Soldering Robotics Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432792 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Soldering Robotics Market Size

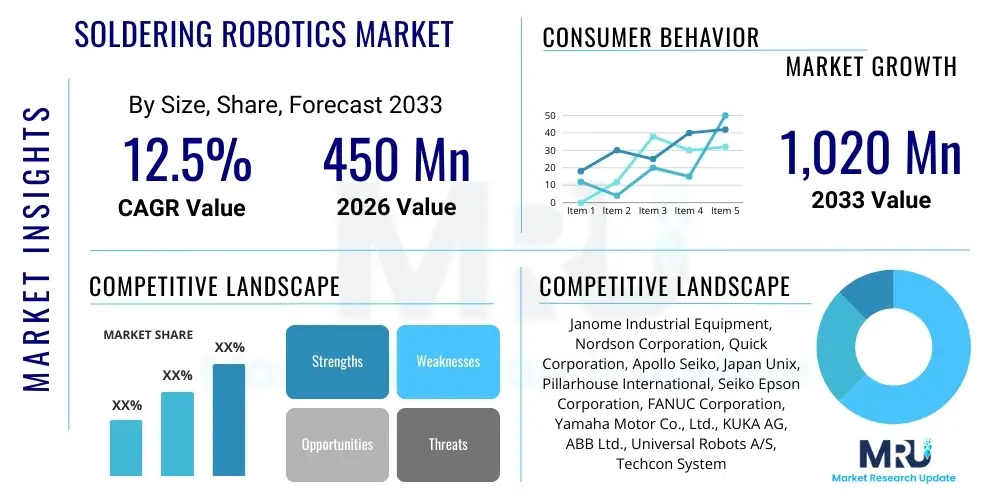

The Soldering Robotics Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.5% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 1,020 Million by the end of the forecast period in 2033.

Soldering Robotics Market introduction

The Soldering Robotics Market encompasses automated systems designed to perform precision soldering tasks in manufacturing environments, replacing manual labor with high-speed, high-accuracy robotic arms. These systems integrate advanced components such as sophisticated vision systems, high-temperature soldering tools (like laser or iron tips), multi-axis robotic platforms, and programmable controllers. The primary function of soldering robots is to ensure consistent quality and throughput in the joining of electronic components onto Printed Circuit Boards (PCBs) or other substrates. This technology is becoming indispensable across industries requiring miniaturization and high reliability, such as consumer electronics, medical device manufacturing, and the rapidly expanding automotive electronics sector, particularly for Electric Vehicle (EV) battery management systems and advanced driver-assistance systems (ADAS) modules. The fundamental shift driving adoption is the need for unparalleled precision and repeatability that manual processes cannot consistently achieve, especially with the move towards smaller pitch sizes and complex surface-mount technology (SMT) applications.

Major applications for soldering robotics span diverse high-tech manufacturing segments. In consumer electronics, they are crucial for assembling smartphones, laptops, and wearables, where space constraints necessitate micro-soldering capabilities. The automotive industry utilizes these robots extensively for mission-critical components, including sensors, engine control units (ECUs), and increasingly complex infotainment systems, demanding robust solder joints that can withstand extreme environmental conditions. Furthermore, in the aerospace and defense sectors, soldering robots guarantee the reliability required for avionics and sensitive communication equipment where component failure is unacceptable. The market growth is also significantly spurred by the global push for smart manufacturing initiatives and Industry 4.0 adoption, positioning automated soldering as a core element of fully integrated production lines, enhancing overall equipment effectiveness (OEE) and reducing operational variability.

The benefits associated with the deployment of soldering robots are multifaceted, extending beyond mere labor replacement. Key advantages include vastly improved solder joint quality, characterized by uniform fillet size and consistent thermal profiles, leading to fewer defects and reduced rework rates. They also offer significantly higher production speeds and continuous operation capabilities, drastically boosting throughput compared to human operators. Driving factors propelling this market include the relentless trend of electronics miniaturization, requiring precise and delicate soldering methods; rising labor costs in traditional manufacturing hubs; and the increasing complexity and volume of electronic products globally. Manufacturers are leveraging these systems not only for efficiency gains but also for enhanced data collection and traceability, ensuring compliance with stringent quality standards in highly regulated industries like medical and automotive manufacturing.

Soldering Robotics Market Executive Summary

The Soldering Robotics Market is undergoing a rapid transformation, characterized by strong business trends centered around integration and specialization. Technologically, the focus has shifted towards intelligent, collaborative robotic solutions (Cobots) that can work safely alongside human operators, increasing flexibility in diverse production environments. Furthermore, the market sees heightened demand for specialized soldering methodologies, particularly laser soldering, which offers non-contact, highly precise heating suitable for heat-sensitive components and fine-pitch applications. Strategic partnerships between robotic arm manufacturers and specialized soldering tool providers are defining the competitive landscape, aiming to offer turnkey, application-specific solutions to end-users. The pervasive adoption of digital twin technology and predictive maintenance within these robotic systems is significantly improving operational uptime and contributing to overall efficiency gains in large-scale manufacturing operations globally.

Regionally, Asia Pacific (APAC) currently dominates the market, driven by the concentration of the world’s largest electronics manufacturing bases in China, South Korea, Japan, and Taiwan. This region benefits from massive government investment in automation infrastructure and a high volume of consumer electronics production. North America and Europe, while having higher average labor costs and mature manufacturing sectors, are focusing heavily on sophisticated, high-mix, low-volume production lines, prioritizing flexibility and quality assurance. The growth trajectory in these developed regions is specifically fueled by the expanding electric vehicle and medical device manufacturing industries, demanding highly specialized and compliant soldering processes. Emerging markets in Latin America and MEA are beginning to adopt soldering robotics, albeit at a slower pace, primarily driven by foreign investment establishing local assembly operations focused on consumer goods and basic automotive components.

Segment trends highlight the critical importance of the component segment, where advancements in vision systems and specialized soldering heads are key determinants of market growth. Vision systems, often incorporating high-resolution cameras and AI-driven defect recognition algorithms, are enhancing accuracy and quality control in real-time. By Type, Iron Soldering Robots remain the workhorse for standard applications due to their cost-effectiveness and robustness, but Laser Soldering Robots are experiencing the highest growth rate, capturing market share in high-precision, miniaturized electronics. In terms of end-use, the Automotive Electronics segment is projected to exhibit the fastest expansion, largely due to the stringent quality requirements and explosive volume growth associated with ADAS, in-car connectivity modules, and complex battery pack assembly within the rapidly maturing electric vehicle ecosystem worldwide.

AI Impact Analysis on Soldering Robotics Market

User queries regarding the impact of Artificial Intelligence (AI) on the Soldering Robotics Market frequently revolve around how AI can enhance precision, minimize defects, and facilitate autonomous decision-making within production lines. Common questions include: Can AI predict and compensate for temperature variations in real-time? How does machine learning improve defect detection beyond standard vision systems? Will AI enable robots to self-program for new PCB layouts? The key themes synthesized from these inquiries highlight user concerns about the transition from deterministic, programmed automation to adaptive, intelligent manufacturing processes. Users anticipate AI will not only optimize the core soldering process but also streamline peripheral activities such as material handling, quality control, and predictive maintenance, leading to fully autonomous, zero-defect production cycles. The expectation is that AI will democratize high-precision soldering by reducing the dependency on highly specialized human programming expertise.

The integration of AI, specifically Machine Learning (ML) and computer vision, is fundamentally transforming the capabilities of soldering robots, pushing them beyond simple programmed path execution. AI algorithms are now deployed to analyze vast datasets collected from sensors regarding temperature profiles, solder feed rates, joint geometry, and component alignment. This analysis allows the robot's control system to execute real-time adjustments (e.g., modifying heat application or dwell time) to maintain optimal solder joint quality despite minor variations in components or environmental factors, effectively achieving a closed-loop, adaptive manufacturing process. This shift significantly reduces the setup time for new product lines, as ML models can quickly learn the optimal parameters for novel component configurations, a critical feature for high-mix, low-volume manufacturers.

Furthermore, AI-enhanced vision systems are providing superior quality assurance capabilities. Traditional Automated Optical Inspection (AOI) systems rely on pre-defined rules, whereas AI-driven inspection uses deep learning models trained on millions of images of both perfect and defective solder joints. This enables the robotic system to identify subtle, non-obvious defects (like insufficient wetting or minor tombstoning) that might pass conventional checks, drastically improving First Pass Yield (FPY). The future deployment of edge AI processing units within the robotic controller will enable ultra-low-latency decision-making, ensuring instantaneous process correction, solidifying AI as an essential component for achieving true 'lights-out' manufacturing capability in the precision electronics assembly sector.

- AI-driven real-time thermal profile optimization and compensation.

- Enhanced quality control through Deep Learning-based defect detection and classification.

- Predictive maintenance schedules based on analysis of robot operational data.

- Autonomous path planning and parameter generation for rapid product changeovers (self-programming).

- Improved calibration accuracy using AI to compensate for mechanical wear and thermal expansion.

- Optimization of material usage (solder wire/flux) via intelligent feedback loops.

DRO & Impact Forces Of Soldering Robotics Market

The market dynamics of soldering robotics are shaped by a complex interplay of Drivers, Restraints, and Opportunities (DRO), collectively forming the market's Impact Forces. Key drivers include the overwhelming global demand for miniaturized and complex electronic devices, which mandates high-precision assembly methods unattainable through manual soldering. Coupled with this is the escalating cost of skilled labor in industrialized economies and the inherent inconsistency of human-performed soldering, particularly for critical components. These factors are compelling Original Equipment Manufacturers (OEMs) across sectors like automotive, aerospace, and medical devices to heavily invest in robust automation solutions to ensure product reliability and traceability. The simultaneous push for Industry 4.0 standards emphasizes integrated, data-driven manufacturing, positioning intelligent soldering robots as central elements in the smart factory ecosystem, thereby accelerating their adoption trajectory across all major manufacturing regions.

Conversely, significant restraints hinder the broader market penetration. The initial capital expenditure required for purchasing, installing, and integrating highly sophisticated robotic soldering systems is substantial, posing a considerable barrier, particularly for Small and Medium-sized Enterprises (SMEs) with limited operational budgets. Furthermore, the complexity associated with programming and maintaining these advanced multi-axis robots requires specialized technical expertise, leading to a shortage of qualified personnel capable of maximizing the systems' potential. There is also technical resistance, especially in legacy production lines, where the integration of new robotics requires extensive retooling and modification of existing infrastructure. Finally, while soldering robotics excel in high-volume, repetitive tasks, their flexibility in rapidly switching between highly diverse product mixes (low-volume, high-mix manufacturing) can sometimes be perceived as a limitation compared to highly skilled human operators, although advancements in AI-driven path planning are mitigating this concern.

Opportunities for growth are primarily centered on technological innovation and market expansion into untapped segments. The emergence of collaborative robots (Cobots) designed for soldering tasks presents a major opportunity, lowering the entry barrier due to their lower cost, easier programming, and inherent safety features, making them highly suitable for flexible assembly lines. The explosive growth in specialized applications, especially in the Electric Vehicle (EV) battery module assembly (requiring precision busbar soldering) and advanced medical implant manufacturing, creates high-value niche markets. Furthermore, developing robust, user-friendly software interfaces and modular system designs that allow quick reconfiguration can address the restraints related to complexity and training, expanding the customer base to smaller manufacturers globally. The shift towards laser soldering technology also opens up new possibilities for working with advanced, heat-sensitive materials and achieving ultra-fine pitch joints, securing future market dominance in next-generation electronics assembly.

Segmentation Analysis

The Soldering Robotics Market is meticulously segmented across key dimensions including Type, End-Use Industry, and Component, allowing for a granular analysis of market drivers and growth pockets. This segmentation reflects the varied technological requirements and application demands within the electronics manufacturing ecosystem. The differentiation between robot types, such as contact (iron) and non-contact (laser) soldering, is critical, as it dictates the level of precision, speed, and suitability for specific component sizes and board materials. Understanding these segments is paramount for key stakeholders, including equipment manufacturers, raw material suppliers, and end-users, enabling them to tailor their strategies and product offerings to capitalize on distinct market needs, especially those segments exhibiting high growth due to rapid technological shifts like the increasing adoption of micro-SMD components.

The Type segmentation directly influences capital investment decisions; for example, while traditional iron soldering robots are robust and suitable for general purpose SMT components, the accelerating miniaturization trend is inherently favoring laser soldering robotics due to their ability to provide highly localized heat input, minimizing thermal stress on neighboring components and maximizing joint integrity on densely packed PCBs. Furthermore, the component segmentation provides insights into the technological value chain, highlighting the crucial role played by proprietary software and advanced vision systems in defining robot performance. As manufacturing processes become more complex and regulated, the demand for sophisticated, integrated vision systems capable of real-time calibration and defect detection is rising faster than the demand for the basic robotic arm hardware itself, illustrating a shift towards software-defined automation solutions.

Analyzing the End-Use Industry segment provides a clear map of market demand intensity. The Automotive Electronics sector stands out due to the high regulatory requirements for component reliability (zero-defect tolerance) and the exponential growth in electronic content per vehicle, driven by ADAS, connectivity, and electrification. This sector demands specialized, high-throughput, and traceable soldering solutions, often requiring dual-arm or specialized large-format robotic systems. The sustained high volume in Consumer Electronics manufacturing, while mature, continues to drive steady demand for high-speed soldering solutions. Conversely, the Medical Devices and Aerospace sectors, characterized by low volume but extremely high value and strict compliance mandates, prioritize quality assurance and system validation over raw speed, demanding the highest level of precision offered by advanced laser soldering robotics and comprehensive data logging capabilities.

- By Type:

- Iron Soldering Robots

- Laser Soldering Robots

- Ultrasonic Soldering Robots (Emerging Applications)

- By End-Use Industry:

- Electronics Manufacturing (Consumer Electronics, Industrial Electronics, Automotive Electronics)

- Automotive (ECUs, Sensors, Lighting, EV Battery Modules)

- Medical Devices (Implants, Diagnostic Equipment)

- Aerospace & Defense

- Others (Telecommunications, R&D)

- By Component:

- Robotic Arm (Cartesian, SCARA, Articulated)

- Soldering Head/Tool (Tips, Nozzles, Laser Heads)

- Vision System/Sensors (Cameras, Temperature Sensors)

- Controller Hardware

- Software & Programming Tools

- Peripheral Equipment (Fume Extraction, Feeders)

Value Chain Analysis For Soldering Robotics Market

The Value Chain for the Soldering Robotics Market is complex and involves several distinct stages, beginning with upstream raw material and component suppliers, flowing through system integrators and distributors, and finally reaching the downstream end-users. The upstream segment is defined by the providers of core technologies, including manufacturers of precision motion control systems (motors, encoders), robotic arm structures (e.g., specialized SCARA or articulated arms tailored for minimal vibration), and highly specialized vision components. Key inputs also include soldering material suppliers providing high-purity solder wire, paste, and fluxes, whose quality directly impacts the performance of the automated system. Technological breakthroughs in this upstream segment, particularly in high-speed, high-accuracy vision processing and thermal management components, are critical in dictating the final robot system capabilities and differentiating competitive offerings in the broader market.

The midstream segment is dominated by the Original Equipment Manufacturers (OEMs) and specialized system integrators. OEMs focus on designing, assembling, and programming the core soldering robot platforms, often licensing or manufacturing the robotic arms internally. System integrators play a vital role in customizing these platforms to specific manufacturing environments, linking the soldering robot with existing conveyor systems, feeders, and overall Manufacturing Execution Systems (MES). The distribution channel is bifurcated into direct sales for major, high-volume customers (like large electronics contract manufacturers) seeking comprehensive support and customized solutions, and indirect sales through regional distributors or value-added resellers (VARs) who provide localized sales, technical support, and training to smaller or geographically dispersed end-users. The reliance on indirect channels is often higher in emerging markets where local presence and rapid support are competitive necessities.

Downstream analysis focuses on the end-users and the long-term service and support requirements. End-users span the full spectrum of electronics manufacturing, from high-volume consumer goods producers requiring continuous operation to specialized medical device manufacturers needing rigorous validation protocols. The critical downstream value lies in maintenance contracts, spare parts supply, software updates, and application support. Effective service provision, often utilizing remote diagnostics and augmented reality tools, is a significant differentiator, ensuring high system uptime—a non-negotiable requirement in automated production lines. Direct communication between OEMs and large end-users regarding feedback on performance, process limitations, and desired future features is crucial for iterative product development, ensuring that robotic solutions remain aligned with the evolving demands of advanced electronics assembly techniques.

Soldering Robotics Market Potential Customers

Potential customers for Soldering Robotics are primarily entities engaged in high-precision, high-volume electronic component assembly where quality, repeatability, and speed are critical operational metrics. These end-users typically require automated solutions to handle increasingly complex and miniature components, particularly surface-mount devices (SMD) with fine pitch sizes, that are difficult or impossible to solder manually with consistent quality. The largest segment of potential buyers is Contract Electronics Manufacturers (CEMs) or Electronics Manufacturing Services (EMS) providers, which handle assembly tasks for multiple clients across various industries. These companies require flexible, high-throughput systems to rapidly switch between different product batches while maintaining stringent quality control, making advanced, integrated soldering robots a vital investment for maintaining their competitive edge and profitability.

Another major segment constitutes captive manufacturers, particularly those in the automotive and medical device industries. Automotive OEMs and Tier 1 suppliers are increasingly integrating complex electronics (like battery management systems, radar modules, and ADAS ECUs) which necessitate highly reliable solder joints, often under extreme environmental specifications. These manufacturers prioritize robots offering validation, traceability, and high precision, often favoring laser soldering solutions for sensitive parts. Similarly, medical device manufacturers, producing items like pacemakers, hearing aids, and specialized surgical tools, require robotics to adhere to strict regulatory standards (e.g., FDA requirements), focusing on minimizing contamination, ensuring biocompatibility, and guaranteeing zero defects, thus making precision soldering automation essential for compliance and safety.

The aerospace and defense sector represents a high-value, albeit lower volume, customer base. These organizations demand the absolute highest reliability for components used in avionics, missile guidance systems, and communication equipment, where the cost of failure is catastrophic. They are willing to invest in the most advanced, often custom-built, soldering robotic systems that provide unparalleled accuracy and comprehensive data logging capabilities. Finally, smaller, specialized R&D labs and educational institutions also form a niche customer segment, utilizing smaller, often collaborative soldering robots for prototyping, small-batch testing, and technical training, contributing to the diffusion of soldering automation technology across different scales of operation.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 1,020 Million |

| Growth Rate | 12.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Janome Industrial Equipment, Nordson Corporation, Quick Corporation, Apollo Seiko, Japan Unix, Pillarhouse International, Seiko Epson Corporation, FANUC Corporation, Yamaha Motor Co., Ltd., KUKA AG, ABB Ltd., Universal Robots A/S, Techcon Systems, JBC Tools, Shenzhen Zhongtuo Automation Technology, Hanwha Precision Machinery, Essemtec AG, IPTE Factory Automation, Promation, Scara Robots. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Soldering Robotics Market Key Technology Landscape

The technology landscape of the Soldering Robotics Market is defined by the convergence of precision mechanics, advanced software, and thermal control systems, increasingly augmented by artificial intelligence. The foundational technology remains the multi-axis robotic arm, predominantly SCARA (Selective Compliance Assembly Robot Arm) and high-speed, articulated robots, chosen for their speed, repeatability, and relatively compact footprint suitable for integration into existing production lines. Crucially, the differentiation now lies in the end-of-arm tooling, specifically the soldering head technology. While conventional contact soldering tips (iron soldering) benefit from highly sophisticated temperature sensing and rapid heating/cooling cycles to maximize tip life and thermal consistency, the burgeoning technology is laser soldering. Laser systems use focused infrared energy (typically 1064nm wavelength for fiber lasers) to achieve non-contact, highly localized heating, minimizing collateral thermal damage to adjacent components, making them the technology of choice for high-density, miniature components (like 0201 or 01005 chips) and heat-sensitive substrates.

Software and control systems represent the most significant area of ongoing technological advancement. Modern soldering robots rely on sophisticated programming interfaces that move away from complex proprietary code towards graphical, intuitive user interfaces that facilitate rapid path generation and parameter setting. Kinematics software ensures highly precise movement paths, compensating for geometric imperfections and ensuring consistency across hundreds of thousands of operations. Furthermore, the integration of 3D vision systems—often incorporating structured light or stereoscopic imaging—allows the robot to accurately locate components and solder pads in three-dimensional space, adjusting the tool path dynamically to account for small variations in PCB placement or component tolerance, achieving true "teach-less" functionality in many advanced applications. This robust sensory feedback loop is essential for maintaining the stringent quality requirements of modern electronics manufacturing, particularly in zero-defect environments.

The latest technological evolution is the incorporation of AI/Machine Learning capabilities, driving predictive and adaptive soldering processes. AI algorithms analyze data from vision systems, thermal sensors, and motion controllers to predict potential joint defects before they occur and automatically modify variables like laser power, dwell time, or solder feed rate in real-time. This level of process control minimizes scrap and maximizes throughput. Additionally, the development of specialized materials, such as low-residue, no-clean fluxes optimized for automated dispensing, complements the robotic system's efficiency. The continuous drive towards modularity and interoperability, utilizing industry standards like OPC UA for communication, ensures that next-generation soldering robots can seamlessly integrate with the broader manufacturing ecosystem, including MES and Enterprise Resource Planning (ERP) systems, completing the vision of a fully connected, smart factory environment.

Regional Highlights

- Asia Pacific (APAC): APAC is the global manufacturing hub for electronics, commanding the largest share of the Soldering Robotics Market. This dominance is attributed to the massive scale of consumer electronics production (smartphones, computing devices), the presence of major electronics manufacturing services (EMS) providers, and robust government initiatives promoting industrial automation (e.g., 'Made in China 2025'). Countries like China, South Korea, and Japan lead in both demand and technological supply. The region is characterized by high volume, relatively lower average labor costs compared to the West, and a necessity for maximizing throughput, driving significant investment in high-speed, multi-head soldering robotic systems. Furthermore, the burgeoning electric vehicle battery manufacturing sector in China and South Korea is creating specific, large-scale demand for precision busbar and connection soldering automation.

- North America: North America represents a mature, high-value market focused on quality, innovation, and compliance, particularly within the medical device, aerospace, and advanced automotive electronics segments. The demand here is driven by the need to secure domestic supply chains, address high skilled labor costs, and achieve uncompromising product reliability. Adoption tends to favor highly sophisticated, flexible robotic solutions, including collaborative robots (Cobots) for shorter production runs, and advanced laser soldering for specialized high-mix, low-volume (HMLV) applications. Technological leadership and early adoption of AI-enhanced systems are key characteristics of this region's market dynamic.

- Europe: Europe is characterized by stringent quality standards, particularly in the automotive (German OEMs) and industrial electronics sectors. Market growth is stable, driven by the expansion of Industry 4.0 initiatives and a focus on operational efficiency and sustainable manufacturing practices. Central European countries, notably Germany and Poland, are key adopters. The region exhibits a strong demand for flexible automation capable of handling high-mix production environments, alongside specialized robotic systems compliant with EU environmental directives (RoHS, REACH), ensuring safe operation and material traceability.

- Latin America, Middle East, and Africa (LAMEA): This region is an emerging market for soldering robotics, largely driven by foreign direct investment establishing local assembly operations, particularly in Mexico (serving the North American automotive market) and Brazil (consumer electronics). The adoption rate is lower than in developed regions, but is accelerating due to rising local wages and the necessity to improve product quality to meet international export standards. The market is primarily focused on cost-effective, standard Iron Soldering Robots, with selective investment in advanced systems tailored for specific export-oriented manufacturing clusters.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Soldering Robotics Market.- Janome Industrial Equipment

- Nordson Corporation

- Quick Corporation

- Apollo Seiko

- Japan Unix

- Pillarhouse International

- Seiko Epson Corporation

- FANUC Corporation

- Yamaha Motor Co., Ltd.

- KUKA AG

- ABB Ltd.

- Universal Robots A/S

- Techcon Systems

- JBC Tools

- Shenzhen Zhongtuo Automation Technology

- Hanwha Precision Machinery

- Essemtec AG

- IPTE Factory Automation

- Promation

- Scara Robots

Frequently Asked Questions

Analyze common user questions about the Soldering Robotics market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary advantages of laser soldering robots over traditional iron soldering robots?

Laser soldering robots offer superior precision, non-contact heating, and localized thermal control, making them ideal for ultra-fine pitch components and heat-sensitive substrates. They provide higher process consistency and significantly reduce thermal stress on adjacent electronic components compared to contact iron soldering methods.

How does the integration of AI improve the performance and reliability of soldering automation systems?

AI enhances performance by enabling real-time adaptive process control, where the system automatically adjusts temperature and path parameters based on visual and thermal feedback. This results in minimized defects, optimized material usage, and advanced predictive maintenance scheduling, maximizing operational uptime.

Which end-use industry is expected to drive the highest growth rate for soldering robotics adoption through 2033?

The Automotive Electronics sector, driven by the explosive demand for Electric Vehicle (EV) battery management systems and complex Advanced Driver-Assistance Systems (ADAS) modules, is projected to exhibit the highest Compound Annual Growth Rate (CAGR) due to stringent reliability requirements and massive production scaling.

What is the typical Return on Investment (ROI) period for integrating a high-precision soldering robot system?

The typical ROI period varies widely based on application volume and complexity, but high-volume electronics manufacturers often achieve payback within 18 to 36 months, primarily through reduced defect rates, minimized rework costs, and significant gains in production throughput and labor efficiency.

Are collaborative soldering robots (Cobots) suitable for high-volume manufacturing environments?

While traditional articulated robots dominate ultra-high-volume lines, collaborative soldering robots are increasingly used in high-mix, medium-volume manufacturing due to their flexibility, ease of programming, and ability to operate safely alongside human workers, enhancing system scalability and rapid product changeovers.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager