Sole Machine Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433799 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Sole Machine Market Size

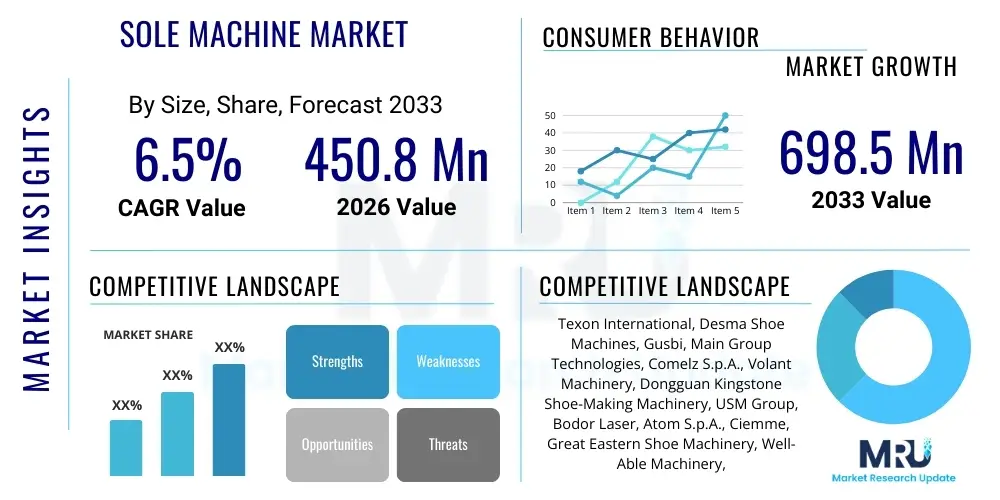

The Sole Machine Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 450.8 million in 2026 and is projected to reach USD 698.5 million by the end of the forecast period in 2033.

This growth trajectory is underpinned by significant investments across Asia Pacific, particularly in major footwear manufacturing hubs like Vietnam, China, and India, which are rapidly modernizing production capabilities. The focus on automation and precision engineering in sole production is driving the replacement cycle of older, less efficient machinery with advanced systems offering features such as multi-density molding and robotic handling. Furthermore, the rising global demand for specialized athletic and performance footwear, which requires complex sole structures manufactured under stringent quality controls, necessitates high-end sole machinery, thereby boosting market valuation.

The market valuation is also influenced by increasing regulatory pressures concerning worker safety and environmental sustainability. Modern sole machines are designed to reduce volatile organic compound (VOC) emissions associated with traditional cementing processes and improve energy efficiency during high-temperature operations like vulcanization and injection molding. Manufacturers are increasingly adopting closed-loop systems and integrating features that facilitate the processing of recycled materials (e.g., recycled EVA and TPU), contributing to the premium segment of the market and pushing the overall market value upward over the forecast period.

Sole Machine Market introduction

The Sole Machine Market encompasses the comprehensive range of specialized industrial equipment utilized in the manufacturing, processing, and finishing of footwear soles, including outsoles, midsoles, and insoles. These machines are pivotal in the footwear supply chain, enabling mass production with high precision, speed, and consistency. Key machinery types include injection molding machines for thermoplastic polyurethanes (TPU) and ethylene-vinyl acetate (EVA), compression molding presses for rubber and phylon materials, automated sole attaching and cementing lines, and complex computer numerical control (CNC) finishing equipment used for intricate sole geometries. The primary product description centers around equipment that ensures material integrity, dimensional accuracy, and aesthetic quality of the finished sole unit.

Major applications of sole machines span the entire spectrum of footwear manufacturing, ranging from casual and dress shoes to highly technical athletic, safety, and specialized occupational footwear. The machinery is crucial for sectors focused on performance footwear, where sole characteristics—such as cushioning, grip, and weight—are critical performance determinants. Benefits derived from the adoption of modern sole machines include substantial reduction in labor dependency, improved production throughput, enhanced material yield due to precision control, and the ability to handle innovative, multi-layered sole designs that were previously unattainable through traditional methods. This efficiency gain is essential for maintaining competitive pricing and meeting rapid fashion cycle demands.

Driving factors propelling market growth include the robust global consumption of footwear, particularly in emerging economies characterized by rising disposable incomes and shifting lifestyle trends favoring athletic and comfort-focused shoes. Furthermore, the continuous innovation in sole materials, such as bio-based polymers and advanced elastomers requiring specialized processing conditions, mandates the upgrade of existing machinery. The push toward Industry 4.0 principles, integrating robotics, automation, and predictive maintenance capabilities into sole manufacturing lines, is a fundamental driver, enhancing operational efficiency and reducing downtime across high-volume production facilities worldwide.

- Market Intro: Specialized industrial equipment for manufacturing, processing, and finishing footwear soles (outsoles, midsoles, insoles).

- Product Description: Includes injection molding, compression molding, vulcanization presses, automated cementing lines, and CNC finishing systems designed for various sole materials (e.g., TPU, EVA, Rubber, Phylon).

- Major Applications: Athletic and performance footwear, casual and dress shoes, safety footwear, and occupational boots.

- Benefits: High precision and consistency, reduced labor costs, increased production throughput, improved material yield, and facilitation of complex, multi-density sole designs.

- Driving factors: Growing global footwear demand, technological advancements in sole materials, stringent quality requirements in performance footwear, and increasing adoption of factory automation (Industry 4.0).

Sole Machine Market Executive Summary

The Sole Machine Market is experiencing a robust period of expansion driven primarily by the escalating demand for highly automated production lines, especially within the Asia Pacific region, which functions as the global center for footwear manufacturing. Current business trends indicate a strong preference for multi-station injection molding machines capable of handling diverse materials simultaneously, optimizing the production of sophisticated, multi-component soles required by premium athletic brands. Key players are concentrating on developing modular machine designs that offer flexibility in switching between different sole types and materials with minimal downtime, effectively addressing the volatile nature of consumer preferences and the necessity for short production runs. Furthermore, there is a discernible trend toward integrating sustainability features, such as enhanced energy recovery systems and compatibility with sustainable sole compounds, positioning these features as critical competitive differentiators in procurement decisions.

Regionally, the Asia Pacific market dominates due to the sheer volume of production and the massive ongoing capital expenditure programs aimed at replacing manual labor with sophisticated automation solutions in countries like China, Vietnam, and Indonesia. This region's dominance is reinforced by local government incentives supporting advanced manufacturing technology adoption. Conversely, North America and Europe, while smaller in production volume, exhibit high demand for advanced, specialized machinery used in localized, niche manufacturing (e.g., custom orthopedic soles or high-fashion limited editions) and sophisticated research and development operations focused on material science and rapid prototyping. These mature markets prioritize machinery that excels in precision, quality control, and connectivity, often leading the adoption curve for AI-driven maintenance and quality assurance systems.

In terms of segmentation trends, the machinery type segment is seeing rapid growth in the automated cementing and sole attaching segment, necessitated by the industry-wide shift away from manual adhesive application due to quality consistency and worker health concerns. The material processing capability segment shows increasing prominence for equipment designed specifically for Thermoplastic Elastomers (TPE) and specialized rubbers that offer superior performance characteristics. End-user analysis reveals that large-scale contract manufacturers and branded manufacturers investing heavily in vertical integration are the primary purchasers, demanding high-capacity, durable equipment. The aftermarket services segment, including predictive maintenance software and spare parts, is also growing disproportionately, reflecting the industry's reliance on maximizing equipment uptime and operational efficiency.

AI Impact Analysis on Sole Machine Market

Common user questions regarding the impact of Artificial Intelligence (AI) on the Sole Machine Market primarily revolve around operational efficiency, predictive maintenance, and quality control. Users frequently inquire: "How can AI reduce material waste in injection molding?" or "Can AI systems predict machine failure before it causes production stoppage?" and "What is the role of machine learning in optimizing sole curing times for different materials?" These questions reflect a primary concern among manufacturers about maximizing utilization rates and minimizing the high costs associated with material defects and unexpected downtime. Users expect AI to move beyond simple data aggregation toward real-time decision-making, optimizing complex parameters such as temperature profiles, injection pressure, and cycle times in highly precise sole production processes.

The key themes emerging from this analysis center on the shift from reactive to proactive manufacturing environments. Manufacturers anticipate that AI will enhance process stability by continuously analyzing sensor data from machinery—such as hydraulic pressure, screw rotation speed, and mold temperature—to automatically adjust operating parameters, ensuring consistent sole quality regardless of minor environmental or material variations. Furthermore, there is significant interest in using computer vision and deep learning algorithms integrated into post-production inspection systems. These AI-enhanced quality control systems can identify subtle defects (e.g., air bubbles, inconsistent density, minor dimensional deviations) far faster and more reliably than human inspectors, thereby reducing scrap rates and ensuring that products meet increasingly stringent brand standards.

Expectations for AI’s influence include streamlining the entire product development cycle. AI algorithms are being explored to simulate the mechanical performance of various sole designs and material combinations before physical prototyping begins, drastically cutting down R&D time and cost. The long-term expectation is that fully autonomous sole manufacturing cells, governed by sophisticated AI platforms, will become the norm, managing everything from raw material feeding and optimal machine scheduling to final assembly and packaging, thereby fundamentally altering the labor dynamics and capital expenditure requirements of the footwear industry.

- Predictive Maintenance: AI algorithms analyze sensor data (vibration, temperature, pressure) to forecast equipment failure, optimizing maintenance schedules and minimizing unscheduled downtime.

- Optimized Quality Control: Integration of machine vision systems powered by deep learning for real-time, high-speed detection of dimensional, cosmetic, and structural sole defects, reducing scrap rate significantly.

- Process Parameter Optimization: Machine learning fine-tuning of complex machinery variables (e.g., injection speed, cooling time) to achieve consistent material properties and energy efficiency.

- Design and Simulation: AI assists in simulating the performance (e.g., cushioning, durability) of new sole designs and material compositions, accelerating the R&D phase.

- Energy Management: Utilization of smart algorithms to optimize machine scheduling and power consumption during peak load times, improving overall manufacturing sustainability.

DRO & Impact Forces Of Sole Machine Market

The dynamics of the Sole Machine Market are shaped by a complex interplay of Drivers, Restraints, and Opportunities (DRO), which collectively constitute the principal impact forces influencing investment decisions and technological adoption across the global footwear sector. Key drivers include the overwhelming need for automation in high-volume manufacturing regions, primarily due to rising labor costs and shortages of skilled manual workers. This necessity is coupled with the continuous demand from consumers for technologically advanced footwear requiring sophisticated, multi-component sole structures that only specialized machinery can reliably produce. These forces mandate capital expenditure on new, high-precision sole production equipment, sustaining market growth.

However, the market faces significant restraints, most notably the high initial capital investment required for purchasing and integrating advanced sole manufacturing lines, which can be prohibitive for small and medium-sized enterprises (SMEs). Furthermore, the long lifespan of existing, older machinery in many factories means replacement cycles can be slow, especially when economic uncertainty prevails. The complexity of operating and maintaining advanced CNC and robotic sole systems necessitates specialized technical expertise, which presents a significant barrier in regions where such skill sets are scarce, often slowing the adoption rate of cutting-edge technology.

The opportunities within the Sole Machine Market are predominantly centered on sustainability and digital transformation. There is a vast opportunity for manufacturers to develop machinery optimized for processing innovative, eco-friendly sole materials, such as recycled rubber, bio-based polymers, and thermoplastic elastomers (TPEs), aligning with global sustainability mandates and brand demands for green supply chains. Additionally, the development and integration of IoT capabilities and cloud-based monitoring systems provide opportunities for equipment providers to shift toward service-based models (Machine-as-a-Service or predictive maintenance contracts), creating recurring revenue streams and improving client operational efficiency, thereby maximizing the overall impact forces driving future market innovation and investment.

- Drivers: Growing global footwear consumption, increasing automation necessity due to rising labor costs, technological advancements demanding complex sole designs, and stringent quality control requirements.

- Restraints: High initial capital expenditure and integration costs, long machinery replacement cycles in established markets, and the scarcity of technical expertise required for operating and maintaining advanced automation systems.

- Opportunities: Development of machinery optimized for sustainable and recycled sole materials, adoption of Industry 4.0 technologies (IoT, AI) for predictive maintenance, and expansion into emerging markets requiring foundational manufacturing automation.

- Impact forces: Globalization of the supply chain pushing for cost efficiency (automation), consumer trends towards specialized performance footwear (driving technical machinery), and environmental regulations demanding cleaner manufacturing processes.

Segmentation Analysis

The Sole Machine Market is segmented based on machinery type, application, operation type, material processed, and end-user, offering a detailed view of technological specialization and market demand patterns. The segmentation by machinery type is crucial as it reflects the primary technologies employed in sole creation, ranging from high-pressure injection molding utilized for plastic and elastomeric soles to vulcanization presses required for traditional rubber outsoles. This technical differentiation directly correlates with the final footwear segment being addressed, as athletic shoes typically require multi-component injection molding systems, while heavy-duty safety boots rely more on specialized direct-injection (DIP) processes or heavy-duty compression molding.

Segmentation by operation type highlights the ongoing trend toward automation, with fully automatic and robotic systems commanding a higher market share in terms of value, despite semi-automatic machines remaining relevant for smaller volume manufacturers or highly specialized bespoke operations. The material processed segment is vital for understanding future growth, particularly the increasing investment in machinery capable of handling advanced materials like specialized EVA foams, TPEs, and highly elastic polyurethanes, all of which require precise temperature and pressure control. This technological specialization ensures that machine manufacturers remain aligned with material science innovations in the footwear industry.

The segmentation across end-users categorizes demand between large-scale contract manufacturers (OEMs/ODMs), who require high-throughput, robust machinery for mass production, and branded manufacturers who often invest in smaller, more flexible systems for research, rapid prototyping, or localized bespoke production lines. Analyzing these segments confirms that the growth engine of the market is currently centered on high-volume, automated injection molding machinery within the contract manufacturing sphere in APAC, while maintenance and upgrades of specialized finishing equipment continue to drive value in mature markets like North America and Europe, focusing heavily on precision and digital integration capabilities.

- By Machinery Type:

- Injection Molding Machines (TPU, PVC, EVA, PU)

- Compression Molding Presses (Rubber, Phylon)

- Vulcanization Presses

- Automated Sole Attaching and Cementing Machines

- Sole Edge Trimming and Finishing Machines (CNC/Robotic)

- Roughing and Buffing Machines

- By Operation Type:

- Fully Automatic

- Semi-Automatic

- Manual (Niche applications)

- By Application:

- Athletic and Sports Footwear

- Casual and Lifestyle Footwear

- Safety and Industrial Footwear

- Dress and Formal Footwear

- By Material Processed:

- Thermoplastic Polyurethane (TPU)

- Ethylene-Vinyl Acetate (EVA)

- Rubber and Composites

- Polyurethane (PU)

- Thermoplastic Elastomers (TPE)

- By End-User:

- Contract Manufacturers (OEM/ODM)

- Branded Footwear Manufacturers

- Small and Medium Enterprises (SMEs)

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Sole Machine Market

The value chain for the Sole Machine Market begins with the upstream raw material suppliers, consisting primarily of specialized component manufacturers providing high-precision hydraulics, advanced electrical control systems (PLCs), sophisticated molds, high-tensile structural steels, and integrated robotic arms. The efficiency and quality of the sole machine heavily depend on the durability and accuracy of these upstream components. Key machine manufacturers, who form the core of the value chain, focus intensely on design, engineering, and assembly, integrating these complex components into functional, high-speed sole production lines. A significant portion of the value addition at this stage comes from intellectual property related to proprietary control software, thermal management systems, and patented molding technologies crucial for multi-density sole production.

The downstream analysis highlights the key role of distribution channels, which include direct sales teams, specialized regional distributors, and system integrators. Due to the high-capital nature and technical complexity of sole machinery, direct sales channels are often preferred by major manufacturers, allowing for closer technical support, customized installation, and comprehensive after-sales training. Regional distributors, conversely, play a critical role in penetrating smaller, fragmented markets and providing local inventory and immediate service response. System integrators are increasingly important, especially when factories require merging new sole machinery with existing automated conveying or warehousing systems, ensuring seamless operational flow across the production floor.

The end of the value chain is defined by the sole machine's immediate customers—large footwear contract manufacturers and global brands—who utilize the machinery to produce billions of sole units annually. The indirect channel influence is exerted by fashion trends, athletic performance standards, and evolving environmental mandates, which dictate the type of sole materials and designs required, thereby directly influencing the specifications and complexity demanded from the sole machine manufacturers. The shift toward digital services, including remote diagnostics and performance monitoring, represents a growing secondary revenue stream within the downstream segment, enhancing long-term customer relationship value beyond the initial equipment sale.

Sole Machine Market Potential Customers

Potential customers for sole machines primarily consist of entities involved in the volume production or specialized fabrication of footwear. The largest segment of buyers comprises Tier 1 and Tier 2 contract manufacturers (OEMs and ODMs), predominantly located in Asian production hubs. These companies operate massive manufacturing facilities and rely on high-capacity, durable, and highly automated machinery to meet the production quotas of major global footwear brands like Nike, Adidas, Puma, and New Balance. Their purchasing criteria are heavily skewed toward throughput efficiency, energy consumption metrics, and the ability of the machine to handle diverse and complex material specifications consistently across millions of units.

Another crucial customer segment includes large, vertically integrated branded footwear manufacturers who maintain their own production facilities, often for proprietary technology testing, high-end specialized lines, or rapid prototyping. These brands demand cutting-edge machinery that provides maximum flexibility, precision for customized products, and seamless integration with their internal R&D processes, often leading the adoption of new technologies such as robotic finishing and 3D printing hybridization for sole components. Their purchasing decisions are often driven by strategic technological superiority and intellectual property protection, rather than purely by immediate capital cost.

Furthermore, specialized segments such as manufacturers of safety footwear, medical/orthopedic footwear, and bespoke high-fashion shoes represent important niche potential customers. Safety footwear producers require machines capable of robust direct injection processes (DIP) for bonding durable sole materials to heavy-duty uppers, ensuring stringent safety compliance. Medical and orthopedic manufacturers require highly precise, flexible machinery capable of smaller batch, highly customized sole fabrication. Although purchasing smaller volumes, these specialized customers often seek premium, highly reliable, and certified machinery with advanced control capabilities, representing a high-value, albeit lower volume, segment of the market.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450.8 Million |

| Market Forecast in 2033 | USD 698.5 Million |

| Growth Rate | CAGR 6.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Texon International, Desma Shoe Machines, Gusbi, Main Group Technologies, Comelz S.p.A., Volant Machinery, Dongguan Kingstone Shoe-Making Machinery, USM Group, Bodor Laser, Atom S.p.A., Ciemme, Great Eastern Shoe Machinery, Well-Able Machinery, Tien Kang, Sheng Chi Precision, Yuan Chi Machinery, True North, C&G Industries, G.T.S. Machinery, Hong Kong Precise Engineering. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Sole Machine Market Key Technology Landscape

The Sole Machine Market's technological landscape is characterized by increasing sophistication in process control, automation integration, and material handling capabilities, moving decisively toward Industry 4.0 standards. Central to this evolution is the advancement of multi-color, multi-density injection molding technology, which allows for the creation of complex sole units with varying material hardness and structural features in a single process cycle. This minimizes assembly steps, enhances sole performance, and drastically reduces labor intensity. Modern injection systems utilize highly accurate metering pumps and sophisticated thermal management systems to ensure material consistency, particularly for high-performance thermoplastic polyurethanes (TPU) and specialized high-resilience EVA compounds, critical for modern athletic cushioning systems. Furthermore, servo-hydraulic systems are replacing traditional hydraulic drives, offering superior energy efficiency and far greater precision in injection and clamping forces.

Automation and robotics play an equally critical role. Robotic arms are increasingly employed for delicate or repetitive tasks such as sole roughing, automated primer application, and precise placement of insoles or specialized components before final attachment. The adoption of automated cementing lines utilizing robotic dispensers and vision systems is rapidly increasing, moving away from manual gluing processes that are inconsistent and expose workers to hazardous volatile organic compounds (VOCs). These automated systems leverage advanced sensors and computer vision to verify alignment and application volume, significantly improving the quality and durability of the sole-to-upper bond, which is a major quality determinant in footwear manufacturing.

Furthermore, digital technologies, particularly Computer Numerical Control (CNC) and three-dimensional (3D) scanning/printing, are pivotal in the finishing and prototyping segments. High-speed 5-axis CNC machines are used for precise sole edge trimming and complex anatomical sculpting. Concurrently, 3D printing technology, while not yet dominant for mass production of final soles, is integrated into the R&D and mold making process, enabling rapid iteration of sole designs and testing of new molding parameters. The overarching technological trend is the seamless connectivity of all these disparate machines via Industrial IoT (IIoT) platforms, facilitating centralized monitoring, remote diagnostics, and data-driven process optimization, transforming the factory floor into a smart manufacturing environment.

Regional Highlights

The global Sole Machine Market exhibits distinct regional dynamics, largely defined by manufacturing volume, labor costs, and technological maturity. Asia Pacific (APAC) stands as the undisputed leader, accounting for the largest market share both in terms of value and volume shipments. This dominance is attributable to the region housing the world’s major footwear manufacturing hubs, particularly in China, Vietnam, Indonesia, and India. Massive investments in automation are fueling growth in APAC as manufacturers seek to mitigate rising labor wages and enhance efficiency to remain competitive globally. The demand here is massive and concentrated on high-throughput, reliable machinery, such as large-scale multi-station injection molding and fully automated assembly lines. Governmental policies supporting high-tech manufacturing further accelerate the adoption cycle in this region.

Europe represents a highly mature market characterized by demand for specialized, high-precision equipment suitable for niche high-fashion, safety, and technically advanced footwear manufacturing. While production volumes are lower compared to APAC, the value per machine sale is often higher, reflecting the demand for advanced features like specialized PU mixing and dispensing systems, rapid prototyping capabilities, and superior connectivity (Industry 4.0 readiness). Key countries such as Italy and Germany, home to renowned machinery and component manufacturers, are also centers for technological innovation, often driving the global standards for machinery performance and reliability. The focus in Europe is less on expansion and more on replacement, modernization, and incorporating sustainable processing capabilities.

North America maintains a robust market, driven primarily by localized manufacturing of specialized products (e.g., medical orthotics, high-end hiking boots, and military footwear) and significant R&D spending by global brands. This region exhibits a strong preference for highly flexible, modular, and automated machinery that allows for quick changeovers and smaller batch sizes, supporting the trend toward customization and quick-to-market strategies. The implementation of AI for quality assurance and the adoption of advanced material processing equipment for specialized foams and composites are key regional highlights. Latin America (LATAM) and the Middle East and Africa (MEA) are emerging markets, with LATAM (especially Brazil and Mexico) focusing on modernizing outdated infrastructure and MEA showing slow but steady growth, primarily driven by investments in regional self-sufficiency for basic casual and safety footwear production.

- Asia Pacific (APAC): Dominates the market due to high production volumes in China, Vietnam, and Indonesia. Growth is driven by automation necessitated by rising labor costs and continuous factory modernization efforts. Demand is concentrated on high-throughput injection molding and automated cementing systems.

- Europe: Characterized by high technological maturity, focusing on specialized, precision machinery for high-value segments (e.g., luxury, technical safety, R&D). Strong demand for advanced PU dispensing and robotic finishing systems, emphasizing sustainability and energy efficiency.

- North America: Market driven by niche production, quick-turn prototyping, and R&D activities. Preference for flexible, modular automation and early adoption of AI/vision systems for enhanced quality control and highly customized output.

- Latin America (LATAM): Showing steady modernization efforts, particularly in Brazil and Mexico, shifting toward semi-automatic and basic automatic machinery to improve local production quality and efficiency.

- Middle East and Africa (MEA): Nascent market primarily focused on establishing basic footwear manufacturing capabilities to serve regional demand, with initial investments focused on durable, reliable entry-level sole processing equipment.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Sole Machine Market.- Texon International

- Desma Shoe Machines

- Gusbi

- Main Group Technologies

- Comelz S.p.A.

- Volant Machinery

- Dongguan Kingstone Shoe-Making Machinery

- USM Group

- Bodor Laser

- Atom S.p.A.

- Ciemme

- Great Eastern Shoe Machinery

- Well-Able Machinery

- Tien Kang

- Sheng Chi Precision

- Yuan Chi Machinery

- True North Automation

- C&G Industries

- G.T.S. Machinery

- Hong Kong Precise Engineering

Frequently Asked Questions

Analyze common user questions about the Sole Machine market and generate a concise list of summarized FAQs reflecting key topics and concerns.What major technological innovations are currently driving the Sole Machine Market?

The market is primarily driven by the adoption of multi-density, multi-color injection molding technology and advanced automation, including robotic systems for sole roughing and automated cementing. These innovations maximize output efficiency, reduce manual labor requirements, and enable the production of complex, high-performance sole structures in a single, controlled process.

How does the shift towards sustainable materials impact machinery investment?

The industry's focus on sustainability necessitates investment in new machinery optimized to handle challenging recycled and bio-based materials (like rEVA and bio-TPU). Manufacturers are prioritizing equipment with precise temperature control and specialized screw designs to ensure uniform processing and superior physical properties of these environmentally friendly sole compounds, driving the replacement of older, less adaptable machines.

Which geographic region dominates the demand for Sole Machines and why?

Asia Pacific (APAC), particularly Vietnam and China, dominates the demand for sole machines. This is due to APAC being the world's largest footwear manufacturing base, coupled with increasing labor costs that mandate continuous, large-scale investment in high-throughput automation and efficient robotic assembly lines to maintain global competitiveness.

What are the primary restraints affecting the growth of the Sole Machine Market?

The most significant restraints include the exceptionally high initial capital outlay required for purchasing modern, automated sole manufacturing lines. Additionally, the long operational lifespan of existing older equipment in many factories delays replacement cycles, and the scarcity of technical expertise needed to operate and maintain sophisticated CNC and AI-integrated systems poses a persistent challenge.

What is the role of Industry 4.0 in modern sole manufacturing machinery?

Industry 4.0 is crucial, integrating IIoT sensors, cloud connectivity, and AI into sole machines. This enables predictive maintenance, real-time remote diagnostics, and continuous process optimization. This digitalization improves quality consistency, minimizes downtime, and allows manufacturers to leverage production data for efficiency and energy consumption improvements across globally distributed facilities.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager