Sole Cleaning Machine Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436288 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Sole Cleaning Machine Market Size

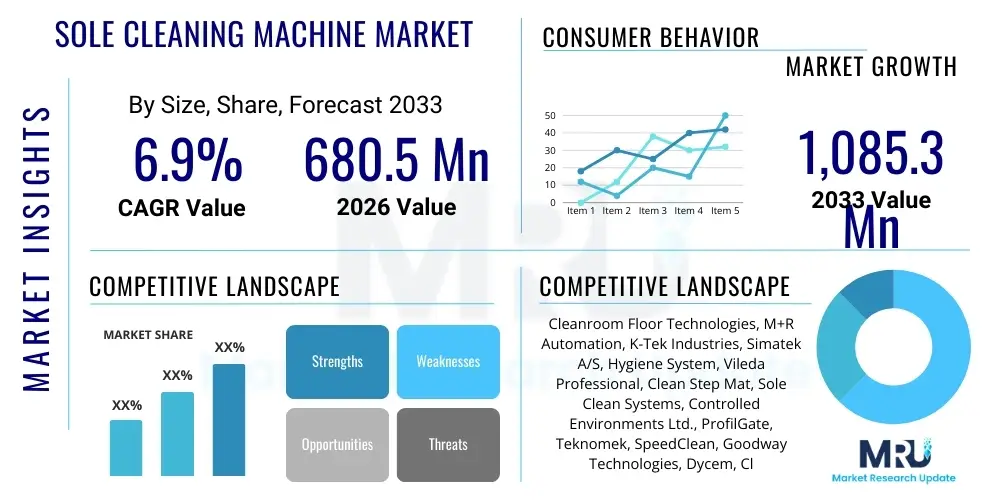

The Sole Cleaning Machine Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.85% between 2026 and 2033. The market is estimated at USD 680.5 Million in 2026 and is projected to reach USD 1,085.3 Million by the end of the forecast period in 2033. This consistent expansion is predominantly driven by increasingly stringent industrial hygiene standards across sensitive sectors such as pharmaceuticals, microelectronics manufacturing, and food processing, where controlling cross-contamination is critical for operational compliance and product integrity. The mandatory requirements for cleanroom protocols and standardized entry procedures necessitate reliable and efficient sole cleaning solutions, propelling market investment.

The growth trajectory reflects a broader global shift towards automation in contamination control, moving away from traditional, less effective methods like sticky mats or manual scrubbing. Modern sole cleaning machines, incorporating advanced features like wet cleaning capabilities, integrated vacuum systems, and intelligent sensor technology, offer superior efficacy and repeatability, justifying higher capital expenditure for end-users seeking maximal cleanliness assurance. Furthermore, technological enhancements focused on energy efficiency and ease of maintenance are lowering the total cost of ownership, making these systems more accessible to a wider range of small and medium-sized enterprises (SMEs) operating in controlled environments.

Sole Cleaning Machine Market introduction

The Sole Cleaning Machine Market encompasses specialized equipment designed to automatically remove particulate matter, dust, debris, and contaminants from the soles of footwear worn by personnel entering controlled, sterile, or sensitive environments. These machines utilize various mechanisms, including rotating brushes, integrated vacuum systems, solvent dispensers, and sticky rollers, to ensure high levels of hygiene compliance and prevent cross-contamination pathways within facilities. Products range from basic dry cleaning systems suitable for light industrial use to highly sophisticated wet cleaning and disinfection units mandatory for ISO-certified cleanrooms, catering to diverse operational requirements and regulatory mandates across the globe. The fundamental utility of these devices lies in their ability to standardize the decontamination process, eliminating human error and significantly reducing the particulate load carried into critical zones, thereby safeguarding product quality and operational safety.

Major applications of sole cleaning machines span several high-value industries, most notably encompassing pharmaceutical manufacturing facilities, biotechnology laboratories, semiconductor fabrication plants, healthcare surgical suites, and specialized food and beverage processing units. In these contexts, maintaining environmental integrity is non-negotiable, and the investment in robust sole cleaning technology acts as a primary barrier against contamination ingress. The inherent benefits include enhanced contamination control, adherence to globally recognized quality standards (such as GMP and FDA regulations), improved workflow efficiency by expediting entry procedures, and ultimately, reduction in costly product recalls or batch failures linked to environmental contamination. The evolution of these machines emphasizes customization, offering features tailored for specific contamination types, ranging from fine powders in chemical processing to biological agents in research settings, ensuring comprehensive applicability across varied industrial landscapes.

Driving factors for sustained market growth are deeply rooted in tightening global regulatory frameworks and increasing awareness regarding the economic implications of industrial contamination. The proliferation of advanced manufacturing techniques, particularly in microelectronics and biologics, requires ultra-clean environments, pushing manufacturers to invest in state-of-the-art cleaning technologies. Furthermore, the rising adoption of automation and robotic integration within manufacturing floors necessitates reliable floor and sole cleanliness to protect sensitive machinery from abrasive particulates. The convenience, consistency, and verifiable results offered by automated sole cleaning machines over traditional manual methods provide a compelling case for widespread corporate adoption, solidifying their position as essential infrastructure in modern contamination control strategies, especially in regions experiencing rapid industrialization and stringent quality control adoption.

Sole Cleaning Machine Market Executive Summary

The Sole Cleaning Machine Market exhibits robust growth, fueled by convergent trends in industrial automation, heightened global quality control mandates, and advancements in sensor and brush technology. Key business trends indicate a strong move toward integrated solutions, where sole cleaning is often combined with hand sanitization and access control systems to create holistic personnel hygiene checkpoints. Manufacturers are focusing heavily on modular designs that allow for easier integration into existing facility layouts and scalable deployment based on specific cleanroom classifications. Furthermore, the market is witnessing increased competitive intensity in the development of dry cleaning technologies that utilize advanced vacuum and ionization techniques, minimizing the need for wet cleaning agents in moisture-sensitive environments, thereby broadening application scope across industries like aerospace and defense that require meticulous environmental specifications.

Regionally, Asia Pacific (APAC) stands out as the fastest-growing market, primarily driven by massive investments in semiconductor fabrication plants (fabs) and pharmaceutical manufacturing hubs, particularly in countries like China, South Korea, and India. North America and Europe remain mature, highly regulated markets characterized by high adoption rates of premium, fully automated systems and a focus on compliance with strict GMP and ISO standards. The European market, in particular, showcases a strong preference for sustainable and energy-efficient sole cleaning machines, often incorporating advanced filtration systems and recyclable components. In contrast, emerging markets in Latin America and MEA are beginning to adopt basic and semi-automatic models, motivated by modernization efforts in food safety and resource extraction industries, signifying significant untapped potential for entry-level products.

Segment trends highlight the growing dominance of automatic sole cleaning machines over semi-automatic and manual versions, reflecting the industry's demand for high throughput and verifiable cleaning consistency. The dry cleaning segment is gaining traction due to operational simplicity and suitability for environments sensitive to moisture, though the wet cleaning segment remains essential for biological contamination removal. By application, the pharmaceutical and biotechnology sectors maintain the largest market share due to critical regulatory scrutiny, but the electronics and semiconductor segments are accelerating rapidly, driven by the requirement for ultra-low particulate contamination levels (e.g., ISO Class 1 to 5 cleanrooms). Customization based on brush material, size, and cleaning sequence optimization is becoming a critical differentiator for leading market players seeking to address niche industry requirements effectively and provide superior, tailored contamination management solutions.

AI Impact Analysis on Sole Cleaning Machine Market

User queries regarding the integration of Artificial Intelligence (AI) in the Sole Cleaning Machine Market primarily revolve around predictive maintenance schedules, enhanced cleaning efficacy verification, and integration with wider smart facility management systems. Users are keenly interested in how AI can move these machines beyond simple automated cleaning functions to become intelligent nodes within a contamination control network. Key themes include the feasibility of using computer vision and AI algorithms to detect residual contamination in real-time post-cleaning, the potential for AI to optimize brush speeds and cleaning cycles based on environmental data (e.g., humidity, particulate load entering the zone), and the development of self-diagnostic capabilities to minimize downtime. The consensus concern centers on the necessity of seamless integration with existing Manufacturing Execution Systems (MES) and Building Management Systems (BMS) without requiring extensive infrastructural overhaul. Users anticipate that AI integration will translate directly into measurable improvements in operational compliance and reduced human intervention, transforming sole cleaning from a static process into a dynamic, responsive hygiene protocol.

The application of AI in sole cleaning machines is poised to revolutionize process reliability and efficiency verification, particularly by enabling sophisticated anomaly detection. AI-powered diagnostics can analyze vibration patterns, motor performance data, and cleaning fluid turbidity to predict component failure well before it occurs, drastically improving machine uptime and reducing unforeseen maintenance costs. Furthermore, machine learning models can process data from entry sensors, tracking foot traffic patterns and correlating them with ambient particulate monitoring systems. This analysis allows the machine to dynamically adjust its cleaning intensity and duration for specific shifts or personnel groups identified as higher contamination risks, ensuring optimal resource utilization and superior cleanliness results that are precisely tailored to real-time operational needs and fluctuating environmental conditions.

The ultimate impact of AI will be the transformation of sole cleaning machines into data-generating, adaptive contamination barriers. AI models facilitate the immediate reporting and logging of cleaning effectiveness for regulatory audits, providing granular, irrefutable evidence of compliance. By analyzing long-term operational data, AI can optimize energy consumption during low-traffic periods and flag persistent ingress points requiring structural changes to the facility layout. This intelligent oversight enhances the overall efficacy of the cleanroom protocol, moving the industry toward a proactive, predictive maintenance and compliance model rather than a purely reactive one. This forward-looking capability ensures that hygiene protocols remain robust against continuously evolving operational complexities and stringent quality demands.

- AI-driven predictive maintenance scheduling based on usage metrics and component degradation analysis.

- Real-time verification of cleaning efficacy using integrated computer vision systems and contamination algorithms.

- Dynamic optimization of cleaning cycles (speed, brush intensity, fluid use) based on incoming particulate load and traffic density.

- Seamless integration with Building Management Systems (BMS) and access control for comprehensive hygiene logging.

- Automated self-diagnosis and fault reporting, minimizing machine downtime and operational disruptions.

- Enhanced energy management protocols through intelligent sensing of peak and off-peak operating hours.

- Data aggregation and reporting capabilities crucial for regulatory compliance and audit trails (AEO optimization).

DRO & Impact Forces Of Sole Cleaning Machine Market

The dynamics of the Sole Cleaning Machine Market are shaped by a complex interplay of stringent regulatory demands (Drivers), high initial investment costs (Restraints), vast technological integration potential (Opportunities), and concentrated market pressure from established industrial automation giants (Impact Forces). The primary driver is the global escalation of quality standards, particularly in sensitive manufacturing sectors where environmental contamination poses severe financial and safety risks, pushing industries toward mandatory automated cleaning solutions. Conversely, the significant upfront capital expenditure required for high-end, fully automated systems, coupled with skepticism regarding the total lifetime cost of ownership, acts as a critical restraint, particularly for smaller enterprises in cost-sensitive economies. The opportunity landscape is defined by the ongoing evolution of sensor technology and IoT integration, allowing for the creation of smart, interconnected cleaning systems that offer superior efficiency and data reporting capabilities, opening avenues for subscription-based service models and predictive maintenance contracts. The overall impact forces are primarily driven by continuous innovation cycles and the need for vendors to differentiate through verifiable performance metrics and adherence to niche industry standards.

Specific drivers include the expansion of GMP (Good Manufacturing Practices) enforcement across emerging economies and the rapid growth of the global healthcare and life sciences sectors, which inherently require pristine operational environments. The increasing prevalence of cleanroom technology in non-traditional applications, such as large-scale data centers and precision optics manufacturing, further broadens the market base. However, market growth is hampered by restraints such as resistance to change from facilities that rely on low-cost, conventional contamination control methods like simple tacky mats, which require less initial investment despite offering inferior long-term cleanliness. Furthermore, the specialized nature of these machines necessitates expert installation and periodic maintenance, creating operational dependencies that can be viewed as a constraint by end-users seeking maximal operational autonomy. Overcoming these restraints requires extensive educational campaigns highlighting the long-term return on investment (ROI) derived from reduced contamination-related losses and improved product yield, coupled with the introduction of more standardized, easy-to-install modular units.

Opportunities for market expansion are abundant in developing next-generation sole cleaning technologies that incorporate sophisticated bio-decontamination capabilities, crucial for BSL-3 and BSL-4 laboratories, or highly effective dry cleaning methods suitable for explosive or moisture-sensitive industrial settings. The push towards sustainable manufacturing practices also creates opportunities for machines utilizing minimal water or eco-friendly cleaning agents, appealing to environmentally conscious corporate entities. The competitive environment (Impact Forces) dictates that manufacturers must not only focus on cleaning effectiveness but also on user experience, ergonomics, and seamless data integration with enterprise resource planning (ERP) systems. The market impact forces emphasize a concentration of innovation in sensor fusion and material science, striving for brushes and cleaning components with extended lifecycles and superior particulate capture rates, positioning technological superiority as the decisive factor in market share acquisition.

Segmentation Analysis

The Sole Cleaning Machine Market is meticulously segmented based on Type, Operation Mode, Cleaning Method, Application, and geographic Region, reflecting the diverse requirements of the target industries. Segmentation by Type includes compact, medium-duty, and heavy-duty machines, tailored to varying traffic volumes and particulate burdens. Operation Mode distinguishes between fully automatic systems, which require minimal personnel interaction, and semi-automatic systems, often used in smaller facilities or transitional zones. Cleaning Method is a fundamental differentiator, splitting the market into Dry Cleaning (utilizing vacuum and brushes) and Wet Cleaning (incorporating water, solvents, or disinfectants), each catering to specific contamination types and environmental sensitivities. This granular segmentation allows manufacturers to precisely target their product offerings and optimize performance specifications for highly regulated environments, ensuring regulatory adherence and superior contamination control aligned with industry-specific requirements.

Segmentation by Application is critical, as it directly correlates machine specifications with regulatory intensity. The pharmaceutical and biotechnology sectors demand the highest standards, often requiring wet cleaning machines capable of certified disinfection. Conversely, the electronics and semiconductor industry prioritizes dry cleaning with static dissipation features to protect sensitive components from electrostatic discharge and fine particulate matter. Other major segments include food and beverage processing, where hygiene protocols are paramount, and aerospace and defense, which require stringent cleanliness for precision component manufacturing and assembly. This application-specific analysis underscores the market's specialized nature, where a one-size-fits-all approach is impractical, necessitating customizable solutions and focused sales strategies.

The strategic analysis of these segments reveals shifts in market preference towards automation and integrated cleaning stations. The convergence of strict regulatory oversight and the pursuit of operational excellence drive the adoption of fully automatic, heavy-duty machines in high-traffic, high-risk areas. Furthermore, the growing trend of modular contamination control solutions means that machines are increasingly being designed to interface seamlessly with adjacent hygiene equipment, such as air showers and specialized flooring systems. Understanding these segmentation nuances is crucial for competitive advantage, enabling companies to allocate R&D resources towards developing solutions that meet the precise technological and compliance thresholds required by the fastest-growing and most profitable end-user segments globally.

- By Operation Mode:

- Fully Automatic Sole Cleaning Machines

- Semi-Automatic Sole Cleaning Machines

- By Cleaning Method:

- Dry Sole Cleaning Systems (Brush & Vacuum)

- Wet Sole Cleaning Systems (Fluid & Disinfectant)

- By Type/Size:

- Compact/Entry-level Machines

- Medium-Duty Industrial Machines

- Heavy-Duty High-Capacity Machines

- By Application/End-User:

- Pharmaceutical and Biotechnology

- Electronics and Semiconductor Manufacturing

- Food and Beverage Processing

- Healthcare and Hospitals (Surgical Suites)

- Automotive and Aerospace Assembly

- Research Laboratories and Data Centers

- By Region:

- North America (U.S., Canada, Mexico)

- Europe (Germany, U.K., France, Italy, Rest of Europe)

- Asia Pacific (China, Japan, South Korea, India, Rest of APAC)

- Latin America (Brazil, Argentina, Rest of Latin America)

- Middle East and Africa (UAE, Saudi Arabia, South Africa, Rest of MEA)

Value Chain Analysis For Sole Cleaning Machine Market

The value chain for the Sole Cleaning Machine Market begins with upstream activities involving the sourcing of highly specialized materials and components, followed by manufacturing, distribution, and critical downstream installation and service. Upstream analysis focuses heavily on raw material providers for durable components, including high-grade stainless steel for corrosion resistance, specialized synthetic polymers for brush filaments designed for specific contamination removal (e.g., electrostatic discharge safety), and complex electromechanical parts such as high-efficiency vacuum pumps, motors, and integrated sensor arrays. Quality control at this stage is paramount, as the durability and reliability of the final product directly depend on the performance of these foundational components. Suppliers specializing in IoT sensors, microcontrollers, and automation software also play a crucial role, dictating the technological sophistication of the final machine and enabling features like network connectivity and predictive diagnostics. Establishing robust supply chain resilience and minimizing reliance on single sources for proprietary components are major strategic considerations for manufacturers in this market.

The mid-stream activities involve the design, assembly, and testing of the sole cleaning machines. Manufacturers differentiate themselves through proprietary brush designs, cleaning fluid delivery systems, and ergonomic considerations tailored for industrial environments. Effective manufacturing requires meticulous assembly processes, particularly for cleanroom-compatible models that must not generate particulates themselves. Quality assurance procedures, including testing for cleaning efficacy, noise levels, and compliance with electrical and safety standards (e.g., CE, UL certification), are rigorous. Downstream activities are characterized by distribution channels that are often highly specialized, relying on partnerships with distributors who possess deep expertise in cleanroom technology, industrial hygiene, and regulatory requirements within specific vertical markets. The complexity of installation, which often involves integration with existing facility infrastructure and access control systems, necessitates specialized installation teams and comprehensive post-sale support.

Distribution channels in the Sole Cleaning Machine Market are split between direct sales and indirect sales via authorized distributors or system integrators. Direct channels are typically utilized for large-scale pharmaceutical or semiconductor projects where customization and close manufacturer-client interaction are necessary, ensuring that complex specifications are met precisely. Indirect channels leverage established cleanroom equipment dealers who offer localized support, maintenance contracts, and rapid supply of consumables like brushes and cleaning agents. For optimal market penetration, manufacturers must balance direct engagement with strategic partnerships, particularly in emerging markets where local distributor knowledge of regional compliance standards and logistical challenges is invaluable. The long-term profitability of the value chain is increasingly driven by recurring revenue from service contracts, maintenance, and the supply of specialized consumables, placing significant emphasis on downstream customer relationship management and service excellence.

Sole Cleaning Machine Market Potential Customers

The primary consumers and end-users of Sole Cleaning Machines are entities operating in highly regulated or contamination-sensitive environments where the integrity of products and processes is directly dependent on environmental cleanliness. These include organizations within the life sciences, such as pharmaceutical manufacturers, biotechnology firms producing sterile products, and clinical research organizations. These users are typically mandated by regulatory bodies like the FDA, EMA, or local health ministries to implement verified and consistent decontamination procedures, making automated sole cleaning equipment an essential compliance tool. Their purchasing decisions are driven by validation documentation, machine reliability, and the ability to seamlessly integrate the cleaning cycle into existing gowning protocols, prioritizing operational efficiency and verifiable cleaning efficacy over initial cost. The shift towards personalized medicine and complex biologics further amplifies the need for meticulous contamination control in this sector.

Beyond life sciences, the electronics and semiconductor industry represents a vast and rapidly growing customer base. Facilities engaged in wafer fabrication, microchip assembly, and display manufacturing operate under ultra-clean standards (ISO Class 1 to 5), where even microscopic dust particles can cause catastrophic yield losses. These customers specifically seek dry cleaning sole machines equipped with advanced features like electrostatic discharge (ESD) protection and ultra-fine particulate capture capabilities, prioritizing zero-contamination ingress. Furthermore, the food and beverage industry, particularly in high-risk processing areas like dairy, meat packaging, and prepared foods, is increasingly adopting sole cleaning solutions to mitigate risks associated with biological contamination and foreign material ingress, thereby safeguarding public health and brand reputation against costly recalls. They focus on machines that are robust, easy to sanitize, and resistant to corrosive cleaning chemicals required in their operations.

Other significant end-user segments include precision manufacturing (e.g., optics, aerospace components), specialized logistics facilities handling sensitive materials, and high-security data centers where equipment reliability is linked to dust control. Institutional buyers, such as research laboratories, university cleanrooms, and large hospital networks (especially those with highly controlled sterile processing departments), also constitute key segments. These diverse potential customers share a fundamental need for standardized, repeatable, and verifiable contamination control at the personnel entry point, underscoring the broad applicability of sole cleaning technology. Manufacturers must tailor their marketing and product development efforts to address the unique compliance requirements, operational throughput, and specific contamination challenges inherent to each customer vertical, utilizing specific industry compliance standards as primary selling points.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 680.5 Million |

| Market Forecast in 2033 | USD 1,085.3 Million |

| Growth Rate | 6.85% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Cleanroom Floor Technologies, M+R Automation, K-Tek Industries, Simatek A/S, Hygiene System, Vileda Professional, Clean Step Mat, Sole Clean Systems, Controlled Environments Ltd., ProfilGate, Teknomek, SpeedClean, Goodway Technologies, Dycem, Clean Air Products, NORDIC AIR CLEAN, Liberty Industries, KOSMIK, S-Clean, ZARGES. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Sole Cleaning Machine Market Key Technology Landscape

The Sole Cleaning Machine Market is increasingly defined by the integration of advanced electromechanical systems and smart connectivity features designed to maximize contamination removal efficiency and enhance regulatory compliance tracking. Core technology centers around high-performance rotating brush mechanisms, which utilize proprietary filament materials and optimized rotational speeds to physically dislodge particulate matter without causing excessive friction or static buildup. The latest innovation involves multi-directional brush systems that simultaneously clean the sole and the sides of the footwear, significantly improving contamination capture. Coupled with these brushes are integrated high-efficiency particulate air (HEPA) filtration vacuum systems for dry cleaning models, ensuring that removed contaminants are safely captured and not re-released into the environment. Furthermore, wet cleaning systems are evolving to incorporate automated, highly controlled dispensing of specialized non-foaming cleaning agents and disinfectants, often featuring UV-C light sterilization modules to address microbiological contaminants, offering a multi-layered decontamination approach that meets the rigorous demands of aseptic environments.

Sensor technology and IoT connectivity represent the current frontier in sole cleaning machine evolution. Modern machines are equipped with presence sensors and weight sensors to automatically initiate cleaning cycles upon personnel entry, ensuring consistent process activation and conserving energy during idle periods. Crucially, sophisticated network modules allow these machines to connect to facility networks, enabling remote monitoring of operational status, maintenance alerts, and performance data logging. This real-time data integration facilitates robust audit trails required by regulatory bodies, automatically recording the time, duration, and completion status of every cleaning cycle. The integration of access control mechanisms, such as turnstiles or locking doors linked to the cleaning cycle completion, enforces compliance by ensuring that personnel cannot proceed into the critical zone until the sole cleaning process has been successfully executed, effectively automating protocol adherence.

Further technological advancements focus on sustainability and user interface enhancements. Manufacturers are developing brush materials with longer lifecycles and utilizing high-efficiency motors to reduce power consumption, aligning with broader corporate sustainability goals. The user interface (UI) is shifting toward intuitive touchscreens that provide operational feedback, cycle status, and customizable settings for different user profiles or contamination levels. In terms of maintenance, modular component design is becoming standard, facilitating rapid replacement of brushes, fluid tanks, and filters, significantly minimizing the mean time to repair (MTTR). This combination of mechanical robustness, intelligent control, and connectivity is transforming sole cleaning machines from simple cleaning devices into smart, verifiable, and integral components of advanced facility contamination management systems, pushing the boundaries of automated hygiene standards across global industries. The reliance on highly sensitive photoelectric sensors for detecting the exact position of footwear and ensuring complete coverage during the cleaning process is paramount for achieving optimal results, necessitating high-precision manufacturing of these sensor arrays.

Regional Highlights

The global Sole Cleaning Machine market demonstrates varied growth patterns and technological adoption rates across key geographic regions, heavily influenced by industrial concentration, regulatory maturity, and infrastructure investment cycles. North America, particularly the United States, represents a highly mature market characterized by early adoption, stringent FDA and GMP regulations, and a significant presence of leading pharmaceutical, biotech, and semiconductor manufacturers. Demand in this region is focused on high-throughput, fully automatic machines with comprehensive data logging and connectivity features, reflecting the premium placed on compliance verification and operational integration. The continuous expansion of controlled environment requirements in emerging high-tech sectors, such as cannabis cultivation and advanced materials research, further solidifies North America's position as a primary revenue generator, albeit with slower volume growth compared to APAC. Companies here prioritize innovation in dry cleaning technologies and superior service infrastructure.

Europe mirrors North America in terms of regulatory rigor (driven by EMA and ISO standards) but exhibits a greater emphasis on environmental performance and energy efficiency. Markets in Germany, Switzerland, and the UK show high demand for durable, modular systems designed for long operational lifecycles and minimal resource consumption. The presence of a strong automotive and aerospace precision manufacturing base also drives demand for specialized cleaning solutions that manage metallic debris and specialized composite particulates. Conversely, the Asia Pacific region is the global growth engine, propelled by massive capital expenditure in infrastructure, rapid industrialization, and the relocation of global manufacturing supply chains, especially in electronics and generics pharmaceuticals. Countries like China, India, and South Korea are seeing explosive growth in cleanroom construction, leading to high volume demand for both mid-range and high-end sole cleaning equipment. This region often prioritizes scalability and cost-effectiveness alongside meeting evolving regulatory requirements, often leapfrogging older technologies.

Latin America and the Middle East & Africa (MEA) currently hold smaller market shares but offer substantial future growth potential. In Latin America, modernization efforts in the food and beverage sectors, particularly in Brazil and Mexico, are boosting demand for entry-level and semi-automatic hygiene solutions focused on basic microbial control. The MEA region, particularly the UAE and Saudi Arabia, is experiencing growth tied to diversification efforts into specialized manufacturing, healthcare, and biotech hubs, requiring advanced contamination control infrastructure. Growth in these regions is often project-based, linked to large government or foreign direct investment in new industrial parks or specialized laboratories. However, market adoption remains sensitive to economic volatility and requires educational efforts to overcome reliance on traditional, lower-cost cleaning methods. Strategic penetration in these regions often relies on offering scalable solutions and strong localized support partnerships to manage complex import regulations and maintenance logistics.

- North America: Focus on regulatory compliance (FDA/GMP), high-end automation, and biotech/pharmaceutical sector demand.

- Europe: Emphasis on sustainability, energy efficiency, ISO standards compliance, and high quality required by aerospace and automotive industries.

- Asia Pacific (APAC): Highest growth rate, driven by semiconductor fabrication expansion (China, South Korea) and rapid growth in generic drug manufacturing (India).

- Latin America: Emerging growth in food safety and modernization of healthcare facilities; cost sensitivity is a key factor.

- Middle East and Africa (MEA): Project-driven growth linked to economic diversification, healthcare infrastructure development, and specialized research facilities.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Sole Cleaning Machine Market.- Cleanroom Floor Technologies

- M+R Automation

- K-Tek Industries

- Simatek A/S

- Hygiene System

- Vileda Professional

- Clean Step Mat

- Sole Clean Systems

- Controlled Environments Ltd.

- ProfilGate

- Teknomek

- SpeedClean

- Goodway Technologies

- Dycem

- Clean Air Products

- NORDIC AIR CLEAN

- Liberty Industries

- KOSMIK

- S-Clean

- ZARGES

Frequently Asked Questions

Analyze common user questions about the Sole Cleaning Machine market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of a sole cleaning machine and why is it necessary for cleanrooms?

The primary function is to automatically remove 99% of particulate matter, dust, and microbiological contaminants from footwear soles prior to entry into controlled environments. It is necessary for cleanrooms (e.g., ISO Class 7 and higher) to comply with stringent regulatory standards (e.g., GMP, FDA) and prevent cross-contamination, which is critical for product quality and manufacturing yield in sensitive industries like pharmaceuticals and microelectronics.

How do dry cleaning systems compare to wet cleaning systems in terms of efficacy and application?

Dry cleaning systems utilize rotating brushes and powerful HEPA vacuum filtration and are preferred in moisture-sensitive environments like semiconductor manufacturing where water exposure is detrimental. Wet cleaning systems use specialized fluid and disinfectants, offering superior microbiological decontamination and are mandatory in aseptic pharmaceutical or biosafety level (BSL) laboratories where biological control is the highest priority. Efficacy depends heavily on matching the method to the specific contamination type.

What are the typical maintenance requirements and associated operational costs of these machines?

Typical maintenance involves periodic cleaning of the machine components, regular replacement of consumables such as brushes, filters (HEPA/ULPA), and cleaning fluids, and scheduled technical checks of motors and sensors. Operational costs primarily include energy consumption and the ongoing expense of specialized consumables. Modern machines offer modular design and predictive maintenance alerts (often IoT-enabled) to reduce labor time and overall cost of ownership.

Which industries are the major drivers of demand for high-end automatic sole cleaning equipment?

The major drivers of demand are the Pharmaceutical and Biotechnology sectors, followed closely by Electronics and Semiconductor manufacturing. These industries face the most stringent regulatory pressures regarding environmental monitoring and contamination control, requiring verifiable, automated, high-throughput systems that seamlessly integrate with facility access control and data logging systems for compliance auditing.

How is Artificial Intelligence (AI) expected to enhance the performance of sole cleaning machines?

AI is expected to enhance performance by enabling predictive maintenance, automatically adjusting cleaning parameters (e.g., brush speed, cycle time) based on real-time contamination load data, and providing verifiable, data-driven evidence of cleaning efficacy through integrated visual and particulate analysis. This moves the technology from reactive cleaning to proactive, intelligent contamination management.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager