Soldering Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435562 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Soldering Market Size

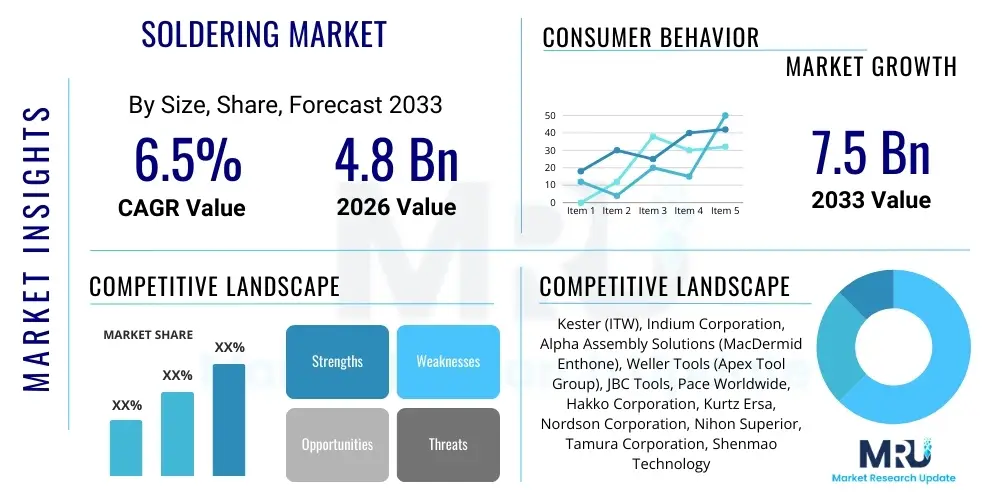

The Soldering Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 4.8 Billion in 2026 and is projected to reach USD 7.5 Billion by the end of the forecast period in 2033.

Soldering Market introduction

The Soldering Market encompasses the global trade of materials, equipment, and consumables essential for establishing durable electrical and mechanical connections in electronic assemblies and other industrial applications. Products range from high-precision soldering stations and rework systems to various types of solder alloys (lead-free, tin-silver-copper) and chemical fluxes, catering to the increasingly sophisticated demands of modern electronics manufacturing. The fundamental purpose of soldering is to ensure reliable interconnection, particularly critical in densely populated Printed Circuit Boards (PCBs) where thermal management and joint integrity are paramount for device longevity and performance across sectors like telecommunications, automotive electronics, and consumer devices.

Major applications driving market expansion include the rapid deployment of 5G infrastructure, the proliferation of Internet of Things (IoT) devices, and the complex electronic systems utilized in Advanced Driver-Assistance Systems (ADAS) within the automotive sector. Benefits derived from advanced soldering solutions include enhanced process control, reduced defect rates through automated systems (such as selective and reflow soldering), and compliance with stringent environmental regulations, particularly concerning the adoption of robust lead-free alloys. The market is significantly influenced by the continuous trend toward miniaturization, necessitating finer pitch components and highly precise deposition techniques for solder paste and flux.

Driving factors propelling market growth are primarily the increasing demand for high-reliability electronic components in mission-critical applications, coupled with sustained investment in semiconductor fabrication and outsourced assembly and test (OSAT) services globally, particularly across the Asia Pacific region. Furthermore, the constant innovation in soldering technology, focused on improving throughput and accommodating heat-sensitive components, continues to push market boundaries. The need for specialized rework solutions to repair complex multi-layer PCBs without damaging adjacent components further solidifies the demand for sophisticated soldering tools and materials, guaranteeing future market stability and expansion.

Soldering Market Executive Summary

The Soldering Market is experiencing robust growth fueled by transformative business trends, specifically the global shift toward automated manufacturing and the necessity for high-reliability connections in advanced electronics. Key business trends include the increasing adoption of Industry 4.0 principles, integrating smart soldering equipment capable of real-time process monitoring, data logging, and predictive maintenance, enhancing overall manufacturing efficiency. Furthermore, supply chain resilience, particularly the strategic sourcing of specialized solder alloys and fluxes, remains a significant operational focus for major Original Equipment Manufacturers (OEMs) and Electronics Manufacturing Services (EMS) providers, influencing investment in advanced robotics for handling precision soldering tasks across high-volume production lines.

Regionally, Asia Pacific (APAC) dominates the Soldering Market due to its massive concentration of consumer electronics production, semiconductor manufacturing hubs, and electric vehicle (EV) battery assembly facilities, necessitating vast quantities of specialized soldering materials and equipment. North America and Europe, while possessing slower manufacturing volume growth, lead in the adoption of sophisticated, high-end automated selective and vapor phase soldering systems driven by strict quality control standards in the aerospace, defense, and medical device sectors. Emerging markets in Latin America and MEA are showing increased investment in foundational electronics assembly, steadily contributing to the global demand curve, particularly for entry-level and mid-range soldering equipment.

Segment trends reveal a significant pivot toward lead-free solder materials (driven by RoHS and REACH regulations), particularly alloys incorporating tin, silver, and copper, which offer superior mechanical strength and thermal performance. Process segmentation highlights the expanding utilization of automated reflow soldering for Surface Mount Technology (SMT) and selective soldering systems for through-hole components in mixed-technology boards, optimizing both speed and precision. The application segment sees the automotive sector, driven by the electrification trend and autonomous driving technologies, becoming a primary consumer of high-reliability soldering consumables, demanding materials capable of withstanding extreme thermal cycling and vibration stress.

AI Impact Analysis on Soldering Market

User inquiries regarding AI's influence on the Soldering Market predominantly revolve around three key themes: quality control automation, process optimization, and predictive maintenance capabilities. Users are keen to understand how AI-driven machine vision systems can eliminate human error in inspecting solder joints (e.g., detecting insufficient wetting, bridging, or voids) at high speed, ensuring zero-defect production lines. There is also considerable interest in AI algorithms managing complex soldering profiles (thermal ramps and dwell times) in real-time, especially for sensitive components, aiming for dynamic optimization based on varying board conditions or material characteristics. Lastly, manufacturers frequently ask about integrating AI for equipment health monitoring, forecasting failures in heating elements or pump systems in wave and selective soldering machines, thereby maximizing uptime and reducing unplanned maintenance costs.

The integration of Artificial Intelligence (AI) and Machine Learning (ML) is fundamentally transforming soldering processes, moving them beyond traditional programmed automation toward cognitive manufacturing environments. AI algorithms analyze vast datasets generated during the soldering process—including temperature profiles, vibration patterns, and visual inspection data—to identify subtle correlations indicative of potential defects or process drift before they occur. This predictive capability allows manufacturers to adjust process parameters proactively, significantly enhancing First Pass Yield (FPY) rates, which is crucial for high-value assemblies like those used in aerospace or medical diagnostics. Furthermore, AI-powered systems are becoming essential in managing the complexity introduced by smaller, denser PCBs and novel materials, where standard fixed parameters often fail to produce optimal results.

This technological evolution is leading to the concept of the 'Self-Optimizing Soldering Line,' where equipment learns from every board processed, continuously refining thermal profiles and material deposition amounts. Such advancements reduce the dependency on highly specialized technicians for process setup and maintenance, democratizing high-precision manufacturing. However, the initial capital investment required for AI-integrated hardware and the need for skilled data scientists to train and maintain these models pose transitional challenges, especially for smaller market participants. Nonetheless, the long-term benefits in quality assurance, throughput, and reduction of scrap material solidify AI's role as a primary innovation catalyst in the future of the Soldering Market, establishing new benchmarks for interconnection reliability.

- AI enhances visual inspection reliability by identifying microscopic defects and analyzing joint geometry with superior speed and consistency compared to human operators.

- Predictive maintenance driven by ML reduces equipment downtime by analyzing operational telemetry data from soldering stations and large-scale reflow/wave systems.

- Optimization algorithms dynamically adjust thermal profiles and flux deposition rates in automated systems based on real-time component mass and board characteristics.

- AI facilitates rapid root cause analysis (RCA) by correlating process parameters with observed failures, accelerating fault resolution in complex manufacturing environments.

- Generative AI tools are starting to assist in designing optimal fixture configurations and nozzle patterns for selective soldering machines, maximizing efficiency.

DRO & Impact Forces Of Soldering Market

The dynamics of the Soldering Market are shaped significantly by the interplay of powerful drivers, stringent restraints, and lucrative opportunities, collectively defining the market's trajectory and creating profound impact forces. Key drivers include the exponential growth in demand for connected devices (IoT, smart consumer electronics) and the intensive electrification of the automotive industry, which requires reliable power electronics and control units, demanding specialized, high-temperature soldering solutions. Restraints primarily involve the high complexity and cost associated with implementing highly automated selective and reflow soldering equipment, particularly for Small and Medium Enterprises (SMEs), alongside the environmental and health concerns associated with certain chemical fluxes and the ongoing challenge of completely eliminating trace lead exposure in global supply chains. Opportunities abound in the development of novel lead-free alloys offering better wetting characteristics and thermal stability, alongside the proliferation of automated rework solutions addressing the high cost of scrapping complex multi-layer boards.

Impact forces stemming from these factors manifest in various forms across the value chain. Economic forces, driven by increasing global electronics assembly volumes, create a high, consistent demand floor for soldering consumables and maintenance services. Regulatory forces, centered around RoHS, REACH, and similar environmental directives, compel rapid material substitution and investment in greener soldering technologies (e.g., water-soluble fluxes), fundamentally altering product development cycles for suppliers. Technological forces, characterized by miniaturization and the transition to flexible PCBs and micro-BGA/CSP components, continuously necessitate higher precision equipment and advanced thermal management capabilities during the soldering process, pushing manufacturers toward adopting expensive, high-throughput systems like vapor phase soldering.

Furthermore, competitive forces are intense, with major material suppliers constantly innovating to provide solder pastes compatible with lower temperature profiles to protect heat-sensitive components, while equipment manufacturers compete on throughput, accuracy, and integration with Industry 4.0 platforms. The long-term trajectory suggests a market defined by hyper-automation, material science breakthroughs addressing performance gaps left by legacy lead alloys, and an increasing geographical spread of advanced manufacturing capacity, making process reliability a non-negotiable standard for market participants. Successfully navigating these impact forces requires substantial R&D investment and compliance infrastructure to maintain market relevance.

Segmentation Analysis

The Soldering Market is meticulously segmented based on product type, process utilized, and the end-use application, reflecting the specialized requirements of diverse electronics manufacturing environments globally. Analyzing these segments provides strategic insights into investment priorities and technological development areas. The segmentation by product type is crucial, differentiating between capital expenditure items (like soldering stations, reflow ovens, and rework systems) and consumable operating expenses (solder paste, wire, and flux), with consumables typically accounting for a larger portion of the market volume due to continuous usage in high-volume production. The rapid growth of Surface Mount Technology (SMT) has consistently favored segments related to solder paste and highly accurate dispensing and screening equipment, ensuring precise material placement on fine pitch components.

Process segmentation, encompassing wave, reflow, selective, and hand soldering, indicates the complexity and scale of manufacturing operations. Reflow soldering holds the largest market share due to its essential role in SMT assembly, driven by efficiency and scalability. However, selective soldering is witnessing the fastest growth, particularly in automotive and industrial control applications where the mixing of SMT and traditional through-hole components on a single board demands highly targeted, automated connections that are impervious to shadowing effects often seen in wave soldering processes. Hand soldering remains vital for specialized rework, prototyping, and low-volume, high-mix assembly, ensuring a persistent demand for high-quality soldering irons and specialized tips for micro-components.

The application segmentation is directly tied to global macroeconomic trends, with the Electronics & Telecommunication sector remaining the dominant consumer, driven by continuous innovation in mobile devices, network equipment, and data centers. The Automotive segment is the primary growth engine, propelled by stringent reliability requirements for components operating in harsh environments (e.g., engine control units, battery management systems for EVs). Understanding these application needs is paramount, as medical and aerospace sectors demand extremely high-reliability, zero-defect processes, often utilizing specialized fluxes and solder alloys tested for long-term operational integrity under stress conditions, influencing material innovation and equipment certification requirements across the industry.

- By Product Type:

- Soldering Stations and Irons

- Rework Systems (Hot Air and Infrared)

- Solder Materials (Wire, Bar, Preforms)

- Solder Paste and Flux

- Automated Soldering Equipment (Robots, Ovens)

- By Process:

- Reflow Soldering (Convection, Vapor Phase)

- Wave Soldering

- Selective Soldering

- Hand Soldering and Specialized Rework

- By Application:

- Electronics and Telecommunication

- Automotive Electronics (Including EV/HEV)

- Aerospace and Defense

- Industrial Machinery and Control

- Medical Devices and Healthcare

- Consumer Electronics

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America

- Middle East and Africa (MEA)

Value Chain Analysis For Soldering Market

The value chain for the Soldering Market begins with the upstream procurement of raw materials, primarily tin, silver, copper, and specialized chemicals required for fluxes and solder pastes. Upstream activities are characterized by intensive commodity market fluctuations, necessitating strong hedging strategies by large solder material manufacturers who process these raw metals into high-purity alloys, wire, and powder. Equipment manufacturers, another crucial upstream segment, focus on precision engineering, thermal management system design, and software integration for automated soldering machinery (reflow ovens, selective soldering systems), sourcing complex components like robotics arms, nozzles, and heating elements, where intellectual property related to thermal efficiency is a key differentiator.

The intermediate stage involves the material and equipment suppliers creating and distributing finished soldering products. Distribution channels are varied, including highly specialized direct sales teams for complex capital equipment that requires installation and training, and indirect distribution through industrial distributors and specialized electronic component suppliers for consumables like solder wire and flux. This intermediary layer manages inventory, provides technical support, and ensures compliance with regional environmental standards, acting as the critical link between specialized raw material processing and diverse electronics manufacturing end-users. Efficiency in this stage dictates the speed of technological adoption in downstream manufacturing processes.

Downstream analysis focuses on the end-users: primarily Electronics Manufacturing Services (EMS) providers, Original Equipment Manufacturers (OEMs) in sectors like automotive and computing, and smaller contract manufacturers specializing in prototype or niche assemblies. Direct distribution is common for high-value automated systems sold to large EMS companies, ensuring tailored configuration and ongoing service agreements. Indirect channels handle the majority of consumable sales to the broader industrial base. The effectiveness of the overall value chain relies heavily on seamless collaboration and rapid feedback loops between the downstream users—who report performance needs and defect rates—and the upstream material developers, driving continuous improvements in alloy compositions and thermal processing techniques necessary for reliable, miniaturized electronics.

Soldering Market Potential Customers

The primary consumers and buyers in the Soldering Market are highly diversified organizations involved in high-precision electronic assembly and device manufacturing across critical infrastructure sectors. The largest customer base resides within the Electronics Manufacturing Services (EMS) sector, encompassing major global players that manage high-volume production for multiple OEMs, demanding scalable, reliable, and standardized soldering equipment and vast quantities of consumables. These EMS providers are constantly seeking equipment that offers superior throughput and compliance with diverse client specifications, including specific lead-free requirements for different regional markets. Their purchasing decisions are highly sensitive to cost-of-ownership (COO), efficiency metrics, and machine uptime reliability, often favoring integrated solutions that communicate seamlessly with existing factory management systems.

Another major segment comprises Original Equipment Manufacturers (OEMs) who handle in-house production, particularly those operating in highly regulated or performance-critical industries such as Automotive, Aerospace, and Medical Devices. Customers in these sectors prioritize quality and traceability above all else. For automotive electronics, the need for robust soldering joints that withstand extreme temperature cycling (AEC-Q100 standards) drives demand for specialized high-melting-point solder alloys and highly controlled selective soldering processes. Medical device manufacturers, dealing with life-critical products, require validated and precise soldering processes, generating steady demand for specialized, certified rework stations and extremely pure consumables to ensure long-term device function.

Furthermore, the expanding ecosystem of small to medium-sized enterprises (SMEs) focused on niche markets, prototypes, and R&D activities constitutes a significant portion of the potential customer base for entry-to-mid-level soldering stations and hand tools. Educational institutions and repair centers also contribute to the demand, requiring durable, easy-to-use soldering irons and ancillary equipment. The future growth of this customer base is intrinsically linked to the global expansion of IoT development and edge computing, where new product introduction (NPI) teams consistently require flexible and high-precision soldering tools to quickly iterate on complex PCB designs involving novel component types.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.8 Billion |

| Market Forecast in 2033 | USD 7.5 Billion |

| Growth Rate | CAGR 6.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Kester (ITW), Indium Corporation, Alpha Assembly Solutions (MacDermid Enthone), Weller Tools (Apex Tool Group), JBC Tools, Pace Worldwide, Hakko Corporation, Kurtz Ersa, Nordson Corporation, Nihon Superior, Tamura Corporation, Shenmao Technology, Solder Chemistry, Qualitek International, Fusion Inc., Eutectic Corporation, Henkel AG & Co. KGaA, Senju Metal Industry Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Soldering Market Key Technology Landscape

The Soldering Market is characterized by continuous technological evolution aimed at improving thermal efficiency, precision, and adherence to environmental mandates. A key area of innovation is the development of advanced lead-free solder alloys, specifically those engineered to minimize tin whisker growth—a reliability concern—while offering superior wetting performance comparable to SnPb alloys. Technologies such as low-temperature solders (LTS) are gaining traction, enabling the processing of highly temperature-sensitive components and minimizing energy consumption in the reflow process. Furthermore, specialized flux formulations, particularly water-soluble and no-clean fluxes, are being optimized for specific applications, ensuring minimal residue and maximizing electrical reliability in demanding environments like high-frequency telecommunications equipment.

In terms of equipment, the technological landscape is dominated by automation and enhanced process control. Selective soldering technology, utilizing nitrogen inerting and highly precise nozzle control, has matured significantly, offering repeatable, high-quality connections for through-hole components without excessive thermal stress to the adjacent SMT parts. Reflow oven technology has shifted towards vapor phase soldering for high-complexity, multi-layer PCBs, providing highly uniform thermal transfer that minimizes the risk of overheating sensitive components and ensures homogenous joint formation across the entire board surface. These systems often incorporate sophisticated software for thermal profiling, ensuring strict adherence to component manufacturer specifications (Maximum Reflow Temperature).

The emergence of Industry 4.0 has led to the integration of advanced sensors and data analytics platforms within all major soldering equipment. Modern soldering stations and automated lines are equipped with sensors to monitor tip temperature, power consumption, and thermal stability in real-time, providing comprehensive data for quality assurance and traceability. Robotic soldering systems, often employing high-definition vision systems, are used for complex and intricate joints, delivering unparalleled consistency and eliminating the inherent variability of manual processes. This technological push toward closed-loop control systems and real-time process verification is crucial for managing the challenges posed by increasingly miniaturized component sizes (01005 and smaller) and dense board layouts, which demand extreme placement accuracy and thermal precision.

Regional Highlights

Regional dynamics play a crucial role in defining the Soldering Market, dictated largely by manufacturing volumes, regulatory environments, and technological adoption rates.

- Asia Pacific (APAC): APAC is the epicenter of global electronics manufacturing, encompassing major production hubs in China, South Korea, Taiwan, Japan, and Vietnam. This region exhibits the highest demand for soldering materials and equipment, driven by high-volume production of consumer electronics, IT hardware, and significant investment in electric vehicle (EV) battery manufacturing and charging infrastructure. The competitive landscape often favors cost-effective, high-throughput automated systems, although there is a growing trend toward high-precision equipment adoption, particularly in Japan and South Korea, where next-generation semiconductor packaging and advanced display technologies are concentrated. Regulatory compliance with lead-free mandates, while implemented, faces constant pressure due to the sheer volume of output, making material sourcing and quality control challenging. The rapid pace of 5G network rollout further accelerates demand for high-frequency PCB assembly.

- North America: The North American market is characterized by high-value, low-volume, and high-mix manufacturing, focusing heavily on aerospace, defense, medical devices, and high-performance computing (HPC). Demand here is concentrated on sophisticated, high-reliability soldering solutions, including specialized vapor phase reflow systems and automated selective soldering equipment with superior traceability features. The region leads in adopting advanced quality control techniques, utilizing AI-powered automated optical inspection (AOI) systems integrated with soldering lines. Lead-free compliance is standard, and there is an increased focus on developing robust soldering solutions for extreme environment applications, often requiring ITAR-compliant manufacturing processes and specialized military-grade alloys, demanding premium, reliable equipment from suppliers.

- Europe: The European market, particularly Germany, France, and the UK, emphasizes technological innovation and environmental sustainability. Strict adherence to REACH and RoHS directives drives demand for environmentally friendly fluxes and highly reliable lead-free materials, including alternatives that offer better long-term reliability than standard SAC alloys. The market is strong in the automotive (driven by European EV production standards) and industrial automation sectors, requiring durable, vibration-resistant soldering joints. European manufacturers often invest heavily in sophisticated, energy-efficient soldering equipment and integrated factory management systems (Industry 4.0), valuing precision and efficiency over sheer production volume. The strategic push towards localized semiconductor manufacturing also promises future growth in advanced assembly techniques.

- Latin America (LATAM): The LATAM market, led by Mexico and Brazil, serves as a significant regional assembly hub, often catering to North American demand (near-shoring trend). The market primarily focuses on standard consumer electronics assembly and automotive parts. While adoption of automated soldering equipment is growing, hand soldering and semi-automated processes still hold a substantial share due to cost considerations. The primary drivers are local consumer demand and exports, creating a stable but price-sensitive market for mid-range soldering consumables and refurbished or moderately automated equipment. The push for local content laws is gradually driving higher investment in advanced assembly capabilities.

- Middle East and Africa (MEA): The MEA region is currently a smaller, rapidly developing market focused mainly on telecommunication infrastructure, basic consumer electronics assembly, and specialized defense applications. Growth is concentrated in Gulf Cooperation Council (GCC) countries, driven by government initiatives to diversify economies through technology parks and smart city projects. Demand is selective, focused on large infrastructure projects, leading to fluctuating requirements for advanced soldering technology. Equipment procurement is often high-spec but lower volume, catering to localized repair, maintenance, and small-scale assembly operations, with a reliance on international suppliers for advanced materials and high-end machinery, reflecting nascent manufacturing maturity.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Soldering Market.- Kester (ITW)

- Indium Corporation

- Alpha Assembly Solutions (MacDermid Enthone)

- Weller Tools (Apex Tool Group)

- JBC Tools

- Pace Worldwide

- Hakko Corporation

- Kurtz Ersa

- Nordson Corporation

- Nihon Superior

- Tamura Corporation

- Shenmao Technology

- Solder Chemistry

- Qualitek International

- Fusion Inc.

- Eutectic Corporation

- Henkel AG & Co. KGaA

- Senju Metal Industry Co., Ltd.

- Metcal (OK International)

- Pillarhouse International

Frequently Asked Questions

Analyze common user questions about the Soldering market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary drivers for the adoption of lead-free soldering materials?

The primary drivers are global regulatory mandates, specifically the European Union's RoHS (Restriction of Hazardous Substances) Directive and similar legislation worldwide, which restrict the use of lead in electronic and electrical equipment. Additionally, market demand for environmentally responsible products and improved long-term reliability in high-stress applications are compelling manufacturers to adopt lead-free alloys like SAC (Tin-Silver-Copper).

How is the miniaturization trend impacting soldering equipment requirements?

Miniaturization demands significantly higher precision and control from soldering equipment. Manufacturers require finer solder paste printing capability, highly accurate robotic dispensing, and advanced optical inspection (AOI) systems to handle micro-components (e.g., 01005s) and fine-pitch BGA/CSP packages, necessitating sophisticated reflow ovens and precise selective soldering nozzles for targeted heat application.

What is the main difference between wave soldering and selective soldering processes?

Wave soldering is a mass soldering process used for traditional through-hole components where the entire PCB bottom passes over a molten solder wave, ideal for high-volume legacy assembly. Selective soldering, conversely, is an automated, highly controlled process where only specific joints are contacted by a localized solder fountain, offering greater thermal control and preventing damage to adjacent surface mount components on mixed-technology boards, crucial for complex automotive and industrial assemblies.

Which application sector currently exhibits the fastest growth in the Soldering Market?

The Automotive Electronics sector, particularly the Electric Vehicle (EV) and Hybrid Electric Vehicle (HEV) segments, is showing the fastest growth. This is driven by the proliferation of high-power electronics (inverters, chargers, battery management systems) which require extremely reliable, thermally robust soldering connections capable of withstanding severe vibration and thermal cycling demands, boosting demand for specialized high-performance solder materials and automated selective systems.

How does Artificial Intelligence (AI) enhance quality control in modern soldering lines?

AI enhances quality control by powering advanced Automated Optical Inspection (AOI) systems. These systems use machine learning algorithms to analyze solder joint characteristics (e.g., fillet size, alignment, void presence) against pre-trained perfect models, identifying subtle defects faster and more reliably than traditional rule-based programming or human inspectors, leading to near-zero defect manufacturing and improved process optimization.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Hand Soldering Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Hot Bar Soldering Machine Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Dual Channel Digital Soldering Station Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Single Channel Digital Soldering Station Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Laser Soldering Machine Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager