computing. North American manufacturers prioritize technological superiority, stringent quality compliance, and reliable data traceability. The market shows steady growth, driven mainly by the necessity to upgrade existing 2D and older 3D SPI systems to modern AI-enabled platforms that ensure zero-defect output for critical applications.

- Europe: Similar to North America, the European market is highly quality-focused, particularly due to the dominance of the automotive industry (Germany, Italy) and high-value industrial automation. European manufacturers demand robust integration with manufacturing execution systems (MES) and adherence to quality standards like ISO/TS 16949. The demand focuses on precision and reliability, with a steady replacement cycle favoring vendors who offer strong local technical support and comprehensive data management capabilities compliant with regional data security requirements.

- Latin America, Middle East, and Africa (LAMEA): These regions represent emerging SPI markets. While overall volume is lower compared to APAC, growth is anticipated, particularly in Mexico (serving the North American automotive sector) and specific industrial/telecom hubs in Brazil and the UAE. Adoption is motivated by global manufacturers establishing local assembly plants and the gradual improvement of local manufacturing quality standards, leading to increasing demand for entry-level and mid-range 3D SPI systems.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Solder Paste Inspection (SPI) System Market.- Koh Young Technology

- Saki Corporation

- Nordson Corporation (CyberOptics)

- Mirtec

- Parmi Corp

- Viscom AG

- ViTrox Corporation

- Omron Corporation

- GÖPEL electronic

- Machine Vision Products (MVP)

- Test Research, Inc. (TRI)

- Jintop

- Unicomp Technology

- Mek Marantz Electronics

- ASC International

- ViALUX GmbH

- Camtek

- Pemtron

- Gen3 Systems

- Kyoritsu Electric

Frequently Asked Questions

Analyze common user questions about the Solder Paste Inspection (SPI) System market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of a Solder Paste Inspection (SPI) System in PCB assembly?

The primary function of an SPI system is to inspect the volume, height, area, and alignment of solder paste immediately after printing and before component placement. It ensures the solder deposit meets strict specifications, as printing defects cause up to 70% of soldering failures.

How does 3D SPI technology differ from traditional 2D SPI?

3D SPI utilizes structured light or laser techniques (like Moiré) to measure the actual height (Z-axis) and volume of the solder deposit, providing comprehensive volumetric data. 2D SPI only measures the X-Y dimensions (area), offering incomplete data for modern fine-pitch components.

Which application segment is driving the fastest growth in the SPI market?

The Automotive Electronics segment is currently driving the fastest growth due to the stringent quality requirements for ADAS, electric vehicle components, and safety-critical ECUs, necessitating the high reliability and 100% inspection capabilities offered by advanced SPI systems.

What role does AI play in modern Solder Paste Inspection?

AI, specifically deep learning, enhances SPI systems by improving defect classification accuracy, drastically reducing false call rates, and enabling predictive process control. AI allows the system to autonomously recommend adjustments to the solder printer, closing the manufacturing loop.

What are the key defects detected by SPI systems?

SPI systems are designed to detect critical defects related to solder paste printing, including insufficient volume, excessive volume, bridging (shorting potential), misalignment (registration errors), slumping, and variations in deposit height which impact solder joint reliability.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Solder Paste Inspection (SPI) System Market Size Report By Type (In-line SPI System, Off-line SPI System), By Application (Automotive Electronics, Consumer Electronics, Industrials, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- 3D Solder Paste Inspection (SPI) System Market Statistics 2025 Analysis By Application (Automotive Electronics, Consumer Electronics, Industrials, Others), By Type (Off-line SPI System, In-line SPI System), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Solder Paste Inspection (SPI) System Market Statistics 2025 Analysis By Application (Automotive Electronics, Consumer Electronics, Industrials), By Type (In-line SPI System, Off-line SPI System), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager