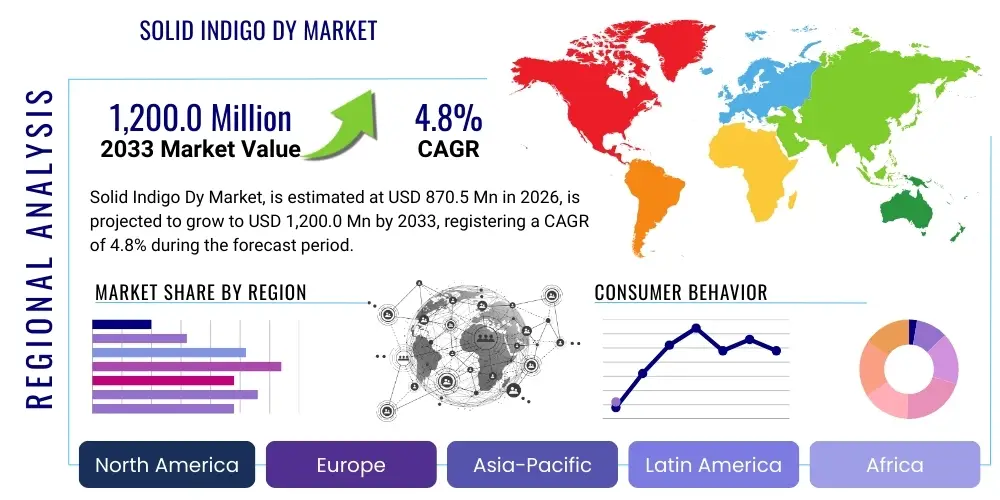

Solid Indigo Dy Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438381 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Solid Indigo Dy Market Size

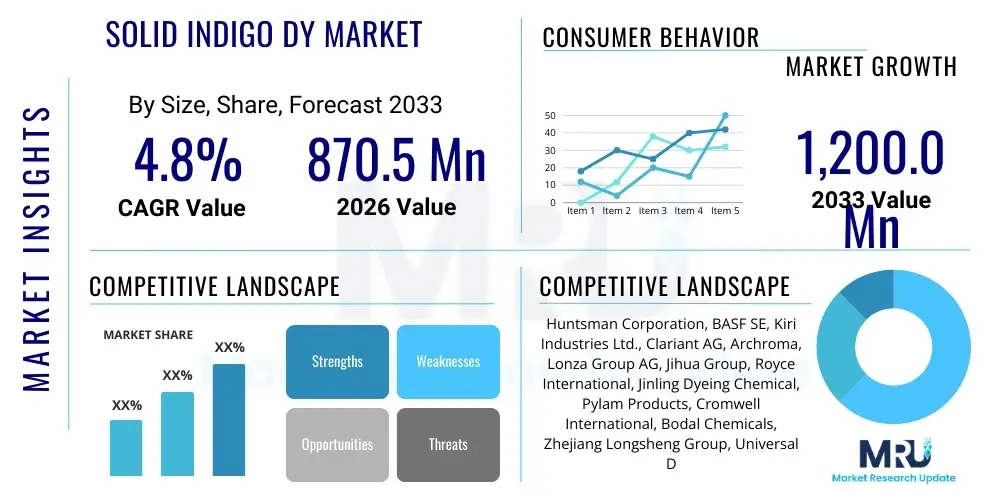

The Solid Indigo Dy Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 870.5 Million in 2026 and is projected to reach USD 1,200.0 Million by the end of the forecast period in 2033. This growth trajectory is fundamentally driven by the sustained demand from the denim and textile industries, particularly in emerging economies where fast fashion and apparel consumption are escalating rapidly. Furthermore, advancements in dying processes that favor solid forms for reduced waste and enhanced consistency are bolstering market valuation.

Solid Indigo Dy Market introduction

The Solid Indigo Dye Market revolves around the production, distribution, and consumption of synthetic indigo dye in its high-concentration solid form, primarily as powder or granules, used extensively for coloring cellulose fibers, most notably cotton used in denim manufacturing. Indigo, the oldest known natural dye, has been largely replaced by synthetic indigo due to its cost-effectiveness, purity, and consistent supply. The solid form is preferred by large-scale textile processors for its ease of storage, reduced transportation costs, and high active ingredient concentration compared to liquid formulations. This solid concentration allows for more efficient handling and dosing in industrial vat dyeing processes, crucial for achieving the distinctive and highly sought-after blue color of denim.

Major applications of Solid Indigo Dye are overwhelmingly concentrated within the apparel and textile sectors, particularly in the production of denim jeans, jackets, and other indigo-dyed garments. The dye's unique characteristic of binding only to the surface of the fiber, rather than penetrating it completely, is what facilitates the desired wash-down and fading effects that consumers associate with quality denim. Beyond textiles, smaller applications include use in printing inks, food colorants, and specialized coatings, though these segments constitute a minor proportion of overall demand. The utility of the solid form is tied directly to the efficiency improvements it offers in supply chain management and manufacturing consistency.

Key benefits driving market adoption include its eco-friendliness compared to certain sulfur-based dyes, its unparalleled light fastness and wash fastness, and the stability of the solid chemical structure. Driving factors encompass the rising global population, increasing disposable incomes in Asia Pacific fueling the demand for branded apparel, and the continuous innovation in sustainable dyeing techniques. Conversely, stringent environmental regulations regarding wastewater discharge containing dye residues and the competitive threat from new alternative coloring agents present minor headwinds to sustained, aggressive growth, necessitating technological investment in cleaner production methods.

Solid Indigo Dy Market Executive Summary

The Solid Indigo Dye Market is positioned for stable expansion, underpinned by resilient global demand for denim and sustainable manufacturing practices seeking highly concentrated chemical inputs. Business trends indicate a strong focus on backward integration among major manufacturers to secure stable raw material supply (aniline and formaldehyde) and optimize production efficiencies to maintain competitive pricing against Chinese and Indian producers. Furthermore, there is a pronounced shift towards high-purity, environmentally compliant solid indigo formulations that reduce the requirement for heavy reducing agents, aligning with global green textile initiatives. Strategic collaborations between dye producers and large denim mills are becoming commonplace, aimed at customizing dye properties for advanced finishing techniques.

Regionally, Asia Pacific dominates the market, largely due to China, India, and Bangladesh serving as the world's major textile manufacturing hubs and consumer bases. These regions exhibit robust CAGR potential driven by domestic demand and export activities. North America and Europe, while mature markets, emphasize premium, high-quality denim, focusing their demand on dyes produced with stringent sustainability certifications (e.g., bluesign approved). The Middle East and Latin America show promising growth as regional textile industries mature and local apparel consumption increases, requiring stable supplies of high-quality solid indigo dye inputs.

Segment trends reveal that the Powder segment holds the largest market share due to its established use and cost-effectiveness, although the Granule segment is accelerating in adoption because granules offer superior dust control, easier handling, and more precise automatic dosing in modern industrial settings, addressing worker safety concerns. By application, the Apparel and Textile segment remains overwhelmingly dominant. The shift toward sustainable processing, including electrochemical reduction of indigo, is an underlying technical trend affecting all segments, demanding solid dye forms optimized for these advanced, greener systems rather than traditional hydrosulfite reduction.

AI Impact Analysis on Solid Indigo Dy Market

Users frequently inquire about how AI can optimize the highly chemical and process-intensive production of Solid Indigo Dye, specifically focusing on efficiency gains, quality control, and reducing environmental waste. Key concerns center on whether AI can predict and minimize the highly sensitive reduction process variability inherent in indigo vat dyeing, and if machine learning models can assist in designing new, safer chemical synthesis routes for the solid dye itself. Users anticipate that AI and predictive analytics will transform inventory management, forecasting supply chain disruptions for aniline and formaldehyde, and crucially, optimizing the complex color matching and consistency required by international textile buyers. The consensus is that while AI won't replace the physical dye, it will fundamentally redefine operational management from raw material sourcing to final dye application.

- AI optimizes reaction parameters in synthetic indigo production, improving yield and purity consistency.

- Machine learning algorithms predict optimal dyeing recipes and vat conditions in textile mills, reducing chemical usage and effluent toxicity.

- Predictive maintenance schedules for large-scale production equipment minimize downtime and operational variability.

- AI-driven supply chain management forecasts demand for solid indigo, optimizing inventory levels and reducing logistics costs.

- Computer vision and colorimetry integrated with AI ensure superior batch-to-batch color consistency in the dyed fabric.

- Generative AI assists chemists in designing novel, bio-based indigo precursors, accelerating sustainable material development.

DRO & Impact Forces Of Solid Indigo Dy Market

The Solid Indigo Dye Market is fundamentally shaped by a confluence of driving forces related to global apparel consumption and restraints concerning environmental compliance, balanced by significant opportunities in technological advancements. The primary driver is the sustained, pervasive popularity of denim globally; denim is a fashion staple across all demographics and regions, ensuring a stable, non-cyclical demand floor for indigo dye. This driver is amplified by emerging market urbanization and the resultant increase in disposable income, especially in Asia Pacific, where manufacturing capacity expansion directly translates into higher solid indigo consumption. Furthermore, the efficiency and cost benefits associated with using solid, highly concentrated dye forms (reduced water weight in transport, easier storage) act as an internal industry driver favoring this market structure.

However, the market faces considerable restraints, primarily stemming from environmental regulations. Indigo dyeing, particularly the traditional reduction process, generates significant wastewater laden with chemicals (such as sodium hydrosulfite) and residual color, leading to strict regulatory scrutiny in Europe and North America, and increasingly in China. The need for costly effluent treatment facilities and the high compliance burden acts as a barrier to entry and restrains market growth, pushing mills towards adopting costlier, yet cleaner, technologies like electrochemical dyeing. Another restraint is the fluctuating price and geopolitical instability concerning key petrochemical raw materials, specifically aniline, which directly impacts the profitability and pricing of the final solid indigo product.

Significant opportunities are present in developing and commercializing greener, more sustainable indigo substitutes or modified solid indigo processes. The shift toward bio-based indigo derived from plant sources or genetically modified microorganisms presents a long-term opportunity for premiumization, catering to the ethical and sustainable fashion market segment. Opportunities also exist in market consolidation and geographical expansion, where major players can acquire smaller, niche dye producers specializing in specific solid formulations (e.g., highly micronized powders or specialized granules) or establish manufacturing hubs closer to rapidly growing textile centers in Southeast Asia, thereby shortening supply chains and enhancing responsiveness to customer demand. The underlying impact forces thus balance stable demand against the pressure for environmental innovation.

Segmentation Analysis

The Solid Indigo Dye market is comprehensively segmented primarily by Type (which denotes the physical form and purity), by Application (the end-use industries), and by Geography (regional consumption patterns and manufacturing bases). Understanding these segments is crucial as different types of solid indigo cater to varying levels of textile processing sophistication and compliance requirements. For instance, high-purity granules are often favored by premium denim manufacturers in developed regions seeking minimal environmental footprint and automated processes, whereas standard powders are more prevalent in high-volume, cost-sensitive markets in Asia. The segmentation reflects both the technical specifications of the dye product and the industrial demands of the vast global textile supply chain.

The segmentation by application clearly highlights the market's dependence on the textile industry, particularly the denim sector, which accounts for the overwhelming majority of solid indigo demand. The minor, yet growing, non-textile segments represent diversification potential but are unlikely to significantly alter the market structure in the immediate forecast period. Regional segmentation is vital for strategic planning, revealing that capacity growth and consumption momentum are strongly centralized in the Asia Pacific region, whereas technological innovation and environmental regulatory drivers originate predominantly from North America and Europe, influencing the standards applied globally to dye quality and processing requirements across all product segments.

- By Type:

- Standard Powder (92%-94% purity)

- High Purity Powder (96% purity and above)

- Granules (Dust-free formulation)

- By Application:

- Apparel and Textile Industry (Denim, Casual wear)

- Non-Textile Applications (Printing Inks, Food Colorant, Other Chemicals)

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Solid Indigo Dy Market

The Solid Indigo Dy value chain begins with the upstream segment involving the procurement and processing of key petrochemical raw materials, primarily aniline and formaldehyde, derived from the petroleum industry. This stage is critical as the quality and stable pricing of these precursors directly dictate the cost structure and production efficiency of synthetic indigo. Upstream suppliers are typically large chemical companies, and their market power can influence the final price of solid indigo. The core manufacturing stage involves complex chemical synthesis using highly specialized equipment, transforming aniline and formaldehyde into indigo crude, followed by purification and finally, conversion into the solid forms—powder or granules—ready for market distribution. High energy inputs and strict safety standards characterize the manufacturing process.

The downstream segment focuses on distribution channels and the ultimate consumption by end-users. Distribution is primarily handled through a mix of direct sales channels, where major dye manufacturers supply large, integrated textile mills directly, and indirect channels, utilizing regional chemical distributors and agents who cater to smaller or dispersed dyeing facilities. The final consumption stage is dominated by large denim and apparel manufacturers in key textile production hubs. The efficiency of the downstream segment relies heavily on timely logistics and maintaining the stability and concentration of the solid dye during storage and transit.

The value chain is undergoing optimization aimed at reducing environmental impact, which affects the distribution and manufacturing stages. Manufacturers are investing in systems that allow for 'just-in-time' delivery of solid dye to minimize inventory holding costs for textile mills. The trend toward high-purity and granule forms is driven by end-users demanding products that integrate seamlessly into automated dosing systems, minimizing human contact and maximizing consistency. Therefore, connectivity between dye manufacturer quality control standards and the specific application needs of the large denim mills remains the most critical linkage in the entire value chain.

Solid Indigo Dy Market Potential Customers

The primary and largest demographic of potential customers for Solid Indigo Dye are industrial textile processing facilities, specifically large-scale denim mills and integrated garment manufacturers. These customers operate continuously and require vast quantities of high-purity, standardized indigo dye in bulk solid form to maintain uninterrupted vat dyeing processes. Geographical concentration dictates that the largest customers are found in major textile exporting countries such as China, India, Bangladesh, Vietnam, and Turkey. These mills demand competitive pricing, high purity, consistent particle size distribution, and stringent compliance documentation to meet international brand standards.

Secondary potential customers include regional dyeing houses and finishing companies that specialize in smaller-batch, high-fashion, or specialized niche textile treatments. While their volume demand is lower than the mega-mills, they often require tailored solutions, such as ultra-fine micronized powders for specific washing effects or rapid-dissolving granules for highly automated machines. These smaller entities typically procure solid indigo through local chemical distributors rather than directly from the primary manufacturers.

In addition to the core textile sector, potential customers also exist in tangential chemical and manufacturing industries, although these volumes are significantly smaller. These include companies producing specialized printing inks, certain types of plastics or polymers requiring blue colorants, and pharmaceutical firms utilizing indigo derivatives. For all customer types, the shift toward sustainable chemistry means that suppliers offering robust documentation regarding the reduced environmental footprint of their solid indigo production process will gain a distinct competitive advantage and secure long-term purchasing contracts.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 870.5 Million |

| Market Forecast in 2033 | USD 1,200.0 Million |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Huntsman Corporation, BASF SE, Kiri Industries Ltd., Clariant AG, Archroma, Lonza Group AG, Jihua Group, Royce International, Jinling Dyeing Chemical, Pylam Products, Cromwell International, Bodal Chemicals, Zhejiang Longsheng Group, Universal Dyes & Chemicals, Lonsen Kexiang Co. Ltd., Jiangsu Yabang Dyestuff Co. Ltd., S. C. Johnson & Son, Sandoz, Xuzhou Hongda Chemical. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Solid Indigo Dy Market Key Technology Landscape

The technology landscape for Solid Indigo Dye is characterized by continuous refinement in synthesis methods and a pivotal shift in application technologies geared towards sustainability. The core synthesis route, often derived from the Heumann method, involves complex reactions utilizing aniline and formaldehyde. Recent technological advancements focus heavily on optimizing this synthesis to increase purity levels (moving towards 96% and above), reduce energy consumption in the drying and granulation phases, and minimize by-product formation. Granulation technology is particularly crucial in the solid dye market, employing techniques like spray drying and fluidized bed granulation to create uniform, low-dust, and easily dispersible granules, which enhance user safety and automate dosing in industrial settings. These proprietary granulation methods are key differentiators among leading market players.

A transformative technology impacting the application side is the commercial adoption of electrochemical reduction of indigo. Traditionally, solid indigo is solubilized and reduced using large amounts of sodium hydrosulfite, a strong reducing agent that contributes significantly to effluent pollution (sulfur content). Electrochemical reduction (ECR) technology uses electricity to generate the necessary reducing power directly in the dye bath, eliminating the need for hydrosulfite and drastically reducing chemical waste. The solid indigo used must be compatible with these ECR systems, pushing manufacturers to develop solid forms that dissolve rapidly and maintain stability in the specialized electrochemical environment. This technological adaptation is driven by regulatory pressure and the textile industry's net-zero targets.

Furthermore, digital technologies, including sophisticated process control systems and AI integration, are becoming standard in modern solid indigo manufacturing plants. These systems monitor reaction kinetics in real-time, optimize temperature and pressure, and ensure batch consistency, which is vital for maintaining the high standards demanded by global textile brands. The emphasis is on "green chemistry" principles, with research continuing into bio-based indigo production via fermentation (using modified bacteria or yeast). While still niche and more expensive than synthetic solid indigo, bio-indigo represents a significant long-term technological opportunity that could disrupt the conventional petrochemical-based solid dye market, especially for premium, eco-conscious product lines.

Regional Highlights

Regional dynamics are central to the Solid Indigo Dy Market, reflecting varied manufacturing capabilities, consumption patterns, and regulatory environments.

- Asia Pacific (APAC): This region is the undisputed epicenter of both production and consumption. Driven by colossal manufacturing bases in China, India, and Southeast Asian nations (Vietnam, Bangladesh), APAC accounts for the largest market share. The regional market growth is fueled by massive denim production for global export and substantial domestic consumption growth due to rising middle-class populations. Investment in new, high-efficiency textile mills ensures sustained high demand for bulk solid indigo.

- Europe: Characterized by high environmental standards and a focus on premium denim (especially in Italy and Turkey), Europe is a mature market prioritizing quality and sustainability. Demand here is geared towards high-purity, environmentally certified solid indigo formulations (e.g., non-hydrosulfite compatible dyes). Consumption growth is steady but slower than APAC, driven primarily by replacement and innovation in textile finishing techniques rather than sheer volume expansion.

- North America: Similar to Europe, the North American market is highly regulated and focused on specialized, sustainable sourcing. Although large-scale textile manufacturing has declined, the region remains a major consumer of finished denim goods, influencing global dye sourcing policies for textile mills abroad. Demand is primarily for imported dyed goods, but local niche manufacturing requires superior quality, environmentally compliant solid indigo.

- Latin America (LATAM): Countries like Brazil and Mexico possess substantial domestic textile industries and growing apparel markets. LATAM shows promising growth, balancing cost-effectiveness with increasing environmental consciousness. The region is moving towards modernizing its dyeing facilities, favoring the shift from traditional liquid or crude forms to standardized, efficient solid indigo products.

- Middle East and Africa (MEA): This region represents an emerging market segment. While consumption is smaller, textile hubs like Turkey (often grouped with Europe) and parts of North Africa are expanding their production capacity, creating new pockets of demand for solid indigo, predominantly sourced through competitive global imports. Growth is volatile but exhibits high potential as regional industrialization progresses.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Solid Indigo Dy Market.- Huntsman Corporation

- BASF SE

- Kiri Industries Ltd.

- Clariant AG

- Archroma

- Lonza Group AG

- Jihua Group

- Royce International

- Jinling Dyeing Chemical

- Pylam Products

- Cromwell International

- Bodal Chemicals

- Zhejiang Longsheng Group

- Universal Dyes & Chemicals

- Lonsen Kexiang Co. Ltd.

- Jiangsu Yabang Dyestuff Co. Ltd.

- S. C. Johnson & Son

- Sandoz

- Xuzhou Hongda Chemical

- Atul Ltd.

Frequently Asked Questions

Analyze common user questions about the Solid Indigo Dy market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected Compound Annual Growth Rate (CAGR) for the Solid Indigo Dy Market?

The Solid Indigo Dy Market is projected to grow at a CAGR of 4.8% between 2026 and 2033, driven primarily by consistent demand from the global denim manufacturing sector and technological advancements favoring concentrated solid dye forms.

Which geographical region dominates the consumption of Solid Indigo Dye?

The Asia Pacific (APAC) region, spearheaded by manufacturing hubs like China and India, dominates the consumption of Solid Indigo Dye due to its overwhelming share of global textile and denim production capacity.

What is the primary factor restraining market growth in the Solid Indigo Dy sector?

The primary factor restraining market growth is the imposition of stringent environmental regulations concerning wastewater discharge, particularly related to chemical residues from traditional reduction processes used in indigo dyeing.

How does the shift to granule formulation benefit the Solid Indigo Dy market?

The shift to granules offers significant benefits, including enhanced industrial safety due to reduced dust formation, easier automated handling and dosing in modern mills, and superior consistency compared to standard powder formulations.

What technological innovation is addressing the environmental concerns of indigo dyeing?

Electrochemical Reduction (ECR) technology is the key innovation addressing environmental concerns, as it allows for the reduction of solid indigo without relying on chemical reducing agents like sodium hydrosulfite, thereby minimizing polluting effluent.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager